Noticias del mercado

-

17:38

Mexico will import U.S. light crude oil

Mexico's state oil company Pemex said on Wednesday that it received a license to import U.S. light crude oil. The first U.S. shipment will arrive in the first half of November, according to a Pemex spokesman. He also said that the license is limited to 75,000 barrel per day for one year.

-

16:33

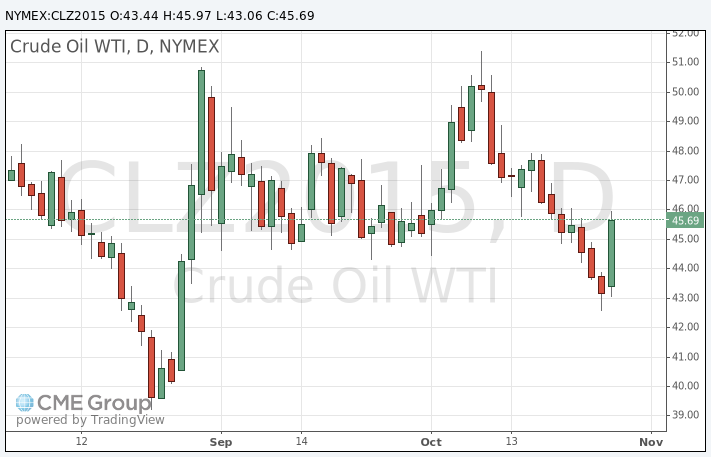

Oil prices rise on U.S. crude oil inventories data as oil products inventories dropped

Oil prices rose on U.S. crude oil inventories data as oil products inventories dropped. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 3.38 million barrels to 480.0 million in the week to October 23. It was the fifth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories decreased by 1.1 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 785,000 barrels.

U.S. crude oil imports dropped by 417,000 barrels per day.

Refineries in the U.S. were running at 87.6% of capacity, up from 86.4% the previous week.

WTI crude oil for December delivery climbed to $45.97 a barrel on the New York Mercantile Exchange.

Brent crude oil for December increased to $47.19 a barrel on ICE Futures Europe.

-

16:29

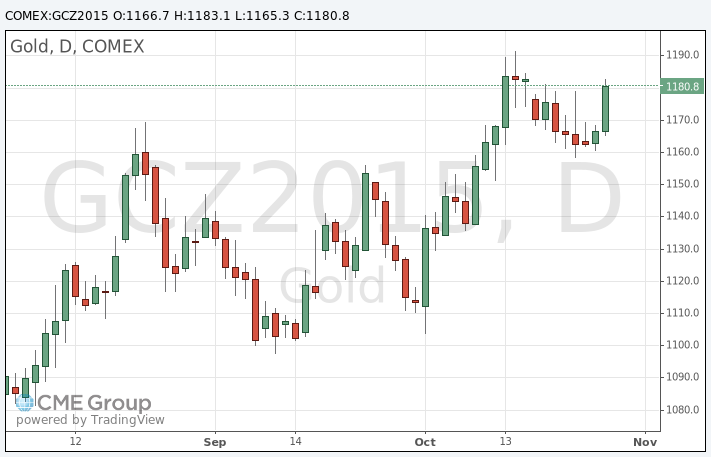

Gold price climbs ahead of the release of the Fed's monetary policy meeting results

Gold price rose ahead of the release of the Fed's monetary policy meeting results. It is unlikely that the Fed will change its monetary policy. Market participants will closely monitor Fed's statement for signals when the Fed plans to start raising its interest rates.

The interest rate hike by the Fed would weigh on gold price.

December futures for gold on the COMEX today increased to 1183.10 dollars per ounce.

-

16:16

U.S. crude inventories climb by 3.38 million barrels to 480.0 million in the week to October 23

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 3.38 million barrels to 480.0 million in the week to October 23. It was the fifth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories decreased by 1.1 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 785,000 barrels.

U.S. crude oil imports dropped by 417,000 barrels per day.

Refineries in the U.S. were running at 87.6% of capacity, up from 86.4% the previous week.

-

10:18

Bloomberg News poll: China’s central bank will not cut its lending and deposit interest rates further until 2017

According to a poll by Bloomberg News, China's central bank will not cut its lending and deposit interest rates further until 2017. The economy in China is expected to grow 6.9% in the fourth quarter, according to a poll.

-

07:58

Oil prices rebounded slightly, but remained under pressure

West Texas Intermediate futures for December delivery are currently at $43.29 (+0.21%), while Brent crude stabilized around $46.88 (+0.15%) after recent declines. However prices may fall one more time as data by the American Petroleum Institute suggest a 4.1 million barrel build in U.S. oil stocks in the week to October 23. The Energy Information Administration will publish its more accurate report later today.

On Tuesday BP, Europe's third-largest oil company, announced further spending cuts to about $19 billion this year after investing about $23 billion in 2014 and more asset sales over the coming years to withstand a prolonged period of low oil prices. BP's profits fell 40% in the third quarter.

-

07:45

Gold advanced slightly

Gold climbed to $1,171.00 (+0.45%), but gains were limited as investors were cautious ahead of Fed interest decision announcement.

Most market participants don't expect the Fed to raise rates at this week's meeting, but they will be looking for signs of readiness to do so in December. Fed policymakers' messages suggest that they have been concerned over slow global economic growth and mixed domestic data. That's why some analysts believe that a rate hike can be postponed till 2016.

-

00:32

Commodities. Daily history for Sep Oct 27’2015:

(raw materials / closing price /% change)

Oil 43.31 +0.25%

Gold 1,166.60 +0.07%

-