Noticias del mercado

-

21:00

New Zealand: RBNZ Interest Rate Decision, 2.75% (forecast 2.75%)

-

19:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

18:40

American focus: the US dollar fell against most major currencies

The US dollar fell against major currencies as investors doubted the feasibility of investments in the US currency before the second half of the day will be announced the results of the meeting of the Federal Reserve System.

Most investors believe the Fed will keep interest rates unchanged. Some, moreover, are concerned that a series of weak economic data may reduce the tendency of the central bank to raise interest rates in the next few months. The probability of a prolonged low interest rates put pressure on the dollar, as the increase in borrowing costs would make it more attractive for investors.

"If the Fed rhetoric points to a lower likelihood of higher interest rates in the next few months, it may affect on the dollar", - said Joe Manimbo, senior market analyst at Western Union.

According to futures on a bet the Fed, market participants estimate the probability of a rate hike on Wednesday at 5%. The probability of a rate hike at the meeting on December 15-16 is 34%, although earlier this year it was above 50%.

The euro rose against the dollar by updating yesterday's high, which was related to statements of representatives of the ECB on the theme of QE. Today, the ECB's chief economist, Peter Pret refuted the view that the Central Bank carried out a program of quantitative easing does not allow the government of the eurozone countries to carry out the necessary reforms, as a result of the program the cost of borrowing is very low. Pret also said that criticism of the aggressive policy of the ECB should be thinking about what would happen if such measures were not taken. "This would lead to deflation and perhaps depression," - said Pret. Meanwhile, a representative of the ECB Hansson said that he sees no compelling reason to consider the likelihood of policy change in December, knowing what we know today. He added that bank lending is restored, and the internal economy of the eurozone is quite stable.

A slight pressure is applied to the data for Germany. The results of a monthly survey GfK showed that German consumer confidence weakened again, registering with the third monthly decline in a row, which was caused by the deterioration of economic expectations of households and willingness to make large purchases. According to the data, forward-looking consumer confidence index in November fell to 9.4 points against 9.6 points in October. Last modified in line with expectations. We also add that the index reached the lowest level since February. Meanwhile, in a statement it reported that the index of economic expectations fell for the fifth time in a row in October - up 2.9 points from 6.4 points in September. The index fell below zero for the first time since May 2013 and was below its long-term average.

-

17:51

European Central Bank Governing Council member Christian Noyer: the central bank’s asset-buying programme is working

European Central Bank (ECB) Governing Council member Christian Noyer said in an interview with German newspaper Frankfurter Allgemeine Zeitung that the central bank's asset-buying programme is working, but more time is needed to get full effect.

"The current programme is functioning well. One cannot expect that it has its full effect after only six months. One has to give it time to bear its full fruit," he said.

-

16:48

European Central Bank Vice President Vitor Constancio: the central bank will continue its quantitative easing until the inflation will rise toward the central bank’s 2% target

European Central Bank (ECB) Vice President Vitor Constancio said on Wednesday that the central bank will continue its quantitative easing until the inflation will rise toward the central bank's 2% target.

"Our main policy rates will stay low for a prolonged period of time, in line with our forward guidance and the asset purchase programmes will keep our balance sheet expanding until we see a sustained adjustment in the path of inflation," he said.

Constancio pointed out that the monetary policy should not be used to resolve financial instability in asset markets.

-

15:32

Italian consumer confidence index climbs to 116.9 in October

The Italian statistical office ISTAT released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index climbed to 116.9 in October from 113.0 in September. September's figure was revised up from 112.7.

The increase was driven by rises in all components: economic, personal, current and future.

The business confidence index climbed to 105.9 in October from 104.4 in September. September's figure was revised up from 104.2.

-

15:30

U.S.: Crude Oil Inventories, October 3.376 (forecast 3.5)

-

14:54

Option expiries for today's 10:00 ET NY cut

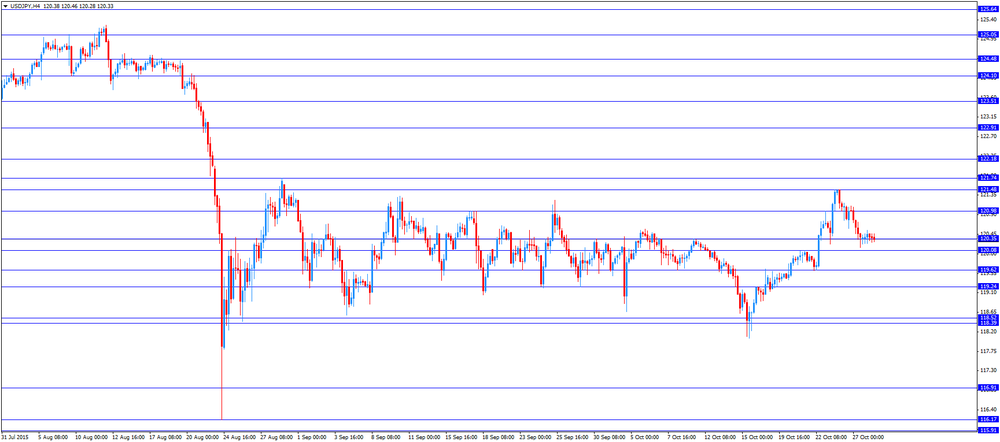

USD/JPY 120.00 (USD 738m) 120.15-20 (300m)

EUR/USD 1.1000 (EUR 567m) 1.1075-80 (1.6bln)

EUR/JPY 134.00 (EUR 440m)

-

14:33

European Central Bank (ECB) chief economist Peter Praet said in Riga on Wednesday that the central bank should use all instruments available to boost the inflation in the Eurozone

-

14:28

European Central Bank Executive Board member Benoit Coeure: further stimulus measures are needed to boost the Eurozone’s inflation as the inflation target could be missed

European Central Bank (ECB) Executive Board member Benoit Coeure said in a speech in Mexico City on Tuesday that further stimulus measures are needed to boost the Eurozone's inflation as the inflation target could be missed.

"If we see a risk that inflation would go back to 2 percent much less quickly or in a much more sluggish way than previously expected, that would imply that de facto real interest rates at this level would be higher," he said.

Coeure pointed out that the discussion about the deposit rate cut has started.

-

14:11

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, q/q Quarter III 0.7% 0.6% 0.5%

00:30 Australia CPI, y/y Quarter III 1.5% 1.7% 1.5%

00:30 Australia Trimmed Mean CPI q/q Quarter III 0.6% 0.5% 0.3%

00:30 Australia Trimmed Mean CPI y/y Quarter III 2.2% 2.4% 2.1%

07:00 Germany Gfk Consumer Confidence Survey November 9.6 9.4 9.4

07:45 France Consumer confidence October 97 97 96

11:00 U.S. MBA Mortgage Applications October 11.8% -3.5%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the Fed's monetary policy meeting results. It is unlikely that the Fed will change its monetary policy. Market participants will closely monitor Fed's statement for signals when the Fed plans to start raising its interest rates.

The euro traded higher against the U.S. dollar despite the negative economic data from the Eurozone. Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index fell to 9.4 in November from 9.6 in October, in line with expectations.

"Although this is the third consecutive drop in the consumer climate and the lowest level since February, the indicator is still very satisfactory. The excellent development of the retail sector is currently an important pillar of the consumer climate," Gfk noted.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index declined to 96 in October from 97 in September. Analysts had expected the index to remain unchanged at 97.

European Central Bank (ECB) Governing Council member Ardo Hansson said on Wednesday that there is no need for further stimulus measures in December.

"I don't see any convincing reason to consider further policy action in December knowing what we know today. If something very fundamental changes, we could perhaps re-evaluate, but now I don't see any need to take such a step," he said.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The weaker-than-expected economic data from the U.K. still weighed on the pound. The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the second quarter. It was the slowest pace since the fourth quarter of 2012.

EUR/USD: the currency pair rose to $1.1090

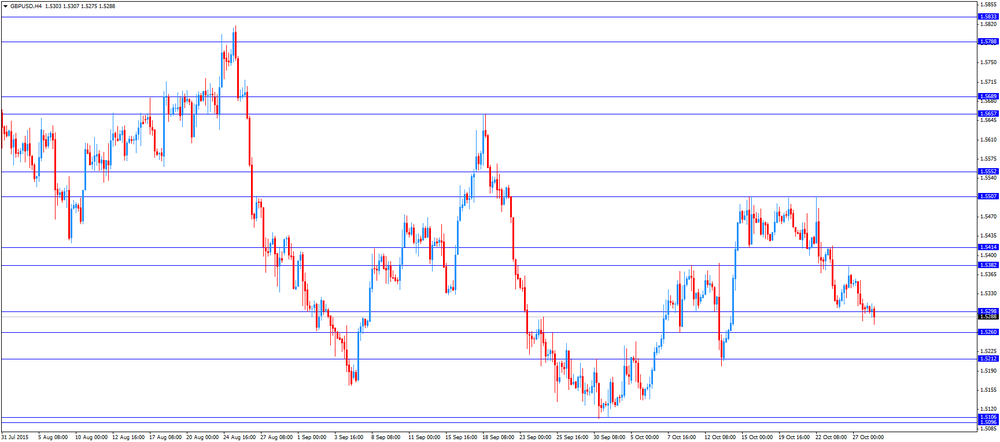

GBP/USD: the currency pair fell to $1.5275

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.75% 2.75%

20:00 New Zealand RBNZ Rate Statement

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.2% -0.5%

23:50 Japan Industrial Production (YoY) (Preliminary) September -0.4%

-

14:00

Orders

EUR/USD

Offers 1.1075-80 1.1100 1.1125 1.1150 1.1175-80 1.1200 1.1220 1.1250 1.1275 1.1300

Bids 1.1025-30 1.1000 1.0985 1.0960 1.0930 1.0900 1.0885 1.0850 1.0830 1.0800

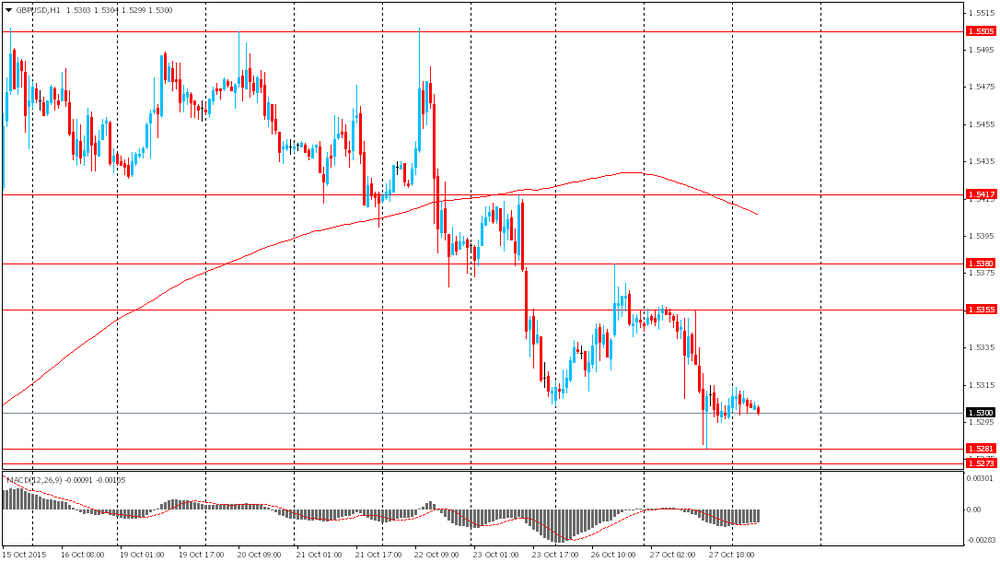

GBP/USD

Offers 1.5320-25 1.5355-60 1.5380-85 15400 1.5420-25 1.5445-50 1.5480 1.5500-10 1.5525-30 1.5550

Bids 1.5285 1.5265 1.5250 1.5220 1.5200 1.5175-80 1.5150 1.5130 1.5100 1.5085 1.5065 1.5050

EUR/GBP

Offers 0.7225-30 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100 0.7085 0.7050

EUR/JPY

Offers 133.20 133.50-60 133.75-80 134.00 134.20-25 134.50

Bids 132.70-75 132.50 132.25-30 132.00 131.80 131.50 131.30 131.00

USD/JPY

Offers 120.65 120.80 121.00 121.20 121.35 121.50 121.80 122.00 122.25 122.50

Bids 120.20-25 120.00 119.80-85 119.50 119.25-30 119.00 118.80 118.50

AUD/USD

Offers 0.7140 0.7180 0.720 0.7220 0.7250 0.7265 0.7280-85 0.7300 0.7325 0.7335 0.7350

Bids 0.7115-20 0.7100 0.7085 0.7065 0.7050 0.7030 0.7000 0.6985 0.6960 0.6930 0.6900

-

12:00

U.S.: MBA Mortgage Applications, October -3.5%

-

11:42

European Central Bank Governing Council member Ardo Hansson: there is no need for further stimulus measures in December

European Central Bank (ECB) Governing Council member Ardo Hansson said on Wednesday that there is no need for further stimulus measures in December.

"I don't see any convincing reason to consider further policy action in December knowing what we know today. If something very fundamental changes, we could perhaps re-evaluate, but now I don't see any need to take such a step," he said.

-

11:36

French consumer confidence index falls to 96 in October

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index declined to 96 in October from 97 in September.

Analysts had expected the index to remain unchanged at 97.

The index of the outlook on consumers' saving capacity fell to -5 in October from -2 in September.

The index of households' assessment of their financial situation in the past twelve months was up to -24 in October from -26 in September.

The index of the outlook on consumers' financial situation for next twelve months decreased to -10 in October from -7 in September.

The index of the outlook on unemployment rising in coming months climbed to 60 in October from 45 in the previous month.

The index for future inflation expectations dropped to -42 in October from -41 in September.

-

11:27

German Gfk consumer confidence index declines to 9.4 in November

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index fell to 9.4 in November from 9.6 in October, in line with expectations.

The decrease was driven by declines in 2 of 3 indicators.

The economic expectations index plunged by 9.3 points to -2.9 points in October, while the willingness to buy index fell 4.5 points to 45.9.

The income expectations index remained unchanged at 47.7 in October.

"Although this is the third consecutive drop in the consumer climate and the lowest level since February, the indicator is still very satisfactory. The excellent development of the retail sector is currently an important pillar of the consumer climate," Gfk noted.

-

11:21

German import prices decline 0.7% in September

Destatis released its import prices data for Germany on Wednesday. German import prices declined by 4.0% in September from last year, after a 3.1% fall in August.

The decline was driven by a drop in energy prices, which plunged 31.9% in September.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.7% in September, after a 1.5% fall in August.

On a yearly base, import prices excluding crude oil and mineral oil products climbed by 0.2% in August.

Export prices increased 0.3% year-on-year in September, after a 0.8% rise in August.

On a monthly base, export prices were down 0.3% in September, after a 0.5% decline in August.

-

11:11

Consumer prices in Australia climb 0.5% in the third quarter

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia rose 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% increase in the second quarter.

On a yearly basis, Australia's consumer price inflation remained unchanged at 1.5% in the third quarter, missing expectations for a rise to 1.7%.

The annual inflation was mainly driven by higher prices for education alcohol and health care.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) fell to 2.1% year-on-year in the third quarter from 2.2% in the second quarter, missing expectations for an increase to 2.4%.

-

11:04

Retail sales in Japan decline at an annual rate of 0.2% in September

According to the Ministry of Economy, Trade and Industry, retail sales in Japan declined at an annual rate of 0.2% in September, missing expectations for a 0.4% rise, after a 0.8% gain in August. It was the first drop in six months.

The decline was partly driven by lower fuel, and home electronics and cars sales.

Fuel sales slid 15.4% year-on-year in September.

-

10:49

Bank of Canada Deputy Governor Timothy Lane: the central bank may adjust its core inflation measure next year

The Bank of Canada (BoC) Deputy Governor Timothy Lane said in a speech on Tuesday that the central bank may adjust its core inflation measure next year.

"We are examining the properties of these measures of core inflation to determine whether the Bank should continue the practice of identifying one pre-eminent measure as its operational guide," he said.

Lane noted that underlying inflation in Canada is around 1.5% to 1.7%.

He also said that the depreciation of the Canadian dollar supported Canadian export and real economy.

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 738m) 120.15-20 (300m)

EUR/USD 1.1000 (EUR 567m) 1.1075-80 (1.6bln)

EUR/JPY 134.00 (EUR 440m)

-

10:36

UBS cuts its 2016 growth forecast for China

UBS cut its 2016 growth forecast for China due to increasing risks. The economy is expected to expand 6.2% in 2016, down from the previous estimate of a 6.5% growth.

"Despite seemingly better-than-expected near term growth, we see greater downward pressures for the economy in 2016. Property destocking has been sharper than previously envisaged, bringing with it a greater negative spillover effect on China's industrial and mining sectors, where much excess capacity remains," UBS China economist Wang Tao.

-

10:18

Bloomberg News poll: China’s central bank will not cut its lending and deposit interest rates further until 2017

According to a poll by Bloomberg News, China's central bank will not cut its lending and deposit interest rates further until 2017. The economy in China is expected to grow 6.9% in the fourth quarter, according to a poll.

-

10:11

European Central Bank chief economist Peter Praet: there are “no taboos” in case of expansion of the central bank’s asset-buying programme

European Central Bank (ECB) chief economist Peter Praet said in an interview on Tuesday that there were "no taboos" in case of expansion of the central bank's asset-buying programme. He already used the phrase "no taboos" in November 2014 before the ECB announced its decision to introduce its quantitative easing.

Praet noted that a risk was growing that the inflation in the Eurozone will not reach 2% target by 2017.

"We are in a situation where the timeframe for achieving the inflation objective risks once again to be moved back. We will assess this in December, notably in light of the new macroeconomic staff projections," he said.

-

08:46

France: Consumer confidence , October 96 (forecast 97)

-

08:46

France: Consumer confidence , October 96 (forecast 97)

-

08:32

Options levels on wednesday, October 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1226 (1989)

$1.1158 (1883)

$1.1109 (483)

Price at time of writing this review: $1.1043

Support levels (open interest**, contracts):

$1.0992 (3622)

$1.0941 (4009)

$1.0871 (5139)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 43879 contracts, with the maximum number of contracts with strike price $1,1500 (3316);

- Overall open interest on the PUT options with the expiration date November, 6 is 53671 contracts, with the maximum number of contracts with strike price $1,0900 (5139);

- The ratio of PUT/CALL was 1.22 versus 1.26 from the previous trading day according to data from October, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5601 (1252)

$1.5502 (2328)

$1.5404 (1496)

Price at time of writing this review: $1.5289

Support levels (open interest**, contracts):

$1.5196 (2908)

$1.5098 (1913)

$1.4999 (1733)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20995 contracts, with the maximum number of contracts with strike price $1,5350 (2562);

- Overall open interest on the PUT options with the expiration date November, 6 is 21401 contracts, with the maximum number of contracts with strike price $1,5200 (2908);

- The ratio of PUT/CALL was 1.02 versus 1.01 from the previous trading day according to data from October, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Gfk Consumer Confidence Survey, November 9.4 (forecast 9.4)

-

07:40

Foreign exchange market. Asian session: the U.S. dollar little changed ahead of Fed interest rate decision

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia CPI, q/q Quarter III 0.7% 0.6% 0.5%

00:30 Australia CPI, y/y Quarter III 1.5% 1.7% 1.5%

00:30 Australia Trimmed Mean CPI q/q Quarter III 0.6% 0.5% 0.3%

00:30 Australia Trimmed Mean CPI y/y Quarter III 2.2% 2.4% 2.1%

The U.S. dollar little changed ahead of Fed monetary policy decision, which will be announced later today. Most market participants expect the Federal Reserve to hold onto soft policy and postpone a rate increase till 2016. Tomorrow the central bank will only publish its monetary policy statement, there will be no conference. However investors will eye the statement to find clues on the timing of the first rate hike in nearly a decade.

The Australian dollar fell against the greenback amid sharp declines in commodity prices. Worse-than-expected inflation data also weighed on the AUD. The consumer price index rose by 0.5% in the third quarter compared to 0.6% expected and 0.7% previous. Consumer prices rose by 1.5% on an annualized basis, while economists had expected a 1.7% growth. Now market participants expect the Reserve Bank of Australia to lower its benchmark interest rate.

The Reserve Bank of New Zealand will hold a meeting today. The bank is expected to leave its key interest rate at 2.75% waiting for new economic data and moves of other central banks.

EUR/USD: the pair fell to $1.1020 in Asian trade

USD/JPY: the pair traded within Y120.25-55

GBP/USD: the pair traded within $1.5295-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Gfk Consumer Confidence Survey November 9.6 9.4

07:45 France Consumer confidence October 97 97

11:00 U.S. MBA Mortgage Applications October 11.8%

14:30 U.S. Crude Oil Inventories October 8.028 3.5

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.75% 2.75%

20:00 New Zealand RBNZ Rate Statement

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.2% -0.5%

23:50 Japan Industrial Production (YoY) (Preliminary) September -0.4%

-

01:32

Australia: CPI, q/q, Quarter III 0.5% (forecast 0.6%)

-

01:31

Australia: CPI, y/y, Quarter III 1.5% (forecast 1.7%)

-

01:31

Australia: Trimmed Mean CPI y/y, Quarter III 2.1% (forecast 2.4%)

-

01:30

Australia: Trimmed Mean CPI q/q, Quarter III 0.3% (forecast 0.5%)

-

00:50

Japan: Retail sales, y/y, September -0.2% (forecast 0.4%)

-

00:30

Currencies. Daily history for Oct 27’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1046 -0,05%

GBP/USD $1,5304 -0,29%

USD/CHF Chf0,986 +0,35%

USD/JPY Y120,39 -0,49%

EUR/JPY Y132,98 -0,55%

GBP/JPY Y184,23 -0,79%

AUD/USD $0,7199 -0,60%

NZD/USD $0,6767 -0,09%

USD/CAD C$1,3264 +0,79%

-