Noticias del mercado

-

21:12

U.S. stocks closed

U.S. stocks soared, after erasing earlier gains following the Federal Reserve's policy meeting statement, as banks and energy companies led a rally.

Equities had advanced into the afternoon Fed statement, boosted by Apple Inc. following its better-than-expected results and by energy shares as oil surged the most in eight weeks. A signal that policy makers are still considering an interest-rate increase this year briefly undercut the gains before banks jumped on the prospects for stronger profits.

The economy is still expanding at a "moderate" pace, Fed officials said as they left interest rates unchanged, and they will consider tightening policy at their next meeting in December without making a commitment to act this year. Even with a slower pace of recent job gains, labor market indicators show slack has diminished since early this year, the Federal Open Market Committee said.

The Fed removed a line from September's statement saying that global economic and financial developments "may restrain economic activity somewhat," saying only that the central bank is monitoring the international situation.

Policy makers last month opted to not raise rates after China's slowdown and its August currency devaluation added uncertainty to the global economic picture, sparking turmoil in financial markets. Markets have calmed this month, and a rate cut by China's central bank last week helped the S&P 500 erase a loss for the year.

The main U.S. equity gauge is poised for its best monthly gain in four years after rebounding almost 12 percent from an August low. Energy, raw-material and industrial shares have helped propel the October rally, the same groups that weighed heavily during the benchmark's worst quarter since 2011 amid concern that weakness in China would spread.

Uneven data, including weaker-than-forecast new-home sales and consumer confidence reports this week, have held down expectations for higher borrowing costs this year. After the Fed statement, traders priced in a 54 percent chance of a January rate increase, up from about 43 percent earlier today. The central bank has held the federal funds target rate in a range of zero to 0.25 percent since December 2008.

Investors are also look to quarterly results. PayPal Holdings Inc., Marriott International Inc. and Amgen Inc. are among 44 S&P 500 companies posting earnings today, with analysts projecting profits for index members dropped 6.1 percent in the third quarter. Of those that have released results this season, about 75 percent have exceeded profit projections, while 55 percent missed sales estim

-

20:00

DJIA 17651.45 70.02 0.40%, NASDAQ 5051.11 20.96 0.42%, S&P 500 2075.23 9.34 0.45%

-

18:34

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes was boosted by gains in Apple and energy stocks on Wednesday, ahead of the Federal Reserve's policy statement later in the day.

Apple (AAPL) sold 48 million iPhones in the latest reported quarter and reported a near doubling of revenue from China, allaying concerns about its business in the world's second-largest economy.

While the central bank is not expected to raise rates at the meeting, traders will parse the statement for clues on when it will pull the trigger.

Most of Dow stocks in positive area (20 of 30). Top looser - The Boeing Company (BA, -1.32%). Top gainer - Apple Inc. (AAPL, +2.81%).

Most of S&P index sectors in positive area. Top looser - Basic Materials (+2,3%). Top looser - Utilities (-0.3%).

At the moment:

Dow 17592.00 +79.00 +0.45%

S&P 500 2072.75 +12.25 +0.59%

Nasdaq 100 4643.75 +11.50 +0.25%

Oil 45.86 +2.66 +6.16%

Gold 1176.90 +11.10 +0.95%

U.S. 10yr 2.07 +0.04

-

18:00

European stocks closed: FTSE 6437.80 72.53 1.14%, DAX 10831.96 139.77 1.31%, CAC 40 4890.58 43.51 0.90%

-

17:59

European stocks close: stocks closed higher ahead of the release of the Fed's monetary policy meeting results

Stock indices closed higher ahead of the release of the Fed's monetary policy meeting results. It is unlikely that the Fed will change its monetary policy. Market participants will closely monitor Fed's statement for signals when the Fed plans to start raising its interest rates.

European Central Bank (ECB) Governing Council member Christian Noyer said in an interview with German newspaper Frankfurter Allgemeine Zeitung that the central bank's asset-buying programme is working, but more time is needed to get full effect.

"The current programme is functioning well. One cannot expect that it has its full effect after only six months. One has to give it time to bear its full fruit," he said.

ECB Vice President Vitor Constancio said on Wednesday that the central bank will continue its quantitative easing until the inflation will rise toward the central bank's 2% target.

Constancio pointed out that the monetary policy should not be used to resolve financial instability in asset markets.

ECB Governing Council member Ardo Hansson said on Wednesday that there is no need for further stimulus measures in December.

"I don't see any convincing reason to consider further policy action in December knowing what we know today. If something very fundamental changes, we could perhaps re-evaluate, but now I don't see any need to take such a step," he said.

Meanwhile, the economic data from the Europe was negative. Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index fell to 9.4 in November from 9.6 in October, in line with expectations.

"Although this is the third consecutive drop in the consumer climate and the lowest level since February, the indicator is still very satisfactory. The excellent development of the retail sector is currently an important pillar of the consumer climate," Gfk noted.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index declined to 96 in October from 97 in September. Analysts had expected the index to remain unchanged at 97.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,437.8 +72.53 +1.14 %

DAX 10,831.96 +139.77 +1.31 %

CAC 40 4,890.58 +43.51 +0.90 %

-

17:59

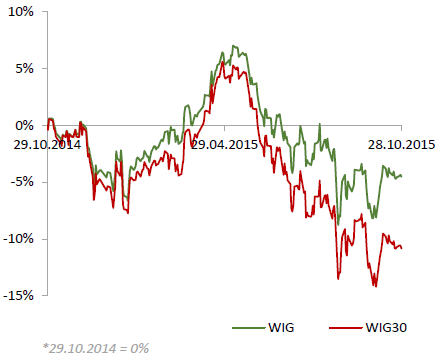

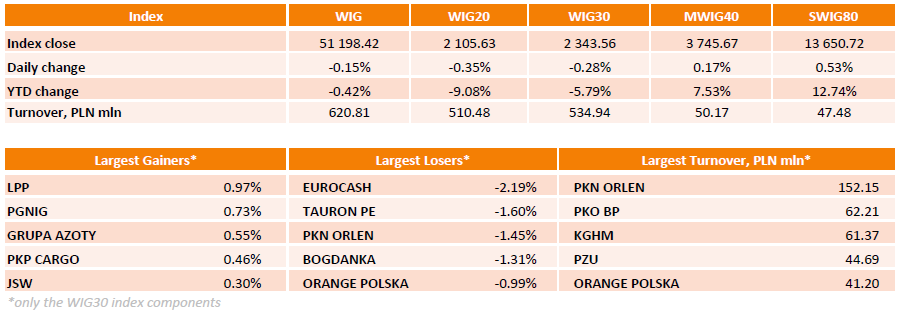

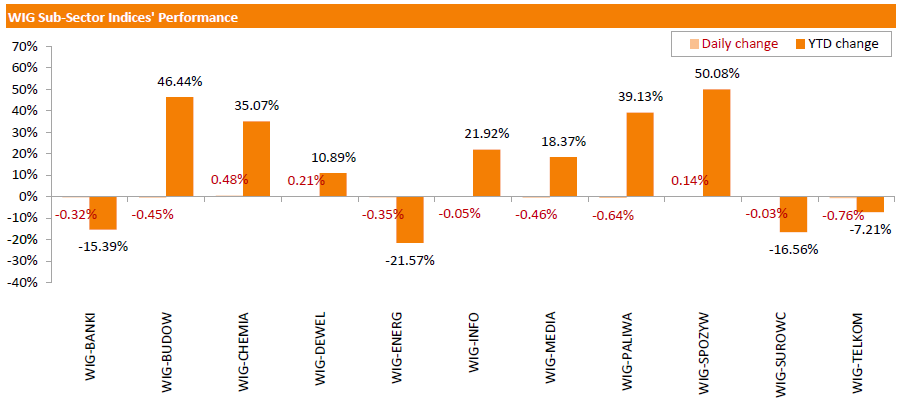

WSE: Session Results

Polish equity market closed lower on Wednesday. The broad market measure, the WIG index, lost 0.15%. Sector-wise, telecommunication stocks (-0.76%) and oil and gas sector names (-0.64%) fared the worst. On the contrary, chemicals (+0.48%) outperformed.

The large-cap stocks' measure, the WIG30 Index, fell by 0.28%. The decliners were led by EUROCASH (WSE: EUR), which tumbled by 2.19%. Other major laggards included TAURON PE (WSE: TPE), PKN ORLEN (WSE: PKN) and BOGDANKA (WSE: LWB), plunging by 1.6%, 1.45% and 1.31% respectively. On the other side of the ledger, LPP (WSE: LPP) and PGNIG (WSE: PGN) recorded the strongest daily results, advancing by 0.97% and 0.73% respectively.

-

17:51

European Central Bank Governing Council member Christian Noyer: the central bank’s asset-buying programme is working

European Central Bank (ECB) Governing Council member Christian Noyer said in an interview with German newspaper Frankfurter Allgemeine Zeitung that the central bank's asset-buying programme is working, but more time is needed to get full effect.

"The current programme is functioning well. One cannot expect that it has its full effect after only six months. One has to give it time to bear its full fruit," he said.

-

16:48

European Central Bank Vice President Vitor Constancio: the central bank will continue its quantitative easing until the inflation will rise toward the central bank’s 2% target

European Central Bank (ECB) Vice President Vitor Constancio said on Wednesday that the central bank will continue its quantitative easing until the inflation will rise toward the central bank's 2% target.

"Our main policy rates will stay low for a prolonged period of time, in line with our forward guidance and the asset purchase programmes will keep our balance sheet expanding until we see a sustained adjustment in the path of inflation," he said.

Constancio pointed out that the monetary policy should not be used to resolve financial instability in asset markets.

-

15:32

Italian consumer confidence index climbs to 116.9 in October

The Italian statistical office ISTAT released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index climbed to 116.9 in October from 113.0 in September. September's figure was revised up from 112.7.

The increase was driven by rises in all components: economic, personal, current and future.

The business confidence index climbed to 105.9 in October from 104.4 in September. September's figure was revised up from 104.2.

-

14:36

U.S. Stocks open: Dow +0.27%, Nasdaq -0.06%, S&P +0.15%

-

14:33

European Central Bank (ECB) chief economist Peter Praet said in Riga on Wednesday that the central bank should use all instruments available to boost the inflation in the Eurozone

-

14:28

European Central Bank Executive Board member Benoit Coeure: further stimulus measures are needed to boost the Eurozone’s inflation as the inflation target could be missed

European Central Bank (ECB) Executive Board member Benoit Coeure said in a speech in Mexico City on Tuesday that further stimulus measures are needed to boost the Eurozone's inflation as the inflation target could be missed.

"If we see a risk that inflation would go back to 2 percent much less quickly or in a much more sluggish way than previously expected, that would imply that de facto real interest rates at this level would be higher," he said.

Coeure pointed out that the discussion about the deposit rate cut has started.

-

14:20

Before the bell: S&P futures +0.13%, NASDAQ futures +0.18%

U.S. stock-index futures advanced before the Federal Reserve's policy statement.

Global Stocks:

Nikkei 18,903.02 +125.98 +0.67%

Hang Seng 22,956.57 -186.16 -0.80%

Shanghai Composite 3,375.16 -59.17 -1.72%

FTSE 6,391.28 +26.01 +0.41%

CAC 4,859.14 +12.07 +0.25%

DAX 10,736.72 +44.53 +0.42%

Crude oil $43.55 (+0.81%)

Gold $1174.20 (+0.72%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Apple Inc.

AAPL

116.68

1.86%

1.1M

Deere & Company, NYSE

DE

77.33

1.59%

1.3K

Barrick Gold Corporation, NYSE

ABX

7.65

1.32%

6.0K

Hewlett-Packard Co.

HPQ

27.80

1.28%

1.8K

Merck & Co Inc

MRK

54.00

0.99%

41.0K

Visa

V

78.25

0.94%

0.4K

Yahoo! Inc., NASDAQ

YHOO

34.55

0.73%

0.8K

Caterpillar Inc

CAT

70.80

0.58%

17.8K

UnitedHealth Group Inc

UNH

119.88

0.43%

0.1K

Starbucks Corporation, NASDAQ

SBUX

62.98

0.43%

2.1K

Wal-Mart Stores Inc

WMT

57.68

0.35%

0.2K

International Business Machines Co...

IBM

138.31

0.33%

2.2K

ALTRIA GROUP INC.

MO

61.25

0.31%

69.0K

Exxon Mobil Corp

XOM

81.33

0.30%

1.4K

Nike

NKE

131.20

0.29%

0.1K

Amazon.com Inc., NASDAQ

AMZN

612.64

0.27%

6.2K

Chevron Corp

CVX

87.90

0.23%

0.8K

Tesla Motors, Inc., NASDAQ

TSLA

210.80

0.21%

4.6K

Ford Motor Co.

F

14.77

0.20%

10.1K

Facebook, Inc.

FB

103.88

0.17%

29.9K

American Express Co

AXP

74.13

0.16%

0.1K

Google Inc.

GOOG

709.50

0.14%

1.9K

Intel Corp

INTC

34.50

0.09%

0.7K

JPMorgan Chase and Co

JPM

63.70

0.09%

6.3K

Procter & Gamble Co

PG

77.35

0.08%

0.6K

Citigroup Inc., NYSE

C

52.65

0.08%

1.0K

Goldman Sachs

GS

186.40

0.05%

1.0K

Cisco Systems Inc

CSCO

29.05

0.00%

11.2K

E. I. du Pont de Nemours and Co

DD

62.05

0.00%

0.4K

General Motors Company, NYSE

GM

34.97

0.00%

1.3K

General Electric Co

GE

29.44

-0.07%

1.9K

Microsoft Corp

MSFT

53.63

-0.11%

27.7K

Pfizer Inc

PFE

34.95

-0.11%

1.5K

Walt Disney Co

DIS

113.55

-0.19%

0.5K

ALCOA INC.

AA

8.70

-0.34%

7.0K

Yandex N.V., NASDAQ

YNDX

14.75

-1.60%

7.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.42

-1.64%

11.3K

Twitter, Inc., NYSE

TWTR

28.04

-10.53%

1.1M

-

13:46

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Buy from Hold at Stifel Research; target $34

Apple (AAPL) upgraded to Overweight from Sector Weight at Pacific Crest

Downgrades:

Other:

Twitter (TWTR) reiterated with a Sector Perform at RBC Capital; target lowered to $34 from $41

Twitter (TWTR) reiterated with a Buy at Pivotal Research; target $43

Apple (AAPL) target raised to $179 from $172 at Piper Jaffray

DuPont (DD) target raised to $65 from $62 at RBC Capital Mkts

-

13:35

-

12:00

European stock markets mid session: stocks traded higher ahead of the release of the Fed’s monetary policy meeting results

Stock indices traded higher ahead of the release of the Fed's monetary policy meeting results. It is unlikely that the Fed will change its monetary policy.

European Central Bank (ECB) Governing Council member Ardo Hansson said on Wednesday that there is no need for further stimulus measures in December.

"I don't see any convincing reason to consider further policy action in December knowing what we know today. If something very fundamental changes, we could perhaps re-evaluate, but now I don't see any need to take such a step," he said.

Meanwhile, the economic data from the Europe was negative. Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index fell to 9.4 in November from 9.6 in October, in line with expectations.

"Although this is the third consecutive drop in the consumer climate and the lowest level since February, the indicator is still very satisfactory. The excellent development of the retail sector is currently an important pillar of the consumer climate," Gfk noted.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index declined to 96 in October from 97 in September. Analysts had expected the index to remain unchanged at 97.

Current figures:

Name Price Change Change %

FTSE 100 6,391.19 +25.92 +0.41 %

DAX 10,764.02 +71.83 +0.67 %

CAC 40 4,865.63 +18.56 +0.38 %

-

11:42

European Central Bank Governing Council member Ardo Hansson: there is no need for further stimulus measures in December

European Central Bank (ECB) Governing Council member Ardo Hansson said on Wednesday that there is no need for further stimulus measures in December.

"I don't see any convincing reason to consider further policy action in December knowing what we know today. If something very fundamental changes, we could perhaps re-evaluate, but now I don't see any need to take such a step," he said.

-

11:36

French consumer confidence index falls to 96 in October

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index declined to 96 in October from 97 in September.

Analysts had expected the index to remain unchanged at 97.

The index of the outlook on consumers' saving capacity fell to -5 in October from -2 in September.

The index of households' assessment of their financial situation in the past twelve months was up to -24 in October from -26 in September.

The index of the outlook on consumers' financial situation for next twelve months decreased to -10 in October from -7 in September.

The index of the outlook on unemployment rising in coming months climbed to 60 in October from 45 in the previous month.

The index for future inflation expectations dropped to -42 in October from -41 in September.

-

11:27

German Gfk consumer confidence index declines to 9.4 in November

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index fell to 9.4 in November from 9.6 in October, in line with expectations.

The decrease was driven by declines in 2 of 3 indicators.

The economic expectations index plunged by 9.3 points to -2.9 points in October, while the willingness to buy index fell 4.5 points to 45.9.

The income expectations index remained unchanged at 47.7 in October.

"Although this is the third consecutive drop in the consumer climate and the lowest level since February, the indicator is still very satisfactory. The excellent development of the retail sector is currently an important pillar of the consumer climate," Gfk noted.

-

11:21

German import prices decline 0.7% in September

Destatis released its import prices data for Germany on Wednesday. German import prices declined by 4.0% in September from last year, after a 3.1% fall in August.

The decline was driven by a drop in energy prices, which plunged 31.9% in September.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.7% in September, after a 1.5% fall in August.

On a yearly base, import prices excluding crude oil and mineral oil products climbed by 0.2% in August.

Export prices increased 0.3% year-on-year in September, after a 0.8% rise in August.

On a monthly base, export prices were down 0.3% in September, after a 0.5% decline in August.

-

11:11

Consumer prices in Australia climb 0.5% in the third quarter

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia rose 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% increase in the second quarter.

On a yearly basis, Australia's consumer price inflation remained unchanged at 1.5% in the third quarter, missing expectations for a rise to 1.7%.

The annual inflation was mainly driven by higher prices for education alcohol and health care.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) fell to 2.1% year-on-year in the third quarter from 2.2% in the second quarter, missing expectations for an increase to 2.4%.

-

11:04

Retail sales in Japan decline at an annual rate of 0.2% in September

According to the Ministry of Economy, Trade and Industry, retail sales in Japan declined at an annual rate of 0.2% in September, missing expectations for a 0.4% rise, after a 0.8% gain in August. It was the first drop in six months.

The decline was partly driven by lower fuel, and home electronics and cars sales.

Fuel sales slid 15.4% year-on-year in September.

-

10:49

Bank of Canada Deputy Governor Timothy Lane: the central bank may adjust its core inflation measure next year

The Bank of Canada (BoC) Deputy Governor Timothy Lane said in a speech on Tuesday that the central bank may adjust its core inflation measure next year.

"We are examining the properties of these measures of core inflation to determine whether the Bank should continue the practice of identifying one pre-eminent measure as its operational guide," he said.

Lane noted that underlying inflation in Canada is around 1.5% to 1.7%.

He also said that the depreciation of the Canadian dollar supported Canadian export and real economy.

-

10:36

UBS cuts its 2016 growth forecast for China

UBS cut its 2016 growth forecast for China due to increasing risks. The economy is expected to expand 6.2% in 2016, down from the previous estimate of a 6.5% growth.

"Despite seemingly better-than-expected near term growth, we see greater downward pressures for the economy in 2016. Property destocking has been sharper than previously envisaged, bringing with it a greater negative spillover effect on China's industrial and mining sectors, where much excess capacity remains," UBS China economist Wang Tao.

-

10:18

Bloomberg News poll: China’s central bank will not cut its lending and deposit interest rates further until 2017

According to a poll by Bloomberg News, China's central bank will not cut its lending and deposit interest rates further until 2017. The economy in China is expected to grow 6.9% in the fourth quarter, according to a poll.

-

10:11

European Central Bank chief economist Peter Praet: there are “no taboos” in case of expansion of the central bank’s asset-buying programme

European Central Bank (ECB) chief economist Peter Praet said in an interview on Tuesday that there were "no taboos" in case of expansion of the central bank's asset-buying programme. He already used the phrase "no taboos" in November 2014 before the ECB announced its decision to introduce its quantitative easing.

Praet noted that a risk was growing that the inflation in the Eurozone will not reach 2% target by 2017.

"We are in a situation where the timeframe for achieving the inflation objective risks once again to be moved back. We will assess this in December, notably in light of the new macroeconomic staff projections," he said.

-

07:43

Global Stocks: U.S. stock indices declined ahead of Fed monetary policy decision

U.S. stock indices mostly retreated on Monday ahead of Federal Reserve monetary policy decision.

The Dow Jones Industrial Average fell 41.62, or 0.2%, to 17,581.43. The S&P 500 declined 5.29 points, or 0.3%, to 2,065.89 (its energy sector fell 1.2%). The Nasdaq Composite Index slid 4.56, or 0.09%, to 5,030.15.

A report by Markit Economics showed that the U.S. services sector continued expanding in October, but at a slower pace than in September. The preliminary Services PMI declined to 54.4 compared to September final reading of 55.1. Economists expected the index to be unchanged.

Meanwhile a preliminary report by the Conference Board showed that the consumer confidence index fell to 97.6 in October from 102.6 in September (revised from 103.0), while economists had expected a 103.0 points reading. The index of expectations declined to 88.0 in October compared to 90.8 in September, while the current assessment index fell to 112.1 points from 120.3 points.

This morning in Asia Hong Kong Hang Seng fell 0.58%, or 133.25, to 23,009.48. China Shanghai Composite Index lost 0.69%, or 23.78, to 3.410.56. The Nikkei added 0.52%, or 97.08, to 18,874.12.

Asian indices are trading mixed ahead of Fed and BOJ meetings (today and on Friday respectively).

Chinese stocks declined after UBS Group AG cut China's growth forecast for 2016 to 6.2%.

-

03:05

Nikkei 225 18,881.21 +104.17 +0.55 %, Hang Seng 23,071.49 -71.24 -0.31 %, Shanghai Composite 3,418.96 -15.37 -0.45 %

-

00:31

Stocks. Daily history for Sep Oct 27’2015:

(index / closing price / change items /% change)

Nikkei 225 18,777.04 -170.08 -0.90 %

Hang Seng 23,142.73 +26.48 +0.11 %

Shanghai Composite 3,434.27 +4.69 +0.14 %

FTSE 100 6,365.27 -51.75 -0.81 %

CAC 40 4,847.07 -50.06 -1.02 %

Xetra DAX 10,692.19 -109.15 -1.01 %

S&P 500 2,065.89 -5.29 -0.26 %

NASDAQ Composite 5,030.15 -4.56 -0.09 %

Dow Jones 17,581.43 -41.62 -0.24 %

-