Noticias del mercado

-

21:24

U.S. stocks closed

A rally in U.S. stocks stalled Thursday, after equities reached a two-month high, as investors weighed corporate earnings and prospects for higher interest rates this year.

The Standard & Poor's 500 Index was little changed at 2,089.40 at 4 p.m. in New York, near the highest level since Aug. 18, after briefly erasing losses in the final half hour. The gauge is up 8.8 percent in October, poised for its best month in four years, boosted by gains in commodity producers and technology shares.

Fed officials yesterday forecast moderate growth, and dropped a reference to global risks in a policy statement following a two-day meeting. They also referred to their "next meeting" on Dec. 15-16 as they discussed the timing for raising interest rates. Traders are now pricing in a 52 percent chance of liftoff in December, compared with as low as 30 percent last week. Prior to the Fed meeting, March was the first month showing at least even odds for a rate increase.

Data continues to be the Fed's guide toward an eventual rate boost, and a report today showed the economy expanded at a slower pace in the third quarter as companies took advantage of gains in consumer and business spending to reduce bloated stockpiles. A separate measure showed contract signings to purchase previously owned homes unexpectedly fell in September by the most since the end of 2013, indicating the residential real estate market is cooling from its recent brisk pace.

October Rally

The S&P 500 has rebounded as much as 12 percent from an August low, rising Wednesday to its highest since Aug. 18 amid gains in banks and oil companies. The October rally has been spurred by advances in energy and raw-material shares, the same groups that helped drag the index to its worst quarter since 2011. Both are headed for their strongest monthly increase since 2011 amid easing concern that weakness in China will spread.

Corporate earnings season remains an influence on investor sentiment, with a little less than half of the companies in the S&P 500 yet to report. Of those that have reported, 76 percent beat profit projections, while 55 percent missed sales estimates. Chevron Corp., Exxon Mobil Corp. and Colgate-Palmolive Co. are among 21 companies scheduled to release results on Friday.

-

20:00

DJIA 17738.33 -41.19 -0.23%, NASDAQ 5073.11 -22.58 -0.44%, S&P 500 2087.24 -3.11 -0.15%

-

18:39

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes eased on Thursday after the Federal Reserve rekindled expectations of an interest rate hike in December and data suggested the economy was ready. The Fed, which kept rates unchanged at its policy meeting that ended Wednesday, downplayed concerns about global growth and indicated confidence in the U.S. job market's recovery. Data on Thursday underscored the strength in the labor market, showing that new applications for unemployment benefits remained near levels last seen in 1973.

Most of Dow stocks in negative area (22 of 30). Top looser - Pfizer Inc. (PFE, -1.92%). Top gainer - UnitedHealth Group Incorporated (UNH, +0.74%).

Most of S&P index sectors in negative area. Top looser - Conglomerates (+1,4%). Top gainer - Utilities (-1.1%).

At the moment:

Dow 17672.00 -30.00 -0.17%

S&P 500 2082.50 -2.00 -0.10%

Nasdaq 100 4663.50 -10.25 -0.22%

Oil 46.05 +0.11 +0.24%

Gold 1147.30 -28.80 -2.45%

U.S. 10yr 2.16 +0.07

-

18:00

European stocks close: stocks closed lower on the disappointing corporate earnings

Stock indices closed lower on the disappointing corporate earnings.

Meanwhile, the economic data from the Europe was mixed. The European Commission released its economic sentiment index for the Eurozone on Thursday. The index increased to 105.9 in October from 105.6 in September. Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by stronger confidence in the retail and construction sectors.

The industrial confidence index increased to -2.0 in October from -2.3 in September, beating expectations for a decline to -2.7. September's figure was revised down from -2.2.

The final consumer confidence index was down to -7.7 in October from -7.1 in September, in line with expectations.

The business climate index climbed to 0.44 in October from 0.36 in September. September's figure was revised up from 0.34. Analysts had expected the index to decline to 0.32.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany fell by 5,000 in October, exceeding expectations for a 4,000 decline, after a 1,000 increase in September. September's figure was revised down from a 3,000 rise.

The unemployment rate remained unchanged at 6.4% in October, in line with expectations.

The number of unemployed people was 1.87 million in September, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.5% in September.

Destatis released its consumer price data for Germany on Thursday. German preliminary consumer price index was flat in October, beating expectations for a 0.1% decline, after a 0.2% fall in September.

On a yearly basis, German preliminary consumer price index increased to 0.3% in October from 0.0% in September, exceeding expectations for a rise to 0.2%.

The annual increase was mainly driven by a rise in services prices, which were up 1.2% year-on-year in October.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Thursday. The number of mortgages approvals in the U.K. was down to 68,874 in September from 70,664 in August, missing expectations for an increase to 72,450. August's figure was revised down from 71,030.

Net lending to individuals in the U.K. increased by £4.85 billion in September, after a £4.7 billion gain in August. August's figure was revised up from a £4.3 billion increase.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.6% in October, exceeding expectations for a 0.5% rise, after a 0.5% increase in September.

On a yearly basis, house prices rose to 3.9% in October from 3.8% in September. Analysts had expected house prices to rise by 3.8%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,395.8 -42.00 -0.65 %

DAX 10,800.84 -31.12 -0.29 %

CAC 40 4,885.82 -4.76 -0.10 %

-

18:00

European stocks closed: FTSE 6395.80 -42.00 -0.65%, DAX 10800.84 -31.12 -0.29%, CAC 40 4885.82 -4.76 -0.10%

-

17:54

WSE: Session Results

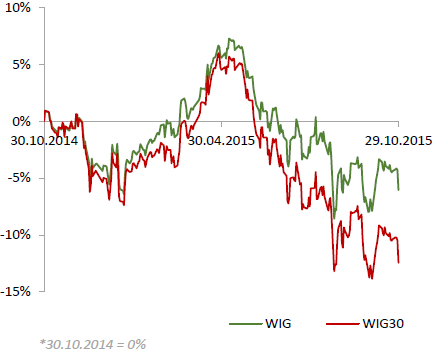

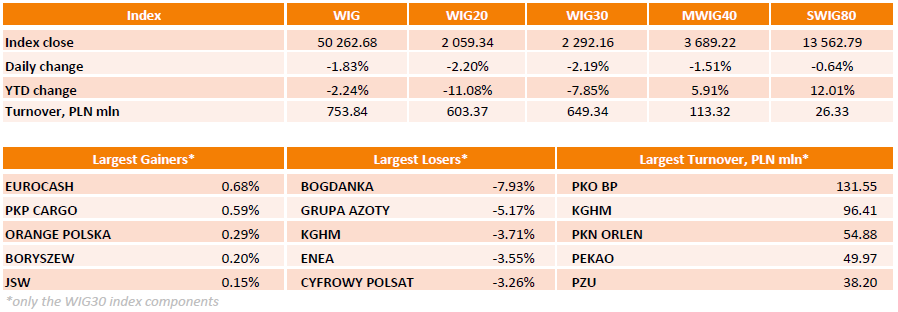

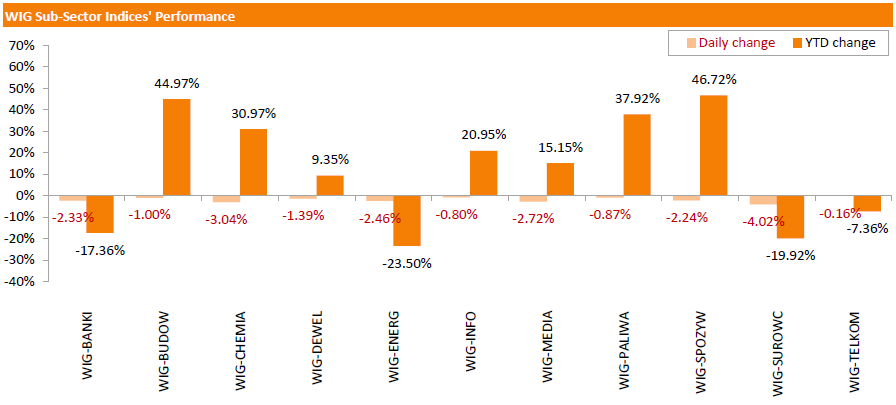

Polish equity market closed lower on Thursday. The broad marker measure, the WIG Index, plunged by 1.83%. All sectors in the WIG Index were down. Materials (-4.02%) fared the worst, followed by chemicals (-3.04%) and media sector (-2.72%).

The large-cap stocks' measure, the WIG30 Index, lost 2.19%. BOGDANKA (WSE: LWB) was the sharpest decliner among the indicator's constituents with its shares' quotations being beaten down 7.93% after the company reported a 29% y/y fall in Q3 net profit on lower coal sales. It was followed by GRUPA AZOTY (WSE: ATT), KGHM (WSE; KGH) and ENEA (WSE: ENA), dropping 5.17%, 3.71% and 3.55% respectively. On the other side of the ledger, EUROCASH (WSE: EUR) and PKP CARGO (WSE: PKP) were recorded as the biggest gainers, advancing 0.68% and 0.59% respectively.

-

17:47

Eurozone’s leading economic index is flat in September

The Conference Board released its leading economic index for the Eurozone on Wednesday. The leading economic index was flat in September, after a 0.2% rise in August.

The coincident economic index, which measures current economic activity, was up 0.1% in September, after a flat reading in August.

"The Euro Area Leading Economic Index was unchanged in September, and its six-month change has slowed in recent months, suggesting economic activity is unlikely to accelerate in the coming months," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

17:03

U.S. House of Representatives approves a budget deal

The U.S. House of Representatives approved a budget deal on Wednesday. 266 to 167 voted for the deal. 79 Republicans joined Democrats to approve the deal.

The deal means that debt limit was raised through March 2017.

Federal spending on defence and domestic programmes will rise over $80 billion for the next two years.

-

16:36

China’s new economic growth target could be 6.5%

China's Communist Party approved a five-year reform plan on Thursday. The plan will run from 2016 to 2020. No details were revealed.

Most analysts expect that the economic growth target will be downgraded to 6.5% from 7.0%. A 6.5% growth is needed to achieve the party's target of doubling GDP and per-capita income of both urban and rural residents by 2020.

China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

-

15:59

CBI retail sales balance slides to +19% in October

The Confederation of British Industry (CBI) released its retail sales balance data on Thursday. The CBI retail sales balance plunged to +19% in October from +49% in September.

Sales expectations for next month were down to +24% in October from +51% in September.

"Low inflation and improving wages mean the prospects for sales growth are decent, but challenges remain, like the weakening global economy and competitive pressures in the retail sector, so we can't take this positive outlook for granted," CBI Director of Economics, Rain Newton-Smith, said.

-

15:20

U.S. pending home sales plunge 2.3% in September

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. slid 2.3% in September, missing expectations for a 1.0% gain, after a 1.4% drop in August.

The decline was partly lead by a drop in the Northeast.

"There continues to be a dearth of available listings in the lower end of the market for first-time buyers, and realtors in many areas are reporting stronger competition than what's normal this time of year because of stubbornly-low inventory conditions. Additionally, the rockiness in the financial markets at the end of the summer and signs of a slowing U.S. economy may be causing some prospective buyers to take a wait-and-see approach," the NAR's chief economist Lawrence Yun said.

-

15:14

German consumer price inflation is flat in October

Destatis released its consumer price data for Germany on Thursday. German preliminary consumer price index was flat in October, beating expectations for a 0.1% decline, after a 0.2% fall in September.

On a yearly basis, German preliminary consumer price index increased to 0.3% in October from 0.0% in September, exceeding expectations for a rise to 0.2%.

The annual increase was mainly driven by a rise in services prices, which were up 1.2% year-on-year in October.

Goods prices dropped 0.8% year-on-year in October, driven by a decline in energy prices. Energy prices slid 8.6% year-on-year in October.

-

15:03

U.S. economy expands at 1.9% in the third quarter

The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased by 1.9% in the third quarter, missing expectations for a 1.6% gain, after a 3.9% rise in the second quarter.

The slower rise was mainly driven by a drop in private inventory investment.

Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

The personal consumption expenditures (PCE) price index rose 1.2% in the third quarter, missing expectations for a 3.2% gain, after a 2.2% increase in the second quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.3% in the third quarter, missing forecasts of a 1.4% rise, after a 1.9% gain in the second quarter.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation.

-

14:49

Canadian industrial product prices decline in September, while raw materials prices climb

Statistics Canada released its industrial product and raw materials price indexes on Thursday. The Industrial Product Price Index (IPPI) fell 0.3% in September, missing forecasts for a 0.1% drop, after a 0.3% decline in August.

The decrease was mainly driven by lower prices for energy and petroleum products, which slid 3.6% in September.

15 of the 21 commodity groups increased, 4 declined and 2 were unchanged.

The Raw Materials Price Index (RMPI) climbed 3.0% in September, after a 6.8% fall in August. August's figure was revised down from a 6.6% decline.

The rise was driven by higher prices for crude energy products. Crude energy products rose by 8.2% in September.

3 of the 6 commodity groups rose and 3 decreased.

-

14:41

Initial jobless claims increase by 1,000 to 260,000 in the week ending October 24

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 24 in the U.S. rose by 1,000 to 260,000 from 259,000 in the previous week.

Analysts had expected the initial jobless claims to increase to 263,000.

Jobless claims remained below 300,000 the 34th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 37,000 to 2,144,000 in the week ended October 17. It was the lowest level since November 2000.

-

14:34

U.S. Stocks open: Dow -0.23%, Nasdaq -0.51%, S&P -0.26%

-

14:26

Before the bell: S&P futures -0.42%, NASDAQ futures -0.60%

U.S. stock-index futures held declines after data showed the economy expanded at a slower pace.

Global Stocks:

Nikkei 18,935.71 +32.69 +0.17%

Hang Seng 22,819.94 -136.63 -0.60%

Shanghai Composite 3,388.07 +12.87 +0.38%

FTSE 6,372.78 -65.02 -1.01%

CAC 4,854.26 -36.32 -0.74%

DAX 10,786.14 -45.82 -0.42%

Crude oil $45.35 (-1.28%)

Gold $1153.00 (-1.96%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Pfizer Inc

PFE

36.15

1.97%

479.1K

ALTRIA GROUP INC.

MO

62.01

0.93%

1.0K

Procter & Gamble Co

PG

76.85

0.44%

8.2K

Boeing Co

BA

148.50

0.42%

0.2K

Barrick Gold Corporation, NYSE

ABX

7.71

0.26%

21.0K

UnitedHealth Group Inc

UNH

119.78

0.00%

5.5K

Starbucks Corporation, NASDAQ

SBUX

63.40

-0.17%

1.4K

Goldman Sachs

GS

190.94

-0.20%

0.5K

Wal-Mart Stores Inc

WMT

57.52

-0.21%

0.2K

Amazon.com Inc., NASDAQ

AMZN

615.70

-0.23%

0.4K

Facebook, Inc.

FB

103.93

-0.26%

5.4K

E. I. du Pont de Nemours and Co

DD

63.20

-0.27%

0.4K

Ford Motor Co.

F

14.93

-0.27%

105.8K

AMERICAN INTERNATIONAL GROUP

AIG

63.69

-0.31%

0.7K

Caterpillar Inc

CAT

71.70

-0.38%

1.4K

3M Co

MMM

157.46

-0.39%

0.1K

Google Inc.

GOOG

710.00

-0.41%

5.1K

McDonald's Corp

MCD

112.42

-0.46%

0.8K

Verizon Communications Inc

VZ

46.25

-0.49%

5.3K

AT&T Inc

T

33.25

-0.51%

0.1K

Intel Corp

INTC

34.53

-0.52%

1.8K

Walt Disney Co

DIS

113.75

-0.52%

2.8K

General Electric Co

GE

29.23

-0.54%

0.7K

Microsoft Corp

MSFT

53.69

-0.54%

12.3K

JPMorgan Chase and Co

JPM

65.14

-0.55%

4.3K

Citigroup Inc., NYSE

C

54.35

-0.60%

3.1K

Cisco Systems Inc

CSCO

29.18

-0.61%

3.2K

Apple Inc.

AAPL

118.45

-0.69%

207.9K

Tesla Motors, Inc., NASDAQ

TSLA

211.25

-0.80%

2.2K

The Coca-Cola Co

KO

42.38

-0.82%

0.8K

Twitter, Inc., NYSE

TWTR

30.61

-0.84%

29.4K

Visa

V

78.10

-0.98%

6.2K

ALCOA INC.

AA

8.90

-1.00%

2.6K

Yahoo! Inc., NASDAQ

YHOO

34.83

-1.01%

0.2K

Exxon Mobil Corp

XOM

81.34

-1.14%

0.5K

Chevron Corp

CVX

88.00

-1.99%

2.6K

Yandex N.V., NASDAQ

YNDX

15.38

-2.10%

1.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.53

-2.12%

13.8K

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) reiterated with a Buy at Topeka Capital Markets; target lowered to $136 from $138

-

13:34

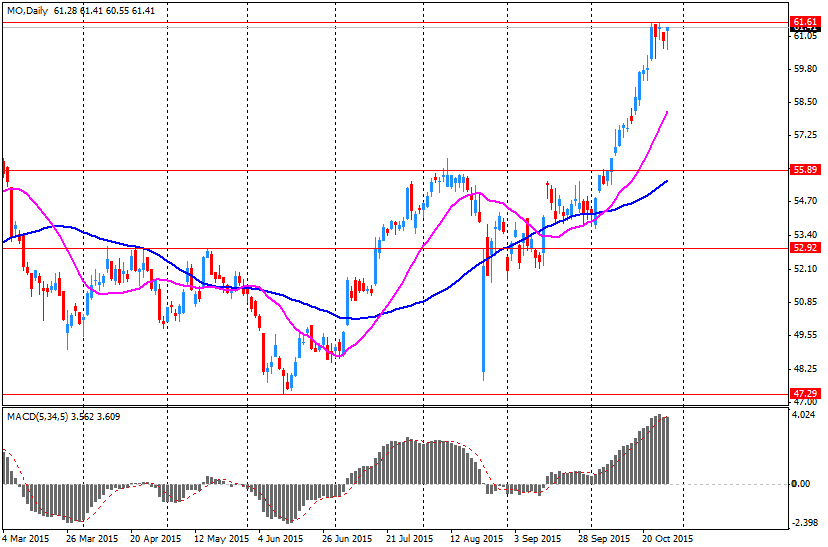

Company News: Altria (MO) posts good Q3 results

Altria reported Q3 earnings of $0.75 per share (versus $0.69 in Q3 FY 2014), slightly missing analysts' consensus of $0.76.

The company's revenues amounted to $4.978 bln (+4.7% y/y), beating consensus estimate of $4.903 bln.

The company reaffirmed its FY 2015 guidance with earnings expected to be within the range of $2.76 to $2.81 per share. The analysts' consensus forecast for the company's EPS FY 2015 stands at $2.81.

MO rose to $62.10 (+1.07%) in pre-market trading.

-

12:00

European stock markets mid session: stocks traded lower on the disappointing corporate earnings

Stock indices traded lower on the disappointing corporate earnings.

Meanwhile, the economic data from the Europe was mixed. The European Commission released its economic sentiment index for the Eurozone on Thursday. The index increased to 105.9 in October from 105.6 in September. Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by stronger confidence in the retail and construction sectors.

The industrial confidence index increased to -2.0 in October from -2.3 in September, beating expectations for a decline to -2.7. September's figure was revised down from -2.2.

The final consumer confidence index was down to -7.7 in October from -7.1 in September, in line with expectations.

The business climate index climbed to 0.44 in October from 0.36 in September. September's figure was revised up from 0.34. Analysts had expected the index to decline to 0.32.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany fell by 5,000 in October, exceeding expectations for a 4,000 decline, after a 1,000 increase in September. September's figure was revised down from a 3,000 rise.

The unemployment rate remained unchanged at 6.4% in October, in line with expectations.

The number of unemployed people was 1.87 million in September, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.5% in September.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Thursday. The number of mortgages approvals in the U.K. was down to 68,874 in September from 70,664 in August, missing expectations for an increase to 72,450. August's figure was revised down from 71,030.

Net lending to individuals in the U.K. increased by £4.85 billion in September, after a £4.7 billion gain in August. August's figure was revised up from a £4.3 billion increase.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.6% in October, exceeding expectations for a 0.5% rise, after a 0.5% increase in September.

On a yearly basis, house prices rose to 3.9% in October from 3.8% in September. Analysts had expected house prices to rise by 3.8%.

Current figures:

Name Price Change Change %

FTSE 100 6,386.51 -51.29 -0.80 %

DAX 10,828.93 -3.03 -0.03 %

CAC 40 4,871.5 -19.08 -0.39 %

-

11:55

Retail sales in Spain rise at a seasonally adjusted rate of 0.6% in September

The Spanish statistical office INE released its retail sales data on Thursday. Retail sales in Spain rose at a seasonally adjusted rate of 0.6% in September, after a 0.1% gain in August.

Food sales were down 0.5% in September, while non-food sales climbed by 0.7%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 4.3% in September, after a 3.0% rise in August. August's figure was revised down from a 3.1% gain.

Sales of non-food products jumped 5.8% in September from a year ago, while food sales declined 0.2%.

-

11:48

Preliminary consumer price inflation in Spain rises 0.7% in October

The Spanish statistical office INE released its preliminary consumer price inflation data on Thursday. Consumer price inflation in Spain was up 0.7% in October, after a 0.3% drop in September.

On a yearly basis, consumer prices fell by 0.7% in October, after a 0.9% decrease in September.

The annual decline was mainly driven by the decline in the prices of fuels and lubricants (diesel and petrol).

-

11:43

Nationwide: UK house prices rise 0.6% in October

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.6% in October, exceeding expectations for a 0.5% rise, after a 0.5% increase in September.

On a yearly basis, house prices rose to 3.9% in October from 3.8% in September. Analysts had expected house prices to rise by 3.8%.

"Over the past five months annual price growth has remained in a fairly narrow range between 3% and 4%, broadly consistent with earnings growth over the longer term. While this bodes well for a sustainable increase in housing market activity, much will depend on whether building activity can keep pace with increasing demand," Nationwide's chief economist, Robert Gardner, said.

-

11:39

Number of unemployed people in Germany declines by 5,000 in October

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany fell by 5,000 in October, exceeding expectations for a 4,000 decline, after a 1,000 increase in September. September's figure was revised down from a 3,000 rise.

The unemployment rate remained unchanged at 6.4% in October, in line with expectations.

The number of unemployed people was 1.87 million in September, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.5% in September.

-

11:29

Eurozone’s economic sentiment index is up to 105.9 in October

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index increased to 105.9 in October from 105.6 in September. Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by stronger confidence in the retail and construction sectors.

The industrial confidence index increased to -2.0 in October from -2.3 in September, beating expectations for a decline to -2.7. September's figure was revised down from -2.2.

The final consumer confidence index was down to -7.7 in October from -7.1 in September, in line with expectations.

The business climate index climbed to 0.44 in October from 0.36 in September. September's figure was revised up from 0.34. Analysts had expected the index to decline to 0.32.

-

11:21

Number of mortgages approvals in the U.K. fall to 68,874 in September

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Thursday. The number of mortgages approvals in the U.K. was down to 68,874 in September from 70,664 in August, missing expectations for an increase to 72,450. August's figure was revised down from 71,030.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. rose by £1.261 billion in September, beating expectations for a £1.100 billion increase, after a £1.163 billion gain in August. August's figure was revised up from £0.860 billion.

Net lending to individuals in the U.K. increased by £4.85 billion in September, after a £4.7 billion gain in August. August's figure was revised up from a £4.3 billion increase.

-

11:04

Preliminary industrial production in Japan climbs 1.0% in September

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Thursday evening. Preliminary industrial production in Japan climbed 1.0% in September, beating expectations for a 0.5% decrease, after a 1.2% drop in August.

The increase was mainly driven by rises in chemical, electronic parts and electrical machinery industry.

On a yearly basis, Japan's industrial production was down 0.9% in September, after a 0.4% decline in August.

-

10:39

Reserve Bank of New Zealand kept its monetary policy unchanged

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The RBNZ kept its interest rate unchanged at 2.75% as widely expected by analysts.

The central bank noted that further monetary policy easing is possible, but it will depend on the incoming economic data.

"To ensure that future average CPI inflation settles near the middle of the target range, some further reduction in the Official Cash Rate (OCR) seems likely," the RBNZ Governor Graeme Wheeler said.

He noted that the inflation was below the 1%-3% target range, driven by earlier strength in the New Zealand dollar and lower global oil prices. Wheeler expects the inflation to return within the target range by early 2016.

The RBNZ governor also said that strong house price inflation in Auckland is a risk to financial stability.

Wheeler noted that the recent rise in diary prices was contributed to improved household and business sentiment.

-

10:25

The Fed keeps its monetary unchanged in October but mentions that an interest rate hike in December is still on the table

The Fed released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.00%-0.25%. This decision was widely expected by analysts.

FOMC members voted 9-1 to keep interest rates unchanged. Only Richmond Fed President Jeffrey Lacker voted to raise interest rate by 0.25%.

The Fed pointed out that an interest rate hike in December is still on the table.

"In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation," the Fed said in its statement.

It seems that the Fed's assessment of current economic conditions changed as it removed the sentence "recent global economic and financial developments may restrain economic activity somewhat".

The Fed expects the U.S. economy to recover moderately, and the employment and inflation to move toward its targets.

-

10:11

European Central Bank chief economist Peter Praet defends the central bank’s monetary policy

European Central Bank (ECB) chief economist Peter Praet said in Riga on Wednesday that the central bank's quantitative easing was needed as the growth in the Eurozone was below the level it was before the financial crisis, and there were risks to longer-term inflation expectations.

He also said that the central bank should use all instruments available to boost the inflation in the Eurozone.

The value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

-

07:42

Global Stocks: U.S. stock indices gained after Fed signaled rate hike in December was possible

U.S. stock indices climbed on Wednesday after the Federal Reserve left its monetary policy unchanged, but gave a hint that a rate increase in December is possible.

The Dow Jones Industrial Average rose 198.09, or 1.1%, to 17,779.52. The S&P 500 gained 24.46 points, or 1.2%, to 2,090.35 (its financial sector rose 2.4%). The Nasdaq Composite Index added 65.55, or 1.3%, to 5,095.69.

Fed's statement did not mention its concern seen in September that market turbulence and worldwide events might hold back economic activity in the U.S. This does not guarantee a rate hike in the current year, but it signals that obstacles mentioned in September decreased.

Apple reported that it almost doubled its earnings in China thus dismissing concerns over its business in the world's second-biggest economy.

This morning in Asia Hong Kong Hang Seng fell 0.38%, or 87.43, to 22,869.14. China Shanghai Composite Index gained 0.12%, or 4.18, to 3.379.38. The Nikkei lost 0.15%, or 27.83, to 18,875.19.

Asian indices are trading mixed despite strong gains in U.S. equities.

Chinese stocks declined after better-than-expected industrial production data lowered chances for easing at Bank of Japan Friday meeting.

-

03:07

Nikkei 225 18,902.15 -0.87 0.00%, Hang Seng 22,956.55 -0.02 0.00%, Shanghai Composite 3,397.34 +22.14 +0.66 %

-

00:31

Stocks. Daily history for Sep Oct 28’2015:

(index / closing price / change items /% change)

Nikkei 225 18,903.02 +125.98 +0.67%

Hang Seng 22,956.57 -186.16 -0.80%

Shanghai Composite 3,375.16 -59.17 -1.72%

FTSE 100 6,437.8 +72.53 +1.14%

CAC 40 4,890.58 +43.51 +0.90%

Xetra DAX 10,831.96 +139.77 +1.31%

S&P 500 2,090.35 +24.46 +1.18%

NASDAQ Composite 5,095.69 +65.55 +1.30%

Dow Jones 17,779.52 +198.09 +1.13%

-