Noticias del mercado

-

16:52

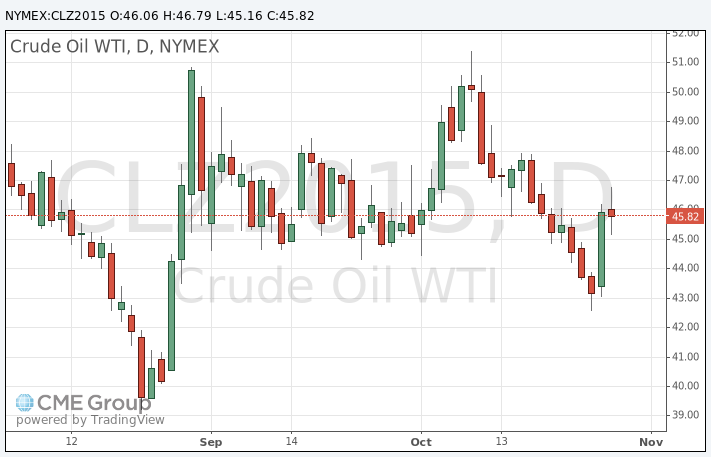

Oil prices decrease after yesterday’s significant rise

Oil prices declined after yesterday's significant rise. WTI crude yesterday rose more than 6%, while Brent crude increased more than 4%. U.S. crude oil inventories data supported yesterday's increase. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 3.38 million barrels to 480.0 million in the week to October 23. It was the fifth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories decreased by 1.1 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 785,000 barrels.

The U.S. GDP data weighed on oil prices. The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased by 1.9% in the third quarter, missing expectations for a 1.6% gain, after a 3.9% rise in the second quarter.

The slower rise was mainly driven by a drop in private inventory investment.

Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

WTI crude oil for December delivery declined to $45.16 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $49.01 a barrel on ICE Futures Europe.

-

16:41

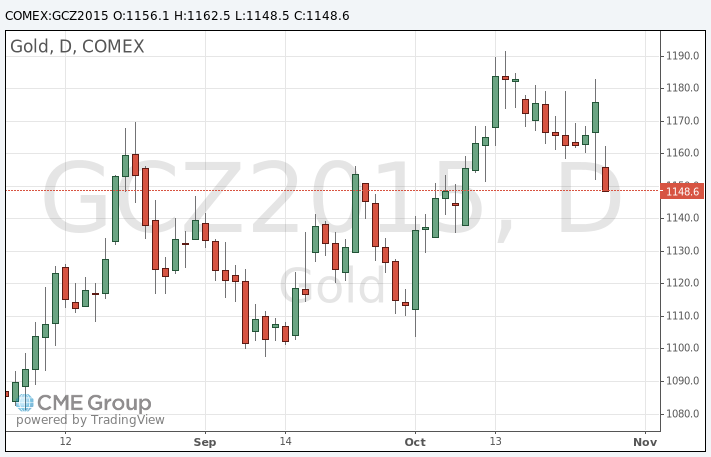

Gold price declines as an interest rate hike by the Fed this year is still possible

Gold price fall as an interest rate hike by the Fed this year is still possible. The Fed released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.00%-0.25%. This decision was widely expected by analysts.

The Fed pointed out that an interest rate hike in December is still on the table.

"In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation," the Fed said in its statement.

The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased by 1.9% in the third quarter, missing expectations for a 1.6% gain, after a 3.9% rise in the second quarter.

The slower rise was mainly driven by a drop in private inventory investment.

Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

December futures for gold on the COMEX today declined to 1150.10 dollars per ounce.

-

16:36

China’s new economic growth target could be 6.5%

China's Communist Party approved a five-year reform plan on Thursday. The plan will run from 2016 to 2020. No details were revealed.

Most analysts expect that the economic growth target will be downgraded to 6.5% from 7.0%. A 6.5% growth is needed to achieve the party's target of doubling GDP and per-capita income of both urban and rural residents by 2020.

China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

-

15:03

U.S. economy expands at 1.9% in the third quarter

The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased by 1.9% in the third quarter, missing expectations for a 1.6% gain, after a 3.9% rise in the second quarter.

The slower rise was mainly driven by a drop in private inventory investment.

Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

The personal consumption expenditures (PCE) price index rose 1.2% in the third quarter, missing expectations for a 3.2% gain, after a 2.2% increase in the second quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.3% in the third quarter, missing forecasts of a 1.4% rise, after a 1.9% gain in the second quarter.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation.

-

14:41

Initial jobless claims increase by 1,000 to 260,000 in the week ending October 24

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 24 in the U.S. rose by 1,000 to 260,000 from 259,000 in the previous week.

Analysts had expected the initial jobless claims to increase to 263,000.

Jobless claims remained below 300,000 the 34th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 37,000 to 2,144,000 in the week ended October 17. It was the lowest level since November 2000.

-

10:51

Thomson Reuters’ GFMS Gold Survey: gold price is expected to be below $1,100/oz in the fourth quarter 2015

Thomson Reuters released its GFMS Gold Survey on Wednesday. It expect gold price to be below $1,100/oz in the fourth quarter 2015, lower than the previous estimate of $1,175/oz. Thomson Reuters said in its survey that the uncertainty over the Fed's interest rate hike weighs on gold.

An annual average gold price is expected to be $1,159/oz in 2015, lower than the previous estimate of $1,180/oz.

Gold output in the third quarter 2015 was estimated at 851 tonnes.

Physical gold demand in the third quarter 2015 climbed by 7% year-on-year.

-

10:25

The Fed keeps its monetary unchanged in October but mentions that an interest rate hike in December is still on the table

The Fed released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.00%-0.25%. This decision was widely expected by analysts.

FOMC members voted 9-1 to keep interest rates unchanged. Only Richmond Fed President Jeffrey Lacker voted to raise interest rate by 0.25%.

The Fed pointed out that an interest rate hike in December is still on the table.

"In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation," the Fed said in its statement.

It seems that the Fed's assessment of current economic conditions changed as it removed the sentence "recent global economic and financial developments may restrain economic activity somewhat".

The Fed expects the U.S. economy to recover moderately, and the employment and inflation to move toward its targets.

-

07:47

Oil prices rebounded slightly, but remained under pressure

West Texas Intermediate futures for December delivery declined to $45.67 (-0.59%), while Brent crude retreated to $48.83 (-0.45%) amid profit taking after Wednesday's gains, which were generated by a smaller-than-expected buildup in U.S. crude inventories.

Federal Reserve's hints to a rate hike in December keep oil under pressure because higher rates would boost the dollar thus making dollar-denominated crude more expensive for importers using other currencies.

The Energy Information Administration reported on Wednesday that U.S. crude stockpile rose by 3.4 million barrels in the week to October 23, while the American Petroleum Institute had expected a 4.1 million-barrel growth. At the same time refinery utilization rate advanced to 87.6% from 86.4%.

-

07:44

Gold under pressure after Fed meeting

On Thursday gold slightly rebounded from its loss in the previous session, but still remained around its two-week low at $1,161.40 (-1.25%). Short-covering and physical demand helped the precious metal climb.

The Federal Reserve put pressure on bullion when it said in its monetary policy statement (this time the benchmark interest rate remained unchanged) that raising rates at the next meeting depends on the progress made on employment and inflation. Market participants will be closely watching U.S. economic data.

Holdings in SPDR Gold Trust, the biggest gold-backed exchange-traded fund in the world, fell 0.17% to 694.34 tonnes on Wednesday.

-

00:31

Commodities. Daily history for Sep Oct 28’2015:

(raw materials / closing price /% change)

Oil 46.07 +0.28%

Gold 1,157.40 -1.59%

-