Noticias del mercado

-

17:14

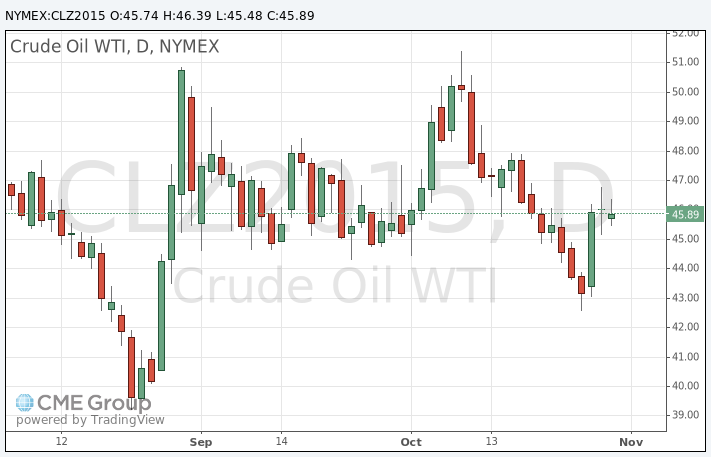

Oil prices increase, but concerns over the global oil oversupply continue to weigh on oil prices

Oil prices rose, but concerns over the global oil oversupply continued to weigh on oil prices.

Market participants continued to eye Wednesday's U.S. crude oil inventories data. U.S. crude inventories increased by 3.38 million barrels to 480.0 million in the week to October 23. It was the fifth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories decreased by 1.1 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 785,000 barrels.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported last Friday that the number of active U.S. rigs declined by 1 rigs to 594 last week. It was the eighth consecutive decrease.

WTI crude oil for December delivery increased to $46.39 a barrel on the New York Mercantile Exchange.

Brent crude oil for December rose to $49.12 a barrel on ICE Futures Europe.

-

16:23

Gold price falls on speculation that the Fed will start raising its interest rate this year

Gold price decline on speculation that the Fed will start raising its interest rate this year. The Fed released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.00%-0.25%. This decision was widely expected by analysts.

The Fed pointed out that an interest rate hike in December is still on the table.

"In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation," the Fed said in its statement.

The U.S. economic data remained mixed. The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending rose 0.1% in September, missing expectations for a 0.2% gain, after a 0.4% increase in August. It was the smallest increase since January.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

This data suggests that American consumers were cautious due to a slowdown abroad.

Personal spending was partly driven by higher demand for durable goods and services. Spending on durable goods rose 0.8% in September, while spending on services increased by 0.4%.

December futures for gold on the COMEX today declined to 1139.60 dollars per ounce.

-

14:00

U.S. personal spending climbs 0.1% in September, the smallest increase since January

The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending rose 0.1% in September, missing expectations for a 0.2% gain, after a 0.4% increase in August. It was the smallest increase since January.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

This data suggests that American consumers were cautious due to a slowdown abroad.

Personal spending was partly driven by higher demand for durable goods and services. Spending on durable goods rose 0.8% in September, while spending on services increased by 0.4%.

The saving rate climbed to 4.8% in September from 4.7% in August.

Personal income increased 0.1% in September, missing expectations for a 0.2% rise, after a 0.4% gain in August. It was the smallest rise since March.

August's figure was revised up from a 0.3% increase.

Wages and salaries were flat in September, after a 0.5% rise in August.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in September, missing forecasts of a 0.2% increase, after a 0.1% gain in August.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.3% in September.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

08:03

Oil prices declined

West Texas Intermediate futures for December delivery fell to $45.77 (-0.63%), while Brent crude retreated to $48.57 (-0.47%) after a report by the U.S. Department of Commerce showed that the economic growth of the world's biggest oil consumer slowed.

Now traders are getting ready for data on China's economic activity (world's second-biggest oil consumer). "Clearly China demand is a key question for energy markets at the moment. With the manufacturing PMI due Monday I wouldn't expect anyone getting too carried away," said Michael McCarthy, leading market strategist at CMC Markets.

Meanwhile total sales of refined products in the third quarter at Sinopec, China's biggest refiner, officially known as China Petroleum & Chemical, dropped 3.4% on an annualized basis. This is a weak result compared to a 5.3% rise in the first half of the year.

-

07:47

Gold stabilized after Thursday drop

Gold is currently at $1,148.50 (0.10%). This morning the precious metal stabilized after a sharp fall on Thursday, which was triggered by expectations that the Federal Reserve could still raise interest rates till the end of the year.

Some analysts say that gold may receive support from physical buying in China ahead of the Lunar New Year celebrations, but still fundamentals remain unfavorable.

-

01:02

Commodities. Daily history for Sep Oct 29’2015:

(raw materials / closing price /% change)

Oil 45.71 -0.76%

Gold 1,147.40 +0.01%

-