Noticias del mercado

-

18:09

Federal Reserve Bank of Kansas City President Esther George: the U.S. economy expands in line with trend in 2015

Federal Reserve Bank of Kansas City President Esther George said on Friday that the U.S. economy expands in line with trend in 2015. She noted that the U.S. labour market recovered "fairly rapidly".

"We have been fortunate to see a labour market that has healed fairly rapidly. You should continue to see confidence on the part of consumers in terms of having confidence in jobs," George said.

-

17:59

Bank of Japan Governor Haruhiko Kuroda: inflation starts move toward the central bank’s 2% target when the effect of low oil prices will dissipate

Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference on Friday that inflation starts move toward the central bank's 2% target when the effect of low oil prices will dissipate.

He pointed that the BoJ will adjust its quantitative easing if needed.

"We will make necessary adjustments to our program to achieve the 2% inflation target as soon as possible," Kuroda said.

-

17:53

San Francisco Federal Reserve President John Williams: the Fed has not made a decision on its interest rates

San Francisco Federal Reserve President John Williams said in an interview with The Associated Press on Friday that the Fed has not made a decision on its interest rates. He added that the Fed said the interest rate hike in December is possible to avoid surprising investors if it decides to raise its interest rates.

Williams pointed out that he wants to analyse more economic data in the coming weeks to decide if to vote for an interest rate hike or not.

-

17:45

Richmond Fed President Jeffrey Lacker explains his decision to vote for an interest rate hike

Richmond Fed President Jeffrey Lacker explained on Friday why he voted for an interest rate hike at the Fed's latest monetary policy meeting. He pointed out that "the steady growth in output and household spending" justify higher interest rates.

"I dissented because I believe that an increase in our interest rate target is needed, given current economic conditions and the medium-term outlook," Lacker said in a statement.

"My assessment was also supported by labor markets that had tightened considerably and my confidence that inflation will return to our 2 percent objective after the temporary effects of low energy and import prices have passed," he added.

-

17:37

Central Bank of Russia keeps its key interest rate unchanged at 11.0% in October

The Central Bank of Russia (CBR) kept its interest rate unchanged at 11.0% on Friday. This decision was not expected by analysts. Analysts had expected the interest rate cut.

But the central bank noted that it is ready to lower its interest rate further.

"As inflation slows down in line with the forecast, the Bank of Russia will continue with a downward revision of its key rate, at one of its forthcoming Board of Directors meetings. In making its rate decisions, the Bank of Russia will be guided by changes in the balance between inflation risks and the risks of economy cooling," the CBR said.

The central bank cut its interest rate five times in 2015.

-

17:28

GfK’s U.K. consumer confidence index declines to 2 in October

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index fell to 2 in October from 3 in September. Analysts had expected the index to increase to 4.

3 of 5 measures increased.

"The good news on the domestic front - with households lifted by wage growth, low interest rates and near-zero inflation - is being tempered by concerns about our ability to shrug off the global downturn," Joe Staton, Head of Market Dynamics at GfK, said.

-

17:20

Spain’s economy expands 0.8% the third quarter

The Spanish statistical office INE released its preliminary gross domestic product (GDP) for Spain on Friday. Spain's economy expanded 0.8% the third quarter, after a 1.0% growth in the second quarter.

It was the ninth consecutive increase.

On a yearly, GDP grew 3.4% in the third quarter, after a 3.1% in the second quarter. It was the fastest growth since the fourth quarter of 2007.

-

16:32

Greek retail sales climbed 11.3% in August

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Friday. Greek retail sales jumped 11.3% in August.

On a yearly basis, Greek retail sales fell by 2.2% in August, after a 7.3% drop in July.

Sales of food products decreased by 3.4% in August, sales of non-food products climbed by 2.9%, while sales of automotive fuel dropped by 3.4%.

-

16:19

Greek producer prices decrease 0.5% in September

The Hellenic Statistical Authority released its producer price index (PPI) data on Friday. Greek producer prices decreased 0.5% in September.

Domestic market prices fell by 0.5% in September, while foreign market prices slid 0.7%.

On a yearly basis, Greek PPI plunged 10.4% in September, after a 9.9% drop in August.

Domestic market prices slid 8.8% year-on-year in September, while foreign market prices dropped 15.2%.

Energy prices plunged 25.2% year-on-year, while non-durable consumer goods industrial prices were up 0.4% year-on-year.

-

16:08

Chicago purchasing managers' index jumps to 56.2 in October

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The Chicago purchasing managers' index climbed to 56.2 in October from 48.7 in September, exceeding expectations for an increase to 49.0. It was the highest reading since January.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was driven by a rise in production and in new orders. The production index rose to 63.4 in October from 43.6 in September, while the new orders index was up to 59.4 from 49.5.

The employment index fell to 50.6 in October from 52.3 in September.

"The disappointing September data look more like an aberration than the start of a trend, and the October results mark a good start to the final quarter of the year. Respondents were optimistic that orders will continue to pick-up, consistent with an acceleration in economic activity in Q4," Chief Economist of MNI Indicators Philip Uglow said.

-

15:55

Thomson Reuters/University of Michigan final consumer sentiment index rises to 90.0 in October

The Thomson Reuters/University of Michigan final consumer sentiment index increased to 90.0 in October from 87.2 in September, down from the preliminary estimate of 92.1 and missing expectations a rise to 92.5.

"Gains in employment, a near zero inflation rate, and less pressing material aspirations have provided consumers with a renewed sense of optimism about their future financial situation," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index rose to 102.3 in October from 101.2 in September, down from a preliminary reading of 106.7.

The index of consumer expectations was up to 82.1 in October from 78.2 in September, down from a preliminary reading of 82.7.

The inflation expectations for the next year declined to 2.7% in October from 2.8% in September.

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, October 90 (forecast 92.5)

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E631mn), $1.0900(E591mn), $1.0925(E1.12bn), $1.0950(E782mn), $1.0985(E350mn), $1.1000(E1.19bn)

USD/JPY: Y120.00($531mn), Y120.75($628mn), Y121.00($1.65bn), Y121.50($804mn), Y121.95-122.00($1.59bn)

GBP/USD: $1.5345(Gbp215mn) *USD/CHF: Chf0.9750($460mn), Chf0.9850($200mn)

AUD/USD: $0.6900(A$3.55bn), $0.7100(A$326mn), $0.7123-25(A$828mn), $0.7200(A$1.04bn)

Aud/JPY: Y83.10(A$250mn), Y87.50(A$205mn)

USD/CAD: C$1.3120($330mn), C$1.3250-65($341mn)

-

14:45

U.S.: Chicago Purchasing Managers' Index , October 56.2 (forecast 49)

-

14:41

Producer prices in Italy decrease 0.2% in September

The Italian statistical office Istat released its producer price inflation data for Italy on Friday. Italian producer prices decreased 0.2% in September, after a 0.6% decline in August. August's figure was revised up from a 0.7% drop.

Producer price declined by 0.2% on domestic market and by 0.1% on non-domestic market in September.

On a yearly basis, Italian PPI fell 3.0% in September, after a 2.8% drop in August. August's figure was revised up from a 2.9% fall.

Producer price slid 3.8% on domestic market and by 0.7% on non-domestic market in September.

-

14:37

Preliminary consumer prices in Italy increase 0.2% in October

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Friday. Preliminary consumer prices in Italy rose 0.2% in October, after a 0.4% fall in September.

The increase was mainly driven by a rise in prices of electricity, of gas and of unprocessed food. Prices of electricity jumped 2.9% in October, prices of gas rose 1.9%, while prices of unprocessed food were up 0.8%.

On a yearly basis, consumer prices climbed 0.3% in October, after a 0.2% increase in September.

The increase was driven by a rise in unprocessed food and higher prices for services related to recreation including repair and personal care. Prices for unprocessed food climbed 4.2% year-on-year in October, while prices for services related to recreation including repair and personal care rose 1.5% year-on-year.

Consumer price inflation excluding unprocessed food and energy prices remained unchanged at 0.8% year-on-year in October.

-

14:23

Italy’s unemployment rate decreases to 11.8% in September, the lowest level since December 2012

The Italian statistical office Istat released its unemployment data on Friday. The seasonally adjusted unemployment rate decreased to 11.8% in September from 11.9 in August. It was the lowest level since December 2012.

The number of unemployed people was 3.016 million in September, down by 1.1% from the month before.

The youth unemployment rate fell to 40.5% in September from 40.7% in August.

The employment rate decreased to 56.5% in September from 56.6% in August.

-

14:11

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies after the release of the weaker-than-expected U.S. personal spending data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence October -18.9 10.5

00:05 United Kingdom Gfk Consumer Confidence October 3 4 2

00:30 Australia Private Sector Credit, m/m September 0.6% 0.8%

00:30 Australia Producer price index, q / q Quarter III 0.3% 0.9%

00:30 Australia Producer price index, y/y Quarter III 1.1% 1.7%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

04:00 Japan Housing Starts, y/y September 8.8%

04:00 Japan Construction Orders, y/y September -15.6%

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted September -0.7% Revised From -0.4% 0.4% 0.0%

07:00 Germany Retail sales, real unadjusted, y/y September 2.1% Revised From 2.5% 4.2% 3.4%

08:00 Switzerland KOF Leading Indicator October 100.4 100 99.8

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October -0.1% 0% 0.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) October 0.9% 0.9% 1.0%

10:00 Eurozone Unemployment Rate September 10.9% Revised From 11% 11% 10.8%

12:30 Canada GDP (m/m) August 0.3% 0.1% 0.1%

12:30 U.S. Personal Income, m/m September 0.4% Revised From 0.3% 0.2% 0.1%

12:30 U.S. Personal spending September 0.4% 0.2% 0.1%

12:30 U.S. PCE price index ex food, energy, m/m September 0.1% 0.2% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September 1.3% 1.3%

The U.S. dollar traded mixed against the most major currencies after the release of the weaker-than-expected U.S. personal spending data. The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending rose 0.1% in September, missing expectations for a 0.2% gain, after a 0.4% increase in August. It was the smallest increase since January.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

This data suggests that American consumers were cautious due to a slowdown abroad.

Personal spending was partly driven by higher demand for durable goods and services. Spending on durable goods rose 0.8% in September, while spending on services increased by 0.4%.

The saving rate climbed to 4.8% in September from 4.7% in August.

Personal income increased 0.1% in September, missing expectations for a 0.2% rise, after a 0.4% gain in August. It was the smallest rise since March.

August's figure was revised up from a 0.3% increase.

Wages and salaries were flat in September, after a 0.5% rise in August.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in September, missing forecasts of a 0.2% increase, after a 0.1% gain in August.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.3% in September.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

The euro traded higher against the U.S. dollar after the positive economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.0% in October from -0.1% in September, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco to an annual rate of 1.0% in October from 0.9% in September. Analysts expected the inflation to remain unchanged.

Food, alcohol and tobacco prices were up 1.5% in October, non-energy industrial goods prices gained 0.4%, and services prices climbed 1.3%, while energy prices dropped 8.7%.

Eurozone's unemployment rate declined to 10.8% in September from 10.9% in August. It was the lowest reading since January 2012.

August's figure was revised down from 11.0%.

Analysts had expected the unemployment rate to rise to 11.0%.

There were 17.323 million unemployed in the Eurozone in September, down from 17.454 million in August.

The lowest unemployment rate in the Eurozone in September was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (25.0% in July 2015) and Spain (21.6%).

The youth unemployment rate was 22.1% in the Eurozone in September, compared to 23.4% in September a year ago.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar after the release of the Canadian GDP data. Canada's GDP growth rose 0.1% in August, in line with expectations, after a 0.3% gain in July.

The increase was driven by rises in manufacturing, mining, quarrying, and oil and gas extraction, and retail trade sector.

The mining, quarrying, and oil and gas extraction sector rose 0.4% in August, manufacturing output increased 0.4%, while the retail trade sector climbed 0.6%.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator declined to 99.8 in October from 100.3 in September, missing expectations for a fall to 100.0. August's figure was revised down from 100.4.

According to the institute, the outlook for the Swiss economy continued "digesting the exchange rate shock".

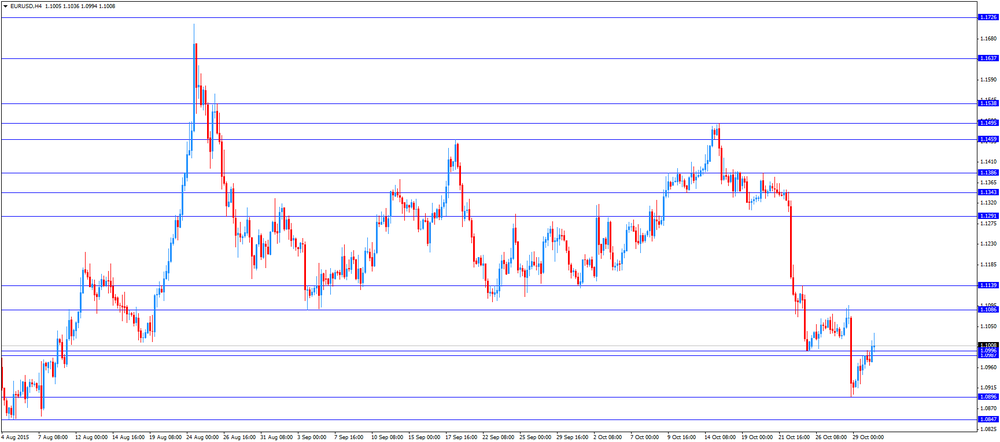

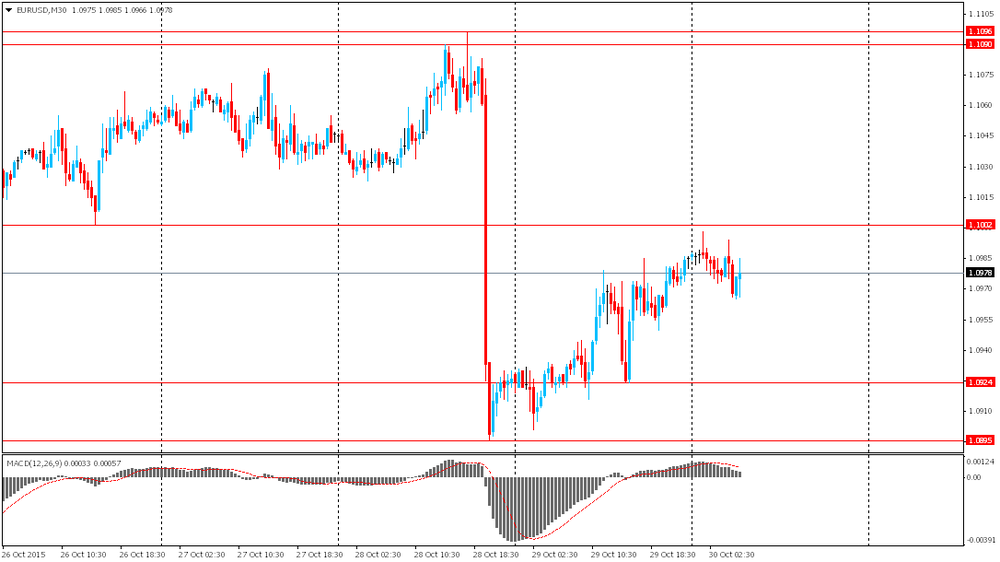

EUR/USD: the currency pair increased to $1.1036

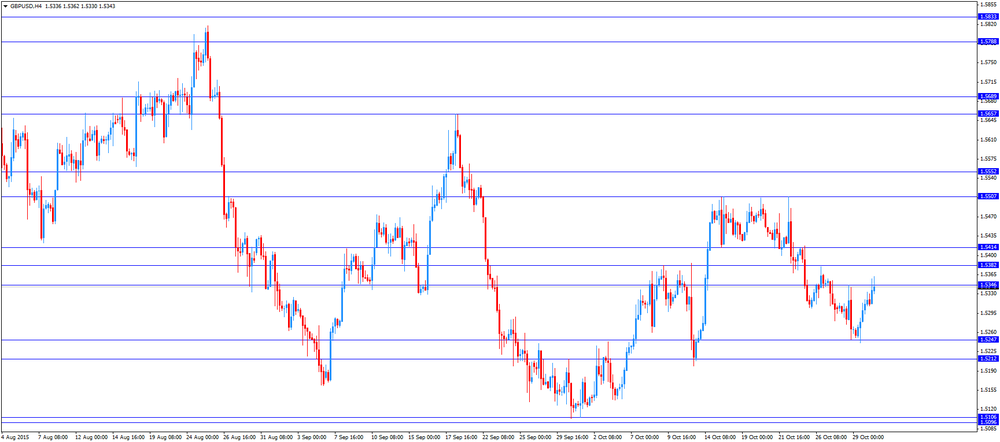

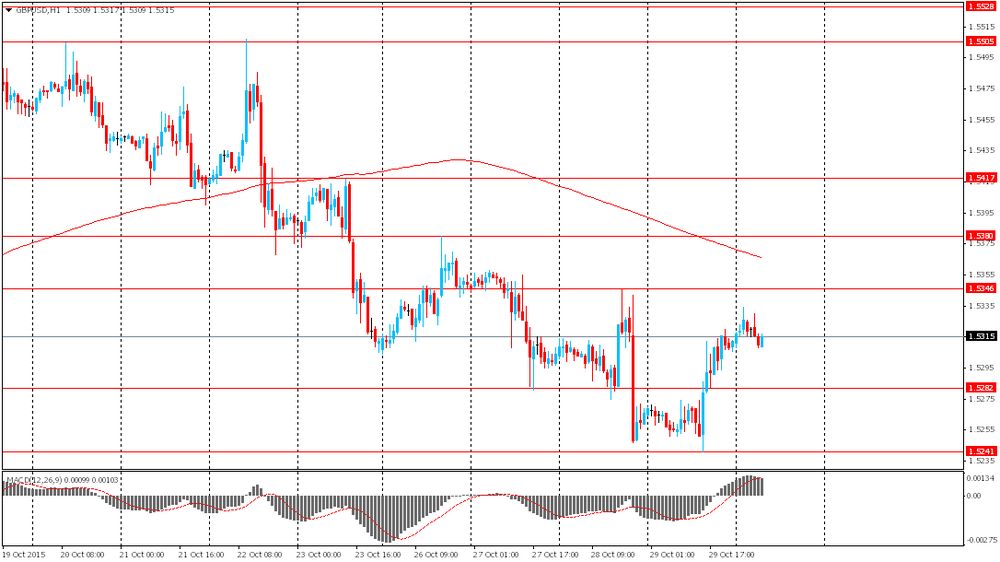

GBP/USD: the currency pair was up to $1.5362

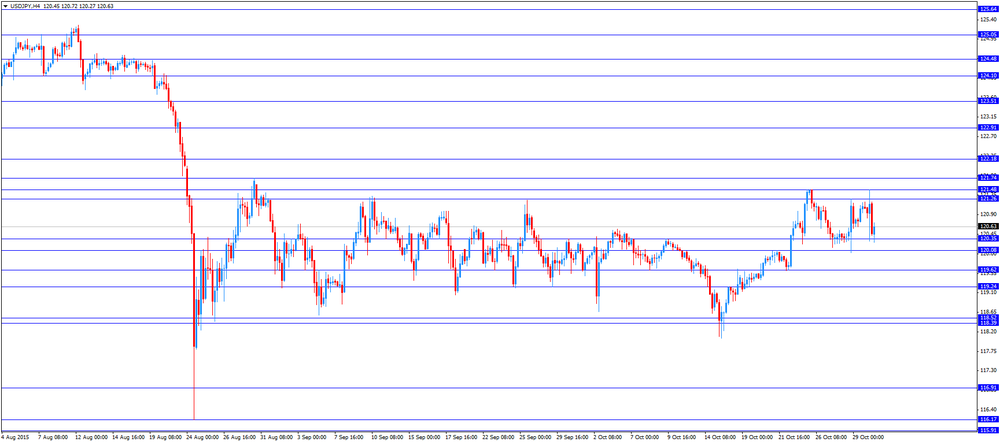

USD/JPY: the currency pair fell to Y120.27

The most important news that are expected (GMT0):

13:45 U.S. Chicago Purchasing Managers' Index October 48.7 49

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 87.2 92.5

14:00 U.S. FOMC Member Williams Speaks

-

14:00

U.S. personal spending climbs 0.1% in September, the smallest increase since January

The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending rose 0.1% in September, missing expectations for a 0.2% gain, after a 0.4% increase in August. It was the smallest increase since January.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

This data suggests that American consumers were cautious due to a slowdown abroad.

Personal spending was partly driven by higher demand for durable goods and services. Spending on durable goods rose 0.8% in September, while spending on services increased by 0.4%.

The saving rate climbed to 4.8% in September from 4.7% in August.

Personal income increased 0.1% in September, missing expectations for a 0.2% rise, after a 0.4% gain in August. It was the smallest rise since March.

August's figure was revised up from a 0.3% increase.

Wages and salaries were flat in September, after a 0.5% rise in August.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in September, missing forecasts of a 0.2% increase, after a 0.1% gain in August.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.3% in September.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:00

Orders

EUR/USD

Offers 1.1050 1.1075-80 1.1100 1.1140

Bids 1.0950 1.0920 1.0900 1.0885 1.0850 1.0830 1.0800

GBP/USD

Offers 1.5380-85 15400 1.5420-25 1.5445-50

Bids 1.5300-10 1.5250 1.5220 1.5200 1.5175-80 1.5150 1.5130 1.5100 1.5085 1.5065 1.5050

EUR/GBP

Offers 0.7180-85 0.7200 0.7220-25 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7145-50 0.7130 0.7100 0.7085 0.7050 0.7030 0.7000

EUR/JPY

Offers 133.50-60 133.75-80 134.00 134.20-25 134.50

Bids 132.20 132.00 131.50 131.30 131.00

USD/JPY

Offers 121.50 121.80 122.00

Bids 120.20-25 120.00 119.80-85 119.50 119.25-30 119.00

AUD/USD

Offers 0.7140 0.7180 0.720 0.7220 0.7250 0.7265 0.7280-85 0.7300

Bids 0.7080 0.7065 0.7050 0.7030 0.7000 0.6985 0.6960 0.6930 0.6900

-

13:38

Canada's GDP rises 0.1% in August

Statistics Canada released GDP (gross domestic product) growth data on Friday. Canada's GDP growth rose 0.1% in August, in line with expectations, after a 0.3% gain in July.

The increase was driven by rises in manufacturing, mining, quarrying, and oil and gas extraction, and retail trade sector.

The mining, quarrying, and oil and gas extraction sector rose 0.4% in August, manufacturing output increased 0.4%, while the retail trade sector climbed 0.6%.

-

13:30

U.S.: PCE price index ex food, energy, m/m, September 0.1% (forecast 0.2%)

-

13:30

Canada: GDP (m/m) , August 0.1% (forecast 0.1%)

-

13:30

U.S.: PCE price index ex food, energy, Y/Y, September 1.3%

-

13:30

U.S.: Personal Income, m/m, September 0.1% (forecast 0.2%)

-

13:30

U.S.: Personal spending , September 0.1% (forecast 0.2%)

-

11:52

French producer prices increase 0.1% in September

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices increased 0.1% in September, after a 1.0% decline in August.

The increase was driven a rise in prices for mining and quarrying products, energy and water, which were up 1.5% in September.

On a yearly basis, French PPI fell 2.6% in September, after a 2.1% drop in August.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 34.7 year-on-year in September.

Import prices decreased 0.5% in September, after a 1.5% fall in August.

-

11:44

French consumer spending is flat in September

French statistical office INSEE released its consumer spending data on Friday. French consumer spending was flat in September, after a 0.1% gain in August.

Spending on durable goods climbed by 1.4% in September, driven be higher car purchases.

Spending on food declined 0.6% in September, while spending on energy fell 0.1%.

On a yearly basis, consumer spending climbed 2.6% in September.

-

11:31

KOF leading indicator for Switzerland declines to 99.8 in October

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator declined to 99.8 in October from 100.3 in September, missing expectations for a fall to 100.0. August's figure was revised down from 100.4.

According to the institute, the outlook for the Swiss economy continued "digesting the exchange rate shock".

"A slight downward pressure on the KOF Economic Barometer results from indicators in the sectors banking, construction and hotels and catering. The downward pressure is cushioned by improved prospects for consumption and a stable development of the manufacturing sector and of the export opportunities. However, the changes in all these indicators bundles in October are very small," the KOF said.

-

11:26

German adjusted retail sales are flat in September

Destatis released its retail sales for Germany on Friday. German adjusted retail sales were flat in September, missing forecasts of a 0.4% gain, after a 0.7% drop in August. August's figure was revised down from a 0.4% decrease.

On a yearly basis, German retail sales jumped 3.4% in September, missing expectations for a 4.2% gain, after a 2.1% rise in August. August's figure was revised down from a 2.5% increase.

Sales of non-food products increased at an annual rate of 3.5% in September, while sales of food products climbed by 2.0%.

-

11:20

Eurozone's unemployment rate drops to 10.8% in September, the lowest reading since January 2012

Eurostat released its unemployment data for the Eurozone on Friday. Eurozone's unemployment rate declined to 10.8% in September from 10.9% in August. It was the lowest reading since January 2012.

August's figure was revised down from 11.0%.

Analysts had expected the unemployment rate to rise to 11.0%.

There were 17.323 million unemployed in the Eurozone in September, down from 17.454 million in August.

The lowest unemployment rate in the Eurozone in September was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (25.0% in July 2015) and Spain (21.6%).

The youth unemployment rate was 22.1% in the Eurozone in September, compared to 23.4% in September a year ago.

-

11:13

Preliminary consumer price inflation in the Eurozone rises to 0.0% year-on-year in October

Eurostat released its consumer price inflation data for the Eurozone on Friday. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.0% in October from -0.1% in September, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco to an annual rate of 1.0% in October from 0.9% in September. Analysts expected the inflation to remain unchanged.

Food, alcohol and tobacco prices were up 1.5% in October, non-energy industrial goods prices gained 0.4%, and services prices climbed 1.3%, while energy prices dropped 8.7%.

-

11:02

Bank of Japan cuts its growth and inflation forecasts

The Bank of Japan (BoJ) downgraded its growth and inflation forecasts. The inflation for the fiscal year 2015 ending on March 31 is expected to be 0.1%, down from the previous estimate of 0.7% (the BoJ said last year that the inflation in Japan will reach 2% in 2015).

The central bank expects the inflation to be 1.4% in 2016, down from the previous estimate of 1.9%, and 1.8% in 2017.

Japan's economy is expected to expand 1.2% in the fiscal year 2015, down from the previous estimate of 1.7%, 1.4% in 2016, down from the previous estimate of 1.5%, and 0.3% in 2017, up from the previous estimate of 0.2%.

-

11:02

Eurozone: Harmonized CPI ex EFAT, Y/Y, October 1.0% (forecast 0.9%)

-

11:00

Eurozone: Unemployment Rate , September 10.8% (forecast 11%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, October 0.0% (forecast 0%)

-

10:56

Bank of Japan keeps its monetary policy unchanged in October

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts. But some analysts speculated that the central could add further stimulus measures.

The BoJ board members voted 8-1 to keep monetary policy unchanged. The BoJ board member, Takahide Kiuchi, said again that the central bank should cut its asset purchases to 45 trillion yen annually.

BoJ Governor Haruhiko Kuroda said on October 16 that the consumer price inflation trend was improving, adding that the consumer price inflation excluding fresh food and energy increased more than 1%. He noted that "domestic demand is on track to strengthen".

-

10:48

Japan's national CPI excluding fresh food remains unchanged at an annual rate of -0.1% in September

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) declined to an annual rate of 0.0% in September from 0.2% in August.

Japan's national CPI excluding fresh food remained unchanged at an annual rate of -0.1% in September, beating expectations for a drop to -0.2%.

The decline was driven by fuel prices. Fuel prices dropped 7.1% year-on-year in September.

Household spending in Japan fell 0.4% year-on-year in September, after a 2.9% rise in August.

-

10:30

Average weekly earnings of Canadian non-farm payroll employees increases 0.8% in August

Statistics Canada released its average weekly earnings data of Canadian non-farm payroll employees on Thursday. Average weekly earnings of Canadian non-farm payroll employees increased 0.8% in August year-on-year.

Weekly earnings were C$947 in August

Employees in Canada worked an average 32.8 hours per week in August, down from 33.0 in the same month a year earlier.

Total non-farm employment declined by 58,600 month-on-month in August.

-

10:22

YouGov/Citi survey: expectations for inflation in the U.K. in the next 12 months fall in October

According to a monthly YouGov/Citi survey, expectations for inflation in the U.K. in the next 12 months fell in October. Inflation expectations declined to 1.4% in October from 1.5% in September.

Expectations for inflation over the next five to 10 years remained unchanged at 2.7%.

-

10:10

European Central Bank (ECB) Executive Board member Sabine Lautenschlaeger: a long period of low interest rates could have a negative impact on the business models of certain banks

European Central Bank (ECB) Executive Board member Sabine Lautenschlaeger said in an interview to German newspaper Handelsblatt on Thursday that a long period of low interest rates could have a negative impact on the business models of certain banks.

"Banks can cope with a short phase of low interest rates. When this lasts for longer, the viability of the business models of certain institutions and how well they cope with a slump in their interest income come into question," she said.

Lautenschlaeger added that those banks may need more capital to offset a drop in their interest income.

-

09:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E631mn), $1.0900(E591mn), $1.0925(E1.12bn), $1.0950(E782mn), $1.0985(E350mn), $1.1000(E1.19bn)

USD/JPY: Y120.00($531mn), Y120.75($628mn), Y121.00($1.65bn), Y121.50($804mn), Y121.95-122.00($1.59bn)

GBP/USD: $1.5345(Gbp215mn) *USD/CHF: Chf0.9750($460mn), Chf0.9850($200mn)

AUD/USD: $0.6900(A$3.55bn), $0.7100(A$326mn), $0.7123-25(A$828mn), $0.7200(A$1.04bn)

Aud/JPY: Y83.10(A$250mn), Y87.50(A$205mn)

USD/CAD: C$1.3120($330mn), C$1.3250-65($341mn)

-

09:00

Switzerland: KOF Leading Indicator, October 99.8 (forecast 100)

-

08:26

Options levels on friday, October 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1167 (1628)

$1.1094 (2253)

$1.1041 (1262)

Price at time of writing this review: $1.0982

Support levels (open interest**, contracts):

$1.0916 (4273)

$1.0858 (5501)

$1.0822 (1595)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 50847 contracts, with the maximum number of contracts with strike price $1,1200 (4085);

- Overall open interest on the PUT options with the expiration date November, 6 is 54484 contracts, with the maximum number of contracts with strike price $1,0900 (5501);

- The ratio of PUT/CALL was 1.17 versus 1.07 from the previous trading day according to data from October, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.5601 (1220)

$1.5501 (2428)

$1.5403 (1645)

Price at time of writing this review: $1.5338

Support levels (open interest**, contracts):

$1.5294 (2637)

$1.5197 (2861)

$1.5099 (1920)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 21449 contracts, with the maximum number of contracts with strike price $1,5350 (2553);

- Overall open interest on the PUT options with the expiration date November, 6 is 21533 contracts, with the maximum number of contracts with strike price $1,5200 (2861);

- The ratio of PUT/CALL was 1.00 versus 1.03 from the previous trading day according to data from October, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Retail sales, real adjusted , September 0.0% (forecast 0.4%)

-

08:00

Germany: Retail sales, real unadjusted, y/y, September 3.4% (forecast 4.2%)

-

07:32

Foreign exchange market. Asian session: the New Zealand dollar rose amid business confidence data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence October -18.9 10.5

00:05 United Kingdom Gfk Consumer Confidence October 3 4 2

00:30 Australia Private Sector Credit, m/m September 0.6% 0.8%

00:30 Australia Producer price index, q / q Quarter III 0.3% 0.9%

00:30 Australia Producer price index, y/y Quarter III 1.1% 1.7%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

The yen was volatile this morning. At the beginning of the session it gained substantially against the U.S. dollar after the Board of Bank of Japan voted 8-1 to continue increasing monetary base at annual pace of 80 trln yen. However later the yen fell as investors awaited BOJ Governor Kuroda's press conference to see clues on the monetary policy's future.

The New Zealand dollar rose amid a positive report on business confidence published by ANZ. The corresponding index rose to 10.5% in October from -18.9 reported previously. Business confidence data allow to analyze the economic situation in the short-term future. A higher reading suggests greater investment, which is favorable for production. Activity outlook came in at 23.7% vs 16.7% in the previous survey.

EUR/USD: the pair fluctuated within $1.0965-95 in Asian trade

USD/JPY: the pair rose to Y121.45

GBP/USD: the pair traded within $1.5310-35

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted September -0.4% 0.4%

07:00 Germany Retail sales, real unadjusted, y/y September 2.5% 4.2%

08:00 Switzerland KOF Leading Indicator October 100.4 100

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October -0.1% 0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) October 0.9% 0.9%

10:00 Eurozone Unemployment Rate September 11% 11%

12:30 Canada GDP (m/m) August 0.3% 0.1%

12:30 U.S. Personal Income, m/m September 0.3% 0.2%

12:30 U.S. Personal spending September 0.4% 0.2%

12:30 U.S. PCE price index ex food, energy, m/m September 0.0%

12:30 U.S. PCE price index ex food, energy, Y/Y September 0.3%

13:45 U.S. Chicago Purchasing Managers' Index October 48.7 49

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 87.2 92.5

14:00 U.S. FOMC Member Williams Speaks

-

03:59

Japan: BoJ Interest Rate Decision, 0%

-

01:30

Australia: Producer price index, q / q, Quarter III 0.9%

-

01:30

Australia: Producer price index, y/y, Quarter III 1.7%

-

01:30

Australia: Private Sector Credit, m/m, September 0.8%

-

01:04

United Kingdom: Gfk Consumer Confidence, October 2 (forecast 4)

-

01:01

Currencies. Daily history for Oct 29’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0985 +0,54%

GBP/USD $1,5312 +0,30%

USD/CHF Chf 0,9889 -0,50%

USD/JPY Y121,05 -0,04%

EUR/JPY Y132,98 +0,50%

GBP/JPY Y185,34 +0,25%

AUD/USD $0,7079 -0,28%

NZD/USD $0,6692 -0,15%

USD/CAD C$1,3165 -0,24%

-

01:00

New Zealand: ANZ Business Confidence, October 10.5

-

00:31

Japan: National CPI Ex-Fresh Food, y/y, September -0.1% (forecast -0.2%)

-

00:31

Japan: Tokyo CPI ex Fresh Food, y/y, October -0.2% (forecast -0.1%)

-

00:30

Japan: Tokyo Consumer Price Index, y/y, October 0.1%

-

00:30

Japan: National Consumer Price Index, y/y, September 0.0%

-

00:30

Japan: Unemployment Rate, September 3.4% (forecast 3.4%)

-

00:01

Schedule for today, Friday, Oct 30’2015:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence October -18.9

00:05 United Kingdom Gfk Consumer Confidence October 3 4

00:30 Australia Private Sector Credit, m/m September 0.6%

00:30 Australia Producer price index, q / q Quarter III 0.3%

00:30 Australia Producer price index, y/y Quarter III 1.1%

03:00 Japan BoJ Interest Rate Decision 0%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

04:00 Japan Housing Starts, y/y September 8.8%

04:00 Japan Construction Orders, y/y September -15.6%

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted September -0.4% 0.4%

07:00 Germany Retail sales, real unadjusted, y/y September 2.5% 4.2%

08:00 Switzerland KOF Leading Indicator October 100.4 100

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October -0.1% 0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) October 0.9%

10:00 Eurozone Unemployment Rate September 11% 11%

12:30 Canada GDP (m/m) August 0.3% 0.1%

12:30 U.S. Personal Income, m/m September 0.3% 0.2%

12:30 U.S. Personal spending September 0.4% 0.2%

12:30 U.S. PCE price index ex food, energy, m/m September 0.0%

12:30 U.S. PCE price index ex food, energy, Y/Y September 0.3%

13:45 U.S. Chicago Purchasing Managers' Index October 48.7 49

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 87.2 92.5

14:00 U.S. FOMC Member Williams Speaks

-