Noticias del mercado

-

21:00

New Zealand: RBNZ Interest Rate Decision, 3.50% (forecast 3.50%)

-

20:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

17:32

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies ahead of the Fed's interest rate decision

The U.S. dollar traded higher against the most major currencies ahead of the Fed's interest rate decision. Investors expect that the Fed might keep its interest rate on hold for a longer period as recent released U.S. economic has been mixed. They are awaiting new signs for further monetary policy in the U.S.

The euro traded lower against the U.S. dollar. The Gfk German consumer confidence index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator increased to 1.42 points in December from 1.29 points in November.

Speculation that the Swiss National Bank (SNB) was intervening in the market still weighed on the Swiss franc. The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on Tuesday that the central bank is prepared to intervene in markets.

The New Zealand dollar traded lower against the U.S. dollar ahead the Reserve Bank of New Zealand's interest rate decision. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback despite the weaker-than-expected consumer inflation from Australia. Australia's consumer price index climbed 0.2% in the fourth quarter, missing forecasts of a 0.3% rise, after a 0.5% increase in the third quarter.

On a yearly basis, Australia's consumer price inflation declined to 1.7% in the fourth quarter from 2.3% in the third quarter, missing expectations for a rise to 1.8%.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan. In the overnight trading session, the yen traded mixed against the greenback.

-

16:30

U.S.: Crude Oil Inventories, January +8.9

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E545mn), $1.1400(E849mn)

USD/JPY: Y117.75($200mn), Y118.00($200mn), Y118.40($450mn), Y119.00($240mn)

GBP/USD: $1.5175(stg200mn),

AUD/USD: $0.7990(A$942mn), $0.8025(A$398mn)

NZD/USD: $0.7650(NZ$598mn)

-

14:00

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar despite the better-than-expected Gfk German consumer confidence index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, y/y Quarter IV +2.3% +1.8% +1.7%

00:30 Australia CPI, q/q Quarter IV +0.5% +0.3% +0.2%

07:00 Germany Gfk Consumer Confidence Survey February 9.0 9.1 9.3

07:00 Switzerland UBS Consumption Indicator December 1.29 1.42

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Investors expect that the Fed might keep its interest rate on hold for a longer period as recent released U.S. economic has been mixed. They are awaiting new signs for further monetary policy in the U.S.

The euro traded mixed against the U.S. dollar despite the better-than-expected Gfk German consumer confidence index. The index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. Switzerland's UBS consumption indicator increased to 1.42 points in December from 1.29 points in November.

Speculation that the Swiss National Bank (SNB) was intervening in the market still weighed on the Swiss franc. The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on Tuesday that the central bank is prepared to intervene in markets.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.5218

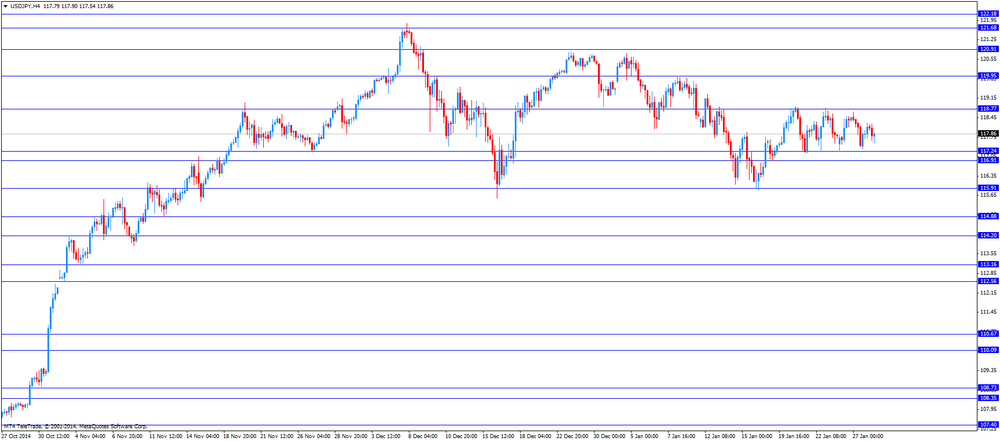

USD/JPY: the currency pair fell to $117.54

The most important news that are expected (GMT0):

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -213 -27

23:50 Japan Retail sales, y/y December +0.4% +0.9%

-

13:50

Orders

EUR/USD

Offers $1.1500, $1.1445/60, $1.1400

Bids $1.1220

GBP/USD

Offers $1.5300

Bids $1.5125/20, $1.5100

AUD/USD

Offers $0.8100

Bids $0.7950, $0.7910/00, $0.7850, $0.7815

EUR/JPY

Offers Y135.50, Y135.00, Y134.45/50, Y134.00

Bids Y133.10/00, Y132.10/00

USD/JPY

Offers Y119.00, Y118.30/35, Y118.00

Bids Y117.50, Y117.10/00, Y116.95/85

-

13:27

Gfk German consumer confidence index climbed to the highest level since November 2001

Market research company GfK released its consumer confidence index for Germany on Wednesday. The Gfk German consumer confidence index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Gfk said that "the upward trend is continuing in the consumer climate, and the outlook for consumer spending is looking increasingly brighter".

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E545mn), $1.1400(E849mn)

USD/JPY: Y117.75($200mn), Y118.00($200mn), Y118.40($450mn), Y119.00($240mn)

GBP/USD: $1.5175(stg200mn),

AUD/USD: $0.7990(A$942mn), $0.8025(A$398mn)

NZD/USD: $0.7650(NZ$598mn)

-

10:20

Press Review: How Draghi's Perfect Timing Will Save Europe

BLOOMBERG

How Draghi's Perfect Timing Will Save Europe

Timing may prove everything for Mario Draghi.

His European Central Bank is beginning a historic 1.1 trillion-euro ($1.25 trillion) bond buying plan at a moment economists at Credit Suisse Group AG declare "propitious." Those at Bank of America Corp. say it "could not be better."

Why this rare optimism? The region may have actually turned a corner even before President Draghi announced the stimulus, lending the ECB's program a nice tailwind. It's like how it's easier to push a car that's already moving than one that's completely still.

"QE's effectiveness may be boosted if it goes with the flow of an upturn in economic momentum," Credit Suisse's economics team said in a Jan. 23 report. "QE has been launched at a time in which market expectations for euro area growth are far too gloomy and inconsistent with hard data, let alone near-term prospects."

Source: http://www.bloomberg.com/news/articles/2015-01-28/how-draghi-s-perfect-timing-will-save-europe

REUTERS

Fed seen remaining patient with rate guidance amid global turmoil

(Reuters) - The Federal Reserve is expected to signal it remains on track to begin raising interest rates later this year, as the central bank shows confidence that low inflation and rising risks from abroad have yet to derail the U.S. economic recovery.

The Fed's first two-day policy meeting of the year concludes on Wednesday, and policymakers will likely restate their "patient" approach to raising rates, while also voicing faith that theeconomy will continue improving.

Fed Chair Janet Yellen faces growing skepticism that the central bank can tighten monetary policy by mid-year, with a strengthening dollar and falling oil prices adding to worries that inflation readings remain too low for the Fed to begin hiking.

Source: http://www.reuters.com/article/2015/01/28/us-usa-fed-idUSKBN0L10DZ20150128

BLOOMBERG

Ringgit Falls After Singapore Unexpectedly Eases Monetary Policy

(Bloomberg) -- Malaysia's ringgit dropped after Singapore unexpectedly loosened monetary policy, joining a global round of easing amid slowing economic growth and the risk of deflation.

The Singapore dollar fell as much 1.3 percent against the greenback, the biggest loss since 2010, as the central bank said Wednesday it will reduce the slope of its currency band while sticking with a modest and gradual appreciation. Malaysia's monetary authority meets today and the consensus in a Bloomberg survey is for no change.

"The ringgit is weakening because of the surprise move by the Monetary Authority of Singapore," said Jonathan Cavenagh, a foreign-exchange strategist at Westpac Banking Corp. in Singapore. "That's the main driver."

-

08:30

Foreign exchange market. Asian session: U.S. dollar mixed ahead of FED interest rate decision and FOMC statement

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia CPI, y/y Quarter IV +2.3% +1.8% +1.7%

00:30 Australia CPI, q/q Quarter IV +0.5% +0.3% +0.2%

07:00 Germany Gfk Consumer Confidence Survey December 9.0 9.1 9.3

07:00 Switzerland UBS Consumption Indicator December 1.29 1.42

The U.S. dollar traded slightly stronger against the euro, the British pound and the Japanese yen and lost against the New Zealand and Australian dollar after a mixed set of U.S. data yesterday, including soft spending data and disappointing earnings. Today all eyes will be on the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT. U.S. indicators lost momentum lately. Some analyst see the broadly stronger dollar and falling oil prices as a reason fuelling doubts that the FED will raise interest rates as soon as previously predicted.

The Australian dollar rose for a third day against the U.S. dollar supported by solid CPI data making a rate cut next week less probable. Australia's Leading Index for December improved from -0.1% to 0.0%. Australia's CPI rose +0.2% in the fourth quarter and 1.7% year on year with both readings 0.1% below expectations and below the Bank of Australia's inflation target between 2-3%. In the previous quarter inflation rose by 0.5%, year on year +2.3%. Late in the day data on the Conference Board Australia Leading Index will be published at 23:00.

New Zealand's dollar halted its fall after trading at the weakest since 2012 on Monday. In the Asian session the currency traded stronger currently quoted at USD0.7461. All eyes are now on the RBNZ Interest Rate Decision and the Statement scheduled for 20:00 GMT. At 21:45 the Trade Balance for December will be published.

The Japanese yen traded lower against the greenback on Wednesday in the absence of any major economic data in the region. Late in the day data on Retail Sales is due at 23:30 GMT.

EUR/USD: the euro traded slightly weaker against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

15:30 U.S. Crude Oil Inventories January +10.1

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -213 -27

23:00 Australia Conference Board Australia Leading Index November -0.2%

23:50 Japan Retail sales, y/y December +0.4% +0.9%

-

08:00

Germany: Gfk Consumer Confidence Survey, December 9.3 (forecast 9.1)

-

08:00

Switzerland: UBS Consumption Indicator, December 1.42

-

07:34

Options levels on wednesday, January 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1564 (2058)

$1.1504 (2779)

$1.1458 (1306)

Price at time of writing this review: $1.1369

Support levels (open interest**, contracts):

$1.1276 (4774)

$1.1222 (1608)

$1.1154 (3627)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 78931 contracts, with the maximum number of contracts with strike price $1,2100 (6536);

- Overall open interest on the PUT options with the expiration date February, 6 is 74515 contracts, with the maximum number of contracts with strike price $1,1700 (6719);

- The ratio of PUT/CALL was 0.94 versus 0.95 from the previous trading day according to data from January, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5402 (540)

$1.5305 (509)

$1.5209 (1096)

Price at time of writing this review: $1.5180

Support levels (open interest**, contracts):

$1.5094 (1632)

$1.4997 (1029)

$1.4898 (1674)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 16635 contracts, with the maximum number of contracts with strike price $1,5150 (1137);

- Overall open interest on the PUT options with the expiration date February, 6 is 17104 contracts, with the maximum number of contracts with strike price $1,4900 (1674);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from January, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:30

Australia: CPI, q/q, Quarter IV +0.2% (forecast +0.3%)

-

01:30

Australia: CPI, y/y, Quarter IV +1.7% (forecast +1.8%)

-

01:01

Currencies. Daily history for Jan 27’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1380 +1,25%

GBP/USD $1,5195 +0,76%

USD/CHF Chf0,9027 -0,01%

USD/JPY Y117,87 -0,48%

EUR/JPY Y134,12 +0,76%

GBP/JPY Y179,08 +0,28%

AUD/USD $0,7935 +0,16%

NZD/USD $0,7451 +0,36%

USD/CAD C$1,2398 -0,60%

-

00:30

Australia: Leading Index, December 0.0%

-

00:00

Schedule for today, Wednesday, Jan 28’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia CPI, y/y Quarter IV +2.3% +1.8%

00:30 Australia CPI, q/q Quarter IV +0.5% +0.3%

07:00 Germany Gfk Consumer Confidence Survey December 9.0 9.1

07:00 Switzerland UBS Consumption Indicator December 1.29

15:30 U.S. Crude Oil Inventories January +10.1

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -213 -27

23:00 Australia Conference Board Australia Leading Index November -0.2%

23:50 Japan Retail sales, y/y December +0.4% +0.9%

-