Noticias del mercado

-

21:00

Dow +4.3 17,391.51 +0.02% Nasdaq +8.93 4,690.43 +0.19% S&P -4.8 2,024.75 -0.24%

-

21:00

New Zealand: RBNZ Interest Rate Decision, 3.50% (forecast 3.50%)

-

20:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

18:04

European stocks close: stocks closed mixed as Greek bank stocks weighed on markets

Stock indices closed mixed as Greek bank stocks weighed on markets. Greek bank stocks declined as investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The Gfk German consumer confidence index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,825.94 +14.33 +0.21%

DAX 10,710.97 +82.39 +0.78%

CAC 40 4,610.94 -13.27 -0.29%

-

18:00

European stocks closed: FTSE 100 6,825.94 +14.33 +0.21% CAC 40 4,610.94 -13.27 -0.29% DAX 10,710.97 +82.39 +0.78%

-

17:40

Oil: A review of the market situation

Prices for WTI moderately decreased, approaching the level of $ 45 per barrel, which is associated with the release of data on oil reserves in the United States, as well as the strengthening of the US dollar.

US Department of Energy announced that commercial oil stocks rose 8.9 million barrels to 406.7 million barrels, compared to the average forecast of four million. Barrels. The latter value was the highest for the entire period of statistics with the US Department of Energy in August 1982. Meanwhile, gasoline inventories fell 2.6 million barrels to 238.3 million barrels. Analysts had expected growth to 400,000 barrels. Distillate stocks fell by 3.9 million barrels to 132.7 million barrels, while analysts had expected a decline of 1.6 million barrels. Utilization rate of refining capacity rose by 2.5 percentage points to 88%. Analysts expected the growth rate by 0.1 percentage points.

Yesterday the American Petroleum Institute (API) reported that US crude stocks rose by 12.7 million barrels to 405.1 million barrels in the week ended Jan. 23. According to the API, gasoline inventories fell by 5 million barrels, while distillate stocks - by 670,000 barrels. Analysts speculated that oil reserves will rise by 4.1 million barrels, gasoline inventories rise by 300,000 barrels, while distillate inventories decreased by 1.7 million.

The course of trade is also affected by expectations of the outcome of the meeting of the Fed's monetary policy, which is expected to keep the policy rate unchanged. Investors will closely monitor the FOMC statement for indications that interest rates will remain unchanged at near zero for some time to come.

Market participants also drew attention to the updated forecasts for oil prices from Barclays and UBS. «In the next few months, we expect a further decline in prices - the head of Barclays Commodities Research Michael Cohen. - To the extent that Brent, WTI and will be traded just below $ 40 a barrel. After that, the fall can be stopped. "Compared with the December forecast average annual cost of both brands of oil decreased by 1.6 times: by Brent - from $ 72 to $ 44, according to WTI - from $ 66 to $ 42 per barrel.

Meanwhile, UBS expects that this year mark WTI will cost an average of $ 49 per barrel compared with the previous forecast of $ 64.75 per barrel. Evaluation for 2016 decreased to $ 62.5 per barrel from $ 75. The average price of Brent, the expected in 2015 will be $ 52.5 per barrel compared to the previously forecasted $ 69.75 per barrel. 2016 outlook deteriorated to $ 67.5 from $ 80.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) dropped to 45.23 dollars per barrel on the New York Mercantile Exchange.

March futures price for North Sea petroleum mix of Brent increased by $ 0.10 to $ 49.37 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies ahead of the Fed's interest rate decision

The U.S. dollar traded higher against the most major currencies ahead of the Fed's interest rate decision. Investors expect that the Fed might keep its interest rate on hold for a longer period as recent released U.S. economic has been mixed. They are awaiting new signs for further monetary policy in the U.S.

The euro traded lower against the U.S. dollar. The Gfk German consumer confidence index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

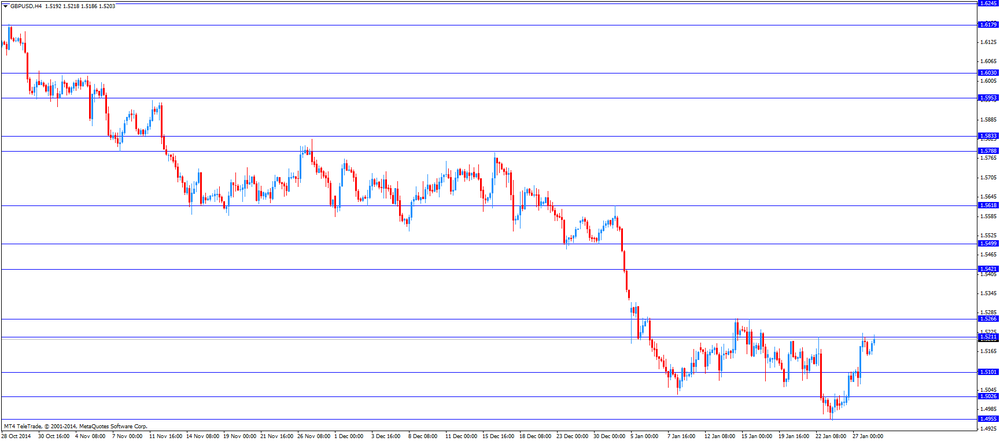

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator increased to 1.42 points in December from 1.29 points in November.

Speculation that the Swiss National Bank (SNB) was intervening in the market still weighed on the Swiss franc. The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on Tuesday that the central bank is prepared to intervene in markets.

The New Zealand dollar traded lower against the U.S. dollar ahead the Reserve Bank of New Zealand's interest rate decision. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback despite the weaker-than-expected consumer inflation from Australia. Australia's consumer price index climbed 0.2% in the fourth quarter, missing forecasts of a 0.3% rise, after a 0.5% increase in the third quarter.

On a yearly basis, Australia's consumer price inflation declined to 1.7% in the fourth quarter from 2.3% in the third quarter, missing expectations for a rise to 1.8%.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan. In the overnight trading session, the yen traded mixed against the greenback.

-

17:20

Gold: a review of the market situation

Gold prices fell slightly today, dropping at the same time below $ 1290, which is associated with the expectations of the outcome of the meeting of the Federal Reserve System.

Investors expect the Fed's indication that interest rates will remain unchanged at near zero for some time to come. At the same time, some investors accept a positive impact on the Fed precious metals. "Gold prices may obtain further support on the eve of the statement to be made on the results of the Fed meeting," - analysts say ANZ ..

"In our opinion, the Central Bank will pay special attention to slowing global economic growth and underline the unhurried approach to raising interest rates," - wrote analyst Edward Meir INTL FCStone.

Pressure on gold also has reduced demand of investors in the asset-seekers. "Despite the increased uncertainty in the euro area in connection with the new Greek government, the demand for gold as a safe haven as a whole has not increased," - said Howie Lee, an investment analyst at Phillip Futures.

Little influenced by data from Germany. It is learned that the February consumer confidence index from the German Gfk rose to around 9.3 (up to November 2001). It should be noted that the published value of the index has exceeded analysts' forecasts, which accounted for 9.1. Believe in the GfK, consumers in Germany, apparently acted strong drop in energy prices over the past few weeks. "So, reducing the cost of gasoline and heating oil supports the growth of disposable income and gives consumers more freedom of choice of other expenses and purchases," - noted in the study group.

The cost of the February gold futures on the COMEX today fell to 1287.00 dollars per ounce.

-

16:30

U.S.: Crude Oil Inventories, January +8.9

-

15:34

U.S. Stocks open: Dow +0.40%, Nasdaq +1.19%, S&P +0.58%

Dow 17,457.56 +70.35 +0.40%

Nasdaq 4,737.14 +55.64 +1.19%

S&P 500 2,041.33 +11.78 +0.58%

10 Year Yield 1.81% -0.02 --

Gold $1,285.60 -6.10 -0.47%

Oil $45.11 -1.12 -2.42%

-

15:26

Before the bell: S&P futures +0.27%, Nasdaq futures +1.00%

U.S. stock-index futures advanced as Apple Inc. and Yahoo! Inc. rallied while investors awaited a Federal Reserve decision on interest rates.

Global markets:

Nikkei 17,795.73 +27.43 +0.15%

Hang Seng 24,861.81 +54.53 +0.22%

Shanghai Composite 3,306.54 -46.42 -1.38%

FTSE 6,804.22 -7.39 -0.11%

CAC 4,604.17 -20.04 -0.43%

DAX 10,662.48 +33.90 +0.32%

Crude oil $45.33 (-1.95%)

Gold $1288.00 (-0.29%)

-

15:12

Stocks before the bell

(company / ticker / price / change, % / volume)

International Business Machines Co...

IBM

154.00

+0.21%

35.8K

General Motors Company, NYSE

GM

33.50

+0.24%

104.2K

ALTRIA GROUP INC.

MO

54.73

+0.31%

0.1K

Starbucks Corporation, NASDAQ

SBUX

88.62

+0.32%

30.4K

The Coca-Cola Co

KO

42.53

+0.33%

203.0K

Procter & Gamble Co

PG

86.79

+0.35%

20.8K

American Express Co

AXP

82.71

+0.38%

1.8K

Microsoft Corp

MSFT

42.83

+0.40%

144.7K

Nike

NKE

94.90

+0.42%

1.1K

Citigroup Inc., NYSE

C

48.52

+0.43%

87.6K

General Electric Co

GE

24.49

+0.45%

358.7K

McDonald's Corp

MCD

89.97

+0.45%

10.0K

Johnson & Johnson

JNJ

102.57

+0.47%

512.2K

3M Co

MMM

164.45

+0.50%

1.6K

JPMorgan Chase and Co

JPM

56.48

+0.50%

3.4K

Deere & Company, NYSE

DE

86.50

+0.53%

0.3K

UnitedHealth Group Inc

UNH

110.60

+0.54%

0.4K

Wal-Mart Stores Inc

WMT

88.00

+0.54%

36.2K

Tesla Motors, Inc., NASDAQ

TSLA

207.14

+0.56%

3.8K

Goldman Sachs

GS

177.50

+0.57%

33.9K

Verizon Communications Inc

VZ

46.62

+0.58%

7.9K

Merck & Co Inc

MRK

62.94

+0.61%

0.5K

Walt Disney Co

DIS

94.57

+0.64%

2.0K

Caterpillar Inc

CAT

80.40

+0.69%

8.0K

Home Depot Inc

HD

105.90

+0.70%

1.9K

Intel Corp

INTC

34.45

+0.78%

401.7K

Google Inc.

GOOG

522.95

+0.83%

7.9K

United Technologies Corp

UTX

120.30

+0.96%

1.0K

Amazon.com Inc., NASDAQ

AMZN

310.00

+1.06%

3.8K

ALCOA INC.

AA

16.10

+1.13%

12.0K

Ford Motor Co.

F

14.87

+1.16%

21.7K

AT&T Inc

T

33.21

+1.22%

118.7K

Cisco Systems Inc

CSCO

27.30

+1.49%

725.4K

Facebook, Inc.

FB

76.97

+1.57%

186.8K

Boeing Co

BA

136.45

+3.00%

214.0K

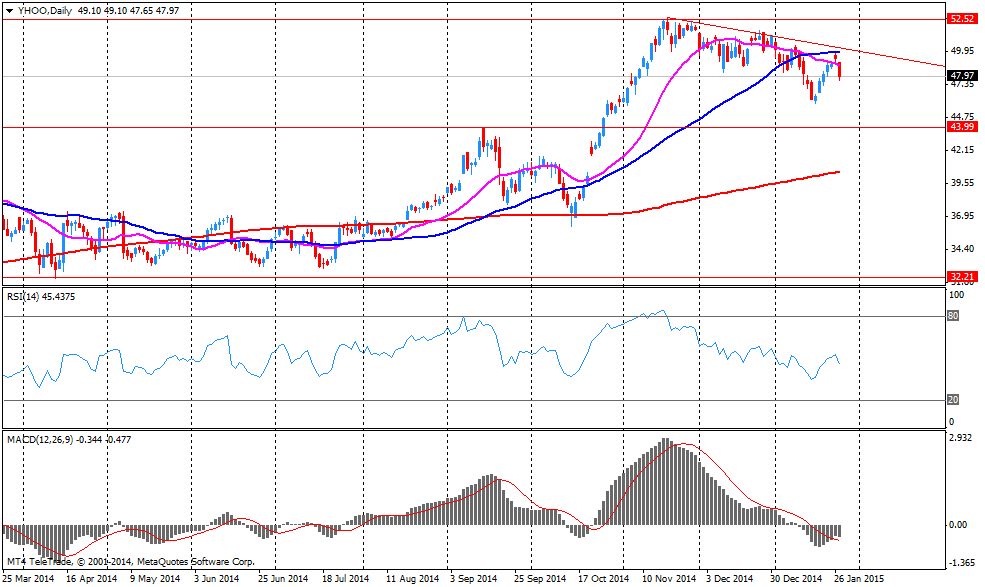

Yahoo! Inc., NASDAQ

YHOO

50.13

+4.46%

2.5M

Apple Inc.

AAPL

117.84

+7.97%

3.9M

Yandex N.V., NASDAQ

YNDX

16.21

0.00%

0.3K

Exxon Mobil Corp

XOM

90.90

-0.05%

199.9K

Pfizer Inc

PFE

32.58

-0.06%

73.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.36

-0.11%

9.5K

Chevron Corp

CVX

108.05

-0.19%

19.3K

Twitter, Inc., NYSE

TWTR

38.80

-0.31%

104.4K

E. I. du Pont de Nemours and Co

DD

72.90

-0.38%

145.2K

Hewlett-Packard Co.

HPQ

38.56

-0.72%

83.1K

Barrick Gold Corporation, NYSE

ABX

13.00

-0.84%

126.8K

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded to Neutral from Underweight at JP Morgan, target lowered to $78 from $80

Downgrades:

Caterpillar (CAT) downgraded to Underweight from Neutral at Atlantic Equities

Other:

Apple (AAPL) target raised to $140 from $135 at Evercore ISI

Apple (AAPL) target raised to $160 from $143 at Cantor Fitzgerald

Apple (AAPL) target raised to $115 from $113 at Cowen

3M (MMM) target raised to $180 from $167 at FBR Capital

Yahoo! (YHOO) target raised to $59 from $50 at Evercore ISI

Yahoo! (YHOO) target raised at Cowen to $60 from $38

Yahoo! (YHOO) target raised to $61 from $53 at Jefferies

Caterpillar (CAT) target lowered to $84 from $100 at RBC Capital Mkts

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E545mn), $1.1400(E849mn)

USD/JPY: Y117.75($200mn), Y118.00($200mn), Y118.40($450mn), Y119.00($240mn)

GBP/USD: $1.5175(stg200mn),

AUD/USD: $0.7990(A$942mn), $0.8025(A$398mn)

NZD/USD: $0.7650(NZ$598mn)

-

14:50

Company News: Boeing (BA) reported better than expected fourth quarter profits

Boeing (BA) earned $2.31 per share in the fourth quarter, beating analysts' estimate of $2.10. Revenue in the fourth quarter increased 2.9% year-over-year to $24.47 billion, exceeding analysts' estimate of $23.90 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $8.20-$8.40 (analysts' estimate: $8.65), while revenue is expected to be $94.5-$96.5 billion in fiscal year 2015 (analysts' estimate: $93.37 billion).

Boeing (BA) shares increased to $137.00 (+3.41%) prior to the opening bell.

-

14:43

Company News: Yahoo! (YHOO) reported second fiscal quarter earnings in line with expectations, revenue declined

Yahoo! (YHOO) earned $0.30 per share (excluding non-recurring items) in the fourth quarter, beating analysts' estimate of $0.29. Revenue in the fourth quarter decreased 1.7% year-over-year to $1.18 billion, in line with analysts' estimate.

The company announces plan to spin off about a 15% Alibaba Group (BABA) stake. The spinoff is expected to complete by the end of 2015.

Yahoo! (YHOO) shares rose to $50.45 (+5.13%) prior to the opening bell.

-

14:34

Company News: AT&T (T) reported fourth quarter earnings in line with expectations, revenue increased

AT&T (T) earned $0.55 per share (excluding non-recurring items) in the fourth quarter, in line with analysts' estimate. Revenue in the fourth quarter increased 3.8% year-over-year to $34.44 billion, beating analysts' estimate of $34.30 billion.

AT&T (T) shares increased to $33.20 (+1.19%) prior to the opening bell.

-

14:18

Company News: Apple (AAPL) reported record first fiscal quarter profits

Apple (AAPL) earned $3.06 per share in the first fiscal quarter, beating analysts' estimate of $2.60. Revenue in the first fiscal quarter increased 29.5% year-over-year to $74.60 billion, exceeding analysts' estimate of $67.53 billion. Gross margin was 39.9%, exceeding the company's estimate of 37,5%-38,5% and analysts' estimate of 38.4%.

The company released its forecasts for the second quarter. Revenue is expected to be $52.0-$55.0 billion in the second quarter (analysts' estimate: $53.75 billion), while gross margin is expected to be 38.5%-39.5% billion (analysts' estimate: 38.7%).

Apple (AAPL) shares increased to $118.69 (+8.75%) prior to the opening bell.

-

14:00

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar despite the better-than-expected Gfk German consumer confidence index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, y/y Quarter IV +2.3% +1.8% +1.7%

00:30 Australia CPI, q/q Quarter IV +0.5% +0.3% +0.2%

07:00 Germany Gfk Consumer Confidence Survey February 9.0 9.1 9.3

07:00 Switzerland UBS Consumption Indicator December 1.29 1.42

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Investors expect that the Fed might keep its interest rate on hold for a longer period as recent released U.S. economic has been mixed. They are awaiting new signs for further monetary policy in the U.S.

The euro traded mixed against the U.S. dollar despite the better-than-expected Gfk German consumer confidence index. The index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. Switzerland's UBS consumption indicator increased to 1.42 points in December from 1.29 points in November.

Speculation that the Swiss National Bank (SNB) was intervening in the market still weighed on the Swiss franc. The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on Tuesday that the central bank is prepared to intervene in markets.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.5218

USD/JPY: the currency pair fell to $117.54

The most important news that are expected (GMT0):

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -213 -27

23:50 Japan Retail sales, y/y December +0.4% +0.9%

-

13:50

Orders

EUR/USD

Offers $1.1500, $1.1445/60, $1.1400

Bids $1.1220

GBP/USD

Offers $1.5300

Bids $1.5125/20, $1.5100

AUD/USD

Offers $0.8100

Bids $0.7950, $0.7910/00, $0.7850, $0.7815

EUR/JPY

Offers Y135.50, Y135.00, Y134.45/50, Y134.00

Bids Y133.10/00, Y132.10/00

USD/JPY

Offers Y119.00, Y118.30/35, Y118.00

Bids Y117.50, Y117.10/00, Y116.95/85

-

13:27

Gfk German consumer confidence index climbed to the highest level since November 2001

Market research company GfK released its consumer confidence index for Germany on Wednesday. The Gfk German consumer confidence index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Gfk said that "the upward trend is continuing in the consumer climate, and the outlook for consumer spending is looking increasingly brighter".

-

13:00

European stock markets mid-session: Indices turn slightly negative after positive start

European indices could not hold on to early gains and turn negative. Published corporate earnings were mixed. Greek shares slump following the victory of the left-wing anti-austerity party Syriza and are down 10% this week.

Earlier today data on Germany's Gfk Consumer Confidence Survey for December showed a reading above estimates with 9.3 points compared to 9.0 in the previous month. Analysts expected an increase to 9.1 points.

The FTSE 100 index is currently trading +0.05% quoted at 6,808.11 points. Germany's DAX 30 lost -0.05% trading at 10,623.75, below its all-time high at 10,810.57 hit on Tuesday. France's CAC 40 shed early gains, currently trading at 4,613.162 points, -0.23%.

Today all eyes will be on the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT - after European trading hours. The FOMC is expected to retain the "patient" approach to rise benchmark interest rates. The wording of the FOMC statement will be closely watched to get further indications on when the FED is going to raise benchmark interest rates from near zero levels. It's the first statement after the SNB's move to scrap the exchange floor for the franc and after the ECB announced quantitative easing.

-

12:20

Oil: Prices under pressure ahead of U.S. Crude inventories

Brent crude and West Texas Intermediate are trading lower today ahead of U.S. Crude Oil Inventories due at 15:30 GMT to get an indication on demand from the world's largest consumer of oil. Stockpiles are forecasted having increased by 4.1 million barrels last week. Yesterday the American Petroleum Institute reported that stockpiles increased by 12.7 million barrels.

Brent Crude lost -0.79%, currently trading at USD49.21 a barrel, still below the important USD50 level but getting closer as the U.S. dollar weakened. On January 13th Crude hit a low at USD45.19. West Texas Intermediate declined by -1.73% currently quoted at USD45.43.

Oil prices fell by nearly 60 percent over the past six months, and both key brands of oil are currently trading below $ 50 a barrel as the worldwide supply exceeds demand in a period of low global economic growth and the OPEC refusing to cut output rates to stabilize prices. Smaller OPEC members want to cut production but the organisation, responsible for 40% of worldwide production focuses on its fight for market share.

-

12:00

Gold prices further decline before FED Interest Rate Decision and FOMC statement

Gold is trading lower today as investors remain cautious ahead of much anticipated Interest Rate Decision of the Federal Reserve Bank scheduled for 19:00 GMT. The bank is expected to keep policy on hold. Yesterday gold climbed by almost 1% on mixed U.S. data casting shadows on the economic outlook of the U.S. The wording of the FOMC statement will be closely watched to get further indications on when the FED is going to raise benchmark interest rates from near zero levels. It's the first statement after the SNB's move to scrap the exchange floor for the franc and after the ECB announced quantitative easing.

Gold prices rose nearly 9 percent this year, after declining for two consecutive years, ending 2014 almost flat. Speculations that the FED will hold back its benchmark interest-rate hike till the end of the year further helped gold but the forecast for the current year remains uncertain.

The precious metal is currently quoted at USD1,287.20, -0,46% a troy ounce. On Thursday last week gold reached a five-month high at USD1,307.40.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E545mn), $1.1400(E849mn)

USD/JPY: Y117.75($200mn), Y118.00($200mn), Y118.40($450mn), Y119.00($240mn)

GBP/USD: $1.5175(stg200mn),

AUD/USD: $0.7990(A$942mn), $0.8025(A$398mn)

NZD/USD: $0.7650(NZ$598mn)

-

10:20

Press Review: How Draghi's Perfect Timing Will Save Europe

BLOOMBERG

How Draghi's Perfect Timing Will Save Europe

Timing may prove everything for Mario Draghi.

His European Central Bank is beginning a historic 1.1 trillion-euro ($1.25 trillion) bond buying plan at a moment economists at Credit Suisse Group AG declare "propitious." Those at Bank of America Corp. say it "could not be better."

Why this rare optimism? The region may have actually turned a corner even before President Draghi announced the stimulus, lending the ECB's program a nice tailwind. It's like how it's easier to push a car that's already moving than one that's completely still.

"QE's effectiveness may be boosted if it goes with the flow of an upturn in economic momentum," Credit Suisse's economics team said in a Jan. 23 report. "QE has been launched at a time in which market expectations for euro area growth are far too gloomy and inconsistent with hard data, let alone near-term prospects."

Source: http://www.bloomberg.com/news/articles/2015-01-28/how-draghi-s-perfect-timing-will-save-europe

REUTERS

Fed seen remaining patient with rate guidance amid global turmoil

(Reuters) - The Federal Reserve is expected to signal it remains on track to begin raising interest rates later this year, as the central bank shows confidence that low inflation and rising risks from abroad have yet to derail the U.S. economic recovery.

The Fed's first two-day policy meeting of the year concludes on Wednesday, and policymakers will likely restate their "patient" approach to raising rates, while also voicing faith that theeconomy will continue improving.

Fed Chair Janet Yellen faces growing skepticism that the central bank can tighten monetary policy by mid-year, with a strengthening dollar and falling oil prices adding to worries that inflation readings remain too low for the Fed to begin hiking.

Source: http://www.reuters.com/article/2015/01/28/us-usa-fed-idUSKBN0L10DZ20150128

BLOOMBERG

Ringgit Falls After Singapore Unexpectedly Eases Monetary Policy

(Bloomberg) -- Malaysia's ringgit dropped after Singapore unexpectedly loosened monetary policy, joining a global round of easing amid slowing economic growth and the risk of deflation.

The Singapore dollar fell as much 1.3 percent against the greenback, the biggest loss since 2010, as the central bank said Wednesday it will reduce the slope of its currency band while sticking with a modest and gradual appreciation. Malaysia's monetary authority meets today and the consensus in a Bloomberg survey is for no change.

"The ringgit is weakening because of the surprise move by the Monetary Authority of Singapore," said Jonathan Cavenagh, a foreign-exchange strategist at Westpac Banking Corp. in Singapore. "That's the main driver."

-

10:00

European Stocks. First hour: Indices continue rally after pause

European indices continue to rise after a pause with good corporate results boosting sentiment almost reversing previous losses. Recently markets were supported by the unprecedented economic stimulus program known as quantitative easing unveiled on the 22nd by the ECB. The influence of the outcome of the Greek elections on the markets was limited.

Data on Germany's Gfk Consumer Confidence Survey for December showed a reading above estimates with 9.3 points compared to 9.0 in the previous month. Analysts expected an increase to 9.1 points.

The FTSE 100 index is currently trading +0.24% quoted at 6,827.84 points. Germany's DAX 30 added +0.51% trading at 10,682.36, below its all-time high at 10,810.57 points hit on Tuesday. France's CAC 40 rose by +0.30%, currently trading at 4,638.19 points.

Today all eyes will be on the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT - after European trading hours. The FOMC is expected to retain the "patient" approach to rise benchmark interest rates.

-

09:00

Global Stocks: U.S. indices decline, Nikkei extends one-month high

U.S. markets closed lower on Tuesday after a mixed set of U.S. data, including soft spending data and disappointing earnings. The DOW JONES index lost -1.65%, closing at 17,387.21. The S&P 500 declined by -1.34% with a final quote of 2,029.55 points. Apple and Yahoo rallied in post-market trading on corporate news.

The consumer confidence index for the U.S. rose to 102.9 in January from 93.1 in December, exceeding expectations for a rise to 94.4. U.S. durable goods orders dropped 3.4% in December, missing expectations for a 0.5% increase, after a 2.1% decline in November. The decline was driven by falling orders for computers, metals and electrical equipment. The S&P/Case-Shiller home price index increased 4.3% in November, missing expectations for a 4.5% rise, after a 4.5% gain in October. That was the slowest pace since October 2012.

Today investors look ahead to the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT.

Chinese stock markets were mixed on Wednesday. Hong Kong's Hang Seng is trading +0.22% at 24,862.41 points. China's Shanghai Composite closed at 3,306.54 points -1.38%.

Japan's Nikkei rose on Wednesday to one-month highs, closing +0.15% with a final quote of 17,795.73 reversing early losses caused by mixed U.S. data and profit taking. A weaker Japanese yen supported exporter shares.

-

08:30

Foreign exchange market. Asian session: U.S. dollar mixed ahead of FED interest rate decision and FOMC statement

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia CPI, y/y Quarter IV +2.3% +1.8% +1.7%

00:30 Australia CPI, q/q Quarter IV +0.5% +0.3% +0.2%

07:00 Germany Gfk Consumer Confidence Survey December 9.0 9.1 9.3

07:00 Switzerland UBS Consumption Indicator December 1.29 1.42

The U.S. dollar traded slightly stronger against the euro, the British pound and the Japanese yen and lost against the New Zealand and Australian dollar after a mixed set of U.S. data yesterday, including soft spending data and disappointing earnings. Today all eyes will be on the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT. U.S. indicators lost momentum lately. Some analyst see the broadly stronger dollar and falling oil prices as a reason fuelling doubts that the FED will raise interest rates as soon as previously predicted.

The Australian dollar rose for a third day against the U.S. dollar supported by solid CPI data making a rate cut next week less probable. Australia's Leading Index for December improved from -0.1% to 0.0%. Australia's CPI rose +0.2% in the fourth quarter and 1.7% year on year with both readings 0.1% below expectations and below the Bank of Australia's inflation target between 2-3%. In the previous quarter inflation rose by 0.5%, year on year +2.3%. Late in the day data on the Conference Board Australia Leading Index will be published at 23:00.

New Zealand's dollar halted its fall after trading at the weakest since 2012 on Monday. In the Asian session the currency traded stronger currently quoted at USD0.7461. All eyes are now on the RBNZ Interest Rate Decision and the Statement scheduled for 20:00 GMT. At 21:45 the Trade Balance for December will be published.

The Japanese yen traded lower against the greenback on Wednesday in the absence of any major economic data in the region. Late in the day data on Retail Sales is due at 23:30 GMT.

EUR/USD: the euro traded slightly weaker against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

15:30 U.S. Crude Oil Inventories January +10.1

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -213 -27

23:00 Australia Conference Board Australia Leading Index November -0.2%

23:50 Japan Retail sales, y/y December +0.4% +0.9%

-

08:00

Germany: Gfk Consumer Confidence Survey, December 9.3 (forecast 9.1)

-

08:00

Switzerland: UBS Consumption Indicator, December 1.42

-

07:34

Options levels on wednesday, January 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1564 (2058)

$1.1504 (2779)

$1.1458 (1306)

Price at time of writing this review: $1.1369

Support levels (open interest**, contracts):

$1.1276 (4774)

$1.1222 (1608)

$1.1154 (3627)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 78931 contracts, with the maximum number of contracts with strike price $1,2100 (6536);

- Overall open interest on the PUT options with the expiration date February, 6 is 74515 contracts, with the maximum number of contracts with strike price $1,1700 (6719);

- The ratio of PUT/CALL was 0.94 versus 0.95 from the previous trading day according to data from January, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5402 (540)

$1.5305 (509)

$1.5209 (1096)

Price at time of writing this review: $1.5180

Support levels (open interest**, contracts):

$1.5094 (1632)

$1.4997 (1029)

$1.4898 (1674)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 16635 contracts, with the maximum number of contracts with strike price $1,5150 (1137);

- Overall open interest on the PUT options with the expiration date February, 6 is 17104 contracts, with the maximum number of contracts with strike price $1,4900 (1674);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from January, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 17,744.21 -24.09 -0.14%, Hang Seng 24,775.59 -31.69 -0.13%, Shanghai Composite 3,306.54 -46.42 -1.38%

-

01:30

Australia: CPI, q/q, Quarter IV +0.2% (forecast +0.3%)

-

01:30

Australia: CPI, y/y, Quarter IV +1.7% (forecast +1.8%)

-

01:04

Commodities. Daily history for Jan 27’2015:

(raw materials / closing price /% change)

Light Crude 45.59 -1.38%

Gold 1,292.30 +0.05%

-

01:03

Stocks. Daily history for Jan 27’2015:

(index / closing price / change items /% change)

TOPIX 1,426.38 +24.30 +1.73%

SHANGHAI COMP 3,354.36 -28.82 -0.85%

HANG SENG 24,807.28 -102.62 -0.41%

FTSE 100 6,811.61 -40.79 -0.60%

CAC 40 4,624.21 -50.92 -1.09%

Xetra DAX 10,628.58 -169.75 -1.57%

S&P 500 2,029.55 -27.54 -1.34%

NASDAQ Composite 4,681.5 -90.27 -1.89%

Dow Jones 17,387.21 -291.49 -1.65%

-

01:01

Currencies. Daily history for Jan 27’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1380 +1,25%

GBP/USD $1,5195 +0,76%

USD/CHF Chf0,9027 -0,01%

USD/JPY Y117,87 -0,48%

EUR/JPY Y134,12 +0,76%

GBP/JPY Y179,08 +0,28%

AUD/USD $0,7935 +0,16%

NZD/USD $0,7451 +0,36%

USD/CAD C$1,2398 -0,60%

-

00:30

Australia: Leading Index, December 0.0%

-

00:00

Schedule for today, Wednesday, Jan 28’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia CPI, y/y Quarter IV +2.3% +1.8%

00:30 Australia CPI, q/q Quarter IV +0.5% +0.3%

07:00 Germany Gfk Consumer Confidence Survey December 9.0 9.1

07:00 Switzerland UBS Consumption Indicator December 1.29

15:30 U.S. Crude Oil Inventories January +10.1

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -213 -27

23:00 Australia Conference Board Australia Leading Index November -0.2%

23:50 Japan Retail sales, y/y December +0.4% +0.9%

-