Noticias del mercado

-

21:00

Dow -229.04 17,449.66 -1.30% Nasdaq -62.94 4,708.82 -1.32% S&P -19.68 2,037.41 -0.96%

-

18:20

The Netherlands’ central bank denied the increase of its gold holdings

Reports released today showed that the Netherlands' central bank, De Nederlandsche Bank (DNB), raised its holdings by 9.61 tonnes to 622.08 tonnes in December, based on International Monetary Fund (IMF) figures. That was the first rise since December 1998. The Dutch central bank's holdings have been unchanged since 2008.

De Nederlandsche Bank denied this information later. The central bank said on its official website that its gold stock remained unchanged at 19.691 million fine troy ounces.

The DNB added that the same information has been reported to the IMF.

-

18:07

European stocks close: stocks closed lower, companies’ earnings results and Greece stocks weighed on markets

Stock indices traded lower, companies' earnings results and Greece stocks weighed on markets. Siemens AG shares declined 3.1% after the company reported a decrease in first-quarter profit.

Royal Philips NV shares 6.0% after the company reported a 67% drop in annual net profit.

Greek stocks declined as investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The U.K. gross domestic product (GDP) climbed 0.5% in the fourth quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the third quarter.

On a yearly basis, the U.K. GDP increased 2.7% in the fourth quarter, missing forecasts of a 2.8 rise, after a 2.6% gain in the third quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,811.61 -40.79 -0.60%

DAX 10,628.58 -169.75 -1.57%

CAC 40 4,624.21 -50.92 -1.09%

-

18:00

European stocks closed: FTSE 100 6,811.61 -40.79 -0.60% CAC 40 4,624.21 -50.92 -1.09% DAX 10,628.58 -169.75 -1.57%

-

17:40

Oil: a review of the market situation

Prices for Brent crude rose moderately, entrenched near the mark of $ 49, as a weaker dollar offset the impact of the global oversupply. As for oil brand WTI, then its value has risen above $ 45.

"The market is looking for the right impetus to push oil prices up," - said Hans van Cleef, senior energy economist at ABN AMRO Bank in the Netherlands. However, he noted that today's growing price does not necessarily mean that the recession has already been completed. "We continue to be below the closing levels compared to last week," - said the expert.

The course of today's trading was also influenced mixed US data. The US Commerce Department announced that the total volume of orders for durable goods fell last month by 3.4% compared to expectations for a gain of 0.5%. Meanwhile, another report showed that sales of new homes rose by 11.6 percent to an annual rate of 481,000 in December from a revised figure of November 431 000. Economists had expected new home sales will rise to a level of 450,000 compared to 438,000 , which was originally reported in the previous month. The number of unsold homes corresponds to 5.5 months of sales.

It also became known that the index of consumer confidence from the Conference Board, which increased in December, rose sharply in January. The index is currently 102.9 (1985 = 100) compared to 93.1 in December. Assess the current situation index rose to 112.6 from 99.9, while the expectations index rose to 96.4 from 88.5 in December.

In addition, higher prices helped expectations publication of data on oil and petroleum products in the United States to measure the volume of demand from the world's largest oil consumer. Experts note that the government report to be released tomorrow may show the growth of oil reserves by 3.8 million barrels for the week ended January 23.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 45.60 dollars per barrel on the New York Mercantile Exchange.

March futures price for North Sea petroleum mix of Brent increased by $ 0.71 to $ 48.84 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data. New home sales climbed 11.6% to a seasonally adjusted annual rate of 481,000 units in December from 431,000 units in November. November's figure was revised down from 438,000 units. Analysts had expected new home sales to reach 450,000 units.

The Conference Board released its consumer confidence index for the U.S. rose to 102.9 in January from 93.1 in December, exceeding expectations for a rise to 94.4. December's figure was revised up from 92.6. That was the highest level since August 2007.

The U.S. durable goods orders dropped 3.4% in December, missing expectations for a 0.5% increase, after a 2.1% decline in November. November's figure was revised down from a 0.9% decrease.

The decline was driven by falling orders for computers, metals and electrical equipment. Orders for computers plunged 10.4%, orders for primary metals fell 1.5%, orders for communications equipment declined 1.6% and orders for transportation gear decreased 9.2%.

The U.S. durable goods orders excluding transportation fell 0.8% in December, missing expectations for a 0.5% gain, after a 1.3% decrease in November.

The S&P/Case-Shiller home price index increased 4.3% in November, missing expectations for a 4.5% rise, after a 4.5% gain in October. That was the slowest pace since October 2012.

The euro rose against the U.S. dollar in the absence of any major market reports from the Eurozone.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

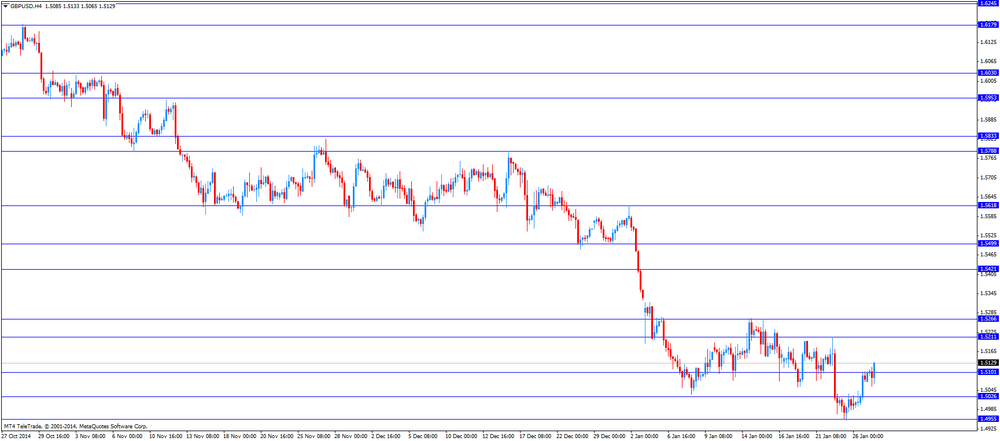

The British pound increased against the U.S. dollar despite the weaker-than-expected economic data from the U.K. The U.K. gross domestic product (GDP) climbed 0.5% in the fourth quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the third quarter.

On a yearly basis, the U.K. GDP increased 2.7% in the fourth quarter, missing forecasts of a 2.8 rise, after a 2.6% gain in the third quarter.

The number of mortgage approvals decreased to 35,700 in December from 36,700 in November, the lowest reading since April 2013.

The Swiss franc traded mixed against the U.S. dollar. The Swiss franc fell in the morning trading session on speculation that the Swiss National Bank (SNB) was intervening in the market. The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on Tuesday that the central bank is prepared to intervene in markets.

The Swiss National Bank's (SNB) monetary policy data for the week ending 23 January 2015 released on Monday showed that the amount of cash commercial banks hold with the SNB rose last week. Data indicates that the central bank may have intervened after discontinuing the 1.20 per euro exchange rate floor on January 15th.

The SNB declined to comment.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded lower against the greenback as Greek parliament election results still weighed on the kiwi.

The Australian dollar traded slightly higher against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback. The National Australia Bank's business confidence index climbed to 2 in December from 1 in November, missing expectations for a rise to 4.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan. In the overnight trading session, the yen rose against the greenback.

-

17:20

Gold: a review of the market situation

Gold prices rose markedly, approaching the mark of $ 1,300 per ounce, which is due to the depreciation of the US dollar in anticipation of meeting the US Federal Reserve. Most analysts suggest that the Fed recognizes the uncertain future of the global economy and again promise to show restraint in tightening policy. However, analysts still expect the regulator to raise interest rates in the middle of the year.

Higher prices for precious metals also helps the weak US statistics. Ministry of Commerce announced that orders for durable goods fell last month by 3.4% compared to expectations of 0.5%. The volume of orders for durable goods excluding transportation equipment fell by 0.8% in December against the forecast of + 0.5%. Meanwhile, the volume of new orders for non-defense capital goods in the industry excluding aircrafts fell by 0.6% last month. The volume of deliveries in non-defense capital goods industry excluding aircrafts decreased by 0.2%.

Also, market participants assess the current data from the IMF, to show that Russia in December increased its volume of gold bullion at 20.73 tons to 1,208,23 tons. RF inferior in terms of gold reserves USA, Germany, Italy and France. Russian gold buying volumes in December were the largest since September, when it bought 37 tonnes. It is worth emphasizing, purchase and sale of gold by central banks may have a significant impact on the price of gold. Central banks after two decades of stay in the number of sellers of gold moved in 2010 to the category of its customers amid growing interest in the metal after the global economic crisis of 2008.

Meanwhile, it became known that the stocks of the world's largest gold ETF-secured fund SPDR Gold Trust rose on the results Monday at 0.24 percent, while reaching the level of 743.44 tons.

As for the situation in the physical market, there is a decline in demand: margins in Singapore fell to $ 0,70-1,00 per ounce from $ 1.20 in early January, and margins in Hong Kong - up to 50-70 cents from $ 1 two weeks ago .

The cost of the February gold futures on the COMEX today rose to 1293.40 dollars per ounce.

-

17:02

New home sales climbed 11.6% in December

The U.S. Commerce Department released new home sales data on Tuesday. New home sales climbed 11.6% to a seasonally adjusted annual rate of 481,000 units in December from 431,000 units in November.

November's figure was revised down from 438,000 units.

Analysts had expected new home sales to reach 450,000 units.

Overall for 2014, 435,000 units has been sold compared with 429,000 in 2013.

-

16:47

U.S. consumer confidence index reaches the highest level since August 2007

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 102.9 in January from 93.1 in December, exceeding expectations for a rise to 94.4. December's figure was revised up from 92.6.

That was the highest level since August 2007.

The director of economic indicators at The Conference Board Lynn Franco said that consumer confidence was driven by positive current business and labour market conditions.

-

16:28

S&P/Case-Shiller home price index increased 4.3% in November

The S&P/Case-Shiller home price index increased 4.3% in November, missing expectations for a 4.5% rise, after a 4.5% gain in October. That was the slowest pace since October 2012.

Chairman of the index committee at S&P Dow Jones Indices David Blitzer said that "prospects for a home run in 2015 aren't good".

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

16:02

U.S. durable goods orders dropped 3.4% in December

The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders dropped 3.4% in December, missing expectations for a 0.5% increase, after a 2.1% decline in November. November's figure was revised down from a 0.9% decrease.

The decline was driven by falling orders for computers, metals and electrical equipment. Orders for computers plunged 10.4%, orders for primary metals fell 1.5%, orders for communications equipment declined 1.6% and orders for transportation gear decreased 9.2%.

Orders for motor vehicles rose 2.7%.

The U.S. durable goods orders excluding transportation fell 0.8% in December, missing expectations for a 0.5% gain, after a 1.3% decrease in November.

The U.S. durable goods orders excluding defence decreased 0.6% in December.

-

16:00

U.S.: Richmond Fed Manufacturing Index, January 6

-

16:00

U.S.: Consumer confidence , January 102.9 (forecast 94.4)

-

16:00

U.S.: New Home Sales, December 481 (forecast 450)

-

15:45

U.S.: Services PMI, January 54.0

-

15:36

U.S. Stocks open: Dow -1.02%, Nasdaq -1.60%, S&P -1.19%

Dow 17,498.93 -179.77 -1.02%

Nasdaq 4,695.59 -76.17 -1.60%

S&P 500 2,032.58 -24.51 -1.19%

10 Year Yield 1.76% -0.07 --

Gold $1,286.30 +6.90 +0.54%

Oil $45.48 +0.33 +0.73%

-

15:28

Before the bell: S&P futures -1.17%, Nasdaq futures -1.41%

U.S. stock-index futures fell as results from Caterpillar Inc. to Microsoft Corp. and DuPont Co. disappointed investors.

Global markets:

Nikkei 17,768.3 +299.78 +1.72%

Hang Seng 24,807.28 -102.62 -0.41%

Shanghai Composite 3,354.36 -28.82 -0.85%

FTSE 6,790.03 -62.37 -0.91%

CAC 4,608.34 -66.79 -1.43%

DAX 10,646.22 -152.11 -1.41%

Crude oil $45.42 (+0.62%)

Gold $1285.60 (+0.48%)

-

15:16

Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

12.88

+1.50%

53.4K

AT&T Inc

T

33.05

-0.39%

79.1K

Apple Inc.

AAPL

112.48

-0.55%

1.0M

UnitedHealth Group Inc

UNH

110.88

-0.65%

3.9K

Travelers Companies Inc

TRV

106.36

-0.66%

0.1K

American Express Co

AXP

82.69

-0.73%

8.4K

Walt Disney Co

DIS

94.24

-0.77%

1.7K

Nike

NKE

95.60

-0.78%

6.9K

Chevron Corp

CVX

108.02

-0.79%

0.8K

Verizon Communications Inc

VZ

46.59

-0.79%

18.3K

Exxon Mobil Corp

XOM

91.01

-0.82%

8.0K

The Coca-Cola Co

KO

42.60

-0.93%

0.8K

Ford Motor Co.

F

14.93

-0.99%

21.4K

Johnson & Johnson

JNJ

101.20

-1.04%

5.7K

Amazon.com Inc., NASDAQ

AMZN

306.43

-1.04%

4.3K

International Business Machines Co...

IBM

154.70

-1.06%

18.6K

Pfizer Inc

PFE

32.45

-1.07%

55.6K

Home Depot Inc

HD

105.19

-1.10%

0.7K

JPMorgan Chase and Co

JPM

56.11

-1.16%

1.4K

Boeing Co

BA

132.40

-1.25%

2.8K

General Electric Co

GE

24.27

-1.30%

72.2K

Citigroup Inc., NYSE

C

48.25

-1.31%

14.4K

Cisco Systems Inc

CSCO

27.60

-1.32%

22.0K

McDonald's Corp

MCD

89.45

-1.35%

3.2K

Goldman Sachs

GS

177.77

-1.47%

1.5K

3M Co

MMM

161.50

-1.67%

13.8K

ALCOA INC.

AA

15.73

-2.18%

25.5K

Procter & Gamble Co

PG

87.20

-2.66%

107.4K

Deere & Company, NYSE

DE

86.00

-2.75%

9.2K

E. I. du Pont de Nemours and Co

DD

72.00

-2.85%

3.7K

Intel Corp

INTC

34.69

-3.11%

404.1K

United Technologies Corp

UTX

115.00

-3.16%

7.0K

Caterpillar Inc

CAT

78.84

-8.36%

692.1K

Microsoft Corp

MSFT

42.90

-8.74%

5.1M

-

15:11

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Microsoft (MSFT) downgraded to Neutral from Buy at Nomura, target lowered to $50 from $56

Microsoft (MSFT) downgraded to Neutral from Overweight at JP Morgan, target lowered to $47 from $53

Other:

Microsoft (MSFT) target lowered to $52 from $54 at Piper Jaffray; Overweight (47.01)

Honeywell (HON) target raised from $106 to $115 at Argus

-

15:04

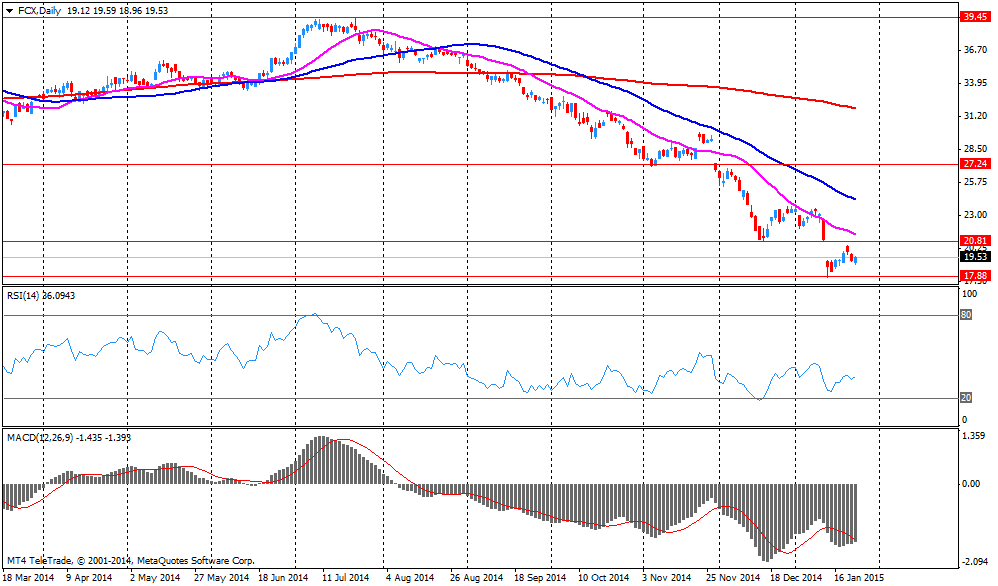

Company News: Freeport-McMoRan (FCX) reported weaker than expected fourth quarter earnings, but revenue exceeds forecasts

Freeport-McMoRan (FCX) earned $0.25 per share in the fourth quarter, missing analysts' estimate of $0.35. Revenue in the fourth quarter dropped 11.00% year-over-year to $5.24 billion, missing analysts' estimate of $4.89 billion.

The company has taken steps to significantly reduce capital spending due to falling oil prices.

Freeport-McMoRan (FCX) shares decreased to $18.05 (-7.72%) prior to the opening bell.

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, November +4.3% (forecast +4.5%)

-

14:58

Company News: Pfizer Inc. (PFE) reported better than expected fourth quarter profits

Pfizer Inc. (PFE) earned $0.55 per share in the fourth quarter, beating analysts' estimate of $0.53. Revenue in the fourth quarter decreased 3.2% year-over-year to $13.12 billion, but beating analysts' estimate of $12.83 billion.

The company released its forecasts for 2015. EPS is expected to be $2.00-$2.10 (analysts' estimate: $2.18), whilerevenue is expected to be $44.5-$46.5 billion in 2015 (analysts' estimate: $47.37 billion).

Pfizer Inc. (PFE) shares declined to $32.30 (-1.52%) prior to the opening bell.

-

14:52

Company News: 3M (MMM) reported better than expected fourth quarter earnings, but revenue missed forecasts

3M (MMM) earned $1.81 per share in the fourth quarter, missing analysts' estimate of $1.80. Revenue in the fourth quarter increased 2.0% year-over-year to $7.72 billion, but missing analysts' estimate of $7.77 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $8.00-$8.30 (analysts' estimate:$8.20).

3M (MMM) are not traded prior to the opening bell yet.

-

14:47

Company News: United Technologies Corp (UTX) reported fourth quarter earnings in line with expectations, revenue missed forecasts

United Technologies Corp (UTX) earned $1.62 per share in the fourth quarter, in line with analysts' estimate. Revenue in the fourth quarter increased 1.4% year-over-year to $17.00 billion, but missing analysts' estimate of $17.16 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $6.85-$7.05 (analysts' estimate: $7.19), while revenue is expected to be $65.00-$66.00 billion in fiscal year 2015 (analysts' estimate: $66.92 billion).

United Technologies Corp (UTX) shares fell to $115.00 (-3.16%) prior to the opening bell.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E635mn), $1.1400(E849mn)

USD/JPY: Y117.75($200mn), Y118.00($200mn), Y118.40($450mn), Y119.00($240mn)

GBP/USD: $1.5175 (stg200mn),

AUD/USD: $0.8025 (A$398mn)

NZD/USD: $0.7650 (NZ$598mn)

-

14:41

Company News: DuPont (DD) reported fourth quarter earnings in line with expectations, revenue declined

DuPont (DD) earned $0.71 per share in the fourth quarter, in line with analysts' estimate. Revenue in the fourth quarter decreased 4.8% year-over-year to $7.38 billion, missing analysts' estimate of $7.79 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $4.00-$4.20 (analysts' estimate: $4.47).

DuPont (DD) shares fell to $72.70 (-1.90%) prior to the opening bell.

-

14:33

U.S.: Durable Goods Orders ex Transportation , December -0.8% (forecast +0.5%)

-

14:33

Company News: Caterpillar (CAT) reported better than expected fourth quarter revenue, but earnings missed forecasts

Caterpillar (CAT) earned $1.35 per share in the fourth quarter, missing analysts' estimate of $1.57. Revenue in the fourth quarter decreased 1.1% year-over-year to $14.24 billion, but exceeding analysts' estimate of $14.18 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $4.75 (analysts' estimate: $6.71), while revenue is expected to be $50.00 billion in fiscal year 2015 (analysts' estimate: $54.87 billion).

Caterpillar (CAT) shares decreased to $79.59 (-7.49%) prior to the opening bell.

-

14:32

U.S.: Durable Goods Orders , December -3.4% (forecast +0.5%)

-

14:25

Company News: Procter & Gamble (PG) reported weaker than expected second fiscal quarter profits

Procter & Gamble (PG) earned $1.06 per share in the second fiscal quarter, missing analysts' estimate of $1.13. Revenue in the second fiscal quarter decreased 4.4% year-over-year to $20.16 billion, missing analysts' estimate of $20.57 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $4.09 (analysts' estimate: $4.17), while revenue is expected to be $77.29-$78.09 billion in fiscal year 2015 (analysts' estimate: $79.04 billion).

Procter & Gamble (PG) shares fell to $87.75 (-2.04%) prior to the opening bell.

-

14:19

Company News: Microsoft (MSFT) reported second fiscal quarter earnings in line with expectations, revenue increased better than expected

Microsoft (MSFT) earned $0.71 per share in the second fiscal quarter, in line with analysts' estimate. Revenue in the second fiscal quarter rose 8.0% year-over-year to $26.47 billion, beating analysts' estimate of $26.27 billion.

Microsoft (MSFT) shares decreased to $43.53 (-7.40%) prior to the opening bell.

-

14:12

Figures on durable goods orders and new-home sales will be delayed

Figures on durable goods orders and new-home sales will be delayed as the opening of the U.S. Commerce Department will be delayed by a blizzard.

The U.S. Commerce Department has said it will publish figures on its website.

-

14:04

Foreign exchange market. European session: the British pound declined against the U.S. dollar despite the better-than-expected retail sales data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia National Australia Bank's Business Confidence December 1 4 2

02:00 China Leading Index December 0.9% 1.1%

09:30 United Kingdom BBA Mortgage Approvals December 36.7 35.7

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV +0.7% +0.6% +0.5%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV +2.6% +2.8% +2.7%

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. durable goods orders are expected to increase 0.5% in December, after a 0.9% drop in November.

The U.S. durable goods orders excluding transportation are expected to rise 0.5% in December, after a 0.7% fall in November.

The U.S. consumer confidence is expected to climbs to 94.4 in January from 92.6 from December.

New home sales in the U.S. are expected to rise to 450,000 units in December from 438,000 units in November.

The euro traded higher against the U.S. dollar in the absence of any major market reports from the Eurozone.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The British pound increased against the U.S. dollar despite the weaker-than-expected economic data from the U.K. The U.K. gross domestic product (GDP) climbed 0.5% in the fourth quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the third quarter.

On a yearly basis, the U.K. GDP increased 2.7% in the fourth quarter, missing forecasts of a 2.8 rise, after a 2.6% gain in the third quarter.

The number of mortgage approvals decreased to 35,700 in December from 36,700 in November, the lowest reading since April 2013.

The Swiss franc traded higher against the U.S. dollar, recovering its losses. The Swiss franc fell on speculation that the Swiss National Bank (SNB) was intervening in the market. The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on Tuesday that the central bank is prepared to intervene in markets.

The Swiss National Bank's (SNB) monetary policy data for the week ending 23 January 2015 released on Monday showed that the amount of cash commercial banks hold with the SNB rose last week. Data indicates that the central bank may have intervened after discontinuing the 1.20 per euro exchange rate floor on January 15th.

The SNB declined to comment.

EUR/USD: the currency pair rose to $1.1345

GBP/USD: the currency pair increased to $1.5133

USD/JPY: the currency pair fell to $117.68

The most important news that are expected (GMT0):

13:30 U.S. Durable Goods Orders December -0.9% Revised From -0.7% +0.5%

13:30 U.S. Durable Goods Orders ex Transportation December -0.7% Revised From -0.4% +0.5%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November +4.5% +4.5%

14:00 U.S. Consumer confidence January 92.6 94.4

15:00 U.S. New Home Sales December 438 450

-

14:00

Orders

EUR/USD

Offers $1.1500, $1.1450/60, $1.1400, $1.1380, $1.1350

Bids $1.1220, $1.1200

GBP/USD

Offers $1.5195-200, $1.5150/60, $1.5120

Bids $1.4950

AUD/USD

Offers $0.8100, $0.8000

Bids $0.7850, $0.7815, $0.7800, $0.7750

EUR/JPY

Offers Y135.00, Y134.45/50, Y134.00

Bids Y133.10/00, Y132.50, Y132.10/00, Y131.50, Y131.20/00, Y130.50

USD/JPY

Offers Y119.00, Y118.35/40

Bids Y117.55/50, Y117.10/00, Y116.95/85

EUR/GBP

Offers stg0.7595/600

Bids stg0.7400

-

13:27

Swiss National Bank Vice President Jean-Pierre Danthine: the central bank is prepared to intervene in markets

The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on Tuesday that the central bank is prepared to intervene in markets.

Danthine noted that some time is needed "to find a new exchange rate balance".

The volume of SNB interventions could reach about CHF100 billion in January, the SNB vice president pointed out.

The Swiss National Bank's (SNB) monetary policy data for the week ending 23 January 2015 released on Monday showed that the amount of cash commercial banks hold with the SNB rose last week. Data indicates that the central bank may have intervened after discontinuing the 1.20 per euro exchange rate floor on January 15th.

The SNB declined to comment.

-

13:00

European stock markets mid-session: Indices decline on mixed earnings and concerns over Greece

European indices pause the rally fuelled by the European Central Bank's large scale quantitative easing as investors are cautious after the Greek vote on Sunday. The anti-austerity party Syriza won a decisive victory within 2 seats of the absolute majority. Alexis Tsirpas, the new Prime Minister, has pledged to keep Greece within the monetary union but wants to renegotiate Greek debt. Now all eyes are on the FED's interest rate decision tomorrow to get an indication on when interest rates might rise. Mixed earnings from companies like Siemens and Philips further fuelled market caution.

In the U.K. the preliminary Gross domestic product expanded less-than-expected in the fourth quarter according to the Office for National statistics as construction and production shrank. Consumer demand increased. GDP grew by seasonally adjusted +0.5%, the lowest in a year, in the last quarter of 2014, not meeting forecasts of an increase by +0.6% and less than the previous reading of +0.7%, dampening the economic outlook. Year on year GDP grew +2.7% in the fourth quarter, 0.1% below economist's estimates. An increase of +0.1% compared to the previous quarter.

In today's session the commodity heavy FTSE 100 index is trading -0.51% quoted at 6,817.65. France's CAC 40 lost -1.00% trading at 4,628.21. Germany's DAX 30 is currently trading -1.02% at 10,688.58 points.

-

12:20

Oil: Prices recover today ahead of U.S. stockpile data

Brent crude and West Texas Intermediate are trading higher today.Brent Crude added +0.54%, currently trading at USD48.42 a barrel, still below the important USD50 level. On January 13th Crude hit a low at USD45.19. West Texas Intermediate rose by +0.40% currently quoted at USD45.33.

Yesterday, Gary Cohn, president of Goldman Sachs and a former oil trader said prices could reach a level of USD30.

Prices were under pressure recently as Saudi Arabia's new King Slaman assured a smooth transition and reaffirmed that there will be no change in Saudi Arabia's policy towards cuts in production. Ali al-Naimi will stay oli minister. The OPEC warned that low oil price may lead to a decline in investment and oil prices could spike in long term due to reduced output.

Oil prices fell by nearly 60 percent over the past six months, and both key brands of oil are currently trading below $ 50 a barrel as the worldwide supply exceeds demand in a period of low global economic growth and the OPEC refusing to cut output rates to stabilize prices. Smaller OPEC members want to cut production but the organisation, responsible for 40% of worldwide production focuses on its fight for market share.

-

12:00

Gold prices flat before FED policy meeting

Gold is trading almost flat today. Earlier in the session the precious metal further declined for a third day hitting a one-week low at USD1,272.00. Markets await the FED's two-day policy meeting. The European Union agreed to work with the new Greek government to keep the country in the Eurozone after the anti-austerity party Syriza scored a win, making gold less attractive as safe haven asset.

Gold prices rose nearly 9 percent this year, after declining for two consecutive years, ending 2014 almost flat. Speculations that the FED will hold back its benchmark interest-rate hike till the end of the year further helped gold but the forecast for the current year remains uncertain.

The precious metal is currently quoted at USD1,280.60, -0,02% a troy ounce. On Thursday last week gold reached a five-month high at USD1,307.40.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E635mn), $1.1400(E849mn)

USD/JPY: Y117.75($200mn), Y118.00($200mn), Y118.40($450mn), Y119.00($240mn)

GBP/USD: $1.5175 (stg200mn),

AUD/USD: $0.8025 (A$398mn)

NZD/USD: $0.7650 (NZ$598mn)

-

10:50

U.K. economy grew less-than-expected in the fourth quarter of 2014

The preliminary Gross domestic product expanded less-than-expected in the fourth quarter according to the Office for National statistics as construction and production shrank. Consumer demand increased. GDP grew by seasonally adjusted +0.5%, the lowest in a year, in the last quarter of 2014, not meeting forecasts of an increase by +0.6% and less than the previous reading of +0.7%, dampening the economic outlook.

Year on year GDP grew +2.7% in the fourth quarter, 0.1% below economist's estimates. An increase of +0.1% compared to the previous quarter.

-

10:31

United Kingdom: BBA Mortgage Approvals, December 35.7

-

10:30

United Kingdom: GDP, q/q, Quarter IV +0.5% (forecast +0.6%)

-

10:30

United Kingdom: GDP, y/y, Quarter IV +2.7% (forecast +2.8%)

-

10:20

Press Review: EU Hunts Formula to Keep Greece in Euro After Tsipras Win

BLOOMBERG

EU Hunts Formula to Keep Greece in Euro After Tsipras Win

European finance ministers started work on reviving Greece's troubled rescue program as new Prime Minister Alexis Tsipras took office promising to end austerity.

Finance chiefs from the 19-nation euro area signaled their willingness to do a deal with Tsipras -- so long as the new Greek prime minister drops his demand for a debt writedown. At a meeting in Brussels on Monday, ministers agreed quickly to work with the new government to help keep Greece in the euro, Dutch Finance Minister Jeroen Dijsselbloem said.

"We stand ready to support them in that ambition," said Dijsselbloem, who led the meeting.

REUTERS

Oil gives up early gains on firm dollar, shrugs off OPEC comments

(Reuters) - Oil gave up early gains with Brent futures slipping below $48 on Tuesday as a stronger dollar weighed, offsetting comments from producer group OPEC that prices may have found a floor.

The Secretary-General of the Organization of the Petroleum Exporting Countries, Abdullah al-Badri, said oil prices may have bottomed out and warned of a risk of a future jump to $200 a barrel if investment in new supplies was too low.

"Crude oil markets continue to consolidate near term," ANZ analysts said, adding that Brent traded in the range of $48-$50 last week and showed little direction.

Source: http://www.reuters.com/article/2015/01/27/us-markets-oil-idUSKBN0L003R20150127

BLOOMBERG

Yuan Gains as Steepest Two-Day Drop Since 2008 Seen Excessive

China's yuan rose by the most in four weeks as the central bank strengthened the reference rate after the currency's biggest two-day slide since 2008.

The People's Bank of China raised the daily fixing 0.03 percent to 6.1364 a dollar after weakening it by 0.22 percent over the previous two days. The onshore yuan fell to near the lower limits of its trading band on Monday and the greenback's 14-day relative-strength index touched 69.8, near the 70 level that indicates to some traders the U.S. currency will weaken. Industrial profits fell 8 percent in December, the most in data going back to late 2011, an official report showed Tuesday.

"Yuan moves today look like a technical rebound after significant declines in past sessions," said Banny Lam, co-head of research at Agricultural Bank of China International Securities Co. in Hong Kong. "With a backdrop of weakening fundamentals in China and broad-based dollar strength, it's hard to see much room for yuan appreciation for now."

-

10:00

European Stocks. First hour: Indices slightly lower – ECB fuelled rally pauses

European indices pause the rally fuelled by the European Central Bank's large scale quantitative easing as investors are cautious after the Greek vote on Sunday. Now all eyes are on the FED's interest rate decision tomorrow to get an indication on when interest rates might rise.

The FTSE 100 index is currently trading +0.02% quoted at 6,853.92 points. Markets participants await data on U.K's GDP due at 09:30 GMT. Germany's DAX 30 lost -0.20% trading at 10,776.48 close to its all-time highs despite Siemens' disappointing quarterly earnings. France's CAC 40 declined by -0.26%, currently trading at 4,662.85 points.

Markets await a set of important U.S. data starting at 13:30 GMT and EUROFIN meetings starting at 10:00.

-

09:00

Global Stocks: U.S. indices add gains, Nikkei rallies, Chinese stocks lose

U.S. markets closed higher on Monday despite the win of Syriza, the anti-austerity party, in Greek elections as investors deemed a new crisis in the Eurozone less probable and energy stocks added gains. The DOW JONES index added +0.03%, closing at 17,678.70. The S&P 500 gained +0.26% with a final quote of 2,057.09 points. Trading volume was light with many traders leaving early due to the announced massive snow-storm.

Chinese stock markets declined on Tuesday with financial and property shares losing the most o concerns of a slowdown in economic growth. Hong Kong's Hang Seng is trading -0.57% at 24,782.27 points. China's Shanghai Composite closed at 3,354.36 points -0.85%.

Japan's Nikkei rose on Tuesday to one-month highs, closing +1.72% with a final quote of 17,768.30. Machinery makers and financials were among the top performers. Market participants were relieved that the result of the Greek elections did not impact European stock markets as much as anticipated.

-

08:30

Foreign exchange market. Asian session: U.S. dollar mixed to weaker

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia National Australia Bank's Business Confidence December 1 4 2

02:00 China Leading Index December 0.9% 1.1%

The U.S. dollar traded weaker to flat against most major currencies. The euro dropped to a low at USD1.1097 yesterday on concerns the Greek elections results could lead to instability in Europe but recovered during the session and remained stronger. Markets await the FED's interest rate decision tomorrow and a set of U.S. data later in the day starting at 13:30 GMT.

The Australian dollar recouped losses after touching the weakest level since June 2009 yesterday against the greenback but is trading almost flat during the Asian session. National Australia Bank's Business Confidence for December rose from 1 to 2, missing forecasts of an increase to 4. China's Leading Index for December rose from 0.9% to 1.1%. China is Australia's most important trade partner. Next week the Royal Bank of Australia will meet to decide on whether to cut interest rates or not. Currently they are at a record low of 2.5% but weakening commodity prices may lead to a further cut in the middle of the year.

New Zealand's dollar halted its fall after trading at the weakest since 2012 yesterday. In the Asian session the currency traded almost flat currently quoted at USD0.7425.

The Japanese yen traded higher against the greenback on Tuesday gaining some ground after yesterday's losses in the absence of any major economic data.

EUR/USD: the euro traded almost flat against the greenback

USD/JPY: the U.S. dollar traded weaker against the yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV +0.7% +0.6%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV +2.6% +2.8%

10:00 Eurozone ECOFIN Meetings

13:30 U.S. Durable Goods Orders December -0.9% Revised From -0.7% +0.5%

13:30 U.S. Durable Goods Orders ex Transportation December -0.7% Revised From -0.4% +0.5%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November +4.5% +4.5%

14:00 U.S. Consumer confidence January 92.6 94.4

14:45 U.S. Services PMI (Preliminary) January 53.3

15:00 U.S. Richmond Fed Manufacturing Index January 7

15:00 U.S. New Home Sales December 438 450

21:30 U.S. API Crude Oil Inventories January +5.7

23:30 Australia Leading Index December -0.1%

-

07:35

Options levels on tuesday, January 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1502 (2223)

$1.1436 (777)

$1.1362 (764)

Price at time of writing this review: $1.1227

Support levels (open interest**, contracts):

$1.1110 (3411)

$1.1044 (2328)

$1.1007 (2132)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 76759 contracts, with the maximum number of contracts with strike price $1,2100 (6507);

- Overall open interest on the PUT options with the expiration date February, 6 is 73233 contracts, with the maximum number of contracts with strike price $1,1700 (6718);

- The ratio of PUT/CALL was 0.95 versus 0.97 from the previous trading day according to data from January, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.5302 (451)

$1.5205 (947)

$1.5109 (456)

Price at time of writing this review: $1.5091

Support levels (open interest**, contracts):

$1.4993 (1003)

$1.4896 (1670)

$1.4798 (1165)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 16441 contracts, with the maximum number of contracts with strike price $1,5150 (1137);

- Overall open interest on the PUT options with the expiration date February, 6 is 16938 contracts, with the maximum number of contracts with strike price $1,4900 (1670);

- The ratio of PUT/CALL was 1.03 versus 1.04 from the previous trading day according to data from January, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:06

Nikkei 225 17,732.85 +264.33 +1.51%, Hang Seng 24,856.64 -53.26 -0.21%, Shanghai Composite 3,384.7 +1.52 +0.04%

-

03:01

China: Leading Index , December 1.1%

-

01:30

Australia: National Australia Bank's Business Confidence, December 2 (forecast 4)

-

00:31

Commodities. Daily history for Jan 26’2015:

(raw materials / closing price /% change)

Light Crude 45.08 -0.16%

Gold 1,281.30 +0.15%

-

00:30

Currencies. Daily history for Jan 26’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1238 +0,28%

GBP/USD $1,5079 +0,54%

USD/CHF Chf0,9028 +2,51%

USD/JPY Y118,44 +0,53%

EUR/JPY Y133,10 +0,80%

GBP/JPY Y178,58 +1,06%

AUD/USD $0,7922 +0,05%

NZD/USD $0,7424 -0,42%

USD/CAD C$1,2472 +0,40%

-

00:30

Stocks. Daily history for Jan 26’2015:

(index / closing price / change items /% change)

Nikkei 225 17,468.52 -43.23 -0.25%

Hang Seng 24,909.9 +59.45 +0.24%

Shanghai Composite 3,383.94 +32.18 +0.96%

FTSE 100 6,852.4 +19.57 +0.29%

CAC 40 4,675.13 +34.44 +0.74%

Xetra DAX 10,798.33 +148.75 +1.40%

S&P 500 2,057.09 +5.27 +0.26%

NASDAQ Composite 4,771.76 +13.88 +0.29%

Dow Jones 17,678.7 +6.10 +0.03%

-

00:06

Schedule for today, Tuesday, Jan 27’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia National Australia Bank's Business Confidence December 1 4

02:00 China Leading Index December 0.9%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV +0.7% +0.6%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV +2.6% +2.8%

10:00 Eurozone ECOFIN Meetings

13:30 U.S. Durable Goods Orders December -0.9% Revised From -0.7% +0.5%

13:30 U.S. Durable Goods Orders ex Transportation December -0.7% Revised From -0.4% +0.5%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November +4.5% +4.5%

14:00 U.S. Consumer confidence January 92.6 94.4

14:45 U.S. Services PMI (Preliminary) January 53.3

15:00 U.S. Richmond Fed Manufacturing Index January 7

15:00 U.S. New Home Sales December 438 450

21:30 U.S. API Crude Oil Inventories January +5.7

23:30 Australia Leading Index December -0.1%

-