Noticias del mercado

-

22:45

New Zealand: Building Permits, m/m, December 2.3%

-

18:00

European stocks closed: FTSE 100 5,931.78 -58.59 -0.98% CAC 40 4,322.16 -58.20 -1.33% DAX 9,639.59 -241.23 -2.44%

-

17:09

The Confederation of British Industry Director of Economics, Rain Newton-Smith: a weak global growth and competitive pressures from abroad weigh on the U.K. manufacturing sector

The Confederation of British Industry (CBI) Director of Economics, Rain Newton-Smith, said on Thursday that a weak global growth and competitive pressures from abroad weigh on the U.K. manufacturing sector.

"Manufacturers are still feeling the hit from weaker global growth and competitive pressures from abroad. And while low oil prices are a boon for the economy as a whole, businesses in the North Sea industry are suffering," she said.

Newton-Smith noted, commenting on the latest U.K. GDP data, that "the UK economy ended 2015 in decent health".

-

17:00

The People's Bank of China injects 340 billion yuan into market

The People's Bank of China (PBoC) on Thursday injected 340 billion yuan ($52 billion) into market to boost liquidity via seven-day reverse repos and 28-day reverse repos.

The central bank usually injects extra money before the Lunar New Year holiday.

-

16:53

Japan's Economy and Fiscal Policy Minister Akira Amari resigns

Japan's Economy and Fiscal Policy Minister Akira Amari resigned amid corruption allegations on Thursday. He denied that he received bribes from a construction company.

Amari was the architect of "Abenomics" and Japan's lead negotiator for the Trans Pacific Partnership (TPP) trade deal.

Amari will be replaced by Nobuteru Ishihara, former environment minister.

-

16:43

The Swiss National Bank Vice Chairman Fritz Zurbruegg: it was the right decision to remove the franc/euro cap last January

The Swiss National Bank (SNB) Vice Chairman Fritz Zurbruegg said in interview with the Swiss newspaper Corriere del Ticino on Thursday that it was the right decision to remove the franc/euro cap last January.

"It was the right decision at the right time," he said.

Zurbruegg noted that the Swiss economy was holding up despite the strong franc.

He pointed out that there was no the risk of deflation.

"Inflation is very low and remains in negative territory this year. This is due to a transition of the sharp fall in oil and the strength of the franc and does not pose the risk of deflation," the SNB vice chairman said.

-

16:32

Retail sales in Japan decline at an annual rate of 1.1% in December

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan declined at an annual rate of 1.1% in December, missing expectations for a 0.1% fall, after a 1.0% drop in November. It was the second consecutive monthly drop.

The decline was partly driven by lower fuel, and cars sales. Fuel sales slid 16.4% year-on-year in December, while car sales dropped 2.1%.

On a monthly basis, retail sales were down 0.2% in December, after a 2.5% decrease in November.

-

16:20

New Zealand’s trade deficit narrows to NZ$53 million in December

Statistics New Zealand released its trade data on late Wednesday evening. New Zealand's trade deficit narrowed to NZ$53 million in December from NZ$799 million in November. November's figure was revised down from a deficit of NZ$779 million.

Analysts had expected the deficit to decline to NZ$131 million.

Exports rose 0.6% in December, driven by logs, wood and wood articles, while imports declined 2.6%.

Exports dropped 2.2% year-on-year in December, driven by milk powder, while imports increased by 2.5%.

In 2015 as whole, the trade deficit was NZ$3.5 billion.

"The depreciating New Zealand dollar has an upward effect on import and export prices," Statistics NZ international statistics senior manager Jason Attewell said.

-

16:08

U.S. pending home sales rise 0.1% in December

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. rose 0.1% in December, missing expectations for a 0.8% gain, after a 1.1% drop in November. November's figure was revised down from a 0.9% decline.

The increase was mainly lead by a rise the Northeast.

"Warmer than average weather and more favourable inventory conditions compared to other parts of the country encouraged more households in the Northeast to make the decision to buy last month," the NAR's chief economist Lawrence Yun said.

"Overall, while sustained job creation is spurring more activity compared to a year ago, the ability to find available homes in affordable price ranges is difficult for buyers in many job creating areas. With homebuilding still grossly inadequate, steady price appreciation and tight supply conditions aren't going away any time soon," he added.

-

16:00

U.S.: Pending Home Sales (MoM) , December 0.1% (forecast 0.8%)

-

15:08

U.S. durable goods orders slide 5.1% in December

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders plunged 5.1% in December, missing expectations for a 0.6% fall, after a 0.5% drop in November. November's figure was revised down from a flat reading.

The decline was mainly driven by a weak demand for transportation equipment, which fell by 12.4% in December.

The U.S. durable goods orders excluding transportation dropped 1.2% in December, missing expectations for a 0.1% decrease, after a 0.5% decline in November. November's figure was revised down from a 0.1% drop.

The U.S. durable goods orders excluding defence slid 2.9 % in December, after a 2.0% decline in November. November's figure was revised down from a 1.5% decrease.

-

14:50

Initial jobless claims drop to 278,000 in the week ending January 23

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 23 in the U.S. dropped by 16,000 to 278,000 from 294,000 in the previous week. The previous week's figure was revised down from 293,000.

Analysts had expected jobless claims to fall to 282,000.

Jobless claims remained below 300,000 the 47th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims rose by 49,000 to 2,268,000 in the week ended January 16.

-

14:48

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.00 (USD 353m) 118.00 (USD 1.1bln) 118.50 (805m) 119.25 (340m)

EUR/USD 1.0800 (EUR 861m) 1.0820-25 (687m) 1.0900 (855m)

USD/CHF 1.0200 (USD 284m)

USD/CAD 1.3800 (USD 500m) 1.4150 (USD 605m) 1.4245 (335m) 1.4450 (375m)

-

14:35

CBI retail sales balance slides to +16% in January

The Confederation of British Industry (CBI) released its retail sales balance data on Thursday. The CBI retail sales balance plunged to +16% in January from +19% in November.

Sales growth is expected to slow next month, while orders are expected to decline.

"Retailers have had a steady start to the year through the January sales period. However with competition remaining fierce and persistent price deflation in the sector, it's not surprising the outlook for retailers in February looks subdued," CBI Director of Economics, Rain Newton-Smith, said.

-

14:30

U.S.: Initial Jobless Claims, January 278 (forecast 282)

-

14:30

U.S.: Durable Goods Orders , December -5.1% (forecast -0.6%)

-

14:30

U.S.: Continuing Jobless Claims, January 2268 (forecast 2217)

-

14:30

U.S.: Durable Goods Orders ex Transportation , December -1.2% (forecast -0.1%)

-

14:30

U.S.: Durable goods orders ex defense, November -2.9%

-

14:22

German consumer price inflation decreases 0.8% in January

Destatis released its consumer price data for Germany on Thursday. German preliminary consumer price index decreased 0.8% in January, in line with expectations, after a 0.1% decrease in December.

On a yearly basis, German preliminary consumer price index rose to 0.5% in January from 0.3% in December, in line with expectations.

The annual increase was mainly driven by a rise in services prices, which were up 1.2% year-on-year in January.

Goods prices dropped 0.3% year-on-year in January, driven by a decline in energy prices. Energy prices slid 5.8% year-on-year in January.

-

14:17

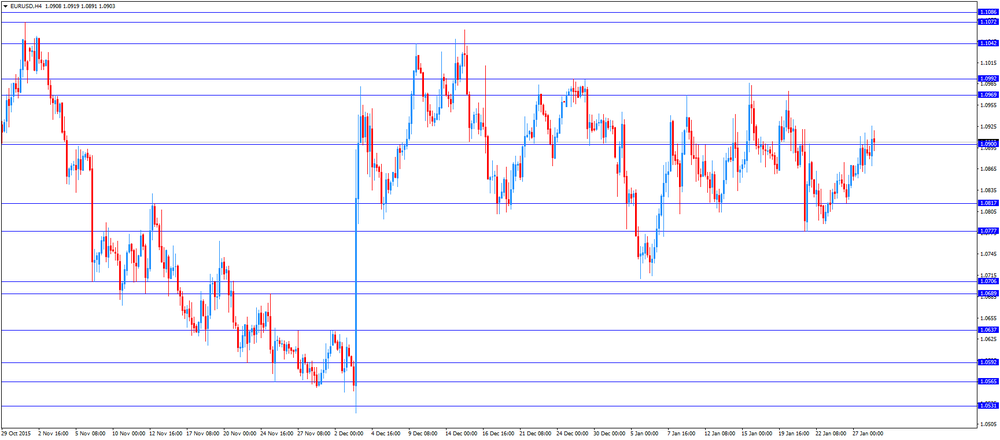

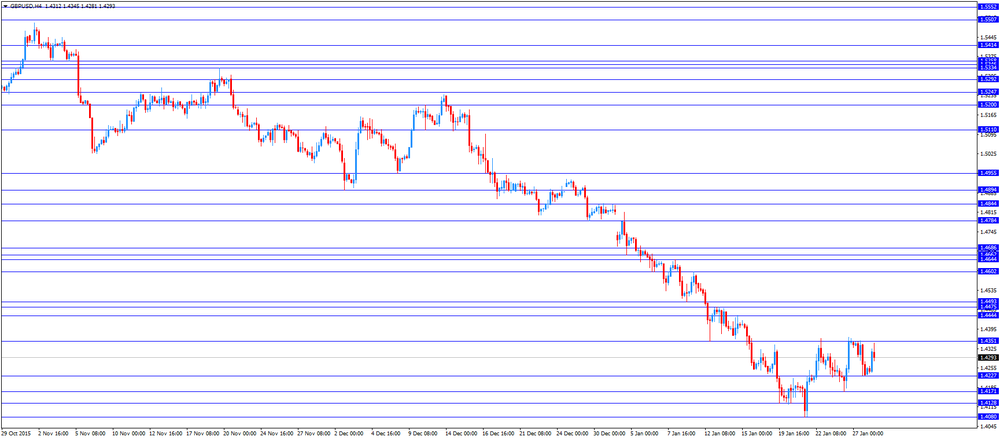

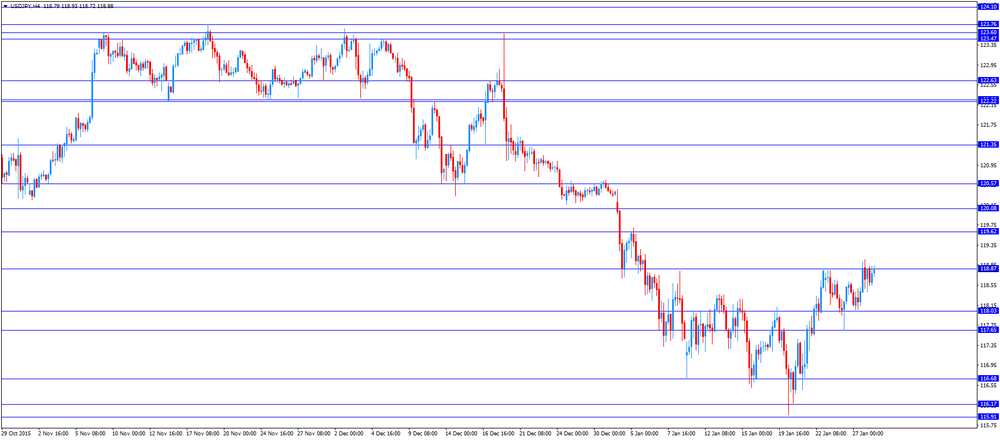

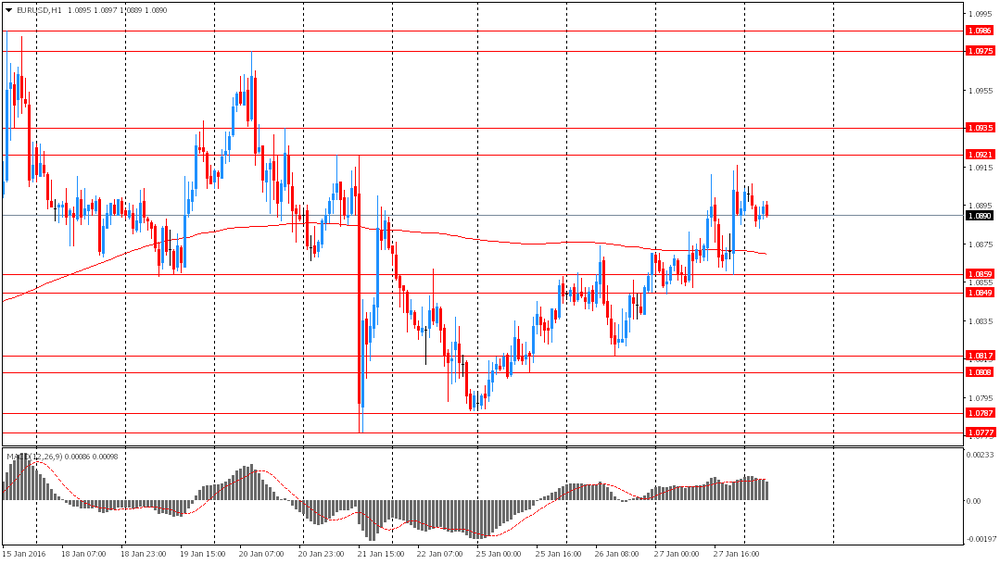

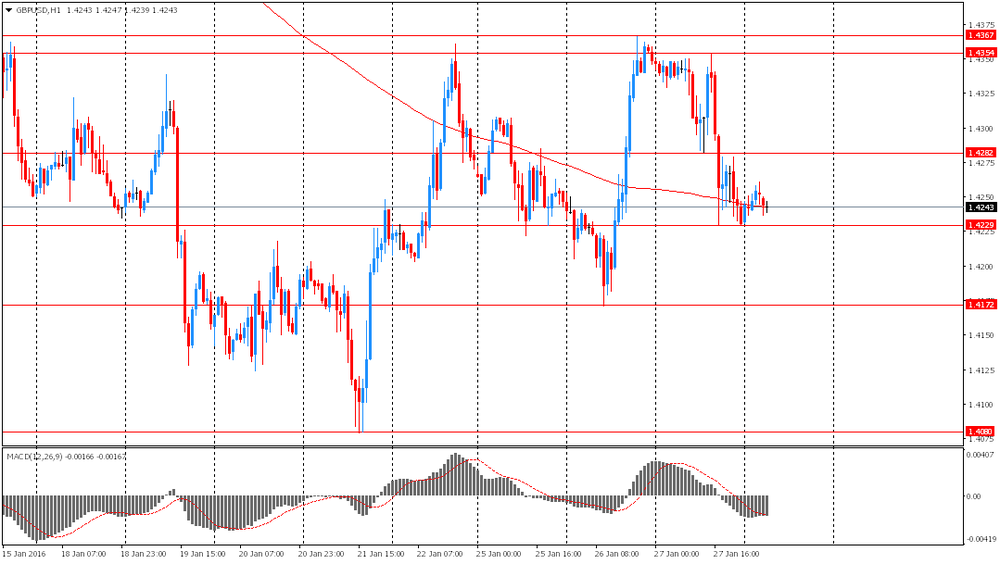

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of the U.K. GDP data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Export Price Index, q/q Quarter IV 0.0% -3.8% -5.4%

00:30 Australia Import Price Index, q/q Quarter IV 1.4% -0.8% -0.3%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV 0.4% 0.5% 0.5%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV 2.1% 1.9% 1.9%

10:00 Eurozone Economic sentiment index January 106.7 Revised From 106.8 106.4 105

10:00 Eurozone Business climate indicator January 0.39 Revised From 0.41 0.39 0.29

10:00 Eurozone Industrial confidence January -2 -2.4 -3.2

10:00 Eurozone Consumer Confidence (Finally) January -5.7 -6.3 -6.3

13:00 Germany CPI, m/m (Preliminary) January -0.1% -0.8% -0.8%

13:00 Germany CPI, y/y (Preliminary) January 0.3% 0.5% 0.5%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 11,000 to 282,000 last week.

The U.S. durable goods orders are expected to decrease 0.6% in December, after a flat reading in November.

The U.S. durable goods orders excluding transportation are expected to fall 0.1% in December, after a 0.1% decline in November.

Pending home sales in the U.S. expected to decline 0.1% in December, after a 0.1% drop in November.

The Fed's interest rate decision weighed on the U.S. dollar. The Fed kept its interest rate unchanged at 0.25% - 0.50% on Wednesday as widely expected by analysts. But the Fed noted that it was "closely monitoring global economic and financial developments and is assessing their implications for the labour market and inflation, and for the balance of risks to the outlook". Market participants speculate that the Fed could delay its further interest rate hikes.

The euro traded higher against the U.S. dollar despite the release of the mixed economic data from the Eurozone. Destatis released its consumer price data for Germany on Thursday. German preliminary consumer price index decreased 0.8% in January, in line with expectations, after a 0.1% decrease in December.

On a yearly basis, German preliminary consumer price index rose to 0.5% in January from 0.3% in December, in line with expectations.

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index slid to 105.0 in January from 106.7 in December. December's figure was revised down from 106.8.

Analysts had expected the index to decline to 106.4.

The drop was driven by a fall in confidence in industry and a decline in consumer confidence.

The industrial confidence index fell to -3.2 in January from -2.0 in December, missing expectations for a drop to -2.4.

The final consumer confidence index was down to -6.3 in January from -5.7 in December, in line with expectations.

The business climate index decreased to 0.29 in January from 0.39 in December. December's figure was revised down from 0.41. Analysts had expected the index to remain unchanged at 0.39.

The British pound traded higher against the U.S. dollar after the release of the U.K. GDP data. The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the fourth quarter, in line with expectations, after a 0.4% rise in the third.

The growth was mainly driven by a strong output in the services sector, which climbed 0.7% in the fourth quarter.

Construction fell 0.1% in the fourth quarter, while production declined 0.2%.

On a yearly basis, the preliminary U.K. GDP increased 1.9% in the fourth quarter, in line with forecasts, after a 2.1% gain in the third quarter. It was the slowest pace since the first quarter of 2013.

In 2015 as whole, U.K. GDP rose 2.2%, after a 2.9% growth in 2014.

The Confederation of British Industry (CBI) released its retail sales balance data on Thursday. The CBI retail sales balance plunged to +16% in January from +19% in November.

EUR/USD: the currency pair rose to $1.0926

GBP/USD: the currency pair climbed to $1.4345

USD/JPY: the currency pair increased to Y118.93

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims January 293 282

13:30 U.S. Durable Goods Orders December 0% -0.6%

13:30 U.S. Durable Goods Orders ex Transportation December -0.1% -0.1%

13:30 U.S. Durable goods orders ex defense November -1.5%

15:00 U.S. Pending Home Sales (MoM) December -0.9% 0.8%

21:45 New Zealand Building Permits, m/m December 1.8%

23:30 Japan Unemployment Rate December 3.3% 3.3%

23:30 Japan Tokyo Consumer Price Index, y/y January 0.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January 0.1% 0.1%

23:30 Japan Household spending Y/Y December -2.9% -2.4%

23:30 Japan National Consumer Price Index, y/y December 0.3% 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y December 0.1% 0.1%

-

14:00

Germany: CPI, y/y , January 0.5% (forecast 0.5%)

-

14:00

Germany: CPI, m/m, January -0.8% (forecast -0.8%)

-

13:44

Orders

EUR/USD

Offers 1.0920-25 1.0945-50 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0870 1.0850 1.0830 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

Offers 1.4285 1.4300 1.4320 1.4355-60 1.4380 1.4400 1.4425-30 1.4450

Bids 1.4250 1.4225-30 1.4200 1.4170-75 1.4150 1.4130 1.4100

EUR/GBP

Offers 0.7655-60 0.7680 0.7700 0.7720-25 0.7750-55

Bids 0.7620 0.7600 0.7575-80 0.7560 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 129.80 130.00 130.30 130.50 130.75 131.00

Bids 129.50 129.30 128.25 128.00 127.80 127.50

USD/JPY

Offers 118.85-90 119.00 119.30 119.50 119.75 120.00

Bids 118.50 118.25-30 118.00 117.85 117.70 117.50 117.30 117.00

AUD/USD

Offers 0.7085 0.7100 0.7130 0.7150 0.7180 0.7200

Bids 0.7050 0.7030 0.7015 0.7000 0.6980 0.6950

-

12:02

Unemployment rate in Spain decline to 20.9% in the fourth quarter

The Spanish statistical office INE released its labour market figures on Thursday. The unemployment rate was 20.9% in the fourth quarter, down from 21.2% in the third quarter. It was the lowest level in four years.

The number of registered unemployed people fell by 71,300 in the fourth quarter to 4.78 million, the lowest level since the end of 2010.

In 2015 as whole, the number of registered unemployed people declined by 678,200.

Spain's unemployment rate is the second-highest unemployment rate in the Eurozone after Greece.

-

11:54

Retail sales in Spain rise at a seasonally adjusted rate of 0.2% in December

The Spanish statistical office INE released its retail sales data on Thursday. Retail sales in Spain rose at a seasonally adjusted rate of 0.2% in December, after a 0.6% decline in November.

Food sales were up 0.9% in December, while non-food sales decreased by 0.5%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 2.2% in December, after a 3.3% rise in November.

Sales of non-food products jumped 3.0% in December from a year ago, while food sales fell 0.2%.

In 2015 as whole, retail sales rose by 3.6%.

-

11:46

German import prices decline 1.2% in December

Destatis released its import prices data for Germany on Thursday. German import prices declined by 3.1% in December from last year, after a 3.5% fall in November.

The decline was driven by a drop in energy prices, which plunged 25.9% year-on-year in December.

Import prices decline since January 2013.

On a monthly base, import prices decreased 1.2% in December, after a 0.2% fall in November.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 0.9% in December.

In 2015 as whole, import prices slid 2.6%, after a 2.2% fall in 2014.

Export prices increased 0.2% year-on-year in December, after a 0.3% rise in November.

On a monthly base, export prices were down 0.4% in December, after a 0.1% rise in November.

In 2015 as whole, export prices climbed 0.9%.

-

11:38

U.K. gross domestic product (GDP) climbs 0.5% in the fourth quarter

The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the fourth quarter, in line with expectations, after a 0.4% rise in the third.

The growth was mainly driven by a strong output in the services sector, which climbed 0.7% in the fourth quarter.

Construction fell 0.1% in the fourth quarter, while production declined 0.2%.

On a yearly basis, the preliminary U.K. GDP increased 1.9% in the fourth quarter, in line with forecasts, after a 2.1% gain in the third quarter. It was the slowest pace since the first quarter of 2013.

In 2015 as whole, U.K. GDP rose 2.2%, after a 2.9% growth in 2014.

-

11:28

Eurozone’s economic sentiment index slides to 105.0 in January

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index slid to 105.0 in January from 106.7 in December. December's figure was revised down from 106.8.

Analysts had expected the index to decline to 106.4.

The drop was driven by a fall in confidence in industry and a decline in consumer confidence.

The industrial confidence index fell to -3.2 in January from -2.0 in December, missing expectations for a drop to -2.4.

The final consumer confidence index was down to -6.3 in January from -5.7 in December, in line with expectations.

The business climate index decreased to 0.29 in January from 0.39 in December. December's figure was revised down from 0.41. Analysts had expected the index to remain unchanged at 0.39.

-

11:16

The Fed keeps its monetary unchanged in January

The Fed released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50%. This decision was widely expected by analysts.

The Fed said that the U.S. economy is expected to continue to expand moderately, while the U.S. labour market is expected to continue to strengthen. But the Fed noted that it was "closely monitoring global economic and financial developments and is assessing their implications for the labour market and inflation, and for the balance of risks to the outlook".

The Fed also said that inflation is expected to remain at low levels due to a further drop in energy prices.

The Fed raised its interest rate to the range 0.25% - 0.50% from 0.00% - 0.25% in December.

-

11:00

Eurozone: Economic sentiment index , January 105 (forecast 106.4)

-

11:00

Eurozone: Consumer Confidence, January -6.3 (forecast -6.3)

-

11:00

Eurozone: Industrial confidence, January -3.2 (forecast -2.4)

-

11:00

Eurozone: Business climate indicator , January 0.29 (forecast 0.39)

-

10:44

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.00 (USD 353m) 118.00 (USD 1.1bln) 118.50 (805m) 119.25 (340m)

EUR/USD 1.0800 (EUR 861m) 1.0820-25 (687m) 1.0900 (855m)

USD/CHF 1.0200 (USD 284m)

USD/CAD 1.3800 (USD 500m) 1.4150 (USD 605m) 1.4245 (335m) 1.4450 (375m) -

10:39

Reserve Bank of New Zealand keeps its monetary policy unchanged in January

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The RBNZ kept its interest rate unchanged at 2.5% as widely expected by analysts.

The central bank hinted that further monetary policy easing is possible, but it will depend on the incoming economic data.

"Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range," the RBNZ Governor Graeme Wheeler said.

He noted that the inflation and the economic growth in New Zealand are expected to rise in 2016, adding that global growth, global financial market conditions, dairy prices, net immigration, and pressures in the housing market are risks to the outlook.

The RBNZ governor also said that a further depreciation of the New Zealand dollar was appropriate due to low export prices.

Wheeler noted that house price inflation in Auckland is a risk to financial stability.

The RBNZ lowered its interest rate to 2.50% from 2.75% in December.

-

10:30

United Kingdom: GDP, q/q, Quarter IV 0.5% (forecast 0.5%)

-

10:30

United Kingdom: GDP, y/y, Quarter IV 1.9% (forecast 1.9%)

-

10:08

The number of registered job seekers without any employment activity in France rises 0.4% in December

The French labour ministry said on Wednesday that the number of registered job seekers without any employment activity rose 0.4% in December.

The total number of fully unemployed was 3.591 million people.

The number of job seekers climbed 2.6% in 2015, the smallest increase since 2010.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012. The French government is struggling to bring down unemployment.

Hollande said in a speech last Monday that the government will spend €2.00 billion to create more jobs in France.

-

08:33

Options levels on thursday, January 28, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0973 (4706)

$1.0953 (1757)

$1.0924 (1372)

Price at time of writing this review: $1.0876

Support levels (open interest**, contracts):

$1.0845 (3310)

$1.0815 (4537)

$1.0779 (9858)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 42903 contracts, with the maximum number of contracts with strike price $1,1000 (5853);

- Overall open interest on the PUT options with the expiration date February, 5 is 65573 contracts, with the maximum number of contracts with strike price $1,0800 (9858);

- The ratio of PUT/CALL was 1.53 versus 1.57 from the previous trading day according to data from January, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.4502 (1887)

$1.4404 (1029)

$1.4307 (381)

Price at time of writing this review: $1.4257

Support levels (open interest**, contracts):

$1.4193 (1173)

$1.4096 (908)

$1.3998 (436)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 24544 contracts, with the maximum number of contracts with strike price $1,4700 (3101);

- Overall open interest on the PUT options with the expiration date February, 5 is 22451 contracts, with the maximum number of contracts with strike price $1,4550 (1987);

- The ratio of PUT/CALL was 0.91 versus 0.92 from the previous trading day according to data from January, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:49

Foreign exchange market. Asian session: the U.S. dollar gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Export Price Index, q/q Quarter IV 0.0% -3.8% -5.4%

00:30 Australia Import Price Index, q/q Quarter IV 1.4% -0.8% -0.3%

The U.S. dollar climbed against most major currencies after declining yesterday amid Fed's statement. The Federal Reserve's Federal Open Market Committee kept interest rates unchanged as expected. The central bank admitted that economic growth slowed. However the Fed indicated that interest rates could still be raised in March

The yen declined amid Japan retail sales data. Retail sales fell by 1.1% y/y in December matching last year's reading. Economists had expected a modest decline of 0.1%. Retail sales fell by 0.2% in December after the 2.5% drop in November. Investors are also waiting for the Bank of Japan meeting. Some market participants expect the BOJ to add stimulus amid slowing inflation and stocks turmoil.

The New Zealand dollar fell after the Reserve Bank of New Zealand left its benchmark rate unchanged in line with expectations. However the central bank signaled it was ready to cut rates further if inflation growth does not pick up pace in the coming months. "Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range," RBNZ Governor Graeme Wheeler said.

EUR/USD: the pair fell to $1.0870 in Asian trade

USD/JPY: the pair rose to Y118.90

GBP/USD: the pair traded within $1.4230-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV 0.4% 0.5%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV 2.1% 1.9%

10:00 Eurozone Economic sentiment index January 106.8 106.4

10:00 Eurozone Business climate indicator January 0.41 0.39

10:00 Eurozone Industrial confidence January -2 -2.4

10:00 Eurozone Consumer Confidence (Finally) January -5.7 -6.3

13:00 Germany CPI, m/m (Preliminary) January -0.1% -0.8%

13:00 Germany CPI, y/y (Preliminary) January 0.3% 0.5%

13:30 U.S. Continuing Jobless Claims January 2208 2217

13:30 U.S. Initial Jobless Claims January 293 282

13:30 U.S. Durable Goods Orders December 0% -0.6%

13:30 U.S. Durable Goods Orders ex Transportation December -0.1% -0.1%

13:30 U.S. Durable goods orders ex defense November -1.5%

15:00 U.S. Pending Home Sales (MoM) December -0.9% 0.8%

21:45 New Zealand Building Permits, m/m December 1.8%

23:30 Japan Unemployment Rate December 3.3% 3.3%

23:30 Japan Tokyo Consumer Price Index, y/y January 0.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January 0.1% 0.1%

23:30 Japan Household spending Y/Y December -2.9% -2.4%

23:30 Japan National Consumer Price Index, y/y December 0.3% 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y December 0.1% 0.1%

-

01:30

Australia: Import Price Index, q/q, Quarter IV -0.3% (forecast -0.8%)

-

01:30

Australia: Export Price Index, q/q, Quarter IV 5.4% (forecast -3.8%)

-

00:50

Japan: Retail sales, y/y, December -1.1% (forecast -0.1%)

-

00:34

Currencies. Daily history for Jan 27’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0892 +0,21%

GBP/USD $1,4232 -0,82%

USD/CHF Chf1,015 -0,15%

USD/JPY Y118,68 +0,23%

EUR/JPY Y129,25 +0,42%

GBP/JPY Y168,9 -0,59%

AUD/USD $0,7025 +0,31%

NZD/USD $0,6430 -1,04%

USD/CAD C$1,4090 -0,18%

-

00:01

Schedule for today, Thursday, Jan 28’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Export Price Index, q/q Quarter IV 0.0% -3.8%

00:30 Australia Import Price Index, q/q Quarter IV 1.4% -0.8%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV 0.4% 0.5%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV 2.1% 1.9%

10:00 Eurozone Economic sentiment index January 106.8 106.4

10:00 Eurozone Business climate indicator January 0.41 0.39

10:00 Eurozone Industrial confidence January -2 -2.4

10:00 Eurozone Consumer Confidence (Finally) January -5.7 -6.3

13:00 Germany CPI, m/m (Preliminary) January -0.1% -0.8%

13:00 Germany CPI, y/y (Preliminary) January 0.3% 0.5%

13:30 U.S. Continuing Jobless Claims January 2208 2217

13:30 U.S. Initial Jobless Claims January 293 282

13:30 U.S. Durable Goods Orders December 0% -0.6%

13:30 U.S. Durable Goods Orders ex Transportation December -0.1% -0.1%

13:30 U.S. Durable goods orders ex defense November -1.5%

15:00 U.S. Pending Home Sales (MoM) December -0.9% 0.8%

21:45 New Zealand Building Permits, m/m December 1.8%

23:30 Japan Unemployment Rate December 3.3% 3.3%

23:30 Japan Tokyo Consumer Price Index, y/y January 0.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January 0.1% 0.1%

23:30 Japan Household spending Y/Y December -2.9% -2.4%

23:30 Japan National Consumer Price Index, y/y December 0.3% 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y December 0.1% 0.1%

-