Noticias del mercado

-

22:45

New Zealand: Trade Balance, mln, December -53 (forecast -131)

-

21:02

New Zealand: RBNZ Interest Rate Decision, 2.5% (forecast 2.5%)

-

20:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

18:01

European stocks closed: FTSE 100 5,990.37 +78.91 +1.33% CAC 40 4,380.36 +23.55 +0.54% DAX 9,880.82 +58.07 +0.59%

-

17:16

European Central Bank Executive Board member Benoît Cœuré: Eurozone’s countries should use fiscal space to boost the economic growth in the Eurozone

The European Central Bank (ECB) Executive Board member Benoît Cœuré said on Wednesday that Eurozone's countries should use fiscal space to boost the economic growth in the Eurozone.

"Using fiscal space would speed up the euro area's return to growth and support the ECB's objective of medium-term price stability. But, in many countries, such fiscal space simply does not exist, because rules have not been enforced in the past," he said.

-

16:30

U.S.: Crude Oil Inventories, January 8.383 (forecast 3.3)

-

16:27

Fitch cuts New Zealand’s outlook to "stable" from "positive"

Rating agency Fitch Ratings affirmed New Zealand's sovereign debt rating at 'AA' on Tuesday, but downgraded the outlook to "stable" from "positive". The reason for the downgrade was a weaker growth outlook.

"Fitch expects a slight rebound in business investment from its currently subdued level, and continued high net immigration levels to support consumption growth. We assume this will be partly offset by lower dairy production and slower residential investment growth, with stronger construction activity in Auckland unable to fully replace a decreasing contribution from the Canterbury rebuild," the agency said.

-

16:20

New home sales in the U.S. jump 10.8% in December

The U.S. Commerce Department released new home sales data on Wednesday. New home sales increased 10.8% to a seasonally adjusted annual rate of 544,000 units in December from 491,000 units in November. November's figure was revised up from 490,000 units.

Analysts had expected new home sales to reach 500,000 units.

The increase was mainly driven by higher sales in the Midwest. New home sales in the Midwest soared 31.6% in December.

-

16:00

U.S.: New Home Sales, December 544 (forecast 500)

-

15:52

Profits of industrial companies in China drop 4.7% in December

China's National Bureau of Statistics (NBS) said on Wednesday that profits of industrial companies in China declined 4.7% in December from a year earlier, after a 1.4% fall in November.

In 2015 as whole, industrial profits fell 2.3% from a year earlier.

Profits in the mining sector dropped 58.2% in 2015, while manufacturing profits rose 2.8%.

-

15:48

The German government cuts its growth forecasts for 2016

The German government on Wednesday lowered its growth forecasts for 2016 due to the slowdown in emerging economies, which could lead to lower exports. The government expects the German economy to expand 1.7% this year, down from its previous forecast of a 1.8% growth.

Exports are expected to rise 3.2% in 2016, while imports are expected to increase 4.8%.

The government forecasts domestic consumption to rise 1.9% this year.

-

14:57

Australian leading economic index falls 0.3% in December

Westpac Bank released the Westpac-Melbourne Institute leading economic index for Australia on late Tuesday evening. The leading economic index decreased 0.3% in December, after a 0.3% drop in November. November's figure was revised down from a 0.2% fall.

"This is another disappointing result. The Index has now been growing below trend for the last eight months. It continues to signal that growth in the Australian economy in the first half of 2016 will be below trend," Westpac's Chief Economist, Bill Evans, said.

-

14:49

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.35 (USD 400m) 118.00 (225m)

EUR/USD 1.0700 (EUR 1.5bln) 1.0750 (EUR 402m) 1.0800 (2.3bln) 1.0850-55 (660m)

AUD/USD 0.6950 (AUD 501m)

AUD/NZD 1.1000 (AUD 1.5bln)

AUD/JPY 84.25 (AUD 332m)

EUR/JPY 129.50 (EUR 229m)

-

14:21

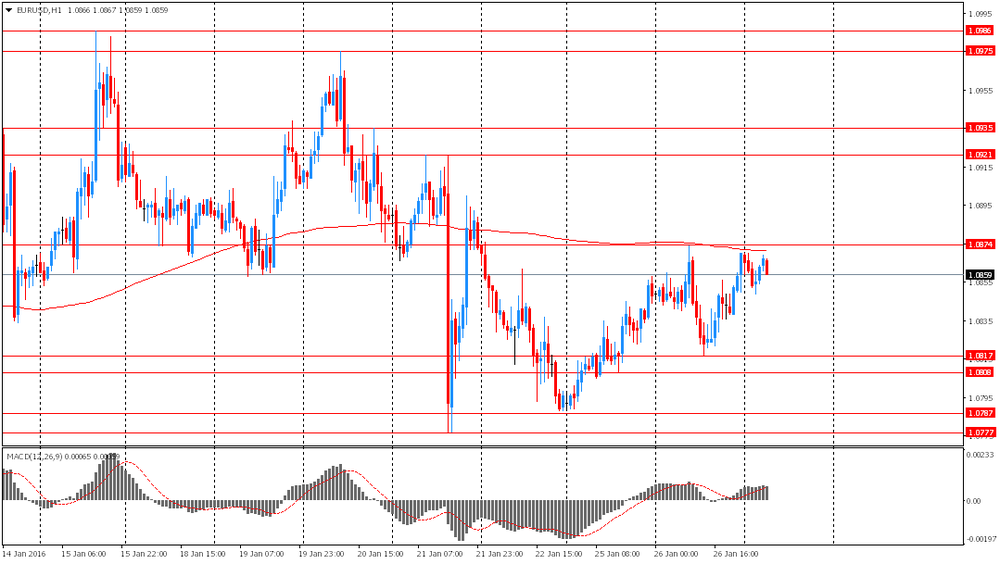

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the better-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, q/q Quarter IV 0.5% 0.3% 0.4%

00:30 Australia CPI, y/y Quarter IV 1.5% 1.6% 1.7%

00:30 Australia Trimmed Mean CPI q/q Quarter IV 0.3% 0.5% 0.6%

00:30 Australia Trimmed Mean CPI y/y Quarter IV 2.1% 2.1% 2.1%

07:00 United Kingdom Nationwide house price index January 0.8% 0.6% 0.3%

07:00 United Kingdom Nationwide house price index, y/y January 4.5% 4.7% 4.4%

07:00 Germany Gfk Consumer Confidence Survey February 9.4 9.3 9.4

07:00 Switzerland UBS Consumption Indicator December 1.55 Revised From 1.66 1.62

07:45 France Consumer confidence January 96 96 97

09:30 United Kingdom BBA Mortgage Approvals December 44.53 Revised From 45 45.5 43.98

12:00 U.S. MBA Mortgage Applications January 9% 8.8%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the Fed's monetary policy meeting results later in the day. Analysts expect the Fed to keep its monetary policy unchanged.

New home sales in the U.S. are expected to rise to 500,000 units in December from 490,000 units in November.

The euro traded higher against the U.S. dollar after the release of the better-than-expected economic data from the Eurozone. Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index remained unchanged at 9.4 in February, beating expectations for a drop to 9.3.

"The consumer climate has therefore been able to withstand the recent growth in risks it is facing. However, in the next few months the escalating terror threat and the rising fears among certain groups of the population that Germany could eventually become overstretched by the persistently high influx of refugees and asylum seekers may cause consumer confidence to wane in the long term. In turn, this would have a lasting impact on the consumer climate," Gfk noted.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index rose to 97 in January from 96 in December. Analysts had expected the index to remain unchanged at 96.

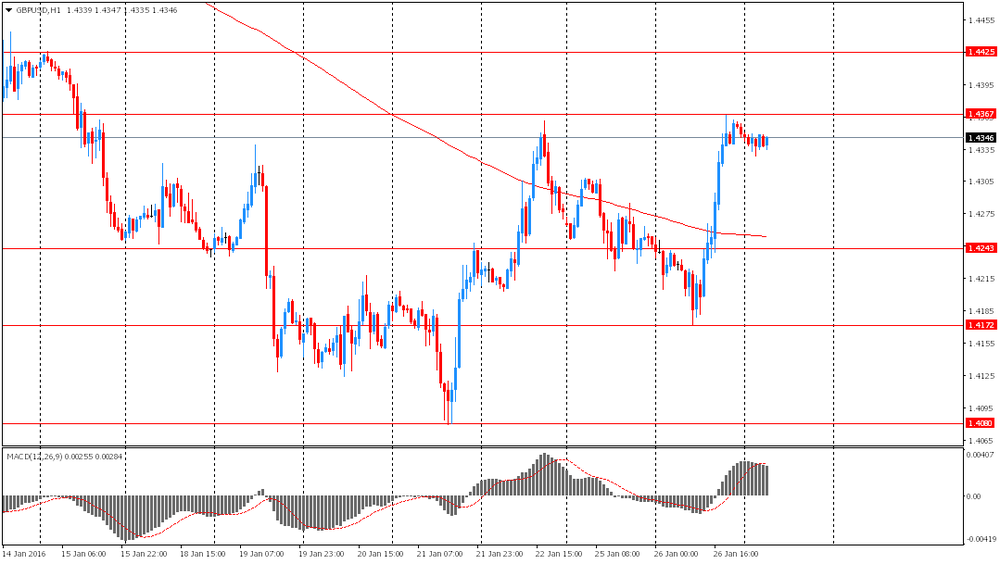

The British pound traded mixed against the U.S. dollar after the release of the U.K. economic data. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals decreased to 43,975 in December from 44,533 in November, missing expectations for a rise to 45,500. November's figure was revised up from 45,437.

"Last year was a strong year for household borrowing. There was a 6% rise in mortgage borrowing compared to 2014 and consumer credit expanded at more than 5% annually within an overall unsecured market which is growing at nearly 10% annually," the chief economist at the BBA, Richard Woolhouse, said.

The Nationwide Building Society released its house prices data for the U.K. on Wednesday. UK house prices were up 0.3% in January, missing expectations for a 0.6% rise, after a 0.8% increase in December.

On a yearly basis, house prices fell to 4.4% in January from 4.5% in December. Analysts had expected house prices to rise by 4.7%.

"As we look ahead, the risks are skewed towards a modest acceleration in house price growth, at least at the national level, Robert Gardner, said.

The Swiss franc traded lower against the U.S. dollar. UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.62 in December from 1.55 in November. November's figure was revised down from 1.66.

The bank expect the consumption to rise.

"Consumer sentiment will likely start the year strong despite a seasonal increase in the unemployment rate in December. As low interest rates provide little incentive to save, people tend to consume more," the bank said.

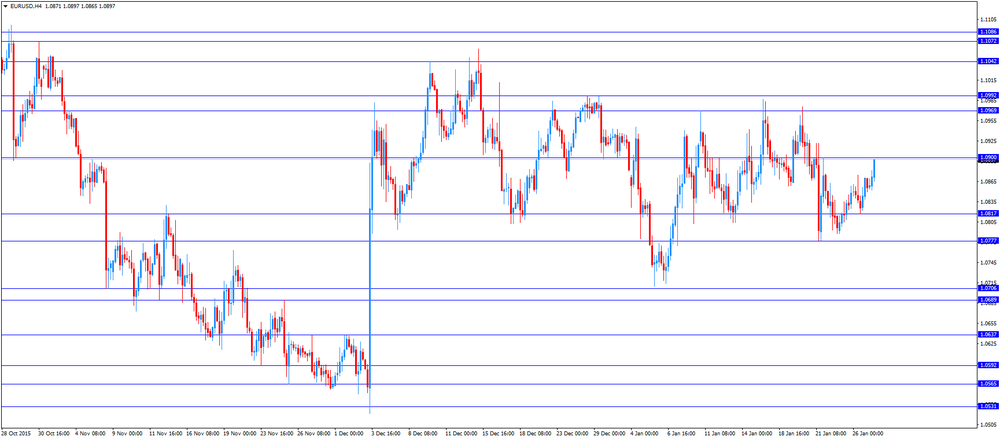

EUR/USD: the currency pair rose to $1.0897

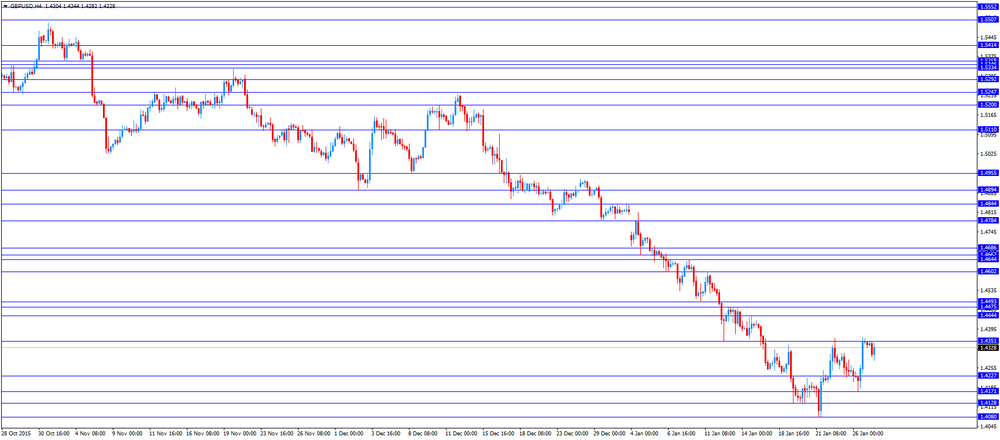

GBP/USD: the currency pair traded mixed

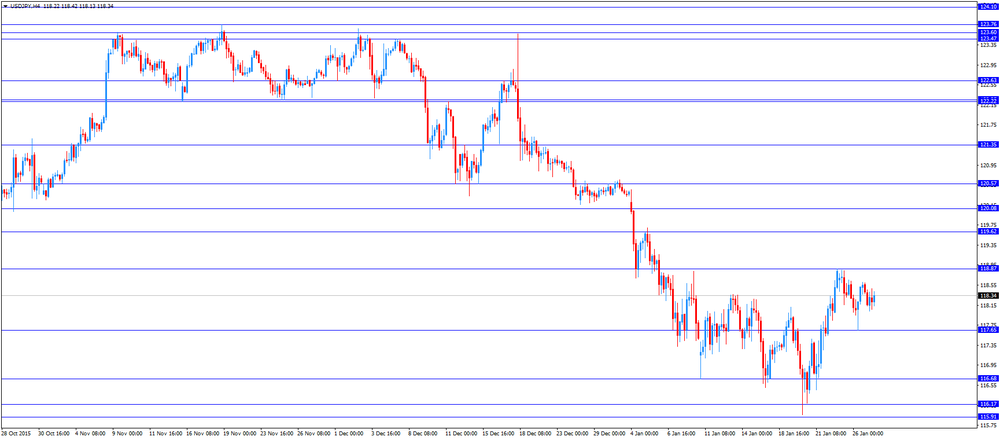

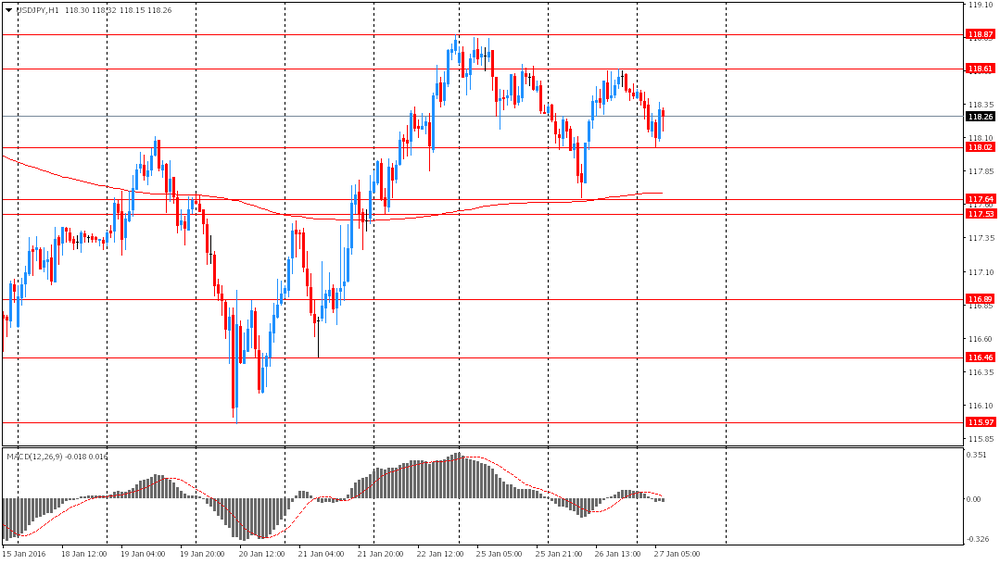

USD/JPY: the currency pair increased to Y118.42

The most important news that are expected (GMT0):

15:00 U.S. New Home Sales December 490 500

15:30 U.S. Crude Oil Inventories January 3.979 3.3

19:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.5% 2.5%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -779 -131

23:50 Japan Retail sales, y/y December -1.0% -0.1%

-

13:48

Orders

EUR/USD

Offers 1.0880-85 1.0900 1.0925 1.0945-50 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0850 1.0830 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

Offers 1.4355-60 1.4380 1.4400 1.4425-30 1.4450 1.4475 1.4500

Bids 1.4300 1.4280 1.4250 1.4230 1.4200 1.4170-75 1.4150

EUR/GBP

Offers 0.7600 0.7625-30 0.7650 0.7680 0.7700 0.7720-25 0.7750-55

Bids 0.7575 0.7560 0.7530 0.7500 0.7485 0.7450 0.7425 0.7400

EUR/JPY

Offers 128.80 129.00 129.30 129.50 129.75 130.00 130.30 130.50

Bids 128.25 128.00 127.80 127.50 127.30 127.00 126.80 126.50

USD/JPY

Offers 118.50 118.60 118.85 119.00 119.30 119.50 119.75 120.00

Bids 118.00 117.85 117.70 117.50 117.30 117.00 116.75-80 116.50 116.30 116.00

AUD/USD

Offers 0.7050-55 0.7080 0.7100 0.7130 0.7150 0.7180 0.7200

Bids 0.7020 0.7000 0.6980 0.6950 0.6920 0.6900 0.6875-80 0.6850

-

13:00

U.S.: MBA Mortgage Applications, January 8.8%

-

11:45

Italian consumer confidence index climbs to 118.9 in January

The Italian statistical office ISTAT released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index climbed to 118.9 in January from 117.7 in December. December's figure was revised up from 117.6.

The increase was driven by rises in all components: economic, personal, current and future.

The business confidence index fell to 103.2 in January from 104.0 in December. December's figure was revised down from 104.1.

The decline was driven by less favourable assessments on order books and production expectations.

-

11:33

UBS consumption index rises to 1.62 in December

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.62 in December from 1.55 in November. November's figure was revised down from 1.66.

The bank expect the consumption to rise.

"Consumer sentiment will likely start the year strong despite a seasonal increase in the unemployment rate in December. As low interest rates provide little incentive to save, people tend to consume more," the bank said.

The bank noted that low consumer prices were driven by low energy prices in general and crude oil in particular.

-

11:27

French consumer confidence index rises to 97 in January

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index rose to 97 in January from 96 in December. Analysts had expected the index to remain unchanged at 96.

The index of the outlook on consumers' saving capacity fell to -6 in January from -5 in December.

The index of households' assessment of their financial situation in the past twelve months rose to -24 in January from -25 in December.

The index of the outlook on consumers' financial situation for next twelve months decreased to -8 in January from -7 in December.

The index of the outlook on unemployment rising in coming months dropped to 34 in January from 45 in December.

The index for future inflation expectations was down to -39 in January from -38 in December.

-

11:20

German Gfk consumer confidence index remains unchanged at 9.4 in February

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index remained unchanged at 9.4 in February, beating expectations for a drop to 9.3.

2 of 3 indicators increased.

The economic expectations index rose by 1.3 points to 4.2 points in January, while the willingness to buy index increased 3.7 points to 52.7.

The income expectations index fell by 3.6 points to 47.2 in January.

"The consumer climate has therefore been able to withstand the recent growth in risks it is facing. However, in the next few months the escalating terror threat and the rising fears among certain groups of the population that Germany could eventually become overstretched by the persistently high influx of refugees and asylum seekers may cause consumer confidence to wane in the long term. In turn, this would have a lasting impact on the consumer climate," Gfk noted.

-

11:10

Nationwide: UK house prices rise 0.3% in January

The Nationwide Building Society released its house prices data for the U.K. on Wednesday. UK house prices were up 0.3% in January, missing expectations for a 0.6% rise, after a 0.8% increase in December.

On a yearly basis, house prices fell to 4.4% in January from 4.5% in December. Analysts had expected house prices to rise by 4.7%.

"As we look ahead, the risks are skewed towards a modest acceleration in house price growth, at least at the national level, Robert Gardner, said.

-

10:56

Number of mortgage approvals in the U.K. declines to 43,975 in December

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals decreased to 43,975 in December from 44,533 in November, missing expectations for a rise to 45,500. November's figure was revised up from 45,437.

"Last year was a strong year for household borrowing. There was a 6% rise in mortgage borrowing compared to 2014 and consumer credit expanded at more than 5% annually within an overall unsecured market which is growing at nearly 10% annually," the chief economist at the BBA, Richard Woolhouse, said.

-

10:41

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.35 (USD 400m) 118.00 (225m)

EUR/USD 1.0700 (EUR 1.5bln) 1.0750 (EUR 402m) 1.0800 (2.3bln) 1.0850-55 (660m)

AUD/USD 0.6950 (AUD 501m)

AUD/NZD 1.1000 (AUD 1.5bln)

AUD/JPY 84.25 (AUD 332m)

EUR/JPY 129.50 (EUR 229m)

-

10:30

United Kingdom: BBA Mortgage Approvals, December 43.98 (forecast 45.5)

-

10:29

Consumer prices in Australia climb 0.4% in the fourth quarter

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia rose 0.4% in the fourth quarter, beating expectations for a 0.3% gain, after a 0.5% increase in the third quarter.

The quarterly inflation was mainly driven by higher prices for alcohol and tobacco, clothing and footwear, and recreation and culture.

On a yearly basis, Australia's consumer price inflation rose to 1.7% in the fourth quarter from 1.5% in the third quarter, exceeding expectations for an increase to 1.6%.

The annual inflation was mainly driven by higher prices for alcohol and tobacco, education and health care.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) remained unchanged at 2.1% year-on-year in the fourth quarter, in line with expectations.

-

10:22

JPMorgan & Chase Co.’s chief Asia strategist Adrian Mowat: capital outflows from China could hit $500 billion this year

JPMorgan & Chase Co.'s chief Asia strategist, Adrian Mowat, said on Tuesday that capital outflows from China could hit $500 billion this year. He noted that while China's central bank tries to control the yuan's fall, those holding assets denominated in the yuan could sell to avoid losses.

-

08:47

France: Consumer confidence , January 97 (forecast 96)

-

08:24

Options levels on wednesday, January 27, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0956 (4198)

$1.0929 (1747)

$1.0893 (1492)

Price at time of writing this review: $1.0864

Support levels (open interest**, contracts):

$1.0827 (1196)

$1.0786 (3853)

$1.0757 (9496)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 40979 contracts, with the maximum number of contracts with strike price $1,1000 (4997);

- Overall open interest on the PUT options with the expiration date February, 5 is 64261 contracts, with the maximum number of contracts with strike price $1,0800 (9496);

- The ratio of PUT/CALL was 1.57 versus 1.56 from the previous trading day according to data from January, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.4602 (1840)

$1.4504 (1887)

$1.4408 (970)

Price at time of writing this review: $1.4329

Support levels (open interest**, contracts):

$1.4293 (1062)

$1.4196 (1187)

$1.4098 (975)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 24344 contracts, with the maximum number of contracts with strike price $1,4700 (3101);

- Overall open interest on the PUT options with the expiration date February, 5 is 22496 contracts, with the maximum number of contracts with strike price $1,4550 (2010);

- The ratio of PUT/CALL was 0.92 versus 0.96 from the previous trading day according to data from January, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:05

Foreign exchange market. Asian session: the Australian dollar gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia CPI, q/q Quarter IV 0.5% 0.3% 0.4%

00:30 Australia CPI, y/y Quarter IV 1.5% 1.6% 1.7%

00:30 Australia Trimmed Mean CPI q/q Quarter IV 0.3% 0.5% 0.6%

00:30 Australia Trimmed Mean CPI y/y Quarter IV 2.1% 2.1% 2.1%

07:00 United Kingdom Nationwide house price index January 0.8% 0.6% 0.3%

07:00 United Kingdom Nationwide house price index, y/y January 4.5% 4.7% 4.4%

07:00 Germany Gfk Consumer Confidence Survey February 9.4 9.3 9.4

07:00 Switzerland UBS Consumption Indicator December 1.66 1.62

The Australian dollar rose against the greenback amid domestic consumer price data. A report showed that inflation rose by 0.4% in the fourth quarter after a 0.5% rise in the third quarter. Economists had expected the consumer price index to grow by 0.3%. The CPI rose by 1.7% on a y/y basis in Q4, while economists had expected a 1.6% increase. Higher inflation suggests that the Reserve Bank of Australia is unlikely to cut interest rates any time soon. Petrol prices fell by 5.7%, however prices for tobacco gained 7.4%, while prices for domestic holiday and accommodation rose by 5.9%.

The euro traded range-bound ahead of euro zone inflation data scheduled for this week. Consumer prices are expected to have risen by 0.4% y/y in January after a 0.2% increase in December. Higher inflation would relief ECB policymakers, because they had to use unconventional tools to make inflation grow towards the target level of just under 2%.

France, Spain and Belgium will release their fourth quarter GDP reports. These data will help market participants assess strength of the euro zone economy.

EUR/USD: the pair fluctuated within $1.0850-70 in Asian trade

USD/JPY: the pair fell to Y118.00

GBP/USD: the pair traded within $1.4330-50

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Consumer confidence January 96 96

09:30 United Kingdom BBA Mortgage Approvals December 45 45.5

12:00 U.S. MBA Mortgage Applications January 9%

15:00 U.S. New Home Sales December 490 500

15:30 U.S. Crude Oil Inventories January 3.979 3.3

19:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.5% 2.5%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -779 -131

23:50 Japan Retail sales, y/y December -1.0% -0.1%

-

08:01

United Kingdom: Nationwide house price index, y/y, January 4.4% (forecast 4.7%)

-

08:01

United Kingdom: Nationwide house price index , January 0.3% (forecast 0.6%)

-

08:00

Germany: Gfk Consumer Confidence Survey, February 9.4 (forecast 9.3)

-

08:00

Switzerland: UBS Consumption Indicator, December 1.62

-

01:31

Australia: CPI, y/y, Quarter IV 1.7% (forecast 1.6%)

-

01:31

Australia: Trimmed Mean CPI y/y, Quarter IV 2.1% (forecast 2.1%)

-

01:30

Australia: CPI, q/q, Quarter IV 0.4% (forecast 0.3%)

-

01:30

Australia: Trimmed Mean CPI q/q, Quarter IV 0.6% (forecast 0.5%)

-

01:02

Currencies. Daily history for Jan 26’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0869 +0,19%

GBP/USD $1,4348 +0,70%

USD/CHF Chf1,0165 +0,38%

USD/JPY Y118,41 +0,11%

EUR/JPY Y128,71 +0,31%

GBP/JPY Y169,9 +0,82%

AUD/USD $0,7003 +0,71%

NZD/USD $0,6497 +0,68%

USD/CAD C$1,4116 -1,23%

-

00:31

Australia: Leading Index, December -0.3%

-

00:02

Schedule for today, Wednesday, Jan 27’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia CPI, q/q Quarter IV 0.5% 0.3%

00:30 Australia CPI, y/y Quarter IV 1.5% 1.6%

00:30 Australia Trimmed Mean CPI q/q Quarter IV 0.3% 0.5%

00:30 Australia Trimmed Mean CPI y/y Quarter IV 2.1% 2.1%

07:00 United Kingdom Nationwide house price index January 0.8% 0.6%

07:00 United Kingdom Nationwide house price index, y/y January 4.5% 4.7%

07:00 Germany Gfk Consumer Confidence Survey February 9.4 9.3

07:00 Switzerland UBS Consumption Indicator December 1.66

07:45 France Consumer confidence January 96 96

09:30 United Kingdom BBA Mortgage Approvals December 45 45.5

12:00 U.S. MBA Mortgage Applications January 9%

15:00 U.S. New Home Sales December 490 500

15:30 U.S. Crude Oil Inventories January 3.979 3.5

19:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.5% 2.5%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -779 -130

23:50 Japan Retail sales, y/y December -1.0% -0.1%

-