Noticias del mercado

-

18:00

European stocks closed: FTSE 100 5,911.46 +34.46 +0.59% CAC 40 4,356.81 +45.48 +1.05% DAX 9,822.75 +86.60 +0.89%

-

16:50

Richmond Fed Manufacturing Index falls 2 in January

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing declined to 2 in January from 6 in December, missing expectations for a fall to 3.

The decrease was mainly driven by declines in shipments, new orders and employment.

Shipments sub-index slid to -6 in January from -0 in December.

New orders sub-index was down to 4 from 8.

The employment sub-index declined to 9 from 12.

"The volume of new orders grew modestly this month, although shipments decreased. Hiring increased at a slightly slower pace compared to last month, although average wages continued to increase at a moderate pace in January, and the average workweek lengthened. Raw materials prices rose at a somewhat slower pace, while prices of finished goods rose at a faster pace than in December," the survey said.

-

16:41

U.S. consumer confidence index rises to 98.1 in January

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 98.1 in January from 96.3 in December, exceeding expectations for a rise to 96.5. December's figure was revised down from 96.5.

The present conditions index remained unchanged at 116.4 in January.

The Conference Board's consumer expectations index for the next six months increased to 85.9 in January from 83.0 in December.

The percentage of consumers expecting more jobs in the coming months was down to 22.8% in January from 24.2% in December.

"Consumer confidence improved slightly in January, following an increase in December. Consumers' assessment of current conditions held steady, while their expectations for the next six months improved moderately. For now, consumers do not foresee the volatility in financial markets as having a negative impact on the economy," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:10

U.S. preliminary services purchasing managers' index drops to 53.7 in January

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) dropped to 53.7 in January from 54.3 in December. Analysts had expected the index to fell to 54.0.

A reading above 50 indicates expansion in economic activity.

The drop was driven by a weaker output growth.

"The survey data paint an inauspicious start to the year for the US economy. A struggling manufacturing economy is being accompanied by a services sector where growth showed further signs of losing momentum in January even before the bad weather hit," Markit Chief Economist Chris Williamson said.

-

16:01

U.S.: Richmond Fed Manufacturing Index, January 2 (forecast 3)

-

16:00

U.S.: Consumer confidence , January 98.1 (forecast 96.5)

-

15:45

U.S.: Services PMI, January 53.7 (forecast 54)

-

15:30

S&P/Case-Shiller home price index rises 5.8% in November

The S&P/Case-Shiller home price index increased 5.8% year-on-year in November, exceeding expectations for a 5.7% rise, after a 5.5% gain in October.

Portland, San Francisco and Denver were the largest contributors to the rise, where prices climbed by 11.1%, 11.0% and 10.9%, respectively.

"Home prices extended their gains, supported by continued low mortgage rates, tight supplies and an improving labour market," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index rose by a seasonally adjusted 0.1% rate in November.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:14

U.S. house price index rise 0.5% in November

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.5% on a seasonally adjusted basis in November, exceeding expectations for a 0.4% increase, after a 0.5% gain in October.

On a yearly basis, U.S. house prices climbed 5.9% in November, after a 6.1% rise in October.

"The index levels for October and November 2015 exceeded the prior peak level from March 2007," the FHFA said in its statement.

-

15:01

U.S.: Housing Price Index, m/m, November 0.5% (forecast 0.4%)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, November 5.8% (forecast 5.7%)

-

14:47

Option expiries for today's 10:00 ET NY cut

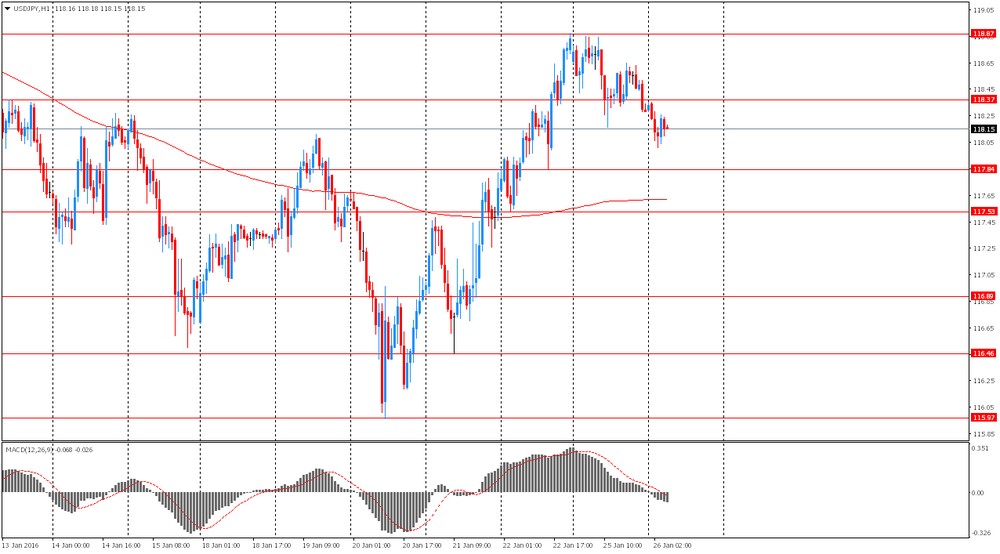

USD/JPY 116.00 (USD 790m) 116.80 (500m) 118.00 (370m) 118.95 (950m)

EUR/USD 1.0750 (EUR 491m) 1.0950 (1.3bln)

AUD/USD 0.6900 (AUD 653m) 0.6950 (200m) 0.7000 (440m)

EUR/JPY 125.50 (EUR bln) 130.50 (1.1bln)

-

14:30

Bank of England Governor Mark Carney: conditions for an interest rate hike were not met yet

The Bank of England (BoE) Governor Mark Carney said before the Treasury Select Committee on Tuesday that conditions for an interest rate hike were not met yet.

"My sense of the reporting was that it correctly identified the conditions that would be required for an interest rate hike hadn't come into play, and that those conditions are not yet in place," he said.

Carney noted that low oil prices support the economy in the medium term.

He pointed out that he will by the end of the year whether he will stay for a longer period as governor of the BoE.

-

14:15

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Switzerland Trade Balance December 3.16 Revised From 3.14 3.33 2.54

10:45 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 5.7% in November, after a 5.5% gain in October.

The U.S. consumer confidence is expected to remain unchanged at 96.5 in January.

The preliminary U.S. services PMI is expected to fall to 54.0 in January from 54.3 in December.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Speculation that the European Central Bank (ECB) will add further stimulus measures in March weighs on the currency pair.

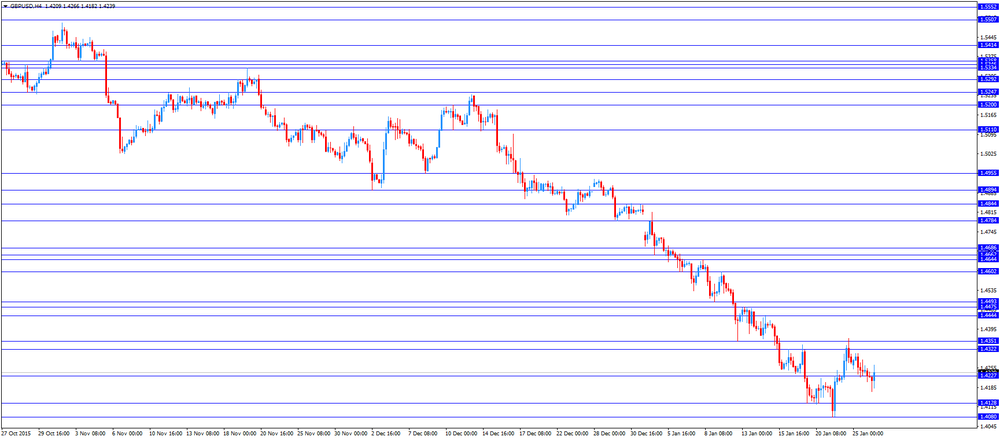

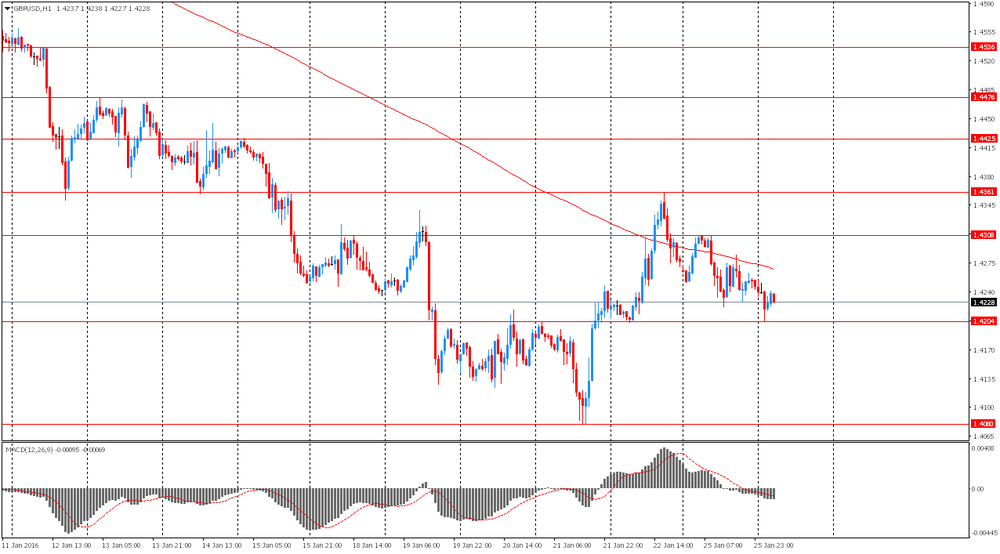

The British pound traded mixed against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney. He said before the Treasury Select Committee on Tuesday that conditions for an interest rate hike were not met yet.

The Swiss franc traded lower against the U.S. dollar. The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus fell to CHF2.54 billion in December from CHF3.16 billion in the previous month. October's figure was revised up from a surplus of CHF3.14 billion.

Exports dropped 1.q% year-on-year in December, while imports were down 6.3% year-on-year.

In 2015 as whole, the Swiss foreign trade surplus climbed to CHF36.61 billion from CHF29.75 billion in 2014.

Exports dropped 0.7% in 2015, while imports declined 0.5%.

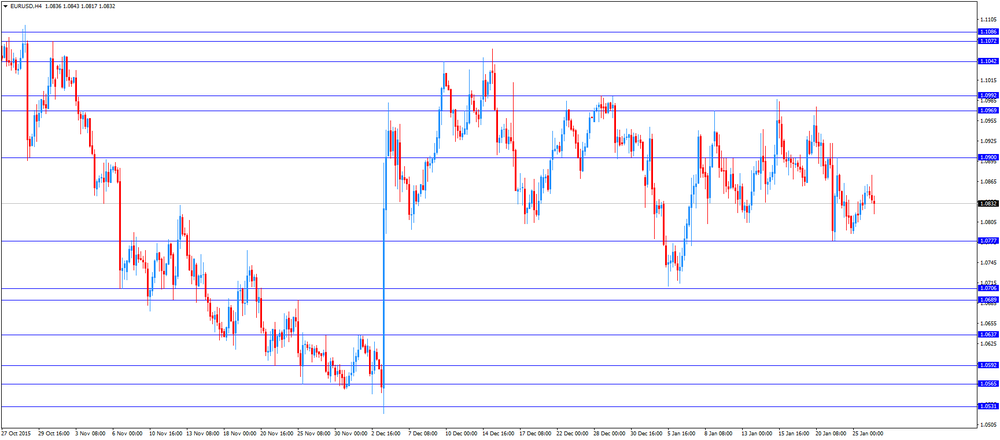

EUR/USD: the currency pair fell to $1.0817

GBP/USD: the currency pair rose to $1.4266

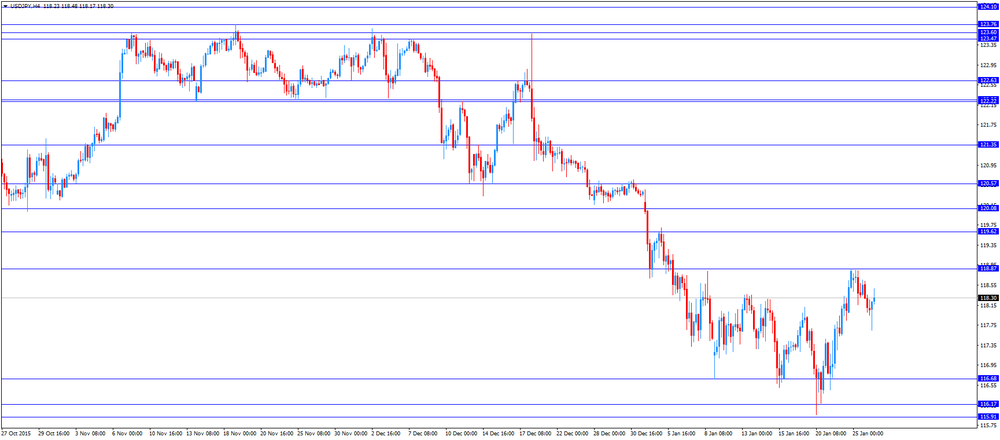

USD/JPY: the currency pair increased to Y118.48

The most important news that are expected (GMT0):

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November 5.5% 5.7%

14:45 U.S. Services PMI (Preliminary) January 54.3 54

15:00 U.S. Consumer confidence January 96.5 96.5

15:00 U.S. Richmond Fed Manufacturing Index January 6 3

-

14:00

Orders

EUR/USD

Offers 1.0875-80 1.09001.0925 1.0945-50 1.0985 1.1000 1.1025 1.1050

Bids 1.0830 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

Offers 1.4200 1.4220-25 1.4245-50 1.4280 1.4300 1.4320-25 1.43500

Bids 1.4170-75 1.4150 1.4120-25 1.4100 1.4085 1.4060 1.4030 1.4000

EUR/GBP

Offers 0.7680 0.7700 0.7720-25 0.7750-55 0.7780 0.7800

Bids 0.7620-25 0.7600 0.7575-80 0.7550 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 128.30 128.50 128.80 129.00 129.30 129.50

Bids 127.80 127.50 127.30 127.00 126.80 126.50

USD/JPY

Offers 118.00 118.20-25 118.40 118.60 118.85 119.00 119.30 119.50

Bids 117.70 117.50 117.30 117.00 116.75-80 116.50 116.30 116.00

AUD/USD

Offers 0.6975-80 0.7000 0.7030 0.7050-55 0.7080 0.7100

Bids 0.6920 0.6900 0.6875-80 0.6850 0.6825-30 0.6800

-

11:40

The People's Bank of China injects 440 billion yuan into market

The People's Bank of China (PBoC) on Tuesday injected 440 billion yuan ($67 billion) into market to boost liquidity via seven-day reverse bond repurchase agreements and via 28-day reverse repos.

The central bank usually injects extra money before the Lunar New Year holiday.

-

11:26

Swiss trade surplus falls to CHF2.54 billion in December

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus fell to CHF2.54 billion in December from CHF3.16 billion in the previous month. October's figure was revised up from a surplus of CHF3.14 billion.

Exports dropped 1.q% year-on-year in December, while imports were down 6.3% year-on-year.

In 2015 as whole, the Swiss foreign trade surplus climbed to CHF36.61 billion from CHF29.75 billion in 2014.

Exports dropped 0.7% in 2015, while imports declined 0.5%.

Low exports were driven by a drop in machine industry, accounting for two fifths of total decline.

Exports to the U.S. and China rose, while exports to the Eurozone declined.

-

11:04

European Central Bank President Mario Draghi: the central bank will fulfil its mandate in reaching 2% inflation target

European Central Bank (ECB) President Mario Draghi said on Monday that the central bank will fulfil its mandate in reaching 2% inflation target.

"Meeting our objective is about credibility. If a central bank sets an objective, it can't just move the goalposts when it misses it. Confidence comes from every party fulfilling its mandate. And that's what the ECB will do," he noted.

Draghi also said that there are "no warning signs of serious financial instability".

The ECB president pointed out that the central bank's stimulus measures led to higher consumption.

-

10:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 116.00 (USD 790m) 116.80 (500m) 118.00 (370m) 118.95 (950m)

EUR/USD 1.0750 (EUR 491m) 1.0950 (1.3bln)

AUD/USD 0.6900 (AUD 653m) 0.6950 (200m) 0.7000 (440m)

EUR/JPY 125.50 (EUR bln) 130.50 (1.1bln)

-

10:56

Bank of England's Monetary Policy Committee member Kristin Forbes: wage growth is not strong enough to start raising interest rates

The Bank of England's (BoE) Monetary Policy Committee member Kristin Forbes said in a speech on Monday that wage growth is not strong enough to start raising interest rates.

"Labour costs are not yet at the levels consistent with inflation meeting the 2% target sustainably in the UK," she said.

"I would like to see a bit more upward movement in these wage and cost measures to build confidence that the normal chain of tight labour markets feeding through into higher wages is still intact," Forbes added.

-

10:11

Japanese Finance Minister Taro Aso will support further stimulus measures by the Bank of Japan

Japanese Finance Minister Taro Aso said on Tuesday that he will support further stimulus measures by the Bank of Japan (BoJ).

"The BOJ has said it would not hesitate (to adjust policy) if necessary so we believe it is adhering to that stance," he said.

"We hope the BOJ will continue its efforts to achieve its price stability target while taking into consideration economic and price conditions," Aso added.

-

08:19

Options levels on tuesday, January 26, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0955 (4021)

$1.0926 (1760)

$1.0886 (1495)

Price at time of writing this review: $1.0854

Support levels (open interest**, contracts):

$1.0811 (1191)

$1.0773 (3876)

$1.0745 (8271)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 40261 contracts, with the maximum number of contracts with strike price $1,1000 (4775);

- Overall open interest on the PUT options with the expiration date February, 5 is 62776 contracts, with the maximum number of contracts with strike price $1,0700 (8832);

- The ratio of PUT/CALL was 1.56 versus 1.57 from the previous trading day according to data from January, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.4502 (1461)

$1.4404 (691)

$1.4308 (329)

Price at time of writing this review: $1.4214

Support levels (open interest**, contracts):

$1.4193 (914)

$1.4096 (844)

$1.3998 (413)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 23069 contracts, with the maximum number of contracts with strike price $1,4700 (3131);

- Overall open interest on the PUT options with the expiration date February, 5 is 22068 contracts, with the maximum number of contracts with strike price $1,4550 (2010);

- The ratio of PUT/CALL was 0.96 versus 0.96 from the previous trading day according to data from January, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:12

Foreign exchange market. Asian session: the yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

07:00 Switzerland Trade Balance December 3.14 3.33 2.54

The yen gained against the U.S. dollar amid declines in oil prices and Asian stocks. These circumstances led to higher demand for the safe-haven currency. The yen gained despite dowish comments from Japanese Finance Minister Taro Aso, who expressed support for the Bank of Japan's will to act "without hesitation". "We hope the BOJ will continue its efforts to achieve its price stability target while taking into consideration economic and price conditions," Aso said.

The euro traded range-bound ahead of euro zone inflation data scheduled for this week. Consumer prices are expected to have risen by 0.4% y/y in January after a 0.2% increase in December. Higher inflation would relief ECB policymakers, because they had to use unconventional tools to make inflation grow towards the target level of just under 2%.

France, Spain and Belgium will release their fourth quarter GDP reports. These data will help market participants assess strength of the euro zone economy.

EUR/USD: the pair fluctuated within $1.0840-60 in Asian trade

USD/JPY: the pair fell to Y117.95

GBP/USD: the pair traded within $1.4205-50

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:45 United Kingdom BOE Gov Mark Carney Speaks

14:00 U.S. Housing Price Index, m/m November 0.5% 0.4%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November 5.5% 5.7%

14:45 U.S. Services PMI (Preliminary) January 54.3 54

15:00 U.S. Consumer confidence January 96.5 96.5

15:00 U.S. Richmond Fed Manufacturing Index January 6 3

23:30 Australia Leading Index December -0.2%

-

08:00

Switzerland: Trade Balance, December 2 (forecast 3.33)

-

00:31

Currencies. Daily history for Jan 25’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0848 +0,48%

GBP/USD $1,4247 -0,21%

USD/CHF Chf1,0126 -0,33%

USD/JPY Y118,28 -0,46%

EUR/JPY Y128,31 +0,02%

GBP/JPY Y168,51 -0,67%

AUD/USD $0,6953 -0,75%

NZD/USD $0,6453 -0,54%

USD/CAD C$1,4289 +0,99%

-

00:06

Schedule for today, Tuesday, Jan 26’2016:

(time / country / index / period / previous value / forecast)

07:00 Switzerland Trade Balance December 3.14

10:45 United Kingdom BOE Gov Mark Carney Speaks

14:00 U.S. Housing Price Index, m/m November 0.5% 0.4%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November 5.5% 5.7%

14:45 U.S. Services PMI (Preliminary) January 54.3 54

15:00 U.S. Consumer confidence January 96.5 97

15:00 U.S. Richmond Fed Manufacturing Index January 6

23:30 Australia Leading Index December -0.2%

-