Noticias del mercado

-

20:20

American focus: the euro has appreciated against the US dollar

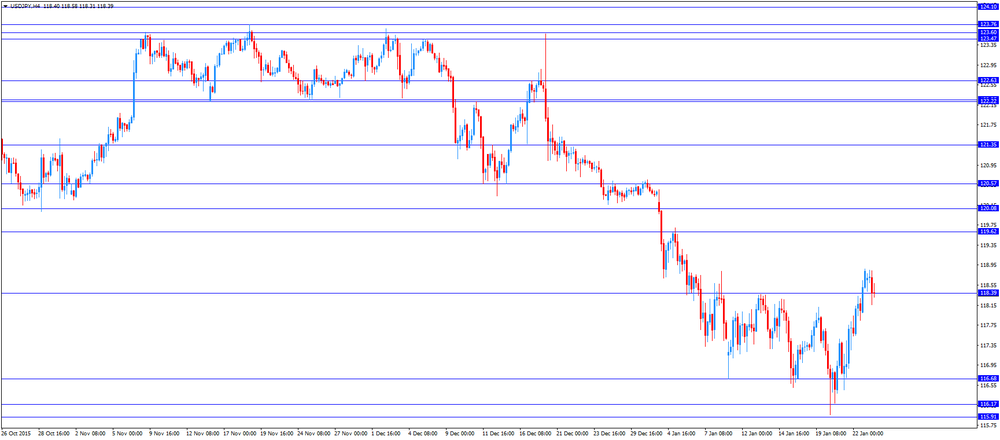

Japanese yen consolidated near the opening level against the US dollar. A slight pressure on the pair has dominate the market risk aversion. Also, investors are waiting for the meeting of the Bank of Japan, which will take place January 29. CFTC data Friday showed that bullish bets on the yen reached a four-year high, as markets removed from the prices easing the Bank of Japan this week. In addition, the reduced expectations that the Fed will raise rates this year 4 times, and it also puts pressure on the US dollar. According to the survey Reuters, economists are now expected in 2016 only 3 increase.

Meanwhile, today the governor of the Bank of Japan Kuroda said that the Central Bank could further expand the program of quantitative easing, "if necessary." The determination of the central bank is partly due to oil prices. "The Bank of Japan has scope for further expansion of quantitative easing - Kuroda said. - If required, we can expand and strengthen further" quantitative easing ". He added that to implement the above can be in many areas. According to him, the heads of the Bank Japan's "no limits" in the choice of means of easing. According to the current forecast of the Bank of Japan, inflation in Japan will reach the target level of 2% approximately in the second half of the 2016 financial year or at the end of 2016 early 2017. The goal can be achieved in the case of acceleration growth in oil prices.

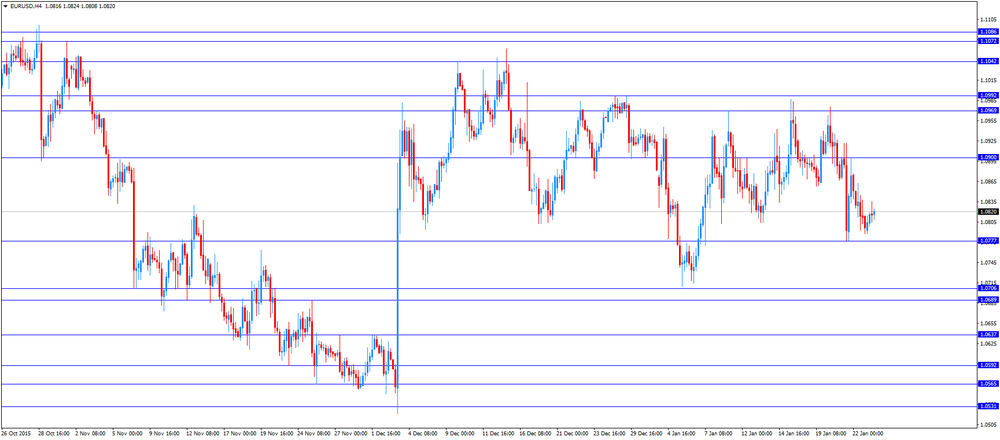

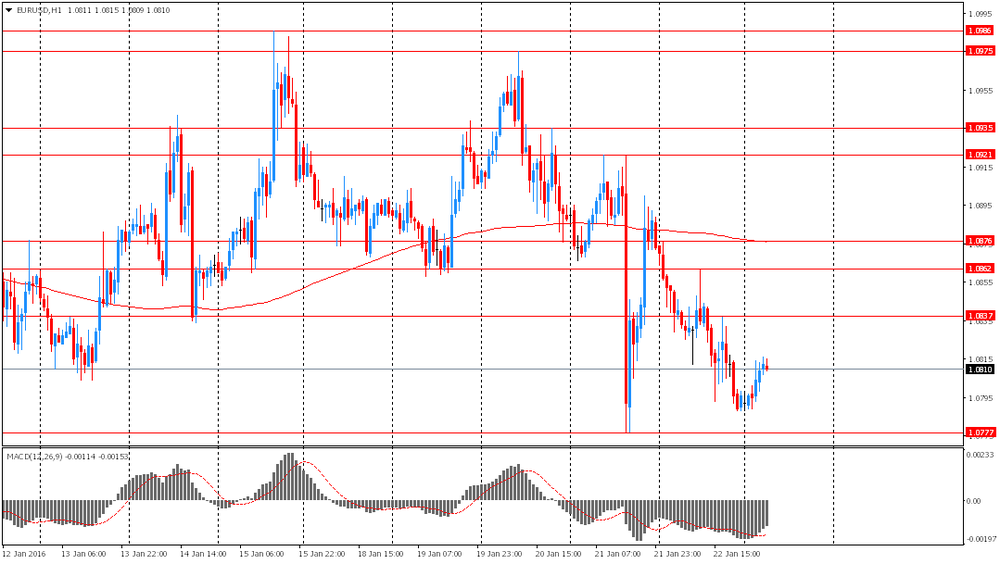

Euro shows a moderate increase against the US dollar, taking advantage of reduced risk appetite. Recall that in the event of falling stock markets and the euro rises in price of oil prices, as a funding currency. Gradually, investors' attention switched to the FOMC meeting on Wednesday, which may have an impact on the dollar. And markets and economists do not expect any changes, which is confirmed by comments from the Fed in recent weeks. Most likely, the Central Bank repeats the thesis of gradual normalization of policy. However, there is a possibility that doubts about the developments on the financial markets and the world will again be mentioned in the text of the statement, in connection with what can be paid more attention to the downside risks to inflation.

In addition, this week will be published data on inflation in the euro area in January. According to a survey of analysts, the annual inflation rate rose by 0.4% after rising 0.2% in December. Rising inflation will force the ECB to breathe a sigh of relief.

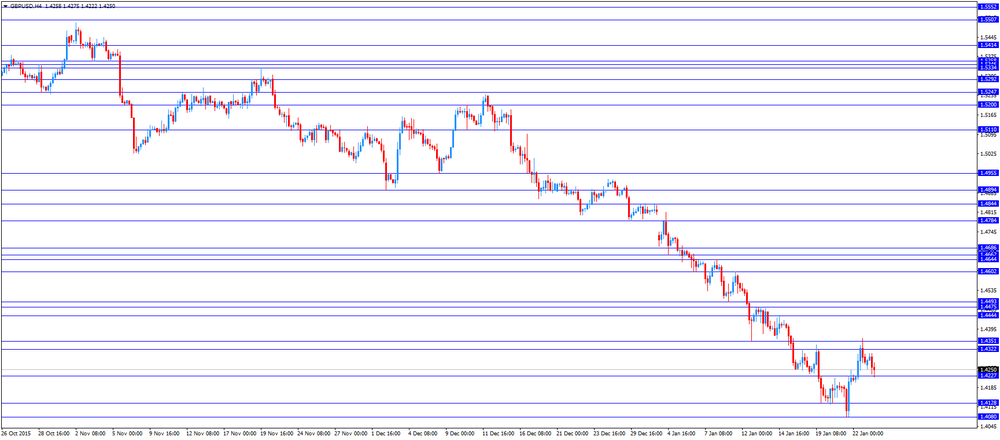

The pound fell slightly against the dollar, returning to the minimum session. Experts note that the main influence on the pair has a total market sentiment and expectations of the speech of the Bank of England Carney on Tuesday, especially after his recent "dovish" comments.

Little influenced by the report from the Confederation of British Industry (CBI), which showed that British manufacturers reported a decline in orders at the beginning of the year against a background of weaker export demand. The balance of the portfolio of orders fell to -15 percent in January from -7 per cent in the previous month. Economists had forecast a -10 percent. The survey also showed that the balance of all new orders in the three months through January improved to -4 percent from -8 percent. Expected balance of orders in the next quarter amounted to 8, and the balance of the volume of production 14. The balance of employment prospects improved from -8 to +8.

Also today, the representative of the management of the Bank of England Kristin Forbes noted that the rate of wage growth in the UK is not so large as to justify raising interest rates. According to her, the growth rate of wages in the UK are still too slow to bring back annual inflation to the target level of 2%. Forbes added that low oil prices have a downward impact on inflation in the UK that provides management with the Bank of England more time. This will allow the management to ensure that the salaries and internal costs in the country are growing.

-

18:00

European stocks closed: FTSE 100 5,877 -23.01 -0.39% CAC 40 4,311.33 -25.36 -0.58% DAX 9,736.15 -28.73 -0.29%

-

17:11

Fitch affirms Belgium’s sovereign debt rating at 'AA'

Rating agency Fitch Ratings on Friday affirmed Belgium's sovereign debt rating at 'AA'. The outlook is negative.

"The ratings balance Belgium's high public debt burden and recent fiscal slippage against its strong net external creditor position, high income and diversified economy, track record of macroeconomic stability and relatively strong governance," the agency said in its statement.

-

17:05

Greek Prime Minister Alexis Tsipras: pension reform should be implemented

Greek Prime Minister Alexis Tsipras said on Sunday that pension reform should be implemented, adding that it is necessary.

"The dilemma is about reforming the system or letting it collapse," he noted.

-

16:31

Standard & Poor's upgrades Greece’s sovereign debt rating to 'B-' from 'CCC+'

Rating agency Standard & Poor's (S&P) said on Friday that it upgraded Greece's sovereign debt rating to 'B-' from 'CCC+' as the agency expects Greece to meet the conditions of the third bailout programme. The outlook is stable.

"By the end of March, we expect a compromise to be reached on pension reform that will balance the government's preference to raise social security contributions and consolidate the separate pension funds into a single system," the agency noted.

-

16:18

European Central Bank purchases €14.48 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €14.48 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.86 billion of covered bonds, and €382 million of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference last Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

15:45

NBB business climate for Belgium slides to -3.0 in January

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate dropped to -3.0 in January from-1.4 in December. Analysts had expected the index to decline to -1.7.

3 of 4 indicators dropped in January.

The business climate index for the manufacturing sector fell to -6.3 in January from -3.7 in December due to a less favourable assessments of the current situation.

The business climate index for the services sector was down to 10.2 in January from 12.9 in December due to a less favourable assessment of the current activity and a downward revision of general market demand forecasts.

The business climate index for the building sector increased to 0.5 in January from -4.7 in December due to more favourable assessments of total order books.

The business climate index for the trade sector dropped to -8.6 in January from -4.8 in December due to a drop in in demand and a reduction in orders placed with suppliers.

-

15:15

Bundesbank’s Monthly Report: low oil prices could boost the economic growth in Germany as consumption could rise

The German Bundesbank said in its monthly report on Monday that low oil prices could boost the economic growth in Germany as consumption could rise.

"Persistently low oil prices could also additionally boost domestic demand owing to the attendant purchasing power gains, the Bundesbank noted.

The Bundesbank also said that the industry could contribute the economic activity as new domestic and foreign orders received by industry increased.

-

15:00

Belgium: Business Climate, January -3.0 (forecast -1.7)

-

14:45

CBI industrial order books balance declines to -15 in January

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance slid to -15 in January from -7% in December.

The index was driven by a weak demand for exports.

"Manufacturers have seen a flat start to 2016 but while we have seen real problems in some industries in the last few months, there are signs that orders and production are stabilising overall," the CBI director of economics Rain Newton-Smith said.

"Uncertainty around the prospects for global growth, uncompetitive energy costs and the strength of the pound have all played their part in UK manufacturers finding conditions tough when trying to sell overseas," he added.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.20-25 (USD 761m) 117.50 (225m) 118.25 (225m) 119.00 (376m)

EUR/USD 1.0700 (EUR 1.2bln) 1.0750 (1.4bln) 1.0800 (1bln) 1.0850 (697m) 1.0900 (1.7bln) 1.1000 (2.9bln)

USD/CHF 1.0000 (USD 400m) 1.0075 (370m)

AUD/USD 0.6850 (243m) 0.6980 (436m)

USD/CAD 1.3900 (USD 320m) 1.4100 (205m)

EUR/JPY 128.75 (EUR 660m)

-

14:24

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the weaker-than-expected Ifo business climate index data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index (Finally) November 104.2 103.9 103.5

05:00 Japan Coincident Index (Finally) November 113.3 116.6 111.9

09:00 Germany IFO - Business Climate January 108.6 Revised From 108.7 108.4 107.3

09:00 Germany IFO - Current Assessment January 112.8 112.8 112.5

09:00 Germany IFO - Expectations January 104.6 Revised From 104.7 104.1 102.4

11:00 Germany Bundesbank Monthly Report

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded mixed against the U.S. dollar after the weaker-than-expected Ifo business climate index data from Germany. German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index declines to 107.3 in January from 108.6 in December. December's figure was revised down from 108.7.

Analysts had expected the index to fall to 108.4.

"The year started with an unpleasant surprise for the German economy," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.5 from 112.8. Analysts had expected the index to remain unchanged at 112.8.

The Ifo expectations index dropped to 102.4 from 104.6, missing expectations for a decrease to 104.1. December's figure was revised down from 104.7.

The British pound traded mixed against the U.S. dollar after the release of the Confederation of British Industry's (CBI) industrial order books balance data. The CBI industrial order books balance slid to -15 in January from -7% in December.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y118.16

The most important news that are expected (GMT0):

14:00 Belgium Business Climate January -1.4 -1.7

18:00 Eurozone ECB President Mario Draghi Speaks

-

13:49

Orders

EUR/USD

Offers 1.0835 1.0850 1.0885 1.09001.0925 1.0945-50 1.0985 1.1000 1.1025 1.1050

Bids 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

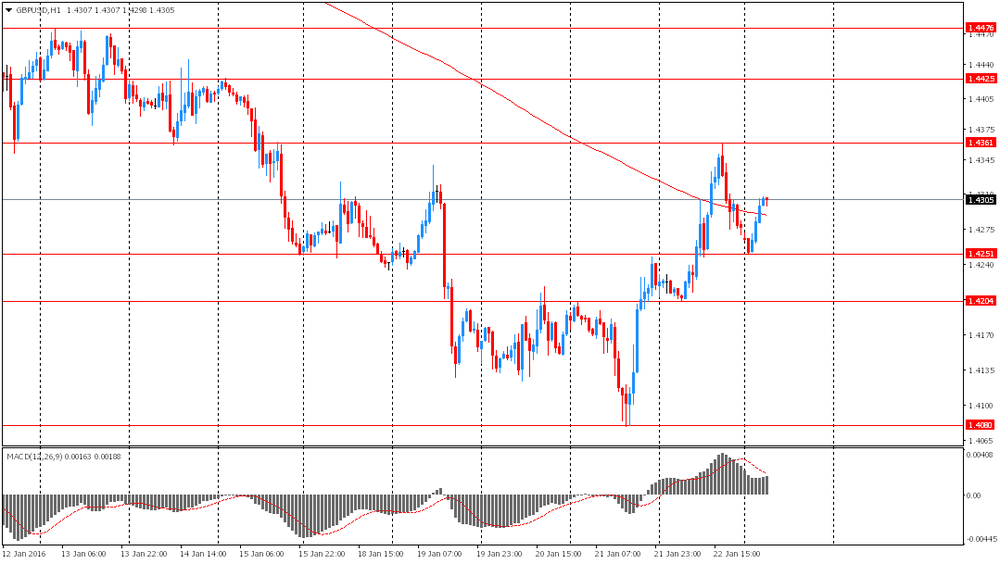

Offers 1.4300 1.4320-25 1.4350 1.4375 1.4400 1.4425-30 1.4450

Bids 1.4250 1.4220 1.4200 1.4180 1.4150 1.4120-25 1.4100 1.4085 1.4060 1.4030 1.400

EUR/GBP

Offers 0.7600 0.7620-25 0.7650 0.7680 0.7700 0.7720-25 0.7750-55

Bids 0.7575-80 0.7550 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 128.50 128.80 129.00 129.30 129.50

Bids 128.00 127.80 127.50 127.30 127.00 126.80 126.50

USD/JPY

Offers 118.60 118.85 119.00 119.30 119.50 119.80 120.00

Bids 118.20-25 118.00 117.80 115.50 117.30 117.00 116.75-80 116.50

AUD/USD

Offers 0.7000 0.7030 0.7050-55 0.7080 0.7100 0.7120 0.7150

Bids 0.8950 0.6930 0.69000.6875-80 0.6850 0.6825-30 0.6800

-

11:45

Industrial turnover in Italy drops at a seasonally adjusted rate of 1.1% in November

The Italian statistical office Istat released its industrial orders data for Italy on Monday. Industrial turnover in Italy slid at a seasonally adjusted rate of 1.1% in November, after a 1.6% decrease in August.

Domestic market orders plunged 1.1% in November, while demand from non-domestic markets fell by 1.1%.

On a yearly basis, the seasonally adjusted industrial turnover in Italy climbed 0.8% in November, after a 1.6% gain in October.

The seasonally adjusted industrial new orders index rose by 1.6% month-on-month in November, after a 4.6% rise in October.

-

11:33

Italian retail sales rise 0.3% in November

The Italian statistical office Istat released its retail sales data for Italy on Monday. Italian retail sales rose by 0.3% in November, after a 0.3% decrease in October.

Sales of food products were up 0.7% in November, while sales of non-food products increased by 0.1%.

On a yearly basis, retail sales in Italy fell 0.3% in November, after a 1.8% rise in October.

-

11:26

Spanish producer prices decline 0.7% in December

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Monday. The Spanish producer prices dropped 0.7% in December, after a 0.1% fall in November.

On a yearly basis, producer price inflation in Spain fell 2.2% in December, after a 2.6% decline in November. Producer prices have been declining since July 2014.

Energy prices slid 7.9% year-on-year in December.

-

11:20

German Ifo business confidence index declines to 107.3 in January

German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index declines to 107.3 in January from 108.6 in December. December's figure was revised down from 108.7.

Analysts had expected the index to fall to 108.4.

"The year started with an unpleasant surprise for the German economy," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.5 from 112.8. Analysts had expected the index to remain unchanged at 112.8.

The Ifo expectations index dropped to 102.4 from 104.6, missing expectations for a decrease to 104.1. December's figure was revised down from 104.7.

-

11:05

Japan's trade deficit turns into a surplus of ¥140.3 billion in December

The Ministry of Finance released its trade data for Japan on the late Sunday evening. Japan's trade deficit turned into a surplus of ¥140.3 billion in December from a deficit of ¥379.7 billion in November.

Analysts had expected a surplus of ¥100.0 billion.

Exports fell 8.0% year-on-year in December, while imports dropped 18.0%.

Exports to Asia declined by 10.3% year-on-year in December, exports to the United States decreased by 3.4%, while exports to the European Union rose by 3.1%.

-

10:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.20-25 (USD 761m) 117.50 (225m) 118.25 (225m) 119.00 (376m)

EUR/USD 1.0700 (EUR 1.2bln) 1.0750 (1.4bln) 1.0800 (1bln) 1.0850 (697m) 1.0900 (1.7bln) 1.1000 (2.9bln)

USD/CHF 1.0000 (USD 400m) 1.0075 (370m)

AUD/USD 0.6850 (243m) 0.6980 (436m)

USD/CAD 1.3900 (USD 320m) 1.4100 (205m)

EUR/JPY 128.75 (EUR 660m)

-

10:50

International Monetary Fund Managing Director Christine Lagarde: the global economy will expand moderately in 2016

International Monetary Fund (IMF) Managing Director Christine Lagarde said at the World Economic Forum in Davos on Saturday that the global economy will expand moderately in 2016, adding that there downside risks to the outlook. Downside risks are low commodity prices and the transition of the Chinese economy, according to Lagarde.

-

10:33

Standard & Poor’s could downgrade sovereign debt ratings of oil-exporting countries this year

Rating agency Standard & Poor's (S&P) said on Friday that it could downgrade sovereign debt ratings of oil-exporting countries this year as oil prices continued to decline.

"We had an important number of downgrades last year in Africa, the Middle East and the CIS, and if our outlooks continue to perform as an indicator of where the ratings may next go, more might be coming up this year," S&P's EMEA head of sovereign ratings Moritz Kraemer said in an interview with Reuters.

-

10:22

National Australia Bank’s business confidence index declines to 3 points in December

The National Australia Bank (NAB) released its business confidence index for Australia on Monday. The index fell to 3 points in December from 5 points in November.

"While recent big declines in oil and equity markets highlight potential risks to the global outlook, relatively positive business conditions appear to have, so far, acted to reassure business sentiment," NAB Group Chief Economist Alan Oster said.

The main business conditions index decreased 7 points in December from 10 points in November, while employment declined to 0 points in from 2 points.

-

10:10

Bank of Japan Governor Haruhiko Kuroda: the central bank could add further stimulus measures if needed to achieve 2% inflation target

Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the World Economic Forum in Davos on Saturday that the central bank could add further stimulus measures if needed to achieve 2% inflation target. He added that there no technical limitation.

"I don't think there is any technical limitation to further strengthen our quantitative and qualitative easing if necessary to achieve our 2% target," Kuroda noted.

-

10:01

Germany: IFO - Expectations , January 102.4 (forecast 104.1)

-

10:00

Germany: IFO - Business Climate, January 107.3 (forecast 108.4)

-

10:00

Germany: IFO - Current Assessment , January 112.5 (forecast 112.8)

-

08:07

Foreign exchange market. Asian session: the euro edged up

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Leading Economic Index (Finally) November 104.2 103.9 103.5

05:00 Japan Coincident Index (Finally) November 113.3 116.6 111.9

The euro edged up against the U.S. dollar after Friday's decline, which was triggered by higher risk sentiment. This week investors are waiting for euro zone inflation data. Consumer prices are expected to have risen by 0.4% y/y in January after a 0.2% increase in December. Higher inflation would relief ECB policymakers, because they had to use unconventional tools to make inflation start growing towards the target level of just under 2%.

France, Spain and Belgium will release their fourth quarter GDP reports. These data will help market participants assess strength of the euro zone economy.

The pound climbed ahead of U.K. GDP data. Analysts surveyed by the Wall Street Journal forecast the country's GDP had grown by 0.5% compared to the same period last year after posting growth of 0.4% in the third quarter. If data meet expectations this would mean that the U.K. economy has partly recovered in the last quarter of 2015.

The Australian dollar slightly declined amid a disappointing report on business conditions from the National Australia Bank. The corresponding index declined to 7 in December from 10 in November. Meanwhile the business confidence index fell to 3 from 5.

EUR/USD: the pair rose to $1.0815 in Asian trade

USD/JPY: the pair traded within Y118.40-85

GBP/USD: the pair rose to $1.4305

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Germany IFO - Business Climate January 108.7 108.4

09:00 Germany IFO - Current Assessment January 112.8 112.8

09:00 Germany IFO - Expectations January 104.7 104.1

11:00 Germany Bundesbank Monthly Report

14:00 Belgium Business Climate January -1.4 -1.7

18:00 Eurozone ECB President Mario Draghi Speaks

-

07:09

Options levels on monday, January 25, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0912 (1730)

$1.0885 (2021)

$1.0845 (1467)

Price at time of writing this review: $1.0816

Support levels (open interest**, contracts):

$1.0759 (3242)

$1.0719 (8666)

$1.0691 (4530)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 40299 contracts, with the maximum number of contracts with strike price $1,1000 (4683);

- Overall open interest on the PUT options with the expiration date February, 5 is 63333 contracts, with the maximum number of contracts with strike price $1,0700 (8888);

- The ratio of PUT/CALL was 1.57 versus 1.53 from the previous trading day according to data from January, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.4503 (1245)

$1.4405 (673)

$1.4309 (330)

Price at time of writing this review: $1.4298

Support levels (open interest**, contracts):

$1.4193 (926)

$1.4096 (837)

$1.3998 (412)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 22981 contracts, with the maximum number of contracts with strike price $1,4700 (3131);

- Overall open interest on the PUT options with the expiration date February, 5 is 22134 contracts, with the maximum number of contracts with strike price $1,4550 (2010);

- The ratio of PUT/CALL was 0.96 versus 0.96 from the previous trading day according to data from January, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:01

Currencies. Daily history for Jan 22’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0796 -0,70%

GBP/USD $1,4277 +0,40%

USD/CHF Chf1,0159 +0,86%

USD/JPY Y118,83 +0,96%

EUR/JPY Y128,28 +0,24%

GBP/JPY Y169,64 +1,35%

AUD/USD $0,7005 +0,11%

NZD/USD $0,6488 -0,63%

USD/CAD C$1,4147 -2,51%

-

00:50

Japan: Trade Balance Total, bln, December 140 (forecast 100)

-