Noticias del mercado

-

21:00

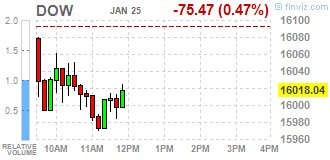

Dow -0.62% 15,993.05 -100.46 Nasdaq -0.65% 4,561.22 -29.96 S&P -0.81% 1,891.47 -15.43

-

18:02

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes in negative area after two-day rally on Monday as retreating crude oil prices weighed on materials and energy stocks. Crude prices resumed their slide, after a strong two-day run, as a record output from Iraq flooded a heavily oversupplied market. American stocks logged their first week of gains in the year last week, with the three indexes closing up 2% on Friday. Investors, already rattled by the volatile start to the year and a steep fall in oil prices, are awaiting U.S. GDP data on Friday for a reading on the health of the economy.

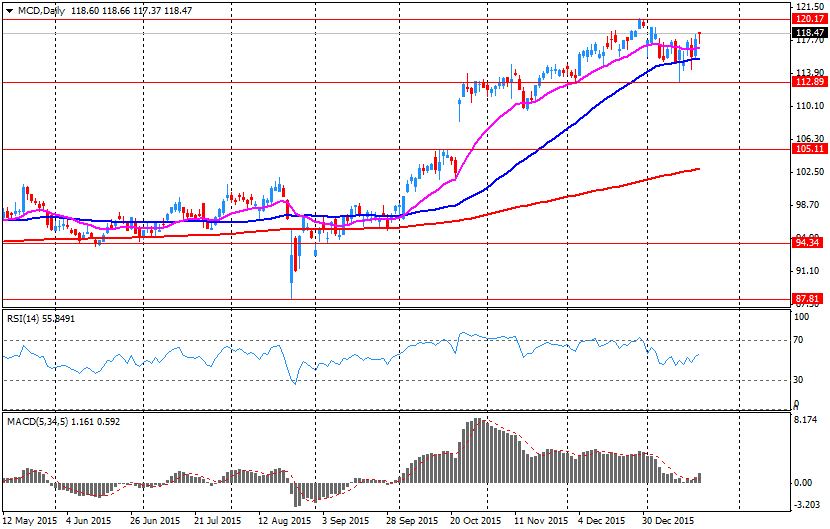

Most of Dow stocks in negative area (19 of 30). Top looser - Caterpillar Inc. (CAT, -4,07%). Top gainer - McDonald's Corp. (MCD, +1,22%).

All S&P sectors also in negative area. Top looser - Basic Materials (-1,9%).

At the moment:

Dow 15906.00 -98.00 -0.61%

S&P 500 1884.50 -14.75 -0.78%

Nasdaq 100 4229.00 -18.50 -0.44%

Oil 30.47 -1.72 -5.34%

Gold 1108.30 +12.00 +1.09%

U.S. 10yr 2.02 -0.03

-

18:00

European stocks close: stocks closed lower as oil prices declined again

Stock indices traded lower as oil prices declined again. Oil prices fell on concerns over the global oil oversupply.

Meanwhile, the economic data from Germany was mostly weaker than expected. German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index declines to 107.3 in January from 108.6 in December. December's figure was revised down from 108.7.

Analysts had expected the index to fall to 108.4.

"The year started with an unpleasant surprise for the German economy," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.5 from 112.8. Analysts had expected the index to remain unchanged at 112.8.

The Ifo expectations index dropped to 102.4 from 104.6, missing expectations for a decrease to 104.1. December's figure was revised down from 104.7.

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance slid to -15 in January from -7% in December.

The index was driven by a weak demand for exports.

"Manufacturers have seen a flat start to 2016 but while we have seen real problems in some industries in the last few months, there are signs that orders and production are stabilising overall," the CBI director of economics Rain Newton-Smith said.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,877 -23.01 -0.39 %

DAX 9,736.15 -28.73 -0.29 %

CAC 40 4,311.33 -25.36 -0.58 %

-

17:52

WSE: Session Results

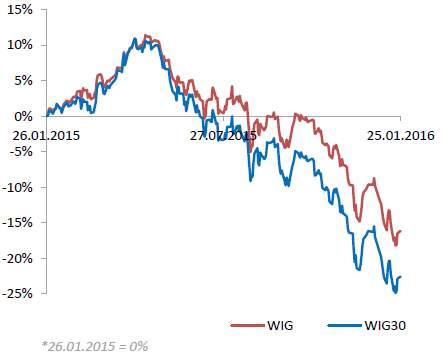

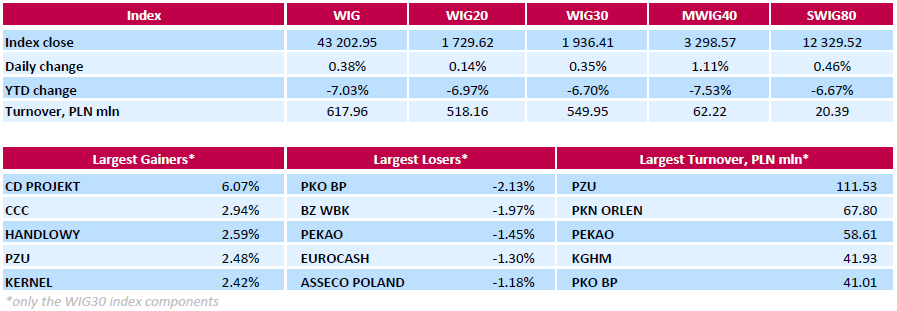

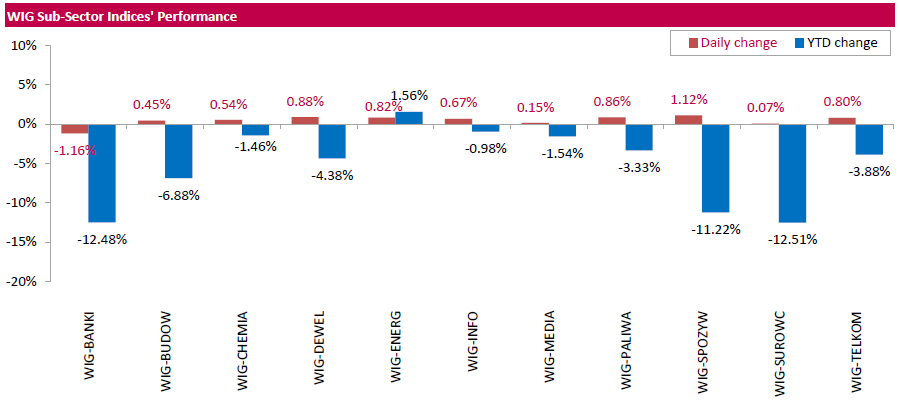

Polish equity market closed slightly higher on Monday. The broad market measure, the WIG index, added 0.38%. Almost all sectors in the WIG generated positive returns. Banking sector (-1.16%) was the only exception. At the same time, food sector (+1.12%) posed the biggest advance.

The large-cap benchmark, the WIG30 Index, rose by 0.35%. Within the index components, videogame developer CD PROJEKT (WSE: CDR) led the gainers, climbing by 6.07%. It was followed by footwear retailer CCC (WSE: CCC), bank HANDLOWY (WSE: BHW), insurer PZU (WSE: PZU) and agricultural holding KERNEL (WSE: KER), jumping by 2.42%-2.94%. On the other side of the ledger, banking sector names PKO BP (WSE: PKO), BZ WBK (WSE: BZW) and PEKAO (WSE: PEO) were among the weakest performers, dropping by 2.13%, 1.97% and 1.45% respectively.

-

17:11

Fitch affirms Belgium’s sovereign debt rating at 'AA'

Rating agency Fitch Ratings on Friday affirmed Belgium's sovereign debt rating at 'AA'. The outlook is negative.

"The ratings balance Belgium's high public debt burden and recent fiscal slippage against its strong net external creditor position, high income and diversified economy, track record of macroeconomic stability and relatively strong governance," the agency said in its statement.

-

17:05

Greek Prime Minister Alexis Tsipras: pension reform should be implemented

Greek Prime Minister Alexis Tsipras said on Sunday that pension reform should be implemented, adding that it is necessary.

"The dilemma is about reforming the system or letting it collapse," he noted.

-

16:31

Standard & Poor's upgrades Greece’s sovereign debt rating to 'B-' from 'CCC+'

Rating agency Standard & Poor's (S&P) said on Friday that it upgraded Greece's sovereign debt rating to 'B-' from 'CCC+' as the agency expects Greece to meet the conditions of the third bailout programme. The outlook is stable.

"By the end of March, we expect a compromise to be reached on pension reform that will balance the government's preference to raise social security contributions and consolidate the separate pension funds into a single system," the agency noted.

-

16:18

European Central Bank purchases €14.48 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €14.48 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.86 billion of covered bonds, and €382 million of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference last Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

15:45

NBB business climate for Belgium slides to -3.0 in January

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate dropped to -3.0 in January from-1.4 in December. Analysts had expected the index to decline to -1.7.

3 of 4 indicators dropped in January.

The business climate index for the manufacturing sector fell to -6.3 in January from -3.7 in December due to a less favourable assessments of the current situation.

The business climate index for the services sector was down to 10.2 in January from 12.9 in December due to a less favourable assessment of the current activity and a downward revision of general market demand forecasts.

The business climate index for the building sector increased to 0.5 in January from -4.7 in December due to more favourable assessments of total order books.

The business climate index for the trade sector dropped to -8.6 in January from -4.8 in December due to a drop in in demand and a reduction in orders placed with suppliers.

-

15:34

U.S. Stocks open: Dow -0.28%, Nasdaq -0.34%, S&P -0.31%

-

15:22

Before the bell: S&P futures -0.66%, NASDAQ futures -0.56%

U.S. stock-index futures fell along with oil prices.

Global Stocks:

Nikkei 17,110.91 +152.38 +0.90%

Hang Seng 19,340.14 +259.63 +1.36%

Shanghai Composite 2,939.24 +22.67 +0.78%

FTSE 5,865.19 -34.82 -0.59%

CAC 4,303.21 -33.48 -0.77%

DAX 9,691.67 -73.21 -0.75%

Crude oil $31.11 (-3.36%)

Gold $1107.00 (+0.98%)

-

15:15

Bundesbank’s Monthly Report: low oil prices could boost the economic growth in Germany as consumption could rise

The German Bundesbank said in its monthly report on Monday that low oil prices could boost the economic growth in Germany as consumption could rise.

"Persistently low oil prices could also additionally boost domestic demand owing to the attendant purchasing power gains, the Bundesbank noted.

The Bundesbank also said that the industry could contribute the economic activity as new domestic and foreign orders received by industry increased.

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

121.88

2.94%

93.1K

Barrick Gold Corporation, NYSE

ABX

8.75

1.98%

17.2K

Yahoo! Inc., NASDAQ

YHOO

30.15

1.34%

52.4K

FedEx Corporation, NYSE

FDX

128.00

0.34%

0.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

3.95

0.25%

42.5K

Amazon.com Inc., NASDAQ

AMZN

597.60

0.20%

10.2K

Intel Corp

INTC

29.95

0.08%

33.0K

Ford Motor Co.

F

12.15

0.08%

1.7K

The Coca-Cola Co

KO

42.07

0.02%

0.2K

Pfizer Inc

PFE

30.71

0.00%

0.5K

Hewlett-Packard Co.

HPQ

9.80

0.00%

0.7K

United Technologies Corp

UTX

86.30

-0.06%

0.2K

Facebook, Inc.

FB

97.88

-0.06%

49.1K

Merck & Co Inc

MRK

51.30

-0.10%

3.8K

Procter & Gamble Co

PG

77.18

-0.23%

3.1K

General Motors Company, NYSE

GM

29.20

-0.27%

1.1K

Tesla Motors, Inc., NASDAQ

TSLA

202.00

-0.27%

0.6K

Home Depot Inc

HD

122.40

-0.29%

1.7K

Wal-Mart Stores Inc

WMT

62.50

-0.30%

0.7K

Boeing Co

BA

124.22

-0.31%

0.2K

E. I. du Pont de Nemours and Co

DD

54.55

-0.35%

0.1K

Google Inc.

GOOG

722.65

-0.36%

1K

Verizon Communications Inc

VZ

46.86

-0.38%

2.6K

AT&T Inc

T

35.00

-0.40%

6.3K

Microsoft Corp

MSFT

52.08

-0.40%

8.6K

Apple Inc.

AAPL

101.01

-0.40%

136.5K

Walt Disney Co

DIS

96.50

-0.41%

2.0K

Cisco Systems Inc

CSCO

23.27

-0.43%

0.1K

General Electric Co

GE

28.10

-0.50%

9.5K

Citigroup Inc., NYSE

C

40.84

-0.54%

0.4K

Goldman Sachs

GS

155.95

-0.58%

0.4K

Starbucks Corporation, NASDAQ

SBUX

58.82

-0.59%

3.4K

Nike

NKE

60.33

-0.90%

1.0K

JPMorgan Chase and Co

JPM

56.39

-0.98%

0.2K

American Express Co

AXP

54.50

-1.02%

5.6K

ALCOA INC.

AA

6.79

-1.16%

32.5K

Johnson & Johnson

JNJ

95.60

-1.19%

0.6K

Chevron Corp

CVX

82.50

-1.24%

1.4K

Exxon Mobil Corp

XOM

75.55

-1.33%

10.4K

Yandex N.V., NASDAQ

YNDX

12.90

-1.75%

1.6K

Twitter, Inc., NYSE

TWTR

17.16

-3.81%

145.5K

Caterpillar Inc

CAT

58.65

-3.82%

8.7K

International Paper Company

IP

34.67

-4.88%

20.8K

-

14:45

CBI industrial order books balance declines to -15 in January

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance slid to -15 in January from -7% in December.

The index was driven by a weak demand for exports.

"Manufacturers have seen a flat start to 2016 but while we have seen real problems in some industries in the last few months, there are signs that orders and production are stabilising overall," the CBI director of economics Rain Newton-Smith said.

"Uncertainty around the prospects for global growth, uncompetitive energy costs and the strength of the pound have all played their part in UK manufacturers finding conditions tough when trying to sell overseas," he added.

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Outperform from Neutral at Macquarie; target $35

Goldman Sachs (GS) upgraded to Buy from Neutral at Nomura

Home Depot (HD) upgraded to Buy from Hold at Deutsche Bank

American Express (AXP) upgraded to Perform from Underperform at Oppenheimer

Yahoo! (YHOO) upgraded to Buy from Hold at Pivotal Research Group; target lowered to $36 from $37

Downgrades:

Twitter (TWTR) downgraded to Hold from Buy at Stifel

JPMorgan Chase (JPM) downgraded to Neutral from Buy at Nomura

American Express (AXP) downgraded to Equal-Weight from Overweight at Morgan Stanley

American Express (AXP) downgraded to Hold from Buy at Argus

Caterpillar (CAT) downgraded to Sell from Neutral at Goldman

Intl Paper (IP) downgraded to Neutral from Buy at Citigroup

Other:

Freeport-McMoRan (FCX) target lowered to $8 from $10 at RBC Capital Mkts

General Electric (GE) target lowered to $33 from $34 at RBC Capital Mkts

Amazon (AMZN) reiterated with an Outperform at Wedbush; target $700

Facebook (FB) reiterated with an Outperform at FBR Capital; target $125

-

14:28

-

13:31

Earnings Season in U.S.: Major Reports of the Week

January 25

Before the Open:

McDonald's (MCD). Consensus EPS $1.23, Consensus Revenue $6237.46 mln

January 26

Before the Open:

3M (MMM). Consensus EPS $1.62, Consensus Revenue $7208.21 mln

DuPont (DD). Consensus EPS $0.27, Consensus Revenue $5312.69 mln

Freeport-McMoRan (FCX). Consensus EPS $-0.16, Consensus Revenue $3911.79 mln

Johnson & Johnson (JNJ). Consensus EPS $1.42, Consensus Revenue $17863.76 mln

Procter & Gamble (PG). Consensus EPS $0.98, Consensus Revenue $16940.63 mln

After the Close:

Apple (AAPL). Consensus EPS $3.23, Consensus Revenue $76596.37 mln

AT&T (T). Consensus EPS $0.63, Consensus Revenue $42798.94 mln

January 27

Before the Open:

Boeing (BA). Consensus EPS $1.24, Consensus Revenue $23580.35 mln

United Tech (UTX). Consensus EPS $1.52, Consensus Revenue $15238.30 mln

After the Close:

Facebook (FB). Consensus EPS $0.68, Consensus Revenue $5373.16 mln

January 28

Before the Open:

Altria (MO). Consensus EPS $0.68, Consensus Revenue $4755.15 mln

Caterpillar (CAT). Consensus EPS $0.69, Consensus Revenue $11445.75 mln

Ford Motor (F). Consensus EPS $0.51, Consensus Revenue $36167.03 mln

After the Close:

Amazon (AMZN). Consensus EPS $1.58, Consensus Revenue $35973.15 mln

Microsoft (MSFT). Consensus EPS $0.70, Consensus Revenue $25239.92 mln

Visa (V). Consensus EPS $0.68, Consensus Revenue $3605.59 mln

January 29

Before the Open:

Chevron (CVX). Consensus EPS $0.53, Consensus Revenue $32785.34 mln

Honeywell (HON). Consensus EPS $1.59, Consensus Revenue $9983.96 mln

MasterCard (MA). Consensus EPS $0.69, Consensus Revenue $2552.24 mln

-

12:00

European stock markets mid session: stocks traded higher as oil prices stabilised above $30 a barrel

Stock indices traded higher as oil prices stabilised above $30 a barrel.

Last week's comments by the European Central Bank (ECB) President Mario Draghi also continued to support the markets. Draghi hinted at a press conference on Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

Meanwhile, the economic data from Germany was mostly weaker than expected. German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index declines to 107.3 in January from 108.6 in December. December's figure was revised down from 108.7.

Analysts had expected the index to fall to 108.4.

"The year started with an unpleasant surprise for the German economy," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.5 from 112.8. Analysts had expected the index to remain unchanged at 112.8.

The Ifo expectations index dropped to 102.4 from 104.6, missing expectations for a decrease to 104.1. December's figure was revised down from 104.7.

Current figures:

Name Price Change Change %

FTSE 100 5,901.39 +1.38 +0.02 %

DAX 9,781.75 +16.87 +0.17 %

CAC 40 4,338.32 +1.63 +0.04 %

-

11:45

Industrial turnover in Italy drops at a seasonally adjusted rate of 1.1% in November

The Italian statistical office Istat released its industrial orders data for Italy on Monday. Industrial turnover in Italy slid at a seasonally adjusted rate of 1.1% in November, after a 1.6% decrease in August.

Domestic market orders plunged 1.1% in November, while demand from non-domestic markets fell by 1.1%.

On a yearly basis, the seasonally adjusted industrial turnover in Italy climbed 0.8% in November, after a 1.6% gain in October.

The seasonally adjusted industrial new orders index rose by 1.6% month-on-month in November, after a 4.6% rise in October.

-

11:33

Italian retail sales rise 0.3% in November

The Italian statistical office Istat released its retail sales data for Italy on Monday. Italian retail sales rose by 0.3% in November, after a 0.3% decrease in October.

Sales of food products were up 0.7% in November, while sales of non-food products increased by 0.1%.

On a yearly basis, retail sales in Italy fell 0.3% in November, after a 1.8% rise in October.

-

11:26

Spanish producer prices decline 0.7% in December

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Monday. The Spanish producer prices dropped 0.7% in December, after a 0.1% fall in November.

On a yearly basis, producer price inflation in Spain fell 2.2% in December, after a 2.6% decline in November. Producer prices have been declining since July 2014.

Energy prices slid 7.9% year-on-year in December.

-

11:20

German Ifo business confidence index declines to 107.3 in January

German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index declines to 107.3 in January from 108.6 in December. December's figure was revised down from 108.7.

Analysts had expected the index to fall to 108.4.

"The year started with an unpleasant surprise for the German economy," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.5 from 112.8. Analysts had expected the index to remain unchanged at 112.8.

The Ifo expectations index dropped to 102.4 from 104.6, missing expectations for a decrease to 104.1. December's figure was revised down from 104.7.

-

11:05

Japan's trade deficit turns into a surplus of ¥140.3 billion in December

The Ministry of Finance released its trade data for Japan on the late Sunday evening. Japan's trade deficit turned into a surplus of ¥140.3 billion in December from a deficit of ¥379.7 billion in November.

Analysts had expected a surplus of ¥100.0 billion.

Exports fell 8.0% year-on-year in December, while imports dropped 18.0%.

Exports to Asia declined by 10.3% year-on-year in December, exports to the United States decreased by 3.4%, while exports to the European Union rose by 3.1%.

-

10:50

International Monetary Fund Managing Director Christine Lagarde: the global economy will expand moderately in 2016

International Monetary Fund (IMF) Managing Director Christine Lagarde said at the World Economic Forum in Davos on Saturday that the global economy will expand moderately in 2016, adding that there downside risks to the outlook. Downside risks are low commodity prices and the transition of the Chinese economy, according to Lagarde.

-

10:22

National Australia Bank’s business confidence index declines to 3 points in December

The National Australia Bank (NAB) released its business confidence index for Australia on Monday. The index fell to 3 points in December from 5 points in November.

"While recent big declines in oil and equity markets highlight potential risks to the global outlook, relatively positive business conditions appear to have, so far, acted to reassure business sentiment," NAB Group Chief Economist Alan Oster said.

The main business conditions index decreased 7 points in December from 10 points in November, while employment declined to 0 points in from 2 points.

-

10:10

Bank of Japan Governor Haruhiko Kuroda: the central bank could add further stimulus measures if needed to achieve 2% inflation target

Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the World Economic Forum in Davos on Saturday that the central bank could add further stimulus measures if needed to achieve 2% inflation target. He added that there no technical limitation.

"I don't think there is any technical limitation to further strengthen our quantitative and qualitative easing if necessary to achieve our 2% target," Kuroda noted.

-

06:50

Global Stocks: U.S. stock indices closed higher

U.S. stock indices climbed on Friday as oil prices rose and expectations for further stimulus from the European Central Bank and the Bank of Japan intensified.

The Dow Jones Industrial Average rose 210.83 points, or 1.3%, to 16,093.51 (+0.7% over the week). The S&P 500 gained 37.91 points, or 2%, to 1,906.90 (+1.4% over the week). The Nasdaq Composite rose 119.12 points, or 2.7%, to 4,574.93 (+2.3% over the week). These were the indices' first weekly gains in 2016.

The S&P's energy sector led gains with a 4.3% increase on Friday.

This morning in Asia Hong Kong Hang Seng rose 1.67%, or 318.84, to 19,399.35. China Shanghai Composite Index climbed 0.77%, or 22.41, to 2,938.97. The Nikkei rose 1.18%, or 199.80, to 17,158.33.

Asian stock indices continued rising after Friday's rally. Gains were supported by rebounding stock markets in the U.S. and Europe.

However some analysts say that prospects of the global economic growth are not so rosy and oil prices, which brought stocks higher recently, are likely to feel the ongoing oversupply issue.

-

03:04

Nikkei 225 17,031.62 +73.09 +0.43 %, Hang Seng 19,293.48 +212.97 +1.12 %, Shanghai Composite 2,929.48 +12.92 +0.44 %

-

01:03

Stocks. Daily history for Sep Jan 22’2016:

(index / closing price / change items /% change)

Nikkei 225 16,958.53 +941.27 +5.88 %

Hang Seng 19,080.51 +538.36 +2.90 %

Shanghai Composite 2,916.6 +36.12 +1.25 %

FTSE 100 5,900.01 +126.22 +2.19 %

CAC 40 4,336.69 +130.29 +3.10 %

Xetra DAX 9,764.88 +190.72 +1.99 %

S&P 500 1,906.9 +37.91 +2.03 %

NASDAQ Composite 4,591.18 +119.12 +2.66 %

Dow Jones 16,093.51 +210.83 +1.33 %

-