Noticias del mercado

-

21:03

DJIA 16069.88 187.20 1.18%, NASDAQ 4578.63 106.57 2.38%, S&P 500 1904.09 35.10 1.88%

-

18:38

WSE: Session Results

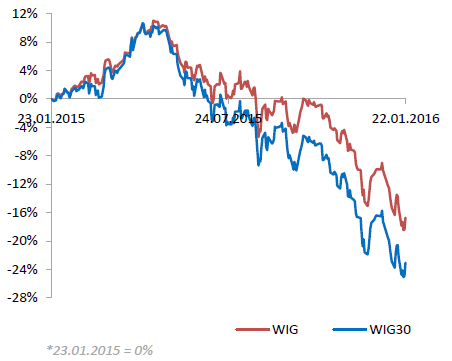

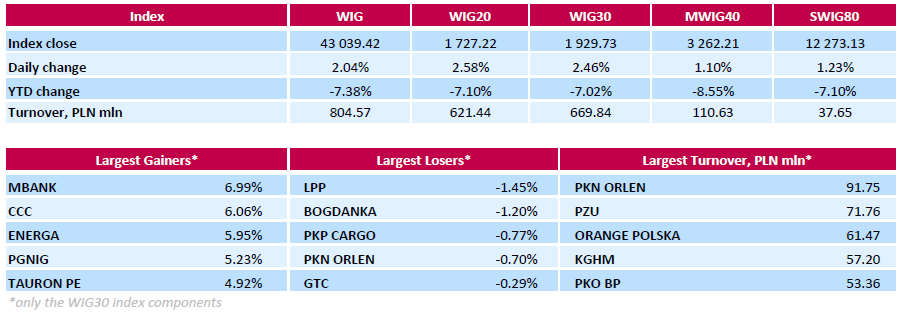

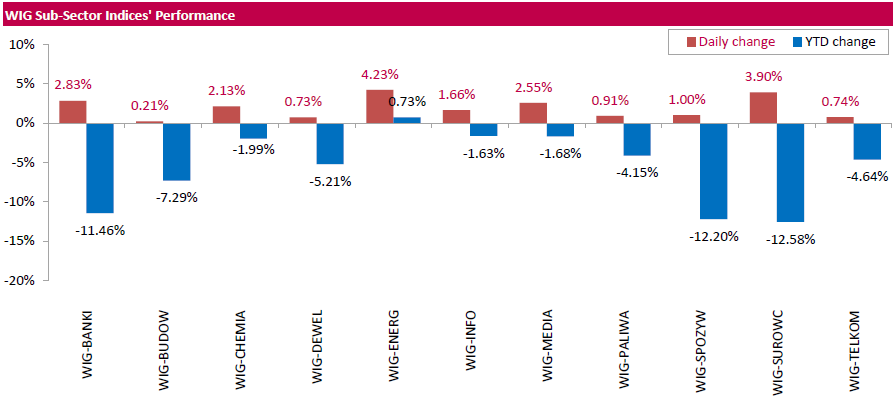

Polish equity market advanced on Friday. The broad market measure, the WIG index, surged by 2.04%. All sectors in the WIG gained, with utilities (+4.23%) and materials (+3.90%) outperforming.

The large-cap stocks' gauge, the WIG30 Index, rose by 2.46%. A majority of the index components recorded advances, with shares of bank MBANK (WSE: MBK; +6.99%), footwear retailer CCC (WSE: CCC; +6.06%) and genco ENERGA (WSE: ENG; +5.95%) leading gains. At the same time, the handful losers included clothing retailer LPP (WSE: LPP; -1.45%), thermal coal miner BOGDANKA (WSE: LWB; -1.2%), railway freight transport operator PKP CARGO (WSE: PKP; -0.77%), oil refiner PKN ORLEN (WSE: PKN; -0.7%) and property developer GTC (WSE: GTC; -0.29%).

-

18:05

Bank of Japan Governor Haruhiko Kuroda: the central bank is ready to add further stimulus measures if needed

Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the World Economic Forum in Davos on Friday that the central bank could add further stimulus measures if falling oil prices will continue on inflation.

-

18:00

European stocks close: stocks closed higher as yesterday's comments by the European Central Bank President Mario Draghi

Stock indices traded higher as yesterday's comments by the European Central Bank (ECB) President Mario Draghi continued to support the markets. He hinted at a press conference on Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

The European Central Bank (ECB) President Mario Draghi said at the World Economic Forum in Davos on Friday that the central bank has "plenty of instruments" to boost inflation in the Eurozone.

Meanwhile, the economic data from the Eurozone was mostly weaker than expected. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 52.3 in January from 53.2 in December. Analysts had expected the index to fall to 53.0.

The decline was driven by a slower pace of expansion in business activity.

Eurozone's preliminary services PMI fell to 53.6 in January from 54.2 in December. Analysts had expected the index to remain unchanged at 54.2.

"The cooling in the pace of growth in euro area business activity at the start of 2016 is a disappointment but not surprising given the uncertainty caused by the financial market volatility seen so far this year", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% - 0.4% in the first quarter.

The European Central Bank (ECB) released its Survey of Professional Forecasters (SPF) for Q1 2016 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.7% in 2016, down from October estimate of 1.0%, 1.4% in 2017, down from October estimate of 1.5%, and 1.6% in 2018.

Long-term inflation forecasts (for 2020) was lowered to 1.8% from 1.9%.

SPF respondents said in its survey that the downgrade was driven by oil price developments.

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. dropped 1.0% in December, missing expectations for a 0.3% decline, after a 1.3% rise in November. November's figure was revised down from a 1.7% increase.

The decline was driven by lower demand for clothing due to warm weather. Sales of clothing and footwear slid 6.3% in December.

On a yearly basis, retail sales in the U.K. jumped 2.6% in December, missing forecasts of 4.3% increase, after a 4.5% rise in November. November's figure was revised down from a 5.0% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,900.01 +126.22 +2.19 %

DAX 9,764.88 +190.72 +1.99 %

CAC 40 4,336.69 +130.29 +3.10 %

-

18:00

European stocks closed: FTSE 5900.01 126.22 2.19%, DAX 9764.88 190.72 1.99%, CAC 40 4336.69 130.29 3.10%

-

17:41

Bank of England Governor Mark Carney: the outlook for the global economy despite the volatility in financial markets

Bank of England (BoE) Governor Mark Carney said in an interview on Thursday with The Wall Street Journal on Friday that the outlook for the global economy despite the volatility in financial markets.

"Recent events are just reinforcing that. I don't think they have fundamentally changed that trajectory," he said.

-

17:41

Wall Street. Major U.S. stock-indexes rose

Major U.S. stocks indexes rose about 1-2% on Friday as a cold wave in the United States and Europe helped oil prices surge for a second day. European Central Bank President Mario Draghi's comments on Thursday suggesting that the bank could ease its monetary policy in its meeting in March also encouraged investors bruised by a brutal selloff that began at the start of 2016. Crude prices, still under pressure from a global glut, were up more than 6 percent as the cold wave boosted short-term demand and traders cashed in their short positions.

Almost all of Dow stocks in positive area (25 of 30). Top looser American Express Company (AXP, -11,14%). Top gainer - Apple Inc. (AAPL, +3,30%).

All of S&P sectors in positive area. Top gainer - Basic Materials (+3,3%).

At the moment:

Dow 15939.00 +152.00 +0.96%

S&P 500 1891.25 +30.25 +1.63%

Nasdaq 100 4227.25 +97.00 +2.35%

Oil 31.53 +2.00 +6.77%

Gold 1100.00 +1.80 +0.16%

U.S. 10yr 2.07 +0.05

-

16:34

European Central Bank President Mario Draghi: the central bank has “plenty of instruments” to boost inflation in the Eurozone

The European Central Bank (ECB) President Mario Draghi said at the World Economic Forum in Davos on Friday that the central bank has "plenty of instruments" to boost inflation in the Eurozone.

"We have the determination, and the willingness and the capacity of the Governing Council, to act and deploy these instruments," he added.

Draghi noted that the monetary policies will differ "for a while".

"It's entirely natural that monetary policies do differ and they will be on a diverging path for a while, and this will be reflected in different interest rates," the ECB president said.

-

16:25

U.S. leading economic index falls 0.2% in December

The Conference Board released its leading economic index (LEI) for the U.S. on Friday. The leading economic index fell 0.2% in December, missing expectations for a 0.1% decrease, after a 0.5% rise in November. November's figure was revised up from a 0.4% increase.

The coincident economic index rose 0.1% in December, after a 0.1% gain in November.

"The U.S. LEI fell slightly in December, led by a drop in housing permits and weak new orders in manufacturing. However, the index continues to suggest moderate growth in the near-term despite the economy losing some momentum at the end of 2015. While the LEI's growth rate has been on the decline, it's too early to interpret this as a substantial rise in the risk of recession," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:18

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 47.0 in January from 43.5 in December, the highest level since June 2015

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 47.0 in January from 43.5 in December. It was the highest level since June 2015.

The rise was driven by a more favourable assessment of the measure of views of the economy.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.0 in in the week ended January 17 from 44.4 the prior week.

The weekly drop was driven by declines in all sub-indexes. The measure of views of the economy declined to 37.7 from 38.0, the buying climate index was down to 39.2 from 39.4, while the personal finances index fell to 55.0 from 55.9.

-

16:11

U.S. existing homes sales increase 14.7% in December

The National Association of Realtors released existing homes sales figures in the U.S. on Friday. Sales of existing homes rose 14.7% to a seasonally adjusted annual rate of 5.46 million in December from 4.76 in November.

Analysts had expected an increase to 5.20 million units.

"While the carryover of November's delayed transactions into December contributed greatly to the sharp increase, the overall pace taken together indicates sales these last two months maintained the healthy level of activity seen in most of 2015," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 32% in December from 31% in November.

"First-time buyers were for the most part held back once again in 2015 by rising rents and home prices, competition from vacation and investment buyers and supply shortages. While these headwinds show little signs of abating, the cumulative effect of strong job growth in recent years and young renters' overwhelming interest to own a home5 should lead to a modest uptick in first-time buyer activity in 2016," Yun said.

-

15:59

Eurozone’s revised government deficit to GDP ratio is 1.9% in the third quarter of 2015

Eurostat released its revised government deficit data for third quarter of 2015 on Friday. Eurozone's government deficit to GDP ratio fell to 1.9% in the third quarter of 2015 from 2.2% in the second quarter of 2015. Total government revenue in the Eurozone was 46.5% of GDP in the third quarter of 2015, while total government expenditure was 48.3% of GDP.

-

15:51

U.S. preliminary manufacturing purchasing managers' index increases to 52.7 in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) increased to 52.7 in January from 52.2 in December, beating expectations for a decline to 51.1.

A reading above 50 indicates expansion in economic activity.

The increase was driven by a faster pace of expansion in output and new business.

"The US manufacturing sector found a new lease of life at the start of the year, with growth of factory output and orders both picking up after the slowdown seen late last year," Markit Chief Economist Chris Williamson.

"It's clearly too early to declare that recent slowdown fears are overplayed, but the sector's resilience in the face of recent financial market volatility is an encouraging omen for growth and employment in the wider economy, especially as sectors such as transport and business services typically move in the same cycle as manufacturing," he added.

-

15:39

U.S. Stocks open: Dow +0.12%, Nasdaq +0.06%, S&P +0.14% Dow +1.18%, Nasdaq +1.71%, S&P +1.48%

-

15:28

Before the bell: S&P futures +1.36%, NASDAQ futures +1.71%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,958.53 +941.27 +5.88%

Hang Seng 19,080.51 +538.36 +2.90%

Shanghai Composite 2,916.6 +36.12 +1.25%

FTSE 5,895.29 +121.50 +2.10%

CAC 4,347.15 +140.75 +3.35%

DAX 9,782.68 +208.52 +2.18%

Crude oil $31.09 (+5.28%)

Gold $1095.60 (-0.24%)

-

15:09

Government debt in the Eurozone reached 91.6% of GDP in the third quarter of 2015

According to Eurostat, government debt in the Eurozone reached 91.6% of GDP in the third quarter of 2015, down from 92.3% in the second quarter of 2015.

The highest ratios of government debt were recorded in Greece (171.0% of GDP), followed by Italy (134.6%) and Portugal (130.5%).

The lowest ratios of government debt were recorded in in Estonia (9.8%) and Luxembourg (21.3%).

Germany' ratio of government debt decreased to 71.9% in the third quarter of 2015 from 72.5% in the second quarter of 2015.

France's ratio of government debt declined to 97.0% in the third quarter of 2015 from 97.7% in the second quarter of 2015.

UK's ratio of government debt fell to 88.6% in the third quarter of 2015 from 89.0% in the second quarter of 2015.

-

15:02

Chicago Fed National Activity Index rises to -0.22 in December

The Federal Reserve Bank of Chicago released its National Activity Index on Friday. The index increased to -0.22 in December from -0.36 in November. November's figure was revised down from -0.30.

The slight increase was mainly driven by a rise in the production.

The production-related indicator rose to -0.26 in December from -0.40 in November.

The employment-related indicator remained unchanged at +0.12 in December.

The personal consumption and housing indicator was down to -0.07 in December from -0.05 in November.

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yandex N.V., NASDAQ

YNDX

13.00

6.73%

3.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.60

6.24%

173.0K

Chevron Corp

CVX

83.55

3.08%

5.9K

Tesla Motors, Inc., NASDAQ

TSLA

205.60

2.82%

26.3K

Hewlett-Packard Co.

HPQ

10.21

2.72%

0.7K

Nike

NKE

62.20

2.71%

27.1K

ALCOA INC.

AA

7.28

2.68%

34.1K

Exxon Mobil Corp

XOM

76.05

2.63%

46.1K

Twitter, Inc., NYSE

TWTR

18.28

2.52%

10.3K

Yahoo! Inc., NASDAQ

YHOO

30.00

2.35%

14.2K

Caterpillar Inc

CAT

60.95

2.11%

0.2K

Amazon.com Inc., NASDAQ

AMZN

586.70

2.03%

12.2K

General Motors Company, NYSE

GM

30.15

2.03%

2.3K

Cisco Systems Inc

CSCO

23.36

2.01%

14.0K

Apple Inc.

AAPL

98.21

1.98%

198.2K

Ford Motor Co.

F

12.24

1.92%

56.4K

Facebook, Inc.

FB

95.93

1.88%

90.0K

Visa

V

72.85

1.80%

4.4K

Google Inc.

GOOG

719.00

1.76%

13.0K

Microsoft Corp

MSFT

51.35

1.72%

42.1K

Citigroup Inc., NYSE

C

40.84

1.72%

20.0K

3M Co

MMM

140.00

1.63%

0.6K

JPMorgan Chase and Co

JPM

56.15

1.63%

10.3K

AMERICAN INTERNATIONAL GROUP

AIG

56.19

1.59%

0.2K

Walt Disney Co

DIS

95.50

1.57%

3.9K

Goldman Sachs

GS

154.00

1.55%

8.8K

Home Depot Inc

HD

122.00

1.48%

0.5K

International Business Machines Co...

IBM

124.64

1.41%

25.5K

Pfizer Inc

PFE

30.99

1.34%

1.2K

Intel Corp

INTC

30.05

1.31%

4.4K

Wal-Mart Stores Inc

WMT

62.60

1.16%

0.6K

Merck & Co Inc

MRK

51.50

1.14%

2.5K

Verizon Communications Inc

VZ

46.38

1.11%

5.1K

ALTRIA GROUP INC.

MO

58.09

1.11%

3.6K

McDonald's Corp

MCD

119.14

1.10%

0.8K

AT&T Inc

T

34.84

0.87%

12.0K

Procter & Gamble Co

PG

77.30

0.76%

0.7K

The Coca-Cola Co

KO

41.55

0.39%

4.9K

Boeing Co

BA

123.30

-0.08%

1.3K

General Electric Co

GE

28.30

-1.01%

653.6K

Barrick Gold Corporation, NYSE

ABX

8.14

-2.28%

9.5K

Starbucks Corporation, NASDAQ

SBUX

57.56

-2.49%

255.5K

American Express Co

AXP

58.86

-6.03%

113.2K

-

14:53

Canadian consumer price inflation declines 0.5% in December

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation fell 0.5% in December, missing expectations for a 0.4% decline, after a 0.1% decline in November.

The monthly decline was mainly driven by a drop in clothing and footwear prices, which dropped 5.2% in December.

On a yearly basis, the consumer price index rose to 1.6% in December from 1.4% in November, missing expectations for a gain to 1.7%.

The consumer price index was mainly driven by higher food and shelter prices. Food prices climbed 3.7% year-on-year in December, while transportation prices increased 0.6%.

The index for recreation, education and reading climbed by 1.7% in December from the same month a year earlier, the shelter index gained 1.1%, while gasoline prices dropped 4.8%.

The Canadian core consumer price index, which excludes some volatile goods, decreased 0.4% in December, after a 0.3% fall in November.

On a yearly basis, core consumer price index in Canada declined to 1.9% in December from 2.0% in November, missing expectations for a rise to 2.1%.

The Bank of Canada's inflation target is 2.0%.

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

American Express (AXP) downgraded to Market Perform from Outperform at Keefe Bruyette

Other:

American Express (AXP) target lowered to $59 from $69 at RBC Capital Mkts

-

14:43

Canadian retail sales climb by 1.7% in November

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 1.7% in November, exceeding expectations for a 0.2% gain, after a 0.1% increase in October.

The rise was mainly driven by higher sales at new car dealers, which increased by 4.5% in November.

Sales at gasoline stations declined 0.6% in November.

Motor vehicle and parts sales increased 3.5% in November, while sales at furniture and home furnishings stores rose 0.4%.

Sales at food and beverage stores were up 1.5% in November.

Canadian retail sales excluding automobiles jumped 1.1% in November, beating expectations for a 0.4% rise, after a flat reading in October.

-

14:26

European Central Bank Governing Council member Ewald Nowotny: the central bank will review its stimulus measures and examine which tools it could use to boost inflation in the Eurozone

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Friday the central bank will review its stimulus measures and examine which tools it could use to boost inflation in the Eurozone.

"We will look at the situation again in March, but we haven't decided on what instruments we will use," he said.

Nowotny also said that the Eurozone could fall into deflation in the first half of the year due to low oil prices.

-

14:23

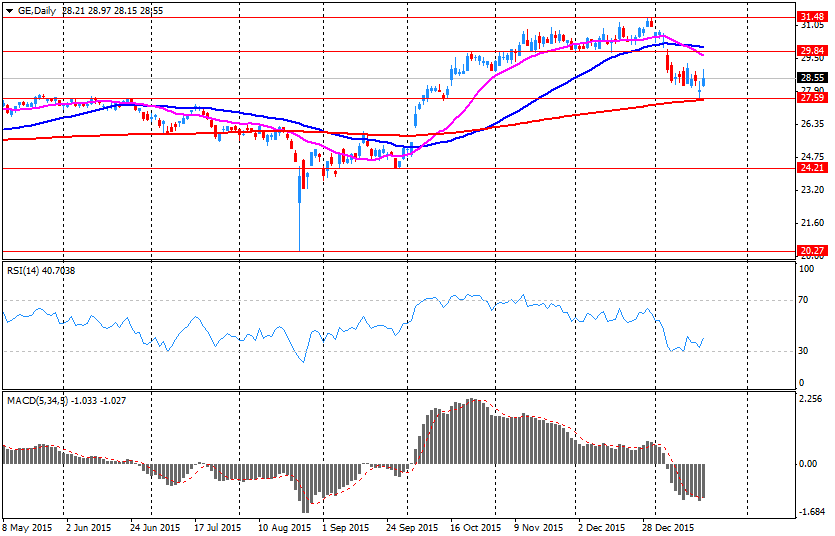

Company News: General Electric (GE) Q4 Earnings Beat Analysts’ Estimate

General Electric reported Q4 FY 2015 earnings of $0.52 per share (versus $0.56 in Q4 FY 2014), beating analysts' consensus of $0.49.

The company's quarterly revenues amounted to $33.839 bln (+1.2% y/y), missing consensus estimate of $35.907 bln.

General Electric reaffirmed guidance for FY 2016, projecting EPS of $1.45-1.55 (versus analysts' consensus estimate of $1.49), cash generation of $30-32 bln, and $26 bln returned to investors.

GE fell to $28.32 (-0.94%) in pre-market trading.

-

12:06

European stock markets mid session: stocks traded higher as yesterday’s comments by the European Central Bank President Mario Draghi continued to support the markets

Stock indices traded higher as yesterday's comments by the European Central Bank (ECB) President Mario Draghi continued to support the markets. He hinted at a press conference on Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

Meanwhile, the economic data from the Eurozone was mostly weaker than expected. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 52.3 in January from 53.2 in December. Analysts had expected the index to fall to 53.0.

The decline was driven by a slower pace of expansion in business activity.

Eurozone's preliminary services PMI fell to 53.6 in January from 54.2 in December. Analysts had expected the index to remain unchanged at 54.2.

"The cooling in the pace of growth in euro area business activity at the start of 2016 is a disappointment but not surprising given the uncertainty caused by the financial market volatility seen so far this year", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% - 0.4% in the first quarter.

The European Central Bank (ECB) released its Survey of Professional Forecasters (SPF) for Q1 2016 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.7% in 2016, down from October estimate of 1.0%, 1.4% in 2017, down from October estimate of 1.5%, and 1.6% in 2018.

Long-term inflation forecasts (for 2020) was lowered to 1.8% from 1.9%.

SPF respondents said in its survey that the downgrade was driven by oil price developments.

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. dropped 1.0% in December, missing expectations for a 0.3% decline, after a 1.3% rise in November. November's figure was revised down from a 1.7% increase.

The decline was driven by lower demand for clothing due to warm weather. Sales of clothing and footwear slid 6.3% in December.

On a yearly basis, retail sales in the U.K. jumped 2.6% in December, missing forecasts of 4.3% increase, after a 4.5% rise in November. November's figure was revised down from a 5.0% gain.

Current figures:

Name Price Change Change %

FTSE 100 5,898.96 +125.17 +2.17 %

DAX 9,760.34 +186.18 +1.94 %

CAC 40 4,336.96 +130.56 +3.10 %

-

11:57

European Central Bank’s Survey of Professional Forecasters: forecasters lower their inflation forecasts

The European Central Bank (ECB) released its Survey of Professional Forecasters (SPF) for Q1 2016 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.7% in 2016, down from October estimate of 1.0%, 1.4% in 2017, down from October estimate of 1.5%, and 1.6% in 2018.

Long-term inflation forecasts (for 2020) was lowered to 1.8% from 1.9%.

SPF respondents said in its survey that the downgrade was driven by oil price developments.

The economic growth in the Eurozone is expected to expand 1.7% this year and 1.8% in 2017, both unchanged from October estimate.

The growth is expected to be driven by private consumption and investment.

-

11:49

Nikkei newspaper: the Bank of Japan is considering to add further stimulus measures

The Nikkei newspaper reported on Friday, citing the central bank's officials, the Bank of Japan (BoJ) was considering to add further stimulus measures. The reason for additional stimulus measures is a further drop in oil prices, according to the Nikkei.

Next BoJ monetary policy meeting will be held on January 28-29.

-

11:46

France's preliminary manufacturing PMI drops in January, while services PMI rises

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI dropped to 50.0 in January from 51.4 in December, missing forecasts of a decline to 51.3.

France's preliminary services PMI rose to 50.6 in January from 49.8 in December. Analysts had expected the index to climb to 50.2.

"Competitive pressures remain strong, with firms cutting their selling prices at the sharpest rate in seven months in a bid to shore up demand, suggesting that inflation is set to remain very weak in the near future. A slight rise in employment - the first since mid-2015 - offers mild reassurance on the labour market front, although does little to suggest a meaningful improvement in the jobless rate is on the cards from its current 18-year high of 10.6%," the Senior Economist at Markit Jack Kennedy said.

-

11:41

Germany's preliminary manufacturing and services PMIs fall in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI fell to 52.1 in January from 53.2 in December, missing forecasts of a decline to 53.0.

The fall in the manufacturing PMI was mainly driven by a weaker increase in purchasing activity.

Germany's preliminary services PMI was down to 55.4 in January from 56.0 in December. Analysts had expected index to decrease to 55.6.

The decline of the services PMI was driven by a weaker rise in business activity.

"Germany's private sector economy was largely unaffected by the recent stock market turmoil and intensifying uncertainty stemming from the so-called migrant crisis at the beginning of the year, according to latest survey result," Markit's economist Oliver Kolodseike noted.

-

11:34

Eurozone's preliminary manufacturing and services PMIs decline in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 52.3 in January from 53.2 in December. Analysts had expected the index to fall to 53.0.

The decline was driven by a slower pace of expansion in business activity.

Eurozone's preliminary services PMI fell to 53.6 in January from 54.2 in December. Analysts had expected the index to remain unchanged at 54.2.

"The cooling in the pace of growth in euro area business activity at the start of 2016 is a disappointment but not surprising given the uncertainty caused by the financial market volatility seen so far this year", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% - 0.4% in the first quarter.

-

11:26

Public sector net borrowing in the U.K. declines to £6.87 billion in December

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. fell to £6.87 billion in December from £12.94 billion in November. November's figure was revised down from £13.56 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks fell by £4.3 billion to £7.5 billion in December from last year.

-

11:14

UK retail sales drop 1.0% in December

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. dropped 1.0% in December, missing expectations for a 0.3% decline, after a 1.3% rise in November. November's figure was revised down from a 1.7% increase.

The decline was driven by lower demand for clothing due to warm weather. Sales of clothing and footwear slid 6.3% in December.

On a yearly basis, retail sales in the U.K. jumped 2.6% in December, missing forecasts of 4.3% increase, after a 4.5% rise in November. November's figure was revised down from a 5.0% gain.

-

10:48

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 52.4 in January

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 52.4 in January from 52.6 in December.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was driven by a slower pace in expansion in new orders, output and employment.

"The start of 2016 was largely positive for the Japanese manufacturing sector, with latest data pointing to a solid improvement in operating conditions. Production rose at a rate little-changed from December's joint 21-month record," economist at Markit, Amy Brownbill, said.

-

10:37

The Foundation for Economic and Industrial Research’s quarterly report: the Greek economy contracts by about 0.5% in 2015

The Greek thin tank, the Foundation for Economic and Industrial Research (IOBE), said its quarterly report on Thursday that the Greek economy contracted by about 0.5% in 2015, less than previously expected (October estimate: -1.5% to -2.0%).

"If the bailout review closes relatively quickly, the economy may turn to positive rates around mid-year, meaning this would contain the recession, which we estimate around 1.0 to 1.5 per cent for the year as a whole," IOBE chief Nikos Vettas said.

-

10:22

Billionaire investor George Soros: there will be a hard-landing in China

Billionaire investor George Soros said in an interview with Bloomberg TV on Thursday that there will be a hard-landing in China, which will contribute to the global deflation.

"A hard landing is practically unavoidable. I'm not expecting it, I'm observing it. China can manage it. It has resources and greater latitude in policies, with $3 trillion in reserves," he said.

Soros noted that the slowdown in the Chinese economy and falling commodity prices are the reasons for the global deflation.

-

10:11

Morgan Stanley Chairman & CEO James Gorman: there will be no hard-landing in China

Morgan Stanley Chairman & CEO James Gorman said in an interview with CNBC on Thursday that there will be no hard-landing in China.

"China is not having a hard-landing here. China is having a natural, mathematical slowdown given the size of the economy," he said.

Gorman noted that the U.S. economy is not "under fundamental stress".

-

06:48

Global Stocks: U.S. stock indices closed higher

U.S. stock indices climbed on Thursday as oil prices rose. Stocks were also supported by European Central Bank President Mario Draghi's comments, which raised expectations for monetary policy easing in March.

The Dow Jones Industrial Average rose 115.94 points, or 0.7%, to 15,882.68. The S&P 500 gained 9.66 points, or 0.5%, to 1,868.99 (7 out of its 10 sectors rose). The Nasdaq Composite edged up 0.37 point, or 0.1%, to 4,472.06.

Data from Philadelphia Fed Manufacturing Survey showed that the index of economic activity slightly rose to -3.5 in January from -5.9 in December. Many economists had expected a more modest increase to -5.0.

This morning in Asia Hong Kong Hang Seng rose 2.23%, or 414.15, to 18,956.30. China Shanghai Composite Index climbed 0.10%, or 2.90, to 2,883.38. The Nikkei surged 5.10%, or 816.53, to 16,833.79.

Asian stock indices rose on gains in oil prices. Japanese stocks jumped with energy companies posting strong gains. Stocks of Inpex Corp and Japan Petroleum Exploration Co rose by 3.7% and 4.3% respectively.

Chinese stocks traded mixed after the recent selloff.

-

03:03

Nikkei 225 16,565.61 +548.35 +3.42 %, Hang Seng 18,975.6 +433.45 +2.34 %, Shanghai Composite 2,913.08 +32.60 +1.13 %

-

00:35

Stocks. Daily history for Sep Jan 21’2016:

(index / closing price / change items /% change)

Nikkei 225 16,017.26 -398.93 -2.43 %

Hang Seng 18,542.15 -344.15 -1.82 %

Shanghai Composite 2,880.8 -95.89 -3.22 %

FTSE 100 5,773.79 +100.21 +1.77 %

CAC 40 4,206.4 +81.45 +1.97 %

Xetra DAX 9,574.16 +182.52 +1.94 %

S&P 500 1,868.99+9.66 +0.52 %

NASDAQ Composite 4,472.06 +0.37 +0.01 %

Dow Jones 15,882.68 +115.94 +0.74 %

-