Noticias del mercado

-

17:51

Oil prices rise more than 5%

Oil prices rose due to taking profit. Cold weather supported oil prices.

But it is likely that oil prices will remain volatile. Concerns over the global oil oversupply still weigh on oil prices. Iran said on Friday that it plans to ship its oil to the European Union in February.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs declined by 1 rigs to 515 last week. It was the lowest level since April 2010.

WTI crude oil for March delivery rose to $31.85 a barrel on the New York Mercantile Exchange.

Brent crude oil for March increased to $31.23 a barrel on ICE Futures Europe.

-

17:33

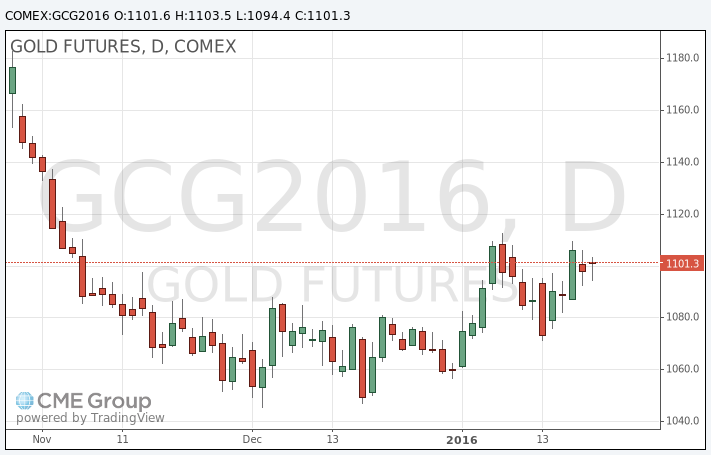

Gold declines as global stock markets rose and on a stronger U.S. dollar

Gold price fell as global stock markets rose and on a stronger U.S. dollar. The U.S. dollar rose against the euro on comments by the European Central Bank (ECB) President Mario Draghi. He hinted at a press conference on Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

The U.S. dollar was also supported by the U.S. economic data. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) increased to 52.7 in January from 52.2 in December, beating expectations for a decline to 51.1.

The National Association of Realtors released existing homes sales figures in the U.S. on Friday. Sales of existing homes rose 14.7% to a seasonally adjusted annual rate of 5.46 million in December from 4.76 in November. Analysts had expected an increase to 5.20 million units.

February futures for gold on the COMEX today dropped to 1094.40 dollars per ounce.

-

07:20

Oil prices surged

West Texas Intermediate futures for March delivery jumped to $30.75 (+4.13%), while Brent crude rose to $30.65 (+4.79%) after European Central Bank President Mario Draghi hinted at policy easing in the coming months. However analysts caution that gains based on such expectations will be short-lived as the global supply glut will remind market participants of itself. Analysts also say that oil prices haven't reached the bottom yet.

More pressure is coming from Iran, which is on track to pump more crude into the oversupplied market. The National Iranian Oil Company said it had ordered to raise output by 500,000 barrels per day after the sanctions were lifted on Sunday.

-

07:09

Gold under pressure

Gold is currently at $1,099.60 (+0.13%). The precious metal gave up some of its earlier gains as stocks rebounded and European Central Bank President Mario Draghi hinted at policy easing in the coming months.

Physical demand in top consumers China and India remained weak.

Fundamentals remain unfavorable. The dollar is expected to do well as the Federal Reserve seems to be determined to raise rates again in 2016. Some analysts expect gold to drop below $1,000 this year.

-

00:36

Commodities. Daily history for Jan 21’2016:

(raw materials / closing price /% change)

Oil 29.85 +1.08%

Gold 1,101.40 +0.29%

-