Noticias del mercado

-

20:22

American focus: the US dollar strengthened

The US dollar rose against other major currencies, as expectations of additional measures to stimulate the economy of the eurozone and Japan supported the US currency, while the investors assess the published statistics in the United States.

The data provided by the Federal Reserve Bank of Chicago showed that the national activity index (CFNAI) improved to -0.22 in December, against -0.36 in November. Two of the four broad categories of indicators have improved since November, but three of the four categories had a negative impact on the index in December. 35 of the 85 individual indicators contributed to the growth of the index, while 50 indicators weighed. 51 index improved from November to December, while 32 indicators deteriorated and two were unchanged. The index, which combines manufacturing indicator increased to -0.26 in December from -0.40 in November. Recall that in December, industrial production fell by 0.4 percent after falling 0.9 percent in November. Meanwhile, the index includes indicators on trade orders and inventories, improved to -0.02 from -0.03 in November. Employment indicator stayed at the level of 0.12, and the index of personal consumption fell to -0.07 from -0.05.

The National Association of Realtors (NAR) reported that the results of December sales in the secondary market rose by 14.7%, amounting to 5.46 million at the same time. Units on an annualized basis. (seasonally adjusted). Experts expect that sales will increase to 5.2 million. Units. with 4.76 million. units in the previous month (revised figure does not). At the end of 2015 the volume of housing sales reached 5.26 million. Units, the highest since 2006. The report also said that inventories of existing homes for sale fell by 12% compared to November, to a level of 1.79 million. Units. (minimum value of the almost ten years). The ratio of inventories to the current volume of sales declined to 3.9 months from 5.1 months in November. The national median home price rose to $ 224,100, which is 7.6% higher than in December 2014. Add the price increase has been celebrated the 46 th consecutive month. Lawrence Yun, chief economist of NAR, said that in 2016 the sales volume is likely to be relatively unchanged for scarce stocks and the broader economic "turbulence". However, he expects the US will sustain recent market volatility.

The US dollar strengthened positions after ECB President Mario Draghi said that the regulator "would need to be reviewed and possibly re-think" its monetary policy meeting in March, when there will be fresh economic forecasts. On Friday morning, Draghi said that the Bank has "sufficient tools" for the achievement of price stability in the euro area.

The US dollar fell to polutoranedelnoy low against the Canadian dollar, as a rebound in oil prices contributed to the growth of the Canadian currency, although the demand for the US dollar is still widely supported. On Friday, oil prices returned to the level of $ 31 per barrel, as a cold front that swept the US and Europe, supports the demand for raw materials. On Wednesday, the first time since 2003 the price of oil fell below $ 27 per barrel along with the collapse of global financial markets, as investors worried that a considerable surplus of raw materials on the market comes at a time of slowing economic growth in the world, especially in China.

On Friday, Canada's statistical data showed that retail sales rose 1.7% in November, well above forecasts growth of 0.2%. The index of retail sales excluding autos rose 1.1% in November, although the expected increase of just 0.4%. A separate report showed that the consumer price index in Canada fell 0.5% in December, below the projected 0.4% fall. In annual terms, the CPI increased by 1.6%. Core CPI (excluding volatile in price of energy and food) fell by 0.4% last month, confounding expectations for a decline of 0.3%.

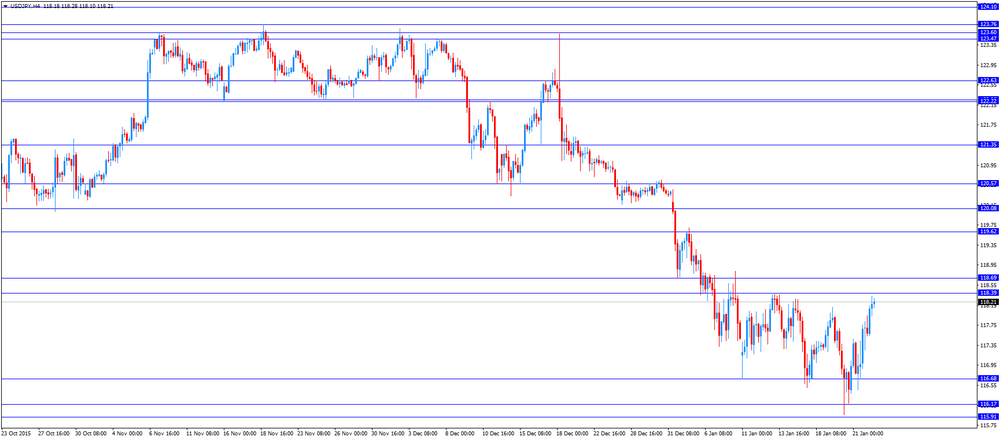

The yen fell against the dollar, reaching a minimum of 8 January, which was associated with a decrease in demand for safe-haven assets because of rising stock markets in Asia and Europe. Pressure on the currency have also speculation that the Bank of Japan is considering new measures easing. In his article today news agency Nikkei reported that the Bank of Japan's seriously mulling the possibility of expanding monetary stimulus measures. The newspaper referred to the comments of a senior official of the Central Bank. In these statements it refers to the fact that the period of low oil prices seem to be long and more people are convinced of this. This means that the consumer price index will have less chance to somehow climb. Also, recently there has been the strengthening of the yen and fall in Japanese stocks. In this regard, the government and the Central Bank strengthened the intentions in the expansion of monetary stimulus. Nikkei also noted that in his report of economic activity, which will be published on January 29, the Bank of Japan lowered its forecast for the growth rate of consumer prices from 1.4% to 1%. It is also very likely that will be extended timeframes to achieve the inflation target of 2%.

An additional factor of pressure on the yen was also a deterioration in the index of manufacturing activity PMI Nikkei-Markit in January to 52.4 points against 52.6 in December. Analysts had forecast that the index improved to 52.8 points. Production rose to 21-month high, while growth in the new orders index fell to a six-month low.

The pound strengthened against the US dollar, rising above $ 1.4300. Investors are hardly paid attention to the weak retail sales in Britain, while focusing on good statistics on volume of borrowing in the public sector. As it became known, the public sector net borrowing fell in December to 6.87 billion. Against 12.94 billion pounds. In November. Experts predicted 10.35 billion. Lbs. The report also reported that net borrowing state. sector (excluding state-owned banks) decreased in December to 4.3 billion. against 7.5 billion pounds. pounds in the previous month. It was expected that the loan will amount to 10.5 billion. Lbs. Last change was largely due to the decrease in borrowings of the central and local governments 2.8 billion. And 1.4 billion pounds. Pounds, respectively. Since the beginning of the financial year, net borrowing state. sector (excluding state-owned banks) amounted to 74.2 billion. pounds, which is 11 billion. pounds, or 12.9 percent less than the same period in 2014.

The euro declined significantly against the dollar, having lost most of the positions, earned the night before. Experts note that the single currency remains under pressure due to yesterday's ECB President Draghi's comments, as well as today's statistics on business activity. In a preliminary report, Markit reported that the private sector in Germany slowed the pace of growth of activity in January, registering with the weakest expansion in three months. The composite PMI index fell to 54.5 in January from 55.5 in December. The PMI index for the services sector fell to 55.4 from 56. It was predicted that the rate will decrease to 55.6. Industrial activity grew at the slowest pace in 8 months - the PMI index was 52.1 against 53.2 in December. It was expected the index to decline to 53.0.

It also became known that the growth of private sector activity in the euro zone slowed in January to its lowest level in eleven months. The composite purchasing managers' index fell to 53.5 from 54.3 in December. Economists expected a decline to 54.2. Manufacturing PMI fell to 52.3 in January from 53.2, which also turned out to be worse than expected (53.0). The latter value was the lowest in three months. Meanwhile, the PMI index for the services sector fell from 54.2 to 53.6 (minimum one year). Economists had expected the index to remain unchanged. Despite the slowdown, business confidence in the private sector has improved, while employment remained at the highest level for the past 4.5 years because of the significant increase in unfilled orders. the study said. In addition, companies have reduced their purchasing costs due to a further drop in oil prices. Against this background, sales prices also decreased in January, said the Markit.

-

18:05

Bank of Japan Governor Haruhiko Kuroda: the central bank is ready to add further stimulus measures if needed

Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the World Economic Forum in Davos on Friday that the central bank could add further stimulus measures if falling oil prices will continue on inflation.

-

17:41

Bank of England Governor Mark Carney: the outlook for the global economy despite the volatility in financial markets

Bank of England (BoE) Governor Mark Carney said in an interview on Thursday with The Wall Street Journal on Friday that the outlook for the global economy despite the volatility in financial markets.

"Recent events are just reinforcing that. I don't think they have fundamentally changed that trajectory," he said.

-

16:34

European Central Bank President Mario Draghi: the central bank has “plenty of instruments” to boost inflation in the Eurozone

The European Central Bank (ECB) President Mario Draghi said at the World Economic Forum in Davos on Friday that the central bank has "plenty of instruments" to boost inflation in the Eurozone.

"We have the determination, and the willingness and the capacity of the Governing Council, to act and deploy these instruments," he added.

Draghi noted that the monetary policies will differ "for a while".

"It's entirely natural that monetary policies do differ and they will be on a diverging path for a while, and this will be reflected in different interest rates," the ECB president said.

-

16:25

U.S. leading economic index falls 0.2% in December

The Conference Board released its leading economic index (LEI) for the U.S. on Friday. The leading economic index fell 0.2% in December, missing expectations for a 0.1% decrease, after a 0.5% rise in November. November's figure was revised up from a 0.4% increase.

The coincident economic index rose 0.1% in December, after a 0.1% gain in November.

"The U.S. LEI fell slightly in December, led by a drop in housing permits and weak new orders in manufacturing. However, the index continues to suggest moderate growth in the near-term despite the economy losing some momentum at the end of 2015. While the LEI's growth rate has been on the decline, it's too early to interpret this as a substantial rise in the risk of recession," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:18

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 47.0 in January from 43.5 in December, the highest level since June 2015

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 47.0 in January from 43.5 in December. It was the highest level since June 2015.

The rise was driven by a more favourable assessment of the measure of views of the economy.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.0 in in the week ended January 17 from 44.4 the prior week.

The weekly drop was driven by declines in all sub-indexes. The measure of views of the economy declined to 37.7 from 38.0, the buying climate index was down to 39.2 from 39.4, while the personal finances index fell to 55.0 from 55.9.

-

16:11

U.S. existing homes sales increase 14.7% in December

The National Association of Realtors released existing homes sales figures in the U.S. on Friday. Sales of existing homes rose 14.7% to a seasonally adjusted annual rate of 5.46 million in December from 4.76 in November.

Analysts had expected an increase to 5.20 million units.

"While the carryover of November's delayed transactions into December contributed greatly to the sharp increase, the overall pace taken together indicates sales these last two months maintained the healthy level of activity seen in most of 2015," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 32% in December from 31% in November.

"First-time buyers were for the most part held back once again in 2015 by rising rents and home prices, competition from vacation and investment buyers and supply shortages. While these headwinds show little signs of abating, the cumulative effect of strong job growth in recent years and young renters' overwhelming interest to own a home5 should lead to a modest uptick in first-time buyer activity in 2016," Yun said.

-

16:00

U.S.: Existing Home Sales , December 5.46 (forecast 5.2)

-

16:00

U.S.: Leading Indicators , December -0.2% (forecast -0.1%)

-

15:59

Eurozone’s revised government deficit to GDP ratio is 1.9% in the third quarter of 2015

Eurostat released its revised government deficit data for third quarter of 2015 on Friday. Eurozone's government deficit to GDP ratio fell to 1.9% in the third quarter of 2015 from 2.2% in the second quarter of 2015. Total government revenue in the Eurozone was 46.5% of GDP in the third quarter of 2015, while total government expenditure was 48.3% of GDP.

-

15:51

U.S. preliminary manufacturing purchasing managers' index increases to 52.7 in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) increased to 52.7 in January from 52.2 in December, beating expectations for a decline to 51.1.

A reading above 50 indicates expansion in economic activity.

The increase was driven by a faster pace of expansion in output and new business.

"The US manufacturing sector found a new lease of life at the start of the year, with growth of factory output and orders both picking up after the slowdown seen late last year," Markit Chief Economist Chris Williamson.

"It's clearly too early to declare that recent slowdown fears are overplayed, but the sector's resilience in the face of recent financial market volatility is an encouraging omen for growth and employment in the wider economy, especially as sectors such as transport and business services typically move in the same cycle as manufacturing," he added.

-

15:46

U.S.: Manufacturing PMI, January 52.7 (forecast 51.1)

-

15:09

Government debt in the Eurozone reached 91.6% of GDP in the third quarter of 2015

According to Eurostat, government debt in the Eurozone reached 91.6% of GDP in the third quarter of 2015, down from 92.3% in the second quarter of 2015.

The highest ratios of government debt were recorded in Greece (171.0% of GDP), followed by Italy (134.6%) and Portugal (130.5%).

The lowest ratios of government debt were recorded in in Estonia (9.8%) and Luxembourg (21.3%).

Germany' ratio of government debt decreased to 71.9% in the third quarter of 2015 from 72.5% in the second quarter of 2015.

France's ratio of government debt declined to 97.0% in the third quarter of 2015 from 97.7% in the second quarter of 2015.

UK's ratio of government debt fell to 88.6% in the third quarter of 2015 from 89.0% in the second quarter of 2015.

-

15:02

Chicago Fed National Activity Index rises to -0.22 in December

The Federal Reserve Bank of Chicago released its National Activity Index on Friday. The index increased to -0.22 in December from -0.36 in November. November's figure was revised down from -0.30.

The slight increase was mainly driven by a rise in the production.

The production-related indicator rose to -0.26 in December from -0.40 in November.

The employment-related indicator remained unchanged at +0.12 in December.

The personal consumption and housing indicator was down to -0.07 in December from -0.05 in November.

-

14:53

Canadian consumer price inflation declines 0.5% in December

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation fell 0.5% in December, missing expectations for a 0.4% decline, after a 0.1% decline in November.

The monthly decline was mainly driven by a drop in clothing and footwear prices, which dropped 5.2% in December.

On a yearly basis, the consumer price index rose to 1.6% in December from 1.4% in November, missing expectations for a gain to 1.7%.

The consumer price index was mainly driven by higher food and shelter prices. Food prices climbed 3.7% year-on-year in December, while transportation prices increased 0.6%.

The index for recreation, education and reading climbed by 1.7% in December from the same month a year earlier, the shelter index gained 1.1%, while gasoline prices dropped 4.8%.

The Canadian core consumer price index, which excludes some volatile goods, decreased 0.4% in December, after a 0.3% fall in November.

On a yearly basis, core consumer price index in Canada declined to 1.9% in December from 2.0% in November, missing expectations for a rise to 2.1%.

The Bank of Canada's inflation target is 2.0%.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 345m)

EUR/USD 1.0750 (EUR 983m) 1.0800 (1.6bln) 1.0850 (788m) 1.0880-90 (1.7bln) 1.0900-10 (700m) 1.1000 (1.7bln)

USD/CAD 1.4300 (USD 350m)

AUD/USD 0.6885 (AUD 226m) 0.6930 (636m) 0.6970 (220m) 0.7020-35 (500m)

-

14:43

Canadian retail sales climb by 1.7% in November

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 1.7% in November, exceeding expectations for a 0.2% gain, after a 0.1% increase in October.

The rise was mainly driven by higher sales at new car dealers, which increased by 4.5% in November.

Sales at gasoline stations declined 0.6% in November.

Motor vehicle and parts sales increased 3.5% in November, while sales at furniture and home furnishings stores rose 0.4%.

Sales at food and beverage stores were up 1.5% in November.

Canadian retail sales excluding automobiles jumped 1.1% in November, beating expectations for a 0.4% rise, after a flat reading in October.

-

14:30

Canada: Consumer price index, y/y, December 1.7% (forecast 1.7%)

-

14:30

Canada: Retail Sales ex Autos, m/m, November 1.1% (forecast 0.4%)

-

14:30

U.S.: Chicago Federal National Activity Index, December -0.22

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, December 1.9% (forecast 2.1%)

-

14:30

Canada: Retail Sales, m/m, November 1.7% (forecast 0.2%)

-

14:30

Canada: Retail Sales YoY, November -0.5%

-

14:30

Canada: Consumer Price Index m / m, December -0.5% (forecast -0.4%)

-

14:26

European Central Bank Governing Council member Ewald Nowotny: the central bank will review its stimulus measures and examine which tools it could use to boost inflation in the Eurozone

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Friday the central bank will review its stimulus measures and examine which tools it could use to boost inflation in the Eurozone.

"We will look at the situation again in March, but we haven't decided on what instruments we will use," he said.

Nowotny also said that the Eurozone could fall into deflation in the first half of the year due to low oil prices.

-

14:15

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mostly weaker-than-expected PMIs from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) January 52.6 52.8 52.4

07:45 Eurozone ECB President Mario Draghi Speaks

08:00 France Manufacturing PMI (Preliminary) January 51.4 51.3 50

08:00 France Services PMI (Preliminary) January 49.8 50.2 50.6

08:30 Germany Manufacturing PMI (Preliminary) January 53.2 53 52.1

08:30 Germany Services PMI (Preliminary) January 56 55.6 55.4

09:00 Eurozone Manufacturing PMI (Preliminary) January 53.2 53 52.3

09:00 Eurozone Services PMI (Preliminary) January 54.2 54.2 53.6

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom PSNB, bln December -12.94 Revised From -13.56 -10.35 -6.87

09:30 United Kingdom Retail Sales (MoM) December 1.3% Revised From 1.7% -0.3% -1%

09:30 United Kingdom Retail Sales (YoY) December 4.5% Revised From 5.0% 4.3% 2.6%

12:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic index. The U.S. preliminary manufacturing PMI is expected to decline to 51.1 in January from 51.2 in December.

The existing home sales in the U.S. are expected to rise to 5.20 million units in December from 4.76 million units in November.

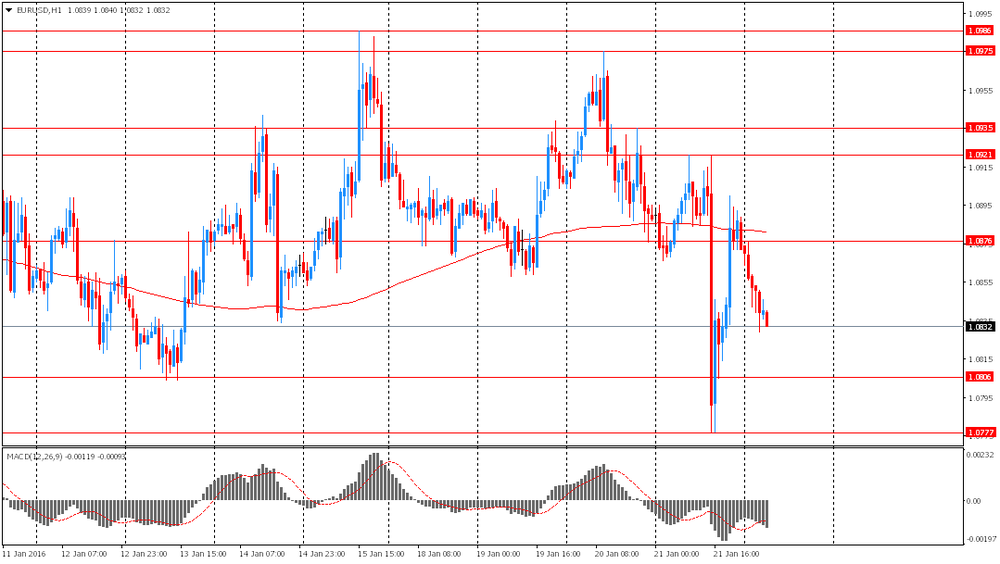

The euro traded lower against the U.S. dollar after the mostly weaker-than-expected PMIs from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 52.3 in January from 53.2 in December. Analysts had expected the index to fall to 53.0.

The decline was driven by a slower pace of expansion in business activity.

Eurozone's preliminary services PMI fell to 53.6 in January from 54.2 in December. Analysts had expected the index to remain unchanged at 54.2.

"The cooling in the pace of growth in euro area business activity at the start of 2016 is a disappointment but not surprising given the uncertainty caused by the financial market volatility seen so far this year", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% - 0.4% in the first quarter.

The European Central Bank (ECB) released its Survey of Professional Forecasters (SPF) for Q1 2016 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.7% in 2016, down from October estimate of 1.0%, 1.4% in 2017, down from October estimate of 1.5%, and 1.6% in 2018.

Long-term inflation forecasts (for 2020) was lowered to 1.8% from 1.9%.

SPF respondents said in its survey that the downgrade was driven by oil price developments.

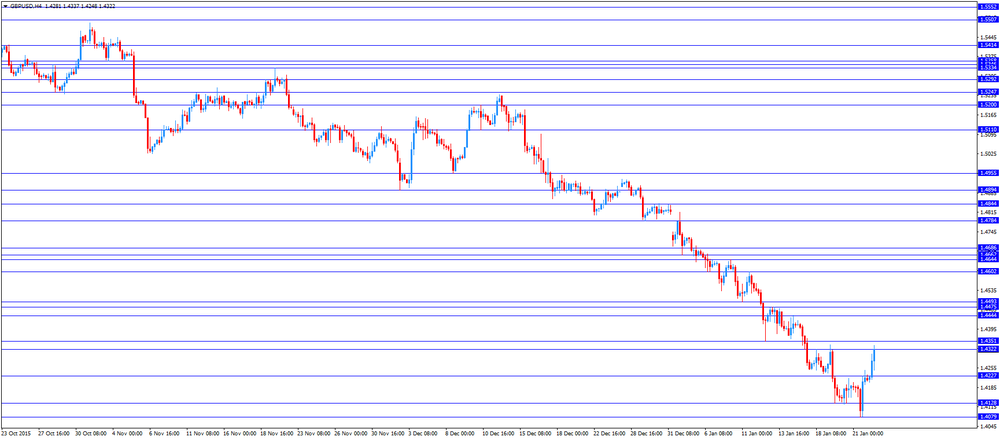

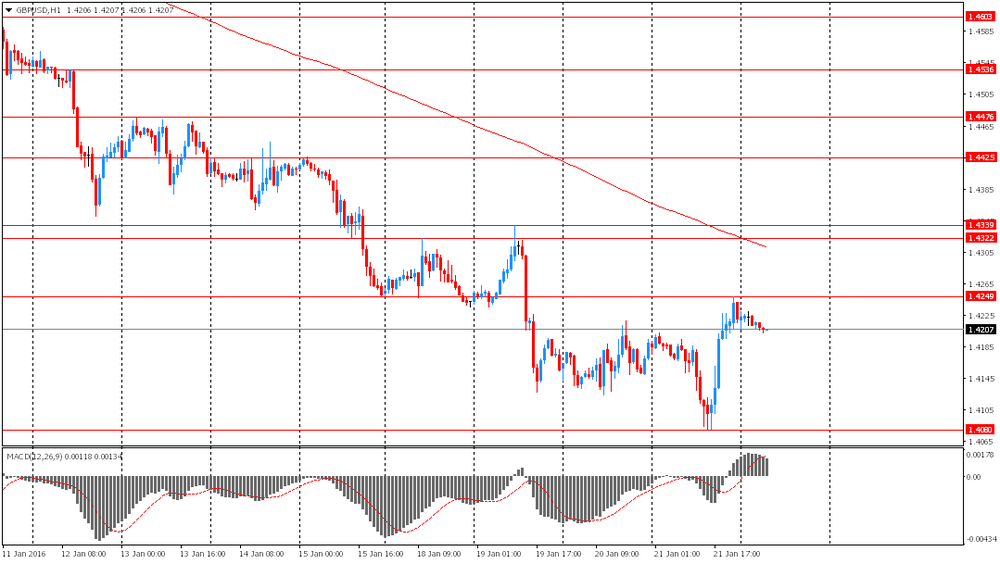

The British pound traded higher against the U.S. dollar despite the weaker-than-expected U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. dropped 1.0% in December, missing expectations for a 0.3% decline, after a 1.3% rise in November. November's figure was revised down from a 1.7% increase.

The decline was driven by lower demand for clothing due to warm weather. Sales of clothing and footwear slid 6.3% in December.

On a yearly basis, retail sales in the U.K. jumped 2.6% in December, missing forecasts of 4.3% increase, after a 4.5% rise in November. November's figure was revised down from a 5.0% gain.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to climb 1.7% year-on-year in December from 1.4% in November.

The core consumer price index in Canada is expected to rise to 2.1% year-on-year in December from 2.0% in November.

Canadian retail sales are expected to increase 0.2% in November, after a 0.1% rise in October.

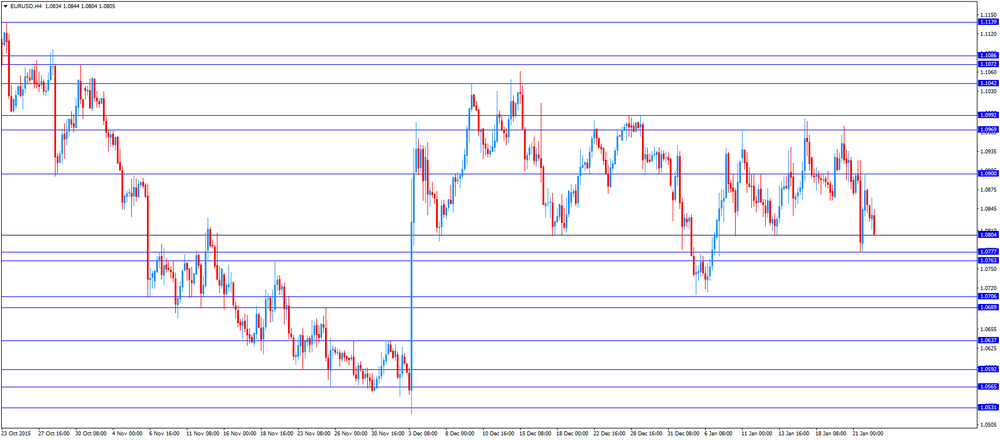

EUR/USD: the currency pair fell to $1.0802

GBP/USD: the currency pair increased to $1.4337

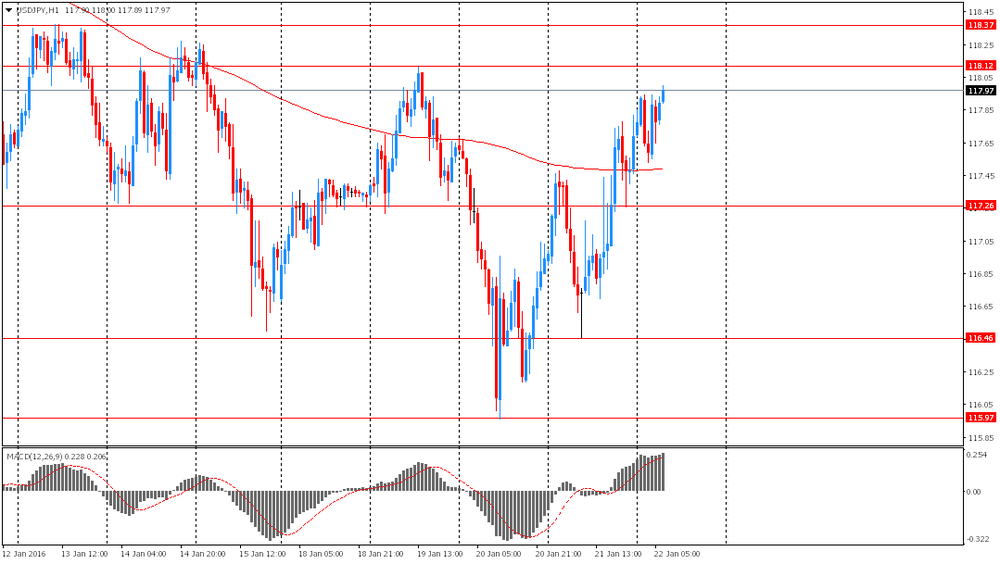

USD/JPY: the currency pair rose to Y118.33

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m November 0.1% 0.2%

13:30 Canada Retail Sales YoY November 1.9%

13:30 Canada Retail Sales ex Autos, m/m November 0.0% 0.4%

13:30 Canada Consumer Price Index m / m December -0.1% -0.4%

13:30 Canada Consumer price index, y/y December 1.4% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December 2% 2.1%

13:30 U.S. Chicago Federal National Activity Index December -0.3

14:00 U.S. Housing Price Index, m/m November 0.5%

14:45 U.S. Manufacturing PMI (Preliminary) January 51.2 51.1

15:00 U.S. Leading Indicators December 0.4% -0.1%

15:00 U.S. Existing Home Sales December 4.76 5.2

-

14:00

Orders

EUR/USD

Offers 1.0850-55 1.0885 1.0900 1.0925 1.0945-50 1.0985 1.1000 1.1025 1.1050

Bids 1.0815-20 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

Offers 1.4250 1.4280 1.4300 1.4325-30 1.4350 1.4375 1.4400 1.4425-30 1.4450

Bids 1.4220 1.4200 1.4180 1.4150 1.4120-25 1.4100 1.4085 1.4060 1.4030 1.4000

EUR/GBP

Offers 0.7620-25 0.7650 0.7680 0.7700 0.7720-25 0.7750-55 0.7780 0.7800

Bids 0.7580-85 0.7550 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 128.50 128.80 129.00 129.30 129.50

Bids 128.00 127.80 127.50 127.30 127.00 126.80 126.50

USD/JPY

Offers 118.20-25 118.50 118.80 119.00 119.30 119.50 119.80 120.00

Bids 118.00 117.80 115.50 117.30 117.00 116.75-80 116.50 116.20 116.00

AUD/USD

Offers 0.7050-55 0.7080 0.7100 0.7120 0.7150

Bids 0.7000 0.6980 0.8950 0.6930 0.6900 0.6875-80 0.6850 0.6825-30 0.6800

-

11:57

European Central Bank’s Survey of Professional Forecasters: forecasters lower their inflation forecasts

The European Central Bank (ECB) released its Survey of Professional Forecasters (SPF) for Q1 2016 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.7% in 2016, down from October estimate of 1.0%, 1.4% in 2017, down from October estimate of 1.5%, and 1.6% in 2018.

Long-term inflation forecasts (for 2020) was lowered to 1.8% from 1.9%.

SPF respondents said in its survey that the downgrade was driven by oil price developments.

The economic growth in the Eurozone is expected to expand 1.7% this year and 1.8% in 2017, both unchanged from October estimate.

The growth is expected to be driven by private consumption and investment.

-

11:49

Nikkei newspaper: the Bank of Japan is considering to add further stimulus measures

The Nikkei newspaper reported on Friday, citing the central bank's officials, the Bank of Japan (BoJ) was considering to add further stimulus measures. The reason for additional stimulus measures is a further drop in oil prices, according to the Nikkei.

Next BoJ monetary policy meeting will be held on January 28-29.

-

11:46

France's preliminary manufacturing PMI drops in January, while services PMI rises

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI dropped to 50.0 in January from 51.4 in December, missing forecasts of a decline to 51.3.

France's preliminary services PMI rose to 50.6 in January from 49.8 in December. Analysts had expected the index to climb to 50.2.

"Competitive pressures remain strong, with firms cutting their selling prices at the sharpest rate in seven months in a bid to shore up demand, suggesting that inflation is set to remain very weak in the near future. A slight rise in employment - the first since mid-2015 - offers mild reassurance on the labour market front, although does little to suggest a meaningful improvement in the jobless rate is on the cards from its current 18-year high of 10.6%," the Senior Economist at Markit Jack Kennedy said.

-

11:41

Germany's preliminary manufacturing and services PMIs fall in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI fell to 52.1 in January from 53.2 in December, missing forecasts of a decline to 53.0.

The fall in the manufacturing PMI was mainly driven by a weaker increase in purchasing activity.

Germany's preliminary services PMI was down to 55.4 in January from 56.0 in December. Analysts had expected index to decrease to 55.6.

The decline of the services PMI was driven by a weaker rise in business activity.

"Germany's private sector economy was largely unaffected by the recent stock market turmoil and intensifying uncertainty stemming from the so-called migrant crisis at the beginning of the year, according to latest survey result," Markit's economist Oliver Kolodseike noted.

-

11:34

Eurozone's preliminary manufacturing and services PMIs decline in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI declined to 52.3 in January from 53.2 in December. Analysts had expected the index to fall to 53.0.

The decline was driven by a slower pace of expansion in business activity.

Eurozone's preliminary services PMI fell to 53.6 in January from 54.2 in December. Analysts had expected the index to remain unchanged at 54.2.

"The cooling in the pace of growth in euro area business activity at the start of 2016 is a disappointment but not surprising given the uncertainty caused by the financial market volatility seen so far this year", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% - 0.4% in the first quarter.

-

11:26

Public sector net borrowing in the U.K. declines to £6.87 billion in December

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. fell to £6.87 billion in December from £12.94 billion in November. November's figure was revised down from £13.56 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks fell by £4.3 billion to £7.5 billion in December from last year.

-

11:14

UK retail sales drop 1.0% in December

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. dropped 1.0% in December, missing expectations for a 0.3% decline, after a 1.3% rise in November. November's figure was revised down from a 1.7% increase.

The decline was driven by lower demand for clothing due to warm weather. Sales of clothing and footwear slid 6.3% in December.

On a yearly basis, retail sales in the U.K. jumped 2.6% in December, missing forecasts of 4.3% increase, after a 4.5% rise in November. November's figure was revised down from a 5.0% gain.

-

10:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 345m)

EUR/USD 1.0750 (EUR 983m) 1.0800 (1.6bln) 1.0850 (788m) 1.0880-90 (1.7bln) 1.0900-10 (700m) 1.1000 (1.7bln)

USD/CAD 1.4300 (USD 350m)

AUD/USD 0.6885 (AUD 226m) 0.6930 (636m) 0.6970 (220m) 0.7020-35 (500m)

-

10:48

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 52.4 in January

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 52.4 in January from 52.6 in December.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was driven by a slower pace in expansion in new orders, output and employment.

"The start of 2016 was largely positive for the Japanese manufacturing sector, with latest data pointing to a solid improvement in operating conditions. Production rose at a rate little-changed from December's joint 21-month record," economist at Markit, Amy Brownbill, said.

-

10:37

The Foundation for Economic and Industrial Research’s quarterly report: the Greek economy contracts by about 0.5% in 2015

The Greek thin tank, the Foundation for Economic and Industrial Research (IOBE), said its quarterly report on Thursday that the Greek economy contracted by about 0.5% in 2015, less than previously expected (October estimate: -1.5% to -2.0%).

"If the bailout review closes relatively quickly, the economy may turn to positive rates around mid-year, meaning this would contain the recession, which we estimate around 1.0 to 1.5 per cent for the year as a whole," IOBE chief Nikos Vettas said.

-

10:30

United Kingdom: Retail Sales (MoM), December -1% (forecast -0.3%)

-

10:30

United Kingdom: Retail Sales (YoY) , December 2.6% (forecast 4.3%)

-

10:30

United Kingdom: PSNB, bln, December -6.87 (forecast -10.35)

-

10:22

Billionaire investor George Soros: there will be a hard-landing in China

Billionaire investor George Soros said in an interview with Bloomberg TV on Thursday that there will be a hard-landing in China, which will contribute to the global deflation.

"A hard landing is practically unavoidable. I'm not expecting it, I'm observing it. China can manage it. It has resources and greater latitude in policies, with $3 trillion in reserves," he said.

Soros noted that the slowdown in the Chinese economy and falling commodity prices are the reasons for the global deflation.

-

10:11

Morgan Stanley Chairman & CEO James Gorman: there will be no hard-landing in China

Morgan Stanley Chairman & CEO James Gorman said in an interview with CNBC on Thursday that there will be no hard-landing in China.

"China is not having a hard-landing here. China is having a natural, mathematical slowdown given the size of the economy," he said.

Gorman noted that the U.S. economy is not "under fundamental stress".

-

10:01

Eurozone: Services PMI, January 53.6 (forecast 54.2)

-

10:00

Eurozone: Manufacturing PMI, January 52.3 (forecast 53)

-

09:30

Germany: Manufacturing PMI, January 52.1 (forecast 53)

-

09:30

Germany: Services PMI, January 55.4 (forecast 55.6)

-

09:00

France: Services PMI, January 50.6 (forecast 50.2)

-

09:00

France: Manufacturing PMI, January 50 (forecast 51.3)

-

08:35

Options levels on friday, January 22, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0987 (3142)

$1.0944 (1820)

$1.0902 (298)

Price at time of writing this review: $1.0817

Support levels (open interest**, contracts):

$1.0777 (3879)

$1.0747 (7664)

$1.0712 (4474)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 39531 contracts, with the maximum number of contracts with strike price $1,1000 (4611);

- Overall open interest on the PUT options with the expiration date February, 5 is 60648 contracts, with the maximum number of contracts with strike price $1,0700 (7811);

- The ratio of PUT/CALL was 1.53 versus 1.51 from the previous trading day according to data from January, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.4503 (1192)

$1.4405 (628)

$1.4308 (364)

Price at time of writing this review: $1.4232

Support levels (open interest**, contracts):

$1.4189 (938)

$1.4093 (772)

$1.3997 (526)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 22927 contracts, with the maximum number of contracts with strike price $1,4700 (3151);

- Overall open interest on the PUT options with the expiration date February, 5 is 22110 contracts, with the maximum number of contracts with strike price $1,4550 (2012);

- The ratio of PUT/CALL was 0.96 versus 0.95 from the previous trading day according to data from January, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:09

Foreign exchange market. Asian session: the Australian dollar rose on higher commodity prices

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) January 52.6 52.8 52.4

The euro declined against the U.S. dollar after European Central Bank President Mario Draghi hinted at possibility of further stimulus at a meeting in March. Draghi also noted that inflation outlook worsened. The ECB left its benchmark interest rate unchanged on Thursday despite low energy costs and concerns over the influence of China's slowing economic growth on the central bank's attempts to reach its inflation target.

The yen declined amid weaker demand for the safe-haven currency after Asian stocks rebounded. The yen was also influenced by talks about more stimulus from the Bank of Japan.

The Australian dollar rose following commodity prices. The AUD was also supported by comments from Chinese official, who said that China will act to counter slowing growth. He noted that the country needed a healthy stock market. China is Australia's major trading partner.

EUR/USD: the pair fell to $1.0830 in Asian trade

USD/JPY: the pair rose to Y118.00

GBP/USD: the pair traded within $1.4205-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 Eurozone ECB President Mario Draghi Speaks

08:00 France Manufacturing PMI (Preliminary) January 51.4 51.3

08:00 France Services PMI (Preliminary) January 49.8 50.2

08:30 Germany Manufacturing PMI (Preliminary) January 53.2 53

08:30 Germany Services PMI (Preliminary) January 56 55.6

09:00 Eurozone Manufacturing PMI (Preliminary) January 53.2 53

09:00 Eurozone Services PMI (Preliminary) January 54.2 54.2

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom PSNB, bln December -13.56 -10.35

09:30 United Kingdom Retail Sales (MoM) December 1.7% -0.3%

09:30 United Kingdom Retail Sales (YoY) December 5.0% 4.3%

12:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

13:30 Canada Retail Sales, m/m November 0.1% 0.2%

13:30 Canada Retail Sales YoY November 1.9%

13:30 Canada Retail Sales ex Autos, m/m November 0.0% 0.4%

13:30 Canada Consumer Price Index m / m December -0.1% -0.4%

13:30 Canada Consumer price index, y/y December 1.4% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December 2% 2.1%

13:30 U.S. Chicago Federal National Activity Index December -0.3

14:00 U.S. Housing Price Index, m/m November 0.5%

14:45 U.S. Manufacturing PMI (Preliminary) January 51.2 51.1

15:00 U.S. Leading Indicators December 0.4% -0.1%

15:00 U.S. Existing Home Sales December 4.76 5.2

-

02:46

Japan: Manufacturing PMI, January 52.6 (forecast 52.8)

-

00:34

Currencies. Daily history for Jan 21’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0872 -0,15%

GBP/USD $1,4220 +0,21%

USD/CHF Chf1,0072 +0,32%

USD/JPY Y117,69 +0,64%

EUR/JPY Y127,97 +0,50%

GBP/JPY Y167,35 +0,86%

AUD/USD $0,6997 +1,31%

NZD/USD $0,6529 +1,55%

USD/CAD C$1,4265 -1,66%

-

00:01

Schedule for today, Friday, Jan 22’2016:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI January 52.6 52.8

07:45 Eurozone ECB President Mario Draghi Speaks

08:00 France Manufacturing PMI January 51.4 51.3

08:00 France Services PMI January 49.8 50.2

08:30 Germany Manufacturing PMI (Preliminary) January 53.2 53

08:30 Germany Services PMI (Preliminary) January 56 55.6

09:00 Eurozone Manufacturing PMI (Preliminary) January 53.2 53

09:00 Eurozone Services PMI (Preliminary) January 54.2 54.2

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom PSNB, bln December -13.56 -10.35

09:30 United Kingdom Retail Sales (MoM) December 1.7% -0.3%

09:30 United Kingdom Retail Sales (YoY) December 5.0% 4.3%

12:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

13:30 Canada Retail Sales, m/m November 0.1% 0.2%

13:30 Canada Retail Sales YoY November 1.9%

13:30 Canada Retail Sales ex Autos, m/m November 0.0% 0.4%

13:30 Canada Consumer Price Index m / m December -0.1% -0.4%

13:30 Canada Consumer price index, y/y December 1.4% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December 2% 2.1%

13:30 U.S. Chicago Federal National Activity Index December -0.3

14:00 U.S. Housing Price Index, m/m November 0.5%

14:45 U.S. Manufacturing PMI (Preliminary) January 51.2 51.1

15:00 U.S. Leading Indicators December 0.4% -0.1%

15:00 U.S. Existing Home Sales December 4.76 5.2

-