Noticias del mercado

-

20:22

American focus: the euro fell on Draghi comments

The euro fell sharply against the US dollar after European Central Bank President Mario Draghi made it clear that the Governing Council may decide on additional stimulus measures at its next meeting in March. Draghi also said that the outlook for inflation "significantly" worsened.

Earlier Thursday, the ECB left its key interest rate unchanged, despite the fact that low energy prices and concerns about the impact on the world economy of China may attempt to disrupt the central bank to return inflation to the target level.

Speaking at a press conference Mario Draghi said the economic stimulus measures implemented by the central bank in June 2014 and most recently extended in December, "strengthened the stability of the euro zone to the recent global economic shocks."

However, he also added that the recent decline in oil prices suggests that the annual inflation rate in 2016 is likely to be "significantly" lower than the forecasts published in the last month.

Economists expect the ECB that inflation will rise from the December level of 0.2% this year to average 1%, and then continue to grow in 2017. However, Draghi said that under the current conditions in the coming months, prices could fall again.

"We re-evaluate our policies and may amend it at the next meeting in March," - said Draghi.

Later, the dollar lost some positions recruited, the dynamics of the US dollar affected the mixed US economic data. The report submitted by the Federal Reserve Bank of Philadelphia, showed that in January, the index of business activity showed a moderate increase, reaching at the same level of -3.5 points versus -5.9 points in December. It is worth noting that many economists had expected growth of this indicator only to the level of -5.0 points.

US Department of Labor said the number of Americans who first applied for unemployment benefits, increased dramatically in the last week, reaching the highest level since the beginning of July, and pointing to some loss of momentum of the labor market. According to the report for the week ended 16 January, the number of initial applications for unemployment insurance increased by 10,000, to a level of 293,000 (seasonally adjusted). Economists, however, expected to decline to 278 000. The figures for the previous week was revised up to 283 000 to 284 000. It is worth emphasizing the number of calls is below 300,000 for 46 consecutive weeks (the longest series since 1970).

The yen fell against the dollar under the influence of today's announcement of government officials. "The Bank of Japan should expand the easing of monetary policy," - said one of the assistants to the Prime Minister of Japan Shinzo Abe. He is sure that there are all necessary conditions. According to him, the volatility in the world markets threatens to undermine "abenomics", which was intended to revive Japan's economy. "The conditions for further easing have developed," - said the adviser, referring to Japan's stock market decline, the strengthening of the yen, sluggish economic growth and easing inflation expectations. Meanwhile, Adviser to the Prime Minister of Japan Abe Shibayama said it was too early to talk about new measures to mitigate the Bank of Japan, as falling stock markets may be temporary. "At this stage we need to closely monitor the situation and exchange information with financial authorities in other countries," - he added. This statement was made amid growing talk about the fact that the Central Bank may take action to stimulate already at the meeting on 28-29 January, increasing the amount of asset purchases.

-

17:52

Business NZ performance of manufacturing index for New Zealand rises to 56.7 in December

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 56.7 in December from 54.9 in November. It was the highest level since October 2014.

November's figure was revised up from 54.7.

A reading above 50 indicates expansion in the manufacturing sector.

The rise was mainly driven by a faster expansion in new orders, deliveries, production and finished stocks.

"Overall, it has been a solid and positive year for the sector. Although the PMI averaged 54.2 over 2015 compared with 56.0 for both 2013 and 2014, the slightly lower expansion level was partly due to the first half of 2015 experiencing a moderate patch of growth. However, results over the last few months have seen the sector in stronger expansion," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

17:45

M3 money supply in Switzerland rises 1.6% in December

The Swiss National Bank (SNB) released its money supply data on Thursday. M3 money supply in Switzerland increased 1.6% year-on-year in December, after a 2.1% rise in November.

M1 money supply was down 1.6% year-on-year in December, after a 2.8% decrease in November.

-

17:39

RICS house price balance for the U.K. increased to +50% in December

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance increased to +50% in December from +49% in November.

RICS Chief Economist, Simon Rubinsohn, said that a further heating up of the U.K. housing market is likely before April.

-

17:00

U.S.: Crude Oil Inventories, January 3.979 (forecast 2.750)

-

16:45

The People's Bank of China injects 400 billion yuan into market

The People's Bank of China (PBoC) said on its website on Thursday that it injected 400 billion yuan ($61 billion) into market to boost liquidity via short-term loans (reverse-repurchase agreements).

The central bank usually injects extra money before the Lunar New Year holiday.

-

16:36

Chinese Vice President Li Yuanchao: China will remain the global growth engine

Chinese Vice President Li Yuanchao said in an interview with Bloomberg News that China will remain the global growth engine.

He pointed out that the country's economy is expected to grow between 6% and 7% over the next five years.

Li noted that the weak global demand weighs on the Chinese economy, but he added that the country's economy "has enormous development potential".

-

16:28

Eurozone’s preliminary consumer confidence index falls to -6.3 in January

The European Commission released its preliminary consumer confidence figures for the Eurozone on Thursday. Eurozone's preliminary consumer confidence index fell to -6.3 in January from -5.7 in December. Analysts had expected the index to remain unchanged at -5.7.

European Union's consumer confidence index climbed by 0.3 points to -4.2 in January.

-

16:08

The European Central Bank President Mario Draghi hints that the central bank may add further stimulus measures in March

The European Central Bank (ECB) President Mario Draghi hinted at a press conference on Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

"Downside risks have increased again amid heightened uncertainty about emerging market economies' growth prospects, volatility in financial and commodity markets, and geopolitical risks. In this environment, euro area inflation dynamics also continue to be weaker than expected," he said.

"It will therefore be necessary to review and possibly reconsider our monetary policy stance at our next meeting in early March, when the new staff macroeconomic projections become available which will also cover the year 2018," Draghi added.

The ECB president pointed out that the central bank's quantitative easing was working, and interest rate is expected to remain "at present or lower levels for an extended period of time".

Draghi noted that the ECB is ready to act if needed.

-

16:00

Eurozone: Consumer Confidence, January -6.3 (forecast -5.7)

-

15:02

Philadelphia Federal Reserve Bank’s manufacturing index climbs to -3.5 in January

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to -3.5 in January from -10.2 in December, exceeding expectations for an increase to -5.0. December's figure was revised down from -5.9.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Manufacturing conditions in the region contracted modestly this month, according to firms responding to the January Manufacturing Business Outlook Survey. The indicator for general activity remained negative this month; however, it rebounded from a lower reading in December," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was up to 9.6 in January from -2.1 in December.

The new orders index increased to -1.4 in January from -11.1 in December.

The prices paid index rose to -1.1 in January from -8.3 in December, while the prices received index climbed to -2.8 from -8.5.

The number of employees index dropped to -1.9 in January from 2.2 in December.

According to the report, the future general activity index slid to 19.1 in January from 24.1 in December.

-

14:51

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.00 (USD 302m) 118.75-85 (305m)

EUR/USD 1.0850-60 ( EUR 1bln) 1.0870 (383m) 1.0900 (335m) 1.0925 (432m) 1.0950-60 (1.2bln)

USD/CHF 0.9825 (USD 318m)

USD/CAD 1.4500 (USD 595m)

AUD/USD 0.6900 (AUD 235m) 0.7000 (1.5bln) 0.7050 (300m)

NZD/USD 0.6425 (NZD 224m)

-

14:47

European Central Bank keeps its interest rate unchanged at 0.05% in January

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

The ECB lowered its deposit rate to -0.3% from -0.2% in December.

-

14:44

Initial jobless claims rise to 293,000 in the week ending January 16

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 16 in the U.S. rose by 10,000 to 293,000 from 283,000 in the previous week. The previous week's figure was revised down from 284,000.

Analysts had expected jobless claims to fall to 278,000.

Jobless claims remained below 300,000 the 46th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 56,000 to 2,208,000 in the week ended January 09.

-

14:36

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the European Central Bank's (ECB) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m November -3.0% -2.7%

00:00 Australia Consumer Inflation Expectation January 4.0% 3.6%

05:30 Japan All Industry Activity Index, m/m November 1.0% -0.7% -1.0%

09:00 Switzerland World Economic Forum Annual Meetings

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic index. The number of initial jobless claims in the U.S. is expected to decline by 6,000 to 278,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to rise to -5 in January from -10.2 in December.

The euro traded lower against the U.S. dollar after the European Central Bank's (ECB) interest rate decision. The ECB kept its interest rate unchanged at 0.05%.

The ECB President Mario Draghi will speak at 13:30 GMT.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

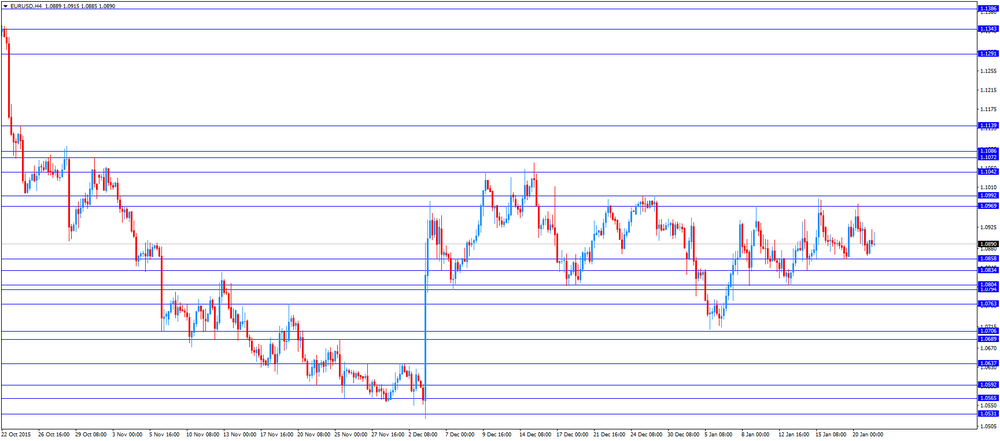

EUR/USD: the currency pair traded mixed

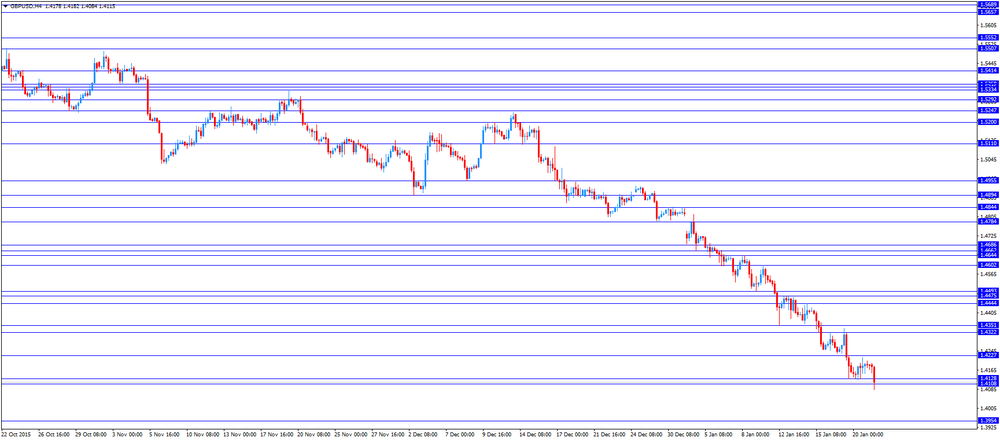

GBP/USD: the currency pair declined to $1.4084

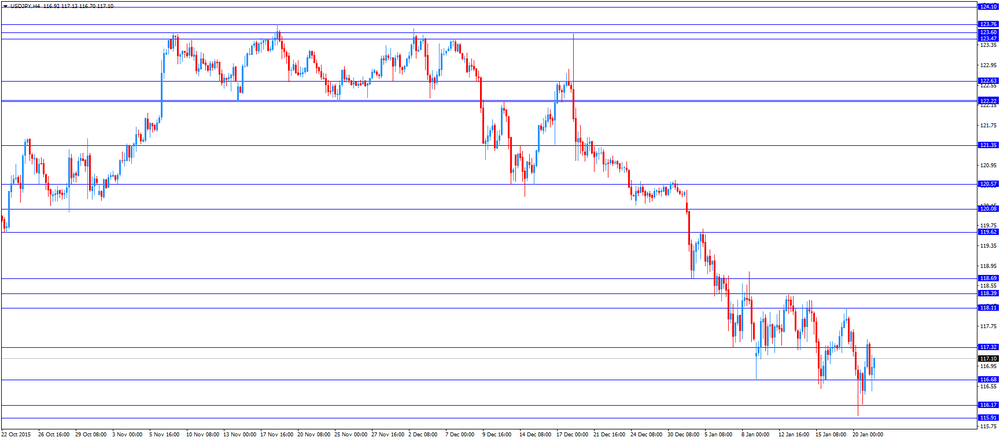

USD/JPY: the currency pair rose to Y117.17

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims January 2263 2248

13:30 U.S. Initial Jobless Claims January 284 278

13:30 U.S. Philadelphia Fed Manufacturing Survey January -10.2 -5

15:00 Eurozone Consumer Confidence (Preliminary) January -5.7 -5.7

16:00 U.S. Crude Oil Inventories January 0.234 2.750

-

14:31

U.S.: Philadelphia Fed Manufacturing Survey, January -3.5 (forecast -5)

-

14:30

U.S.: Initial Jobless Claims, January 293 (forecast 278)

-

14:30

U.S.: Continuing Jobless Claims, January 2208 (forecast 2248)

-

13:59

Orders

EUR/USD

Offers 1.0925 1.0945-50 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0880 1.0855-60 1.0840 1.0825 1.0800 1.0785 1.0765 1.0750 1.0730 1.0700

GBP/USD

Offers 1.4185 1.4200 1.4225-30 1.4250 1.4280 1.4300 1.4325-30 1.4350

Bids 1.4150 1.4120-25 1.4100 1.4085 1.4060 1.4030 1.4000

EUR/GBP

Offers 0.7720-25 0.7750-55 0.7780 0.7800 0.7830 0.7850 0.7875 0.7900

Bids 0.7675-80 0.7650 0.7630 0.7600 0.7580-85 0.7550

EUR/JPY

Offers 127.60 127.80 128.00 128.30 128.50 128.80 129.00 129.30 129.50

Bids 127.00 126.80 126.50 126.30 126.00 125.75 125.50 125.00

USD/JPY

Offers 117.20 117.50 117.85 118.00 118.20 118.50 118.80 119.00

Bids 116.75-80 116.50 116.20 116.00 115.85 115.50 115.30 115.00

AUD/USD

Offers 0.6900 0.6920-25 0.6950 0.6980 0.7000 0.7025-30 0.7050-55

Bids 0.6875-80 0.6850 0.6825-30 0.6800 0.6785 0.6750 0.6730 0.6700

-

13:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

11:47

Spain’s trade deficit widens to €1.85 billion in November

Spain's Economy Ministry released its trade data on Thursday. The trade deficit widened to €1.85 billion in November from €1.60 billion in November a year ago.

Exports rose at an annual rate of 8.6% in November, while imports climbed 9.3%.

In the January to November period, the trade deficit totalled €22.38 billion, down 1.2% from the same period of 2014.

Exports increased 4.3% in the January to November period, while imports gained 3.8%.

-

11:44

Japan’s all industry activity index slides 1.0% in November

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Thursday. The index slid 1.0% in November, missing expectations for a 0.7% fall, after a 0.9% rise in October. October's figure was revised down from a 1.0% increase.

Construction industry activity index dropped 3.0% in November, industrial production index fell 0.9%, while tertiary industry activity declined 0.8%.

-

11:36

MI consumer inflation expectations in Australia decline to 3.6% in January

The Melbourne Institute (MI) released its inflation expectations for Australia on Thursday. The MI consumer inflation expectations in Australia declined to 3.6% in January from 4.0% in December.

72.1% respondents expected inflation to decline within the 0‐5% range, down from 74.2% in December.

-

11:30

HIA new home sales in Australia drop 2.7% in November

The Housing Industry Association (HIA) released its new home sales data for Australia on Thursday. New home sales fell 2.7% in November, after a 3.0% drop in October.

The HIA's chief economist Harley Dale said that a drop was driven by the slowing population growth, higher mortgage costs, and easing property price growth in Sydney and Melbourne.

Sales of detached homes increased 1.1% in November, while sales for multi-units slid 15.1%.

-

11:17

French manufacturing confidence index rises to 102 in January

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 102 in January from 101 in December. December's figure was revised down from 103.

Past change in production index was down to -1 in January from 1 in December.

Personal production expectations index rose to 10 in January from 9 in December, while general production outlook index increased to 2 from 0.

-

11:00

International Monetary Fund Managing Director Christine Lagarde: risks to the global economic growth are bigger than previously expected

International Monetary Fund (IMF) Managing Director Christine Lagarde said at the World Economic Forum in Davos on Wednesday that risks to the global economic growth are bigger than previously expected. According to Lagarde, the risks are falling oil prices, the slowdown in the Chinese economy and diverging monetary policies.

She noted that the global economy is expected to expand moderately this year.

-

10:41

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.00 (USD 302m) 118.75-85 (305m)

EUR/USD 1.0850-60 ( EUR 1bln) 1.0870 (383m) 1.0900 (335m) 1.0925 (432m) 1.0950-60 (1.2bln)

USD/CHF 0.9825 (USD 318m)

USD/CAD 1.4500 (USD 595m)

AUD/USD 0.6900 (AUD 235m) 0.7000 (1.5bln) 0.7050 (300m)

NZD/USD 0.6425 (NZD 224m)

-

08:30

Foreign exchange market. Asian session: the yen recovered

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m November -3.0% -2.7%

00:00 Australia Consumer Inflation Expectation January 4.0% 3.6%

The yen recovered in the second half of the Asian session as higher volatility in stocks increased demand for safe-haven assets.

At the beginning of the session the yen declined against the U.S. dollar after Prime Minister Abe's advisor said there was ground for further monetary policy easing. He added that lack of action from the central bank can contradict basic principles of abenomics.

Market participants are waiting for today's European Central Bank meeting to find hints to further steps to stimulate inflation. The global economic outlook has worsened since the latest ECB meeting in December. Stocks and commodities plunged, concerns over the Chinese economy intensified. Economists believe the euro zone consumer price index may turn negative. Investors hope that authorities will take steps to support inflation.

EUR/USD: the pair fluctuated within $1.0865-00 in Asian trade

USD/JPY: the pair traded around Y117.00

GBP/USD: the pair traded within $1.4170-00

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Switzerland World Economic Forum Annual Meetings

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims January 2263 2248

13:30 U.S. Initial Jobless Claims January 284 278

15:00 Eurozone Consumer Confidence (Preliminary) January -5.7 -5.7

15:00 U.S. Philadelphia Fed Manufacturing Survey January -10.2 -5

16:00 U.S. Crude Oil Inventories January 0.234 2.750

-

08:30

Options levels on thursday, January 21, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1062 (4336)

$1.1004 (3083)

$1.0962 (1822)

Price at time of writing this review: $1.0910

Support levels (open interest**, contracts):

$1.0844 (1188)

$1.0802 (2754)

$1.0744 (7143)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 40048 contracts, with the maximum number of contracts with strike price $1,1000 (4336);

- Overall open interest on the PUT options with the expiration date February, 5 is 60602 contracts, with the maximum number of contracts with strike price $1,0700 (7714);

- The ratio of PUT/CALL was 1.51 versus 1.41 from the previous trading day according to data from January, 20

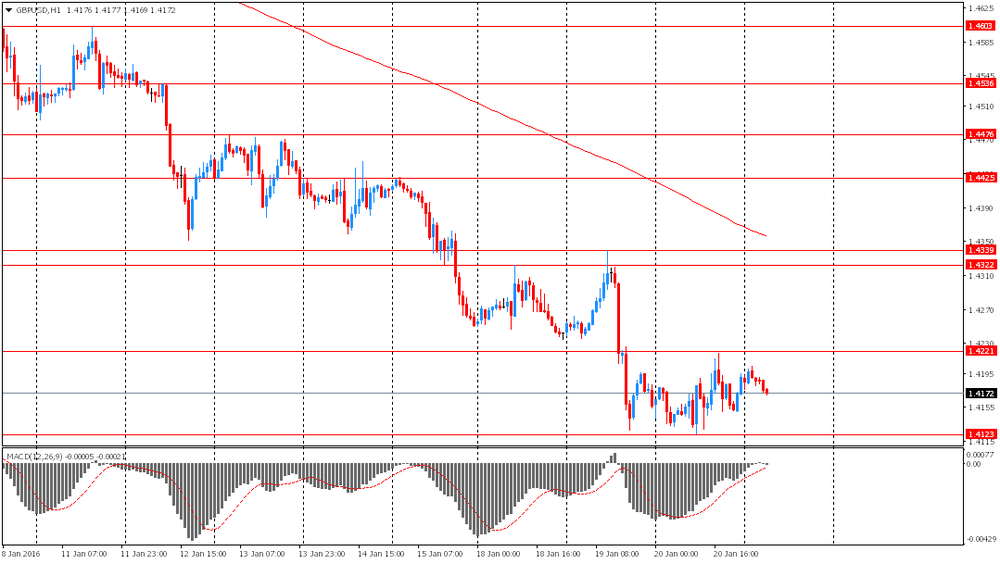

GBP/USD

Resistance levels (open interest**, contracts)

$1.4403 (625)

$1.4306 (316)

$1.4210 (138)

Price at time of writing this review: $1.4162

Support levels (open interest**, contracts):

$1.4091 (715)

$1.3994 (389)

$1.3896 (311)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 22898 contracts, with the maximum number of contracts with strike price $1,4700 (3151);

- Overall open interest on the PUT options with the expiration date February, 5 is 21735 contracts, with the maximum number of contracts with strike price $1,4550 (2011);

- The ratio of PUT/CALL was 0.95 versus 0.95 from the previous trading day according to data from January, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:00

Australia: HIA New Home Sales, m/m, November -2.7%

-

01:00

Australia: Consumer Inflation Expectation, January 3.6%

-

00:29

Currencies. Daily history for Jan 20’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0888 -0,17%

GBP/USD $1,4190 +0,24%

USD/CHF Chf1,004 +0,09%

USD/JPY Y116,94 -0,58%

EUR/JPY Y127,33 -0,75%

GBP/JPY Y165,91 -0,34%

AUD/USD $0,6905 -0,03%

NZD/USD $0,6428 +0,28%

USD/CAD C$1,4502 -0,52%

-

00:01

Schedule for today, Thursday, Jan 21’2016:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m November -3.0%

00:00 Australia Consumer Inflation Expectation January 4.0%

05:30 Japan All Industry Activity Index, m/m November 1.0% -0.7%

09:00 Switzerland World Economic Forum Annual Meetings

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims January 2263 2248

13:30 U.S. Initial Jobless Claims January 284 278

15:00 Eurozone Consumer Confidence (Preliminary) January -5.7 -5.7

15:00 U.S. Philadelphia Fed Manufacturing Survey January -10.2 -5

16:00 U.S. Crude Oil Inventories January 0.234

-