Noticias del mercado

-

22:46

New Zealand: Business NZ PMI, December 56.7

-

20:21

American focus: the Canadian dollar rose

The Canadian dollar regained ground lost against the US dollar after the Bank of Canada left its key interest rate unchanged. However, the bank was downgraded forecast GDP growth in 2016.

The Bank of Canada left the target value of the one-day interest rate unchanged at 0.50%. So he ignored the appeals of a number of economists to mitigate the monetary policy to stimulate the slowing national economy.

According to the Bank of Canada, the country's economic growth in the 4th quarter of 2015, probably stopped "due to a temporary deterioration of the US economy, low investment companies and a number of other temporary factors." In addition, the central bank of the country believe that now the Canadian economy is in the midst of transition, during which the economy is reoriented to export energy to the industry that are not related to resources. Growth in non-oil sectors of activity due to the increase in demand from the United States, a decrease in the Canadian dollar and soft policies in the monetary and fiscal spheres.

The US dollar shows decline against other major currencies after the publication of weak US economic data, while concern about falling oil prices continue to support demand for the yen and the Swiss franc as a safe haven.

The US Labor Department reported that consumer prices unexpectedly fell in December, as the rise in prices in the service sector has been offset by falling energy prices. According to the consumer price index decreased by 0.1 percent after no change in November. Despite the fall in the last month, the consumer price index rose by 0.7 per cent per annum, recording the biggest gain in a year. This change followed an increase of 0.5 percent per annum in November. Experts note that the faster growth in prices due to the effect of the comparison. However, further growth can be limited due to lower oil prices, which are now close to 12-year lows. Economists had expected the CPI to remain unchanged in monthly terms, but increased by 0.8 per cent per annum.

Housing starts and building permits fell at the end of December after a significant increase in the previous month. The last change, along with other weak data reinforces concerns about the state of the economy. The report from the Commerce Department showed that, taking into account fluctuations bookmark new homes fell by 2.5 percent, amounting to 1,149 thousand at the same time. (In terms of annual growth). Meanwhile, the index for November was revised upward - up to 1179 thousand. To 1173 thousand. Experts expect that to grow to 1,200 bookmarks thousand.

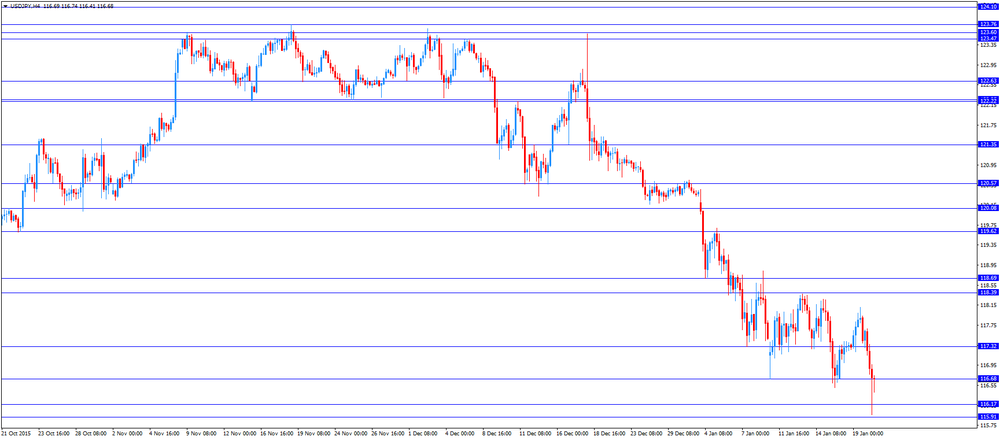

The yen was supported as a safe haven, as oil again dropped below the price of $ 28 a barrel to the lowest since 2003 after the International Energy Agency said that the off-season warm weather and increase in supply will keep oversaturation of the oil market, at least until the end of 2016. A significant decrease in the stock markets of Asia also boosted demand for safe haven. Meanwhile, Chief Cabinet Secretary of Japan Suga said that the drop in oil prices favorably affects the Japanese economy. Earlier the head of the Bank of Japan Kuroda assured markets that the Bank shall immediately take steps, including the easing of monetary policy if inflation worsens the situation.

Focus was also the January economic report the government of Japan. As it became known, the government left unchanged overall assessment of the economic situation in the country, saying that the economic recovery continues at a moderate pace. In addition, the Government has recognized the presence of some of the weaknesses of the economy and the need to monitor market fluctuations. In addition, the government raised the assessment of the situation in industrial production, while noting some weakness in other segments of the economy, such as the export sector.

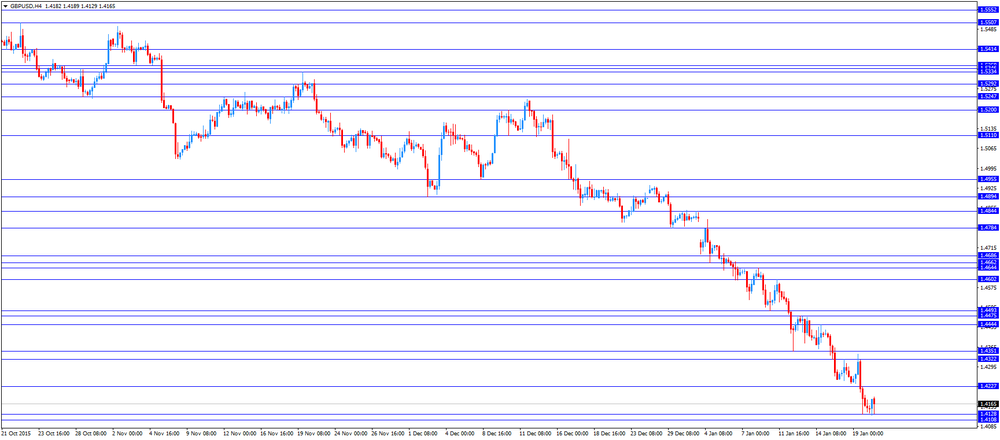

The pound traded mixed against the dollar, but in general remained within a narrow range. Moderate pressure is applied to data on the labor market in Britain. The Office for National Statistics reported that during the three months (to November) wage growth in the UK slowed to the lowest level since February 2015. This change indicates that the Bank of England is likely to will not rush to increase interest rates. The report stated that the average earnings of workers (including bonuses) increased by 2.0 percent in the three months to November. Experts forecast an increase of 2.1% after rising 2.4% in the period from August to October. Average earnings excluding bonuses rose by 1.9%, which was above analysts' estimates (1.8%), but more slowly than in the previous three months (2.0). Separately, in November, the total wages in the private sector, for a change which is closely following the Bank of England increased by 2.2 per cent against 2.1 per cent in October. The unemployment rate fell to 5.1 percent (the lowest value since the beginning of 2006), compared with 5.2 percent in the three months to October. The ONS also said that employment jumped by 267,000, recording the third largest gain since the beginning of statistics in 1971. Given the recent changes in the employment rate rose to a new high of 74.0 percent. The number of unemployed was 1.68 million, up 99 thousand. Less than in the period of June to August and 239 thousand. Less than the same period in 2014.

The Swiss franc fell against the dollar, having lost almost all previously earned position. The pressure on the currency was data published by ZEW institute and Credit Suisse. They showed that the index of Swiss economic expectations declined significantly in January, its lowest level since July 2015, which was caused by deteriorating assessments on economic growth and stock market returns. The survey was conducted among 37 analysts from 4 to 18 January. According to the index of investor expectations fell this month to -3 points compared to 16.6 points in December. The indicator of the current situation worsened in January, from 5.8 points to -8.5 points. The report also reported that nearly half of analysts expect growth in gross domestic product of Switzerland from 1% to 1.5% this year. Recall that in October 2015, about 60% of the analysts foresee growth in 2016 more than 1%. In addition, 87% of respondents said they expected to reduce or zero change in consumer prices this year against 71% in the previous survey in October.

-

17:09

The Institute of International Finance: capital outflows from emerging economies were larger than previously expected

The Institute of International Finance (IIF) said in its report on Wednesday that capital outflows from emerging economies were larger than previously expected. Emerging markets faced net capital outflows of $735 billion in 2015, up from $111 billion in 2014 and up from the previously estimate of $540 billion.

The institute expects total net outflows including errors and omissions of $448 billion in 2016.

China faced the highest outflows, which totalled $676 billion in 2015, according to the IIF.

"The 2015 outflows largely reflected efforts by Chinese corporates to reduce dollar exposure after years of heavy dollar borrowing, as expectations of persistent renminbi appreciation were replaced by rising concerns about a weakening currency," the institute noted.

-

16:48

The People's Bank of China injects 150 billion yuan into market

The People's Bank of China (PBoC) said on its website on Wednesday that it plans to inject 150 billion yuan ($23 billion) into market to boost liquidity via short-term liquidity operations (SLO).

The interest rate on the 6-day lines of credit will be 2.25%, according to the central bank.

-

16:40

The International Labour Organization’s World Employment and Social Outlook: the global unemployment rate is expected to decline in 2017

The International Labour Organization (ILO) released its annual World Employment and Social Outlook report on Tuesday. The ILO said that the global unemployment rate is expected to decline to 5.7% in 2017 from 5.8% in 2014-16, driven by job creation in the U.S. and Europe.

The unemployment rate for developed economies declined to 6.7% in 2015 from 7.1% in 2014.

According to the ILO, emerging economies pose risk to the world of work.

"The significant slowdown in emerging economies coupled with a sharp decline in commodity prices is having a dramatic effect on the world of work," ILO Director-General Guy Ryder said.

-

16:26

Eurozone’s house prices rise 1.0% in the third quarter

Eurostat release its preliminary house price index for the Eurozone on Wednesday. The index increased 1.0% in the third quarter, after a 1.8% gain in the second quarter.

On a yearly basis, house prices climbed 2.3% in the third quarter, after a 1.6% rise in the second quarter.

-

16:17

Bank of Canada keeps its interest rate unchanged at 0.50% in January

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy is appropriate. This decision was expected by analysts.

The BoC expects the Canadian economy to expand 1.4% in 2016 and 2.4% in 2017.

Inflation is expected to rise to about 2% by early 2017 once the effect of low oil prices will dissipate.

According to the central bank, low prices for oil and other commodities weighed on the Canadian economy.

The BoC noted that the Canadian labour market remains resilient.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that "vulnerabilities in the household sector continue to edge higher".

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:46

U.S. weekly earnings rise 0.1% in December

The U.S. Labor Department released its real earnings data on Wednesday. Average weekly earnings rose 0.1% in December, after a 0.1% decrease in November.

The increase was driven by rises in in average hourly earnings.

Average hourly earnings climbed 0.1% in December, after a 0.1% rise in November.

On a yearly basis, real average weekly earnings increased 1.6% in December, while hourly earnings rose 1.8%.

-

15:14

U.S. consumer price inflation declines 0.1% in December

The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation declined 0.1% in December, missing expectations for a flat reading, after a flat reading in November.

The decline was mainly driven by lower energy prices, which slid 2.4% in December.

Shelter costs climbed 0.2% in December.

Gasoline prices fell 2.4% in December, while food prices decreased 0.2%.

On a yearly basis, the U.S. consumer price index increased to 0.7% in December from 0.5% in November, missing expectations for a rise to 0.8%.

The U.S. consumer price inflation excluding food and energy gained 0.1% in December, missing expectations for a 0.2% rise, after a 0.2% increase in November.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.1% in December from 2.0% in November, in line with expectations.

The increase of the consumer price index excluding food and energy was driven by higher prices of rents and medical care.

In 2015 as whole, consumer prices rose 0.7%, after a 0.8% increase in 2014.

The U.S. consumer price index excluding food and energy increased 2.1% in 2015, after a 1.6% gain in 2014.

The consumer price index is not preferred Fed's inflation measure.

-

15:01

Housing starts in the U.S. fall 2.5% in December

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. declined 2.5% to 1.149 million annualized rate in December from a 1.179 million pace in November, missing expectations for an increase to 1.200 million.

November's figure was revised up from 1.173 million units.

The fall was driven by declines in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market. But there is a shortage of houses available for sale.

Building permits in the U.S. fell 3.9% to 1.232 million annualized rate in December from a 1.282 million pace in November, beating expectations for a 1,200 pace.

Starts of single-family homes decreased 3.3% in December. Building permits for single-family homes were up 1.8%.

Starts of multifamily buildings fell 1.0% in December. Permits for multi-family housing dropped 11.4%.

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY 117.00 (USD 300m) 118.00 (334m)

EURUSD 1.0800 ( EUR 1.1bln) 1.0850 (622m) 1.0875 (400m) 1.0900 (786m)

GBPUSD 1.4040 (GBP 356m)

AUDUSD 0.6900 (AUD 208m) 0.7000 (261m)

EURJPY 127.10 (230m) 128.80 (210m)

-

14:43

Canadian manufacturing shipments rise 1.0% in November

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments rose 1.0% in November, beating expectations for a 0.5% increase, after a 1.3% decline in October. October's figure was revised down from a 1.1% fall.

The increase was driven by higher motor vehicle sales, which rose 3.8% in November.

Inventories were flat in November.

-

14:37

Canada’s wholesale sales climb 1.8% in November

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales climbed 1.8% in November, exceeding expectations for a 0.5% gain, after a 0.5% decline in October. October's figure was revised up from a 0.6% decrease.

The increase was mainly driven by higher sales in the motor vehicle and parts subsectors.

Sales of motor vehicle and parts were up 4.8% in November, while sales in the food, beverage and tobacco subsector rose 1.6%.

Sales in the building material and supplies subsector climbed 2.8% in November.

Inventories fell by 0.2% in November.

-

14:30

U.S.: Housing Starts, December 1149 (forecast 1200)

-

14:30

U.S.: Building Permits, December 1232 (forecast 1200)

-

14:30

U.S.: CPI excluding food and energy, m/m, December 0.1% (forecast 0.2%)

-

14:30

U.S.: CPI, Y/Y, December 0.7% (forecast 0.8%)

-

14:30

U.S.: CPI, m/m , December -0.1% (forecast 0%)

-

14:30

Canada: Manufacturing Shipments (MoM), November 1% (forecast 0.5%)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, December 2.1% (forecast 2.1%)

-

14:30

Canada: Wholesale Sales, m/m, November 1.8% (forecast 0.5%)

-

14:18

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the U.K. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany Producer Price Index (MoM) December -0.2% -0.4% -0.5%

07:00 Germany Producer Price Index (YoY) December -2.5% -2.2% -2.3%

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Average Earnings, 3m/y November 2.4% 2.1% 2%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y November 2.0% 1.8% 1.9%

09:30 United Kingdom ILO Unemployment Rate November 5.2% 5.2% 5.1%

09:30 United Kingdom Claimant count December -2.2 Revised From 3.9 2.5 -4.3

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) January 16.6 -3

12:00 U.S. MBA Mortgage Applications January 21.3% 9%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic index. The U.S. consumer price inflation is expected to rise to 0.8% year-on-year in December from 0.5% in November.

The U.S. consumer price index excluding food and energy is expected to climb to 2.1% year-on-year in December from 2.0% in November.

Housing starts in the U.S. are expected to rise to 1.200 million units in December from 1.173 million units in November.

The number of building permits is expected to decrease to 1.200 million units in December from 1.282 million units in November.

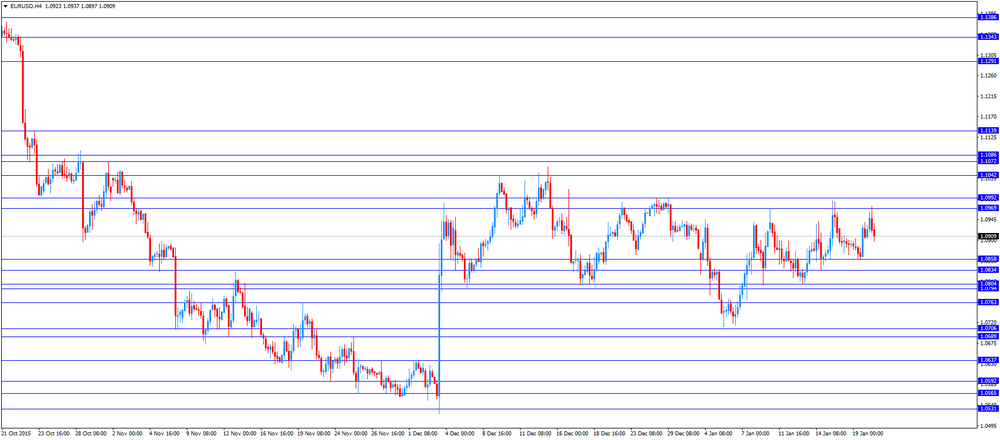

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Wednesday that there are limits to the central bank's monetary policy. He pointed out that the ECB's quantitative easing was working.

The British pound traded mixed against the U.S. dollar after the release of the U.K. labour market data. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.1% in the September to November quarter from 5.2% in the August to October quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to remain unchanged at 5.2%.

The employment rate was 74%. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 1.9% in the September to November quarter, beating expectations for a 1.8% rise, after a 2.0% gain in the August to October quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the September to November quarter, missing expectations for a gain of 2.1%, after a 2.4% increase in the August to October quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its interest rate unchanged.

Canadian manufacturing shipments are expected to rise 0.5% in November, after a 1.1% decline in October.

Wholesales sales in Canada are expected to increase 0.5% in November, after a 0.6% decline in October.

The Swiss franc traded lower against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index plunged to -3.0 in January from 16.6 in December. It was the lowest reading since July 2015.

"Half of the analysts surveyed expect economic growth in Switzerland to stay unchanged. Meanwhile, among the other respondents, the share of analysts who anticipate deterioration exceeds the share of those expecting to see a pickup in economic activity by only three percentage points," the ZEW said.

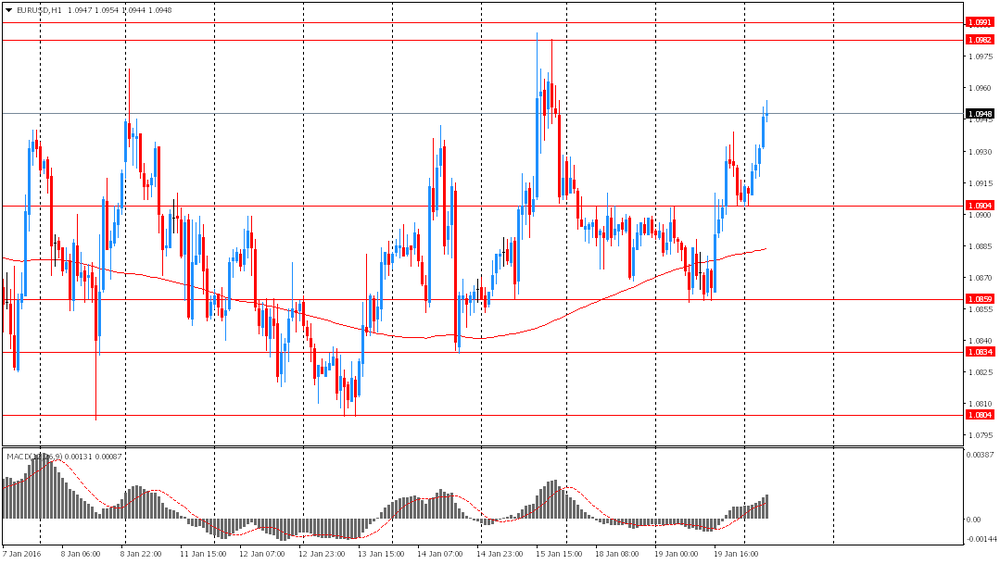

EUR/USD: the currency pair declined to $1.0897

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) November -1.1% 0.5%

13:30 Canada Wholesale Sales, m/m November -0.6% 0.5%

13:30 U.S. Housing Starts December 1173 1200

13:30 U.S. Building Permits December 1282 1200

13:30 U.S. CPI, m/m December 0.0% 0%

13:30 U.S. CPI, Y/Y December 0.5% 0.8%

13:30 U.S. CPI excluding food and energy, m/m December 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y December 2% 2.1%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:30 U.S. Crude Oil Inventories January 0.234

16:15 Canada BOC Press Conference

21:30 New Zealand Business NZ PMI December 54.7

-

13:46

Orders

EUR/USD

Offers 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100 1.1130 1.1160

Bids 1.0900 1.0880 1.0855-60 1.0840 1.0825 1.0800

GBP/USD

Offers 1.4180 1.4200 1.4225-30 1.4250 1.4280 1.4300 1.4325-30 1.4350

Bids 1.4120-25 1.4100 1.4085 1.4060 1.4030 1.4000

EUR/GBP

Offers 0.7775-80 0.7800 0.7830 0.7850 0.7875 0.7900

Bids 0.7720-25 0.7700 0.7685 0.7650 0.7630 0.7600 0.7580-85 0.7550

EUR/JPY

Offers 127.50 127.80 128.00 128.30 128.50 128.80 129.00 129.30 129.50

Bids 127.00 126.80 126.50 126.30 126.00 125.75 125.50

USD/JPY

Offers 116.30 116.50 116.80 117.00 117.20 117.50 117.85 118.00

Bids 115.85 115.50 115.30 115.00

AUD/USD

Offers 0.6880 0.6900 0.6930 0.6950 0.6980 0.7000 0.7025-30 0.7050-55

Bids 0.6825-30 0.6800 0.6785 0.6750 0.6730 0.6700

-

13:00

U.S.: MBA Mortgage Applications, January 9%

-

11:44

European Central Bank Governing Council member Ewald Nowotny: there are limits to the central bank’s monetary policy

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Wednesday that there are limits to the central bank's monetary policy.

"We have to be aware that of course there are limits to monetary policy," he said.

Nowotny pointed out that the ECB's quantitative easing was working.

-

11:39

Foreign direct investment inflows in China drop by an annual rate of 5.8% in December

China's Ministry of Commerce released its foreign direct investment (FDI) data on Wednesday. Foreign direct investment inflows in China fell to 77 billion yuan ($12 billion) in December, down 5.8% from a year earlier.

Non-financial outbound direct investment rose 6.1% year-on-year to $13.89 billion in December.

-

11:29

Greece’s current account narrows to €1.21 billion in November

The Bank of Greece released its current account data on Wednesday. Greece's current account deficit fell to €1.21 billion in November from €1.50 billion in November last year.

The Greek deficit on trade in goods declined to €1.59 billion in November from €1.70 billion in November last year, while the services surplus fell to €375 million from €567.6 billion.

The primary income deficit turned into a surplus of €27.4 million in November from a deficit of €274.4 million in November last year, while the deficit on secondary income declined to €23.4 million from €84.5 million last year.

The capital account surplus decreased to €190.2 million in November from 485.7 million last year.

-

11:20

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index plunges to -3.0 in January

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index plunged to -3.0 in January from 16.6 in December. It was the lowest reading since July 2015.

"Half of the analysts surveyed expect economic growth in Switzerland to stay unchanged. Meanwhile, among the other respondents, the share of analysts who anticipate deterioration exceeds the share of those expecting to see a pickup in economic activity by only three percentage points," the ZEW said.

The current conditions fell to -8.5 in January from -2.7 in December.

-

11:14

U.K. unemployment rate declines to 5.1% in the September to November quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.1% in the September to November quarter from 5.2% in the August to October quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to remain unchanged at 5.2%.

The claimant count slid by 4,300 people in December, beating expectations for a rise by 2,500, after a decrease of 2,200 people in November. November's figure was revised down from a 3,900 increase.

U.K. unemployment in the September to November period dropped by 99,000 to 1.68 million from the previous quarter.

The employment rate was 74%. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 1.9% in the September to November quarter, beating expectations for a 1.8% rise, after a 2.0% gain in the August to October quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the September to November quarter, missing expectations for a gain of 2.1%, after a 2.4% increase in the August to October quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:04

German producer prices drop 0.5% in December

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices declined 0.5% in December, missing expectations for a 0.4% fall, after a 0.2% drop in November.

On a yearly basis, German PPI dropped 2.3% in December, missing expectations for a 2.2% decrease, after a 2.5% fall in November.

PPI excluding energy sector fell by 0.6% year-on-year in December.

Energy prices were down 6.8% year-on-year in December.

Consumer non-durable goods prices rose 0.2% year-on-year in December, intermediate goods sector prices decreased by 2.2%, while capital goods prices increased 0.7% and durable consumer goods sector prices rose 1.5%.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), January -3

-

10:41

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.00 (USD 300m) 118.00 (334m)

EUR/USD 1.0800 ( EUR 1.1bln) 1.0850 (622m) 1.0875 (400m) 1.0900 (786m)

GBP/USD 1.4040 (GBP 356m)

AUD/USD 0.6900 (AUD 208m) 0.7000 (261m)

EUR/JPY 127.10 (230m) 128.80 (210m)

-

10:39

The U.S. Congressional Budget Office expects a higher budget deficit for this year

The U.S. Congressional Budget Office (CBO) said on Tuesday that it expects a higher budget deficit for this year. The office expects a budget deficit of $544 billion, up from a deficit of $439 billion in 2015.

The CBO cut its 2016 revenue forecasts to $3.38 trillion from $3.51 trillion.

"If current laws generally remained unchanged, the deficit would grow over the next 10 years, and by 2026 it would be considerably larger than its average over the past 50 years," the office said.

The CBO expects the U.S. economy to grow solidly this year and next.

-

10:30

United Kingdom: Average Earnings, 3m/y , November 2% (forecast 2.1%)

-

10:30

United Kingdom: ILO Unemployment Rate, November 5.1% (forecast 5.2%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, November 1.9% (forecast 1.8%)

-

10:30

United Kingdom: Claimant count , December -4.3 (forecast 2.5)

-

10:21

Consumer prices in New Zealand slide 0.5% in the fourth quarter

Statistics New Zealand released its consumer price inflation data on late Wednesday evening. Consumer prices in New Zealand dropped 0.5% in the fourth quarter, missing expectations for a 0.2% fall, after a 0.3% increase in the third quarter.

The decline in consumer price inflation was driven by lower petrol and vegetables prices.

On a yearly basis, consumer price inflation increased 0.1% in the fourth quarter, missing forecasts of the 0.4% rise, after a 0.4% gain in the third quarter. It was the weakest rise since 1999.

Lower petrol prices weighed on the annual inflation.

-

10:11

Westpac’ consumer confidence index for Australia declines 3.5% in January

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index fell 3.5% in January, after a 0.8% fall in December.

The index was mainly driven by a drop in the index tracking views on 'family finances vs a year ago', which plunged by 9.4% in January.

"With limited domestic news during the holiday season consumers appear to have been mainly impacted by the spate of negative news on the international front and the spill over effect on financial markets," Westpac Chief Economist Bill Evans said.

"The Reserve Bank Board next meets on February 2. Despite markets confidently expecting that the Reserve bank would cut rates by February Westpac has remained firmly of the view that the Bank will remain on hold throughout the second half of 2015 and the whole of 2016. We retain that view despite some concerns from this survey that consumers may slow their spending in response to this current global uncertainty," he added.

-

08:30

Options levels on wednesday, January 20, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1043 (1932)

$1.1019 (3146)

$1.0983 (1850)

Price at time of writing this review: $1.0949

Support levels (open interest**, contracts):

$1.0884 (517)

$1.0846 (1197)

$1.0791 (3809)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 37455 contracts, with the maximum number of contracts with strike price $1,1000 (3725);

- Overall open interest on the PUT options with the expiration date February, 5 is 52878 contracts, with the maximum number of contracts with strike price $1,0700 (7978);

- The ratio of PUT/CALL was 1.41 versus 1.42 from the previous trading day according to data from January, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.4404 (376)

$1.4307 (290)

$1.4211 (141)

Price at time of writing this review: $1.4154

Support levels (open interest**, contracts):

$1.4091 (733)

$1.3994 (368)

$1.3896 (328)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 22602 contracts, with the maximum number of contracts with strike price $1,4700 (3151);

- Overall open interest on the PUT options with the expiration date February, 5 is 21418 contracts, with the maximum number of contracts with strike price $1,4550 (2011);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from January, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:06

Foreign exchange market. Asian session: the yen rose

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

09:00 Germany Producer Price Index (MoM) December -0.2% -0.4% -0.5%

09:00 Germany Producer Price Index (YoY) December -2.5% -2.2% -2.3%

The yen rose against the U.S. dollar amid persistent uncertainties on global financial markets, which increase demand for safe-haven assets. Asian stocks fell weighed by oil prices after the International Monetary Fund cut its global economic forecast. The IMF released its updated World Economic Outlook on Tuesday projecting the global economy to grow 3.4% in 2016 down from 3.6% expected earlier.

The Australian dollar declined amid domestic consumer confidence data. The Westpac consumer confidence index fell to the lowest level since September 2015 dragging the Australian currency down. The index declined by 3.5% in January after the 0.8% decline in December. Westpac analysts said that consumers were concerned about negative news from abroad. Westpac believes the RBA will keep interest rates at the current level throughout 2016.

EUR/USD: the pair rose to $1.0960 in Asian trade

USD/JPY: the pair fell to Y116.75

GBP/USD: the pair fell to $1.4130

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Average Earnings, 3m/y November 2.4% 2.1%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y November 2.0% 1.8%

09:30 United Kingdom ILO Unemployment Rate November 5.2% 5.2%

09:30 United Kingdom Claimant count December 3.9 2.5

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) January 16.6

12:00 U.S. MBA Mortgage Applications January 21.3%

13:30 Canada Manufacturing Shipments (MoM) November -1.1% 0.5%

13:30 Canada Wholesale Sales, m/m November -0.6% 0.5%

13:30 U.S. Housing Starts December 1173 1200

13:30 U.S. Building Permits December 1282 1200

13:30 U.S. CPI, m/m December 0.0% 0%

13:30 U.S. CPI, Y/Y December 0.5% 0.8%

13:30 U.S. CPI excluding food and energy, m/m December 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y December 2% 2.1%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:30 U.S. Crude Oil Inventories January 0.234

16:15 Canada BOC Press Conference

21:30 New Zealand Business NZ PMI December 54.7

-

08:00

Germany: Producer Price Index (MoM), December -0.5% (forecast -0.4%)

-

08:00

Germany: Producer Price Index (YoY), December -2.3% (forecast -2.2%)

-

02:30

Currencies. Daily history for Jan 19’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0907 +0,15%

GBP/USD $1,4156 -0,61%

USD/CHF Chf1,0031 -0,19%

USD/JPY Y117,62 +0,26%

EUR/JPY Y128,28 +0,38%

GBP/JPY Y166,48 -0,35%

AUD/USD $0,6907 +0,64%

NZD/USD $0,6410 -0,62%

USD/CAD C$1,4577 +0,13%

-

02:02

Schedule for today, Wednesday, Jan 20’2016:

(time / country / index / period / previous value / forecast)

07:00 Germany Producer Price Index (MoM) December -0.2% -0.4%

07:00 Germany Producer Price Index (YoY) December -2.5% -2.2%

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Average Earnings, 3m/y November 2.4% 2.1%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y November 2.0% 1.8%

09:30 United Kingdom ILO Unemployment Rate November 5.2% 5.2%

09:30 United Kingdom Claimant count December 3.9 2.5

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) January 16.6

12:00 U.S. MBA Mortgage Applications January 21.3%

13:30 Canada Manufacturing Shipments (MoM) November -1.1% 0.5%

13:30 Canada Wholesale Sales, m/m November -0.6% 0.5%

13:30 U.S. Housing Starts December 1173 1200

13:30 U.S. Building Permits December 1282 1200

13:30 U.S. CPI, m/m December 0.0% 0%

13:30 U.S. CPI, Y/Y December 0.5% 0.8%

13:30 U.S. CPI excluding food and energy, m/m December 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y December 2% 2.1%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:30 U.S. Crude Oil Inventories January 0.234

16:15 Canada BOC Press Conference

21:30 New Zealand Business NZ PMI December 54.7

-

00:31

Australia: Westpac Consumer Confidence, January -3.5%

-