Noticias del mercado

-

17:45

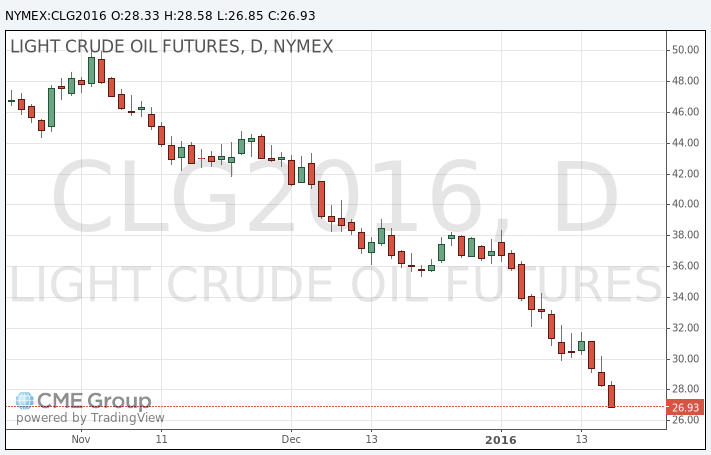

Oil prices fall below $28 a barrel

Oil prices declined on concerns over the global oil oversupply. International Energy Agency (IEA) Executive Director Fatih Birol said in an interview with Bloomberg Television on Wednesday that oil prices will remain under pressure.

"It is the third year in a row we have more supply than demand. Prices will be still under pressure. I don't see any reason why we have a surprise increase in the price in 2016," he said.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Thursday.

WTI crude oil for March delivery dropped to $26.85 a barrel on the New York Mercantile Exchange.

Brent crude oil for March rose to $27.93 a barrel on ICE Futures Europe.

-

17:25

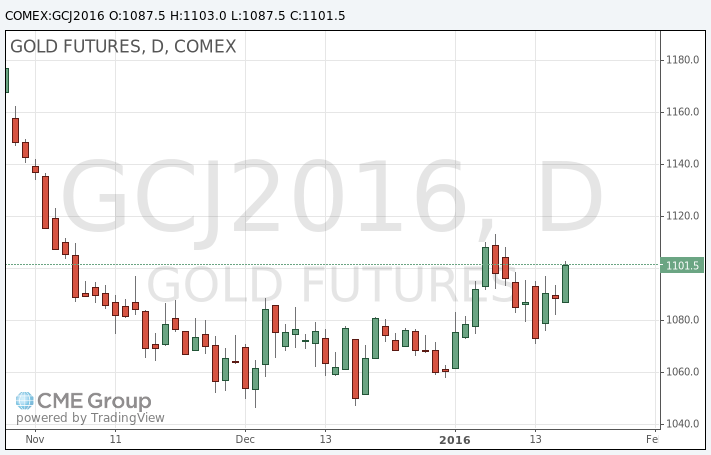

Gold rises due to higher demand for safe-haven assets

Gold increased due to higher demand for safe-haven assets as oil prices continued to declined, and the U.S. dollar and global stock markets fell.

Market participants eyed the U.S. economic data. The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation declined 0.1% in December, missing expectations for a flat reading, after a flat reading in November.

The decline was mainly driven by lower energy prices, which slid 2.4% in December.

On a yearly basis, the U.S. consumer price index increased to 0.7% in December from 0.5% in November, missing expectations for a rise to 0.8%.

The U.S. consumer price inflation excluding food and energy gained 0.1% in December, missing expectations for a 0.2% rise, after a 0.2% increase in November.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.1% in December from 2.0% in November, in line with expectations.

The increase of the consumer price index excluding food and energy was driven by higher prices of rents and medical care.

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. declined 2.5% to 1.149 million annualized rate in December from a 1.179 million pace in November, missing expectations for an increase to 1.200 million.

The fall was driven by declines in starts of single-family and multifamily homes.

Building permits in the U.S. fell 3.9% to 1.232 million annualized rate in December from a 1.282 million pace in November, beating expectations for a 1,200 pace.

February futures for gold on the COMEX today rose to 1103.00 dollars per ounce.

-

16:48

The People's Bank of China injects 150 billion yuan into market

The People's Bank of China (PBoC) said on its website on Wednesday that it plans to inject 150 billion yuan ($23 billion) into market to boost liquidity via short-term liquidity operations (SLO).

The interest rate on the 6-day lines of credit will be 2.25%, according to the central bank.

-

11:39

Foreign direct investment inflows in China drop by an annual rate of 5.8% in December

China's Ministry of Commerce released its foreign direct investment (FDI) data on Wednesday. Foreign direct investment inflows in China fell to 77 billion yuan ($12 billion) in December, down 5.8% from a year earlier.

Non-financial outbound direct investment rose 6.1% year-on-year to $13.89 billion in December.

-

07:48

Oil prices plunged

West Texas Intermediate futures for February delivery, which expires today, fell to $28.72 (-2.87%), while Brent crude dropped to $28.15 (-2.12%) amid the ongoing global supply glut. The International Energy Agency warned that supplies will be excessive this year. Market participants are bracing for Iran to boost exports.

Investors are waiting for the American Petroleum Institute to release its inventories forecast later today. Official data from the Energy Information Administration will be published on Thursday.

-

07:37

Gold climbed

Gold climbed to $1,091.60 (+0.23%) amid growing demand for safe-haven assets as Asian stocks fell and the International Monetary Fund cut its global economic forecast. The IMF released its updated World Economic Outlook on Tuesday projecting the global economy to grow 3.4% in 2016 down from 3.6% expected earlier. The fund also says the world economy expanded by 3.1% in 2015, marking the weakest pace since the 2009 recession. The Chinese economy is expected to grow by 6.3% this year.

Weak physical demand limited bullion's gains as buyers from one of the major consumers China cut spending amid slowing economy.

-

02:35

Commodities. Daily history for Jan 19’2016:

(raw materials / closing price /% change)

Oil$27.97-1.72%

Gold$1,089.20 +0.01%

-