Noticias del mercado

-

17:43

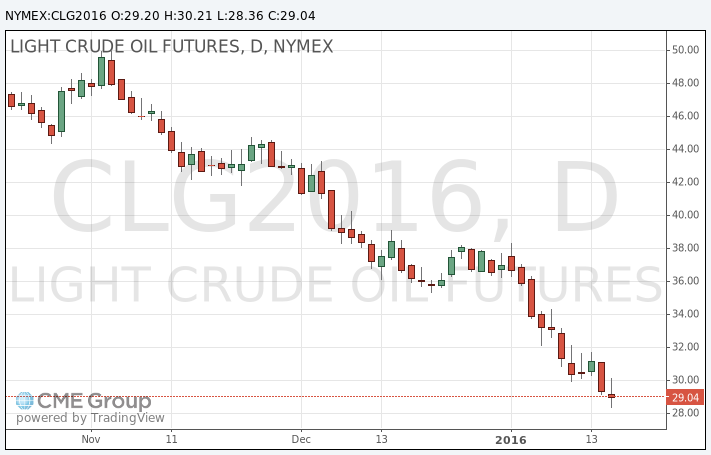

WTI crude declines, while Brent crude rises

WTI crude continued to decline on concerns over the global oil oversupply. The International Energy Agency (IEA) released its monthly report on Wednesday. The agency said that oil oversupply will persist until at least late 2016, driven by a warm winter and the slowdown in the global economy.

The IEA expects global oil demand to expand by 1.2 million barrels a day (mbd) this year, unchanged from its previous estimate, down from 1.8 mbd in 2015.

"We conclude that the oil market faces the prospect of a third successive year when supply will exceed demand by 1 million bpd and there will be enormous strain on the ability of the oil system to absorb it efficiently," the IEA said.

Earlier, oil prices rose on the Chinese economic and oil consumption data. China's National Bureau of Statistics released its gross domestic product (GDP) data on Tuesday. The country's economy expanded 6.8% in the fourth quarter of 2015, after a 6.9% rise in the third quarter. It was the slowest rise since 2009.

In 2015 as whole, China's economy grew 6.9%, after a 7.3% increase in 2014. It was the slowest growth since 1990.

Reuters reported on Tuesday that according to its preliminary calculations, oil consumption in China totalled 10.32 million barrels a day in 2015, up 2.5% from 2014.

WTI crude oil for March delivery dropped to $28.36 a barrel on the New York Mercantile Exchange.

Brent crude oil for March rose to $28.94 a barrel on ICE Futures Europe.

-

17:28

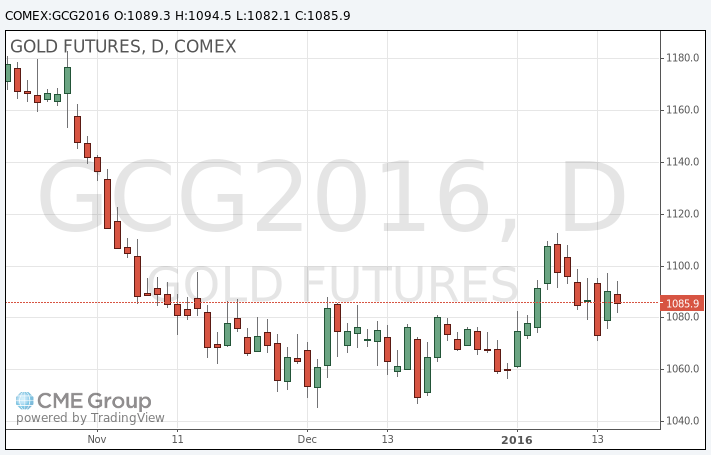

Gold declines as global stock markets rise

Gold declined as global stock markets rose on the Chinese economic data. China's GDP data also supported stock markets. China's National Bureau of Statistics released its gross domestic product (GDP) data on Tuesday. The country's economy expanded 6.8% in the fourth quarter of 2015, after a 6.9% rise in the third quarter. It was the slowest rise since 2009.

In 2015 as whole, China's economy grew 6.9%, after a 7.3% increase in 2014. It was the slowest growth since 1990.

February futures for gold on the COMEX today fell to 1082.10 dollars per ounce.

-

16:53

The People's Bank of China plans to inject over 600 billion yuan into market

The People's Bank of China (PBoC) said on its website on Tuesday that it plans to inject over 600 billion yuan ($91 billion) into market to boost liquidity via its tools of the standing lending facility (SLF), medium-term lending facility (MLF) and pledged supplementary lending (PSL).

-

16:27

Reuters’ calculations: oil consumption in China was 10.32 million barrels a day in 2015

Reuters reported on Tuesday that according to its preliminary calculations, oil consumption in China totalled 10.32 million barrels a day in 2015, up 2.5% from 2014.

-

16:07

International Energy Agency’s monthly report: oil oversupply will persist until at least late 2016

The International Energy Agency (IEA) released its monthly report on Tuesday. The agency said that oil oversupply will persist until at least late 2016, driven by a warm winter and the slowdown in the global economy.

Global oil demand dropped to 1 million barrels a day (mbd) in the fourth quarter from 2.1 mbd in the third quarter.

The IEA expects global oil demand to expand by 1.2 mbd this year, unchanged from its previous estimate, down from 1.8 mbd in 2015.

"We conclude that the oil market faces the prospect of a third successive year when supply will exceed demand by 1 million bpd and there will be enormous strain on the ability of the oil system to absorb it efficiently," the IEA said.

The agency also said that oil supply from non-OPEC producer is expected to decline by 600,000 mbd this year, while Iran's output is expected to rise by additional 300,000 mbd by the end of the first quarter.

The IEA cut OPEC oil demand forecasts by 300,000 mbd to 31.7 mbd in 2016.

-

10:57

China’s industrial production increases 5.9% year-on-year in December

The National Bureau of Statistics said on Tuesday that China's industrial production increased 5.9% year-on-year in December, missing expectations for a 6.0% rise, down from a 6.2% gain in November.

Fixed-asset investment in China climbed 10.0% year-on-year in the January-December period, missing expectations for a 10.2% increase, after a 10.2% rise in the January-November period.

Retail sales in China increased 11.1% year-on-year in December, missing expectations for a 11.3% gain, after a 11.2% rise in November.

These data added to concerns over the slowdown in the Chinese economy.

-

10:45

China’s economy grows 6.9% in 2015

China's National Bureau of Statistics released its gross domestic product (GDP) data on Tuesday. The country's economy expanded 6.8% in the fourth quarter of 2015, after a 6.9% rise in the third quarter. It was the slowest rise since 2009.

In 2015 as whole, China's economy grew 6.9%, after a 7.3% increase in 2014. It was the slowest growth since 1990.

-

10:14

JPMorgan Chase lowers its forecasts for oil prices

JPMorgan Chase on Monday cut its forecasts for oil prices due to the global oil oversupply. The bank expects Brent crude to be around $31.25 a barrel in 2016, down from its previous estimate of $51.50 a barrel, while WTI crude is expected to be $31.5 a barrel, down from its previous estimate of $48.88 a barrel.

-

07:41

Oil prices gained

West Texas Intermediate futures for February delivery climbed to $30.60 (+0.69%), while Brent crude advanced to $29.19 (+2.24%) as data on China's oil demand outweighed concerns over upcoming supplies from Iran. Sources reported that China increased its oil demand by 2.5% in 2015 compared to 2014 despite slowing economy. Preliminary estimations suggest that demand stood at 10.32 barrels per day.

Nevertheless analysts point to the supply glut issue and potential increase in supplies from Iran. Goldman Sachs forecasts Iran's production to rise by 285,000 barrels per day year-on-year in 2016 while BMI Research estimates the rise could be by as much as 400,000 bpd.

-

07:23

Gold steadied

Gold is currently at $1,088.60 (-0.19%) amid contradicting factors. Concerns over China's economy support the safe-haven metal, while the dollar's long-term up-trend keeps a lid on its gains. This morning the National Bureau of Statistics reported that economic growth slowed to 6.8% in the fourth quarter of 2015. Meanwhile the economy expanded by 6.9% over 2015, marking the weakest result since 1990.

Physical demand was sluggish as buyers from one of the major consumers China cut spending amid slowing economy.

-

00:35

Commodities. Daily history for Jan 18’2016:

(raw materials / closing price /% change)

Oil 28.94 -1.63%

Gold 1,088.90 -0.17%

-