Noticias del mercado

-

17:42

Oil prices slides below $29 a barrel

Oil prices fell below $29 a barrel on concerns over the global oil oversupply. International sanctions on Iran were lifted over the weekend after the International Atomic Energy Agency announced that Tehran had fulfilled its commitment.

Iran said on Sunday that it plans to raise its exports by 500,000 barrels per day.

Iran is a member of the Organization of the Petroleum Exporting Countries (OPEC), and is the fifth biggest OPEC oil producer.

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Monday. OPEC said that oil prices will start to recover this year, adding that supply from non-OPEC members will decline due to low oil prices.

"The analysis indicates that 2016 will be a supply-driven market. It will also be the year when the rebalancing process starts," OPEC said in its report.

Supply from non-OPEC members is expected to fall by 660,000 barrels per day (bpd) in 2016.

OPEC's output declined by 210,000 bpd to 32.18 million bpd in December, according to the report.

Global oil demand is expected to climb by 1.26 million bpd in 2016, OPEC noted.

WTI crude oil for March delivery dropped to $28.36 a barrel on the New York Mercantile Exchange.

Brent crude oil for March slid to $27.67 a barrel on ICE Futures Europe.

-

17:30

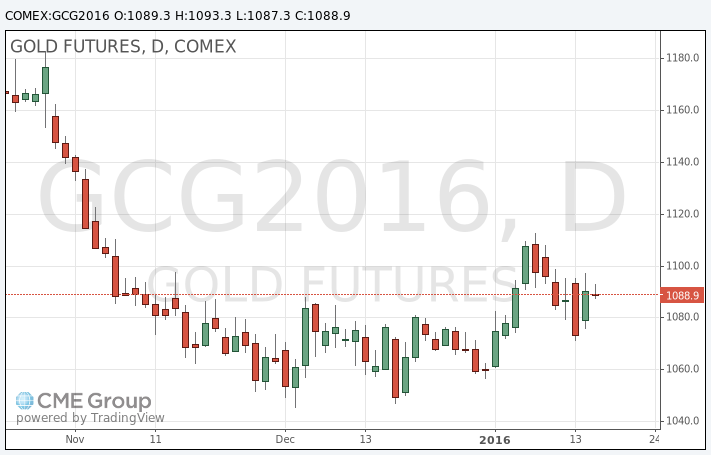

Gold trades little changed

Gold traded little changed in the absence of any major market driver. U.S. stock markets are closed for a public holiday on Monday.

Geopolitical tensions and the slowdown in the Chinese economy support gold. Official economic growth data from China will be released tomorrow. Analysts expect the Chinese economy to expand 6.8% in the fourth quarter, after a 6.9% in the third quarter.

February futures for gold on the COMEX today traded at 1088.90 dollars per ounce.

-

15:51

Saudi oil minister Ali al-Naimi calls for cooperation among oil producing countries

Saudi oil minister Ali al-Naimi on Monday called for cooperation among oil producing countries, which should lead to stability in the global oil market.

"Market forces, as well as the cooperation among the producing nations, always lead to the restoration of stability. This, however, takes some time," he said.

"I'm optimistic about the future, the return of stability to the global oil markets, the improvement of prices and the cooperation among the major producing countries," al-Naimi added.

-

15:43

Oman is ready to cut its oil output

News reported on Monday that Oman, the largest non-OPEC oil producer, is ready to cooperate and to lower oil production, if the other oil producer will do the same.

"Oman is ready to do anything that would stabilize the oil market. 5% or 10% is what I think we need to cut and everyone has to do the same," Oman's oil minister, Mohammad bin Hamad al-Rumhy, said on Monday.

-

15:36

OPEC’s monthly report: oil prices will start to recover this year

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Monday. OPEC said that oil prices will start to recover this year, adding that supply from non-OPEC members will decline due to low oil prices.

"The analysis indicates that 2016 will be a supply-driven market. It will also be the year when the rebalancing process starts," OPEC said in its report.

Supply from non-OPEC members is expected to fall by 660,000 barrels per day (bpd) in 2016.

OPEC's output declined by 210,000 bpd to 32.18 million bpd in December, according to the report.

Global oil demand is expected to climb by 1.26 million bpd in 2016, OPEC noted.

-

11:47

People’s Bank of China injected 55 billion yuan into market

The People's Bank of China (PBoC) injected 55 billion yuan ($8.36 billion) into market through its short-term liquidity operations (SLO) on Monday.

The reason for this injection could be the decision to boost liquidity.

-

11:32

The People's Bank of China will raise the reserve requirement ratio on yuan deposits of offshore bank

The People's Bank of China (PBoC) said on Monday that it raised the reserve requirement ratio on yuan deposits of offshore banks.

The central bank noted that the ratio will be raised to "normal levels" from zero.

Changes will be effective on January 25.

-

11:17

Home prices in China rise in December

China's National Bureau of Statistics (NBS) said on Monday that average new home prices in 70 major cities climbed at an annual rate of 7.7% in December, after a 6.5% gain in November.

The main contributor was Shenzhen, where home prices jumped by 46.8% year-on-year in December.

On a monthly base, house prices increased in 39 of 70 cities, prices slid in 27 cities, while prices remained unchanged in 4 cities.

-

10:41

International sanctions on Iran are lifted

International sanctions on Iran were lifted over the weekend after the International Atomic Energy Agency announced that Tehran had fulfilled its commitment.

Iran said on Sunday that it plans to raise its exports by 500,000 barrels per day.

Iran is a member of the Organization of the Petroleum Exporting Countries (OPEC), and is the fifth biggest OPEC oil producer.

-

10:19

The number of active U.S. rigs falls by 1 rigs to 515 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 1 rigs to 515 last week. It was the lowest level since April 2010.

The gas rig count decreased by 13 to 135.

Combined oil and gas rigs declined by 14 to 650.

-

07:49

Oil prices extended declines

West Texas Intermediate futures for February delivery plunged to $29.75 (-2.11%), while Brent crude dropped to $28.05 (-3.08%) amid concerns that the global supply glut could worsen once Iran boosts exports. On Sunday the UN confirmed that Tehran fulfilled its obligations under a landmark deal to curb its nuclear programme. Iranian deputy oil minister said his country was ready to increase its crude oil exports by 500,000 barrels per day. Many analysts expect prices to remain under pressure.

U.S. crude oil inventories are ample and China's slowing economy is unable to absorb additional supplies.

-

07:15

Gold edged up

Gold slightly climbed to $1,091.30 (+0.06%) amid falling stocks and as weaker-than-expected data on the U.S. economy raised concerns over the chances that the Federal Reserve will conduct another rate hike in March. Retail sales and industrial production missed estimates in December.

Physical demand was sluggish as buyers from one of the major consumers China cut spending amid slowing economy.

Nevertheless a research by Thomson Reuters, quoted in the Financial Times magazine on Sunday, suggested that gold prices could experience upward pressure. The research showed that global production of gold is likely to decline by 3% in 2016 after seven straight years of rising output. Production reached its peak in 2015.

-

01:04

Commodities. Daily history for Jan 15’2016:

(raw materials / closing price /% change)

Oil 29.70 -4.84

Gold 1,088.60 +0.96

-