Noticias del mercado

-

22:01

New Zealand: NZIER Business Confidence, Quarter IV 15%

-

17:07

EY Item Club expects the U.K. economy to expand 2.6% in 2016

EY Item Club released its economic forecasts for the U.K. on Monday. The U.K. economy is expected to expand 2.6% in 2016, after a 2.2% in 2015. According to EY Item Club, the economy will be driven by consumer spending, which is expected to rise 2.8% this year.

Inflation is expected to 0.7% in 2016, 1.6% in 2017 and 1.8% in 2018.

The thin-tank expects that the Bank of England (BoE) will not raise its interest rate until November due to low inflation.

EY Item Club said that it forecasts the BoE's interest rate to be 1% by the middle of 2017 and 1.5% by the end of 2017.

-

16:40

Standard & Poor's affirms Belgium's credit rating

Standard & Poor's affirmed Belgium's credit rating at 'AA/A1+' on Friday. The outlook is stable.

The agency noted that economic recovery and reforms support the fiscal and external positions.

"We expect Belgium to reduce its public deficit and maintain a strong external position on the back of gradual economic recovery, supply side reforms, and fiscal consolidation," S&P said.

-

16:21

European Central Bank purchases €15.27 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €15.27 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.08 billion of covered bonds, and €55 million of asset-backed securities.

The ECB will release its interest rate decision on Thursday. Analysts expect the central bank to keep its monetary policy unchanged.

-

15:57

French President Francois Hollande: the government will spend €2.00 billion to create more jobs in France

French President Francois Hollande said in a speech on Monday that the government will spend €2.00 billion to create more jobs in France.

"These two billion euros will be financed without any new taxes of any kind, in other words, they will be financed by savings," he said.

-

15:05

Australia’s inflation gauge rises 0.2% in December

The TD Securities and Melbourne Institute (MI) released their monthly inflation gauge data on Monday. Australia's inflation gauge was up 0.2% in December, after a 0.1% gain in November.

On a yearly basis, inflation gauge rose 2.0% in December from 1.8% in November.

The rise was mainly driven by rises in prices for fruit and vegetables, holiday travel and accommodation, and meat and seafood.

The trimmed mean of the inflation gauge declined to 1.7% year-on-year in December from 1.8% in November.

"We expect headline inflation to increase by 0.3 per cent in the quarter, to be 1.7 per cent higher than a year ago, while we forecast underlying inflation to increase by 0.5 per cent in the quarter, for an annual rate of 2.0 per cent. These forecasts are entirely consistent with the RBA's November projections," Chief Asia-Pac Macro Strategist at TD Securities, Annette Beacher, said.

-

14:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 115.40 (USD 400m) 116.40-50 (484m)

EUR/USD 1.0875 (EUR 297m) 1.0935 (566m) 1.0950 (230m) 1.1000 (407m)

-

14:35

New motor vehicle sales in Australia decline 0.5% in December

The Australian Bureau of Statistics released its new motor vehicle sales on Monday. New motor vehicle sales in Australia fell 0.5% in December, after a 1.3% rise in November. November's figure was revised up from a 1.0% gain.

Sales of passenger vehicles increased by 0.4% in December, sales of sports utility vehicles were up 0.1%, while sales for other vehicles rose by 0.8%.

On a yearly basis, new motor vehicle sales rose 2.2% in December, after a 6.0% increase in November.

-

14:18

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (MoM) December 1.3% Revised From 1.0% -0.5%

00:30 Australia New Motor Vehicle Sales (YoY) December 6.0% 2.2%

04:30 Japan Tertiary Industry Index November 0.9% -0.8%

04:30 Japan Industrial Production (MoM) (Finally) November 1.4% -1.0% -0.9%

04:30 Japan Industrial Production (YoY) (Finally) -1.4% 1.6% 1.7%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. U.S. are closed for a public holiday today.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The Italian statistical office Istat released its trade data for Italy on Monday. Italy' trade surplus narrowed to €4.41 billion in November from €4.82 billion in October. October's figure was revised up €4.81 billion.

Exports climbed 6.4% year-on-year in November, while imports increased 3.8%.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

According to property tracking website Rightmove, U.K. house prices rose 0.5% in January, after a 1.1% drop in December.

"Encouragingly for first-time buyers there's more fresh choice with more property coming to market in their target sector. With their asking prices pretty much the same as a month ago, perhaps the knock-on effects of the more punitive landlord tax regime have arrived early and they now face a dilemma over whether to buy now or wait to see if prices drop in this sector over the next few months," Rightmove director and housing market analyst, Miles Shipside, said.

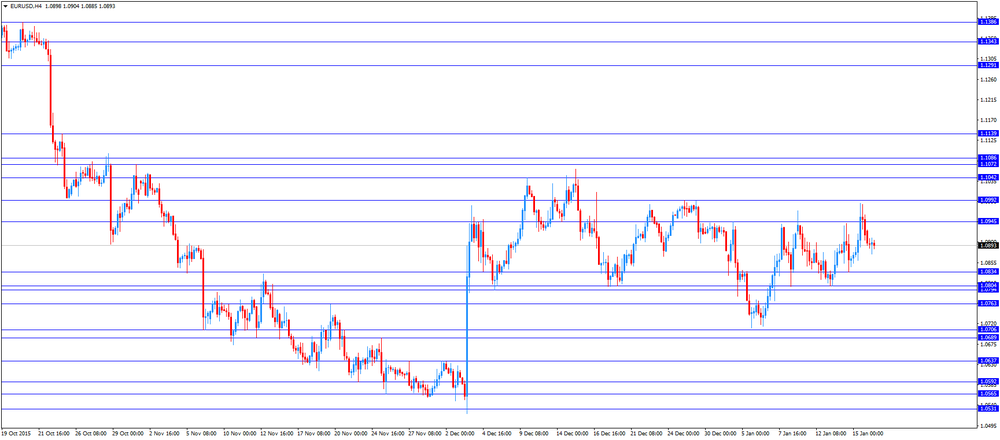

EUR/USD: the currency pair mixed

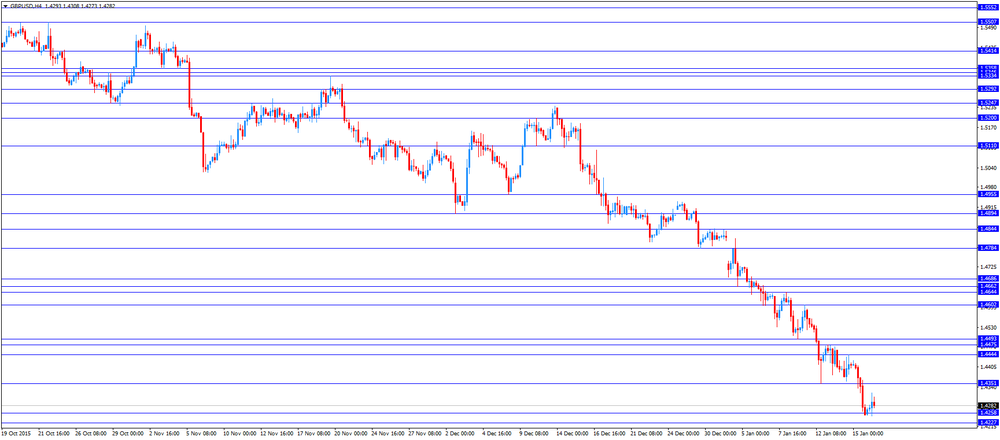

GBP/USD: the currency pair rose to $1.4322

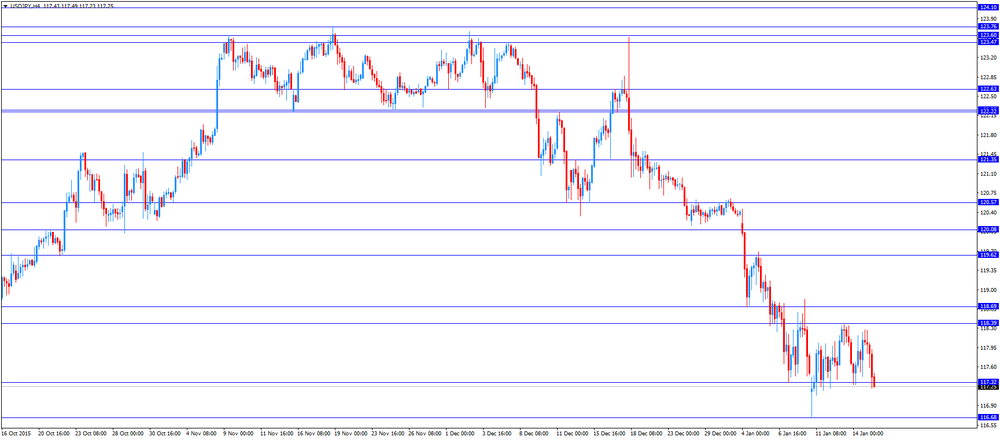

USD/JPY: the currency pair increased to Y117.43

The most important news that are expected (GMT0):

21:00 New Zealand NZIER Business Confidence Quarter IV -14%

-

14:00

Orders

EUR/USD

Offers 1.0900 1.0920 1.0935 1.0950 1.0965 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids1.0855-60 1.0840 1.0825 1.0800-10 1.0780-85 1.0750 1.0720 1.0700 1.0675 1.0650

GBP/USD

Offers 1.4325-30 1.4350 1.4380 1.4400 1.4425 1.4450 1.4480 1.4500

Bids1.4280-85 1.4265 1.4260 1.4230 1.4200 1.4175 1.4150

EUR/GBP

Offers 0.7620 0.7640-45 0.7665 0.7680 0.7700 0.7730 0.7750

Bids0.7580-85 0.7550 0.7525 0.7500 0.7475-80 0.7450 0.7420 0.7400

EUR/JPY

Offers 128.00 128.30 128.50 128.80 129.00 129.30 129.50

Bids127.50 127.30 127.00 126.80 126.50 126.30 126.00

USD/JPY

Offers 117.50 117.65 117.85 118.00.118.25 118.40 118.60 118.80-85 119.00

Bids117.20 117.00 116.85 116.65 116.50 116.30 116.00

AUD/USD

Offers 0.6920 0.6950 0.6980 0.7000 0.7025-30 0.7050-55 0.7080 0.7100

Bids0.6880 0.6865 0.6850 0.6830 0.6800 0.6785 0.6750

-

11:47

People’s Bank of China injected 55 billion yuan into market

The People's Bank of China (PBoC) injected 55 billion yuan ($8.36 billion) into market through its short-term liquidity operations (SLO) on Monday.

The reason for this injection could be the decision to boost liquidity.

-

11:41

Italy’ trade surplus falls to €4.41 billion in November

The Italian statistical office Istat released its trade data for Italy on Monday. Italy' trade surplus narrowed to €4.41 billion in November from €4.82 billion in October. October's figure was revised up €4.81 billion.

Exports climbed 6.4% year-on-year in November, while imports increased 3.8%.

On a monthly basis, exports rose a seasonally-adjusted 3.5% in November, while imports were up 1.4%.

The seasonally-adjusted trade surplus with the EU was €1.48 billion in November, while the trade surplus with non-EU countries was €2.80 billion.

-

11:32

The People's Bank of China will raise the reserve requirement ratio on yuan deposits of offshore bank

The People's Bank of China (PBoC) said on Monday that it raised the reserve requirement ratio on yuan deposits of offshore banks.

The central bank noted that the ratio will be raised to "normal levels" from zero.

Changes will be effective on January 25.

-

11:17

Home prices in China rise in December

China's National Bureau of Statistics (NBS) said on Monday that average new home prices in 70 major cities climbed at an annual rate of 7.7% in December, after a 6.5% gain in November.

The main contributor was Shenzhen, where home prices jumped by 46.8% year-on-year in December.

On a monthly base, house prices increased in 39 of 70 cities, prices slid in 27 cities, while prices remained unchanged in 4 cities.

-

10:31

Rightmove: U.K. house prices rise 0.5% in January

According to property tracking website Rightmove, U.K. house prices rose 0.5% in January, after a 1.1% drop in December.

"Encouragingly for first-time buyers there's more fresh choice with more property coming to market in their target sector. With their asking prices pretty much the same as a month ago, perhaps the knock-on effects of the more punitive landlord tax regime have arrived early and they now face a dilemma over whether to buy now or wait to see if prices drop in this sector over the next few months," Rightmove director and housing market analyst, Miles Shipside, said.

On a yearly basis, house prices in the U.K. climbed 6.5% in January, after a 7.4% increase in December.

-

09:41

Japan's tertiary industry activity index drops 0.8% in November

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Monday. The index dropped 0.8% in November, after a 0.9% increase in October.

The fall was driven by declines in living and amusement-related services, wholesale trade, retail trade, transport and Postal activities, finance and insurance, goods rental and leasing(include automobile rental and leasing), and electricity, gas, heat supply and water industries.

-

09:27

Final industrial production in Japan drops 0.9% in November

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Monday. Final industrial production in Japan declined 0.9% in November, up from the preliminary estimate of a 1.0% drop, after a 1.4% increase in October.

Industrial shipments slid 2.4% in November, up from the preliminary estimate of a 2.5% fall, while inventories rose 0.4%, in line with the preliminary estimate.

On a yearly basis, Japan's industrial production was up 1.7% in November, up from the preliminary estimate of a 1.6% rise, after a 1.4% decline in October.

-

09:22

Option expiries for today's 10:00 ET NY cut

USD/JPY 115.40 (USD 400m) 116.40-50 (484m)

EUR/USD 1.0875 (EUR 297m) 1.0935 (566m) 1.0950 (230m) 1.1000 (407m)

-

08:08

Foreign exchange market. Asian session: the U.S. dollar advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia New Motor Vehicle Sales (MoM) December 1.3% Revised From 1.0% -0.5%

00:30 Australia New Motor Vehicle Sales (YoY) December 6.0% 2.2%

04:30 Japan Tertiary Industry Index November 0.9% -0.8%

04:30 Japan Industrial Production (MoM) (Finally) November 1.4% -1.0% -0.9%

04:30 Japan Industrial Production (YoY) (Finally) -1.4% 1.6% 1.7%

The U.S. dollar rose against the euro and the yen after having declined on Friday. At the end of the previous week the euro gained on weak U.S. data and negative start to the trading session on stock markets. The U.S. commerce department reported on Friday that retail sales unexpectedly declined in December suggesting the country's economy had slowed in the fourth quarter. Retail sales fell by 0.1% in December after a revised 0.4% growth in November. Meanwhile the Federal Reserve reported on Friday that industrial production contracted more than expected in the U.S. in December. The corresponding index fell by 0.4% m/m, while economists had expected a more modest decline of 0.2%. Industrial production fell by 1.8% on an annualized basis.

Market participants also paid attention to comments by Federal Reserve's William Dudley. He admitted that inflation expectations weakened and he would not wish to see the situation worsen.

The Australian dollar rose on domestic inflation data. The TD Securities reported that consumer prices rose by 0.2% in December after the 0.1% rise in November. Inflation rose by 2.0% on a y/y basis. The Reserve Bank of Australia's target range is 2-3%.

EUR/USD: the pair fell to $1.0881 in Asian trade

USD/JPY: the pair rose to Y117.23

GBP/USD: the pair climbed to $1.4276

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

21:00 New Zealand NZIER Business Confidence Quarter IV -14%

-

07:11

Options levels on monday, January 18, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1024 (2914)

$1.0984 (1866)

$1.0957 (1528)

Price at time of writing this review: $1.0896

Support levels (open interest**, contracts):

$1.0863 (517)

$1.0825 (1254)

$1.0772 (3877)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 37216 contracts, with the maximum number of contracts with strike price $1,1050 (3502);

- Overall open interest on the PUT options with the expiration date February, 5 is 52873 contracts, with the maximum number of contracts with strike price $1,0700 (7953);

- The ratio of PUT/CALL was 1.42 versus 1.38 from the previous trading day according to data from January, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.4504 (1056)

$1.4406 (169)

$1.4310 (25)

Price at time of writing this review: $1.4273

Support levels (open interest**, contracts):

$1.4190 (1020)

$1.4094 (627)

$1.3996 (240)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 20561 contracts, with the maximum number of contracts with strike price $1,4700 (3091);

- Overall open interest on the PUT options with the expiration date February, 5 is 19739 contracts, with the maximum number of contracts with strike price $1,4550 (2011);

- The ratio of PUT/CALL was 0.96 versus 0.93 from the previous trading day according to data from January, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:34

Japan: Industrial Production (MoM) , November -0.9% (forecast -1.0%)

-

05:34

Japan: Industrial Production (YoY), 1.7% (forecast 1.6%)

-

05:32

Japan: Tertiary Industry Index , November -0.8%

-

01:32

Australia: New Motor Vehicle Sales (MoM) , December -0.5%

-

01:32

Australia: New Motor Vehicle Sales (YoY) , December 2.2%

-

01:02

Currencies. Daily history for Jan 15’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0917 +0,49%

GBP/USD $1,4251 -1,12%

USD/CHF Chf1,0019 -0,29%

USD/JPY Y116,95 -0,94%

EUR/JPY Y127,67 -0,45%

GBP/JPY Y166,66 -2,07%

AUD/USD $0,6859 -1,79%

NZD/USD $0,6457 -0,23%

USD/CAD C$1,4528 +1,12%

-