Noticias del mercado

-

22:47

New Zealand: CPI, y/y, Quarter IV 0.1% (forecast 0.4%)

-

22:46

New Zealand: CPI, q/q , Quarter IV -0.5% (forecast -0.2%)

-

22:01

U.S.: Net Long-term TIC Flows , November 31.4

-

22:00

U.S.: Total Net TIC Flows, November -3.2

-

20:20

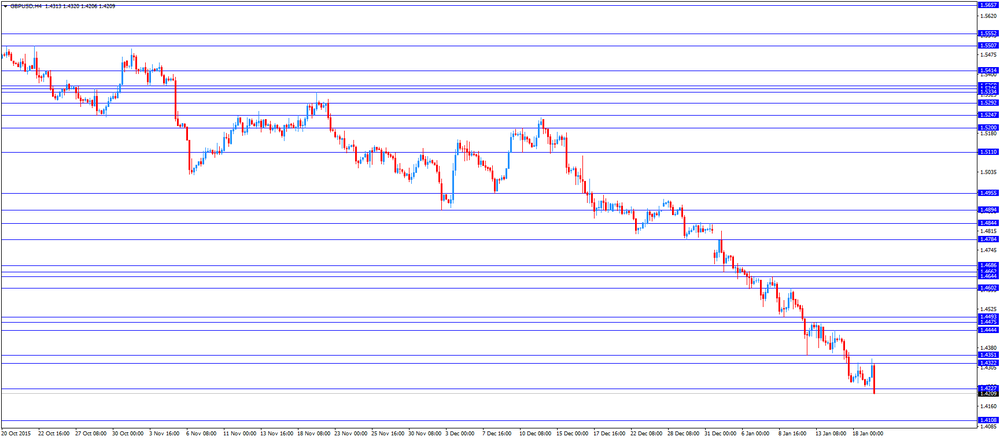

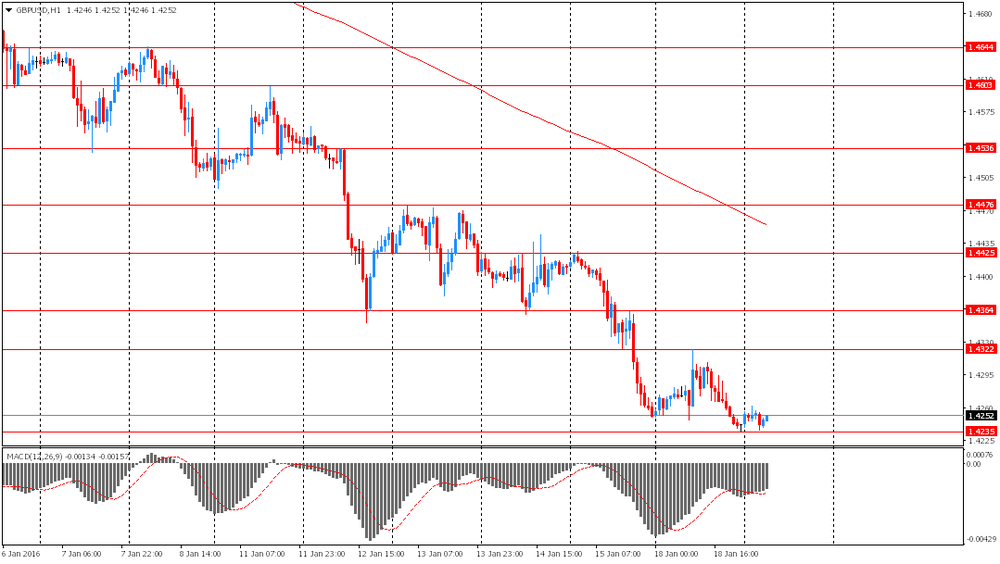

American focus: the pound fell

The British pound fell to a minimum of seven to the dollar after the Bank of England to the head Mark Carney that he does not have "a clear timetable" for raising interest rates. Carney said that now is not the time to raise rates, and added that the British economy is more vulnerable to the problems of the world economy than the United States. He said he expected lower price pressures in 2016. Carney also reiterated that further economic growth and inflation, before the Central Bank will begin to raise interest rates, adding that further increases will be carried out smoothly and gradually.

Earlier today, the Office for National Statistics reported that consumer prices in the UK rose to a 11-month high in December, but at the end of 2015 the rate of increase was the lowest since the start of statistics (1950). According to the report, consumer price index rose in December by 0.1 percent on a monthly basis and by 0.2 percent per annum (maximum increase since January 2015), which was partly due to the highest annual increases in prices of air tickets for 5 years. Experts expect that the prices will remain unchanged in comparison with November, and will grow by 0.2 percent in annual terms. Overall, the 2015 inflation averaged 0.0 percent compared with 1.5 percent in 2014. The last reading was the lowest since 1950. Weak price pressures and an impressive increase in wages will keep the Central Bank from raising interest rates any time soon, especially if the rate of increase in salaries continue to slow down, and the weakness of the world economy have a negative impact on the UK industry. It is currently expected that the Central Bank will raise interest rates only in the 3rd quarter of this year. Also, the data showed that core consumer price index, which excludes the cost of energy, food, alcohol and tobacco, rose to 1.4 percent from 1.2 percent in November. It had expected the index to increase by 1.2 percent. Inflation in the service sector grew at its fastest pace since September 2013, by 2.9 percent per annum. Meanwhile, the prices-received index fell to the manufacturers 1.2 percent, confirming the assessment of experts.

The US dollar rose slightly due to the improvement in risk appetite due to the increase in oil prices and expectations of new stimulus measures in China. China's economic growth met expectations of analysts, but showed the worst result in 25 years, strengthening hopes to introduce measures of monetary easing in the second largest economy in the world, probably by early February. Economic data boosted the index Shanghai SE Composite by 3.25% and reduced the anxiety of a slowdown in the world economy. At that time, as the news from China contributed to the strengthening of the dollar and an increase in US equity markets, analysts were quick to warn that we are probably not talking about a global turn, which hoped investors with long dollar positions. "Today has been a surge in the Chinese stock market, and coupled with the increase in oil prices that helped strengthen currencies dollar bloc, putting pressure on the euro and the yen - said the chief specialist in the global foreign exchange strategy at Brown BrothersHarriman & Co Mark Chandler. - But I would say that it is too early to expect a turning point. "

The euro rose against the dollar after declining in the first half of the day on the background data for Germany and the euro zone. The research results, published by the Centre for European Economic Research (ZEW), revealed that the level of economic confidence in Germany worsened in January, reaching at this 3-month low. According to the indicator of economic sentiment fell to 10.2 in January from 16.1 in December. The last reading was the lowest since October 2015. However, the index was higher than the forecasts of experts at the level of 9 points. We also learned, assessment of the current situation improved slightly in January - the corresponding indicator rose by 4.7 points to 59.7 points.

Meanwhile, the final data provided by the statistical agency Eurostat showed that annual inflation in the eurozone was 0.2% in December, against 0.1% in the previous month. Last modified in line with expectations and a preliminary estimate. Among the countries of the European Union annual inflation was 0.2% as compared to 0.1% in November. The maximum rise in prices in the euro area (in annual terms) was seen in cafes and restaurants (+ 0.10%). Vegetables and tobacco rose by 0.06%, while prices for fuel for transport and heating oil fell by 0.40% and 0.19% respectively. Meanwhile, the cost of gas decreased by 0.1%.

It had little impact as updated forecasts from the IMF. Recall now the IMF has lowered the forecast for global growth in 2016 from 3.6% to 3.4%. The reason for the revision was the problems in the Chinese economy. To the downside risks also include greater strengthening of the US dollar and increased risk aversion. US GDP forecast for 2016 was lowered to 2.6% from 2.8%, and the forecast for eurozone GDP had increased by 0.1% to 1.7%.

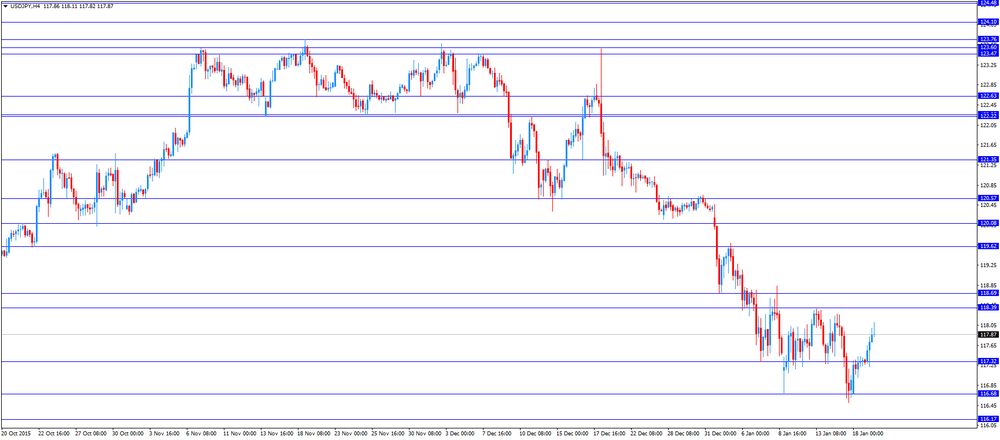

The yen fell against the dollar earlier, breaking the mark of Y118.00, which is associated with a decrease in demand for safe-haven assets amid recovery in prices for oil and copper, as well as expectations of new stimulus measures from the Chinese authorities. Investors also drew attention to the statements of the Bank of Japan's Haruhiko Kuroda, who said today that the central bank has "many tools" to revive inflation. So he dismissed fears that after the aggressive easing of monetary policy for almost three years, a set of tools to further stimulate the economy and inflation could dry out. This statement Kuroda made at a time when the market is increasingly discussing the likelihood of expansion of the asset purchase program at the next meeting of the Bank of Japan, scheduled for the end of January. Now the volume of the program is 80 trillion yen.

-

18:07

Former Fed Chairman Ben Bernanke: the slowdown in the Chinese economy was not the main risk to the global economy

Former Fed Chairman Ben Bernanke said on Tuesday that the slowdown in the Chinese economy was not the main risk to the global economy, adding that a global savings glut was a risk to the global economy.

He noted that the People's Bank of China (PBoC) should be more transparent.

Bernanke also said that markets probably overreacted to China's weak economic data, adding that the correlation between different markets is higher than that between markets and the economy.

He noted that he does not believe that the U.S. dollar will continue to strengthen.

-

17:52

European Central Bank Governing Council member François Villeroy de Galhau: France’s economic growth is disappointing

European Central Bank (ECB) Governing Council member and Governor of the Banque de France, François Villeroy de Galhau, said on Tuesday that France's economic growth was disappointing and remains below the average in the Eurozone. He added that France's and the Eurozone's economies were recovering.

-

16:53

The People's Bank of China plans to inject over 600 billion yuan into market

The People's Bank of China (PBoC) said on its website on Tuesday that it plans to inject over 600 billion yuan ($91 billion) into market to boost liquidity via its tools of the standing lending facility (SLF), medium-term lending facility (MLF) and pledged supplementary lending (PSL).

-

16:37

European Central Bank’s bank lending survey: borrowing conditions for businesses in the Eurozone are expected to continue to improve

The European Central Bank (ECB) said in its bank lending survey (BLS) on Tuesday that borrowing conditions for businesses in the Eurozone are expected to continue to improve.

"Banks continued to ease their terms and conditions on new loans across all categories, mainly driven by a further narrowing of margins on average loans. As with credit standards, the main factor contributing to the easing in terms and conditions was competition," the central bank said.

Demand for loans, especially for loans to enterprises, continued to rise, according to the survey.

-

16:14

NAHB housing market index remains unchanged at 60 in January

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index remained unchanged at 60 in January, missing expectations for an increase to 61. December's figure was revised down from 61.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index decreased to 44 in January from 46 in December, the current sales conditions sub-index increased to 67 from 65, while the sub-index measuring sales expectations in the next six months dropped to 63 from 66.

"After eight months hovering in the low 60s, builder sentiment is reflecting that many markets continue to show a gradual improvement, which should bode well for future home sales in the year ahead," the NAHB Chairman Tom Woods said.

"The economic outlook remains promising, as consumers regain confidence and home values increase, which will help the housing market move forward," the NAHB Chief Economist David Crowe said.

-

16:00

U.S.: NAHB Housing Market Index, January 60 (forecast 61)

-

15:02

International Monetary Fund’s World Economic Outlook: the lender cuts its global growth forecast for 2016 and 2017

The International Monetary Fund (IMF) released its World Economic Outlook on Tuesday. The IMF lowered its global economic growth forecasts due to a modest recovery in advanced economies and the slowdown in emerging economies.

The global economy will expand 3.4% in 2016, down from the previous forecast of 3.6%, and 3.6% in 2017, down from the previous forecast of 3.8%, according to the IMF.

"This coming year is going to be a year of great challenges and policymakers should be thinking about short-term resilience and the ways they can bolster it, but also about the longer-term growth prospects," Maurice Obstfeld, the IMF Economic Counsellor and Director of the Research Department, said.

The IMF said in its report that main risks to the outlook are China's rebalancing of its economy, lower commodity prices, and further interest rate hikes in the United States.

The IMF cut its growth forecasts in advanced economies to 2.1% in 2016 and 2017, down from 2.2% each, while emerging markets expected to expand 4.3% in 2016 and 4.7% in 2017.

The lender upgraded its growth forecast for the Eurozone for 2016 and 2017 to 1.7%.

The U.S. economy is expected to grow 2.6% in 2016 and in 2016, down from the previous forecast of 2.8% each.

China's economy is expected to expand 6.3% in 2016 and 6.0% in 2017, while India's economy is expected to grow 7.5% in 2016 and in 2017.

UK's GDP is expected to rise 2.2% in 2016 and in 2017.

-

14:47

Bank of England Governor Mark Carney: "now is not yet the time to raise interest rates"

The Bank of England (BoE) Governor Mark Carney said in a speech on Tuesday that "now is not yet the time to raise interest rates".

"Well the year has turned, and, in my view, the decision proved straightforward: now is not yet the time to raise interest rates," he said.

Carney noted that he wants to see the sustainable economic growth and a rise inflation before the central bank will start raising its interest rates.

The BoE governor pointed out that the U.K. economic growth slowed, while inflation fell due to low oil prices and will remain at low levels for longer.

-

14:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0875 (EUR 382m) 1.0910 (644m)

NZD/USD 0.6575 (NZD 1.24bln) 0.6700 (1.2bln)

AUD/NZD 1.0650 (AUD 203m)

-

14:37

Foreign investors add C$2.58 billion of Canadian securities in November

Statistics Canada released foreign investment figures on Tuesday. Foreign investors added C$2.58 billion of Canadian securities in November, missing expectations for a C$12.10 rise, after an investment of C$19.08 billion in October. October's figure was revised down from an investment of C$22.08 billion.

Canadian investors added C$16.5 billion of foreign securities in November, mainly U.S. securities.

-

14:30

Canada: Foreign Securities Purchases, November 2.48 (forecast 12.10)

-

14:17

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Industrial Production y/y December 6.2% 6.0% 5.9%

02:00 China Retail Sales y/y December 11.2% 11.3% 11.1%

02:00 China Fixed Asset Investment December 10.2% 10.2% 10.0%

02:00 China GDP y/y Quarter IV 6.9% 6.8% 6.8%

07:00 Germany CPI, m/m (Finally) December 0.1% -0.1% -0.1%

07:00 Germany CPI, y/y (Finally) December 0.4% 0.3% 0.3%

08:15 Switzerland Producer & Import Prices, m/m December 0.4% 0.2% -0.4%

08:15 Switzerland Producer & Import Prices, y/y December -5.5% -5.5%

09:00 Eurozone Current account, unadjusted, bln November 27.5 Revised From 25.9 29.8

09:30 United Kingdom Producer Price Index - Output (MoM) December -0.2% -0.2% -0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) December -13.1% -11.9% -10.8%

09:30 United Kingdom Producer Price Index - Input (MoM) December -1.6% -1.8% -0.8%

09:30 United Kingdom Producer Price Index - Output (YoY) December -1.5% -1.2% -1.2%

09:30 United Kingdom Retail Price Index, m/m December 0.1% 0.1% 0.3%

09:30 United Kingdom Retail prices, Y/Y December 1.1% 1.1% 1.2%

09:30 United Kingdom HICP, m/m December 0.0% 0% 0.1%

09:30 United Kingdom HICP, Y/Y December 0.1% 0.2% 0.2%

09:30 United Kingdom HICP ex EFAT, Y/Y December 1.2% 1.2% 1.4%

10:00 Eurozone ZEW Economic Sentiment January 33.9 27.9 22.7

10:00 Eurozone Construction Output, y/y November 1.1% 2.1%

10:00 Eurozone Harmonized CPI December -0.1% 0% 0.0%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December 0.2% 0.2% 0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December 0.9% 0.9% 0.9%

10:00 Germany ZEW Survey - Economic Sentiment January 16.1 9 10.

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. NAHB housing market index. The NAHB housing market index is expected to remain unchanged at 61 in January.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 10.2 in January from 16.1 in December, beating expectations for a fall to 9.0.

"The beginning of the new year is characterised by capital market turmoil in China, which has also led to significant share price declines in Germany. As in the previous year, weak economic growth in China and other important emerging markets puts a strain on Germany's economic outlook," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 22.7 in January from 33.9 in December, missing expectations for a decline to 27.9.

Eurostat released its final consumer price inflation data for the Eurozone on Tuesday. Eurozone's harmonized consumer price index was flat in December, in line with expectations, after a 0.1% decrease in November.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in December, in line with the preliminary reading.

Construction production in the Eurozone increased 0.8% in November, after a 0.6% rise in October.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus increased to a seasonally adjusted €26.4 billion in November from €25.6 billion in October. October's figure was revised up from a surplus of €20.4 billion.

The British pound traded lower against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney. He said in a speech on Tuesday that "now is not yet the time to raise interest rates".

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.2% year-on-year in December from 0.1% in November, in line with expectations. It was the highest reading since January 2015.

The rise was driven by an increase in air fares, which climbed 46% in December. It was the highest rise since 2002.

On a monthly basis, U.K. consumer prices increased 0.1% in December, beating expectations for a flat reading, after a flat reading in November.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% year-on-year in December from 1.2% in November, beating expectations for a 1.2% gain.

The Retail Prices Index climbed to 1.2% year-on-year in December from 1.1% in November, exceeding expectations for an increase to 1.1%.

In 2015 as a whole, consumer price inflation was 0%, down from 1.5% in 2014. It was the lowest level since 1950.

The consumer price inflation is below the Bank of England's 2% target.

The U.K. house price index rose at a seasonally adjusted rate of 0.8% in November, after a 0.8% increase in October.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.7% in November, after a 7.0% in October. It was the highest rise since March.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Foreign investors are expected to add C$12.1 billion of Canadian securities in November, after an investment of C$22.08 billion in October.

The Swiss franc traded higher against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices fell 0.4% in December, missing expectations for a 0.2% gain, after a 0.4% increase in November.

The decrease was mainly driven by lower prices for mineral oil products.

The Import Price Index decreased by 0.8% in December, while producer prices fell 0.3%.

On a yearly basis, producer and import prices plunged 5.5% in December, after a 5.5% drop in November.

The Import Price Index fell by 9.7% year-on year in December, while producer prices dropped 3.6%.

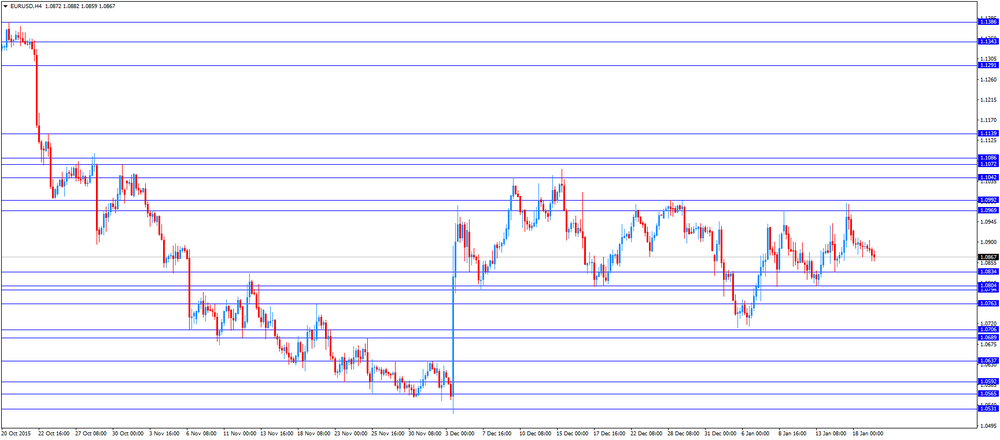

EUR/USD: the currency pair mixed

GBP/USD: the currency pair rose to $1.4322

USD/JPY: the currency pair increased to Y118.11

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases November 22.08 12.10

15:00 U.S. NAHB Housing Market Index January 61 61

21:00 U.S. Net Long-term TIC Flows November -16.6

21:00 U.S. Total Net TIC Flows November 68.9

21:45 New Zealand CPI, q/q Quarter IV 0.3% -0.2%

21:45 New Zealand CPI, y/y Quarter IV 0.4% 0.4%

23:30 Australia Westpac Consumer Confidence January -0.8%

-

14:00

Orders

EUR/USD

Offers 1.0900 1.0920 1.0935 1.0950 1.0965 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0855-60 1.0840 1.0825 1.0800-10 1.0780-85 1.0750 1.0720 1.0700 1.0675 1.0650

GBP/USD

Offers 1.4325-30 1.4350 1.4380 1.4400 1.4425 1.4450 1.4480 1.4500

Bids 1.4285 1.4270 1.4250 1.4225-30 1.4200 1.4175 1.4150

EUR/GBP

Offers 0.7625 0.7645-50 0.7665 0.7680 0.7700 0.7730 0.7750

Bids 0.7580-85 0.7550 0.7525 0.7500 0.7475-80 0.7450 0.7420 0.7400

EUR/JPY

Offers 128.30 128.50 128.80 129.00 129.30 129.50

Bids 128.00 127.80 127.50 127.30 127.00 126.80 126.50

USD/JPY

Offers 118.00.118.25 118.40 118.60 118.80-85 119.00 119.30 119.50

Bids 117.75 117.50 117.20 117.00 116.85 116.65 116.50 116.30 116.00

AUD/USD

Offers 0.6930 0.6950 0.6980 0.7000 0.7025-30 0.7050-55 0.7080 0.7100

Bids 0.6900 0.6875-80 0.6850 0.6830 0.6800 0.6785 0.6750

-

12:05

German final consumer price inflation falls 0.1% in December

Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index were down 0.1% in December, in line with the preliminary estimate, after a 0.1% rise in November.

On a yearly basis, German final consumer price index declined to 0.3% in December from 0.4% in November, in line with the preliminary estimate.

The decline was partly driven by a decline in energy prices, which dropped 6.5% year-on-year in December, while food prices climbed 1.4%.

Consumer prices excluding energy increased 1.1% year-on-year in December.

-

11:59

Switzerland's producer and import prices are down 0.4% in December

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices fell 0.4% in December, missing expectations for a 0.2% gain, after a 0.4% increase in November.

The decrease was mainly driven by lower prices for mineral oil products.

The Import Price Index decreased by 0.8% in December, while producer prices fell 0.3%.

On a yearly basis, producer and import prices plunged 5.5% in December, after a 5.5% drop in November.

The Import Price Index fell by 9.7% year-on year in December, while producer prices dropped 3.6%.

-

11:53

Eurozone’s current account surplus climbs to a seasonally adjusted €26.4 billion in November

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus increased to a seasonally adjusted €26.4 billion in November from €25.6 billion in October. October's figure was revised up from a surplus of €20.4 billion.

The trade surplus declined to €27.0 billion in November from €28.1 billion in October.

The surplus on services increased to €5.9 billion in November from €5.2 billion in October.

The primary income surplus climbed to €4.5 billion in November from €3.6 billion in October, while the secondary income deficit decreased to €11.0 billion from €11.2 billion.

Eurozone's unadjusted current account surplus rose to €29.8 billion in November from €27.5 billion in October. October's figure was revised up from a surplus of €25.9 billion.

-

11:46

UK house price inflation rises 0.8% in November

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index rose at a seasonally adjusted rate of 0.8% in November, after a 0.8% increase in October.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.7% in November, after a 7.0% in October. It was the highest rise since March.

The higher house price inflation was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £288,000 in November, up from £287,000 in October.

-

11:41

UK consumer price inflation rises rose to 0.2% year-on-year in December

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.2% year-on-year in December from 0.1% in November, in line with expectations. It was the highest reading since January 2015.

The rise was driven by an increase in air fares, which climbed 46% in December. It was the highest rise since 2002.

On a monthly basis, U.K. consumer prices increased 0.1% in December, beating expectations for a flat reading, after a flat reading in November.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% year-on-year in December from 1.2% in November, beating expectations for a 1.2% gain.

The Retail Prices Index climbed to 1.2% year-on-year in December from 1.1% in November, exceeding expectations for an increase to 1.1%.

In 2015 as a whole, consumer price inflation was 0%, down from 1.5% in 2014. It was the lowest level since 1950.

The consumer price inflation is below the Bank of England's 2% target.

-

11:33

Eurozone's harmonized consumer price index is flat in December

Eurostat released its final consumer price inflation data for the Eurozone on Tuesday. Eurozone's harmonized consumer price index was flat in December, in line with expectations, after a 0.1% decrease in November.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Restaurants and cafés prices were up 0.10% year-on-year in December, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.40%, heating oil prices decreased by 0.10%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in December, in line with the preliminary reading.

-

11:26

Construction production in the Eurozone increases 0.8% in November

The Eurostat released its construction production data for the Eurozone on Tuesday. Construction production in the Eurozone increased 0.8% in November, after a 0.6% rise in October.

Civil engineering output declined 0.3% in November, while production in the building sector was up 1.1%.

On a yearly basis, construction output increased 2.1% in November, after a 1.1% gain in October.

Civil engineering output fell 0.5% year-on-year in November, while production in the building sector climbed 2.7% year-on-year.

-

11:19

Germany's ZEW economic sentiment index declines to 10.2 in January

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 10.2 in January from 16.1 in December, beating expectations for a fall to 9.0.

The assessment of the current situation in Germany rose by 4.7 points to 59.7 points.

"The beginning of the new year is characterised by capital market turmoil in China, which has also led to significant share price declines in Germany. As in the previous year, weak economic growth in China and other important emerging markets puts a strain on Germany's economic outlook," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 22.7 in January from 33.9 in December, missing expectations for a decline to 27.9.

The assessment of the current situation in the Eurozone rose by 2.1 points to -7.5 points.

-

11:02

Eurozone: Construction Output, y/y, November 2.1%

-

11:02

Eurozone: ZEW Economic Sentiment, January 22.7 (forecast 27.9)

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, December 0.9% (forecast 0.9%)

-

11:00

Germany: ZEW Survey - Economic Sentiment, January 10.2 (forecast 9)

-

11:00

Eurozone: Harmonized CPI, Y/Y, December 0.2% (forecast 0.2%)

-

11:00

Eurozone: Harmonized CPI, December 0.0% (forecast 0%)

-

10:57

China’s industrial production increases 5.9% year-on-year in December

The National Bureau of Statistics said on Tuesday that China's industrial production increased 5.9% year-on-year in December, missing expectations for a 6.0% rise, down from a 6.2% gain in November.

Fixed-asset investment in China climbed 10.0% year-on-year in the January-December period, missing expectations for a 10.2% increase, after a 10.2% rise in the January-November period.

Retail sales in China increased 11.1% year-on-year in December, missing expectations for a 11.3% gain, after a 11.2% rise in November.

These data added to concerns over the slowdown in the Chinese economy.

-

10:45

China’s economy grows 6.9% in 2015

China's National Bureau of Statistics released its gross domestic product (GDP) data on Tuesday. The country's economy expanded 6.8% in the fourth quarter of 2015, after a 6.9% rise in the third quarter. It was the slowest rise since 2009.

In 2015 as whole, China's economy grew 6.9%, after a 7.3% increase in 2014. It was the slowest growth since 1990.

-

10:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0875 (EUR 382m) 1.0910 (644m)

NZD/USD 0.6575 (NZD 1.24bln) 0.6700 (1.2bln)

AUD/NZD 1.0650 (AUD 203m)

-

10:34

Bank of Japan Governor Haruhiko Kuroda: the central bank will do everything to reach 2% inflation target

Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Tuesday that the central bank will do everything to reach 2% inflation target, noting that the central bank has "plenty of tools".

He added that inflation was improving.

-

10:30

United Kingdom: Retail prices, Y/Y, December 1.2% (forecast 1.1%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , December -10.8% (forecast -11.9%)

-

10:30

United Kingdom: Retail Price Index, m/m, December 0.3% (forecast 0.1%)

-

10:30

United Kingdom: HICP, Y/Y, December 0.2% (forecast 0.2%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), December -0.2% (forecast -0.2%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), December -0.8% (forecast -1.8%)

-

10:30

United Kingdom: HICP, m/m, December 0.1% (forecast 0%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , December -1.2% (forecast -1.2%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, December 1.4% (forecast 1.2%)

-

10:24

Bank of England's Monetary Policy Committee member Gertjan Vlieghe would wait until the economic growth was stabilising and inflation was rising before backing an interest rate hike

The Bank of England's (BoE) Monetary Policy Committee member Gertjan Vlieghe said in a speech on Monday that he would wait until the economic growth was stabilising and inflation was rising before backing an interest rate hike.

"The recent evolution of the UK data has been one of growth that is still solid, but has been slowing. Inflation pressures remain muted across a wide range of indicators, despite low levels of unemployment. In order to be confident enough of the medium-term inflation outlook to raise Bank Rate, I would like to see evidence that growth is not slowing further, and that a broad range of indicators related to inflation are generally on an upward trajectory from their current low levels," he said.

Vlieghe added that interest rate will remain "significantly lower than in the past".

-

10:00

Eurozone: Current account, unadjusted, bln , November 29.8

-

09:15

Switzerland: Producer & Import Prices, y/y, December -5.5%

-

09:15

Switzerland: Producer & Import Prices, m/m, December -0.4% (forecast 0.2%)

-

08:13

Foreign exchange market. Asian session: the yen declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 China Industrial Production y/y December 6.2% 6.0% 5.9%

02:00 China Retail Sales y/y December 11.2% 11.3% 11.1%

02:00 China Fixed Asset Investment December 10.2% 10.2% 10.0%

02:00 China GDP y/y Quarter IV 6.9% 6.8% 6.8%

07:00 Germany CPI, m/m (Finally) December 0.1% -0.1% -0.1%

07:00 Germany CPI, y/y (Finally) December 0.4% 0.3% 0.3%

The yen declined against the U.S. dollar after Bank of Japan Governor Haruhiko Kuroda said the bank had many tools to revive inflation. These comments were made on the background of rumors of expansion of the asset purchase program, which currently stands at ¥80 trillion.

The Australian dollar declined amid disappointing data from its major trading partner China. The country's economic growth slowed to 6.8% in the fourth quarter of 2015. Meanwhile the economy expanded by 6.9% over 2015, marking the weakest result since 1990. These data confirmed talks about the economy losing momentum. Retail sales rose by 11.1% y/y in China in December compared to slightly faster growth of 11.2% in November.

EUR/USD: the fluctuated within $1.0880-00 in Asian trade

USD/JPY: the pair traded within Y117.20-70

GBP/USD: the pair traded within $1.4235-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Producer & Import Prices, m/m December 0.4% 0.2%

08:15 Switzerland Producer & Import Prices, y/y December -5.5%

09:00 Eurozone Current account, unadjusted, bln November 25.9

09:30 United Kingdom Producer Price Index - Output (MoM) December -0.2% -0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) December -13.1% -11.9%

09:30 United Kingdom Producer Price Index - Input (MoM) December -1.6% -1.8%

09:30 United Kingdom Producer Price Index - Output (YoY) December -1.5% -1.2%

09:30 United Kingdom Retail Price Index, m/m December 0.1% 0.1%

09:30 United Kingdom Retail prices, Y/Y December 1.1% 1.1%

09:30 United Kingdom HICP, m/m December 0.0% 0%

09:30 United Kingdom HICP, Y/Y December 0.1% 0.2%

09:30 United Kingdom HICP ex EFAT, Y/Y December 1.2% 1.2%

10:00 Eurozone ZEW Economic Sentiment January 33.9 27.9

10:00 Eurozone Construction Output, y/y November 1.1%

10:00 Eurozone Harmonized CPI December -0.1% 0%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December 0.2% 0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December 0.9% 0.9%

10:00 Germany ZEW Survey - Economic Sentiment January 16.1 9

13:30 Canada Foreign Securities Purchases November 22.08 12.10

15:00 U.S. NAHB Housing Market Index January 61 61

21:00 U.S. Net Long-term TIC Flows November -16.6

21:00 U.S. Total Net TIC Flows November 68.9

21:45 New Zealand CPI, q/q Quarter IV 0.3% -0.2%

21:45 New Zealand CPI, y/y Quarter IV 0.4% 0.4%

23:30 Australia Westpac Consumer Confidence January -0.8%

-

08:01

Germany: CPI, m/m, December -0.1% (forecast -0.1%)

-

08:00

Germany: CPI, y/y , December 0.3% (forecast 0.3%)

-

07:10

Options levels on tuesday, January 19, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1024 (2914)

$1.0984 (1866)

$1.0957 (1528)

Price at time of writing this review: $1.0879

Support levels (open interest**, contracts):

$1.0863 (517)

$1.0825 (1254)

$1.0772 (3877)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 37216 contracts, with the maximum number of contracts with strike price $1,1050 (3502);

- Overall open interest on the PUT options with the expiration date February, 5 is 52873 contracts, with the maximum number of contracts with strike price $1,0700 (7953);

- The ratio of PUT/CALL was 1.42 versus 1.38 from the previous trading day according to data from January, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.4504 (1056)

$1.4406 (169)

$1.4310 (25)

Price at time of writing this review: $1.4272

Support levels (open interest**, contracts):

$1.4190 (1020)

$1.4094 (627)

$1.3996 (240)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 20561 contracts, with the maximum number of contracts with strike price $1,4700 (3091);

- Overall open interest on the PUT options with the expiration date February, 5 is 19739 contracts, with the maximum number of contracts with strike price $1,4550 (2011);

- The ratio of PUT/CALL was 0.96 versus 0.93 from the previous trading day according to data from January, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:02

China: Fixed Asset Investment, December 10.0% (forecast 10.2%)

-

03:01

China: Retail Sales y/y, December 11.1% (forecast 11.3%)

-

03:01

China: GDP y/y, Quarter IV 6.8% (forecast 6.8%)

-

03:00

China: Industrial Production y/y, December 5.9% (forecast 6.0%)

-

00:33

Currencies. Daily history for Jan 18’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0891 -0,24%

GBP/USD $1,4242 -0,06%

USD/CHF Chf1,005 +0,31%

USD/JPY Y117,32 +0,32%

EUR/JPY Y127,79 +0,09%

GBP/JPY Y167,07 +0,25%

AUD/USD $0,6863 +0,06%

NZD/USD $0,6450 -0,11%

USD/CAD C$1,4558 +0,21%

-

00:00

Schedule for today, Tuesday, Jan 19’2016:

(time / country / index / period / previous value / forecast)

02:00 China Industrial Production y/y December 6.2% 6.0%

02:00 China Retail Sales y/y December 11.2% 11.3%

02:00 China Fixed Asset Investment December 10.2% 10.2%

02:00 China GDP y/y Quarter IV 6.9% 6.8%

07:00 Germany CPI, m/m (Finally) December 0.1% -0.1%

07:00 Germany CPI, y/y (Finally) December 0.4% 0.3%

08:15 Switzerland Producer & Import Prices, m/m December 0.4%

08:15 Switzerland Producer & Import Prices, y/y December -5.5%

09:00 Eurozone Current account, unadjusted, bln November 25.9

09:30 United Kingdom Producer Price Index - Output (MoM) December -0.2% -0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) December -13.1% -11.9%

09:30 United Kingdom Producer Price Index - Input (MoM) December -1.6% -1.8%

09:30 United Kingdom Producer Price Index - Output (YoY) December -1.5% -1.2%

09:30 United Kingdom Retail Price Index, m/m December 0.1% 0.1%

09:30 United Kingdom Retail prices, Y/Y December 1.1% 1.1%

09:30 United Kingdom HICP, m/m December 0.0% 0%

09:30 United Kingdom HICP, Y/Y December 0.1% 0.2%

09:30 United Kingdom HICP ex EFAT, Y/Y December 1.2% 1.2%

10:00 Eurozone ZEW Economic Sentiment January 33.9

10:00 Eurozone Construction Output, y/y November 1.1%

10:00 Eurozone Harmonized CPI December -0.1% 0%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December 0.2% 0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December 0.9% 0.9%

10:00 Germany ZEW Survey - Economic Sentiment January 16.1 9

13:30 Canada Foreign Securities Purchases November 22.08

15:00 U.S. NAHB Housing Market Index January 61 61

21:00 U.S. Net Long-term TIC Flows November -16.6

21:00 U.S. Total Net TIC Flows November 68.9

21:45 New Zealand CPI, q/q Quarter IV 0.3%

21:45 New Zealand CPI, y/y Quarter IV 0.4%

23:30 Australia Westpac Consumer Confidence January -0.8%

-