Noticias del mercado

-

22:07

US stocks closed

The Standard & Poor's 500 Index closed little changed as consumer shares led an advance, offsetting fresh signs of weakness in crude oil and corporate earnings after economic data in China helped ease some investor concern over a hard landing there.

In contrast to U.S. shares, European and Asian stocks rose amid speculation of further Chinese state aid after a report showed gross domestic product in the world's second-largest economy expanded 6.9 percent in 2015, just shy of the government's 7 percent target, and the least since 1990.

Crude continued to fall Tuesday, with West Texas Intermediate futures losing 3.3 percent. The International Energy Agency trimmed its 2016 estimates for global oil demand amid weakness in China. Markets could "drown in oversupply," sending prices even lower as demand growth slows and Iran revives exports with the end of sanctions, according to the agency.

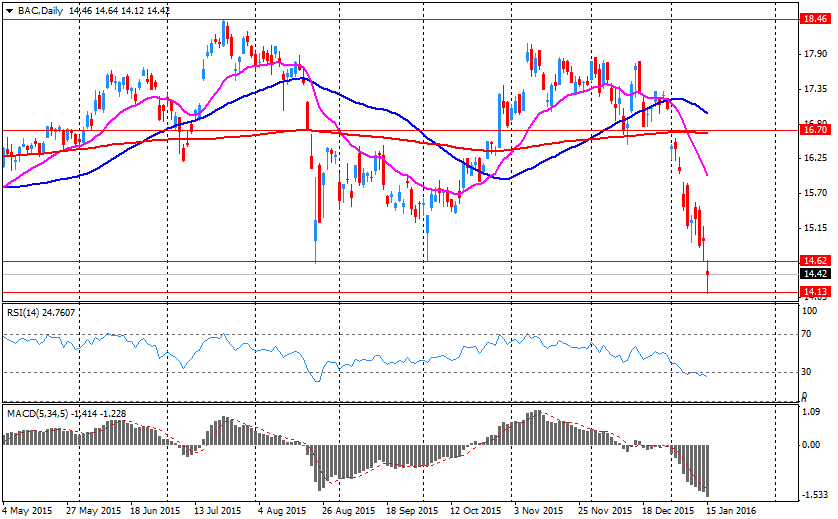

The S&P 500's renewed selling sent the gauge toward a technical signal that indicates it's oversold. Its relative strength index, which measures whether gains or losses have been too fast to sustain, fell to 30, a threshold indicating a rebound may materialize.

The last time the RSI slipped below that level was on Jan. 13, the day before a 1.7 percent rally. The time prior to that was on Aug. 25, when the S&P 500 hit a bottom and rallied 6.5 percent over the next three days.

The S&P 500 trades at 15.2 times the forecast earnings of its members, in line with the index's average of the past four years. It's more expensive than developed markets in Europe, where the Stoxx 600 Index trades for 14.1 times estimated earnings.

The equity benchmark is down almost 12 percent from its record set last May, and has slumped 9.1 percent since the Federal Reserve raised interest rates last month for the first time since 2006. Meanwhile, a measure of volatility has jumped the most since a selloff in August which sent the S&P 500 into its first correction in four years.

While investors fret over the impact China's slowdown will have on global growth, the International Monetary Fund cut its world growth outlook as the commodities slump and political gridlock push Brazil deeper into recession, plunging oil prices hobble Mideast crude producers and the rising dollar curbs U.S. prospects.

The fund also said risks to the global outlook remain tilted to the downside, with the world facing three big adjustments: the emerging-market slowdown, China's shift to growth driven less by exports and manufacturing and the Fed's gradual exit from ultra-low interest rates.

U.S. data today showed confidence among homebuilders was unchanged at the start of year, indicating the residential real estate market was sustaining the steady progress made in 2015. The National Association of Home Builders/Wells Fargo builder sentiment index held at 60 in January after the prior month was revised down a point, figures from the Washington-based group showed.

Corporate earnings are gathering more attention with investors weighing the health of the U.S. economy. Analysts project profits for index members fell 7 percent in the fourth quarter.

-

21:00

DJIA 15925.69 -62.39 -0.39%, NASDAQ 4439.38 -49.03 -1.09%, S&P 500 1867.70 -12.63 -0.67%

-

18:02

European stocks close: stocks closed higher on China's GDP data

Stock indices traded higher on China's GDP data. China's National Bureau of Statistics released its gross domestic product (GDP) data on Tuesday. The country's economy expanded 6.8% in the fourth quarter of 2015, after a 6.9% rise in the third quarter. It was the slowest rise since 2009.

In 2015 as whole, China's economy grew 6.9%, after a 7.3% increase in 2014. It was the slowest growth since 1990.

Meanwhile, the economic data from the Eurozone was mixed. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 10.2 in January from 16.1 in December, beating expectations for a fall to 9.0.

"The beginning of the new year is characterised by capital market turmoil in China, which has also led to significant share price declines in Germany. As in the previous year, weak economic growth in China and other important emerging markets puts a strain on Germany's economic outlook," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 22.7 in January from 33.9 in December, missing expectations for a decline to 27.9.

Eurostat released its final consumer price inflation data for the Eurozone on Tuesday. Eurozone's harmonized consumer price index was flat in December, in line with expectations, after a 0.1% decrease in November.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in December, in line with the preliminary reading.

Construction production in the Eurozone increased 0.8% in November, after a 0.6% rise in October.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus increased to a seasonally adjusted €26.4 billion in November from €25.6 billion in October. October's figure was revised up from a surplus of €20.4 billion.

The Bank of England (BoE) Governor Mark Carney said in a speech on Tuesday that "now is not yet the time to raise interest rates". He noted that he wants to see the sustainable economic growth and a rise inflation before the central bank will start raising its interest rates.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.2% year-on-year in December from 0.1% in November, in line with expectations. It was the highest reading since January 2015.

The rise was driven by an increase in air fares, which climbed 46% in December. It was the highest rise since 2002.

On a monthly basis, U.K. consumer prices increased 0.1% in December, beating expectations for a flat reading, after a flat reading in November.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% year-on-year in December from 1.2% in November, beating expectations for a 1.2% gain.

The Retail Prices Index climbed to 1.2% year-on-year in December from 1.1% in November, exceeding expectations for an increase to 1.1%.

In 2015 as a whole, consumer price inflation was 0%, down from 1.5% in 2014. It was the lowest level since 1950.

The consumer price inflation is below the Bank of England's 2% target.

The U.K. house price index rose at a seasonally adjusted rate of 0.8% in November, after a 0.8% increase in October.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.7% in November, after a 7.0% in October. It was the highest rise since March.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,876.8 +96.88 +1.68 %

DAX 9,664.21 +142.36 +1.50 %

CAC 40 4,272.26 +82.69 +1.97 %

-

18:00

European stocks closed: FTSE 5876.80 96.88 1.68%, DAX 9664.21 142.36 1.50%, CAC 40 4272.26 82.69 1.97%

-

17:52

European Central Bank Governing Council member François Villeroy de Galhau: France’s economic growth is disappointing

European Central Bank (ECB) Governing Council member and Governor of the Banque de France, François Villeroy de Galhau, said on Tuesday that France's economic growth was disappointing and remains below the average in the Eurozone. He added that France's and the Eurozone's economies were recovering.

-

17:47

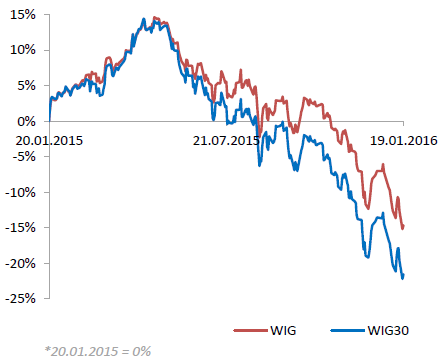

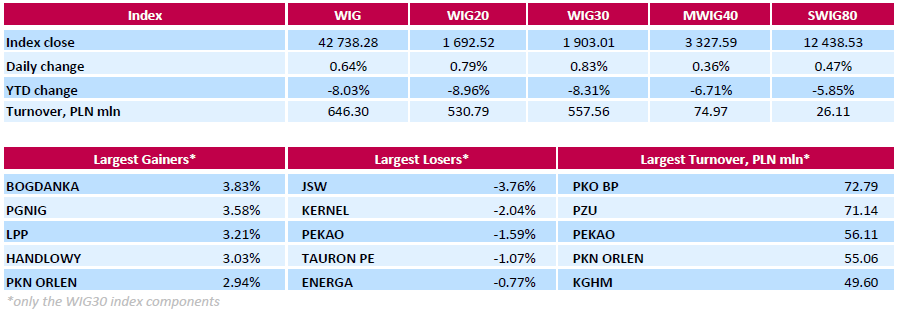

WSE: Session Results

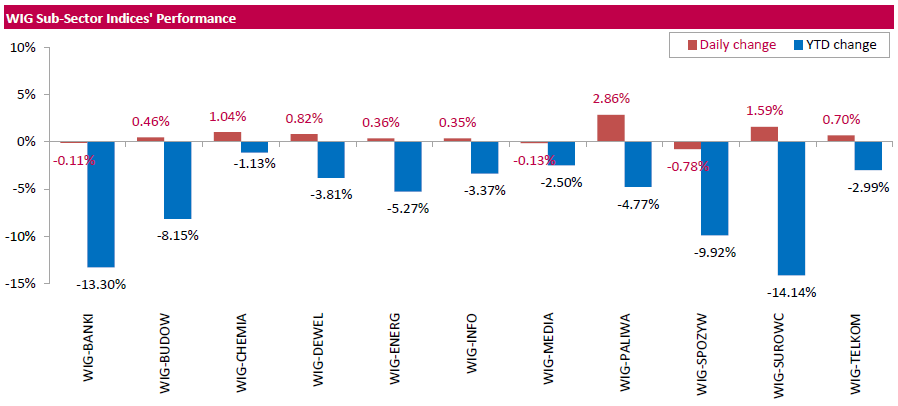

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.64%. Sector-wise, oil and gas sector stocks (+2.86%) fared the best, while food sector names (-0.78%) tumbled the most.

The large-cap stocks' measure, the WIG30 Index, added 0.83%. Within the index components, thermal coal miner BOGDANKA (WSE: LWB) led the gainers with a 3.83% advance, followed by oil and gas company PGNIG (WSE: PGN), clothing retailer LPP (WSE: LPP) and bank HANDLOWY (WSE: BHW), which grew by 3.58%, 3.21% and 3.03% respectively. At the same time, the session's biggest decliners were coking coal miner JSW (WSE: JSW), agricultural producer KERNEL (WSE: KER) and bank PEKAO (WSE: PEO), which quotations fell by 3.76%, 2.04% and 1.59% respectively.

-

17:44

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday morning, bouncing off a steep selloff on Friday and as investors were relieved that China's growth rate did not slow more than expected. China's growth in 2015 was the slowest in 25 years, raising hopes of further stimulus measures from Beijing to rebalance a slowing economy that has rattled investors across markets.

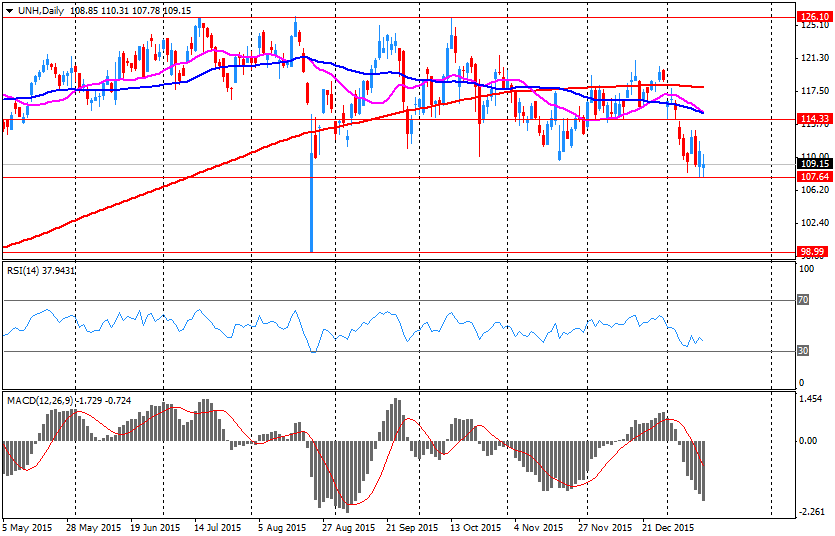

Most of Dow stocks in positive area (19 of 30). Top looser - United Technologies Corporation (UTX, -1,02%). Top gainer - UnitedHealth Group Incorporated (UNH, +3.00%).

Most of S&P sectors also in positive area. Top looser - Conglomerates (-1,6%). Top gainer - Consumer goods (+0,9%).

At the moment:

Dow 16019.00 +107.00 +0.67%

S&P 500 1885.50 +10.50 +0.56%

Nasdaq 100 4157.50 +16.75 +0.40%

Oil 30.24 -0.15 -0.49%

Gold 1085.50 -5.20 -0.48%

U.S. 10yr 2.05 +0.01

-

16:53

The People's Bank of China plans to inject over 600 billion yuan into market

The People's Bank of China (PBoC) said on its website on Tuesday that it plans to inject over 600 billion yuan ($91 billion) into market to boost liquidity via its tools of the standing lending facility (SLF), medium-term lending facility (MLF) and pledged supplementary lending (PSL).

-

16:37

European Central Bank’s bank lending survey: borrowing conditions for businesses in the Eurozone are expected to continue to improve

The European Central Bank (ECB) said in its bank lending survey (BLS) on Tuesday that borrowing conditions for businesses in the Eurozone are expected to continue to improve.

"Banks continued to ease their terms and conditions on new loans across all categories, mainly driven by a further narrowing of margins on average loans. As with credit standards, the main factor contributing to the easing in terms and conditions was competition," the central bank said.

Demand for loans, especially for loans to enterprises, continued to rise, according to the survey.

-

16:14

NAHB housing market index remains unchanged at 60 in January

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index remained unchanged at 60 in January, missing expectations for an increase to 61. December's figure was revised down from 61.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index decreased to 44 in January from 46 in December, the current sales conditions sub-index increased to 67 from 65, while the sub-index measuring sales expectations in the next six months dropped to 63 from 66.

"After eight months hovering in the low 60s, builder sentiment is reflecting that many markets continue to show a gradual improvement, which should bode well for future home sales in the year ahead," the NAHB Chairman Tom Woods said.

"The economic outlook remains promising, as consumers regain confidence and home values increase, which will help the housing market move forward," the NAHB Chief Economist David Crowe said.

-

15:35

U.S. Stocks open: Dow +0.99%, Nasdaq +1.15%, S&P +1.01%

-

15:27

Before the bell: S&P futures +1.36%, NASDAQ futures +1.41%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 17,048.37 +92.80 +0.55%

Hang Seng 19,635.81 +398.36 +2.07%

Shanghai Composite 3,008.54 +94.70 +3.25%

FTSE 5,909.29 +129.37 +2.24%

CAC 4,302.11 +112.54 +2.69%

DAX 9,727.1 +205.25 +2.16%

Crude oil $29.57 за баррель (+0.51%)

Gold $1086.40 за унцию (-0.39%)

-

15:02

International Monetary Fund’s World Economic Outlook: the lender cuts its global growth forecast for 2016 and 2017

The International Monetary Fund (IMF) released its World Economic Outlook on Tuesday. The IMF lowered its global economic growth forecasts due to a modest recovery in advanced economies and the slowdown in emerging economies.

The global economy will expand 3.4% in 2016, down from the previous forecast of 3.6%, and 3.6% in 2017, down from the previous forecast of 3.8%, according to the IMF.

"This coming year is going to be a year of great challenges and policymakers should be thinking about short-term resilience and the ways they can bolster it, but also about the longer-term growth prospects," Maurice Obstfeld, the IMF Economic Counsellor and Director of the Research Department, said.

The IMF said in its report that main risks to the outlook are China's rebalancing of its economy, lower commodity prices, and further interest rate hikes in the United States.

The IMF cut its growth forecasts in advanced economies to 2.1% in 2016 and 2017, down from 2.2% each, while emerging markets expected to expand 4.3% in 2016 and 4.7% in 2017.

The lender upgraded its growth forecast for the Eurozone for 2016 and 2017 to 1.7%.

The U.S. economy is expected to grow 2.6% in 2016 and in 2016, down from the previous forecast of 2.8% each.

China's economy is expected to expand 6.3% in 2016 and 6.0% in 2017, while India's economy is expected to grow 7.5% in 2016 and in 2017.

UK's GDP is expected to rise 2.2% in 2016 and in 2017.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.57

5.06%

188.6K

Yandex N.V., NASDAQ

YNDX

12.55

2.70%

5.1K

Yahoo! Inc., NASDAQ

YHOO

29.89

2.57%

27.0K

Goldman Sachs

GS

159.00

2.18%

1.3K

ALCOA INC.

AA

7.04

2.03%

38.3K

Boeing Co

BA

128.00

1.89%

3.9K

Hewlett-Packard Co.

HPQ

10.30

1.88%

1.0K

Facebook, Inc.

FB

96.72

1.84%

95.9K

Visa

V

73.12

1.80%

1.8K

Procter & Gamble Co

PG

76.29

1.75%

2.2K

Tesla Motors, Inc., NASDAQ

TSLA

208.51

1.72%

2.4K

JPMorgan Chase and Co

JPM

57.99

1.67%

0.6K

Apple Inc.

AAPL

98.71

1.63%

229.9K

Merck & Co Inc

MRK

51.97

1.62%

0.5K

AMERICAN INTERNATIONAL GROUP

AIG

56.99

1.60%

8.9K

McDonald's Corp

MCD

117.00

1.58%

6.9K

Caterpillar Inc

CAT

60.80

1.55%

0.8K

Citigroup Inc., NYSE

C

43.13

1.55%

74.1K

Walt Disney Co

DIS

95.35

1.54%

13.1K

Microsoft Corp

MSFT

51.75

1.49%

47.7K

Google Inc.

GOOG

704.50

1.45%

1.6K

Cisco Systems Inc

CSCO

23.96

1.44%

6.2K

Amazon.com Inc., NASDAQ

AMZN

578.06

1.38%

20.6K

Pfizer Inc

PFE

31.22

1.33%

2.5K

Home Depot Inc

HD

120.80

1.32%

0.4K

Starbucks Corporation, NASDAQ

SBUX

58.69

1.19%

3.9K

Nike

NKE

58.24

1.18%

0.7K

General Motors Company, NYSE

GM

29.92

1.18%

4.4K

Verizon Communications Inc

VZ

44.95

1.17%

23.3K

Ford Motor Co.

F

12.11

1.17%

31.8K

The Coca-Cola Co

KO

41.98

1.16%

0.4K

Exxon Mobil Corp

XOM

78.46

1.13%

27.9K

International Business Machines Co...

IBM

131.50

1.13%

3.3K

Chevron Corp

CVX

84.61

1.12%

2.3K

Johnson & Johnson

JNJ

98.09

1.12%

9.2K

Wal-Mart Stores Inc

WMT

62.61

1.10%

1.5K

General Electric Co

GE

28.80

1.09%

7.4K

Twitter, Inc., NYSE

TWTR

18.13

1.06%

27.8K

Intel Corp

INTC

30.06

1.01%

8.5K

AT&T Inc

T

34.33

1.00%

21.0K

UnitedHealth Group Inc

UNH

110.31

0.95%

0.3K

American Express Co

AXP

63.50

0.94%

0.3K

ALTRIA GROUP INC.

MO

57.67

0.82%

4.5K

Deere & Company, NYSE

DE

73.65

0.72%

7.4K

FedEx Corporation, NYSE

FDX

127.50

0.46%

0.1K

Barrick Gold Corporation, NYSE

ABX

7.92

0.25%

44.8K

E. I. du Pont de Nemours and Co

DD

54.10

0.02%

0.1K

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Procter & Gamble (PG) upgraded to Buy from Hold at Stifel; target $85

McDonald's (MCD) upgraded to Buy at BTIG Research

Downgrades:

Other:

Citigroup (C) target lowered to $60 from $65 at RBC Capital Markets

Walt Disney (DIS) target lowered to $110 from $130 at Stifel

-

14:47

Bank of England Governor Mark Carney: "now is not yet the time to raise interest rates"

The Bank of England (BoE) Governor Mark Carney said in a speech on Tuesday that "now is not yet the time to raise interest rates".

"Well the year has turned, and, in my view, the decision proved straightforward: now is not yet the time to raise interest rates," he said.

Carney noted that he wants to see the sustainable economic growth and a rise inflation before the central bank will start raising its interest rates.

The BoE governor pointed out that the U.K. economic growth slowed, while inflation fell due to low oil prices and will remain at low levels for longer.

-

14:37

Foreign investors add C$2.58 billion of Canadian securities in November

Statistics Canada released foreign investment figures on Tuesday. Foreign investors added C$2.58 billion of Canadian securities in November, missing expectations for a C$12.10 rise, after an investment of C$19.08 billion in October. October's figure was revised down from an investment of C$22.08 billion.

Canadian investors added C$16.5 billion of foreign securities in November, mainly U.S. securities.

-

14:21

Company news: Morgan Stanley (MS) Quarterly Results Beat Expectations

Morgan Stanley reported Q4 FY 2015 earnings of $0.43 per share (versus $0.4 in Q4 FY 2014), beating analysts' consensus of $0.34.

The company's quarterly revenues amounted to $7.738 bln (-0.3% y/y), slightly beating consensus estimate of $7.473 bln.

MS rose to $26.80 (+3.20%) in pre-market trading.

-

14:10

-

14:07

Company News: UnitedHealth Group (UNH) Quarterly Results Beat Expectations

UnitedHealth Group reported Q4 FY 2015 earnings of $1.40 per share (versus $1.64 in Q4 FY 2014), beating analysts' consensus of $1.37.

The company's quarterly revenues amounted to $43.6 bln (+30.4% y/y), generally inline with consensus estimate of $43.1 bln.

UnitedHealth Group reaffirmed guidance for FY 2016, projecting EPS of $7.60-7.80 (versus consensus of $7.70) and revenues of more than $180 bln (versus consensus of $181.52 bln).

UNH rose to $112.84 (+3.27%) in pre-market trading.

-

12:12

European stock markets mid session: stocks traded higher as oil prices slightly recovered

Stock indices traded higher as oil prices slightly recovered. China's GDP data also supported stock markets. China's National Bureau of Statistics released its gross domestic product (GDP) data on Tuesday. The country's economy expanded 6.8% in the fourth quarter of 2015, after a 6.9% rise in the third quarter. It was the slowest rise since 2009.

In 2015 as whole, China's economy grew 6.9%, after a 7.3% increase in 2014. It was the slowest growth since 1990.

Meanwhile, the economic data from the Eurozone was mixed. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 10.2 in January from 16.1 in December, beating expectations for a fall to 9.0.

"The beginning of the new year is characterised by capital market turmoil in China, which has also led to significant share price declines in Germany. As in the previous year, weak economic growth in China and other important emerging markets puts a strain on Germany's economic outlook," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 22.7 in January from 33.9 in December, missing expectations for a decline to 27.9.

Eurostat released its final consumer price inflation data for the Eurozone on Tuesday. Eurozone's harmonized consumer price index was flat in December, in line with expectations, after a 0.1% decrease in November.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in December, in line with the preliminary reading.

Construction production in the Eurozone increased 0.8% in November, after a 0.6% rise in October.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus increased to a seasonally adjusted €26.4 billion in November from €25.6 billion in October. October's figure was revised up from a surplus of €20.4 billion.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.2% year-on-year in December from 0.1% in November, in line with expectations. It was the highest reading since January 2015.

The rise was driven by an increase in air fares, which climbed 46% in December. It was the highest rise since 2002.

On a monthly basis, U.K. consumer prices increased 0.1% in December, beating expectations for a flat reading, after a flat reading in November.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% year-on-year in December from 1.2% in November, beating expectations for a 1.2% gain.

The Retail Prices Index climbed to 1.2% year-on-year in December from 1.1% in November, exceeding expectations for an increase to 1.1%.

In 2015 as a whole, consumer price inflation was 0%, down from 1.5% in 2014. It was the lowest level since 1950.

The consumer price inflation is below the Bank of England's 2% target.

The U.K. house price index rose at a seasonally adjusted rate of 0.8% in November, after a 0.8% increase in October.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.7% in November, after a 7.0% in October. It was the highest rise since March.

Current figures:

Name Price Change Change %

FTSE 100 5,882.02 +102.10 +1.77 %

DAX 9,692.5 +170.65 +1.79 %

CAC 40 4,278.88 +89.31 +2.13 %

-

12:05

German final consumer price inflation falls 0.1% in December

Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index were down 0.1% in December, in line with the preliminary estimate, after a 0.1% rise in November.

On a yearly basis, German final consumer price index declined to 0.3% in December from 0.4% in November, in line with the preliminary estimate.

The decline was partly driven by a decline in energy prices, which dropped 6.5% year-on-year in December, while food prices climbed 1.4%.

Consumer prices excluding energy increased 1.1% year-on-year in December.

-

11:59

Switzerland's producer and import prices are down 0.4% in December

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices fell 0.4% in December, missing expectations for a 0.2% gain, after a 0.4% increase in November.

The decrease was mainly driven by lower prices for mineral oil products.

The Import Price Index decreased by 0.8% in December, while producer prices fell 0.3%.

On a yearly basis, producer and import prices plunged 5.5% in December, after a 5.5% drop in November.

The Import Price Index fell by 9.7% year-on year in December, while producer prices dropped 3.6%.

-

11:53

Eurozone’s current account surplus climbs to a seasonally adjusted €26.4 billion in November

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus increased to a seasonally adjusted €26.4 billion in November from €25.6 billion in October. October's figure was revised up from a surplus of €20.4 billion.

The trade surplus declined to €27.0 billion in November from €28.1 billion in October.

The surplus on services increased to €5.9 billion in November from €5.2 billion in October.

The primary income surplus climbed to €4.5 billion in November from €3.6 billion in October, while the secondary income deficit decreased to €11.0 billion from €11.2 billion.

Eurozone's unadjusted current account surplus rose to €29.8 billion in November from €27.5 billion in October. October's figure was revised up from a surplus of €25.9 billion.

-

11:46

UK house price inflation rises 0.8% in November

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index rose at a seasonally adjusted rate of 0.8% in November, after a 0.8% increase in October.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.7% in November, after a 7.0% in October. It was the highest rise since March.

The higher house price inflation was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £288,000 in November, up from £287,000 in October.

-

11:41

UK consumer price inflation rises rose to 0.2% year-on-year in December

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.2% year-on-year in December from 0.1% in November, in line with expectations. It was the highest reading since January 2015.

The rise was driven by an increase in air fares, which climbed 46% in December. It was the highest rise since 2002.

On a monthly basis, U.K. consumer prices increased 0.1% in December, beating expectations for a flat reading, after a flat reading in November.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% year-on-year in December from 1.2% in November, beating expectations for a 1.2% gain.

The Retail Prices Index climbed to 1.2% year-on-year in December from 1.1% in November, exceeding expectations for an increase to 1.1%.

In 2015 as a whole, consumer price inflation was 0%, down from 1.5% in 2014. It was the lowest level since 1950.

The consumer price inflation is below the Bank of England's 2% target.

-

11:33

Eurozone's harmonized consumer price index is flat in December

Eurostat released its final consumer price inflation data for the Eurozone on Tuesday. Eurozone's harmonized consumer price index was flat in December, in line with expectations, after a 0.1% decrease in November.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Restaurants and cafés prices were up 0.10% year-on-year in December, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.40%, heating oil prices decreased by 0.10%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in December, in line with the preliminary reading.

-

11:26

Construction production in the Eurozone increases 0.8% in November

The Eurostat released its construction production data for the Eurozone on Tuesday. Construction production in the Eurozone increased 0.8% in November, after a 0.6% rise in October.

Civil engineering output declined 0.3% in November, while production in the building sector was up 1.1%.

On a yearly basis, construction output increased 2.1% in November, after a 1.1% gain in October.

Civil engineering output fell 0.5% year-on-year in November, while production in the building sector climbed 2.7% year-on-year.

-

11:19

Germany's ZEW economic sentiment index declines to 10.2 in January

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 10.2 in January from 16.1 in December, beating expectations for a fall to 9.0.

The assessment of the current situation in Germany rose by 4.7 points to 59.7 points.

"The beginning of the new year is characterised by capital market turmoil in China, which has also led to significant share price declines in Germany. As in the previous year, weak economic growth in China and other important emerging markets puts a strain on Germany's economic outlook," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 22.7 in January from 33.9 in December, missing expectations for a decline to 27.9.

The assessment of the current situation in the Eurozone rose by 2.1 points to -7.5 points.

-

10:57

China’s industrial production increases 5.9% year-on-year in December

The National Bureau of Statistics said on Tuesday that China's industrial production increased 5.9% year-on-year in December, missing expectations for a 6.0% rise, down from a 6.2% gain in November.

Fixed-asset investment in China climbed 10.0% year-on-year in the January-December period, missing expectations for a 10.2% increase, after a 10.2% rise in the January-November period.

Retail sales in China increased 11.1% year-on-year in December, missing expectations for a 11.3% gain, after a 11.2% rise in November.

These data added to concerns over the slowdown in the Chinese economy.

-

10:45

China’s economy grows 6.9% in 2015

China's National Bureau of Statistics released its gross domestic product (GDP) data on Tuesday. The country's economy expanded 6.8% in the fourth quarter of 2015, after a 6.9% rise in the third quarter. It was the slowest rise since 2009.

In 2015 as whole, China's economy grew 6.9%, after a 7.3% increase in 2014. It was the slowest growth since 1990.

-

10:34

Bank of Japan Governor Haruhiko Kuroda: the central bank will do everything to reach 2% inflation target

Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Tuesday that the central bank will do everything to reach 2% inflation target, noting that the central bank has "plenty of tools".

He added that inflation was improving.

-

10:24

Bank of England's Monetary Policy Committee member Gertjan Vlieghe would wait until the economic growth was stabilising and inflation was rising before backing an interest rate hike

The Bank of England's (BoE) Monetary Policy Committee member Gertjan Vlieghe said in a speech on Monday that he would wait until the economic growth was stabilising and inflation was rising before backing an interest rate hike.

"The recent evolution of the UK data has been one of growth that is still solid, but has been slowing. Inflation pressures remain muted across a wide range of indicators, despite low levels of unemployment. In order to be confident enough of the medium-term inflation outlook to raise Bank Rate, I would like to see evidence that growth is not slowing further, and that a broad range of indicators related to inflation are generally on an upward trajectory from their current low levels," he said.

Vlieghe added that interest rate will remain "significantly lower than in the past".

-

07:00

Global Stocks: Asian stock indices traded mixed

U.S. stock markets were closed on Monday for the Martin Luther King Jr. holiday.

On Friday the Dow Jones Industrial Average plunged 390.97 points, or 2.4%, to 15,988.08. The S&P 500 declined 44.85 point, or 2.3%, to 1,876.99 (all of its 10 sectors fell). The Nasdaq Composite lost 126.59 points, or 2.7%, to 4,488.42.

This morning in Asia Hong Kong Hang Seng rose 1.07%, or 205.20, to 19,442.65. China Shanghai Composite Index gained 2.51%, or 73.03, to 2,986.86. The Nikkei edged down 0.01%, or 2.38, to 16,953.19.

Asian stock indices traded mixed. Japanese stocks declined amid persistent declines in oil prices and concerns over the Chinese economy. Japanese economic and fiscal policy minister Akira Amari said that low oil prices could influence the economy of Japan in a negative way by hitting stocks.

Chinese stocks rose despite weak GDP data. The National Bureau of Statistics reported that economic growth slowed to 6.8% in the fourth quarter of 2015. Meanwhile the economy expanded by 6.9% over 2015, marking the weakest result since 1990.

Retail sales rose by 11.1% y/y in China in December compared to slightly faster growth of 11.2% in November.

-

03:33

Nikkei 225 16,949.37 -6.20 -0.04 %, Hang Seng 19,332.35 +94.90 +0.49 %, Shanghai Composite 2,910.04 -3.80%

-

00:34

Stocks. Daily history for Sep Jan 18’2016:

(index / closing price / change items /% change)

Nikkei 225 16,955.57 -191.54 -1.12 %

Hang Seng 19,237.45 -283.32 -1.45 %

Shanghai Composite 2,914.49 +13.52 +0.47 %

Topix 1,387.93 -14.52 -1.04 %

FTSE 100 5,779.92 -24.18 -0.42 %

CAC 40 4,189.57 -20.59 -0.49 %

Xetra DAX 9,521.85 -23.42 -0.25 %

-