Noticias del mercado

-

22:28

U.S. stocks closed

U.S. stocks surged back to pare the biggest one-day selloff in five months, with the Dow Jones Industrial Average cutting a loss of 550 points by two-thirds as investors speculated the rout that's wiped more than $15 trillion from global equities has gone too far too fast. A plunge that took oil past $27 a barrel sparked earlier selling that brought global equities near a bear market and fueled haven demand.

The Nasdaq Composite Index and the Standard & Poor's 500 Index shaved losses of more than 3.5 percent as chip shares and those with the most short interest rallied. The afternoon surge wasn't enough to push either into the green at the close, and both ended at the lowest levels in at least 15 months.

Equities markets buffeted by everything from China to oil and rising interest rates are off to the worst start to a year on record at the same time the Federal Reserve and other central banks have signaled a higher threshold before they'll provide relief. The rout in the oil patch is rippling through markets amid growing signs that credit quality is worsening. U.S. bonds now predict the slowest inflation since May 2009 as investors pile into haven assets.

Energy shares fell 2.9 percent, reversing a slide that was deeper than 5 percent. Indexes of chipmakers and consumer durables producers climbed as investors bought shares of some of the most shorted companies.

-

21:00

DJIA 15682.65 -333.37 -2.08%, NASDAQ 4442.53 -34.42 -0.77%, S&P 500 1849.14 -32.19 -1.71%

-

18:40

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes moved deep into the red in volatile trading on Wednesday, extending this year's selloff as oil prices continued to plummet unabated. U.S. crude prices sank 6.3% and Brent crude fell 5.5% as a supply glut bumped up against bearish financial news that deepened worries over demand. Besides collapsing oil prices, fears of a slowdown in China, the world's second-largest economy and a key market for U.S. companies, has also weighed on equities and commodities, leading to turbulent start to the year on Wall Street.

All Dow stocks in negative area (30 of 30). Top looser - Chevron Corporation (CVX, -6,77%).

All S&P sectors also in negative area. Top looser - Basic Materials (-5,5%).

At the moment:

Dow 15378.00 -535.00 -3.36%

S&P 500 1804.50 -68.50 -3.66%

Nasdaq 100 3984.25 -160.25 -3.87%

Oil 27.58 -1.99 -6.73%

Gold 1107.10 +18.00 +1.65%

U.S. 10yr 1.96 -0.08

-

18:00

European stocks close: stocks closed lower as oil prices continued to decline

Stock indices traded lower on a drop in oil prices. Oil prices fell on concerns over the global oil oversupply and on concerns over the slowdown in the Chinese economy.

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Wednesday that there are limits to the central bank's monetary policy. He pointed out that the ECB's quantitative easing was working.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.1% in the September to November quarter from 5.2% in the August to October quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to remain unchanged at 5.2%.

The employment rate was 74%. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 1.9% in the September to November quarter, beating expectations for a 1.8% rise, after a 2.0% gain in the August to October quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the September to November quarter, missing expectations for a gain of 2.1%, after a 2.4% increase in the August to October quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,673.58 -203.22 -3.46 %

DAX 9,391.64 -272.57 -2.82 %

CAC 40 4,124.95 -147.31 -3.45 %

-

18:00

European stocks closed: FTSE 5673.58 -203.22 -3.46%, DAX 9391.64 -272.57 -2.82%, CAC 40 4124.95 -147.31 -3.45%

-

17:59

WSE: Session Results

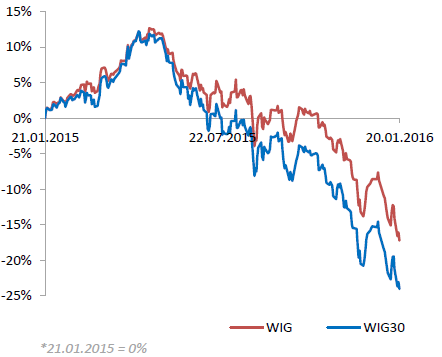

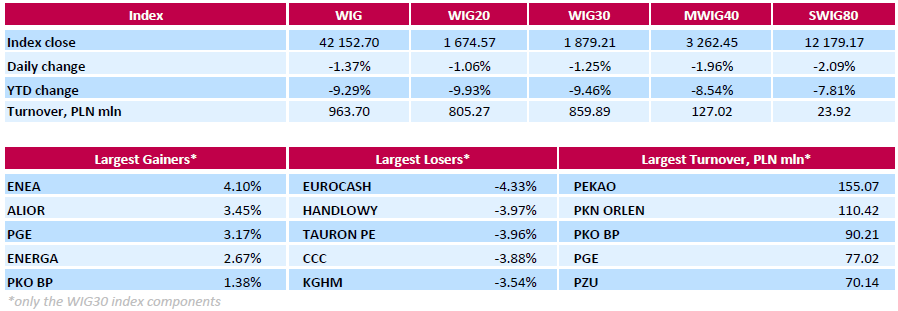

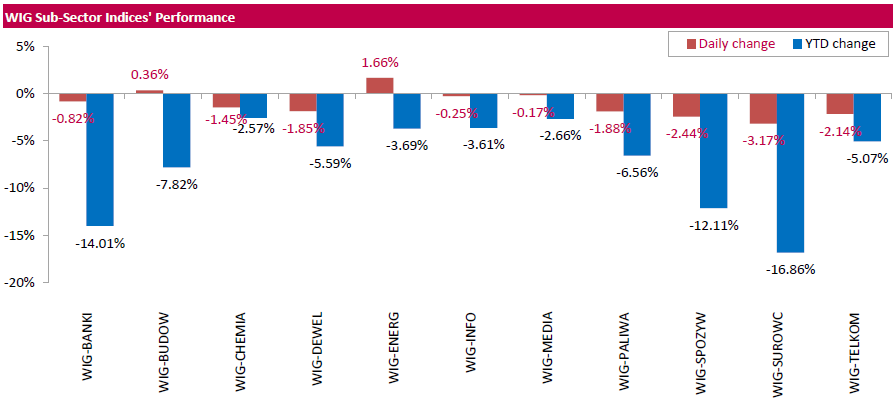

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, lost 1.37%. Except for utilities (+1.66%) and construction sector (+0.36%), every sector in the WIG Index declined, with materials (-3.17%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.25%. Within the index components, FMCG wholesaler EUROCASH (WSE: EUR) recorded the biggest drop, down 4.33%. It was followed by bank HANDLOWY (WSE: BHW), genco TAURON PE (WSE: TPE) and footwear retailer CCC (WSE: CCC), plunging by 3.97%, 3.96% and 3.88% respectively. On the other side of the ledger, gencos ENEA (WSE: ENA), PGE (WSE: PGE) and ENERGA (WSE: ENG) led the gainers, jumping by 2.67%-4.1% after Poland's energy minister said he saw no need to change state-run energy companies' dividend policy in the near term. Other biggest gainers were banks ALIOR (WSE: ALR) and PKO BP (WSE: PKO), advancing 3.45% and 1.38% respectively.

-

16:48

The People's Bank of China injects 150 billion yuan into market

The People's Bank of China (PBoC) said on its website on Wednesday that it plans to inject 150 billion yuan ($23 billion) into market to boost liquidity via short-term liquidity operations (SLO).

The interest rate on the 6-day lines of credit will be 2.25%, according to the central bank.

-

16:40

The International Labour Organization’s World Employment and Social Outlook: the global unemployment rate is expected to decline in 2017

The International Labour Organization (ILO) released its annual World Employment and Social Outlook report on Tuesday. The ILO said that the global unemployment rate is expected to decline to 5.7% in 2017 from 5.8% in 2014-16, driven by job creation in the U.S. and Europe.

The unemployment rate for developed economies declined to 6.7% in 2015 from 7.1% in 2014.

According to the ILO, emerging economies pose risk to the world of work.

"The significant slowdown in emerging economies coupled with a sharp decline in commodity prices is having a dramatic effect on the world of work," ILO Director-General Guy Ryder said.

-

16:26

Eurozone’s house prices rise 1.0% in the third quarter

Eurostat release its preliminary house price index for the Eurozone on Wednesday. The index increased 1.0% in the third quarter, after a 1.8% gain in the second quarter.

On a yearly basis, house prices climbed 2.3% in the third quarter, after a 1.6% rise in the second quarter.

-

16:17

Bank of Canada keeps its interest rate unchanged at 0.50% in January

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy is appropriate. This decision was expected by analysts.

The BoC expects the Canadian economy to expand 1.4% in 2016 and 2.4% in 2017.

Inflation is expected to rise to about 2% by early 2017 once the effect of low oil prices will dissipate.

According to the central bank, low prices for oil and other commodities weighed on the Canadian economy.

The BoC noted that the Canadian labour market remains resilient.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that "vulnerabilities in the household sector continue to edge higher".

-

15:46

U.S. weekly earnings rise 0.1% in December

The U.S. Labor Department released its real earnings data on Wednesday. Average weekly earnings rose 0.1% in December, after a 0.1% decrease in November.

The increase was driven by rises in in average hourly earnings.

Average hourly earnings climbed 0.1% in December, after a 0.1% rise in November.

On a yearly basis, real average weekly earnings increased 1.6% in December, while hourly earnings rose 1.8%.

-

15:36

U.S. Stocks open: Dow -1.45%, Nasdaq -1.35%, S&P -1.32%

-

15:26

Before the bell: S&P futures -1.62%, NASDAQ futures -1.73%

U.S. stock-index futures tumbled.

Global Stocks:

Nikkei 16,416.19 -632.18 -3.71%

Hang Seng 18,886.3 -749.51 -3.82%

Shanghai Composite 2,976.52 -31.22 -1.04%

FTSE 5,725.79 -151.01 -2.57%

CAC 4,158.24 -114.02 -2.67%

DAX 9,449.87 -214.34 -2.22%

Crude oil $27.83 (-2.21%)

Gold $1100.60 (+1.06%)

-

15:14

U.S. consumer price inflation declines 0.1% in December

The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation declined 0.1% in December, missing expectations for a flat reading, after a flat reading in November.

The decline was mainly driven by lower energy prices, which slid 2.4% in December.

Shelter costs climbed 0.2% in December.

Gasoline prices fell 2.4% in December, while food prices decreased 0.2%.

On a yearly basis, the U.S. consumer price index increased to 0.7% in December from 0.5% in November, missing expectations for a rise to 0.8%.

The U.S. consumer price inflation excluding food and energy gained 0.1% in December, missing expectations for a 0.2% rise, after a 0.2% increase in November.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.1% in December from 2.0% in November, in line with expectations.

The increase of the consumer price index excluding food and energy was driven by higher prices of rents and medical care.

In 2015 as whole, consumer prices rose 0.7%, after a 0.8% increase in 2014.

The U.S. consumer price index excluding food and energy increased 2.1% in 2015, after a 1.6% gain in 2014.

The consumer price index is not preferred Fed's inflation measure.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

7.87

3.69%

54.4K

UnitedHealth Group Inc

UNH

112.58

0.00%

1.2K

McDonald's Corp

MCD

116.60

-0.77%

2.4K

AT&T Inc

T

34.15

-1.04%

39.8K

Verizon Communications Inc

VZ

44.37

-1.11%

10.1K

The Coca-Cola Co

KO

41.38

-1.29%

5.6K

Hewlett-Packard Co.

HPQ

9.63

-1.33%

3.7K

Pfizer Inc

PFE

30.28

-1.34%

0.1K

Procter & Gamble Co

PG

75.00

-1.40%

3.5K

United Technologies Corp

UTX

84.00

-1.45%

0.3K

Apple Inc.

AAPL

95.25

-1.46%

402.8K

ALTRIA GROUP INC.

MO

57.50

-1.54%

0.7K

Goldman Sachs

GS

154.35

-1.58%

33.9K

Cisco Systems Inc

CSCO

23.47

-1.59%

5.6K

Ford Motor Co.

F

11.76

-1.59%

49.2K

Johnson & Johnson

JNJ

95.90

-1.64%

3.2K

Travelers Companies Inc

TRV

104.00

-1.66%

7.0K

Microsoft Corp

MSFT

49.70

-1.70%

22.6K

3M Co

MMM

136.00

-1.73%

0.6K

Chevron Corp

CVX

80.10

-1.73%

1.1K

FedEx Corporation, NYSE

FDX

125.00

-1.73%

6.8K

Caterpillar Inc

CAT

57.98

-1.78%

5.5K

Intel Corp

INTC

29.27

-1.78%

10.8K

Amazon.com Inc., NASDAQ

AMZN

564.25

-1.78%

15.2K

Starbucks Corporation, NASDAQ

SBUX

57.50

-1.79%

12.1K

International Paper Company

IP

35.00

-1.80%

0.3K

American Express Co

AXP

61.50

-1.82%

13.4K

Home Depot Inc

HD

117.51

-1.88%

22.0K

Walt Disney Co

DIS

92.20

-1.88%

18.2K

Google Inc.

GOOG

688.60

-1.88%

3.0K

AMERICAN INTERNATIONAL GROUP

AIG

55.10

-1.89%

1.1K

General Electric Co

GE

27.95

-1.90%

13.4K

Visa

V

70.00

-1.95%

8.6K

Boeing Co

BA

123.59

-1.96%

0.7K

Exxon Mobil Corp

XOM

74.90

-1.96%

16.4K

JPMorgan Chase and Co

JPM

55.87

-2.00%

2.6K

Nike

NKE

57.10

-2.09%

1.4K

Facebook, Inc.

FB

93.22

-2.14%

131.9K

Wal-Mart Stores Inc

WMT

61.19

-2.19%

28.7K

Yahoo! Inc., NASDAQ

YHOO

29.05

-2.32%

1.4K

Tesla Motors, Inc., NASDAQ

TSLA

199.90

-2.35%

0.6K

General Motors Company, NYSE

GM

28.70

-2.38%

32.4K

Merck & Co Inc

MRK

50.06

-2.49%

34.1K

Citigroup Inc., NYSE

C

40.83

-2.65%

37.7K

ALCOA INC.

AA

6.56

-2.67%

95.3K

Twitter, Inc., NYSE

TWTR

16.09

-3.59%

86.8K

Yandex N.V., NASDAQ

YNDX

11.50

-3.60%

7.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

3.80

-4.04%

94.5K

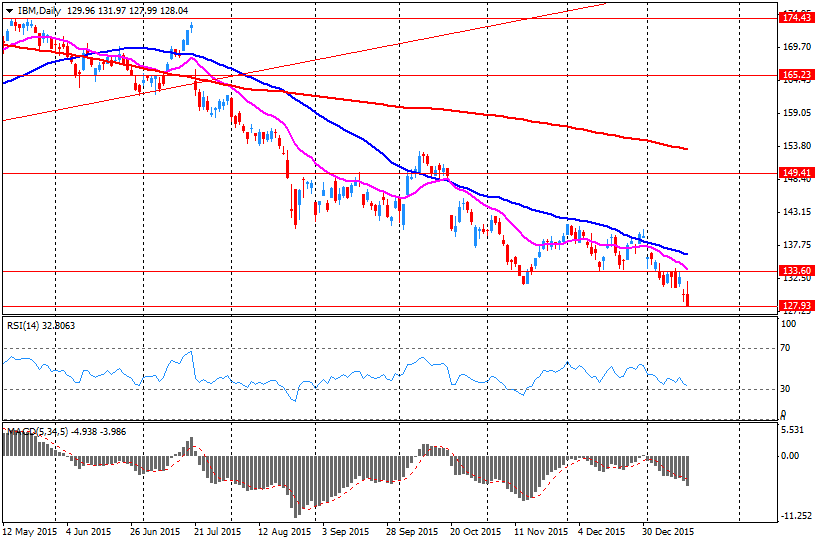

International Business Machines Co...

IBM

121.00

-5.55%

19.8K

-

15:01

Housing starts in the U.S. fall 2.5% in December

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. declined 2.5% to 1.149 million annualized rate in December from a 1.179 million pace in November, missing expectations for an increase to 1.200 million.

November's figure was revised up from 1.173 million units.

The fall was driven by declines in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market. But there is a shortage of houses available for sale.

Building permits in the U.S. fell 3.9% to 1.232 million annualized rate in December from a 1.282 million pace in November, beating expectations for a 1,200 pace.

Starts of single-family homes decreased 3.3% in December. Building permits for single-family homes were up 1.8%.

Starts of multifamily buildings fell 1.0% in December. Permits for multi-family housing dropped 11.4%.

-

14:43

Canadian manufacturing shipments rise 1.0% in November

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments rose 1.0% in November, beating expectations for a 0.5% increase, after a 1.3% decline in October. October's figure was revised down from a 1.1% fall.

The increase was driven by higher motor vehicle sales, which rose 3.8% in November.

Inventories were flat in November.

-

14:37

Canada’s wholesale sales climb 1.8% in November

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales climbed 1.8% in November, exceeding expectations for a 0.5% gain, after a 0.5% decline in October. October's figure was revised up from a 0.6% decrease.

The increase was mainly driven by higher sales in the motor vehicle and parts subsectors.

Sales of motor vehicle and parts were up 4.8% in November, while sales in the food, beverage and tobacco subsector rose 1.6%.

Sales in the building material and supplies subsector climbed 2.8% in November.

Inventories fell by 0.2% in November.

-

14:36

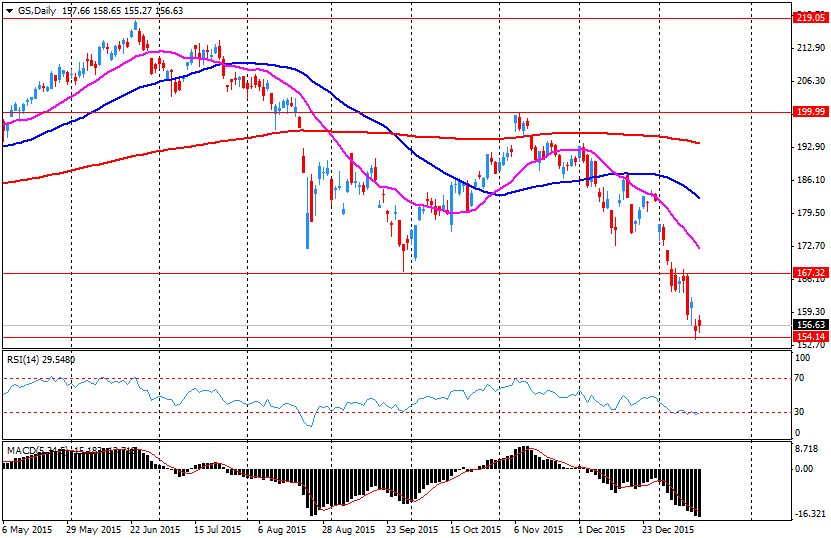

Company News: Goldman Sachs (GS) posts Q4 financial results

Goldman Sachs reported Q4 FY 2015 adjusted earnings of $4.68 per share. Diluted earnings per common share were $1.27. Analysts forecasted EPS of $3.62. In Q4 FY 2014, the company's EPS stood at $4.38.

Goldman Sachs' quarterly revenues amounted to $7.720 bln (-5.5% y/y), beating consensus estimate of $7.044 bln.

GS fell to $154.00 (-1.80%) in pre-market trading.

-

13:09

Company News: IBM (IBM) posts Q4 earnings above analysts' forecasts; issues downside guidance for FY 2016

IBM reported Q4 FY 2015 earnings of $4.84 per share (versus $5.81 in Q4 FY 2014), beating analysts' consensus of $4.81.

The company's quarterly revenues amounted to $22.059 bln (-8.50% y/y), generally inline with consensus estimate of $22.093 bln.

IBM issued downside guidance for FY 2016, projecting EPS of at least $13.50, well below analysts' consensus estimate of $15.06. The company expects its financials will be negatively impacted by a strong US dollar.

IBM fell to $122.07 (-4.71%) in pre-market trading.

-

12:00

European stock markets mid session: stocks traded lower on a drop in oil prices

Stock indices traded lower on a drop in oil prices. Oil prices fell on concerns over the global oil oversupply and on concerns over the slowdown in the Chinese economy.

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Wednesday that there are limits to the central bank's monetary policy. He pointed out that the ECB's quantitative easing was working.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.1% in the September to November quarter from 5.2% in the August to October quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to remain unchanged at 5.2%.

The employment rate was 74%. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 1.9% in the September to November quarter, beating expectations for a 1.8% rise, after a 2.0% gain in the August to October quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the September to November quarter, missing expectations for a gain of 2.1%, after a 2.4% increase in the August to October quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Current figures:

Name Price Change Change %

FTSE 100 5,704.22 -172.58 -2.94 %

DAX 9,376.02 -288.19 -2.98 %

CAC 40 4,135.39 -136.87 -3.20 %

-

11:44

European Central Bank Governing Council member Ewald Nowotny: there are limits to the central bank’s monetary policy

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Wednesday that there are limits to the central bank's monetary policy.

"We have to be aware that of course there are limits to monetary policy," he said.

Nowotny pointed out that the ECB's quantitative easing was working.

-

11:39

Foreign direct investment inflows in China drop by an annual rate of 5.8% in December

China's Ministry of Commerce released its foreign direct investment (FDI) data on Wednesday. Foreign direct investment inflows in China fell to 77 billion yuan ($12 billion) in December, down 5.8% from a year earlier.

Non-financial outbound direct investment rose 6.1% year-on-year to $13.89 billion in December.

-

11:29

Greece’s current account narrows to €1.21 billion in November

The Bank of Greece released its current account data on Wednesday. Greece's current account deficit fell to €1.21 billion in November from €1.50 billion in November last year.

The Greek deficit on trade in goods declined to €1.59 billion in November from €1.70 billion in November last year, while the services surplus fell to €375 million from €567.6 billion.

The primary income deficit turned into a surplus of €27.4 million in November from a deficit of €274.4 million in November last year, while the deficit on secondary income declined to €23.4 million from €84.5 million last year.

The capital account surplus decreased to €190.2 million in November from 485.7 million last year.

-

11:20

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index plunges to -3.0 in January

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index plunged to -3.0 in January from 16.6 in December. It was the lowest reading since July 2015.

"Half of the analysts surveyed expect economic growth in Switzerland to stay unchanged. Meanwhile, among the other respondents, the share of analysts who anticipate deterioration exceeds the share of those expecting to see a pickup in economic activity by only three percentage points," the ZEW said.

The current conditions fell to -8.5 in January from -2.7 in December.

-

11:14

U.K. unemployment rate declines to 5.1% in the September to November quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.1% in the September to November quarter from 5.2% in the August to October quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to remain unchanged at 5.2%.

The claimant count slid by 4,300 people in December, beating expectations for a rise by 2,500, after a decrease of 2,200 people in November. November's figure was revised down from a 3,900 increase.

U.K. unemployment in the September to November period dropped by 99,000 to 1.68 million from the previous quarter.

The employment rate was 74%. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 1.9% in the September to November quarter, beating expectations for a 1.8% rise, after a 2.0% gain in the August to October quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the September to November quarter, missing expectations for a gain of 2.1%, after a 2.4% increase in the August to October quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:04

German producer prices drop 0.5% in December

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices declined 0.5% in December, missing expectations for a 0.4% fall, after a 0.2% drop in November.

On a yearly basis, German PPI dropped 2.3% in December, missing expectations for a 2.2% decrease, after a 2.5% fall in November.

PPI excluding energy sector fell by 0.6% year-on-year in December.

Energy prices were down 6.8% year-on-year in December.

Consumer non-durable goods prices rose 0.2% year-on-year in December, intermediate goods sector prices decreased by 2.2%, while capital goods prices increased 0.7% and durable consumer goods sector prices rose 1.5%.

-

10:39

The U.S. Congressional Budget Office expects a higher budget deficit for this year

The U.S. Congressional Budget Office (CBO) said on Tuesday that it expects a higher budget deficit for this year. The office expects a budget deficit of $544 billion, up from a deficit of $439 billion in 2015.

The CBO cut its 2016 revenue forecasts to $3.38 trillion from $3.51 trillion.

"If current laws generally remained unchanged, the deficit would grow over the next 10 years, and by 2026 it would be considerably larger than its average over the past 50 years," the office said.

The CBO expects the U.S. economy to grow solidly this year and next.

-

10:21

Consumer prices in New Zealand slide 0.5% in the fourth quarter

Statistics New Zealand released its consumer price inflation data on late Wednesday evening. Consumer prices in New Zealand dropped 0.5% in the fourth quarter, missing expectations for a 0.2% fall, after a 0.3% increase in the third quarter.

The decline in consumer price inflation was driven by lower petrol and vegetables prices.

On a yearly basis, consumer price inflation increased 0.1% in the fourth quarter, missing forecasts of the 0.4% rise, after a 0.4% gain in the third quarter. It was the weakest rise since 1999.

Lower petrol prices weighed on the annual inflation.

-

10:11

Westpac’ consumer confidence index for Australia declines 3.5% in January

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index fell 3.5% in January, after a 0.8% fall in December.

The index was mainly driven by a drop in the index tracking views on 'family finances vs a year ago', which plunged by 9.4% in January.

"With limited domestic news during the holiday season consumers appear to have been mainly impacted by the spate of negative news on the international front and the spill over effect on financial markets," Westpac Chief Economist Bill Evans said.

"The Reserve Bank Board next meets on February 2. Despite markets confidently expecting that the Reserve bank would cut rates by February Westpac has remained firmly of the view that the Bank will remain on hold throughout the second half of 2015 and the whole of 2016. We retain that view despite some concerns from this survey that consumers may slow their spending in response to this current global uncertainty," he added.

-

06:55

Global Stocks: Asian stock indices fell

U.S. stock markets closed little changed on Tuesday as renewed declines in oil prices slashed off early gains.

Stocks climbed at the beginning of the session on news from China. The country's GDP growth slowed down to 6.8% in the fourth quarter from 6.9% in the third quarter in line with expectations. The growth pace was the slowest in 25 years and it raised expectations for authorities to take further steps to stimulate the economy.

The Dow Jones Industrial Average closed 27.94 points, or 0.2% higher, at 16,016.02. The S&P 500 added 1 point, or less than 0.1%, to 1,881.33 (its energy sector lost 2.2% on Tuesday and over 10.7% since the beginning of 2016). The Nasdaq Composite lost 11.47 points, or 0.3%, to 4,476.95.

This morning in Asia Hong Kong Hang Seng dropped 3.54%, or 694.38, to 18,941.43. China Shanghai Composite Index fell 1.45%, or 43.57, to 2,964.17. The Nikkei plunged 3.31%, or 563.53, to 16,484.84.

Asian stock indices fell driven by plunging oil prices. Meanwhile the yen, which serves as a safe-haven asset, gained and weighed on stocks of Japanese exporters.

Japanese Economic and fiscal policy minister Akira Amari said on Tuesday that declines in oil prices and stocks are correlated: lower oil prices generate tension in oil producing countries and make investors sell assets, including stocks of Japanese companies.

-

03:02

Nikkei 225 16,718.34 -330.03 -1.94 %, Hang Seng 19,199.35 -436.46 -2.22 %, Shanghai Composite 2,987.32 -20.42 -0.68 %

-

02:31

Stocks. Daily history for Sep Jan 19’2016:

(index / closing price / change items /% change)

Nikkei 225 16,882.96 -45.09 -0.27 %

Hang Seng 19,204.22 +398.36 +2.07 %

Shanghai Composite 3,007.74 +93.90 +3.32 %

FTSE 100 5,876.8 +96.88 +1.68 %

CAC 40 4,272.26 +82.69 +1.97 %

Xetra DAX 9,664.21 +142.36 +1.50 %

S&P 500 1,881.33 +1.00 +0.05 %

NASDAQ Composite 4,476.95 -11.47 -0.26 %

Dow Jones 16,016.02 +27.94 +0.17 %

-