Noticias del mercado

-

22:34

U.S. stocks closed

U.S. stocks overcame an afternoon slump to rebound from the lowest level in 21 months, as crude surged toward $30 amid signals from China and Europe that officials will add to stimulus if needed. Treasuries fell with gold as haven demand waned.

The Dow Jones Industrial Average rose 115 points in a seesaw session that had the gauge erase almost all of a 270-point rally before ending higher. Investors piled into risk assets, boosting European equities to the biggest gain in a month and sending crude 4.2 percent higher, after the European Central Bank said it may bolster support as soon as March. China's vice president said the government would intervene to tamp down market volatility. The yield on the 10-year Treasury note rose to 2.02 percent.

ECB President Mario Draghi signaled at his briefing Thursday that additional support is available as soon as March as distress in China shows few signs of abating and oil's slump fuels disinflation. Risks to economic growth have increased amid the financial-market turmoil that has erased more than $15 trillion from global equity values as markets from Japan to Germany and Brazil plunged into bear territory.

Crude's climb above $29 a barrel in New York provided a glimmer of relief to commodities investors battered by an oversupply in resources from oil to copper and wheat. Calling the country's market "not yet mature," China's Vice President Li Yuanchao said the government would boost regulation in an effort to avoid too much volatility. Corporate earnings may also offer clues on the robustness of the U.S. recovery, with the few companies that have reported so far mostly exceeding estimates.

The S&P 500 rose 0.5 percent at 4 p.m. in New York, capping a session that saw it rise as much as 1.6 percent after falling 1.2 percent Wednesday to the lowest since April 2014. The index has swung from gains to losses for seven consecutive sessions as investors seek a bottom to a rout this year that's erased 8.3 percent from the benchmark.

Energy shares paced gains with a 3.1 percent advance. Chevron Corp. climbed 2.6 percent and Home Depot Inc. surged 3.5 percent as energy and consumer discretionary companies paced the rebound from yesterday's selloff. Verizon Communications Inc. gained 3.5 percent after its profit beat estimates. Union Pacific Corp. fell 4.9 percent after its earnings missed forecasts.

-

21:01

DJIA 15924.05 157.31 1.00%, NASDAQ 4492.55 20.86 0.47%, S&P 500 1874.47 15.14 0.81%

-

19:27

Wall Street. Major U.S. stock-indexes rose

Major U.S. stocks higher on Thursday as oil prices rallied and ECB President Mario Draghi raised hopes of easing monetary policy further as soon as March.

The European Central Bank kept its main rates on hold and Draghi said the central bank would "review and possibly reconsider" its monetary policy stance in March. Many analysts had not expected a rate cut before June.

Oil prices recovered from earlier losses and were sharply higher.

Almost all of Dow stocks in positive area (28 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -0,85%). Top gainer - The Home Depot, Inc. (HD, +4,34%).

All of S&P sectors in positive area. Top gainer - Basic Materials (+3,8%).

At the moment:

Dow 15916.00 +199.00 +1.27%

S&P 500 1877.00 +22.00 +1.19%

Nasdaq 100 4177.00 +44.00 +1.06%

Oil 30.12 +1.77 +6.24%

Gold 1093.60 -12.60 -1.14%

U.S. 10yr 2.03 +0.05

-

18:06

European stocks closed: FTSE 5773.79 100.21 1.77%, DAX 9574.16 182.52 1.94%, CAC 40 4206.40 81.45 1.97%

-

18:01

European stocks close: stocks closed higher on comments by the European Central Bank President Mario Draghi

Stock indices traded higher on comments by the European Central Bank (ECB) President Mario Draghi. He hinted at a press conference on Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

"Downside risks have increased again amid heightened uncertainty about emerging market economies' growth prospects, volatility in financial and commodity markets, and geopolitical risks. In this environment, euro area inflation dynamics also continue to be weaker than expected," he said.

"It will therefore be necessary to review and possibly reconsider our monetary policy stance at our next meeting in early March, when the new staff macroeconomic projections become available which will also cover the year 2018," Draghi added.

The ECB president pointed out that the central bank's quantitative easing was working, and interest rate is expected to remain "at present or lower levels for an extended period of time".

Earlier, the ECB kept its interest rate unchanged at 0.05%.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,773.79 +100.21 +1.77 %

DAX 9,574.16 +182.52 +1.94 %

CAC 40 4,206.4 +81.45 +1.97 %

-

17:55

WSE: Session Results

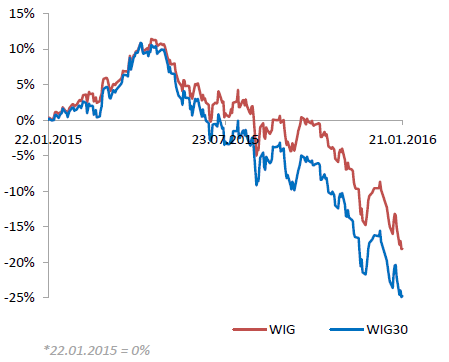

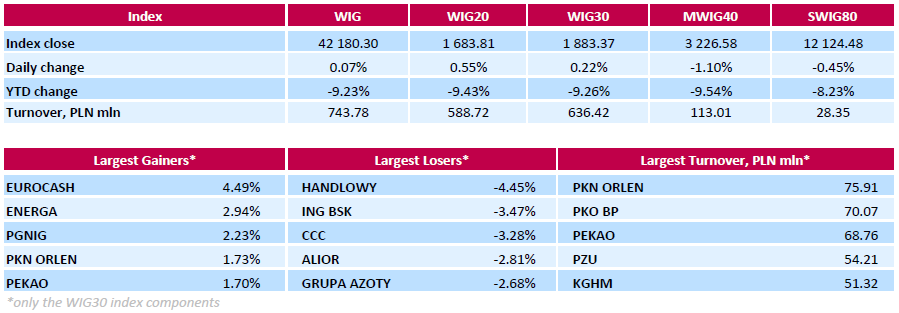

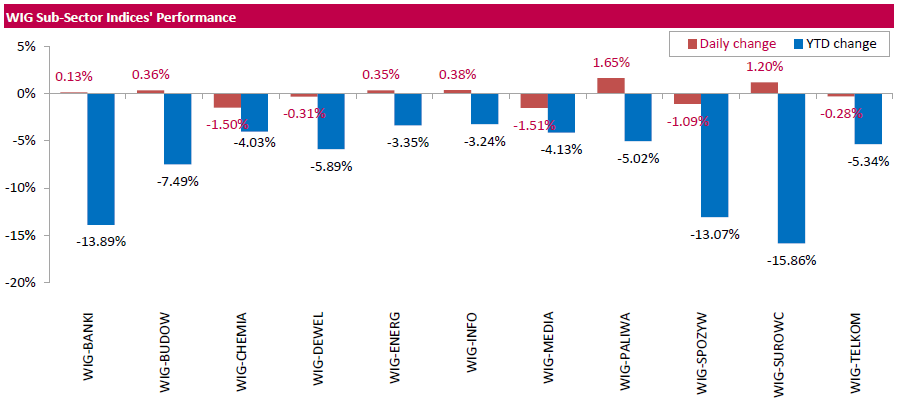

Polish equity market closed slightly higher on Thursday. The broad market measure, the WIG index, added 0.07%. Sector performance within the WIG Index was mixed. Oil and gas sector (+1.65%) was best performer, while media sector (-1.51%) and chemicals (-1.50%) recorded the worst results.

The large-cap benchmark, the WIG30 Index, rose by 0.22%. Within the index components, FMCG wholesaler EUROCASH (WSE: EUR) led the advancers, climbing by 4.49%. It was followed by genco ENERGA (WSE: ENG), oil and gas companies PGNIG (WSE: PGN) and PNK ORLEN (WSE: PKN), and bank PEKAO (WSE: PEO), jumping by 1.7%-2.94%. On the other side of the ledger, banking sector names HANDLOWY (WSE: BHW), ING BSK (WSE: ING) and ALIOR (WSE: ALR) were among the weakest performers, tumbling by 4.45%, 3.47% and 2.81% respectively. Footwear retailer CCC (WSE: CCC) lost 3.28%.

-

17:52

Business NZ performance of manufacturing index for New Zealand rises to 56.7 in December

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 56.7 in December from 54.9 in November. It was the highest level since October 2014.

November's figure was revised up from 54.7.

A reading above 50 indicates expansion in the manufacturing sector.

The rise was mainly driven by a faster expansion in new orders, deliveries, production and finished stocks.

"Overall, it has been a solid and positive year for the sector. Although the PMI averaged 54.2 over 2015 compared with 56.0 for both 2013 and 2014, the slightly lower expansion level was partly due to the first half of 2015 experiencing a moderate patch of growth. However, results over the last few months have seen the sector in stronger expansion," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

17:45

M3 money supply in Switzerland rises 1.6% in December

The Swiss National Bank (SNB) released its money supply data on Thursday. M3 money supply in Switzerland increased 1.6% year-on-year in December, after a 2.1% rise in November.

M1 money supply was down 1.6% year-on-year in December, after a 2.8% decrease in November.

-

17:39

RICS house price balance for the U.K. increased to +50% in December

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance increased to +50% in December from +49% in November.

RICS Chief Economist, Simon Rubinsohn, said that a further heating up of the U.K. housing market is likely before April.

-

16:45

The People's Bank of China injects 400 billion yuan into market

The People's Bank of China (PBoC) said on its website on Thursday that it injected 400 billion yuan ($61 billion) into market to boost liquidity via short-term loans (reverse-repurchase agreements).

The central bank usually injects extra money before the Lunar New Year holiday.

-

16:36

Chinese Vice President Li Yuanchao: China will remain the global growth engine

Chinese Vice President Li Yuanchao said in an interview with Bloomberg News that China will remain the global growth engine.

He pointed out that the country's economy is expected to grow between 6% and 7% over the next five years.

Li noted that the weak global demand weighs on the Chinese economy, but he added that the country's economy "has enormous development potential".

-

16:28

Eurozone’s preliminary consumer confidence index falls to -6.3 in January

The European Commission released its preliminary consumer confidence figures for the Eurozone on Thursday. Eurozone's preliminary consumer confidence index fell to -6.3 in January from -5.7 in December. Analysts had expected the index to remain unchanged at -5.7.

European Union's consumer confidence index climbed by 0.3 points to -4.2 in January.

-

16:08

The European Central Bank President Mario Draghi hints that the central bank may add further stimulus measures in March

The European Central Bank (ECB) President Mario Draghi hinted at a press conference on Thursday that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

"Downside risks have increased again amid heightened uncertainty about emerging market economies' growth prospects, volatility in financial and commodity markets, and geopolitical risks. In this environment, euro area inflation dynamics also continue to be weaker than expected," he said.

"It will therefore be necessary to review and possibly reconsider our monetary policy stance at our next meeting in early March, when the new staff macroeconomic projections become available which will also cover the year 2018," Draghi added.

The ECB president pointed out that the central bank's quantitative easing was working, and interest rate is expected to remain "at present or lower levels for an extended period of time".

Draghi noted that the ECB is ready to act if needed.

-

15:35

U.S. Stocks open: Dow +0.33%, Nasdaq -0.05%, S&P +0.20%

-

15:28

Before the bell: S&P futures +0.69%, NASDAQ futures +0.75%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,017.26 -398.93 -2.43%

Hang Seng 18,542.15 -344.15 -1.82%

Shanghai Composite 2,880.8 -95.89 -3.22%

FTSE 5,758.92 +85.34 +1.50%

CAC 4,221.28 +96.33 +2.34%

DAX 9,610.74 +219.10 +2.33%

Crude oil $28.31 (-0.14%)

Gold $1095.70 (-0.95%)

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Twitter, Inc., NYSE

TWTR

17.95

3.28%

3.6K

ALCOA INC.

AA

6.89

2.23%

30.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.16

2.21%

9.5K

Tesla Motors, Inc., NASDAQ

TSLA

202.00

1.66%

28.5K

Google Inc.

GOOG

709.50

1.58%

1.9K

Citigroup Inc., NYSE

C

41.00

1.26%

5.4K

Verizon Communications Inc

VZ

44.94

1.17%

23.4K

Amazon.com Inc., NASDAQ

AMZN

578.44

1.17%

4.2K

Facebook, Inc.

FB

95.34

1.05%

28.0K

Walt Disney Co

DIS

93.39

0.92%

151.8K

Microsoft Corp

MSFT

51.24

0.89%

11.7K

AT&T Inc

T

34.20

0.88%

6.7K

General Electric Co

GE

28.24

0.86%

16.5K

Ford Motor Co.

F

12.00

0.84%

1.9K

Starbucks Corporation, NASDAQ

SBUX

57.40

0.84%

3.6K

Goldman Sachs

GS

155.00

0.81%

2.3K

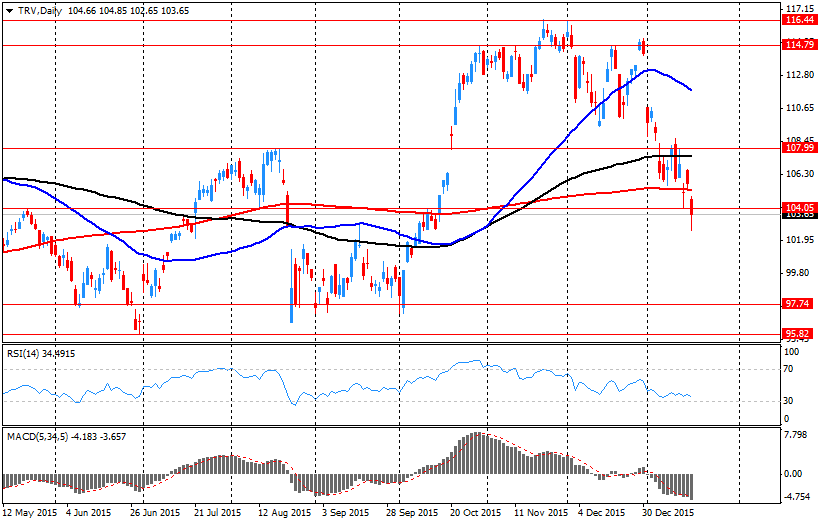

Travelers Companies Inc

TRV

104.49

0.81%

0.2K

JPMorgan Chase and Co

JPM

55.95

0.79%

0.2K

FedEx Corporation, NYSE

FDX

124.15

0.79%

0.8K

Procter & Gamble Co

PG

76.42

0.78%

11.5K

Caterpillar Inc

CAT

59.25

0.75%

0.2K

Intel Corp

INTC

29.80

0.71%

5.3K

Cisco Systems Inc

CSCO

23.04

0.61%

0.2K

Yahoo! Inc., NASDAQ

YHOO

28.94

0.56%

3.8M

Apple Inc.

AAPL

97.32

0.55%

110.5K

Nike

NKE

59.35

0.53%

5.5K

International Business Machines Co...

IBM

122.50

0.53%

326.6K

Hewlett-Packard Co.

HPQ

9.60

0.52%

1.1K

Pfizer Inc

PFE

30.80

0.46%

2.1K

Visa

V

71.00

0.45%

0.2K

McDonald's Corp

MCD

116.24

0.40%

4.9K

Merck & Co Inc

MRK

50.75

0.40%

1.4K

Wal-Mart Stores Inc

WMT

61.02

0.30%

3.5K

The Coca-Cola Co

KO

41.45

0.17%

0.1K

Chevron Corp

CVX

79.11

0.16%

1K

General Motors Company, NYSE

GM

29.45

0.10%

51.8K

Exxon Mobil Corp

XOM

73.22

0.05%

21.5K

Boeing Co

BA

122.14

0.00%

7.0K

ALTRIA GROUP INC.

MO

57.17

-0.09%

4.9K

American Express Co

AXP

62.64

-0.62%

1.0K

AMERICAN INTERNATIONAL GROUP

AIG

54.54

-0.93%

15.9K

Barrick Gold Corporation, NYSE

ABX

7.99

-1.48%

0.9K

Yandex N.V., NASDAQ

YNDX

11.48

-2.71%

4.3K

-

15:02

Philadelphia Federal Reserve Bank’s manufacturing index climbs to -3.5 in January

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to -3.5 in January from -10.2 in December, exceeding expectations for an increase to -5.0. December's figure was revised down from -5.9.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Manufacturing conditions in the region contracted modestly this month, according to firms responding to the January Manufacturing Business Outlook Survey. The indicator for general activity remained negative this month; however, it rebounded from a lower reading in December," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was up to 9.6 in January from -2.1 in December.

The new orders index increased to -1.4 in January from -11.1 in December.

The prices paid index rose to -1.1 in January from -8.3 in December, while the prices received index climbed to -2.8 from -8.5.

The number of employees index dropped to -1.9 in January from 2.2 in December.

According to the report, the future general activity index slid to 19.1 in January from 24.1 in December.

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

General Electric (GE) initiated with a Buy at Citigroup

Honeywell International (HON) initiated with a Buy at Citigroup

3M Company (MMM) initiated with a Buy at Citigroup

-

14:47

European Central Bank keeps its interest rate unchanged at 0.05% in January

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

The ECB lowered its deposit rate to -0.3% from -0.2% in December.

-

14:44

Initial jobless claims rise to 293,000 in the week ending January 16

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 16 in the U.S. rose by 10,000 to 293,000 from 283,000 in the previous week. The previous week's figure was revised down from 284,000.

Analysts had expected jobless claims to fall to 278,000.

Jobless claims remained below 300,000 the 46th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 56,000 to 2,208,000 in the week ended January 09.

-

13:55

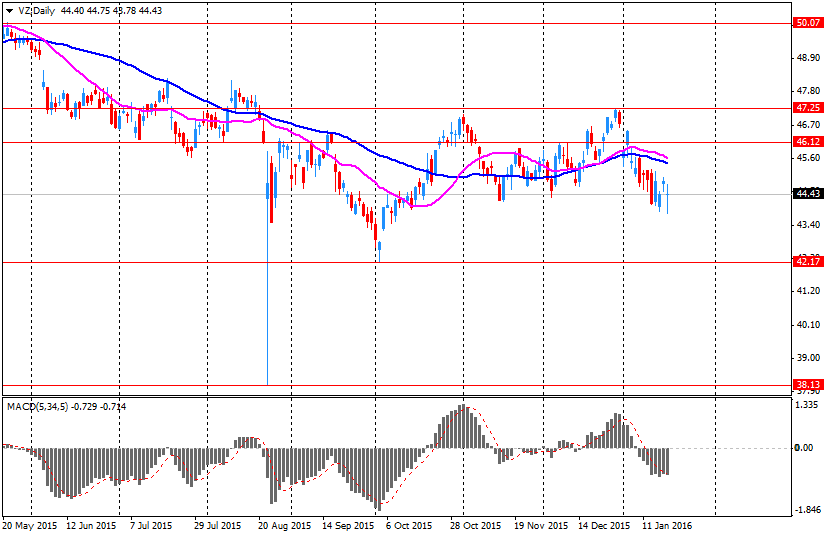

Company News: Verizon (VZ) Quarterly Results Beat Estimates

Verizon reported Q4 FY 2015 earnings of $0.89 per share (versus $0.71 in Q4 FY 2014), beating analysts' consensus of $0.88.

The company's quarterly revenues amounted to $34.254 bln (+3.2% y/y), slightly beating consensus estimate of $34.118 bln.

Verizon reaffirmed guidance for FY 2016, projecting EPS comparable to $3.99 (versus analysts' consensus of $3.97).

VZ rose to $44.75 (+0.74%) in pre-market trading.

-

13:33

Company News: Travelers (TRV) Q4 Earnings Beat Estimates

Travelers reported Q4 FY 2015 earnings of $2.90 per share (versus $3.07 in Q4 FY 2014), beating analysts' consensus of $2.66.

The company's quarterly revenues amounted to $6.023 bln (+0.7% y/y), generally in line with consensus estimate of $6.068 bln.

TRV rose to $104.20 (+0.53%) in pre-market trading.

-

12:01

European stock markets mid session: stocks traded higher ahead of the release of the European Central Bank’s interest rate decision

Stock indices traded higher ahead of the release of the European Central Bank's (ECB) interest rate decision. Analysts expect the central bank to keep its monetary policy unchanged.

Market participants were disappointed in December because they hoped for more stimulus measures by the ECB. The ECB kept its interest rate unchanged at 0.05%, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016. The volume of the monthly purchases remained unchanged.

International Monetary Fund (IMF) Managing Director Christine Lagarde said at the World Economic Forum in Davos on Wednesday that risks to the global economic growth are bigger than previously expected. According to Lagarde, the risks are falling oil prices, the slowdown in the Chinese economy and diverging monetary policies.

Current figures:

Name Price Change Change %

FTSE 100 5,699.28 +25.70 +0.45 %

DAX 9,447.46 +55.82 +0.59 %

CAC 40 4,157.33 +32.38 +0.78 %

-

11:47

Spain’s trade deficit widens to €1.85 billion in November

Spain's Economy Ministry released its trade data on Thursday. The trade deficit widened to €1.85 billion in November from €1.60 billion in November a year ago.

Exports rose at an annual rate of 8.6% in November, while imports climbed 9.3%.

In the January to November period, the trade deficit totalled €22.38 billion, down 1.2% from the same period of 2014.

Exports increased 4.3% in the January to November period, while imports gained 3.8%.

-

11:44

Japan’s all industry activity index slides 1.0% in November

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Thursday. The index slid 1.0% in November, missing expectations for a 0.7% fall, after a 0.9% rise in October. October's figure was revised down from a 1.0% increase.

Construction industry activity index dropped 3.0% in November, industrial production index fell 0.9%, while tertiary industry activity declined 0.8%.

-

11:36

MI consumer inflation expectations in Australia decline to 3.6% in January

The Melbourne Institute (MI) released its inflation expectations for Australia on Thursday. The MI consumer inflation expectations in Australia declined to 3.6% in January from 4.0% in December.

72.1% respondents expected inflation to decline within the 0‐5% range, down from 74.2% in December.

-

11:30

HIA new home sales in Australia drop 2.7% in November

The Housing Industry Association (HIA) released its new home sales data for Australia on Thursday. New home sales fell 2.7% in November, after a 3.0% drop in October.

The HIA's chief economist Harley Dale said that a drop was driven by the slowing population growth, higher mortgage costs, and easing property price growth in Sydney and Melbourne.

Sales of detached homes increased 1.1% in November, while sales for multi-units slid 15.1%.

-

11:17

French manufacturing confidence index rises to 102 in January

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 102 in January from 101 in December. December's figure was revised down from 103.

Past change in production index was down to -1 in January from 1 in December.

Personal production expectations index rose to 10 in January from 9 in December, while general production outlook index increased to 2 from 0.

-

11:00

International Monetary Fund Managing Director Christine Lagarde: risks to the global economic growth are bigger than previously expected

International Monetary Fund (IMF) Managing Director Christine Lagarde said at the World Economic Forum in Davos on Wednesday that risks to the global economic growth are bigger than previously expected. According to Lagarde, the risks are falling oil prices, the slowdown in the Chinese economy and diverging monetary policies.

She noted that the global economy is expected to expand moderately this year.

-

07:13

Global Stocks: U.S. stock indices fell following oil prices

U.S. stock indices plunged on Wednesday following oil prices. A slight rebound in oil prices helped stocks step away from session lows by the end of the session.

The Dow Jones Industrial Average fell 249.28 points, or 1.6% higher, to 15,766.74. The S&P 500 fell 22 points, or 1.2%, to 1,859 (its energy sector lost 2.9%). The Nasdaq Composite declined 5.26 points, or 0.1%, to 4,471.69 after an initial drop of 145 points.

The U.S. Department of Labor reported that consumer prices unexpectedly declined in December as lower energy costs offset higher prices in the services sector. The consumer price index fell by 0.1% in December after being unchanged in November. However on an annualized basis the index rose by 0.7% marking the biggest gain over the year. Experts said that inflation growth may slow down because of persistent declines in oil prices. Economists had expected readings of 0.0% m/m and 0.8% y/y.

This morning in Asia Hong Kong Hang Seng lost 0.85%, or 160.38, to 18,725.92. China Shanghai Composite Index fell 1.02%, or 30.25, to 2,946.44. The Nikkei fell 0.76%, or 124.26, to 16,291.93.

Asian stock indices gave up early gains and turned red. The selloff was encouraged by declines in U.S. stocks and oil, as well as by concerns over global economic growth outlook. A stronger yen put additional pressure on Japanese exporters.

-

03:08

Nikkei 225 16,624.41 +208.22 +1.27 %, Hang Seng 19,181.12 +294.82 +1.56 %, Shanghai Composite 2,937.35 -39.35 -1.32 %

-

00:29

Stocks. Daily history for Sep Jan 20’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,841.53 -61.54 -1.26%

TOPIX 1,338.97 -51.44 -3.70%

SHANGHAI COMP 2,976.52 -31.22 -1.04%

HANG SENG 18,886.3 -749.51 -3.82%

FTSE 100 5,673.58 -203.22 -3.46 %

CAC 40 4,124.95 -147.31 -3.45 %

Xetra DAX 9,391.64 -272.57 -2.82 %

S&P 500 1,859.33 -22.00 -1.17 %

NASDAQ Composite 4,471.69 -5.26 -0.12 %

Dow Jones 15,766.74 -249.28 -1.56 %

-