Noticias del mercado

-

18:12

WSE: Session Results

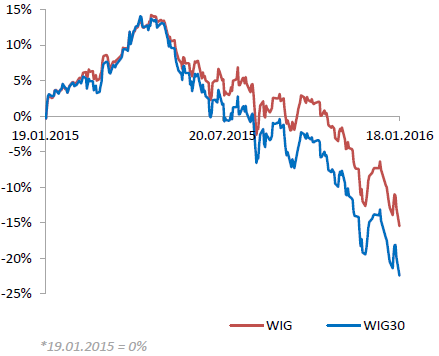

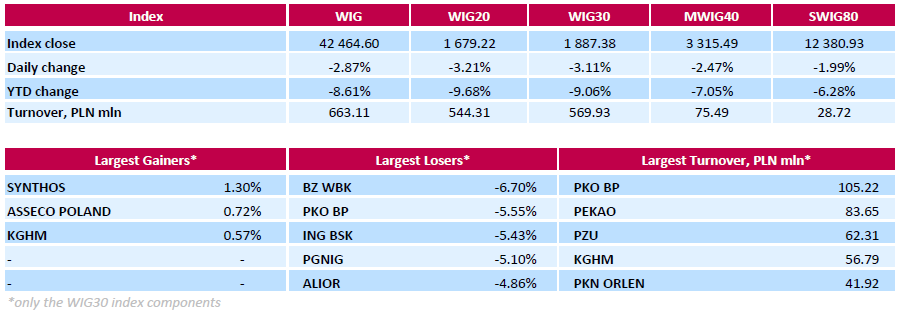

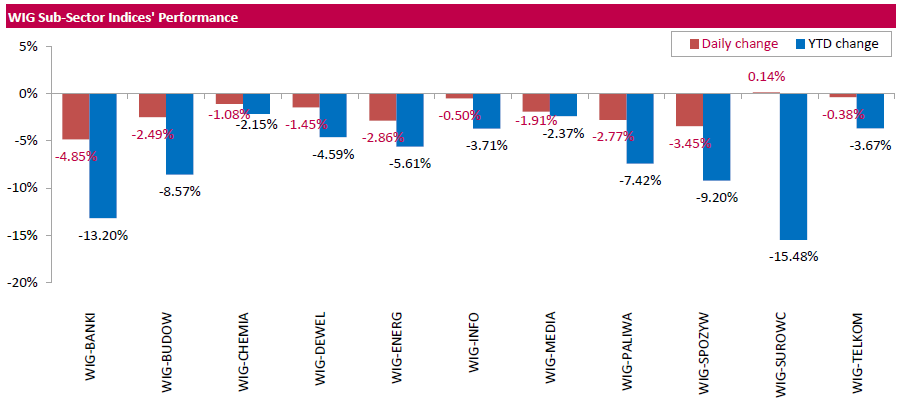

Polish equity market plunged on Monday, with the broad market measure, the WIG Index, declining by 2.87% after an unexpected Poland's foreign currency rating downgrade by Standard & Poor's agency. Materials sector (+0.14%) was the sole gainer among the WIG's 11 industry groups. At the same time, banking sector (-4.85%) was hit the hardest, following the president's Swiss franc mortgage conversion bill presented on Friday.

The large-cap companies' measure, the WIG30 Index, fell by 3.11%. Only three index constituents managed to generate positive returns: chemical producer SYNTHOS (WSE: SNS) gained 1.3%, IT-company ASSECO POLAND (WSE: ACP) added 0.72% and copper mainer KGHM (WSE: KGH) advanced 0.57%. At the same time, the session's most prominent losers were banking names BZ WBK (WSE: BZW), PKO BP (WSE: PKO), ING BSK (WSE: ING) and ALIOR (WSE: ALR), oil and gas producer PGNIG (WSE: PGN), railway freight transport operator PKP CARGO (WSE: PKP) and footwear retailer CCC (WSE: CCC), tumbling between 4.67% and 6.7%.

-

18:00

European stocks close: stocks closed lower on a drop in oil prices

Stock indices traded lower on a drop in oil prices. Concerns over the global oil oversupply weigh on oil prices.

International sanctions on Iran were lifted over the weekend after the International Atomic Energy Agency announced that Tehran had fulfilled its commitment.

Iran said on Sunday that it plans to raise its exports by 500,000 barrels per day.

Iran is a member of the Organization of the Petroleum Exporting Countries (OPEC), and is the fifth biggest OPEC oil producer.

U.S. stock markets are closed for a public holiday on Monday.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,779.92 -24.18 -0.42 %

DAX 9,521.85 -23.42 -0.25 %

CAC 40 4,189.57 -20.59 -0.49 %

-

18:00

European stocks closed: FTSE 5779.92 -24.18 -0.42%, DAX 9521.85 -23.42 -0.25%, CAC 40 4189.57 -20.59 -0.49%

-

17:07

EY Item Club expects the U.K. economy to expand 2.6% in 2016

EY Item Club released its economic forecasts for the U.K. on Monday. The U.K. economy is expected to expand 2.6% in 2016, after a 2.2% in 2015. According to EY Item Club, the economy will be driven by consumer spending, which is expected to rise 2.8% this year.

Inflation is expected to 0.7% in 2016, 1.6% in 2017 and 1.8% in 2018.

The thin-tank expects that the Bank of England (BoE) will not raise its interest rate until November due to low inflation.

EY Item Club said that it forecasts the BoE's interest rate to be 1% by the middle of 2017 and 1.5% by the end of 2017.

-

16:40

Standard & Poor's affirms Belgium's credit rating

Standard & Poor's affirmed Belgium's credit rating at 'AA/A1+' on Friday. The outlook is stable.

The agency noted that economic recovery and reforms support the fiscal and external positions.

"We expect Belgium to reduce its public deficit and maintain a strong external position on the back of gradual economic recovery, supply side reforms, and fiscal consolidation," S&P said.

-

16:21

European Central Bank purchases €15.27 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €15.27 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.08 billion of covered bonds, and €55 million of asset-backed securities.

The ECB will release its interest rate decision on Thursday. Analysts expect the central bank to keep its monetary policy unchanged.

-

15:57

French President Francois Hollande: the government will spend €2.00 billion to create more jobs in France

French President Francois Hollande said in a speech on Monday that the government will spend €2.00 billion to create more jobs in France.

"These two billion euros will be financed without any new taxes of any kind, in other words, they will be financed by savings," he said.

-

15:05

Australia’s inflation gauge rises 0.2% in December

The TD Securities and Melbourne Institute (MI) released their monthly inflation gauge data on Monday. Australia's inflation gauge was up 0.2% in December, after a 0.1% gain in November.

On a yearly basis, inflation gauge rose 2.0% in December from 1.8% in November.

The rise was mainly driven by rises in prices for fruit and vegetables, holiday travel and accommodation, and meat and seafood.

The trimmed mean of the inflation gauge declined to 1.7% year-on-year in December from 1.8% in November.

"We expect headline inflation to increase by 0.3 per cent in the quarter, to be 1.7 per cent higher than a year ago, while we forecast underlying inflation to increase by 0.5 per cent in the quarter, for an annual rate of 2.0 per cent. These forecasts are entirely consistent with the RBA's November projections," Chief Asia-Pac Macro Strategist at TD Securities, Annette Beacher, said.

-

14:35

New motor vehicle sales in Australia decline 0.5% in December

The Australian Bureau of Statistics released its new motor vehicle sales on Monday. New motor vehicle sales in Australia fell 0.5% in December, after a 1.3% rise in November. November's figure was revised up from a 1.0% gain.

Sales of passenger vehicles increased by 0.4% in December, sales of sports utility vehicles were up 0.1%, while sales for other vehicles rose by 0.8%.

On a yearly basis, new motor vehicle sales rose 2.2% in December, after a 6.0% increase in November.

-

12:00

European stock markets mid session: stocks traded lower on a drop in oil prices

Stock indices traded lower on a drop in oil prices. Concerns over the global oil oversupply weigh on oil prices.

International sanctions on Iran were lifted over the weekend after the International Atomic Energy Agency announced that Tehran had fulfilled its commitment.

Iran said on Sunday that it plans to raise its exports by 500,000 barrels per day.

Iran is a member of the Organization of the Petroleum Exporting Countries (OPEC), and is the fifth biggest OPEC oil producer.

U.S. stock markets will be closed for a public holiday on Monday.

Current figures:

Name Price Change Change %

FTSE 100 5,800.18 -3.92 -0.07 %

DAX 9,521.36 -23.91 -0.25 %

CAC 40 4,195.24 -14.92 -0.35 %

-

11:47

People’s Bank of China injected 55 billion yuan into market

The People's Bank of China (PBoC) injected 55 billion yuan ($8.36 billion) into market through its short-term liquidity operations (SLO) on Monday.

The reason for this injection could be the decision to boost liquidity.

-

11:41

Italy’ trade surplus falls to €4.41 billion in November

The Italian statistical office Istat released its trade data for Italy on Monday. Italy' trade surplus narrowed to €4.41 billion in November from €4.82 billion in October. October's figure was revised up €4.81 billion.

Exports climbed 6.4% year-on-year in November, while imports increased 3.8%.

On a monthly basis, exports rose a seasonally-adjusted 3.5% in November, while imports were up 1.4%.

The seasonally-adjusted trade surplus with the EU was €1.48 billion in November, while the trade surplus with non-EU countries was €2.80 billion.

-

11:32

The People's Bank of China will raise the reserve requirement ratio on yuan deposits of offshore bank

The People's Bank of China (PBoC) said on Monday that it raised the reserve requirement ratio on yuan deposits of offshore banks.

The central bank noted that the ratio will be raised to "normal levels" from zero.

Changes will be effective on January 25.

-

11:17

Home prices in China rise in December

China's National Bureau of Statistics (NBS) said on Monday that average new home prices in 70 major cities climbed at an annual rate of 7.7% in December, after a 6.5% gain in November.

The main contributor was Shenzhen, where home prices jumped by 46.8% year-on-year in December.

On a monthly base, house prices increased in 39 of 70 cities, prices slid in 27 cities, while prices remained unchanged in 4 cities.

-

10:31

Rightmove: U.K. house prices rise 0.5% in January

According to property tracking website Rightmove, U.K. house prices rose 0.5% in January, after a 1.1% drop in December.

"Encouragingly for first-time buyers there's more fresh choice with more property coming to market in their target sector. With their asking prices pretty much the same as a month ago, perhaps the knock-on effects of the more punitive landlord tax regime have arrived early and they now face a dilemma over whether to buy now or wait to see if prices drop in this sector over the next few months," Rightmove director and housing market analyst, Miles Shipside, said.

On a yearly basis, house prices in the U.K. climbed 6.5% in January, after a 7.4% increase in December.

-

10:00

Earnings Season in U.S.: Major Reports of the Week

January 19

Before the Open:

Bank of America (BAC). Consensus EPS $0.27, Consensus Revenue $19891.85 mln

Morgan Stanley (MS). Consensus EPS $0.34, Consensus Revenue $7473.32 mln

UnitedHealth (UNH). Consensus EPS $1.38, Consensus Revenue $43109.79 mln

After the Close:

IBM (IBM). Consensus EPS $4.82, Consensus Revenue $22123.53 mln

January 20

Before the Open:

Goldman Sachs (GS). Consensus EPS $3.62, Consensus Revenue $7044.11 mln

January 21

Before the Open:

Travelers (TRV). Consensus EPS $2.66, Consensus Revenue $6068.00 mln

Verizon (VZ). Consensus EPS $0.88, Consensus Revenue $34151.73 mln

After the Close:

American Express (AXP). Consensus EPS $1.13, Consensus Revenue $8399.38 mln

Starbucks (SBUX). Consensus EPS $0.45, Consensus Revenue $5397.07 mln

January 22

Before the Open:

General Electric (GE). Consensus EPS $0.49, Consensus Revenue $36008.63 mln

-

09:41

Japan's tertiary industry activity index drops 0.8% in November

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Monday. The index dropped 0.8% in November, after a 0.9% increase in October.

The fall was driven by declines in living and amusement-related services, wholesale trade, retail trade, transport and Postal activities, finance and insurance, goods rental and leasing(include automobile rental and leasing), and electricity, gas, heat supply and water industries.

-

09:27

Final industrial production in Japan drops 0.9% in November

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Monday. Final industrial production in Japan declined 0.9% in November, up from the preliminary estimate of a 1.0% drop, after a 1.4% increase in October.

Industrial shipments slid 2.4% in November, up from the preliminary estimate of a 2.5% fall, while inventories rose 0.4%, in line with the preliminary estimate.

On a yearly basis, Japan's industrial production was up 1.7% in November, up from the preliminary estimate of a 1.6% rise, after a 1.4% decline in October.

-

06:59

Global Stocks: U.S. stock indices posted sharp declines

U.S. stock indices fell on Friday with plunging oil prices being the biggest contributors to declines as market participants prepared for a rise in supplies from Iran.

The Dow Jones Industrial Average plunged 390.97 points, or 2.4%, to 15,988.08. The S&P 500 declined 44.85 point, or 2.3%, to 1,876.99 (all of its 10 sectors fell). The Nasdaq Composite lost 126.59 points, or 2.7%, to 4,488.42.

A renewed selloff in Chinese stocks weighed on U.S. markets. Meanwhile both S&P 500 and the Dow lost more than 2% over the week. However the Nasdaq outpaced their declines and lost more than 3% over the week.

The Federal Reserve reported on Friday that industrial production contracted more than expected in the U.S. in December. The corresponding index fell by 0.4% m/m, while economists had expected a more modest decline of 0.2%. Industrial production fell by 1.8% on an annualized basis.

This morning in Asia Hong Kong Hang Seng fell 0.50%, or 97.13, to 19,423.64. China Shanghai Composite Index gained 1.10%, or 31.79, to 2,932.76. The Nikkei lost 1.03%, or 177.44, to 16,969.67.

Asian stocks traded mixed as declines in Wall Street encouraged investors to sell. Market participants are waiting for China GDP data due on Tuesday. This report might have significant influence on global stock markets as concerns over the Chinese economy have been key negative factors for stocks.

-

03:03

Nikkei 225 16,900.44 -246.67 -1.44%, Hang Seng 19,330.66 -190.11 -0.97%, Shanghai Composite 2,866.74 -34.23 -1.18%

-

01:03

Stocks. Daily history for Sep Jan 15’2016:

(index / closing price / change items /% change)

Nikkei 225 17,147.11 -93.84 -0.54 %

Hang Seng 19,520.77 -296.64 -1.50 %

Shanghai Composite 2,902.22 -105.43 -3.51 %

FTSE 100 5,804.1 -114.13 -1.93 %

CAC 40 4,210.16 -102.73 -2.38 %

Xetra DAX 9,545.27 -248.93 -2.54 %

S&P 500 1,880.33 -41.51 -2.16 %

NASDAQ Composite 4,488.42 -126.59 -2.74 %

Dow Jones 15,988.08 -390.97 -2.39 %

-