Noticias del mercado

-

21:00

Dow -2.30% 16,002.12 -376.93 Nasdaq -2.79% 4,486.47 -128.53 S&P -2.12% 1,881.15 -40.69

-

18:08

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes sank on Friday morning, with the Nasdaq hitting its lowest since Aug 24 and the Dow briefly dropping below 16000, as oil prices dived to less than $30 per barrel. Brent crude prices, which have fallen 20% this year, were down nearly 5% as the market braced for oil from Iran to flood an already oversupplied market. U.S. retail sales unexpectedly fell 0.1% in December, while industrial output declined for the third straight month in December, underscoring a worsening outlook for fourth-quarter economic growth.

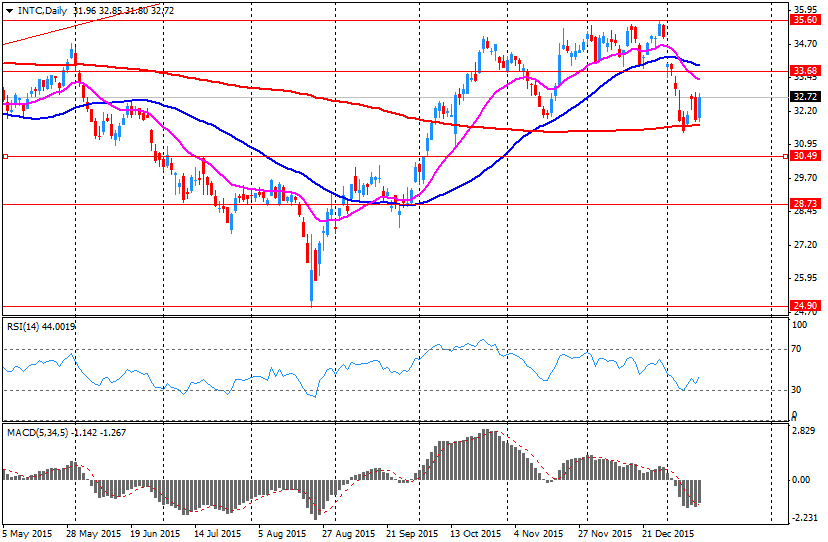

Almost all of Dow stocks in negative area (29 of 30). Top looser - Intel Corporation (INTC, -9,14%). Top gainer - The Home Depot, Inc. (HD, +0.47%).

All of S&P sectors in negative area. Top looser - Basic Materials (-4,2%).

At the moment:

Dow 15898.00 -383.00 -2.35%

S&P 500 1867.75 -46.75 -2.44%

Nasdaq 100 4122.50 -135.00 -3.17%

Crude Oil 30.56 -1.55 -4.83%

Gold 1089.00 +15.40 +1.43%

U.S. 10yr 2.08 +0.02

-

18:00

European stocks closed: FTSE 100 5,804.1 -114.13 -1.93% CAC 40 4,210.16 -102.73 -2.38% DAX 9,545.27 -248.93 -2.54%

-

18:00

European stocks close: stocks closed lower on a drop in oil prices below $30 a barrel

Stock indices traded lower on a drop in oil prices below $30 a barrel. Concerns over the global oil oversupply weigh on oil prices.

Meanwhile, the economic data from the Eurozone was positive. Eurostat released its trade data for the Eurozone on Friday. Eurozone's adjusted trade surplus rose to €22.7 billion in November from €19.8 billion in October.

Exports rose at an adjusted 1.6% in November, while imports decreased 0.1%.

Eurozone's unadjusted trade surplus fell to €23.6 billion in November from €24.1 billion in October.

Exports rose at an unadjusted annual rate of 6.0% in November, while imports increased 5.0%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.5% in November, after a 0.2% rise in October.

The decline was driven by a drop in infrastructure, which plunged 4.3% in November.

On a yearly basis, construction output decreased 1.1% in November, after a 1.0% rise in October. It was the biggest decline since May 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,804.1 -114.13 -1.93 %

DAX 9,545.27 -248.93 -2.54 %

CAC 40 4,210.16 -102.73 -2.38 %

-

17:53

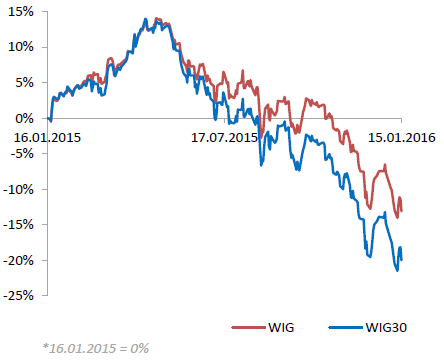

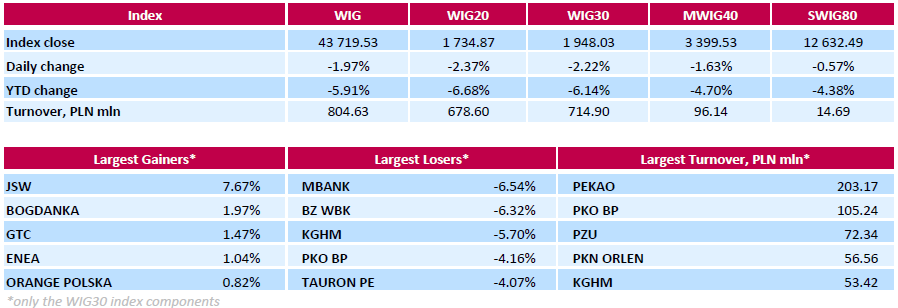

WSE: Session Results

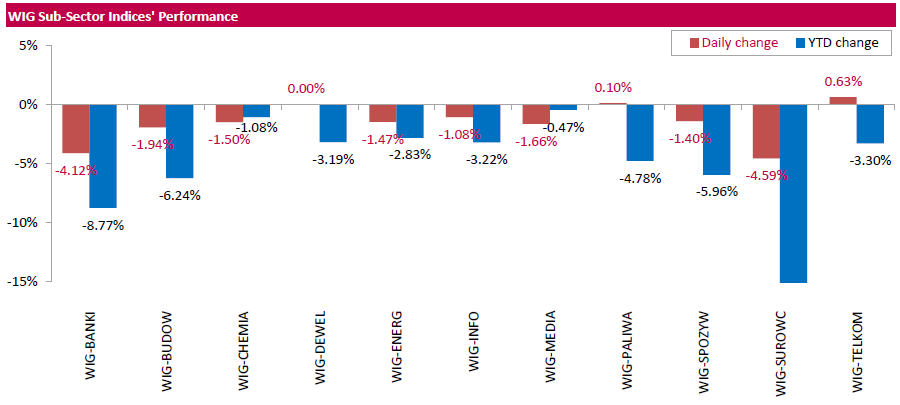

Polish equities plunged on Friday. The broad market benchmark, the WIG Index, lost 1.97%. Almost all sectors in the WIG generated negative returns. The exception were telecoms (+0.63%) and oil and gas sector (+0.10%). At the same time, banking sector (-4.12%) and materials (-4.59%) were the weakest groups.

The large-cap stocks declined by 2.22%, as measured by the WIG30 Index. Within the index components, banks MBANK (WSE: MBK) and BZ WBK (WSE: BZW) were the weakest performers, slumping by 6.54% and 6.32% respectively. Copper producer KGHM (WSE: KGH) was also beaten down heavily, declining by 5.7% on tumbling copper prices. On the other side of the ledger, coking coal producer JSW (WSE: JSW) led a handful of gainers with a 7.67% advance, followed by thermal coal miner BOGDANKA (WSE: LWB) and property developer GTC (WSE: GTC), adding 1.97% and 1.47% respectively.

-

17:23

U.K. leading economic index increases 0.3% in November

The Conference Board (CB) released its leading economic index for the U.K. on Friday. The leading economic index (LEI) increased 0.3% in November, after a 0.1% fall in October.

The coincident index was up 0.2% in November.

-

16:56

New York Fed President William Dudley: the Fed’s further interest rate hikes will be gradual and depend on the incoming economic data

New York Fed President William Dudley said in a speech on Friday that the Fed's further interest rate hikes will be gradual and depend on the incoming economic data.

"Looking ahead, I'll talk about what comes next. No surprises here-it depends on the data. As noted in the December FOMC statement, we expect that the normalization of monetary policy will be quite gradual," he said.

Dudley expressed concerns about low inflation.

"With respect to the risks to the inflation outlook, the most concerning is the possibility that inflation expectations become unanchored to the downside. This would be problematic were it to occur because inflation expectations are an important driver of actual inflation," he noted.

"I expect the increase in resource utilization will be sufficient to push both inflation and inflation expectations higher over time. That said, should the economy unexpectedly weaken, then this fall in inflation expectations would become more concerning," New York Fed president added.

-

16:34

Thomson Reuters/University of Michigan preliminary consumer sentiment index climbs to 93.3 in January

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 93.3 in January from a final reading of 92.6 in December, exceeding expectations for an increase to 93.0.

"Consumer optimism is now dependent on the continuation of an extraordinarily low inflation rate. Rather than welcoming a rising inflation rate as a signal of a strengthening economy, consumers are now more likely to reduce the pace of their spending and thus act to erase the Fed's rationale for higher interest rates," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"Given the favourable overall state of the Sentiment Index, the data continue to indicate that real personal consumption expenditures can be expected to advance by 2.8% in 2016," he added.

The index of current economic conditions declined to 105.1 in January from 108.1 in December, while the index of consumer expectations rose to 85.7 from 82.7.

The one-year inflation expectations fell to 2.4% in January from 2.6% in December.

-

16:27

U.S. business inventories decline 0.2% in November

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories declined 0.2% in November, missing expectations for a 0.1% fall, after a flat reading in October. It was the largest drop since September 2011.

Retail inventories climbed 0.2% in November, wholesale inventories were down 0.3%, while manufacturing inventories fell 0.3%.

Retail sales increased 0.3% in November, while business sales were up 0.2%.

The business inventories/sales ratio remained unchanged at 1.38 months in November. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:36

U.S. Stocks open: Dow -2.21%, Nasdaq -2.84%, S&P -2.09%

-

15:31

U.S. industrial production declines 0.4% in December

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production fell 0.4% in December, missing expectations for a 0.2% decrease, after a 0.9% decline in November. November's fall was the fastest drop since May 2009.

November's figure was revised down from a 0.6% fall.

The drop was mainly driven by a fall in the mining output and utilities. Mining output plunged by 0.8% in December, while utilities production slid 2.0%.

Manufacturing output decreased 0.1% in December, after a 0.1% fall in November. November's figure was revised down from a flat reading.

Capacity utilisation rate decreased to 76.5% in December from 76.9% in November, missing expectations for a decline to 76.8%. November's figure was revised down from 77.0%.

-

15:30

Before the bell: S&P futures -2.52%, NASDAQ futures -2.84%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 17,147.11 -93.84 -0.54%

Hang Seng 19,520.77 -296.64 -1.50%

Shanghai Composite 2,902.22 -105.43 -3.51%

FTSE 5,797.63 -120.60 -2.04%

CAC 4,208.94 -103.95 -2.41%

DAX 9,536.31 -257.89 -2.63%

Crude oil $29.56 (-5.29%)

Gold $1090.40 (+1.56%)

-

15:17

U.S. producer prices fall 0.2% in December

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index fell 0.2% in December, in line with expectations, after a 0.3% rise in November.

A stronger U.S. dollar and weak global demand weigh on inflation.

The decline was mainly driven by a drop in energy prices, which declined 3.4% in December.

Services prices were up 0.1% in December, while prices for goods declined 0.7%.

Wholesale food prices slid 1.3% in December.

On a yearly basis, the producer price index decreased 1.0% in December, in line with expectations, after a 1.1% fall in November.

In 2015 as whole, U.S. producer prices declined 1.0%, after a 0.9% rise in 2014.

The producer price index excluding food and energy rose 0.1% in December, in line with expectations, after a 0.3% increase in November.

On a yearly basis, the producer price index excluding food and energy climbed 0.3% in December, in line with forecasts, after a 0.5% rise in November.

These figures could mean that the Fed will delay its further interest rate hikes.

-

15:04

U.S. retail sales fall 0.1% in December

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales fell 0.1% in December, missing expectations for a flat reading, after a 0.4% gain in November. November's figure was revised up from a 0.2% increase.

The lower increase was mainly driven by a fall in sales at service stations, which dropped 1.1% in December.

Retail sales excluding automobiles decreased 0.1% in December, after a 0.3% rise in November.

Sales at building material and garden equipment stores increased 0.7% in December, while sales at furniture stores climbed 0.9%.

Sales at clothing retailers fell 0.9% in December, while sales at auto dealerships were flat.

These figures could mean that the Fed will delay its further interest rate hikes.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

7.92

4.49%

35.2K

ALTRIA GROUP INC.

MO

57.48

-1.27%

2.0K

International Paper Company

IP

36

-1.48%

14.5K

Procter & Gamble Co

PG

75

-1.51%

0.3K

Merck & Co Inc

MRK

50.98

-1.58%

0.1K

UnitedHealth Group Inc

UNH

108.99

-1.60%

31.3K

United Technologies Corp

UTX

87.59

-1.60%

27.0K

The Coca-Cola Co

KO

41.2

-1.62%

3.7K

Wal-Mart Stores Inc

WMT

62

-1.68%

0.4K

Boeing Co

BA

127

-1.70%

1.3K

Johnson & Johnson

JNJ

97.2

-1.71%

0.1K

AT&T Inc

T

33.71

-1.72%

20.8K

Verizon Communications Inc

VZ

44.1

-1.72%

3.4K

Visa

V

72.47

-1.80%

4.0K

International Business Machines Co...

IBM

130.25

-2.00%

33.9K

American Express Co

AXP

62

-2.04%

26.8K

Deere & Company, NYSE

DE

72.07

-2.08%

0.1K

Cisco Systems Inc

CSCO

24.14

-2.11%

211.6K

Pfizer Inc

PFE

30.45

-2.12%

0.3K

McDonald's Corp

MCD

114.11

-2.15%

31.8K

Google Inc.

GOOG

698

-2.34%

4.1K

Goldman Sachs

GS

157.5

-2.41%

0.5K

General Electric Co

GE

28.36

-2.41%

9.5K

JPMorgan Chase and Co

JPM

56.8

-2.41%

0.8K

Nike

NKE

57.06

-2.48%

11.4K

Home Depot Inc

HD

116.62

-2.51%

2.9K

E. I. du Pont de Nemours and Co

DD

55.93

-2.56%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

55.81

-2.60%

0.5K

Ford Motor Co.

F

11.86

-2.71%

63.8K

Amazon.com Inc., NASDAQ

AMZN

576.8

-2.73%

19.9K

Apple Inc.

AAPL

96.6

-2.93%

378.3K

General Motors Company, NYSE

GM

29.41

-2.94%

7.9K

Microsoft Corp

MSFT

51.54

-2.96%

9.1K

Yahoo! Inc., NASDAQ

YHOO

29.38

-3.10%

5.5K

Starbucks Corporation, NASDAQ

SBUX

57.08

-3.22%

6.0K

Hewlett-Packard Co.

HPQ

10.27

-3.30%

1.9K

Twitter, Inc., NYSE

TWTR

18.37

-3.32%

36.8K

Exxon Mobil Corp

XOM

76.25

-3.63%

71.8K

Citigroup Inc., NYSE

C

43.65

-3.81%

166.9K

Walt Disney Co

DIS

95.25

-3.89%

54.8K

Facebook, Inc.

FB

94.51

-3.92%

132.8K

Caterpillar Inc

CAT

59.73

-4.08%

12.3K

Tesla Motors, Inc., NASDAQ

TSLA

197.75

-4.09%

1.6K

ALCOA INC.

AA

6.94

-4.14%

77.5K

Chevron Corp

CVX

81.5

-4.64%

6.1K

Yandex N.V., NASDAQ

YNDX

12.5

-5.16%

3.9K

Intel Corp

INTC

30.84

-5.80%

183.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

3.85

-8.33%

149.7K

-

14:57

Upgrades and downgrades before the market open

Upgrades:

JPMorgan Chase (JPM) upgraded to Overweight from Neutral at Atlantic Equities

Downgrades:

Walt Disney (DIS) downgraded to Underweight at Barclays

Other:

Intel (INTC) target lowered to $36 at ROTH Capital

Intel (INTC) target lowered to $36 from $38 at Topeka Capital Markets

Intel (INTC) target raised to $41 from $39 at Wedbush

Intel (INTC) target raised to $37 from $36 at Stifel

JPMorgan Chase (JPM) target lowered to $70 from $76 at Argus

Amazon (AMZN) initiated with a Positive at Susquehanna; target $900

-

14:52

NY Fed Empire State manufacturing index drops to -19.37 in January

The New York Federal Reserve released its survey on Friday. The NY Fed Empire State manufacturing index dropped to -19.37 in January from -6.21 in December, missing expectations for an increase to -4.00. December's figure was revised down from -4.59.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The January 2016 Empire State Manufacturing Survey indicates that business activity declined for New York manufacturers at the fastest pace since the Great Recession," the New York Federal Reserve said in its report.

The new orders index plunged to -23.54 in January from-6.18 in December, while the shipments index slid to -14.39 from 4.62.

The general business conditions expectations index for the next six months slid to 9.51 in January from 35.65 in December.

The price-paid index climbed to 16.00 in January from 4.04 in December.

The index for the number of employees rose to -13.00 in January from -16.16 in December.

-

14:48

-

14:37

Bank of England’s quarterly Credit Conditions Survey: demand for personal credit and unsecured loans in the third quarter rose strongly

The Bank of England released its quarterly Credit Conditions Survey on Friday. Demand for personal credit and unsecured loans in the third quarter rose strongly. The central bank added that demand for both types of loans will remain strong in the first quarter.

According to the report, demand for loans from U.K. businesses climbed.

The demand for credit card lending dropped in the fourth quarter.

-

14:34

Company News: Intel (INTC) Q4 Earnings Beat Expectations

Intel reported Q4 FY 2015 earnings of $0.74 per share (versus $0.74 in Q4 FY 2014), beating analysts' consensus of $0.63.

The company's revenues amounted to $14.914 bln (+1.3% y/y), slightly beating consensus estimate of $14.802 bln.

Intel issued in-line guidance for Q1 FY 2016, projecting quarterly revenues of $13.6-14.6 bln versus consensus of $13.89 bln.

INTC fell to $30.90 (-5.62%) in pre-market trading.

-

14:24

International Monetary Fund (IMF) Managing Director Christine Lagarde: the IMF is not ready yet to take part in the third Greek bailout programme

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with the German Süddeutsche Zeitung on Friday that the IMF is not ready yet to take part in the third Greek bailout programme, adding that the IMF will probably only decide in the spring whether to take part or not.

She noted debt sustainability and progress on Greek pension reforms would be key.

-

12:11

European stock markets mid session: stocks traded lower on a drop in oil prices

Stock indices traded lower on a drop in oil prices. Concerns over the global oil oversupply weigh on oil prices.

Meanwhile, the economic data from the Eurozone was positive. Eurostat released its trade data for the Eurozone on Friday. Eurozone's adjusted trade surplus rose to €22.7 billion in November from €19.8 billion in October.

Exports rose at an adjusted 1.6% in November, while imports decreased 0.1%.

Eurozone's unadjusted trade surplus fell to €23.6 billion in November from €24.1 billion in October.

Exports rose at an unadjusted annual rate of 6.0% in November, while imports increased 5.0%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.5% in November, after a 0.2% rise in October.

The decline was driven by a drop in infrastructure, which plunged 4.3% in November.

On a yearly basis, construction output decreased 1.1% in November, after a 1.0% rise in October. It was the biggest decline since May 2013.

Current figures:

Name Price Change Change %

FTSE 100 5,838.46 -79.77 -1.35 %

DAX 9,664.17 -130.03 -1.33 %

CAC 40 4,246.82 -66.07 -1.53 %

-

12:07

Final consumer prices in Italy are flat in December

The Italian statistical office Istat released its final consumer price inflation data for Italy on Friday. Final consumer prices in Italy were flat in December, in line with preliminary reading, after a 0.4% drop in November.

Prices for services related to recreation including repair and personal care rose 0.3% in December, while prices of durable goods increased 0.5%.

On a yearly basis, consumer prices climbed 0.1% in December, in line with preliminary reading, after a 0.1% increase in November.

The increase was mainly driven by higher prices for services related to recreation including repair and personal care. Prices for services related to recreation including repair and personal care rose 0.9% year-on-year in December, after a 0.6% gain in November.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.6% year-on-year in December from 0.7% in November.

From the final data of January 2016, the Istat will change its calculation.

-

11:58

Final consumer price inflation in Spain falls 0.3% in December

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 0.3% in December, in line with the preliminary reading, after a 0.4% increase in November.

On a yearly basis, consumer prices fell by 0.3% in December from a year ago, in line with preliminary reading, after a 0.7% decline in November.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:54

UK’s construction output declines 0.5% in November

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.5% in November, after a 0.2% rise in October.

The decline was driven by a drop in infrastructure, which plunged 4.3% in November.

On a yearly basis, construction output decreased 1.1% in November, after a 1.0% rise in October. It was the biggest decline since May 2013.

-

11:49

Eurozone's unadjusted trade surplus falls to €23.6 billion in November

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus fell to €23.6 billion in November from €24.1 billion in October.

Exports rose at an unadjusted annual rate of 6.0% in November, while imports increased 5.0%.

Eurozone's adjusted trade surplus rose to €22.7 billion in November from €19.8 billion in October.

Exports rose at an adjusted 1.6% in November, while imports decreased 0.1%.

-

11:16

Bank of Japan Governor Haruhiko Kuroda: the central bank has no plans to add further stimulus measures

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Friday that the central bank has no plans to add further stimulus measures, but he added that the central bank is ready to adjust its quantitative easing if needed.

"I don't have plans for further monetary easing at the moment. But we're ready to adjust policy without hesitation if there is any change in the broad price trend," he said.

Kuroda pointed out that inflation was improving.

-

11:09

Head of the Eurogroup Jeroen Dijsselbloem: Athens accepts the International Monetary Fund has to take part in the third bailout programme

The head of the Eurogroup Jeroen Dijsselbloem said on Thursday that Athens accepts the International Monetary Fund has to take part in the third bailout programme.

"Greek Finance Minister confirmed to me that the Greek government accepts that the IMF needs to be part of the process," he said.

Greek Prime Minister Alexis Tsipras said in December that the participation of the IMF was not necessary.

-

10:59

Reuters’ poll: the Bank of England will keep its interest rate unchanged at least until July

According to a Reuters' poll, the Bank of England (BoE) will keep its interest rate unchanged at least until July, noting that uncertainty over UK's membership of the European Union is the biggest risk to the country's economy.

-

10:47

New loans in China fall to 597.8 billion yuan in December

The People's Bank of China (PBoC) released its new loans data on Friday. New loans in local currency in China were 597.8 billion yuan in December, down from November's 708.9 billion yuan and well below expectations of 700 billion yuan.

M2 money supply jumped by 13.3% year-on-year in December, after a 13.7gain in November.

Total social financing increased to 1.82 trillion yuan in December from 1.02 trillion yuan in November.

-

10:38

The Wall Street Journal’s survey: 17% of respondents say the U.S. economy will enter recession in the next year

According to The Wall Street Journal's latest survey, 17% of respondents said that the U.S. economy will enter recession in the next year. It was the highest risk in three years. 80% of respondents noted that there are downside risks to the U.S. economic outlook.

The Wall Street Journal surveyed 76 economists January 8 - January 12.

-

10:22

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.4 in in the week ended January 10

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 44.4 in in the week ended January 10 from 44.2 the prior week. It was the highest level since early October.

The increase was driven by a more favourable assessment of the measure of views of the economy. The measure of views of the economy rose to 38.0 from 37.0.

The buying climate index remained unchanged at 39.4.

The personal finances index fell to 55.9 from 56.2.

-

10:09

Home loans in Australia climb 1.8% in November

The Australian Bureau of Statistics released its home loans data on Friday. Home loans in Australia climbed 1.8% in November, beating expectations for a 0.5% drop, after 0.3% fall in October. October's figure was revised down from a 2.0% rise.

The value of owner occupied loans rose at a seasonally adjusted 2.4% in November, investment lending increased 0.7%, while the number of loans for the construction of dwellings climbed 2.7%.

-

07:09

Global Stocks: U.S. stock indices rose

U.S. stock indices advanced on Thursday as oil prices climbed and a Fed official said that it might take more time to reach the inflation target.

The Dow Jones Industrial Average gained 227.64 points, or 1.4%, to 16,379.05. The S&P 500 rose 31.56 point, or 1.7%, to 1,921.84 (all of its 10 sectors rose). The Nasdaq Composite added 88.94 points, or 2%, to 4,615.00.

St. Louis Fed President James Bullard said that renewed declines in oil prices may extend the period of time required to reach the 2% inflation target. However he did not say in which way slower inflation may influence the pace of rate increases. Now futures suggest a 41% probability of a rate hike in March compared to 47% in the previous month.

Market participants also watched earnings reports. Analysts expect a decline in profits per share.

This morning in Asia Hong Kong Hang Seng fell 1.24%, or 246.59, to 19,570.82. China Shanghai Composite Index dropped 2.94%, or 88.32, to 2,919.33. The Nikkei lost 0.83%, or 143.82, to 17,097.13.

Asian stocks fell amid renewed declines in oil prices and disappointing data from China. The People's Bank of China reported that loans came in at $1.79 trillion in 2015 (18.3% up from 2014). However the bank said that in December loans fell by 36.6% on a y/y basis to $91.3 billion.

-

03:05

Nikkei 225 17,347.65 +106.70 +0.62 %, Hang Seng 19,738.98 -78.43 -0.40 %, Shanghai Composite 2,990.88 -16.77 -0.56 %

-

00:44

Stocks. Daily history for Sep Jan 14’2016:

(index / closing price / change items /% change)

Nikkei 225 17,240.95 -474.68 -2.68%

Hang Seng 19,817.41 -117.47 -0.59%

Shanghai Composite 3,007.65 +58.05 +1.97%

FTSE 100 5,918.23 -42.74 -0.72%

CAC 40 4,312.89 -79.05 -1.80%

Xetra DAX 9,794.2 -166.76 -1.67%

S&P 500 1,921.84 +31.56 +1.67%

NASDAQ Composite 4,615 +88.94 +1.97%

Dow Jones 16,379.05 +227.64 +1.41%

-