Noticias del mercado

-

17:23

U.K. leading economic index increases 0.3% in November

The Conference Board (CB) released its leading economic index for the U.K. on Friday. The leading economic index (LEI) increased 0.3% in November, after a 0.1% fall in October.

The coincident index was up 0.2% in November.

-

16:56

New York Fed President William Dudley: the Fed’s further interest rate hikes will be gradual and depend on the incoming economic data

New York Fed President William Dudley said in a speech on Friday that the Fed's further interest rate hikes will be gradual and depend on the incoming economic data.

"Looking ahead, I'll talk about what comes next. No surprises here-it depends on the data. As noted in the December FOMC statement, we expect that the normalization of monetary policy will be quite gradual," he said.

Dudley expressed concerns about low inflation.

"With respect to the risks to the inflation outlook, the most concerning is the possibility that inflation expectations become unanchored to the downside. This would be problematic were it to occur because inflation expectations are an important driver of actual inflation," he noted.

"I expect the increase in resource utilization will be sufficient to push both inflation and inflation expectations higher over time. That said, should the economy unexpectedly weaken, then this fall in inflation expectations would become more concerning," New York Fed president added.

-

16:34

Thomson Reuters/University of Michigan preliminary consumer sentiment index climbs to 93.3 in January

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 93.3 in January from a final reading of 92.6 in December, exceeding expectations for an increase to 93.0.

"Consumer optimism is now dependent on the continuation of an extraordinarily low inflation rate. Rather than welcoming a rising inflation rate as a signal of a strengthening economy, consumers are now more likely to reduce the pace of their spending and thus act to erase the Fed's rationale for higher interest rates," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"Given the favourable overall state of the Sentiment Index, the data continue to indicate that real personal consumption expenditures can be expected to advance by 2.8% in 2016," he added.

The index of current economic conditions declined to 105.1 in January from 108.1 in December, while the index of consumer expectations rose to 85.7 from 82.7.

The one-year inflation expectations fell to 2.4% in January from 2.6% in December.

-

16:27

U.S. business inventories decline 0.2% in November

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories declined 0.2% in November, missing expectations for a 0.1% fall, after a flat reading in October. It was the largest drop since September 2011.

Retail inventories climbed 0.2% in November, wholesale inventories were down 0.3%, while manufacturing inventories fell 0.3%.

Retail sales increased 0.3% in November, while business sales were up 0.2%.

The business inventories/sales ratio remained unchanged at 1.38 months in November. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, December 93.3 (forecast 93)

-

16:00

U.S.: Business inventories , November -0.2% (forecast -0.1%)

-

15:31

U.S. industrial production declines 0.4% in December

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production fell 0.4% in December, missing expectations for a 0.2% decrease, after a 0.9% decline in November. November's fall was the fastest drop since May 2009.

November's figure was revised down from a 0.6% fall.

The drop was mainly driven by a fall in the mining output and utilities. Mining output plunged by 0.8% in December, while utilities production slid 2.0%.

Manufacturing output decreased 0.1% in December, after a 0.1% fall in November. November's figure was revised down from a flat reading.

Capacity utilisation rate decreased to 76.5% in December from 76.9% in November, missing expectations for a decline to 76.8%. November's figure was revised down from 77.0%.

-

15:17

U.S. producer prices fall 0.2% in December

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index fell 0.2% in December, in line with expectations, after a 0.3% rise in November.

A stronger U.S. dollar and weak global demand weigh on inflation.

The decline was mainly driven by a drop in energy prices, which declined 3.4% in December.

Services prices were up 0.1% in December, while prices for goods declined 0.7%.

Wholesale food prices slid 1.3% in December.

On a yearly basis, the producer price index decreased 1.0% in December, in line with expectations, after a 1.1% fall in November.

In 2015 as whole, U.S. producer prices declined 1.0%, after a 0.9% rise in 2014.

The producer price index excluding food and energy rose 0.1% in December, in line with expectations, after a 0.3% increase in November.

On a yearly basis, the producer price index excluding food and energy climbed 0.3% in December, in line with forecasts, after a 0.5% rise in November.

These figures could mean that the Fed will delay its further interest rate hikes.

-

15:15

U.S.: Industrial Production (MoM), December -0.4% (forecast -0.2%)

-

15:15

U.S.: Capacity Utilization, December 76.5% (forecast 76.8%)

-

15:15

U.S.: Industrial Production YoY , December -1.8%

-

15:04

U.S. retail sales fall 0.1% in December

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales fell 0.1% in December, missing expectations for a flat reading, after a 0.4% gain in November. November's figure was revised up from a 0.2% increase.

The lower increase was mainly driven by a fall in sales at service stations, which dropped 1.1% in December.

Retail sales excluding automobiles decreased 0.1% in December, after a 0.3% rise in November.

Sales at building material and garden equipment stores increased 0.7% in December, while sales at furniture stores climbed 0.9%.

Sales at clothing retailers fell 0.9% in December, while sales at auto dealerships were flat.

These figures could mean that the Fed will delay its further interest rate hikes.

-

14:52

NY Fed Empire State manufacturing index drops to -19.37 in January

The New York Federal Reserve released its survey on Friday. The NY Fed Empire State manufacturing index dropped to -19.37 in January from -6.21 in December, missing expectations for an increase to -4.00. December's figure was revised down from -4.59.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The January 2016 Empire State Manufacturing Survey indicates that business activity declined for New York manufacturers at the fastest pace since the Great Recession," the New York Federal Reserve said in its report.

The new orders index plunged to -23.54 in January from-6.18 in December, while the shipments index slid to -14.39 from 4.62.

The general business conditions expectations index for the next six months slid to 9.51 in January from 35.65 in December.

The price-paid index climbed to 16.00 in January from 4.04 in December.

The index for the number of employees rose to -13.00 in January from -16.16 in December.

-

14:47

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.40 (USD 390m) 118.00 (709m) 118.30 (330m) 118.50 (756m) 119.00 (533m)

EUR/USD 1.0700 (EUR 1.28bln) 1.0750 (1.1bln) 1.0780 (1.1bln) 1.0800 (2.3bln) 1.0900 (1.13bln) 1.1000 (1.9bln)

AUD/USD 0.6875 (AUD 727m) 0.6900 (317m) 0.7000-20 (470m) 0.7050 (889m) 0.7100 (1.1bln)

AUD/JPY 1.0700 (560m)

NZD/USD 0.6615 (NZD 700m)

-

14:37

Bank of England’s quarterly Credit Conditions Survey: demand for personal credit and unsecured loans in the third quarter rose strongly

The Bank of England released its quarterly Credit Conditions Survey on Friday. Demand for personal credit and unsecured loans in the third quarter rose strongly. The central bank added that demand for both types of loans will remain strong in the first quarter.

According to the report, demand for loans from U.K. businesses climbed.

The demand for credit card lending dropped in the fourth quarter.

-

14:31

U.S.: PPI, y/y, December -1% (forecast -1%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, December 0.3% (forecast 0.3%)

-

14:30

U.S.: Retail sales, December -0.1% (forecast 0%)

-

14:30

U.S.: PPI excluding food and energy, m/m, December 0.1% (forecast 0.1%)

-

14:30

U.S.: Retail Sales YoY, December 2.2%

-

14:30

U.S.: NY Fed Empire State manufacturing index , January -19.37 (forecast -4)

-

14:30

U.S.: PPI, m/m, December -0.2% (forecast -0.2%)

-

14:24

International Monetary Fund (IMF) Managing Director Christine Lagarde: the IMF is not ready yet to take part in the third Greek bailout programme

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with the German Süddeutsche Zeitung on Friday that the IMF is not ready yet to take part in the third Greek bailout programme, adding that the IMF will probably only decide in the spring whether to take part or not.

She noted debt sustainability and progress on Greek pension reforms would be key.

-

14:10

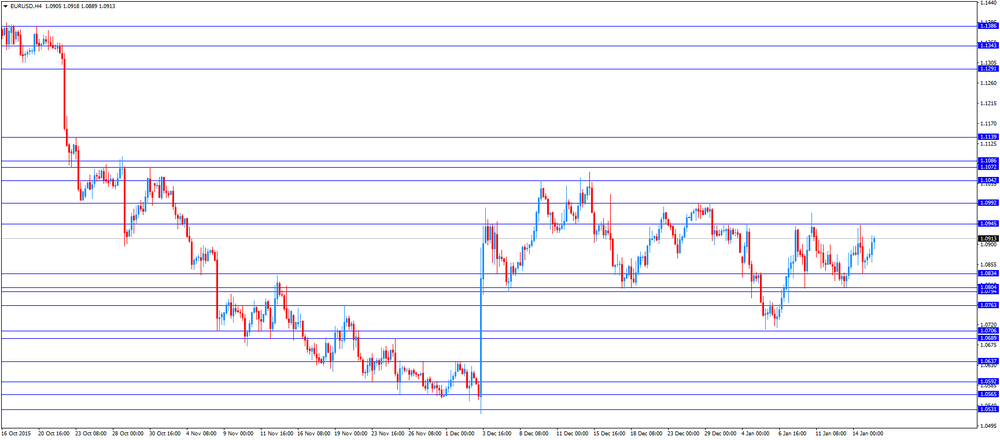

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive trade data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans November -0.3% Revised From 2.0% -0.5% 1.8%

02:00 China New Loans December 708.9 700 597.8

09:30 United Kingdom BOE Credit Conditions Survey

10:00 Eurozone Trade balance unadjusted November 24.1 23.6

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. retail sales are expected to be flat in December, after a 0.2% gain in November.

The U.S. PPI is expected to decline 0.2% in December, after a 0.3% rise in November.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in December, after a 0.3 gain in November.

The U.S. industrial production is expected to decrease 0.2% in December, after a 0.6% fall in November.

The NY Fed Empire State manufacturing index is expected to rise to -4.0 in January from -4.59 in December.

The preliminary Thomson Reuters/University of Michigan consumer sentiment index is expected to rise to 93.0 in January from a final reading of 92.6 in December.

The euro traded higher against the U.S. dollar after the release of the positive trade data from the Eurozone. Eurostat released its trade data for the Eurozone on Friday. Eurozone's adjusted trade surplus rose to €22.7 billion in November from €19.8 billion in October.

Exports rose at an adjusted 1.6% in November, while imports decreased 0.1%.

Eurozone's unadjusted trade surplus fell to €23.6 billion in November from €24.1 billion in October.

Exports rose at an unadjusted annual rate of 6.0% in November, while imports increased 5.0%.

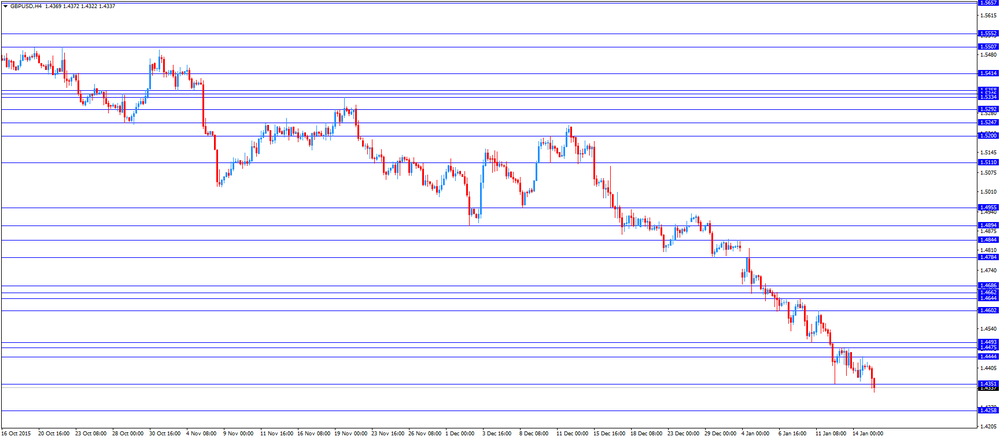

The British pound traded lower against the U.S. dollar despite the negative construction output data from the U.K. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.5% in November, after a 0.2% rise in October.

The decline was driven by a drop in infrastructure, which plunged 4.3% in November.

On a yearly basis, construction output decreased 1.1% in November, after a 1.0% rise in October. It was the biggest decline since May 2013.

EUR/USD: the currency pair rose to $1.0919

GBP/USD: the currency pair declined to $1.4322

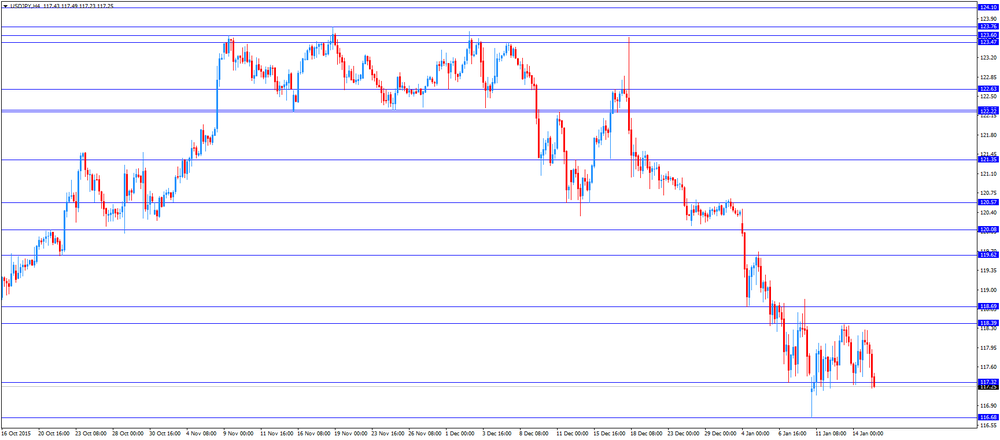

USD/JPY: the currency pair decreased to Y117.22

The most important news that are expected (GMT0):

13:30 U.S. Retail sales December 0.2% 0%

13:30 U.S. Retail Sales YoY December 1.4%

13:30 U.S. NY Fed Empire State manufacturing index January -4.59 -4

13:30 U.S. PPI, m/m December 0.3% -0.2%

13:30 U.S. PPI, y/y December -1.1% -1%

13:30 U.S. PPI excluding food and energy, m/m December 0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December 0.5% 0.3%

14:00 U.S. FOMC Member Dudley Speak

14:15 U.S. Industrial Production (MoM) December -0.6% -0.2%

14:15 U.S. Industrial Production YoY December -1.2%

14:15 U.S. Capacity Utilization December 77% 76.8%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 92.6 93

15:00 U.S. Business inventories November 0% -0.1%

-

14:00

Orders

EUR/USD

Offers 1.0900 1.0930 1.0950 1.0965 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0855-60 1.0840 1.0825 1.0800-10 1.0780-85 1.0750 1.0720 1.0700 1.0675 1.0650

GBP/USD

Offers 1.4400 1.4425-30 1.4450 1.4480 1.4500 1.452025 1.4540 1.4560 1.4585 1.4600 1.4625

Bids 1.4365 1.4350 1.4330 1.4300 1.4285 1.4265 1.4250 1.4230 1.4200

EUR/GBP

Offers 0.7625-30 0.7650 0.7680 0.7700 0.7730 0.7750

Bids 0.7580 0.7550 0.7525 0.7500 0.7475-80 0.7450 0.7420 0.7400

EUR/JPY

Offers 128.30 128.50 128.80 129.00 129.30 129.50 129.80 130.00

Bids 127.80 127.60 127.30 127.00 126.80 126.50 126.30 126.00

USD/JPY

Offers 117.65 117.85 118.00.118.25 118.40 118.60 118.80-85 119.00

Bids 117.20 117.00 116.85 116.65 116.50 116.30 116.00

AUD/USD

Offers 0.6900 0.6920 0.6950 0.6980 0.7000 0.7025-30 0.7050-55 0.7080 0.7100

Bids 0.6865 0.6850 0.6830 0.6800 0.6785 0.6750

-

12:07

Final consumer prices in Italy are flat in December

The Italian statistical office Istat released its final consumer price inflation data for Italy on Friday. Final consumer prices in Italy were flat in December, in line with preliminary reading, after a 0.4% drop in November.

Prices for services related to recreation including repair and personal care rose 0.3% in December, while prices of durable goods increased 0.5%.

On a yearly basis, consumer prices climbed 0.1% in December, in line with preliminary reading, after a 0.1% increase in November.

The increase was mainly driven by higher prices for services related to recreation including repair and personal care. Prices for services related to recreation including repair and personal care rose 0.9% year-on-year in December, after a 0.6% gain in November.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.6% year-on-year in December from 0.7% in November.

From the final data of January 2016, the Istat will change its calculation.

-

11:58

Final consumer price inflation in Spain falls 0.3% in December

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 0.3% in December, in line with the preliminary reading, after a 0.4% increase in November.

On a yearly basis, consumer prices fell by 0.3% in December from a year ago, in line with preliminary reading, after a 0.7% decline in November.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:54

UK’s construction output declines 0.5% in November

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.5% in November, after a 0.2% rise in October.

The decline was driven by a drop in infrastructure, which plunged 4.3% in November.

On a yearly basis, construction output decreased 1.1% in November, after a 1.0% rise in October. It was the biggest decline since May 2013.

-

11:49

Eurozone's unadjusted trade surplus falls to €23.6 billion in November

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus fell to €23.6 billion in November from €24.1 billion in October.

Exports rose at an unadjusted annual rate of 6.0% in November, while imports increased 5.0%.

Eurozone's adjusted trade surplus rose to €22.7 billion in November from €19.8 billion in October.

Exports rose at an adjusted 1.6% in November, while imports decreased 0.1%.

-

11:16

Bank of Japan Governor Haruhiko Kuroda: the central bank has no plans to add further stimulus measures

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Friday that the central bank has no plans to add further stimulus measures, but he added that the central bank is ready to adjust its quantitative easing if needed.

"I don't have plans for further monetary easing at the moment. But we're ready to adjust policy without hesitation if there is any change in the broad price trend," he said.

Kuroda pointed out that inflation was improving.

-

11:09

Head of the Eurogroup Jeroen Dijsselbloem: Athens accepts the International Monetary Fund has to take part in the third bailout programme

The head of the Eurogroup Jeroen Dijsselbloem said on Thursday that Athens accepts the International Monetary Fund has to take part in the third bailout programme.

"Greek Finance Minister confirmed to me that the Greek government accepts that the IMF needs to be part of the process," he said.

Greek Prime Minister Alexis Tsipras said in December that the participation of the IMF was not necessary.

-

11:00

Eurozone: Trade balance unadjusted, November 23.6

-

10:59

Reuters’ poll: the Bank of England will keep its interest rate unchanged at least until July

According to a Reuters' poll, the Bank of England (BoE) will keep its interest rate unchanged at least until July, noting that uncertainty over UK's membership of the European Union is the biggest risk to the country's economy.

-

10:47

New loans in China fall to 597.8 billion yuan in December

The People's Bank of China (PBoC) released its new loans data on Friday. New loans in local currency in China were 597.8 billion yuan in December, down from November's 708.9 billion yuan and well below expectations of 700 billion yuan.

M2 money supply jumped by 13.3% year-on-year in December, after a 13.7gain in November.

Total social financing increased to 1.82 trillion yuan in December from 1.02 trillion yuan in November.

-

10:38

The Wall Street Journal’s survey: 17% of respondents say the U.S. economy will enter recession in the next year

According to The Wall Street Journal's latest survey, 17% of respondents said that the U.S. economy will enter recession in the next year. It was the highest risk in three years. 80% of respondents noted that there are downside risks to the U.S. economic outlook.

The Wall Street Journal surveyed 76 economists January 8 - January 12.

-

10:37

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.40 (USD 390m) 118.00 (709m) 118.30 (330m) 118.50 (756m) 119.00 (533m)

EUR/USD 1.0700 (EUR 1.28bln) 1.0750 (1.1bln) 1.0780 (1.1bln) 1.0800 (2.3bln) 1.0900 (1.13bln) 1.1000 (1.9bln)

AUD/USD 0.6875 (AUD 727m) 0.6900 (317m) 0.7000-20 (470m) 0.7050 (889m) 0.7100 (1.1bln)

AUD/JPY 1.0700 (560m)

NZD/USD 0.6615 (NZD 700m)

-

10:22

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.4 in in the week ended January 10

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 44.4 in in the week ended January 10 from 44.2 the prior week. It was the highest level since early October.

The increase was driven by a more favourable assessment of the measure of views of the economy. The measure of views of the economy rose to 38.0 from 37.0.

The buying climate index remained unchanged at 39.4.

The personal finances index fell to 55.9 from 56.2.

-

10:09

Home loans in Australia climb 1.8% in November

The Australian Bureau of Statistics released its home loans data on Friday. Home loans in Australia climbed 1.8% in November, beating expectations for a 0.5% drop, after 0.3% fall in October. October's figure was revised down from a 2.0% rise.

The value of owner occupied loans rose at a seasonally adjusted 2.4% in November, investment lending increased 0.7%, while the number of loans for the construction of dwellings climbed 2.7%.

-

08:30

Options levels on friday, January 15, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0999 (3039)

$1.0952 (1882)

$1.0920 (1544)

Price at time of writing this review: $1.0879

Support levels (open interest**, contracts):

$1.0999 (3039)

$1.0952 (1882)

$1.0920 (1544)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 36819 contracts, with the maximum number of contracts with strike price $1,1000 (4037);

- Overall open interest on the PUT options with the expiration date February, 5 is 50667 contracts, with the maximum number of contracts with strike price $1,0700 (7984);

- The ratio of PUT/CALL was 1.38 versus 1.42 from the previous trading day according to data from January, 14

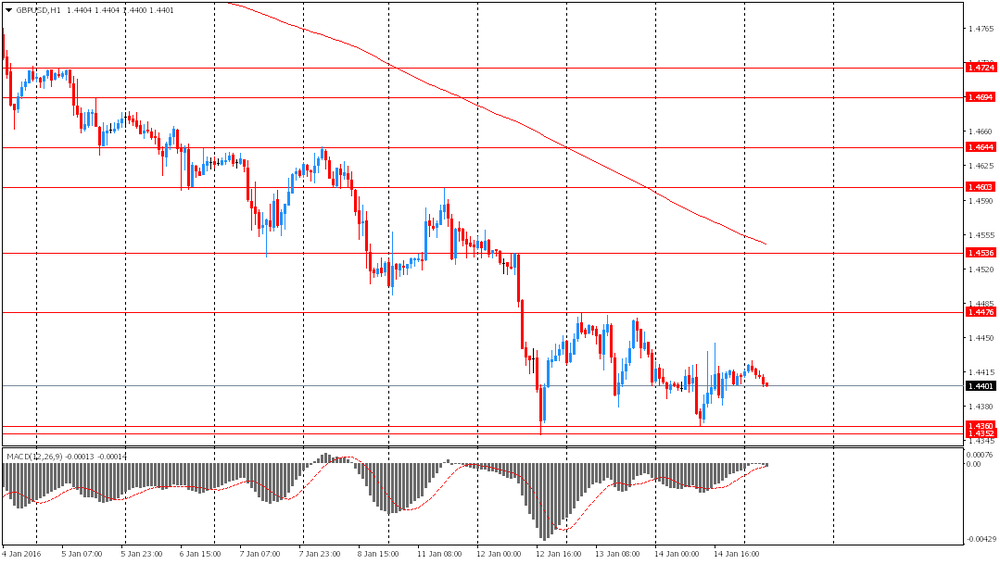

GBP/USD

Resistance levels (open interest**, contracts)

$1.4605 (1761)

$1.4508 (779)

$1.4412 (132)

Price at time of writing this review: $1.4386

Support levels (open interest**, contracts):

$1.4292 (787)

$1.4195 (1000)

$1.4097 (506)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 19917 contracts, with the maximum number of contracts with strike price $1,4700 (3118);

- Overall open interest on the PUT options with the expiration date February, 5 is 18439 contracts, with the maximum number of contracts with strike price $1,4550 (2012);

- The ratio of PUT/CALL was 0.93 versus 0.97 from the previous trading day according to data from January, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:49

Foreign exchange market. Asian session: the Australian dollar declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans November -0.3% Revised From 2.0% -0.5% 1.8%

The Australian dollar declined amid news from China. Today the yuan declined by 0.3% against the U.S. dollar outside mainland China. Now the offshore yuan is cheaper than the mainland. The gap continues to expand, that's why the People's Bank of China might take steps again. The Chinese currency weakened amid declines in the Shanghai Composite index.

Earlier the Australian dollar was supported by home loans data. Home loans rose by 1.8% in November compared to October on a seasonally adjusted basis. The value of loans to investors rose by 0.7%, marking the first increase in seven months. In October they declined a revised 5.8%.

The yen rose after Bank of Japan Governor Haruhiko Kuroda said that the central bank was not considering further monetary policy easing. Kuroda reiterated that the price trend excluding temporary factors remained stable.

EUR/USD: the pair rose to $1.0890 in Asian trade

USD/JPY: the pair fell to Y117.60

GBP/USD: the pair traded within $1.4400-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Trade balance unadjusted November 24.1

13:30 U.S. Retail sales December 0.2% 0%

13:30 U.S. Retail Sales YoY December 1.4%

13:30 U.S. NY Fed Empire State manufacturing index January -4.59 -4

13:30 U.S. PPI, m/m December 0.3% -0.2%

13:30 U.S. PPI, y/y December -1.1% -1%

13:30 U.S. PPI excluding food and energy, m/m December 0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December 0.5% 0.3%

14:00 U.S. FOMC Member Dudley Speak

14:15 U.S. Industrial Production (MoM) December -0.6% -0.2%

14:15 U.S. Industrial Production YoY December -1.2%

14:15 U.S. Capacity Utilization December 77% 76.8%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 92.6 93

15:00 U.S. Business inventories November 0% -0.1%

-

01:32

Australia: Home Loans , November 1.8% (forecast -0.5%)

-

00:41

Currencies. Daily history for Jan 14’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0864 -0,11%

GBP/USD $1,4410 +0,03%

USD/CHF Chf1,0048 -0,10%

USD/JPY Y118,05 +0,32%

EUR/JPY Y128,24 +0,19%

GBP/JPY Y170,11 +0,35%

AUD/USD $0,6982 +0,40%

NZD/USD $0,6472 -0,60%

USD/CAD C$1,4365 +0,19%

-