Noticias del mercado

-

23:57

Schedule for today, Friday, Jan 15’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans November 2.0% -0.5%

10:00 Eurozone Trade balance unadjusted November 24.1

13:30 U.S. Retail sales December 0.2% 0%

13:30 U.S. Retail Sales YoY December 1.4%

13:30 U.S. NY Fed Empire State manufacturing index January -4.59 -4

13:30 U.S. PPI, m/m December 0.3% -0.2%

13:30 U.S. PPI, y/y December -1.1% -1%

13:30 U.S. PPI excluding food and energy, m/m December 0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December 0.5% 0.3%

14:00 U.S. FOMC Member Dudley Speak

14:15 U.S. Industrial Production (MoM) December -0.6% -0.2%

14:15 U.S. Industrial Production YoY December -1.2%

14:15 U.S. Capacity Utilization December 77% 76.8%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 92.6 93

15:00 U.S. Business inventories November 0% -0.1%

-

18:00

European stocks closed: FTSE 100 5,918.23 -42.74 -0.72% CAC 40 4,312.89 -79.05 -1.80% DAX 9,794.2 -166.76 -1.67%

-

17:19

European Central Bank Governing Council member Philip Lane supports the ECB’s use of non-standard measures to achieve 2% inflation target

European Central Bank (ECB) Governing Council member and Governor of the Central Bank of Ireland Philip Lane said in an interview with Central Banking Journal on Thursday that he supports the ECB's use of non-standard measures to achieve 2% inflation target.

He also said that developments in emerging economies should be monitored closely.

-

17:09

St. Louis Fed President James Bullard: the recent drop in oil prices may weigh on the timing when the Fed’s 2% inflation target will be reached

St. Louis Fed President James Bullard said in a speech on Thursday that the recent drop in oil prices may weigh on the timing when the Fed's 2% inflation target will be reached.

"Low inflation expectations may keep actual inflation lower, all else equal, making it more difficult for the Fed to return inflation to target," he said.

"Headline inflation will return to target once oil prices stabilize, but recent further declines in global oil prices are calling into question when such a stabilization may occur," Bullard added.

St. Louis Fed president pointed out that "low oil prices remain a net positive for the U.S. economy".

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:38

Greek import prices slide 1.0% in December

The Hellenic Statistical Authority released its import prices data for Greece on Thursday. Greek import prices slid 1.0% in December, after a 0.2% rise in November.

On a yearly basis, import prices dropped 8.8% in December, after a 10.4% decline in November.

Import prices for energy plunged by 32.3% year-on-year in December, price for durable consumer goods fell by 0.2%, while price for non-durable consumer goods increased by 0.6%.

Prices of capital goods rose 0.5% year-on-year in December, while intermediate goods prices decreased 1.0%.

-

16:34

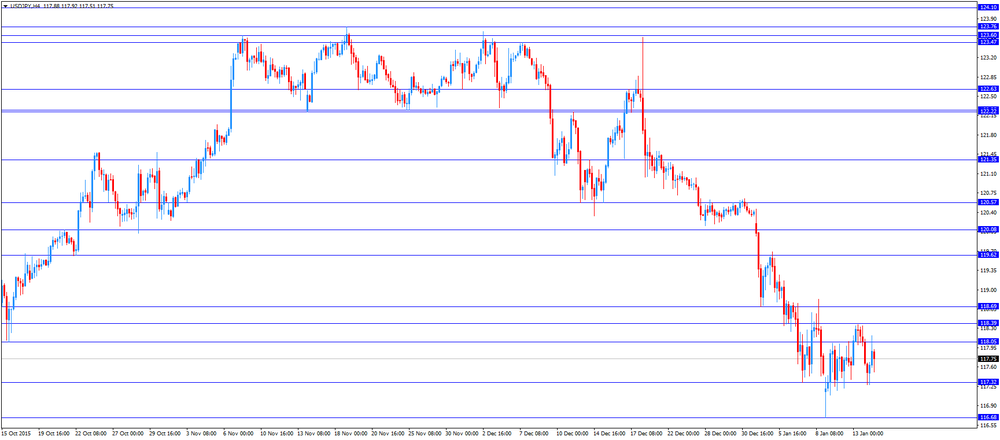

The Bank of Japan could lower its inflation outlook at its next monetary policy meeting in January

Sources close to the Bank of Japan (BoJ) said on Wednesday that the central bank was considering to lower its inflation outlook for fiscal 2016 due to a drop in oil prices.

The sources noted that the BoJ will likely cut its inflation outlook to around 1% for fiscal 2016 at its next monetary policy meeting in January.

The central bank said in October that it expected inflation excluding fresh foods to increase by 1.4% in fiscal 2016.

-

16:28

The European Central Bank's has no plans to add further stimulus measures in the near future despite the recent drop in oil prices

Reuters reported on Thursday that a member of the European Central Bank's (ECB) Governing Council said the central has no plans to add further stimulus measures in the near future despite the recent drop in oil prices.

The member, who did not want to be named, noted that the ECB has done its job, adding that governments should implement structural reforms now.

-

16:17

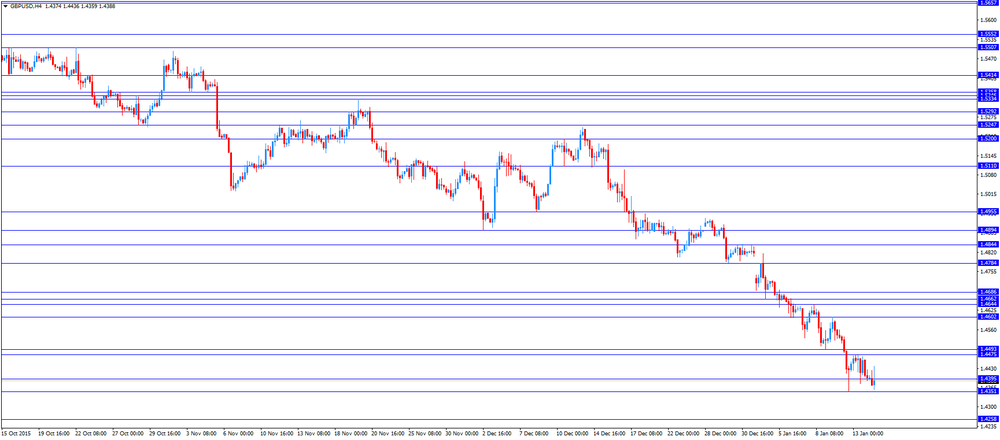

Bank of England's Monetary Policy Committee January minutes: 8-1 split to keep monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its January meeting minutes on Thursday. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate by 0.25%.

The consumer price inflation in the U.K. was 0.1% in November, below the central bank's 2% target. The BoE noted that inflation is expected to rise modestly in the coming months, adding that low energy and food prices weigh on inflation.

"But the 40 % decline in dollar oil prices means that the increase in inflation is now expected to be slightly more gradual in the near term than forecast in the Committee's November Inflation Report projections," the central bank added.

The BoE expects that low oil prices will provide support to household spending in the United Kingdom and its major trading partners.

The central bank said that there are downside risks to the global growth, "primarily emanating from emerging markets.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles".

-

15:58

ECB Monetary Policy Meeting Account: some members wanted a 0.2% cut of the deposit rate

The European Central Bank's (ECB) its minutes of December meeting on Thursday. The minutes showed that some members wanted a 0.2% cut of the deposit rate.

"Some members expressed a preference for a 20 basis point cut in the deposit facility rate at the current meeting, mainly with a view to strengthening the easing impact of this measure and reflecting the view that, to date, no material negative side effects on bank margins and financial stability had emerged," the minutes said.

Most board members supported the extension of the purchases from September 2016 to March 2017.

According to the minutes, the possibility of expanding the monthly volume of purchase and the possibility of the horizon beyond the six month were discussed at the meeting.

The ECB said that it could review the technical parameters of its quantitative easing in spring 2016.

The ECB kept its interest rate unchanged at 0.05% in December, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016. The volume of the monthly purchases remained unchanged.

-

15:43

Canada’s new housing price index climbs 0.2% in November

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.2% in November, in line with expectations, after a 0.3% rise in October.

The increase was mainly driven by a gain in Toronto and Vancouver region. New home prices in Toronto and Oshawa region rose 0.2% in November, while prices in Vancouver climbed 0.5%.

On a yearly basis, new housing price index in Canada climbed 1.6% in November, after a 1.5% gain in October.

-

14:56

U.S. import price index falls 1.2% in December

The U.S. Labor Department released its import and export prices data on Thursday. The U.S. import price index fell by 1.2% in December, beating expectations for a 1.4% decrease, after a 0.5% decline in November. November's figure was revised down from a 0.4% drop.

The decline was mainly driven by lower prices for fuel imports, which slid 10.0% in December.

A strong U.S. currency lowers the price of imported goods.

U.S. export prices declined by 1.1% in December, after a 0.7% fall in November. November's figure was revised down from a 0.6% decrease.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 672m) 119.00 (846m)

EUR/USD 1.0800 (EUR 361m) 1.0825 (354m) 1.0900 (291m)

USD/CAD 1.4000 (USD 1.4bln)

AUD/USD 0.7080 (AUD 614m)

EUR/GBP 0.7300 (EUR 462m) 0.7495 (268m)

-

14:41

Initial jobless claims rise to 284,000 in the week ending January 09

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 09 in the U.S. rose by 7,000 to 284,000 from 277,000 in the previous week. Analysts had expected jobless claims to fall to 275,000.

Jobless claims remained below 300,000 the 45th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 29,000 to 2,263,000 in the week ended January 02.

-

14:30

U.S.: Import Price Index, December -1.2% (forecast -1.4%)

-

14:30

U.S.: Initial Jobless Claims, January 284 (forecast 275)

-

14:30

Canada: New Housing Price Index, MoM, November 0.2% (forecast 0.2%)

-

14:30

U.S.: Continuing Jobless Claims, January 2263 (forecast 2215)

-

14:21

Bank of England keeps its interest rate on hold at 0.5% in January

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

14:11

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the Bank of England's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Changing the number of employed December 75.0 Revised From 71.4 -12.5 -1.0

00:30 Australia Unemployment rate December 5.8% 5.9% 5.8%

06:00 Japan Prelim Machine Tool Orders, y/y December -17.7% Revised From -17.9% -25.8%

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 2,000 to 275,000 last week.

The U.S. import price index is expected to decline 1.4% in December, after a 0.4% fall in November.

The FOMC member James Bullard is expected to speak at 13:30 GMT.

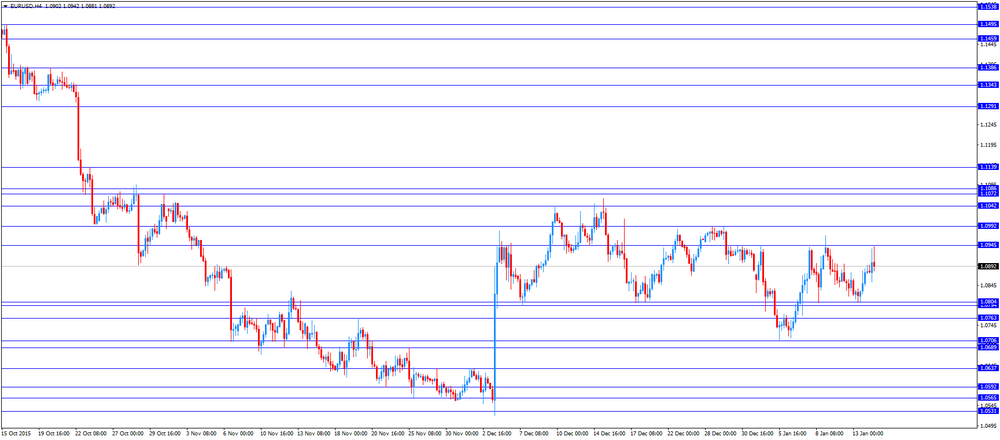

The euro traded higher against the U.S. dollar after the release of the European Central Bank's (ECB) minutes. The minutes showed that some members wanted a 0.2% cut of the deposit rate.

The ECB kept its interest rate unchanged at 0.05% in December, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016. The volume of the monthly purchases remained unchanged.

The British pound traded mixed against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its January meeting minutes today. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Canada's new housing price index is expected to rise 0.2% in November, after a 0.3% gain in October.

EUR/USD: the currency pair rose to $1.0942

GBP/USD: the currency pair dropped to $1.4379

USD/JPY: the currency pair fell to Y117.51

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index, MoM November 0.3% 0.2%

13:30 U.S. Import Price Index December -0.4% -1.4%

13:30 U.S. Initial Jobless Claims January 277 275

13:30 U.S. FOMC Member James Bullard Speaks

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

13:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:45

The European Central Bank lowers the amount of emergency funding (ELA) to Greek banks by €3.8 billion

According to the Bank of Greece on Thursday, the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks by €3.8 billion to €72.0 billion.

"The reduction of €3.8 billion in the ceiling reflects an improvement of the liquidity situation of Greek banks, amid a reduction of uncertainty and the stabilization of private sector deposits flows, as well as the progress achieved in the recapitalisation process of Greek banks," the Bank of Greece said in its statement.

-

11:37

Bank of Japan Governor Haruhiko Kuroda: the central bank id ready to add further stimulus measures if needed

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Thursday that the central bank will do everything to reach 2% inflation target.

-

11:30

German price-adjusted GDP increases 1.7% in 2015

Destatis released its gross domestic product (GDP) growth for Germany on Thursday. Germany's price-adjusted GDP gained by 1.7% year-on-year in 2015, after a 1.6% increase in 2014.

Germany's calendar-adjusted GDP rose by 1.5% year-on-year in 2015, after a 1.6% growth in 2014.

The increase was driven by household consumption.

Household final consumption expenditure climbed by a price-adjusted rate of 1.9% year-on-year in 2015, while government final consumption expenditure jumped by 2.8%.

Price-adjusted exports of goods and services soared 5.4% year-on-year in 2015, while imports rose 5.7%.

The budget surplus was 0.5% of GDP in 2015.

-

11:20

Industrial production in Italy drops 0.5% in November

The Italian statistical office Istat released its industrial production data on Thursday. Industrial production in Italy fell at a seasonally-adjusted rate of 0.5% in November, after a 0.5% rise in October.

Output of consumer goods fell 1.3% in November, output of intermediate goods were down 0.4%, output of investment goods declined 0.8%, while output of energy dropped 0.7%.

On a yearly basis, industrial production in Italy increased at a seasonally-adjusted rate of 0.9% in November, after a 3.0% increase in October. October's figure was revised up from a 2.9% gain.

Output of capital goods jumped 3.6% year-on-year in November, output of consumer goods slid 1.8%, output of energy rose 2.1%, while output of intermediate goods climbed 0.7%.

-

10:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 672m) 119.00 (846m)

EUR/USD 1.0800 (EUR 361m) 1.0825 (354m) 1.0900 (291m)

USD/CAD 1.4000 (USD 1.4bln)

AUD/USD 0.7080 (AUD 614m)

EUR/GBP 0.7300 (EUR 462m) 0.7495 (268m)

-

10:48

German wholesale prices fall 0.8% in December

The German statistical office Destatis released its wholesale prices for Germany on Thursday. German wholesale prices fell 0.8% in December, after a 0.2% decrease in November.

On a yearly basis, wholesale prices in Germany dropped 1.0% in December, after a 1.1% decline in November. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 11.7% drop in solid fuels and related products.

-

10:39

Core machinery orders in Japan slide 14.4% in November

Japan's Cabinet Office released its core machinery orders data on late Wednesday evening. Core machinery orders in Japan plunged 14.4% in November, missing expectations for a 7.9% fall, after a 10.7% rise in October.

On a yearly basis, core machinery orders climbed 1.2% in November, missing expectations for a 6.3% increase, after a 10.3% rise in October.

The total number of machinery orders slid 23.2% in November from a month earlier.

Orders from non-manufacturers dropped 18.0% in November, while orders from manufacturers were down 10.2%.

-

10:25

Australia's unemployment rate remains unchanged at 5.8% in December

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate remained unchanged at 5.8% in December. Analysts had expected the unemployment rate to rise to 5.9%.

The number of employed people in Australia fell by 1,000 in December, beating forecast of a decline by 12,500, after an increase by 75,000 in November. November's figure was revised up from a rise by 71,400.

Full-time employment rose by 17,600 in December, while part-time employment slid by 18,500.

The participation rate decreased to 65.1% in December from 65.3% in November.

-

10:13

Beige Book: the U.S. economic activity expanded in 9 of 12 districts from late-November through early-January

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity expanded in 9 of 12 districts from late-November through early-January.

The Districts of Cleveland's, Richmond's, Chicago's, St. Louis', Minneapolis' and Dallas' activity grew modestly, Atlanta's and San Francisco's economy expanded moderately, the New York District's and the Kansas City District's growth was steady, while Boston's activity was "described as upbeat".

The growth outlook remained mostly positive, the Fed said.

Consumer spending was "slight to moderate in most Districts".

The manufacturing sectors were weak in the most districts as the strong dollar weighed on demand, while the labour market continued to improve.

Overall price pressures were minimal in nearly all districts, the Fed noted.

-

08:29

Foreign exchange market. Asian session: the U.S. dollar slid

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Changing the number of employed December 75.0 Revised From 71.4 -12.5 -1.0

00:30 Australia Unemployment rate December 5.8% 5.9% 5.8%

06:00 Japan Prelim Machine Tool Orders, y/y December -17.9% -25.8%

The U.S. dollar declined slightly against the yen reaching yesterday's low as risk sentiment declined amid concerns over China's economy and oil prices. IG Securities said that it's too early to say that risk sentiment declined based only on trade data. Market participants will closely watch data from China, including GDP, industrial production and retail sales reports due on January 19.

Nevertheless the yen is under pressure because of weak core machinery orders data. Core machinery orders fell by 14.4% in November compared to a 10.7% rise reported previously. Orders fell as weak global economic growth weighed on business confidence in Japan.

The Australian dollar declined slightly amid domestic labor market data. The unemployment rate remained unchanged at 5.8% in December on a seasonally adjusted basis. Economists had expected the index to have advanced to 5.9%. The AUD rebounded later on.

EUR/USD: the pair declined to $1.0861 in Asian trade

USD/JPY: the pair rose to Y117.95

GBP/USD: the pair edged up to $1.4412

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada New Housing Price Index, MoM November 0.3% 0.2%

13:30 U.S. Continuing Jobless Claims January 2230 2215

13:30 U.S. Import Price Index December -0.4% -1.4%

13:30 U.S. Initial Jobless Claims January 277 275

13:30 U.S. FOMC Member James Bullard Speaks

-

08:28

Options levels on thursday, January 14, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1007 (2894)

$1.0947 (1558)

$1.0915 (299)

Price at time of writing this review: $1.0858

Support levels (open interest**, contracts):

$1.0809 (1174)

$1.0760 (3603)

$1.0730 (5899)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 34512 contracts, with the maximum number of contracts with strike price $1,1100 (3136);

- Overall open interest on the PUT options with the expiration date February, 5 is 48871 contracts, with the maximum number of contracts with strike price $1,0700 (7873);

- The ratio of PUT/CALL was 1.42 versus 1.43 from the previous trading day according to data from January, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.4703 (2780)

$1.4606 (1733)

$1.4510 (483)

Price at time of writing this review: $1.4412

Support levels (open interest**, contracts):

$1.4293 (787)

$1.4196 (1009)

$1.4098 (284)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 18907 contracts, with the maximum number of contracts with strike price $1,4700 (2780);

- Overall open interest on the PUT options with the expiration date February, 5 is 18340 contracts, with the maximum number of contracts with strike price $1,4550 (2012);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from January, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:01

Japan: Prelim Machine Tool Orders, y/y , December -25.8%

-

01:30

Australia: Changing the number of employed, December -1 (forecast -12.5)

-

01:30

Australia: Unemployment rate, December 5.8% (forecast 5.9%)

-

00:50

Japan: Core Machinery Orders, y/y, November 1.2% (forecast 6.3%)

-

00:50

Japan: Core Machinery Orders, November -14.4% (forecast -7.9%)

-

00:31

Currencies. Daily history for Jan 13’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0876 +0,17%

GBP/USD $1,4405 -0,28%

USD/CHF Chf1,0058 +0,38%

USD/JPY Y117,67 +0,03%

EUR/JPY Y127,99 +0,20%

GBP/JPY Y169,51 -0,25%

AUD/USD $0,6954 -0,43%

NZD/USD $0,6511 -0,37%

USD/CAD C$1,4338 +0,55%

-

00:05

Schedule for today, Thursday, Jan 14’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Changing the number of employed December 71.4 -12.5

00:30 Australia Unemployment rate December 5.8% 5.9%

06:00 Japan Prelim Machine Tool Orders, y/y December -17.9%

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada New Housing Price Index, MoM November 0.3% 0.2%

13:30 U.S. Continuing Jobless Claims January 2230 2215

13:30 U.S. Import Price Index December -0.4% -1.4%

13:30 U.S. Initial Jobless Claims January 277 275

13:30 U.S. FOMC Member James Bullard Speaks

-