Noticias del mercado

-

20:01

U.S.: Federal budget , December -14.4 (forecast -2.7)

-

18:21

Dallas Fed President Robert Kaplan: 3-4 interest rate hikes this year is “a reasonable base case”

Dallas Fed President Robert Kaplan said in an interview with Bloomberg Television on Wednesday that he would have "bias" to continue the normalisation.

"I would have a bias to want to move toward normalization. It comes with some risk. Every time we increase the federal funds rate, we're going to have to watch and see what the impact is," he said.

Kaplan noted that officials should analyse and understand recent turmoil in international markets, and should not overreact.

He noted that market turbulences may not reflect the U.S. economy.

Dallas Fed president pointed out that he thinks 3-4 interest rate hikes this year is "a reasonable base case".

-

18:06

Boston Fed President Eric Rosengren: further interest rates will be gradual and depend on the incoming economic data

Boston Fed President Eric Rosengren said in a speech on Wednesday that further interest rates will be gradual and depend on the incoming economic data.

"The future path of the federal funds rate will depend on incoming economic data… Further increases in rates are in my view likely to be gradual," he said.

Rosengren noted that there are downside risks to further interest rate hikes.

"While the median forecast provides a reasonable estimate of the likely path of the federal funds rate, my own view is that such a forecast does have downside risks. These downside risks reflect continued headwinds from weakness within countries that represent many of our major trading partners," Boston Fed president said.

"Further tightening will require data continuing to be strong enough that growth will be at or above potential, so that Federal Reserve policymakers can be confident that inflation will reach our 2 percent target," he added.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

18:00

European stocks closed: FTSE 100 5,960.97 +31.73 +0.54% CAC 40 4,391.94 +13.19 +0.30% DAX 9,960.96 -24.47 -0.25%

-

16:49

German Finance Ministry’s monthly report: the economy is expected to expand moderately, driven by private consumption

The German Finance Ministry said in its monthly report on Wednesday that it expects the economy to expand moderately, driven by private consumption.

"The German economy is moderately tilted to the upside, but it can't completely escape the bumpy global economic environment," the ministry said.

-

16:41

Germany’s budget surplus in 2015 is higher than previously expected

The German Finance Ministry said on Wednesday that the country's budget surplus was €12.1 billion in 2015, up from the previous forecast of a €6.1 billion surplus. The surplus was driven by strong tax revenues and one-off effects.

German Finance Minister Wolfgang Schäuble said that he expects a balanced budget in 2016 if the domestic labour market will remain robust. He added that the surplus will be used to cover migration-related costs.

-

16:30

U.S.: Crude Oil Inventories, January 0.234 (forecast 2.6)

-

16:24

European Central Bank (ECB) Executive Board member Peter Praet: effect of low oil prices on inflation in the Eurozone is not temporary

European Central Bank (ECB) Executive Board member Peter Praet said in an interview with the German newspaper Süddeutsche Zeitung that effect of low oil prices on inflation in the Eurozone is not temporary.

"Although falling oil prices have recently played a significant role in low inflation, the effect on inflation is not negligible or temporary," he said.

Praet pointed out that the ECB's stimulus measures helped to stop a decline in inflation expectations and to reduce the risk of deflation.

He noted that governments should implement structural reforms.

-

16:09

Swiss National Bank Vice Chairman Fritz Zurbruegg: price stability is important for competitiveness of companies

The Swiss National Bank (SNB) Vice Chairman Fritz Zurbruegg said on Wednesday that price stability is important for competitiveness of companies.

"By fulfilling its mandate and ensuring price stability, the SNB makes an indirect contribution to the competitiveness of the Swiss economy," he said.

Zurbruegg added that "there is no contradiction between a strong currency and an economy's competitiveness" in the long term.

Zurbruegg noted that the Swiss franc is overvalued, and it is necessary for the central bank to impose negative interest rates and to intervene in the foreign exchange market.

-

15:15

The Federation of German Industries (BDI) expects the German economy to expand around 2% in 2016

The Federation of German Industries (BDI) said on Wednesday that it expects the German economy to expand around 2% in 2016.

BDI President Ulrich Grillo said that the growth is driven by low oil prices, low interest rates and a weak euro, adding that geopolitical tensions could have a negative effect on the German economy.

He noted that the government should invest in the infrastructure.

-

15:00

Moderate growth in the Eurozone is expected in the first and second quarter of 2016

The German IFO, the French Insee and the Italian Istat institutes said in its survey on Tuesday that the economy in the Eurozone is expected to continue to recover moderately. Real gross domestic product (GDP) is expected to rise by 1.5% in 2015, and by 0.4% in the first and second quarter of 2016. The growth will be driven by private consumption.

According to IFO, Insee, and Istat, inflation in the Eurozone is expected to be 0.5% year-on-year in the first quarter of 2016 and 0.4% year-on-year in the second quarter of 2016. Low energy prices weigh on inflation.

Downside risks to the Eurozone's economy are geopolitical tensions in the Middle East and the ongoing structural transformation of the Chinese economy, the survey said.

-

14:50

Option expiries for today's 10:00 ET NY cut

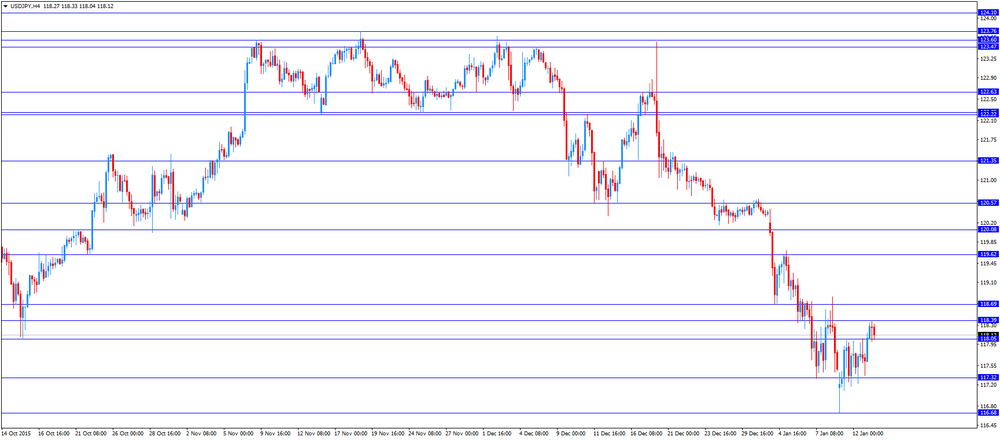

USD/JPY 117.00 (USD 225m) 117.15 (672m) 119.50 (584m)

EUR/USD 1.0800 (EUR 840m) 1.0870 (350m) 1.0950 (625m) 1.1035 (2.5bln)

AUD/USD 0.6900 (AUD 794m) 0.7025 (318m) 0.7075 (911m)

-

14:37

Richmond Fed President Jeffrey Lacker: turmoil in China has no effect on the U.S. economy

Richmond Fed President Jeffrey Lacker said on Tuesday that turmoil in China has no effect on the U.S. economy.

"I think our real economies are linked less than you would think from the extent to which our equity markets seem to have moved in parallel with movements in their exchange rate and their equity markets," he said.

Lacker noted the U.S. stock market's volatility "looks like an overreaction".

Lacker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

14:16

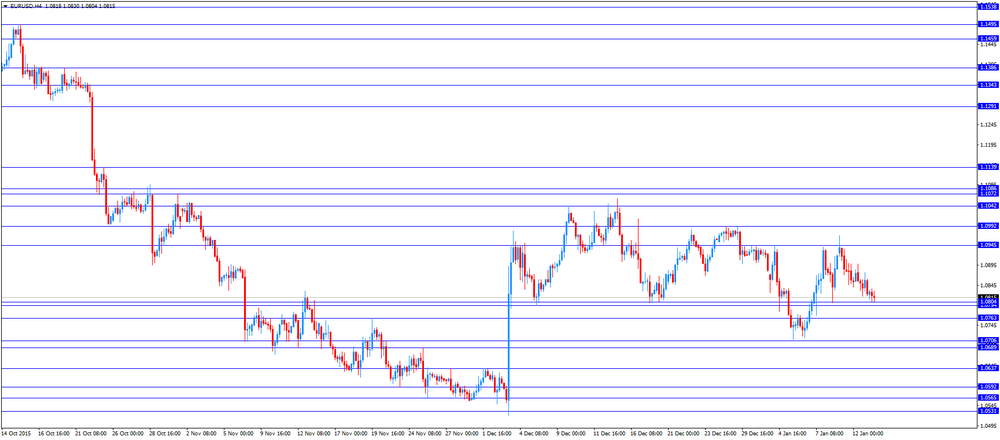

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the weaker-than-expected industrial production data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Trade Balance, bln December 54.1 53 58.2

07:45 France CPI, m/m December -0.2% 0.1% 0.2%

07:45 France CPI, y/y December 0.0% 0.2%

10:00 Eurozone Industrial production, (MoM) November 0.8% Revised From 0.6% -0.3% -0.7%

10:00 Eurozone Industrial Production (YoY) November 2.0% Revised From 1.9% 1.3% 1.1%

12:00 U.S. MBA Mortgage Applications January -11.6% 21.3%

13:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the Fed's Beige Book.

The euro traded mixed against the U.S. dollar after the release of the weaker-than-expected industrial production data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone dropped 0.7% in November, missing expectations for a 0.3% decrease, after a 0.8% rise in October. October's figure was revised up from a 0.6% increase.

The fall was driven by declines in durable consumer goods, energy and capital output.

On a yearly basis, Eurozone's industrial production gained 1.1% in November, missing expectations for a 1.3% rise, after a 2.0% increase in October. October's figure was revised up from a 1.9% gain.

The increase was mainly driven by rises in durable consumer goods, non-durable consumer goods, intermediate goods output and capital goods.

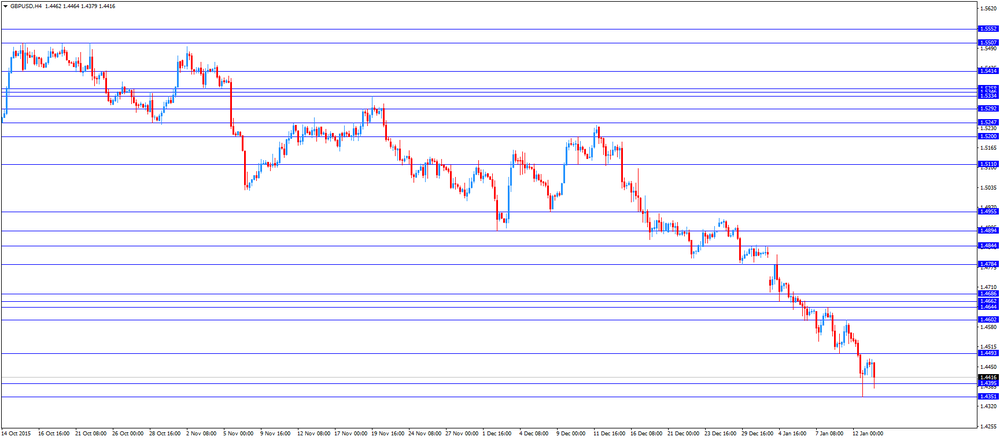

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K. Yesterday's weaker-than-expected industrial production data from the U.K. continued to weigh on the pound.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair dropped to $1.4379

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

15:30 U.S. Crude Oil Inventories January -5.085 2.6

19:00 U.S. Federal budget December -65 -2.7

19:00 U.S. Fed's Beige Book

23:50 Japan Core Machinery Orders November 10.7% -7.9%

23:50 Japan Core Machinery Orders, y/y November 10.3% 6.3%

-

13:00

U.S.: MBA Mortgage Applications, January 21.3%

-

11:43

Greek consumer prices increase 0.1% in December

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Wednesday. Greek consumer prices increased 0.1% in December, after the 0.8% drop in November.

On a yearly basis, the Greek consumer price index declined 0.2% in December, after a 0.7 fall in November. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 3.6% in December, transport costs dropped by 2.1%, clothing and footwear prices were up 0.8%, while household equipment prices were down 1.7%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 2.8% in December, while alcoholic beverages and tobacco prices increased by 1.4%.

-

11:29

France’s current account deficit is €1.4 billion in November

The Bank of France released its current account data on Wednesday. France's current account deficit was €1.4 billion in November, down from a deficit of €1.0 billion in October. October's figure was revised up from a deficit of €1.4 billion.

The trade goods deficit narrowed to €2.9 billion in November from €3.0 billion in October, while the surplus on services fell to €800 billion from €1.3 billion.

-

11:22

Eurozone’s industrial production drops 0.7% in November

Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone dropped 0.7% in November, missing expectations for a 0.3% decrease, after a 0.8% rise in October. October's figure was revised up from a 0.6% increase.

The fall was driven by declines in durable consumer goods, energy and capital output. Durable consumer goods output fell 1.0% in November, capital goods output dropped 1.9%, while energy output plunged 4.3%.

Intermediate goods output was up 0.7% in November, while non-durable consumer goods were up 0.1%.

On a yearly basis, Eurozone's industrial production gained 1.1% in November, missing expectations for a 1.3% rise, after a 2.0% increase in October. October's figure was revised up from a 1.9% gain.

The increase was mainly driven by rises in durable consumer goods, non-durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 1.7% in November from a year ago, capital goods rose by 1.2%, non-durable consumer goods gained by 1.2%, while intermediate goods output increased by 2.1%.

Energy output declined by 2.8% in November from a year ago.

-

11:00

Eurozone: Industrial production, (MoM), November -0.7% (forecast -0.3%)

-

11:00

Eurozone: Industrial Production (YoY), November 1.1% (forecast 1.3%)

-

10:53

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.00 (USD 225m) 117.15 (672m) 119.50 (584m)

EUR/USD 1.0800 (EUR 840m) 1.0870 (350m) 1.0950 (625m) 1.1035 (2.5bln)

AUD/USD 0.6900 (AUD 794m) 0.7025 (318m) 0.7075 (911m)

-

10:47

French consumer price inflation rises 0.2% in December

The French statistical office Insee released its consumer price inflation for France on Wednesday. The French consumer price inflation rose 0.2% in December, exceeding expectations for a 0.1% gain, after a 0.2% fall in November.

On a yearly basis, the consumer price index increased 0.2% in December, after a flat reading in November.

Fresh food prices rose 3.1% year-on-year in December, services prices climbed by 1.1%, while petroleum products prices dropped by 9.7%.

-

10:03

China's trade surplus climbs to $58.2 billion in December

The Chinese Customs Office released its trade data on Wednesday. China's trade surplus climbed to $58.2 billion in December from $54.1 billion in November, beating expectations for a decline to a surplus of $53.0 billion.

Exports fell at an annual rate of 1.4% in December, while imports slid at an annual rate of 7.6%, the fourteenth consecutive decline.

In yuan denomination, exports climbed 2.3% in December, while imports dropped 4.0%.

-

09:01

France: CPI, m/m, December 0.2% (forecast 0.1%)

-

08:47

France: CPI, y/y, December 0.2%

-

08:31

Options levels on wednesday, January 13, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1003 (2691)

$1.0956 (1784)

$1.0900 (299)

Price at time of writing this review: $1.0830

Support levels (open interest**, contracts):

$1.0789 (1184)

$1.0744 (3423)

$1.0716 (5321)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 33438 contracts, with the maximum number of contracts with strike price $1,1150 (3117);

- Overall open interest on the PUT options with the expiration date February, 5 is 47721 contracts, with the maximum number of contracts with strike price $1,0700 (7866);

- The ratio of PUT/CALL was 1.43 versus 1.38 from the previous trading day according to data from January, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.4704 (2513)

$1.4606 (1416)

$1.4509 (220)

Price at time of writing this review: $1.4446

Support levels (open interest**, contracts):

$1.4389 (1217)

$1.4293 (478)

$1.4195 (880)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 17307 contracts, with the maximum number of contracts with strike price $1,4700 (2513);

- Overall open interest on the PUT options with the expiration date February, 5 is 16925 contracts, with the maximum number of contracts with strike price $1,4550 (2012);

- The ratio of PUT/CALL was 0.98 versus 1.06 from the previous trading day according to data from January, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:56

Foreign exchange market. Asian session: the U.S. dollar gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 China Trade Balance, bln December 54.1 53 58.2

The U.S. dollar advanced as calmer financial markets boosted appetite for currencies that offer higher yield rather than safe-haven assets.

The Australian and New Zealand dollars rose on better-than-expected trade balance data from China. The country's trade surplus rose to $58.1 billion in December from $54.1 billion in November. Exports rose by 2.3% in December vs a decline of 8.0% expected by economists. Imports fell by 4.0%. Exports fell by 1.8% over 2015 because of weak demand overseas. Meanwhile imports fell by 13.2%.

EUR/USD: the pair declined to $1.0831 in Asian trade

USD/JPY: the pair rose to Y118.13

GBP/USD: the pair steady at $1.4444

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France CPI, m/m December -0.2% 0.1%

07:45 France CPI, y/y December 0.0%

10:00 Eurozone Industrial production, (MoM) November 0.6% -0.3%

10:00 Eurozone Industrial Production (YoY) November 1.9% 1.3%

12:00 U.S. MBA Mortgage Applications January -11.6%

13:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks

15:30 U.S. Crude Oil Inventories January -5.085 2.6

19:00 U.S. Federal budget December -65 -2.7

19:00 U.S. Fed's Beige Book

23:50 Japan Core Machinery Orders November 10.7% -7.9%

23:50 Japan Core Machinery Orders, y/y November 10.3% 6.3%

-

03:07

China: Trade Balance, bln, December 58.2 (forecast 53)

-

01:02

Currencies. Daily history for Jan 12’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0857 -0,01%

GBP/USD $1,4445 -0,67%

USD/CHF Chf1,002 +0,07%

USD/JPY Y117,64 -0,09%

EUR/JPY Y127,73 -0,10%

GBP/JPY Y169,93 -0,75%

AUD/USD $0,6984 -0,13%

NZD/USD $0,6535 -0,35%

USD/CAD C$1,4259 +0,31%

-

00:01

Schedule for today, Wednesday, Jan 13’2016:

(time / country / index / period / previous value / forecast)

02:00 China Trade Balance, bln December 54.1 53

07:45 France CPI, m/m December -0.2% 0.1%

07:45 France CPI, y/y December 0.0%

10:00 Eurozone Industrial production, (MoM) November 0.6% -0.3%

10:00 Eurozone Industrial Production (YoY) November 1.9% 1.3%

12:00 U.S. MBA Mortgage Applications January -11.6%

13:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks

15:30 U.S. Crude Oil Inventories January -5.085 2.5

19:00 U.S. Federal budget December -65 -2.7

19:00 U.S. Fed's Beige Book

23:50 Japan Core Machinery Orders November 10.7% -7.9%

23:50 Japan Core Machinery Orders, y/y November 10.3% 6.3%

-