Noticias del mercado

-

18:37

National Federation of Independent Business’s small-business optimism index for the U.S. rises to 95.2 in December

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index rose to 95.2 in December from 94.8 in November.

6 of 10 sub-indexes rose last month, 3 sub-index fell, while one sub-index was flat.

"In December, Congress made expensing permanent and passed other favorable tax changes that had an immediate impact on bottom lines. However, prospects for any other substantive policy changes in 2016 are not good," NFIB Chief Economist Bill Dunkelberg said.

-

18:31

European Central Bank (ECB) Governing Council member Josef Bonnici: low oil prices have positive and negative effects

European Central Bank (ECB) Governing Council member Josef Bonnici said on Tuesday that low oil prices have positive and negative effects.

"The oil price fall has some positive impacts through raising the purchasing power of euro zone households, he said.

"There is also an impact on inflation, not in the desired direction," Bonnici added.

-

18:26

François Villeroy de Galhau, the European Central Bank (ECB) Governing Council member and Governor of the Banque de France: keeping interest rates low too long could lead to the next financial crisis

François Villeroy de Galhau, the European Central Bank (ECB) Governing Council member and Governor of the Banque de France, said in a speech on Tuesday that keeping interest rates low too long could lead to the next financial crisis.

"Staying too low for too long may fuel the next financial crisis as liquidity addiction and excess risk taking eventually lead to bubbles and financial instability," he said.

Villeroy de Galhau pointed out that the central bank's quantitative easing will around half a point to inflation in 2016 and almost the same to economic growth in the Eurozone.

He said in an interview with Bloomberg Television in Paris on Tuesday that inflation in the Eurozone remains too low, adding that the central bank has tools to expand its stimulus measures if needed.

-

18:00

European stocks closed: FTSE 100 5,929.24 +57.41 +0.98% CAC 40 4,378.75 +66.01 +1.53% DAX 9,985.43 +160.36 +1.63%

-

17:02

Bank of Japan (BoJ) Governor Haruhiko Kuroda: the BoJ’s and the European Central Bank’s (ECB) monetary policies would succeed in the near future

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in his speech notes on Tuesday that the BoJ's and the European Central Bank's (ECB) monetary policies would succeed in the near future.

"I believe that monetary policy in both the euro area and Japan will succeed in the near future, thereby starting a new chapter for macroeconomics," he said.

Kuroda noted that inflation in Japan improved, supported by the labour market. He added that the central bank is only halfway to its 2% inflation target.

Kuroda cancelled his participation in the conference organised by the Bank of France but his speech notes were published on the BoJ's website.

-

16:24

NIESR’s gross domestic product rises by 0.6% in three months to December and by 2.2% in 2015 as whole

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.6% in three months to December, after a 0.6% growth in three months to November.

According to the NIESR, the U.K. economy grew 2.2% in 2015, after a 2.9% rise in 2014.

"The slowdown in the economy last year was largely due to a sharp moderation in growth of the construction sector and public spending, exacerbated by weaker net trade. The year looks to have ended with reasonable growth, close to the economy's long-run potential. There is little spare capacity in the economy, and we expect the output gap to continue to close in 2016," Jack Meaning, NIESR Research Fellow, said.

-

16:11

Job openings climb to 5.431 million in November

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings rose to 5.431 million in November from 5.349 million in October. October's figure was revised down from 5.383 million.

The number of job openings climbed for total private (4.926 million) and for government (506,000) in November from October.

The hires rate was 3.6% in November.

Total separations increased to 4.930 million in November from 4.901 million in October.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:04

The Federal Reserve transfers a record $97.7 billion to the U.S. Treasury

The Federal Reserve said on Monday that it sent a record $97.7 billion of its estimated 2015 net income to the U.S. Treasury. The 2015 figures are preliminary and could be adjusted. Audited figures are expected to be published in March.

The Federal Reserve provided $96.9 billion to the U.S. Treasury last year.

-

16:01

U.S.: JOLTs Job Openings, November 5.431 (forecast 5.410)

-

16:00

United Kingdom: NIESR GDP Estimate, December 0.6%

-

15:53

Dallas Fed President Robert Kaplan: it was the right decision to hike interest rates in December

Dallas Fed President Robert Kaplan said in a speech on Monday that it was the right decision to hike interest rates in December, adding that further interest rate hikes should be gradual and depend on the incoming economic data.

"I agree with, and argued for, the decision made in December by the FOMC to increase the federal funds rate … Future removals of accommodation will likely be done gradually and will depend on our ongoing assessment of incoming economic data and overall economic conditions," he said.

Kaplan pointed out that the slowdown in the Chinese economy could have a negative impact on the U.S. economy.

"Slower Chinese growth has the potential to further impact commodity prices and create headwinds for GDP growth in the U.S. and other economies," Dallas Fed president noted.

-

15:41

Japan’s consumer confidence index rises to 42.7 in December

Japan's Cabinet Office released its consumer confidence index on Tuesday. The consumer confidence index rose to 42.7 in December from 42.6 in November, beating expectations for a decline to 42.3.

The increase was driven by rises in 2 of 4 sub-indexes. The overall livelihood sub-index increased to 41.1 in December from 40.9 in November, the income growth sub-index was up to 41.8 from 41.1, the employment sub-index fell to 46.3 from 46.7, while the willingness to buy durable goods sub-index remained unchanged at 41.6.

-

15:05

Bank lending in Japan increases 2.2% year-on-year in December

The Bank of Japan released its bank lending data on late Monday evening. Bank lending in Japan increased 2.2% year-on-year in December, after a 2.3% gain in December.

Lending excluding trusts climbed 2.2% year-on-year in December.

-

14:50

Option expiries for today's 10:00 ET NY cut

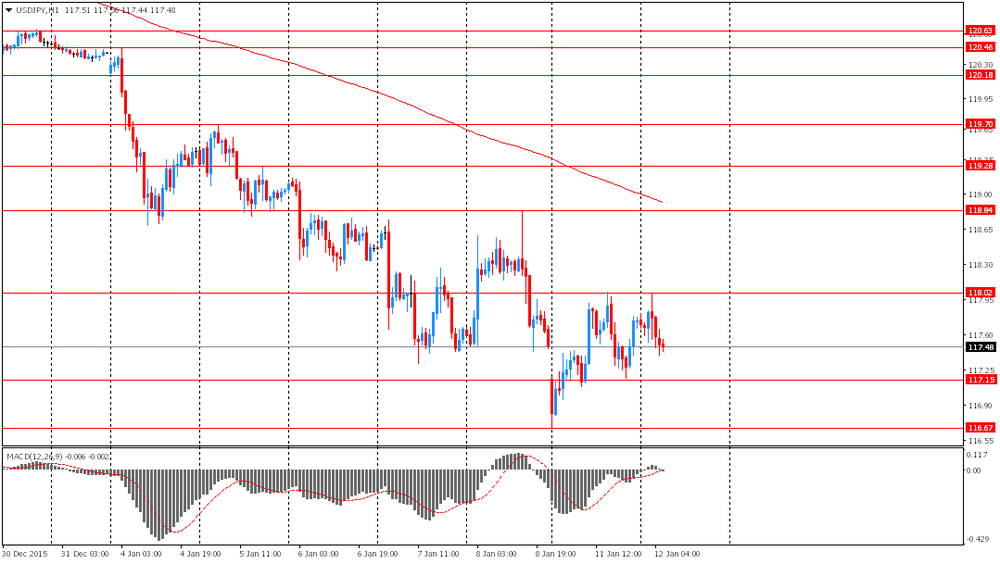

USD/JPY 117.05-15 (USD 400m) 119.50 (350m)

EUR/USD 1.0700 (EUR 768m) 1.0800 (261m) 1.0950-60 (710m)

AUD/USD 0.7000-10 (AUD 570m) 0.7020-25 (300m) 0.7110 (281m)

USD/CAD 1.3900 (USD 525m)

-

14:34

Japan’s Eco Watchers' current conditions index climbs to 48.7 in December

Japan's Cabinet Office released Eco Watchers' Index figures on Tuesday. Japan's economy watchers' current conditions index climbed to 48.7 in December from 46.1 in November, exceeding expectations for a rise to 46.7.

Japan's economy watchers' future conditions index remained unchanged at 48.2 in December.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

14:28

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the weaker-than-expected U.K. industrial production data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Consumer Confidence December 42.6 42.3 42.7

05:00 Japan Eco Watchers Survey: Current December 46.1 46.7 48.7

05:00 Japan Eco Watchers Survey: Outlook December 48.2 48.2

09:30 United Kingdom Industrial Production (MoM) November 0.1% 0.0% -0.7%

09:30 United Kingdom Industrial Production (YoY) November 1.7% 1.7% 0.9%

09:30 United Kingdom Manufacturing Production (MoM) November -0.4% 0.1% -0.4%

09:30 United Kingdom Manufacturing Production (YoY) November -0.2% Revised From -0.1% -0.8% -1.2%

10:30 Japan BOJ Governor Haruhiko Kuroda Speaks

10:30 U.S. FED Vice Chairman Stanley Fischer Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the U.S. job openings data. Job openings in the U.S. are expected to rise to 5.410 million in November from 5.383 million in October.

Market participants continued to eye Friday's labour market data. According to the U.S. Labor Department's labour market data, the U.S. economy added 292,000 jobs in December, exceeding expectations for a rise of 200,000 jobs, after a gain of 252,000 jobs in November. November's figure was revised up from a rise of 211,000 jobs. The U.S. unemployment rate remained unchanged at 5.0% in December, in line with expectations.

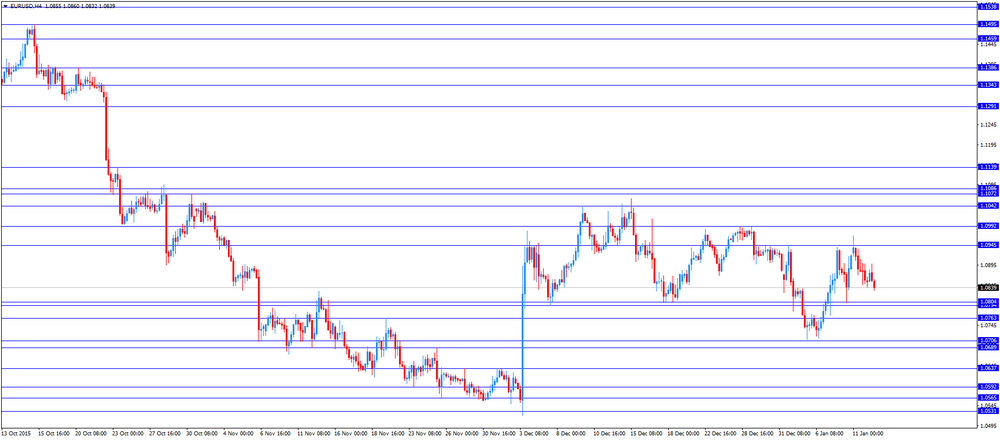

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

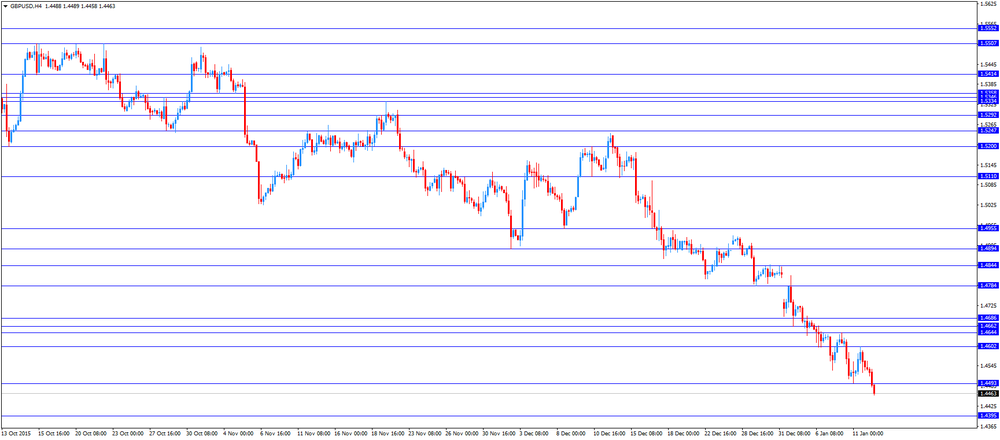

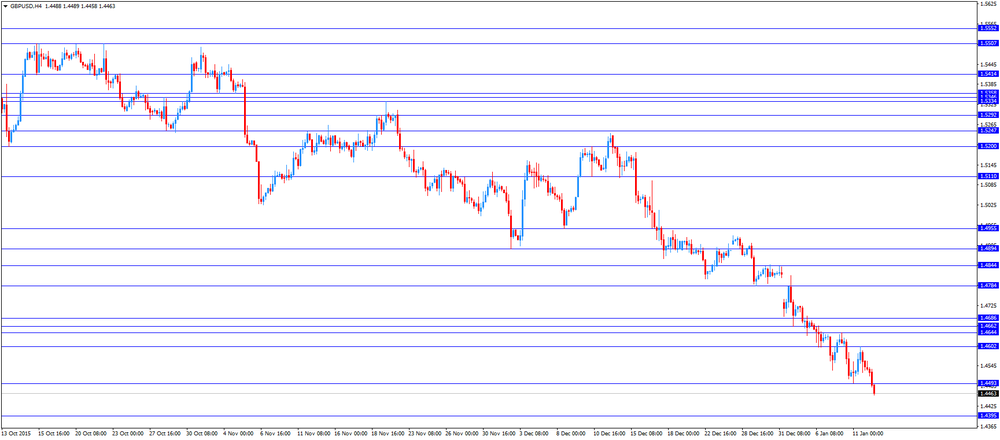

The British pound traded lower against the U.S. dollar after the release of the weaker-than-expected U.K. industrial production data. The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in November, missing expectations for a 0.1% gain, after a 0.4% decrease in October.

Manufacturing output was mainly driven by a drop in basic pharmaceutical products and pharmaceutical preparations, which plunged by 4.9% in November.

On a yearly basis, manufacturing production in the U.K. decreased 1.2% in November, missing forecast of a 0.8% fall, after a 0.2% drop in October. October's figure was revised down from a 0.1% decrease.

Industrial production in the U.K. slid 0.7% in November, missing forecasts of a flat reading, after a 0.1% rise in October.

The decline was driven by a demand for energy. Electricity and gas output plunged 2.1% in November.

On a yearly basis, industrial production in the U.K. gained 0.9% in November, missing expectations for a 1.7% rise, after a 1.7% increase in October.

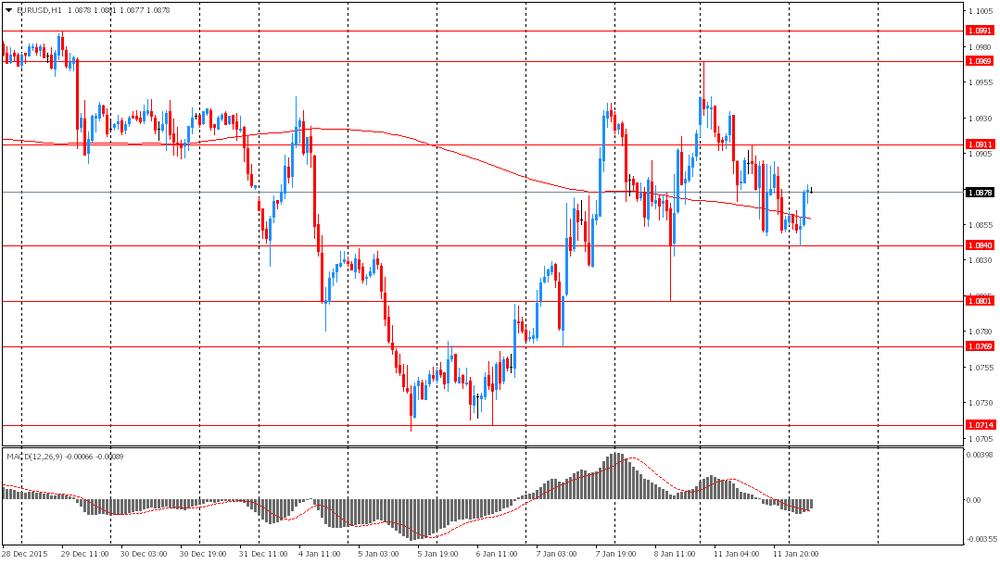

EUR/USD: the currency pair declined to $1.0832

GBP/USD: the currency pair dropped to $1.4413

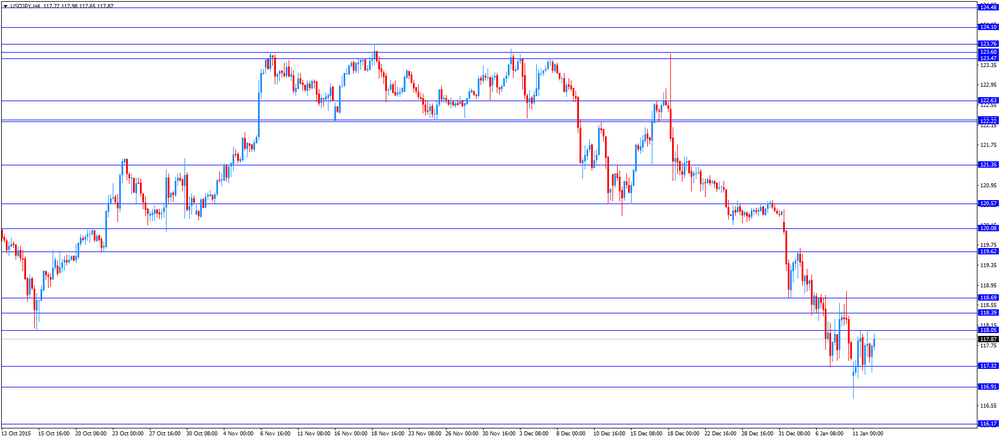

USD/JPY: the currency pair increased Y117.98

The most important news that are expected (GMT0):

14:15 United Kingdom BOE Gov Mark Carney Speaks

15:00 United Kingdom NIESR GDP Estimate December 0.6%

15:00 U.S. JOLTs Job Openings November 5.383 5.410

-

13:51

Orders

EUR/USD

Offers 1.0900 1.0930 1.0950 1.0965 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0875-80 1.0850 1.0830 1.0800 1.0780 1.0750 1.0720 1.0700

GBP/USD

Offers 1.4540 1.4560 1.4585 1.4600 1.4625 1.4640 1.4665 1.4685 1.4700

Bids 1.4500 1.4485 1.4465 1.4450 1.4425 1.4400 1.4380 1.4350

EUR/GBP

Offers 0.7500 0.7525 0.7550-55 0.7575 0.7600

Bids 0.7475-80 0.7450-55 0.7420 0.7400 0.7380-85 0.7365 0.7350

EUR/JPY

Offers 128.20 128.50 128.80 129.00 129.30 129.50 129.80 130.00

Bids 127.80 127.60 127.30 127.00 126.80 126.50 126.30 126.00

USD/JPY

Offers 117.65 117.85 118.00 118.25-30 118.50 118.80-85 119.00

Bids 117.20 117.00 116.85 116.65 116.50 116.30 116.00

AUD/USD

Offers 0.6980 0.7000-05 0.7025 0.7055-60 0.7080 0.7100

Bids 0.6940 0.6925 0.6900 0.6885 0.6865 0.6850

-

11:48

The People’s Bank of China (PBoC) intervens in the offshore yuan market

The People's Bank of China (PBoC) intervened in the offshore yuan market on Tuesday. The offshore yuan strengthened after the intervention. The price gap against the dollar with the onshore yuan was eliminated. The intervention helped to stabilised the markets.

-

11:37

-

11:33

BRC and KPMG sales monitor: U.K. retail sales rise by an annual rate of 0.1% on a like-for-like basis in December

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales increased by an annual rate of 0.1% on a like-for-like basis in December, after a 0.4% decline in November.

On a total basis, retail sales climbed 1.0% year-on-year in December.

"2015 drew to a disappointing close for retailers, with December seeing just 1 per cent sales growth, notwithstanding the strong underlying momentum of an improving consumer environment buoyed by rising real incomes, low inflation and low unemployment," BRC Chief Executive, Helen Dickinson, said.

-

11:15

Bank of France expects the French economy to expand 0.3% in the fourth quarter

The Bank of France cuts its growth forecast for the fourth quarter on Tuesday. The central bank expects the French economy to expand 0.3% in the fourth quarter, unchanged from the previous estimate.

The manufacturing business confidence index increased to 99 in December from 98 in November.

The services business sentiment index remained unchanged at 96 in December.

The construction business sentiment index remained unchanged at 96 in December.

-

11:04

U.K. manufacturing production falls 0.4% in November, while industrial production drops 0.7%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in November, missing expectations for a 0.1% gain, after a 0.4% decrease in October.

Manufacturing output was mainly driven by a drop in basic pharmaceutical products and pharmaceutical preparations, which plunged by 4.9% in November.

On a yearly basis, manufacturing production in the U.K. decreased 1.2% in November, missing forecast of a 0.8% fall, after a 0.2% drop in October. October's figure was revised down from a 0.1% decrease.

Industrial production in the U.K. slid 0.7% in November, missing forecasts of a flat reading, after a 0.1% rise in October.

The decline was driven by a demand for energy. Electricity and gas output plunged 2.1% in November.

On a yearly basis, industrial production in the U.K. gained 0.9% in November, missing expectations for a 1.7% rise, after a 1.7% increase in October.

-

10:44

Option expiries for today's 10:00 ET NY cut

USD/JPY 117.05-15 (USD 400m) 119.50 (350m)

EUR/USD 1.0700 (EUR 768m) 1.0800 (261m) 1.0950-60 (710m)

AUD/USD 0.7000-10 (AUD 570m) 0.7020-25 (300m) 0.7110 (281m)

USD/CAD 1.3900 (USD 525m -

10:40

China’s economy likely expands 7.0% in 2015

Li Pumin, spokesman for China's National Reform and Development Commission (NDRC), said on Tuesday that China achieved its main economic targets in 2015. The economy likely expanded 7.0% in 2015 and added 13 million new jobs.

Official fourth-quarter and full-year 2015 figures will be released on Monday.

-

10:30

United Kingdom: Industrial Production (MoM), November -0.7% (forecast 0.0%)

-

10:30

United Kingdom: Manufacturing Production (YoY), November -1.2% (forecast -0.8%)

-

10:30

United Kingdom: Industrial Production (YoY), November 0.9% (forecast 1.7%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , November -0.4% (forecast 0.1%)

-

10:21

Atlanta Fed President Dennis Lockhart: there will be not enough data on inflation to raise interest rate in January or March

Atlanta Fed President Dennis Lockhart said after a speech in Atlanta on Monday that there will be not enough data on inflation to raise interest rate in January or March.

""How much will we know about inflation trends or developments going into the mid-March meeting? We will have some new data but not a great deal more," he said.

Lockhart pointed out in his speech that he does not think turmoil abroad will have impact on the U.S. economy.

"When such volatility develops, I think it's helpful to look at the real economy of the United States (as opposed to the financial economy) and ask if something is fundamentally wrong. Are there serious imbalances that make the broad economy vulnerable to foreign shocks? I don't see that kind of connection in current circumstances," Atlanta Fed president noted.

-

10:10

Japan’s current account surplus declines to ¥1,143.5 billion in November

Japan's Ministry of Finance released its current account data for Japan late Monday evening. Japan's current account surplus fell to ¥1,143.5 billion in November from ¥1,458.4 billion in October, beating expectations for a surplus of ¥858.5 billion.

The goods trade surplus turned into a deficit of ¥271.5 billion in November, down from a surplus of ¥200.2 billion in October.

Exports dropped at an annual rate of 6.3% in November, while imports plunged 10.9%.

-

08:28

Options levels on tuesday, January 12, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1018 (2658)

$1.0973 (1794)

$1.0940 (1528)

Price at time of writing this review: $1.0886

Support levels (open interest**, contracts):

$1.0829 (152)

$1.0794 (1180)

$1.0746 (3357)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 33518 contracts, with the maximum number of contracts with strike price $1,1150 (3175);

- Overall open interest on the PUT options with the expiration date February, 5 is 46162 contracts, with the maximum number of contracts with strike price $1,0700 (7983);

- The ratio of PUT/CALL was 1.38 versus 1.34 from the previous trading day according to data from January, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.4804 (1112)

$1.4706 (2350)

$1.4610 (1191)

Price at time of writing this review: $1.4533

Support levels (open interest**, contracts):

$1.4490 (984)

$1.4394 (1322)

$1.4296 (511)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 15528 contracts, with the maximum number of contracts with strike price $1,4700 (2350);

- Overall open interest on the PUT options with the expiration date February, 5 is 16460 contracts, with the maximum number of contracts with strike price $1,4550 (2012);

- The ratio of PUT/CALL was 1.06 versus 1.08 from the previous trading day according to data from January, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:27

Foreign exchange market. Asian session: the Australian dollar advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Consumer Confidence December 42.6 42.3 42.7

The Australian dollar rose against the U.S. dollar after the People's Bank of China intervened and decreased the yuan exchange rate spread in Hong Kong and Shanghai. China is Australia's major trading partner.

The pound climbed ahead of the Bank of England meeting scheduled for Thursday. Analysts surveyed by Reuters don't expect the central bank to raise its interest rates until the second quarter of the current year. However some market participants believe that the BOE will not tighten its monetary policy this year at all. A consensus forecast suggests that the bank may raise its benchmark rate by 25 basis points to 0.75% at the end of June.

The yen little changed on economic data. A report showed that Japan Current account surplus rose to ¥1,143.5 billion in November compared to expectations of ¥858.5 billion.

EUR/USD: the pair rose to $1.0885 in Asian trade

USD/JPY: the pair traded within Y117.40-00

GBP/USD: the pair fell to $1.4520

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Industrial Production (MoM) November 0.1% 0.0%

09:30 United Kingdom Industrial Production (YoY) November 1.7% 1.7%

09:30 United Kingdom Manufacturing Production (MoM) November -0.4% 0.1%

09:30 United Kingdom Manufacturing Production (YoY) November -0.1% -0.8%

10:30 Japan BOJ Governor Haruhiko Kuroda Speaks

10:30 U.S. FED Vice Chairman Stanley Fischer Speaks

14:15 United Kingdom BOE Gov Mark Carney Speaks

15:00 United Kingdom NIESR GDP Estimate December 0.6%

15:00 U.S. JOLTs Job Openings November 5.383 5.410

-

06:01

Japan: Consumer Confidence, December 42.7 (forecast 42.3)

-

00:50

Japan: Current Account, bln, November 1143.5 (forecast 858.5)

-

00:32

Currencies. Daily history for Jan 11’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0858 -0,56%

GBP/USD $1,4542 +0,12%

USD/CHF Chf1,0013 +0,68%

USD/JPY Y117,74 +0,21%

EUR/JPY Y127,86 -0,34%

GBP/JPY Y171,2 +0,32%

AUD/USD $0,6993 +0,29%

NZD/USD $0,6558 +0,12%

USD/CAD C$1,4215 +0,49%

-

00:00

Schedule for today, Tuesday, Jan 12’2016:

(time / country / index / period / previous value / forecast)

05:00 Japan Consumer Confidence December 42.6

05:00 Japan Eco Watchers Survey: Current December 46.1 46.7

05:00 Japan Eco Watchers Survey: Outlook December 48.2

09:30 United Kingdom Industrial Production (MoM) November 0.1% 0.0%

09:30 United Kingdom Industrial Production (YoY) November 1.7% 1.7%

09:30 United Kingdom Manufacturing Production (MoM) November -0.4% 0.1%

09:30 United Kingdom Manufacturing Production (YoY) November -0.1% -0.8%

10:30 Japan BOJ Governor Haruhiko Kuroda Speaks

10:30 U.S. FED Vice Chairman Stanley Fischer Speaks

14:15 United Kingdom BOE Gov Mark Carney Speaks

15:00 United Kingdom NIESR GDP Estimate December 0.6%

15:00 U.S. JOLTs Job Openings November 5.383 5.410

-