Noticias del mercado

-

18:00

European stocks closed: FTSE 100 5,871.83 -40.61 -0.69% CAC 40 4,312.74 -21.02 -0.49% DAX 9,825.07 -24.27 -0.25%

-

17:19

Bank of Canada’s Business Outlook Survey: business sentiment deteriorated on low commodity prices

The Bank of Canada (BoC) released its Winter Business Outlook Survey today. The BoC's survey showed that business sentiment deteriorated on low commodity prices.

Exporters benefited from strong U.S. demand and the weak Canadian dollar, the BoC said.

Investment and hiring intentions dropped to their lowest levels since 2009, so BoC Business Outlook Survey.

-

16:43

European Central Bank purchases €8.69 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €8.69 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €591 million of covered bonds, and €27 million of asset-backed securities.

The ECB kept its interest rate unchanged at 0.05% on December 04, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

-

16:27

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 129.33 in December

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index increased to 129.33 in December from 128.27 in November. November's figure was revised down from 128.69.

Seven of the eight components climbed.

"The Employment Trends Index rebounded sharply in December, nearly erasing November's entire decline. However, the slowdown in the ETI growth rate in recent months, combined with weak GDP growth in the fourth quarter, suggests that the pace of job growth is likely to slow in the coming months," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

16:00

U.S.: Labor Market Conditions Index, December 2.9

-

15:17

Germany’s manufacturing turnover declines by 2.3% in November

Destatis released its manufacturing turnover data for Germany on Monday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 2.3% in November, after a 1.8% fall in October. October's figure was revised down up a 2.0% increase.

Domestic turnover decreased by 2.4% in November, while the business with foreign customers dropped 2.1%.

Sales to euro area countries rose 2.6% in November, while sales to other countries were down 5.2%.

On a yearly basis, real manufacturing turnover in Germany was down on seasonally adjusted and on adjusted for working days basis by 0.5% in November.

-

14:49

OECD’s composite leading indicator remains unchanged at 99.8 in November

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator remained unchanged at 99.8 in November.

It signalled stable growth momentum in Canada, Germany, Italy, Japan and in the Eurozone as a whole.

The growth momentum firmed in France and India.

The index for Russia pointed to a loss in growth momentum.

The index for Brazil and China showed tentative signs of stabilisation.

The index for the U.S. and the U.K. pointed to an easing in growth.

-

14:44

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.25 (USD 205m) 119.00 (400m)

EUR/USD 1.0790-0800 (EUR 1.1bln) 1.0975 (503m) 1.1000 (362m)

AUD/USD 0.7045-50 (AUD 750m)

USD/CHF 1.0225 (USD 650m)

EUR/JPY 128.20 (EUR 600m) 129.50 (705m) 131.50 (993m)

-

14:37

Housing starts in Canada drop to a seasonally adjusted annualized rate of 172,965 units in December

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada dropped to a seasonally adjusted annualized rate of 172,965 units in December from 212,028 units in November. November's figure was revised down from 211,916 units.

Housing starts were driven by a drop in the single and multi-unit segment.

"A decrease in both the multiple and single starts segments drove the December trend lower. Starts increased in 2015 compared to 2014, largely driven by the condominium market in Toronto. Had the Toronto condominium starts remained stable in 2015, national starts would have declined on a year-over-year basis," the CMHC's Chief Economist Bob Dugan said.

-

14:14

Canada: Housing Starts, December 173 (forecast 213)

-

14:07

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) December 1.1% Revised From 1.3% -0.1%

02:00 China New Loans December 708.9 700

08:15 Switzerland Retail Sales (MoM) November 0.3% -0.8%

08:15 Switzerland Retail Sales Y/Y November -0.6% Revised From -0.8% 0.3% -3.1%

09:30 Eurozone Sentix Investor Confidence December 15.7 9.6

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major economic reports from the U.S.

Market participants continued to eye Friday's labour market data. According to the U.S. Labor Department's labour market data, the U.S. economy added 292,000 jobs in December, exceeding expectations for a rise of 200,000 jobs, after a gain of 252,000 jobs in November. November's figure was revised up from a rise of 211,000 jobs. The U.S. unemployment rate remained unchanged at 5.0% in December, in line with expectations.

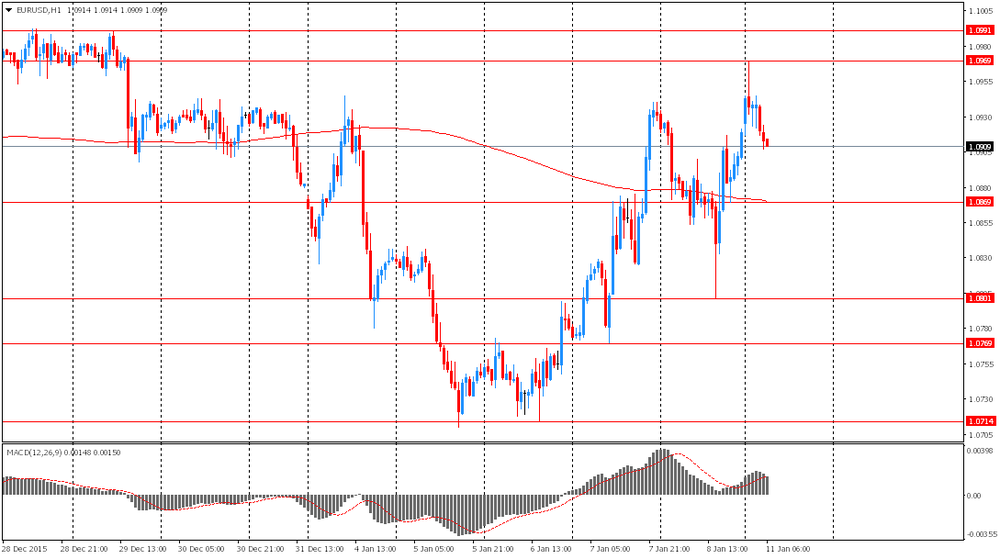

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 9.6 in January from 15.7 in December.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The shakeup at Chinese stock exchanges is perceived more than a "technical issue" by investors. Economic ex-pectations for Asia ex. Japan show the strongest nosedive ever recorded. Yet, economic expectations for the US economy are negative, the first time since October 2012," Sentix said in its statement.

German investor confidence index dropped to 18.1 in January from 22.7 in December.

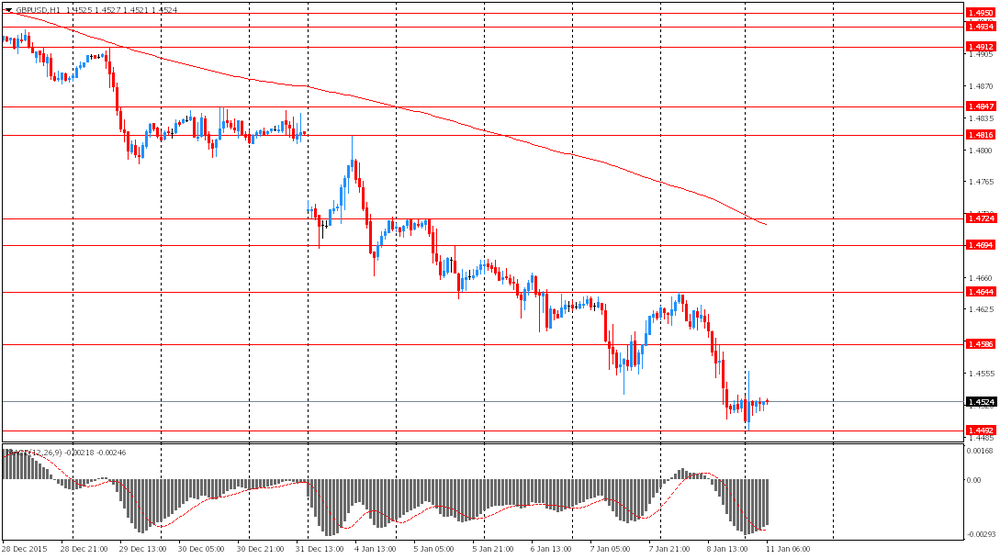

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead the release of the housing market data from Canada. Housing starts in Canada are expected to rise to 213,000 in December from 211,900 in November.

The Swiss franc traded lower against the U.S. dollar after the weak retail sales data from Switzerland. The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were down at an annual rate of 3.1% in November, missing expectations for a 0.3% rise, after a 0.6% decrease in October. October's figure was revised up from a 0.8% drop.

Sales of food, beverages and tobacco fell at an annual rate of 0.4% in November, while non-food sales dropped 1.9%.

On a monthly basis, retail sales slid by 0.8% in November, after a 0.3% rise in October.

Sales of food, beverages and tobacco rose 0.1% in November, while non-food sales decreased 1.3%.

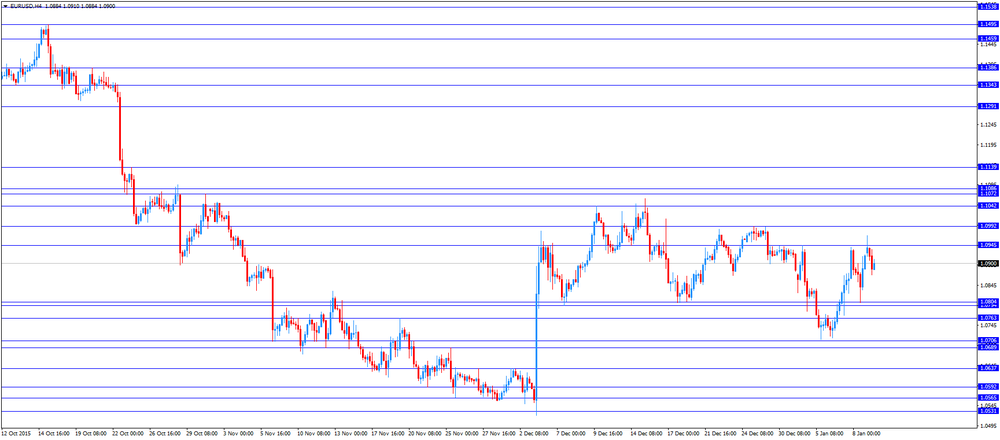

EUR/USD: the currency pair declined to $1.0871

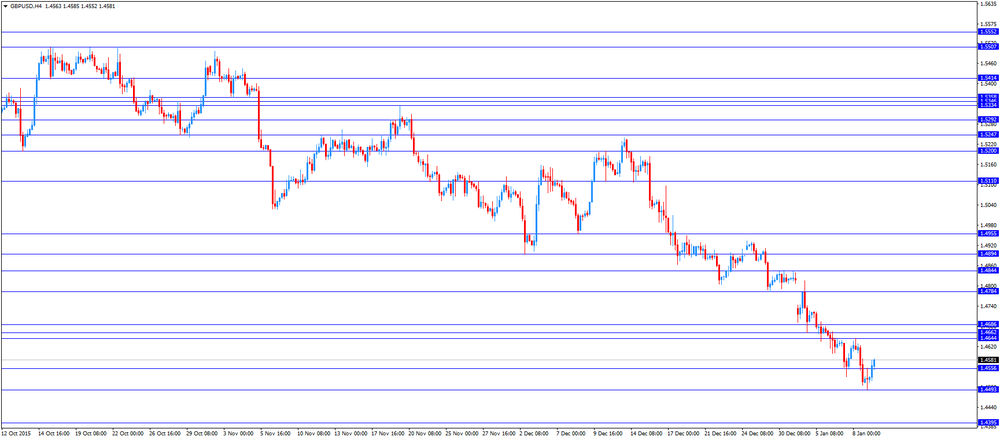

GBP/USD: the currency pair rose to $1.4585

USD/JPY: the currency pair increased Y117.92

The most important news that are expected (GMT0):

13:15 Canada Housing Starts December 211.9 213

15:00 U.S. Labor Market Conditions Index December 0.5

15:30 Canada Bank of Canada Business Outlook Survey

23:50 Japan Current Account, bln November 1458.4 858.5

-

13:46

Orders

EUR/USD

Offers 1.0900 1.0930 1.0950 1.0965 1.0985 1.1000 1.1025 1.1050 1.1080 1.1100

Bids 1.0880 1.0860 1.0830 1.0800 1.0780 1.0750 1.0720 1.0700

GBP/USD

Offers 1.4560 1.4585 1.4600 1.4625 1.4640 1.4665 1.4685 1.4700 1.4725-30 1.4750

Bids 1.4520 1.4500 1.4485 1.4465 1.4450 1.4425 1.4400 1.4380 1.4350

EUR/GBP

Offers 0.7500 0.7520-25 0.7550-55 0.7575 0.7600

Bids 0.7470 0.7450-55 0.7420 0.7400 0.7380-85 0.7365 0.7350

EUR/JPY

Offers 128.50 128.80 129.00 129.30 129.50 129.80 130.00 130.30 130.50

Bids 128.00 127.80 127.50 127.00 126.80 126.50 126.30 126.00

USD/JPY

Offers 118.00 118.25-30 118.50 118.80-85 119.00 119.30 119.60 119.80 120.00

Bids 117.50 117.20 117.00 116.85 116.65 116.50 116.30 116.00

AUD/USD

Offers 0.7025 0.7055-60 0.7080 0.7100 0.7120-25 0.7150

Bids 0.6985 0.6955-60 0.6925-30 0.6900 0.6885 0.6865 0.6850

-

11:49

Industrial production in Spain is flat in November

Spanish statistical office INE released its industrial production figures for Spain on Monday. Industrial production in Spain was flat in November, after a 0.2% gain in October.

On a yearly basis, industrial production in Spain climbed at adjusted 4.2% in November, after a 4.1% increase in October. October's figure was revised up from a 4.0% gain.

Output of capital goods jumped at seasonally adjusted 9.3% year-on-year in November, output of intermediate goods climbed 4.3%, energy production was down 2.5%, while consumer goods output rose 4.0%.

-

11:36

Swiss retail sales decline 3.1% year-on-year in November

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were down at an annual rate of 3.1% in November, missing expectations for a 0.3% rise, after a 0.6% decrease in October. October's figure was revised up from a 0.8% drop.

Sales of food, beverages and tobacco fell at an annual rate of 0.4% in November, while non-food sales dropped 1.9%.

On a monthly basis, retail sales slid by 0.8% in November, after a 0.3% rise in October.

Sales of food, beverages and tobacco rose 0.1% in November, while non-food sales decreased 1.3%.

-

11:27

Sentix investor confidence index for the Eurozone slides to 9.6 in January

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 9.6 in January from 15.7 in December.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The shakeup at Chinese stock exchanges is perceived more than a "technical issue" by investors. Economic ex-pectations for Asia ex. Japan show the strongest nosedive ever recorded. Yet, economic expectations for the US economy are negative, the first time since October 2012," Sentix said in its statement.

The current conditions index fell to 13.0 in January from 13.5 in December.

The expectations index plunged to 6.3 in January from 18.0 in December.

German investor confidence index dropped to 18.1 in January from 22.7 in December.

-

11:00

The U.S. sends a B-52 bomber close to the North-South Korean border

The U.S. sent a B-52 bomber, which is capable to carry nuclear weapons, close to the North-South Korean border in response to a hydrogen nuclear bomb test.

North Korea announced on last Wednesday that it successfully tested hydrogen nuclear bomb.

-

10:48

San Francisco Fed President John Williams: further interest rate hikes should be gradual

San Francisco Fed President John Williams said in a speech on Friday that the Fed's decision to hike its interest rate in December was right, adding that the further interest rate hikes should be gradual.

"The Fed has started the process of raising interest rates, but the path to normal will be gradual and rates are likely to be low by historical standards," he said.

Williams noted that the U.S. economy is good.

"We're very close to full employment, and the economy still has a good head of steam. Consumer spending continues to increase at a solid pace, auto sales have matched their highs of the early 2000s, and strong fundamentals point to continued strength going forward," San Francisco Fed president said.

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.25 (USD 205m) 119.00 (400m)

EUR/USD 1.0790-0800 (EUR 1.1bln) 1.0975 (503m) 1.1000 (362m)

AUD/USD 0.7045-50 (AUD 750m)

USD/CHF 1.0225 (USD 650m)

-

10:34

Chinese consumer price index rises at annual rate of 1.6% in December

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Saturday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in December, in line with expectations, after a 1.5% gain in November.

Food prices rose at an annual rate of 2.7% in December, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation increased 0.5% in December, after a flat reading in November.

The Chinese producer price index (PPI) dropped 5.9% in December, missing expectations for a 5.8% fall, after a 5.9% decline in November.

-

10:21

OECD: consumer price inflation in the OECD area rises to 0.7% year-on-year in November

OECD released its consumer price inflation (CPI) data on Thursday. Consumer price inflation in the OECD area rose to 0.7% year-on-year in November from 0.6% in October.

Energy prices dropped at an annual rate of 10.0% in November, while food prices decreased to 1.2% in November from 1.5% in October.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.8% in November.

November's CPI was 0.4% in Germany, 0.3% in Japan, 0.2% in Italy, 0.5% in the U.S, 1.4% in Canada, and 0.1% in the U.K.

The consumer price inflation in Eurozone was 0.1% in November, while the inflation in China was 1.5%.

-

10:10

Building permits in New Zealand rise 1.8% in November

Statistics New Zealand released its building permits data on late Sunday evening. Building permits in New Zealand rose 1.8% in November, after a 5.4% gain in October. October's figure was revised up from a 5.1% increase.

Residential work rose 23% year-on-year in November, while non-residential work climbed 25%.

"November is usually a big month for residential building consents, and 2015 was no exception. Dwelling consents were up 17 percent from the year before, driven by increases for houses and retirement village units," business indicators manager Clara Eatherley said.

-

09:31

Switzerland: Retail Sales (MoM), November -0.8%

-

09:15

Switzerland: Retail Sales Y/Y, November -3.1% (forecast 0.3%)

-

08:21

Foreign exchange market. Asian session: the Australian dollar fell

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia ANZ Job Advertisements (MoM) December 1.1% Revised From 1.3% -0.1%

The Australian dollar fell against the greenback at the beginning of the session amid inflation data from China. The consumer price index came in at 0.5% in December. Economists had expected a reading of 0.4%. The index rose by 1.6% on an annualized basis after rising 1.5% in the previous month, which is well below the government's 2015 target of 3%.

The Australian dollar was further weighed by ANZ Job Advertisements data. The index declined by 0.1% in December compared to +1.3% reported previously. A low reading is a negative factor for the Australian economy.

The New Zealand dollar was supported by construction permissions data. The corresponding index rose by 1.8% in November after a 5.4% rise in October (revised from +5.1%) marking the tenth straight month of growth. A long-term indicator rose by 0.6% to the highest level since July 2004.

EUR/USD: the pair fluctuated within $1.0905-70 in Asian trade

USD/JPY: the pair traded within Y116.65-45

GBP/USD: the pair traded within $1.4490-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Retail Sales (MoM) November 0.3%

08:15 Switzerland Retail Sales Y/Y November -0.8% 0.3%

09:30 Eurozone Sentix Investor Confidence December 15.7

13:15 Canada Housing Starts December 211.9 213

15:00 U.S. Labor Market Conditions Index December 0.5

15:30 Canada Bank of Canada Business Outlook Survey

23:50 Japan Current Account, bln November 1458.4 858.5

-

07:11

Options levels on monday, January 11, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1062 (1843)

$1.1014 (1548)

$1.0979 (1629)

Price at time of writing this review: $1.0918

Support levels (open interest**, contracts):

$1.0846 (145)

$1.0808 (1027)

$1.0756 (3214)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 32174 contracts, with the maximum number of contracts with strike price $1,1000 (3200);

- Overall open interest on the PUT options with the expiration date February, 5 is 43110 contracts, with the maximum number of contracts with strike price $1,0700 (7027);

- The ratio of PUT/CALL was 1.34 versus 1.43 from the previous trading day according to data from January, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.4803 (1174)

$1.4705 (2328)

$1.4608 (1108)

Price at time of writing this review: $1.4527

Support levels (open interest**, contracts):

$1.4489 (946)

$1.4393 (1256)

$1.4296 (493)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 15346 contracts, with the maximum number of contracts with strike price $1,4700 (2328);

- Overall open interest on the PUT options with the expiration date February, 5 is 16544 contracts, with the maximum number of contracts with strike price $1,4550 (2081);

- The ratio of PUT/CALL was 1.08 versus 0.84 from the previous trading day according to data from January, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:31

Australia: ANZ Job Advertisements (MoM), December -0.1%

-

00:32

Currencies. Daily history for Jan 8’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0919 -0,11%

GBP/USD $1,4525 -0,62%

USD/CHF Chf0,9945 +0,14%

USD/JPY Y117,49 -0,14%

EUR/JPY Y128,29 -0,24%

GBP/JPY Y170,65 -0,77%

AUD/USD $0,6973 -0,52%

NZD/USD $0,6550 -1,13%

USD/CAD C$1,4146 +0,23%

-

00:00

Schedule for today, Monday, Jan 11’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia ANZ Job Advertisements (MoM) December 1.3%

02:00 China New Loans December 708.9 700

08:15 Switzerland Retail Sales (MoM) November 0.3%

08:15 Switzerland Retail Sales Y/Y November -0.8% 0.3%

09:30 Eurozone Sentix Investor Confidence December 15.7

13:15 Canada Housing Starts December 211.9 213

15:00 U.S. Labor Market Conditions Index December 0.5

15:30 Canada Bank of Canada Business Outlook Survey

23:50 Japan Current Account, bln November 1458.4 858.5

-