Noticias del mercado

-

21:00

Dow -0.26% 16,304.63 -41.82 Nasdaq -0.85% 4,604.00 -39.63 S&P -3.02% 1,912.08 -9,95 -0.52%

-

18:28

WSE: Session Results

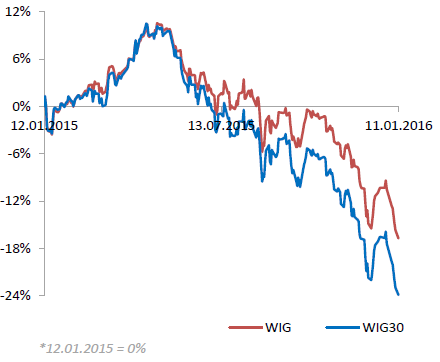

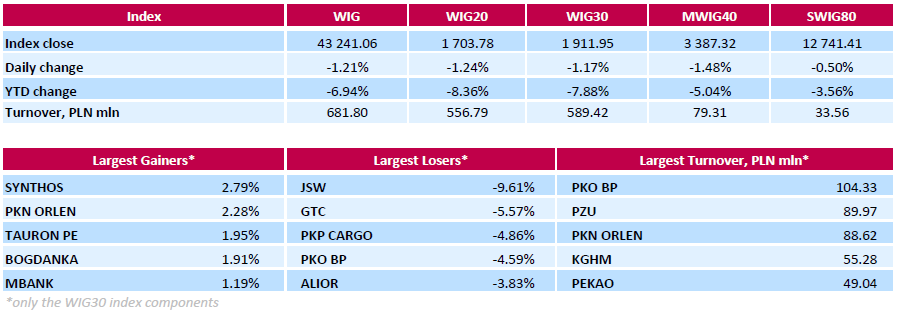

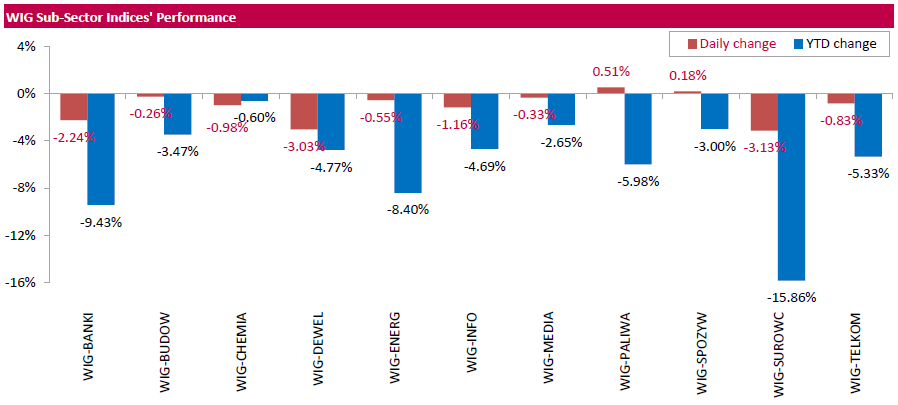

Polish equity market closed lower on Monday. The broad market measure, the WIG Index, lost 1.21%. Except for oil & gas sector (+0.51%) and food sector (+0.18%), every sector in the WIG Index declined, with materials (-3.13%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.17%. The decliners were led by coking coal producer JSW (WSE: JSW), which tumbled by 9.61%. Other biggest laggards included property developer GTC (WSE: GTC), railway freight transport operator PKP CARGO (WSE: PKP) and banks PKO BP (WSE: PKO) and ALIOR (WSE: ALR), which plunged by 3.83%-5.57%. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) recorded the strongest daily result, climbing 2.79%. It was followed by oil refiner PKN ORLEN (WSE: PKN), which gained 2.28% on the back of the news that Poland is analyzing merging the company with other two state-run oil & gas sector companies LOTOS (WSE: LTS; -0.11%) and PGNIG (WSE: PGN; -3.58%).

-

18:00

European stocks close: stocks closed lower on a drop in oil prices and on negative news from China

Stock indices closed lower on a drop in oil prices and on negative news from China. The Chinese stock market dropped again. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Saturday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in December, in line with expectations, after a 1.5% gain in November.

The Chinese producer price index (PPI) dropped 5.9% in December, missing expectations for a 5.8% fall, after a 5.9% decline in November.

Meanwhile, the economic data from Eurozone was weak. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 9.6 in January from 15.7 in December.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The shakeup at Chinese stock exchanges is perceived more than a "technical issue" by investors. Economic ex-pectations for Asia ex. Japan show the strongest nosedive ever recorded. Yet, economic expectations for the US economy are negative, the first time since October 2012," Sentix said in its statement.

German investor confidence index dropped to 18.1 in January from 22.7 in December.

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator remained unchanged at 99.8 in November.

It signalled stable growth momentum in Canada, Germany, Italy, Japan and in the Eurozone as a whole.

The growth momentum firmed in France and India.

The index for Russia pointed to a loss in growth momentum.

The index for Brazil and China showed tentative signs of stabilisation.

The index for the U.S. and the U.K. pointed to an easing in growth.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,871.83 -40.61 -0.69 %

DAX 9,825.07 -24.27 -0.25 %

CAC 40 4,312.74 -21.02 -0.49 %

-

17:29

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Monday. Positive market driver - Apple stocks, as they rebounded off their worst-ever start to a year and with the corporate earnings season set to kick off. Global stocks were mixed as jittery investors looked for stability after a bruising start to the year due to declining oil prices and mounting worries about a China-led slowdown in global economic growth.

Most of Dow stocks in negative area (19 of 30). Top looser - Caterpillar Inc. (CAT, -2,65%). Top gainer - The Home Depot, Inc. (HD, +1.13%).

Almost all S&P sectors also in negative area. Top looser - Basic Materials (-1,7%). Top gainer - Utilities (+0,4%).

At the moment:

Dow 16251.00 +16.00 +0.10%

S&P 500 1909.50 -2.00 -0.10%

Nasdaq 100 4248.50 -13.00 -0.31%

Oil 31.74 -1.42 -4.28%

Gold 1100.60 +2.70 +0.25%

U.S. 10yr 2.15 +0.02

-

17:19

Bank of Canada’s Business Outlook Survey: business sentiment deteriorated on low commodity prices

The Bank of Canada (BoC) released its Winter Business Outlook Survey today. The BoC's survey showed that business sentiment deteriorated on low commodity prices.

Exporters benefited from strong U.S. demand and the weak Canadian dollar, the BoC said.

Investment and hiring intentions dropped to their lowest levels since 2009, so BoC Business Outlook Survey.

-

16:43

European Central Bank purchases €8.69 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €8.69 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €591 million of covered bonds, and €27 million of asset-backed securities.

The ECB kept its interest rate unchanged at 0.05% on December 04, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

-

16:27

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 129.33 in December

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index increased to 129.33 in December from 128.27 in November. November's figure was revised down from 128.69.

Seven of the eight components climbed.

"The Employment Trends Index rebounded sharply in December, nearly erasing November's entire decline. However, the slowdown in the ETI growth rate in recent months, combined with weak GDP growth in the fourth quarter, suggests that the pace of job growth is likely to slow in the coming months," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

15:34

U.S. Stocks open: Dow +0.66%, Nasdaq +0.80%, S&P +0.68%

-

15:27

Before the bell: S&P futures +0.71%, NASDAQ futures +0.68%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei Closed

Hang Seng 19,888.5 -565.21 -2.76%

Shanghai Composite 3,018 -168.42 -5.29%

FTSE 5,932.85 +20.41 +0.35%

CAC 4,372.82 +39.06 +0.90%

DAX 9,938.26 +88.92 +0.90%

Crude oil $32.95 (-0.63%)

Gold $1099.90 (+0.18%)

-

15:17

Germany’s manufacturing turnover declines by 2.3% in November

Destatis released its manufacturing turnover data for Germany on Monday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 2.3% in November, after a 1.8% fall in October. October's figure was revised down up a 2.0% increase.

Domestic turnover decreased by 2.4% in November, while the business with foreign customers dropped 2.1%.

Sales to euro area countries rose 2.6% in November, while sales to other countries were down 5.2%.

On a yearly basis, real manufacturing turnover in Germany was down on seasonally adjusted and on adjusted for working days basis by 0.5% in November.

-

15:08

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALCOA INC.

AA

8.27

2.48%

73.4K

Yandex N.V., NASDAQ

YNDX

13.75

2.46%

23.2K

General Motors Company, NYSE

GM

30.20

2.27%

28.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.52

2.03%

69.7K

Apple Inc.

AAPL

98.64

1.73%

341.2K

Twitter, Inc., NYSE

TWTR

20.30

1.60%

4.6K

Facebook, Inc.

FB

98.35

1.05%

127.0K

Amazon.com Inc., NASDAQ

AMZN

613.00

0.98%

16.1K

Tesla Motors, Inc., NASDAQ

TSLA

212.90

0.90%

1.7K

Ford Motor Co.

F

12.65

0.88%

11.3K

International Business Machines Co...

IBM

132.73

0.84%

0.7K

International Paper Company

IP

36.20

0.84%

2.0K

Merck & Co Inc

MRK

51.50

0.82%

6.5K

Home Depot Inc

HD

124.90

0.81%

1K

Walt Disney Co

DIS

99.95

0.71%

0.4K

Visa

V

73.39

0.70%

0.7K

Citigroup Inc., NYSE

C

46.45

0.69%

11.6K

Chevron Corp

CVX

82.68

0.67%

1.9K

Pfizer Inc

PFE

31.20

0.65%

10.2K

Google Inc.

GOOG

719.00

0.63%

1.5K

AT&T Inc

T

33.74

0.60%

1.6K

Starbucks Corporation, NASDAQ

SBUX

56.97

0.60%

1K

Microsoft Corp

MSFT

52.63

0.57%

1.5K

Procter & Gamble Co

PG

76.40

0.57%

1.1K

Wal-Mart Stores Inc

WMT

63.90

0.57%

4.5K

Caterpillar Inc

CAT

63.64

0.55%

0.7K

Intel Corp

INTC

31.67

0.51%

212.2K

Cisco Systems Inc

CSCO

24.90

0.48%

1.7K

Verizon Communications Inc

VZ

45.00

0.38%

6.6K

Boeing Co

BA

130.45

0.35%

13.0K

Exxon Mobil Corp

XOM

74.95

0.35%

8.8K

General Electric Co

GE

28.55

0.35%

20.1K

Johnson & Johnson

JNJ

98.50

0.35%

0.7K

Goldman Sachs

GS

164.50

0.34%

3.0K

ALTRIA GROUP INC.

MO

58.44

0.34%

0.3K

HONEYWELL INTERNATIONAL INC.

HON

98.65

0.22%

0.1K

Nike

NKE

58.99

0.20%

2.3K

AMERICAN INTERNATIONAL GROUP

AIG

57.50

0.09%

4.1K

Yahoo! Inc., NASDAQ

YHOO

30.64

0.03%

17.8K

The Coca-Cola Co

KO

41.51

0.00%

1.0K

JPMorgan Chase and Co

JPM

58.87

-0.08%

19.6K

Barrick Gold Corporation, NYSE

ABX

8.40

-0.24%

2.9K

McDonald's Corp

MCD

115.08

-0.35%

0.7K

-

14:49

OECD’s composite leading indicator remains unchanged at 99.8 in November

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator remained unchanged at 99.8 in November.

It signalled stable growth momentum in Canada, Germany, Italy, Japan and in the Eurozone as a whole.

The growth momentum firmed in France and India.

The index for Russia pointed to a loss in growth momentum.

The index for Brazil and China showed tentative signs of stabilisation.

The index for the U.S. and the U.K. pointed to an easing in growth.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

General Motors (GM) upgraded to Outperform from Neutral at Credit Suisse; target raised to $38 from $37

Apple (AAPL) upgraded to Buy from Neutral at Mizuho; target lowered to $120 from $125

Downgrades:

JPMorgan Chase (JPM) downgraded to Neutral from Buy at Goldman

Other:

-

14:37

Housing starts in Canada drop to a seasonally adjusted annualized rate of 172,965 units in December

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada dropped to a seasonally adjusted annualized rate of 172,965 units in December from 212,028 units in November. November's figure was revised down from 211,916 units.

Housing starts were driven by a drop in the single and multi-unit segment.

"A decrease in both the multiple and single starts segments drove the December trend lower. Starts increased in 2015 compared to 2014, largely driven by the condominium market in Toronto. Had the Toronto condominium starts remained stable in 2015, national starts would have declined on a year-over-year basis," the CMHC's Chief Economist Bob Dugan said.

-

14:13

Earnings Season in U.S.: Major Reports of the Week

January 11

After the Close:

Alcoa (AA). Consensus EPS $0.01, Consensus Revenue $5278.39 mln

January 14

Before the Open:

JPMorgan Chase (JPM). Consensus EPS $1.32, Consensus Revenue $22395.97 mln

After the Close:

Intel (INTC). Consensus EPS $0.63, Consensus Revenue $14800.77 mln

January 15

Before the Open:

Citigroup (C). Consensus EPS $1.12, Consensus Revenue $17938.49 mln

-

12:00

European stock markets mid session: stocks traded mixed on negative news from China

Stock indices traded mixed on negative news from China. The Chinese stock market dropped again. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Saturday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in December, in line with expectations, after a 1.5% gain in November.

The Chinese producer price index (PPI) dropped 5.9% in December, missing expectations for a 5.8% fall, after a 5.9% decline in November.

Meanwhile, the economic data from Eurozone was weak. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 9.6 in January from 15.7 in December.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The shakeup at Chinese stock exchanges is perceived more than a "technical issue" by investors. Economic ex-pectations for Asia ex. Japan show the strongest nosedive ever recorded. Yet, economic expectations for the US economy are negative, the first time since October 2012," Sentix said in its statement.

German investor confidence index dropped to 18.1 in January from 22.7 in December.

Current figures:

Name Price Change Change %

FTSE 100 5,899.49 -12.95 -0.22 %

DAX 9,859.01 +9.67 +0.10 %

CAC 40 4,326.91 -6.85 -0.16 %

-

11:49

Industrial production in Spain is flat in November

Spanish statistical office INE released its industrial production figures for Spain on Monday. Industrial production in Spain was flat in November, after a 0.2% gain in October.

On a yearly basis, industrial production in Spain climbed at adjusted 4.2% in November, after a 4.1% increase in October. October's figure was revised up from a 4.0% gain.

Output of capital goods jumped at seasonally adjusted 9.3% year-on-year in November, output of intermediate goods climbed 4.3%, energy production was down 2.5%, while consumer goods output rose 4.0%.

-

11:36

Swiss retail sales decline 3.1% year-on-year in November

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were down at an annual rate of 3.1% in November, missing expectations for a 0.3% rise, after a 0.6% decrease in October. October's figure was revised up from a 0.8% drop.

Sales of food, beverages and tobacco fell at an annual rate of 0.4% in November, while non-food sales dropped 1.9%.

On a monthly basis, retail sales slid by 0.8% in November, after a 0.3% rise in October.

Sales of food, beverages and tobacco rose 0.1% in November, while non-food sales decreased 1.3%.

-

11:27

Sentix investor confidence index for the Eurozone slides to 9.6 in January

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 9.6 in January from 15.7 in December.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The shakeup at Chinese stock exchanges is perceived more than a "technical issue" by investors. Economic ex-pectations for Asia ex. Japan show the strongest nosedive ever recorded. Yet, economic expectations for the US economy are negative, the first time since October 2012," Sentix said in its statement.

The current conditions index fell to 13.0 in January from 13.5 in December.

The expectations index plunged to 6.3 in January from 18.0 in December.

German investor confidence index dropped to 18.1 in January from 22.7 in December.

-

11:00

The U.S. sends a B-52 bomber close to the North-South Korean border

The U.S. sent a B-52 bomber, which is capable to carry nuclear weapons, close to the North-South Korean border in response to a hydrogen nuclear bomb test.

North Korea announced on last Wednesday that it successfully tested hydrogen nuclear bomb.

-

10:48

San Francisco Fed President John Williams: further interest rate hikes should be gradual

San Francisco Fed President John Williams said in a speech on Friday that the Fed's decision to hike its interest rate in December was right, adding that the further interest rate hikes should be gradual.

"The Fed has started the process of raising interest rates, but the path to normal will be gradual and rates are likely to be low by historical standards," he said.

Williams noted that the U.S. economy is good.

"We're very close to full employment, and the economy still has a good head of steam. Consumer spending continues to increase at a solid pace, auto sales have matched their highs of the early 2000s, and strong fundamentals point to continued strength going forward," San Francisco Fed president said.

-

10:34

Chinese consumer price index rises at annual rate of 1.6% in December

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Saturday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in December, in line with expectations, after a 1.5% gain in November.

Food prices rose at an annual rate of 2.7% in December, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation increased 0.5% in December, after a flat reading in November.

The Chinese producer price index (PPI) dropped 5.9% in December, missing expectations for a 5.8% fall, after a 5.9% decline in November.

-

10:21

OECD: consumer price inflation in the OECD area rises to 0.7% year-on-year in November

OECD released its consumer price inflation (CPI) data on Thursday. Consumer price inflation in the OECD area rose to 0.7% year-on-year in November from 0.6% in October.

Energy prices dropped at an annual rate of 10.0% in November, while food prices decreased to 1.2% in November from 1.5% in October.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.8% in November.

November's CPI was 0.4% in Germany, 0.3% in Japan, 0.2% in Italy, 0.5% in the U.S, 1.4% in Canada, and 0.1% in the U.K.

The consumer price inflation in Eurozone was 0.1% in November, while the inflation in China was 1.5%.

-

10:10

Building permits in New Zealand rise 1.8% in November

Statistics New Zealand released its building permits data on late Sunday evening. Building permits in New Zealand rose 1.8% in November, after a 5.4% gain in October. October's figure was revised up from a 5.1% increase.

Residential work rose 23% year-on-year in November, while non-residential work climbed 25%.

"November is usually a big month for residential building consents, and 2015 was no exception. Dwelling consents were up 17 percent from the year before, driven by increases for houses and retirement village units," business indicators manager Clara Eatherley said.

-

07:12

Global Stocks: U.S. stock indices fell

U.S. stock indices gave up early gains and closed in red on Friday.

The Dow Jones Industrial Average lost 167.65 points, or 1%, to 16,346.45. The S&P 500 fell 21.08 points, or 1.1%, to 1,922.02 (all of its 10 sectors declined). The Nasdaq Composite fell 45.80 points, or 1%, to 4,643.63.

U.S. stocks advanced at the beginning of the session on a strong jobs report and stable Chinese markets, but falling oil prices dragged indices lower.

The U.S. Department of Labor reported that the U.S. economy created 292,000 new jobs in December vs expectations for 215,000 new jobs. Meanwhile the unemployment rate remained at 5%.

This morning in Asia Hong Kong Hang Seng plunged 2.29%, or 469.36, to 19,984.35. China Shanghai Composite Index dropped 2.91%, or 92.59, to 3,093.83. Japanese markets are on holiday.

Chinese stocks declined amid lack of investor confidence after last week's crisis. Pessimism is supported by weak economic data and outlook.

-

03:04

Hang Seng 19,948.29 -505.42 -2.5 %, Shanghai Composite 3,108.28 -78.14 -2.5 %

-

00:32

Stocks. Daily history for Sep Jan 8’2016:

(index / closing price / change items /% change)

Nikkei 225 17,697.96 -69.38 -0.39 %

Hang Seng 20,453.71 +120.37 +0.59 %

Shanghai Composite 3,186.78 +61.77 +1.98 %

FTSE 100 5,912.44 -41.64 -0.70 %

CAC 40 4,333.76 -69.82 -1.59 %

Xetra DAX 9,849.34-130.51 -1.31 %

S&P 500 1,922.03 -21.06 -1.08 %

NASDAQ Composite 4,643.63 -45.80 -0.98 %

Dow Jones 16,346.45 -167.65 -1.02 %

-