Noticias del mercado

-

21:00

DJIA 16462.21 -51.89 -0.31%, NASDAQ 4681.25 -8.17 -0.17%, S&P 500 1936.69 -6.40 -0.33%

-

18:24

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday. Oil erased earlier gains, pressured by persistent global oversupply and a bleak demand outlook. They have lost about 70% since mid year 2014.

Nonfarm payrolls surged in December and unemployment rate held steady at 5%. October and November payrolls were revised sharply higher.

Most of Dow stocks in negative area (17 of 30). Top looser - Chevron Corporation (CVX, -1,24%). Top gainer - Apple Inc. (AAPL, +1.73%).

S&P sectors mixed. Top looser - Basic Materials (-0,8%). Top gainer - Conglomerates (+0,9%).

At the moment:

Dow 16458.00 +39.00 +0.24%

S&P 500 1938.00 +5.00 +0.26%

Nasdaq 100 4325.00 +35.75 +0.83%

Oil 33.08 -0.19 -0.57%

Gold 1102.70 -5.10 -0.46%

U.S. 10yr 2.14 -0.01

-

18:05

European stocks close: stocks closed lower as a drop in shares of oil companies weighed on stock markets

Stock indices closed lower as a drop in shares of oil companies weighed on stock markets.

Meanwhile, the economic data from Germany was mostly weaker than expected. Destatis released its industrial production data for Germany on Friday. German industrial production fell 0.3% in November, missing expectations for a 0.5% gain, after a 0.5% rise in October. October's figure was revised up from a 0.2% increase.

The output of capital goods decreased 3.3% in November, energy output rose 2.5%, and the production in the construction sector was up 1.6%, while the production of intermediate goods climbed 1.1%. The output of consumer goods jumped 1.9%.

German industrial production excluding energy and construction declined by 0.8% in November.

Germany's seasonally adjusted trade surplus decreased to €19.7 billion in November from 20.5 in October.

Exports rose at a seasonally and calendar-adjusted 0.4% in November, while imports climbed 1.6%.

On a yearly basis, German exports increased 7.7% in November, while imports rose by 5.3%.

Germany's current account surplus was at €24.7 billion in November, up from €22.9 billion in October. October's figure was revised down from a surplus of €23.0 billion.

According to the French Customs, France's trade deficit narrowed to €4.63 billion in November from €4.87 billion in October, missing expectations for a decline to a deficit of €3.95 billion. Exports climbed 3.0% in November, while imports rose 2.0%.

The French statistical office Insee its industrial production figures on Friday. Industrial production in France declined 0.9% in November, missing expectations for a 0.4% decline, after a 0.7% rise in October.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.64 billion in November from £11.20 billion in October. October's figure was revised down from a deficit of £11.83 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 1.3% in November, while imports slid 2.5%.

The total trade deficit, including services, narrowed to £3.17 billion in November from £3.51 billion in October. October's figure was revised down from a deficit of £4.14 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,912.44 -41.64 -0.70 %

DAX 9,849.34 -130.51 -1.31 %

CAC 40 4,333.76 -69.82 -1.59 %

-

18:00

European stocks closed: FTSE 5912.44 -41.64 -0.70%, DAX 9849.34 -130.51 -1.31%, CAC 40 4333.76 -69.82 -1.59%

-

17:54

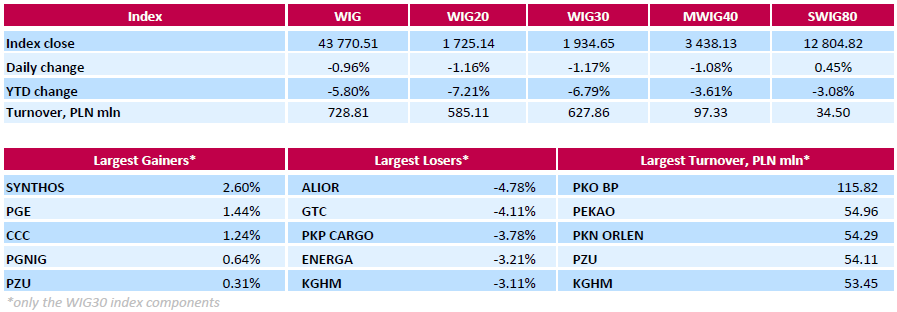

WSE: Session Results

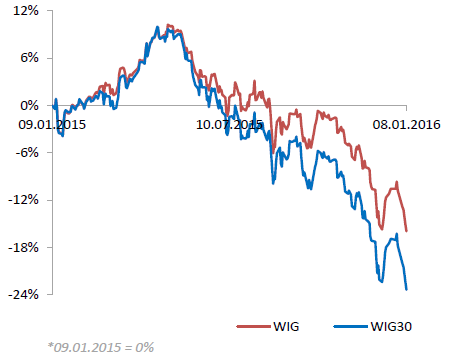

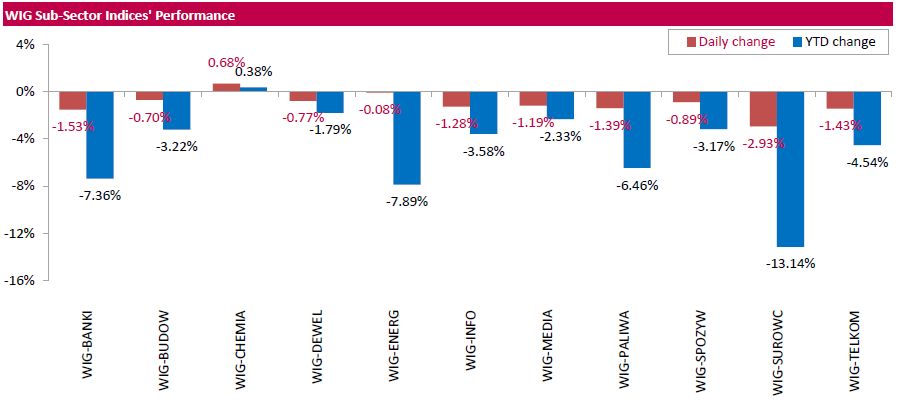

Polish equities declined on Friday. The broad market benchmark, the WIG Index, lost 0.96%. Sector-wise, chemicals sector (+0.68%) was sole gainer within the WIG Index, while materials (-2.93%) lagged behind.

The large-cap stocks plunged by 1.17%, as measured by the WIG30 Index. Within the index components, bank ALIOR (WSE: ALR) and property developer GTC (WSE: GTC) were the weakest performers, tumbling by 4.78% and 4.11% respectively. Other major losers were railway freight transport operator PKP CARGO (WSE: PKP), genco ENERGA (WSE: ENG), copper producer KGHM (WSE: KGH) and videogame developer CD PROJEKT (WSE: CDR), dropping by 3.05%-3.78%. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) led a handful of gainers with a 2.6% advance, followed by genco PGE (WSE: PGE) and footwear retailer CCC (WSE: CCC), adding 1.44% and 1.24% respectively.

-

16:54

European Central Bank Governing Council member Philip Lane: the ECB could add further stimulus measures if needed to reach the 2% inflation target

The European Central Bank (ECB) Governing Council member Philip Lane said in an interview with the Irish Times that the ECB could add further stimulus measures if needed to reach the 2% inflation target.

"It's important to say that no door has been closed. If the data flow over the next number of months is that more needs to be done, more can be done," he said.

Lane noted that there is the uncertainty in the global economy.

"There's an unusually high amount of uncertainty at the moment," he noted.

The ECB kept its interest rate unchanged at 0.05% in December, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016. The volume of the monthly purchases remained unchanged.

-

16:52

Labour cash earnings in Japan were flat in November

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Friday. Labour cash earnings in Japan were flat year-on-year in November, missing expectations for a 0.7% rise, after a 0.7% rise in October.

Contractual earnings increased 0.5% year-on-year in November, while special cash earnings plunged 8.6%.

Total real wages slid 0.4% in November, after a 0.4% drop in October.

-

16:35

Ai Group/HIA Australian Performance of Construction Index is down to 46.8 in December

The Australian Industry Group (AiG) released its construction data for Australia on late Sunday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 46.8 in December from 50.7 in November.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The decline was driven by weak activity in the engineering and commercial construction sectors.

-

16:27

Wholesale inventories in the U.S. falls 0.3% in November

The U.S. Commerce Department released wholesale inventories on Friday. Wholesale inventories in the U.S. fell 0.3% in November, missing expectations for a 0.1 decline, after a 0.3% decrease in October. September's figure was revised down from a 0.1% decline.

The decline was driven by a fall in inventories of non-durable and durable goods. Inventories of non-durable goods decreased 0.5% in November, while inventories of durable goods fell 0.2%.

Wholesale sales slid 1.0% in November, after a 0.2% fall in October.

-

15:48

Retail sales in Australia climb 0.4% in November

The Australian Bureau of Statistics released its retail sales data on Friday. Retail sales in Australia rose 0.4% in November, in line with expectations, after a 0.6% gain in October. October's figure was revised up from a 0.5% increase.

The increase was mainly driven by higher household goods sales and department stores sales. Household goods sales were up 0.6% in November, while department stores sales increased 0.6%.

On a yearly basis, retail sales climbed 4.3% in November, after a 3.9% rise in October.

-

15:41

Japan's leading index declines to 103.9 in November

Japan's Cabinet Office released its preliminary leading index data on Friday. The leading index decreased to 103.9 in November from 104.2 in October.

Japan's coincident index was down to 111.6 in November from 113.2 in October. It was the lowest level since March 2015.

-

15:36

U.S. Stocks open: Dow +0.73%, Nasdaq +1.02%, S&P +0.81%

-

15:26

Before the bell: S&P futures +1.19%, NASDAQ futures +1.26%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 17,697.96 -69.38 -0.39%

Hang Seng 20,453.71 +120.37 +0.59%

Shanghai Composite 3,186.78 +61.77 +1.98%

FTSE 5,997.58 +43.50 +0.73%

CAC 4,421.4 +17.82 +0.40%

DAX 10,072.79 +92.94 +0.93%

Crude oil $33.88 (+1.83%)

Gold $1094.50 (-1.20%)

-

15:08

U.S. unemployment rate remains unchanged at 5.0% in December, 292,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 292,000 jobs in December, exceeding expectations for a rise of 200,000 jobs, after a gain of 252,000 jobs in November. November's figure was revised up from a rise of 211,000 jobs.

The increase was partly driven by a rise in construction, professional and technical services, and health care. Health care sector added 39,200 jobs in December, professional and business services sector added 73,000 jobs, while construction added 45,000.

The manufacturing sector added 8,000 jobs in December, while mining sector shed 8,000 jobs.

The U.S. unemployment rate remained unchanged at 5.0% in December, in line with expectations.

Average hourly earnings were flat in December, missing forecasts of a 0.2% gain, after a 0.2% increase in November.

The labour-force participation rate increased to 62.6% in December from 62.5% in November.

These figures indicate that the Fed may raise its interest rate further this year. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yandex N.V., NASDAQ

YNDX

14.50

3.87%

1.5K

ALCOA INC.

AA

8.50

2.78%

49.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.76

2.67%

19.3K

Twitter, Inc., NYSE

TWTR

20.75

2.42%

23.5K

Citigroup Inc., NYSE

C

48.66

2.31%

17.1K

Amazon.com Inc., NASDAQ

AMZN

621.00

2.15%

20.6K

Ford Motor Co.

F

12.96

2.05%

41.2K

General Motors Company, NYSE

GM

30.60

2.03%

31.9K

Facebook, Inc.

FB

99.78

1.90%

70.9K

JPMorgan Chase and Co

JPM

61.40

1.87%

1.2K

Tesla Motors, Inc., NASDAQ

TSLA

219.50

1.79%

6.8K

Chevron Corp

CVX

84.50

1.78%

9.4K

Goldman Sachs

GS

167.50

1.75%

0.5K

Google Inc.

GOOG

739.00

1.74%

3.8K

Yahoo! Inc., NASDAQ

YHOO

30.68

1.72%

10.1K

AMERICAN INTERNATIONAL GROUP

AIG

59.25

1.59%

0.5K

Hewlett-Packard Co.

HPQ

10.94

1.58%

43.7K

Starbucks Corporation, NASDAQ

SBUX

57.58

1.57%

21.3K

E. I. du Pont de Nemours and Co

DD

62.45

1.54%

10.9K

Microsoft Corp

MSFT

52.93

1.46%

70.4K

Caterpillar Inc

CAT

64.85

1.42%

1.4K

FedEx Corporation, NYSE

FDX

136.50

1.42%

1.3K

General Electric Co

GE

29.37

1.38%

31.0K

International Business Machines Co...

IBM

134.70

1.38%

13.9K

Boeing Co

BA

134.82

1.36%

0.2K

Intel Corp

INTC

32.27

1.35%

8.3K

Cisco Systems Inc

CSCO

25.75

1.34%

1.5K

Visa

V

74.77

1.33%

20.9K

Exxon Mobil Corp

XOM

77.20

1.27%

9.0K

Walt Disney Co

DIS

100.75

1.26%

12.7K

Apple Inc.

AAPL

97.67

1.26%

399.6K

The Coca-Cola Co

KO

42.12

1.20%

0.6K

Johnson & Johnson

JNJ

100.39

1.18%

0.9K

Verizon Communications Inc

VZ

45.80

1.17%

32.4K

Procter & Gamble Co

PG

78.00

1.06%

2.0M

Nike

NKE

60.47

1.04%

5.2K

Wal-Mart Stores Inc

WMT

65.70

1.03%

7.2K

ALTRIA GROUP INC.

MO

58.74

1.03%

1.1K

Pfizer Inc

PFE

31.72

1.02%

2.6K

AT&T Inc

T

33.85

1.01%

19.8K

Travelers Companies Inc

TRV

107.51

1.01%

3.3K

American Express Co

AXP

64.45

0.96%

0.1K

HONEYWELL INTERNATIONAL INC.

HON

100.00

0.78%

0.3K

Home Depot Inc

HD

126.33

0.74%

10.2K

McDonald's Corp

MCD

116.47

0.70%

1.2K

Merck & Co Inc

MRK

52.12

0.31%

0.7K

United Technologies Corp

UTX

92.13

0.25%

0.8K

International Paper Company

IP

36.28

-0.03%

0.2K

Barrick Gold Corporation, NYSE

ABX

8.27

-5.49%

210.9K

-

14:57

Building permits in Canada slide 19.6% in November

Statistics Canada released housing market data on Friday. Building permits in Canada slid 19.6% in November, missing expectations for a 3.0% decline, after a 9.9% gain in October. October's figure was revised up from a 9.1% increase.

The drop was driven by declines in residential and non-residential sectors.

Building permits for non-residential construction plunged 22.7% in November, while permits in the residential sector dropped 17.8%.

-

14:48

Canada’s unemployment rate remains unchanged at 7.1% in December

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 7.1% in December, in line with expectations.

The labour participation rate rose to 65.9% in December from 65.8% in November.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people climbed by 22,800 jobs in December, exceeding expectations for a rise of 10,000 jobs, after a 35,700 decrease in November.

The increase was driven by a rise in part-time work. Full-time employment was down by 6,400 in December, while part-time employment increased by 38,400 jobs.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) upgraded to Outperform from Market Perform at Bernstein

Alcoa (AA) upgraded to Outperform from Neutral at Macquarie

Barrick Gold (ABX) upgraded to Buy from Neutral at Sterne Agee CRT

Downgrades:

United Tech (UTX) downgraded to Market Perform from Outperform at Bernstein

Freeport-McMoRan (FCX) downgraded to Neutral from Outperform at Macquarie

Other:

Microsoft (MSFT) initiated with a Outperform at BMO Capital Markets; target $64

Apple (AAPL) target lowered to $125 from $130 at Cowen

Apple (AAPL) target lowered to $146 from $160 at Canaccord Genuity

-

14:27

Greek industrial production jumps 3.2% in November

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Friday. Greek industrial production jumped 3.2% in November, after a 1.2% decline in October.

On a yearly basis, industrial production in Greece rose at an adjusted rate of 1.8% in November, after a 1.9% drop in October.

Production in the manufacturing sector increased at an annual rate of 1.1% in November, output in the mining and quarrying sector slid 1.3%, while electricity production climbed by 5.5%.

-

12:00

European stock markets mid session: stocks traded higher as the Chinese stock market stabilised

Stock indices traded higher as the Chinese stock market stabilised. The China Securities Regulatory Commission announced on Thursday that it suspended circuit-breaker rules. The circuit-breaker rules intended to stop free-falling share prices and to calm markets.

Yesterday's trading session was halted after less than half an hour after opening as China's central continued to devaluate the yuan. It was the shortest trading day in the stock market's 25-year history.

Meanwhile, the economic data from Eurozone was mostly weaker than expected. Destatis released its industrial production data for Germany on Friday. German industrial production fell 0.3% in November, missing expectations for a 0.5% gain, after a 0.5% rise in October. October's figure was revised up from a 0.2% increase.

The output of capital goods decreased 3.3% in November, energy output rose 2.5%, and the production in the construction sector was up 1.6%, while the production of intermediate goods climbed 1.1%. The output of consumer goods jumped 1.9%.

German industrial production excluding energy and construction declined by 0.8% in November.

Germany's seasonally adjusted trade surplus decreased to €19.7 billion in November from 20.5 in October.

Exports rose at a seasonally and calendar-adjusted 0.4% in November, while imports climbed 1.6%.

On a yearly basis, German exports increased 7.7% in November, while imports rose by 5.3%.

Germany's current account surplus was at €24.7 billion in November, up from €22.9 billion in October. October's figure was revised down from a surplus of €23.0 billion.

According to the French Customs, France's trade deficit narrowed to €4.63 billion in November from €4.87 billion in October, missing expectations for a decline to a deficit of €3.95 billion. Exports climbed 3.0% in November, while imports rose 2.0%.

The French statistical office Insee its industrial production figures on Friday. Industrial production in France declined 0.9% in November, missing expectations for a 0.4% decline, after a 0.7% rise in October.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.64 billion in November from £11.20 billion in October. October's figure was revised down from a deficit of £11.83 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 1.3% in November, while imports slid 2.5%.

The total trade deficit, including services, narrowed to £3.17 billion in November from £3.51 billion in October. October's figure was revised down from a deficit of £4.14 billion.

Current figures:

Name Price Change Change %

FTSE 100 5,985.84 +31.76 +0.53 %

DAX 10,025.77 +45.92 +0.46 %

CAC 40 4,403.41 -0.17 0.00%

-

11:45

Switzerland’s consumer price inflation declines 0.4% in December

The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index fell 0.4% in December, missing expectations for a 0.3% fall, after a 0.1% decrease in November.

The decline was partly driven by lower prices for petroleum and food products.

On a yearly basis, Switzerland's consumer price index rose to -1.3% in December from -1.4% in November, missing forecasts for a 1.2% drop.

-

11:34

U.K. trade deficit in goods narrows to £10.64 billion in November

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.64 billion in November from £11.20 billion in October. October's figure was revised down from a deficit of £11.83 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 1.3% in November, while imports slid 2.5%.

The total trade deficit, including services, narrowed to £3.17 billion in November from £3.51 billion in October. October's figure was revised down from a deficit of £4.14 billion.

-

11:23

France's trade deficit narrows to €4.63 billion in November

According to the French Customs, France's trade deficit narrowed to €4.63 billion in November from €4.87 billion in October, missing expectations for a decline to a deficit of €3.95 billion. October's figure was revised down from a deficit of €4.58 billion.

Exports climbed 3.0% in November, while imports rose 2.0%.

On a yearly basis, exports rose 2.0% in November, while imports gained 2.1%.

-

11:17

French industrial production drops 0.9% in November

The French statistical office Insee its industrial production figures on Friday. Industrial production in France declined 0.9% in November, missing expectations for a 0.4% decline, after a 0.7% rise in October. October's figure was revised up from a 0.5% increase.

Manufacturing output increased 0.4% in November, while construction output climbed 0.2%.

Output in mining and quarrying, energy, water supply and waste management dropped 6.7% in November.

On a yearly basis, the French industrial production climbed 2.8% in November, after a 2.3% gain in October.

-

11:07

German industrial production declines 0.3% in November

Destatis released its industrial production data for Germany on Friday. German industrial production fell 0.3% in November, missing expectations for a 0.5% gain, after a 0.5% rise in October. October's figure was revised up from a 0.2% increase.

The output of capital goods decreased 3.3% in November, energy output rose 2.5%, and the production in the construction sector was up 1.6%, while the production of intermediate goods climbed 1.1%.

The output of consumer goods jumped 1.9%.

German industrial production excluding energy and construction declined by 0.8% in November.

-

10:55

Germany's seasonally adjusted trade surplus falls to €19.7 billion in November

Destatis released its trade data for Germany on Friday. Germany's seasonally adjusted trade surplus decreased to €19.7 billion in November from 20.5 in October.

Exports rose at a seasonally and calendar-adjusted 0.4% in November, while imports climbed 1.6%.

On a yearly basis, German exports increased 7.7% in November, while imports rose by 5.3%.

Germany's current account surplus was at €24.7 billion in November, up from €22.9 billion in October. October's figure was revised down from a surplus of €23.0 billion.

-

10:43

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in December

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Friday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in December.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.7 in December from 3.4% in November, in line with expectations.

The number of unemployed people in Switzerland rose by 10,486 to 158,629 in December from a month earlier.

The youth unemployment rate was up to 3.7% in December from 3.6% in November.

-

10:33

Chicago Federal Reserve President Charles Evans: the Fed should hike its interest rate twice this year as inflation remains very low

Chicago Federal Reserve President Charles Evans said in a speech on Thursday that the Fed should hike its interest rate twice this year as inflation remains very low.

"I am less optimistic about the inflation outlook than most of my colleagues. Given the persistently-low- inflation record of the past six years and given how slowly inflation evolves when it is at such low levels, it may be difficult to return inflation to target over the next two or three years," he said.

"From my perspective, the costs of raising the federal funds rate too quickly far exceed the costs of removing accommodation too slowly," Evans added.

Evans is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:19

Billionaire George Soros: the global markets are facing a crisis

Billionaire George Soros said at an economic forum in Sri Lanka on Thursday that the global markets are facing a crisis, noting that China is a main risk factor for the global economy.

"China has a major adjustment problem. I would say it amounts to a crisis. When I look at the financial markets there is a serious challenge which reminds me of the crisis we had in 2008," he said.

Soros pointed out that the slowdown in the Chinese economy and the devaluation of the yuan weigh on the global economy.

-

10:07

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.2 in in the week ended January 03

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 44.2 in in the week ended January 03 from 43.6 the prior week. It was the highest level since October 11.

The increase was driven by a more favourable assessment of the measure of views of the economy. The measure of views of the economy rose to 37.0 from 34.5.

The buying climate fell to 39.4 from 40.6.

The personal finances index increased to 56.2 from 55.6.

-

07:22

Global Stocks: U.S. stock indices fell

U.S. stock indices dropped on Thursday on concerns over strength of the Chinese economy.

The Dow Jones Industrial Average lost 392.14 points, or 2.3%, to 16,514.37. The S&P 500 plunged 47.18 points, or 2.4%, to 1,943.08. The Nasdaq Composite dropped 146.34 points, or 3%, to 4,689.43.

The U.S. Department of Labor reported that the number of initial unemployment claims declined by 10,000 to 277,000 in the week ending January 2 pointing to positive progress in the labor market. However economists had expected a more significant decline to 275,000.

This morning in Asia Hong Kong Hang Seng gained 1.06%, or 215.83, to 20,549.17. China Shanghai Composite Index rose 2.74%, or 85.77, to 3,210.77. The Nikkei declined 0.06%, or 9.96, to 17,757.38.

Asian stock indices outside Japan advanced. Chinese stocks rose after yesterday's plunge. Today Chinese authorities suspended the recently implemented tool, which automatically stops trading once stocks drop 5-7%. Experts explained that the system encouraged investors to sell stocks after declines reached 5%.

-

03:05

Nikkei 225 17,861 +93.66 +0.53 %, Hang Seng 20,333.95 +0.61 0.00%, Shanghai Composite 3,213.42 +88.41 +2.83 %

-

00:32

Stocks. Daily history for Sep Jan 7’2016:

(index / closing price / change items /% change)

HANG SENG 20,385.48 -595.33 -2.84%

S&P/ASX 200 5,010.34 -112.79 -2.20%

TOPIX 1,457.94 -30.90 -2.08%

SHANGHAI COMP 3,115.9 -245.94 -7.32%

FTSE 100 5,954.08 -119.30 -2.0 %

CAC 40 4,403.58 -76.89 -1.7 %

Xetra DAX 9,979.85 -234.17 -2.3 %

S&P 500 1,943.09 -47.17 -2.4 %

NASDAQ Composite 4,689.43 -146.34 -3.0 %

Dow Jones Industrial Average 16,514.1 -392.41 -2.3 %

-