Noticias del mercado

-

22:10

US stocks closed

The Standard & Poor's 500 Index capped its worst-ever four-day start to a year as turmoil in China spread around the world and billionaire George Soros warned that a larger crisis may be brewing.

The U.S. equities benchmark ended the first four days of 2016 lower by 4.9 percent, while the Dow Jones Industrial Average has erased more than 900 points so far this year. Selling in global equities began in China, where shares fell 7 percent after the central bank weakened the yuan an eighth day. Crude settled at a 12-year low, and copper dipped below $2 for the first time since 2009. The yen reached a four-month high and gold surged on haven demand.

Fresh concern that China's slowdown will hamper global growth has wiped $2.5 trillion off the value of global equities this year, as the nation's tolerance for a weaker currency is viewed as evidence policy makers are struggling to revive an economy that's the world's biggest user of resources. U.S. crude's tumble toward $30 a barrel heightened fears of disinflation and fueled concern that junk-rated energy producers won't be able to stay solvent.

Concern briefly eased after the China Securities Regulatory Commission announced the suspension of a new stock circuit-breaker that forced local exchanges to shut for the second day this week before the move gave way to anxiety that policy makers are struggling with how to contain the months-long turmoil in its financial markets.

The Standard & Poor's 500 Index slid 2.4 percent at 4 p.m in New York. The index is down 4.9 percent this year, its worst start in data going back to 1928. The MSCI All-Country World Index fell for a fourth day, bringing its slide this year to 5.2 percent.

China's devaluation revived the angst that sent financial markets into turmoil last summer, driving U.S. stocks to three-month lows Wednesday in a selloff led by commodity producers. Comments by Soros exacerbated market jitters after he told an economic forum in Sri Lanka today that global markets are facing a crisis and investors need to be very cautious.

-

21:00

DJIA 16535.74 -370.77 -2.19%, NASDAQ 4708.33 -127.43 -2.64%, S&P 500 1946.37 -43.89 -2.21%

-

18:33

The Bank of Canada Governor Stephen Poloz: the weak Canadian dollar helps the Canadian economy to adjust to low oil prices

The Bank of Canada (BoC) Governor Stephen Poloz said in a speech on Thursday that the weak Canadian dollar helps the Canadian economy to adjust to low oil prices.

"The depreciation of our currency is a natural part of the process," he noted.

"Movements in exchange rates are helping economies, including ours, make the adjustments that must take place," Poloz added.

Poloz pointed out that the central bank's monetary policy is focussed on the inflation target.

"The Bank of Canada will continue to run an independent monetary policy, anchored by our inflation target, and we will use our tools to manage risks along the way," the BoC president said.

-

18:31

Wall Street. Major U.S. stock-indexes fell

Major U.S. stocks lower on Thursday, as market volatility in China and a relentless slide in oil prices unnerved investors, already jittery after a shaky start to the year. China allowed the biggest fall in the yuan in five months, and Shanghai stocks were halted for the second time this week after another brutal selloff tripped a new circuit breaker.

Almost all Dow stocks in negative area (28 of 30). Top looser - The Boeing Company (BA, -2,45%). Top gainer - Wal-Mart Stores Inc. (WMT, +1.96%).

All S&P sectors also in negative area. Top looser - Basic Materials (-1,7%).

At the moment:

Dow 16616.00 -222.00 -1.32%

S&P 500 1959.00 -27.00 -1.36%

Nasdaq 100 4371.00 -75.75 -1.70%

Oil 33.47 -0.50 -1.47%

Gold 1106.30 +14.40 +1.32%

U.S. 10yr 2.18 +0.00

-

18:26

British Chambers of Commerce’s Quarterly Economic Survey: the most key balances were weaker in Q4 than in Q3

The British Chambers of Commerce (BCC) released its Quarterly Economic Survey for the U.K. on Thursday. The BCC said that the most key balances were weaker in Q4 than in Q3, noting that the UK economy is facing challenges, despite the growth.

"Coming after relatively weak figures in our Q3 survey, the falling balances in Q4 highlight the risk that the pace of growth may slow further in the short term. The results also underscore the serious obstacles that the UK will face when trying to rebalance the economy towards net exports. While worsening global circumstances are the main impediment, the domestic drive towards boosting net exports is also inadequate," David Kern, Chief Economist of the British Chambers of Commerce, said.

-

18:18

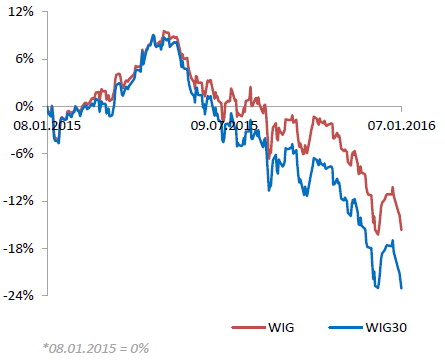

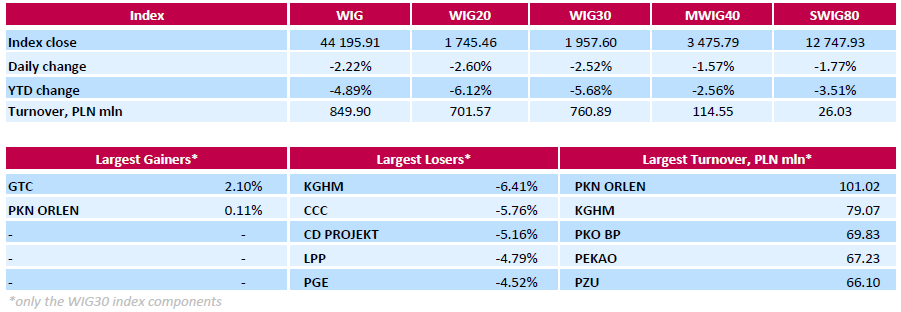

WSE: Session Results

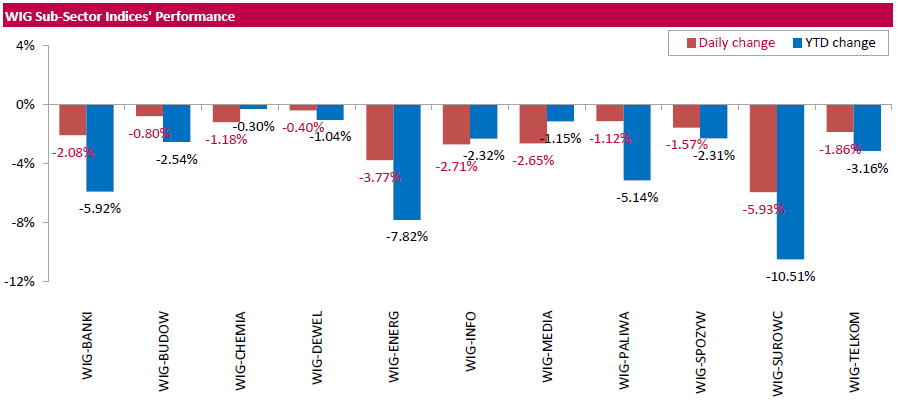

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, fell by 2.22%. All sectors in the WIG Index were down. Materials (-5.93%) fared the worst, followed by utilities (-3.77%) and IT sector (-2.71%).

The large-cap stocks' measure, the WIG30 Index, dropped by 2.52%. Property developer GTC (WSE: GTC) and oil refiner PKN ORLEN (WSE: PKN) were the only gainers among the WIG30 Index components, advancing 2.1% and 0.11% respectively. At the same time, copper producer KGHM (WSE: KGH) recorded the biggest daily decline, slumping 6.41% on concerns over future demand for copper from China, the world's largest consumer of the metal. Other most prominent losers were retailers CCC (WSE: CCC) and LPP (WSE: LPP), videogame developer CD PROJEKT (WSE: CDR) and genco PGE (WSE: PGE), tumbling by 4.52%-5.76%.

-

18:05

European stocks close: stocks closed lower on concerns over the slowdown in the Chinese economy

Stock indices traded lower on concerns over the slowdown in the Chinese economy. The People's Bank of China (PBoC) continued to devaluate the yuan. The central bank set the yuan midpoint at 6.5646, down 0.5% from the day before. It was the lowest level since March 2011. Trading was halted after stocks plunged.

Falling oil prices also weighed on the stock markets.

Meanwhile, the economic data from Eurozone was mixed. The European Commission released its economic sentiment index for the Eurozone on Thursday. The index increased to 106.8 in December from 106.1 in November. Analysts had expected the index to remain unchanged at 106.1.

The increase was driven by higher confidence in industry.

The industrial confidence index climbed to -2.0 in December from -3.2 in November, exceeding expectations for a gain to -2.9.

The final consumer confidence index was up to -5.7 in December from -5.9 in November, in line with expectations.

The business climate index increased to 0.41 in December from 0.36 in November. Analysts had expected the index to rise to 0.40.

Eurostat released its unemployment data for the Eurozone on Thursday. Eurozone's unemployment rate declined to 10.5% in November from 10.6% in October. It was the lowest reading since October 2011. October's figure was revised down from 10.7%. Analysts had expected the unemployment rate to rise to 10.7%.

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales rose 0.2% in November, missing forecasts of a 0.5% gain, after a 0.1% fall in October. October's figure was revised up from a 0.4% drop.

On a yearly basis, German unadjusted retail sales jumped 2.3% in November, missing expectations for a 2.4% gain, after a 2.1% rise in October.

German seasonal adjusted factory orders climbed 1.5% in November, exceeding expectations for a 0.1% increase, after a 1.7% rise in October. October's figure was revised up from a 1.8% gain.

The rise was driven by an increase in foreign and domestic orders. Foreign orders increased by 0.6% in November, while domestic orders rose by 2.6%.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. jumped 1.7% in December, exceeding expectations for a 0.5% gain, after a flat reading in November. November's figure was revised up from a 0.2% decrease.

On a yearly basis, house prices climbed 9.5% in the three months to December, after a 9.0% increase in the three months to November. Analysts had expected the index to rise 9.0%.

"There remains, however, a substantial gap between demand and supply with the latest figures showing a further decline in the number of properties available for sale. This situation is unlikely to change significantly in the short-term, resulting in continuing upward pressure on prices," Halifax's housing economist Martin Ellis said.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,954.08 -119.30 -1.96 %

DAX 9,979.85 -234.17 -2.29 %

CAC 40 4,403.58 -76.89 -1.72 %

-

18:00

European stocks closed: FTSE 5954.08 -119.30 -1.96%, DAX 9979.85 -234.17 -2.29%, CAC 40 4403.58 -76.89 -1.72%

-

16:58

China’s foreign-exchange reserves drop in December

According to data released by the People's Bank of China (PBoC) on Thursday, China's foreign-exchange reserves declined by $107.9 billion to $3.33 trillion in December, after a drop by $87.2 billion in November. The latest fall was the biggest monthly decline on record.

China's foreign exchange reserves plunged $512.66 billion in 2015. It was the biggest annual fall on record.

-

16:46

The People’s Bank of China adds 70 billion yuan to the financial system

The People's Bank of China (PBoC) on Thursday added 70 billion yuan to the financial system.

The central bank added 130 billion yuan to the financial system on Tuesday. It was the biggest injection since September 2015.

-

16:42

The People’s Bank of China continues to devaluate the yuan

The People's Bank of China (PBoC) continued to devaluate the yuan. The central bank set the yuan midpoint at 6.5646, down 0.5% from the day before. It was the lowest level since March 2011, and the highest cut since August 2015.

-

16:37

China suspends circuit-breaker rules

The China Securities Regulatory Commission announced on Thursday that it suspended circuit-breaker rules. The circuit-breaker rules intended to stop free-falling share prices and to calm markets.

Today's trading session was halted after less than half an hour after opening as China's central continued to devaluate the yuan. It was the shortest trading day in the stock market's 25-year history.

-

16:27

China's securities regulator announces new rules to restrict selling by big shareholders

China's securities regulator today announced new rules to restrict selling by big shareholders. These rules will take effect on January 9.

Big shareholders can't sell more than 1% of a listed company's share capital every three months, and they have to disclose their plans 15 days in advance.

-

16:12

Canada’s Ivey purchasing managers’ index plunges to 49.9 in December

Canada's seasonally adjusted Ivey purchasing managers' index plunged to 49.9 in December from 63.6 in November. Analysts had expected the index to decline to 56.7.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was up to 54.2 in December from 53.4 in November, while employment index fell to 51.8 from 53.8.

The prices index was decreased to 54.8 in December from 55.2 in November, while inventories slid to 41.7 from 58.4.

-

15:54

Richmond Fed President Jeffrey Lacker: inflation in the U.S. is likely to return to 2% target over the near term

Richmond Fed President Jeffrey Lacker said in a speech on Thursday that the U.S. inflation is likely to return to 2% target over the near term.

"After the price of oil bottoms out, I would expect to see headline inflation move significantly higher. And after the value of the dollar ultimately tops out, core inflation should move back toward 2 percent," he said.

Lacker noted that the Fed should continue to hike its interest rate.

"While there is uncertainty about the pace at which monetary policy rates will rise, the case for an upward adjustment in rates should be clear," Richmond Fed president said.

Lacker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

15:34

U.S. Stocks open: Dow -1.53%, Nasdaq -2.16%, S&P -1.64%

-

15:32

Greek unemployment rate declines to 24.5% in October

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.5% in October from 24.6% in September. August's figure was revised up from 24.6%.

The number of unemployed fell by 8,289 persons compared with September 2015.

The youth unemployment rate was 48.6% in October.

-

15:25

Before the bell: S&P futures -2.13%, NASDAQ futures -2.72%

U.S. stock-index futures sank.

Global Stocks:

Nikkei 17,767.34 -423.98 -2.33%

Hang Seng 20,333.34 -647.47 -3.09%

Shanghai Composite 3,115.9 -245.94 -7.32%

FTSE 5,909.35 -164.03 -2.70%

CAC 4,364.02 -116.45 -2.60%

DAX 9,876.57 -337.45 -3.30%

Crude oil $32.71 (-3.71%)

Gold $1102.80 (+1.00%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

8.15

2.64%

15.7K

E. I. du Pont de Nemours and Co

DD

63.38

0.00%

0.4K

International Paper Company

IP

37.39

0.00%

32.6K

Verizon Communications Inc

VZ

44.87

-1.43%

2.6K

HONEYWELL INTERNATIONAL INC.

HON

100.75

-1.46%

48.3K

Wal-Mart Stores Inc

WMT

62.61

-1.48%

19.2K

AT&T Inc

T

33.54

-1.53%

84.8K

Deere & Company, NYSE

DE

74.45

-1.60%

0.5K

Pfizer Inc

PFE

31.10

-1.61%

2.4K

United Technologies Corp

UTX

91.62

-1.61%

2.7K

McDonald's Corp

MCD

116.40

-1.69%

8.0K

The Coca-Cola Co

KO

41.60

-1.70%

10.5K

Johnson & Johnson

JNJ

98.65

-1.73%

7.7K

Procter & Gamble Co

PG

76.50

-1.75%

9.7K

International Business Machines Co...

IBM

132.70

-1.83%

4.8K

ALTRIA GROUP INC.

MO

58.05

-1.89%

2.5K

General Electric Co

GE

29.67

-1.92%

142.8K

Amazon.com Inc., NASDAQ

AMZN

620.50

-1.92%

43.0K

UnitedHealth Group Inc

UNH

113.25

-1.94%

0.4K

Nike

NKE

60.29

-1.95%

8.7K

Boeing Co

BA

136.00

-2.04%

2.0K

Goldman Sachs

GS

166.34

-2.06%

9.2K

3M Co

MMM

141.50

-2.07%

1.3K

Twitter, Inc., NYSE

TWTR

20.93

-2.15%

48.8K

Google Inc.

GOOG

727.50

-2.17%

12.2K

Facebook, Inc.

FB

100.73

-2.18%

99.8K

American Express Co

AXP

63.00

-2.20%

1.0K

Exxon Mobil Corp

XOM

75.75

-2.22%

27.0K

Home Depot Inc

HD

126.20

-2.23%

2.5K

Starbucks Corporation, NASDAQ

SBUX

56.80

-2.29%

18.1K

Caterpillar Inc

CAT

64.70

-2.30%

7.1K

Walt Disney Co

DIS

98.05

-2.30%

15.0K

Merck & Co Inc

MRK

51.21

-2.31%

1.7K

Chevron Corp

CVX

84.05

-2.35%

46.2K

General Motors Company, NYSE

GM

30.50

-2.46%

7.5K

Visa

V

73.40

-2.48%

5.6K

Apple Inc.

AAPL

98.20

-2.48%

721.7K

Intel Corp

INTC

32.25

-2.51%

53.5K

JPMorgan Chase and Co

JPM

61.23

-2.52%

13.8K

Citigroup Inc., NYSE

C

48.84

-2.55%

22.9K

Cisco Systems Inc

CSCO

25.30

-2.73%

22.2K

Ford Motor Co.

F

12.75

-2.75%

129.0K

FedEx Corporation, NYSE

FDX

136.89

-2.76%

0.5K

AMERICAN INTERNATIONAL GROUP

AIG

58.07

-2.81%

8.4K

Yandex N.V., NASDAQ

YNDX

14.54

-2.87%

1.9K

Hewlett-Packard Co.

HPQ

10.95

-3.01%

29.9K

Tesla Motors, Inc., NASDAQ

TSLA

212.30

-3.08%

10.1K

Microsoft Corp

MSFT

52.38

-3.09%

53.7K

Yahoo! Inc., NASDAQ

YHOO

30.95

-3.76%

23.1K

ALCOA INC.

AA

8.28

-3.83%

359.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.90

-4.38%

331.9K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

HP Inc. (HPQ) downgraded to Market Perform from Outperform at Wells Fargo

Other:

Apple (AAPL) target lowered to $130 from $140 at RBC Capital Mkts

-

14:40

Initial jobless claims decline to 277,000 in the week ending January 02

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 02 in the U.S. declined by 10,000 to 277,000 from 287,000 in the previous week. Analysts had expected jobless claims to fall to 275,000.

Jobless claims remained below 300,000 the 44th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 25,000 to 2,230,000 in the week ended December 26.

-

14:27

Italy’s unemployment rate decreases to 11.3% in November, the lowest level since October 2012

The Italian statistical office Istat released its unemployment data on Thursday. The seasonally adjusted unemployment rate decreased to 11.3% in November from 11.5% in October. It was the lowest level since November 2012.

The number of unemployed people was 2.871 million in November, down by 1.6% from the month before.

The youth unemployment rate fell to 38.1% in November from 39.3% in October.

The employment rate increased to 56.4% in November from 56.3% in October.

-

12:54

European stock markets mid session: stocks traded lower on concerns over the slowdown in the Chinese economy

Stock indices traded lower on concerns over the slowdown in the Chinese economy. The People's Bank of China (PBoC) continued to devaluate the yuan. The central bank set the yuan midpoint at 6.5646, down 0.5% from the day before. It was the lowest level since March 2011. Trading was halted after stocks plunged.

Falling oil prices also weighed on the stock markets.

Meanwhile, the economic data from Eurozone was mixed. The European Commission released its economic sentiment index for the Eurozone on Thursday. The index increased to 106.8 in December from 106.1 in November. Analysts had expected the index to remain unchanged at 106.1.

The increase was driven by higher confidence in industry.

The industrial confidence index climbed to -2.0 in December from -3.2 in November, exceeding expectations for a gain to -2.9.

The final consumer confidence index was up to -5.7 in December from -5.9 in November, in line with expectations.

The business climate index increased to 0.41 in December from 0.36 in November. Analysts had expected the index to rise to 0.40.

Eurostat released its unemployment data for the Eurozone on Thursday. Eurozone's unemployment rate declined to 10.5% in November from 10.6% in October. It was the lowest reading since October 2011. October's figure was revised down from 10.7%. Analysts had expected the unemployment rate to rise to 10.7%.

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales rose 0.2% in November, missing forecasts of a 0.5% gain, after a 0.1% fall in October. October's figure was revised up from a 0.4% drop.

On a yearly basis, German unadjusted retail sales jumped 2.3% in November, missing expectations for a 2.4% gain, after a 2.1% rise in October.

German seasonal adjusted factory orders climbed 1.5% in November, exceeding expectations for a 0.1% increase, after a 1.7% rise in October. October's figure was revised up from a 1.8% gain.

The rise was driven by an increase in foreign and domestic orders. Foreign orders increased by 0.6% in November, while domestic orders rose by 2.6%.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. jumped 1.7% in December, exceeding expectations for a 0.5% gain, after a flat reading in November. November's figure was revised up from a 0.2% decrease.

On a yearly basis, house prices climbed 9.5% in the three months to December, after a 9.0% increase in the three months to November. Analysts had expected the index to rise 9.0%.

"There remains, however, a substantial gap between demand and supply with the latest figures showing a further decline in the number of properties available for sale. This situation is unlikely to change significantly in the short-term, resulting in continuing upward pressure on prices," Halifax's housing economist Martin Ellis said.

Current figures:

Name Price Change Change %

FTSE 100 5,909.61 -163.77 -2.70 %

DAX 9,842.79 -371.23 -3.63 %

CAC 40 4,353.58 -126.89 -2.83 %

-

12:44

German seasonal adjusted factory orders jump 1.5% in November

Destatis released its factory orders data for Germany on Thursday. German seasonal adjusted factory orders climbed 1.5% in November, exceeding expectations for a 0.1% increase, after a 1.7% rise in October. October's figure was revised up from a 1.8% gain.

The rise was driven by an increase in foreign and domestic orders. Foreign orders increased by 0.6% in November, while domestic orders rose by 2.6%.

New orders from the Eurozone declined 0.5% in November, while orders from other countries climbed 1.4%.

Orders of the intermediate goods increased by 4.8% in November, capital goods orders were down 0.1%, while consumer goods orders dropped 2.4%.

-

12:36

German adjusted retail sales rise .2% in November

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales rose 0.2% in November, missing forecasts of a 0.5% gain, after a 0.1% fall in October. October's figure was revised up from a 0.4% drop.

On a yearly basis, German unadjusted retail sales jumped 2.3% in November, missing expectations for a 2.4% gain, after a 2.1% rise in October.

Sales of non-food products increased at an annual rate of 2.3% in November, while sales of food, beverages and tobacco products climbed by 2.4%.

-

12:32

House prices in the U.K. jump 1.7% in December

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. jumped 1.7% in December, exceeding expectations for a 0.5% gain, after a flat reading in November. November's figure was revised up from a 0.2% decrease.

On a yearly basis, house prices climbed 9.5% in the three months to December, after a 9.0% increase in the three months to November. Analysts had expected the index to rise 9.0%.

"There remains, however, a substantial gap between demand and supply with the latest figures showing a further decline in the number of properties available for sale. This situation is unlikely to change significantly in the short-term, resulting in continuing upward pressure on prices," Halifax's housing economist Martin Ellis said.

-

12:26

Eurozone’s economic sentiment index climbs to 106.8 in December

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index increased to 106.8 in December from 106.1 in November. Analysts had expected the index to remain unchanged at 106.1.

The increase was driven by higher confidence in industry.

The industrial confidence index climbed to -2.0 in December from -3.2 in November, exceeding expectations for a gain to -2.9.

The final consumer confidence index was up to -5.7 in December from -5.9 in November, in line with expectations.

The business climate index increased to 0.41 in December from 0.36 in November. Analysts had expected the index to rise to 0.40.

-

12:17

Eurozone's unemployment rate drops to 10.5% in November, the lowest reading since October 2011

Eurostat released its unemployment data for the Eurozone on Thursday. Eurozone's unemployment rate declined to 10.5% in November from 10.6% in October. It was the lowest reading since October 2011.

October's figure was revised down from 10.7%.

Analysts had expected the unemployment rate to rise to 10.7%.

There were 16.924 million unemployed in the Eurozone in November, down by 130.000 from October.

The lowest unemployment rate in the Eurozone in November was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (24.6% in September 2015) and Spain (21.4%).

The youth unemployment rate was 22.5% in the Eurozone in November, compared to 23.2% in October a year ago.

-

12:12

Eurozone’s retail sales fall 0.3% in November

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.3% in November, missing expectations for a 0.2% rise, after a 0.2% decline in October. October's figure was revised down from a 0.1% fall.

The decline was mainly driven by lower non-food sales and automotive fuel sales. Non-food sales fell 0.4% in November, while automotive fuel sales declined 0.7%.

Food, drinks and tobacco sales slid 0.1% in November.

On a yearly basis, retail sales in the Eurozone climbed 1.4% in November, missing forecasts of a 2.0% gain, after a 2.4% increase in October. October's figure was revised down from a 2.5% gain.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 1.8% year-on-year in November, gasoline sales increased 1.8%, while food, drinks and tobacco sales rose 0.8%.

-

10:07

Fed’s December monetary policy meeting minutes: Fed officials express concerns about low inflation in the U.S

The Fed released its December monetary policy meeting minutes on Wednesday. The Fed raised its interest rate in December. Fed officials expressed concerns about low inflation in the U.S., saying that they "would carefully monitor actual and expected progress toward its inflation goal".

Fed officials said that labour market continued to improve, noting that "underutilization of labour resources has diminished appreciably since early this year".

According to the minutes, the U.S. economy is expected to grow moderately, while the labour market is expected to continue to improve.

The minutes showed that further interest rate hikes will depend on the labour market and inflation data.

Fed officials pointed out that the downside risks to U.S. economy from global economic and financial developments diminished since late summer.

-

09:41

Fed Vice Chairman Stanley Fischer: the Fed is likely to raise its interest rate faster than expected by markets

Fed Vice Chairman Stanley Fischer said in an interview with CNBC on Wednesday that the Fed is likely to raise its interest rate faster than expected by markets. He said that market expectations of the two interest rate hikes in 2016 are "too low".

Fischer pointed out that the Fed does not know how many interest rate hikes there will be this year.

-

09:21

Australia's trade deficit narrows to A$2.90 billion in November

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit narrowed to A$2.90 billion in November from A$3.25 billion in October, exceeding expectations for a decline to a deficit of A$3.10 billion. October's figure was revised up from a deficit of A$3.30 billion.

Exports increased by 1.0% in November, while imports fell 1.0%.

Exports were driven by a rise in rural goods exports.

-

09:13

World Bank lowered its global economic forecasts for 2016 and 2017

The World Bank on Wednesday cut its global economic growth forecast for 2016 and 2017 due to weak growth in major emerging economies.

The World Bank expects that the global economy would grow 2.9% in 2016, down from its June forecast of 3.3%. 2017 global growth was downgraded to 3.1%, down from its June forecast of 3.2%.

"This outlook is expected to be buttressed by recovery in major high-income economies, stabilizing commodity prices, and a continuation of low interest rates. All this does not rule out the fact that there is a low-probability risk of disorderly slowdown in major emerging markets, as U.S. interest rates rise after a long break and the US dollar strengthens, and as a result of geopolitical concerns," World Bank Senior Vice President and Chief Economist Kaushik Basu said in the report.

The global economy was estimated to expand 2.4% in 2015.

China's economy is expected to expand 6.7% in 2016 (6.9% in 2015), down from its June forecast of 7.0%, and 6.5% in 2017, down from its June forecast of 6.9%.

Growth in the U.S. is expected to expand 2.7% in 2016, down from its June forecast of 2.8, and 2.4% in 2017, unchanged from its June forecast.

In the Eurozone, the economy is expected to grow 1.7% in 2016, down from its June forecast of 1.8%, and 1.7% in 2017, up from its June forecast of 1.6%.

In Japan, the economy is expected to expand 1.3% in 2016, down from its June forecast of 1.7%, and 0.9% in 2017, down from its June forecast of 1.2%.

Developing countries are expected to grow by 4.8% in 2016, down from its June forecast of 5.2%.

-

07:14

Global Stocks: U.S. stock indices fell

U.S. stock indices dropped on Wednesday amid plunging oil prices and geopolitical tensions.

The Dow Jones Industrial Average lost 251.8 points, or 1.47%, to 16,906. The S&P 500 lost 26.39 points, or 1.31%, to 1,990 (all of its 10 sectors closed lower). The Nasdaq Composite declined 55.67 points, or 1.14%, to 4,835.

The U.S. Department of Commerce reported that the trade deficit declined substantially in November as both imports and exports fell. The deficit contracted by 5% to $42.37 billion compared to October. Exports and imports fell by 0.9% and 1.7% respectively.

Minutes of the Federal Reserve's December meeting showed yesterday that the decision to raise interest rates was made by an unanimous vote, but some policy makers expressed concerns over low inflation and negative influence from slow growth in emerging economies.

This morning in Asia Hong Kong Hang Seng fell 2.44%, or 511.40, to 20,469.41. China Shanghai Composite Index plunged 7.32%, or 245.95, to 3,115.89. The Nikkei fell 2.16%, or 392.85, to 17,798.47.

Asian stock indices fell. Japanese stocks dropped amid substantial declines in Chinese markets and lack of positive dynamics in U.S. stock indices. A stronger yen also weighed on stocks.

Trading in Chinese markets was stopped within less than half an hour after the open time amid sharp declines in stock prices. Investors panicked after the central bank of China lowered the exchange rate of the national currency to 6.5646 yuan per dollar (the minimum level since August 2015).

-

03:01

Nikkei 225 17,852.95м-338.37 -1.86 %, Hang Seng 20,381.3 -599.51 -2.86 %, Shanghai Composite 3,178.7 -183.14 -5.45 %

-

00:36

Stocks. Daily history for Sep Jan 6’2016:

(index / closing price / change items /% change)

Nikkei 225 18,191.32 -182.68 -0.99 %

Hang Seng 20,980.81 -207.91 -0.98 %

Shanghai Composite 3,361.84 +74.13 +2.25 %

FTSE 100 6,073.38 -63.86 -1.04 %

CAC 40 4,480.47 -57.16 -1.26 %

Xetra DAX 10,214.02 -96.08 -0.93 %

S&P 500 1,990.26 -26.45 -1.31 %

NASDAQ Composite 4,835.77 -55.67 -1.14 %

Dow Jones 16,906.51 -252.15 -1.47 %

-