Noticias del mercado

-

22:11

U.S. stocks closed

U.S. stocks tumbled to three-month lows, following equities around the world after China weakened its currency, stoking investor concern that a slowdown in the world's second-largest economy will damp global growth.

Energy and raw-material companies in the Standard & Poor's 500 Index led the selloff, losing at least 2.6 percent as China's move revived the angst that sent financial markets into turmoil last summer. Chevron Corp. declined 3.9 percent, while copper producer Freeport-McMoRan Inc. slid 8 percent. Six of the benchmark's 10 main industries dropped at least 1 percent.

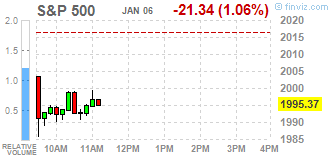

The S&P 500 lost 1.3 percent to 1,990.40 at 4 p.m. in New York, trimming a drop of as much as 1.9 percent while sliding to its lowest level since Oct. 6.

China's central bank set the yuan's reference rate at an unexpectedly weak level, adding to anxiety about an economic slowdown that has dominated markets this week. The S&P 500 on Monday kicked off 2016 with its worst start in 15 years. Adding to geopolitical worries, North Korea claims it successfully tested its first hydrogen bomb, which follows a recent buildup of tension between Saudi Arabia and Iran.

Commodity producers fell amid speculation that weakness in China would weigh on demand for raw materials. Brent crude oil dropped below $35 a barrel to its lowest since 2004, while West Texas Intermediate futures lost more than 5 percent. Apache Corp. and Murphy Oil Corp. tumbled 11 percent to the steepest losses in seven years.

China's currency devaluation last August triggered a global rout that drove the S&P 500 to its first correction in four years, after it had reached an all-time high as recently as May. Now, UBS Group AG's technical strategists predict the U.S. benchmark will enter a bear market as early as this year.

Weak Beginning

The S&P 500 has fallen 2.6 percent in the first three days of the year. That's better than the 2.7 percent plunge to start 2015, which marked the worst opening since 2008. The index swung wildly last January before ending the month lower by 3.1 percent. The poor start to 2016 has left the benchmark index 6.6 percent below its all-time high set in May.

Sentiment has turned more cautious on stocks after the Federal Reserve's first interest-rate increase since 2006 and forecasts for little to no growth in corporate earnings until March. Fed officials have stressed that while the pace of future hikes will be gradual, it will depend on progress in economic data.

Equities offered little reaction to the Fed's latest meeting minutes, which showed some policy makers saw the decision to raise interest rates as a "close call." Minutes from the December gathering said "almost all" of the rate-setting committee's participants were satisfied the criteria for tighter policy had been met.

Data Wednesday showed companies added more workers than projected in December, indicating the job market had momentum as 2015 came to a close. A separate report showed service companies continued to outperform their manufacturing counterparts in December as orders and employment picked up. Other data said factory orders in November fell, in line with forecasts from economists surveyed by Bloomberg.

-

21:00

DJIA 16836.70 -321.96 -1.88%, NASDAQ 4808.39 -83.04 -1.70%, S&P 500 1980.96 -35.75 -1.77%

-

18:00

European stocks close: stocks closed lower on geopolitical tensions and on concerns over the slowdown in the Chinese economy

Stock indices traded lower on geopolitical tensions and on concerns over the slowdown in the Chinese economy. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3.

North Korea announced on Wednesday morning that it successfully tested hydrogen nuclear bomb. The announcement followed detection of a 5.1 magnitude earthquake. It would be the fourth nuclear test since 2006.

Meanwhile, the economic data from Eurozone was mixed. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) remained unchanged at 54.2 in December, up from the preliminary reading of 53.9.

The index was driven by a rise in business activity in Germany, Italy, Spain and Ireland.

Eurozone's final composite output index rose to 54.3 in December from 54.2 in November, up from the preliminary reading of 54.0.

"The Eurozone economy starts 2016 on a solid footing and well placed to enjoy a year of robust expansion. Growth of business activity continued to edge higher at the end of 2015, with an upturn in the PMI rounding off the strongest quarter for four and-a-half years," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy grew at 0.4% in the fourth quarter and 1.5% in 2015.

Germany's final services purchasing managers' index (PMI) rose to 56.0 in December from 55.6 in November, up from the preliminary reading of 55.4. It was the highest level since July 2014.

France's final services purchasing managers' index (PMI) dropped to 49.8 in December from 51.0 in November, down from the preliminary reading of 50.0.

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.2% in November, in line with expectations, after a 0.3% decrease in October.

On a yearly basis, Eurozone's producer price index dropped 3.2% in November, missing expectations for a 3.1% decrease, after a 3.2% fall in October. October's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in November.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. declined to 55.5 in December from 55.9 in November, missing expectations for a fall to 55.6.

A reading above 50 indicates expansion in the sector.

The decline was driven by a slower growth in new business and job creation.

"The services sector remained the key driver of the UK's economic upturn in December, helping to offset the recent weakness seen in manufacturing and putting the economy on the starting block for another year of 2-2.5% growth in 2016," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy expanded 0.5% in the fourth quarter of 2015.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,073.38 -63.86 -1.04 %

DAX 10,214.02 -96.08 -0.93 %

CAC 40 4,480.47 -57.16 -1.26 %

-

18:00

European stocks closed: FTSE 6066.08 -71.16 -1.16%, DAX 10217.27 -92.83 -0.90%, CAC 40 4478.38 -59.25 -1.31%

-

17:15

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell more than percent in early trading on Wednesday as investors looked for safe havens after China allowed its currency to weaken further and oil prices fell to their lowest in more than 11 years. Investors were also nervous about rising geopolitical tensions after North Korea said it had successfully tested a hydrogen bomb and Saudi Arabia cut ties with Iran. The People's Bank of China on Wednesday set the yuan's official midpoint rate at its weakest level in 4,5 years, while a PMI survey showed services sector activity expanded at its slowest rate in 17 months in December in the country.

Almost all Dow stocks in negative area (28 of 30). Top looser - Chevron Corporation (CVX, -3,88%). Top gainer - Wal-Mart Stores Inc. (WMT, +0.87%).

All S&P sectors also in negative area. Top looser - Basic Materials (-3,2%).

At the moment:

Dow 16870.00 -211.00 -1.24%

S&P 500 1988.75 -23.00 -1.14%

Nasdaq 100 4448.75 -35.00 -0.78%

Oil 34.42 -1.55 -4.31%

Gold 1087.70 +9.30 +0.86%

U.S. 10yr 2.20 -0.05

-

17:09

Australian Industry Group’s services purchasing managers’ index for Australia slides to 46.3 in December, the lowest level since November 2014

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Tuesday evening. The index slid to 46.3 in December from 48.2 in October. It was the lowest level since November 2014.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Four of the five activity sub-indexes were below 50 points in December.

Main contributor to the drop was the sales sub-index, which slid by 6.3 points in December.

-

16:33

U.S. factory orders decline 0.2% in November

The U.S. Commerce Department released factory orders data on Wednesday. Factory orders in the U.S. declined 0.2% in November, in line with expectations, after a 1.3% rise in October. October's figure was revised down from a 1.5% increase.

Durable goods orders were flat in November, while orders for nondurable goods declined 0.4%.

Factory orders excluding transportation declined 0.3% in November, after a 0.1% rise in October.

-

16:21

ISM non-manufacturing purchasing managers’ index falls to 55.3 in December

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index fell to 55.3 in December from 55.9 in November, missing expectations for an increase to 56.0.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index jumped to 58.2 in December from 57.5 in November.

The business activity/production index rose to 58.7 in December from 58.2 in November.

The ISM's employment index was up to 55.7 in December from 55.0 in November.

The prices index declined to 49.7 in December from 50.3 in November.

-

15:50

Final U.S. services PMI drops to 54.3 in December

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Wednesday. Final U.S. services purchasing managers' index (PMI) fell to 54.3 in December from 56.1 in November, up from the preliminary reading of 53.7. It was the lowest level since January 2015

The index was driven by weaker confidence among clients.

"While the survey data indicate that the economy grew at a reasonably healthy 1.9% annualised clip in the fourth quarter, the weakness seen in the final month of the year raises concerns that growth is losing momentum, possibly quite markedly," Chief Economist at Markit Chris Williamson said.

-

15:42

BRC: U.K. shop prices are down 2.0% year-on-year in December

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 2.0% year-on-year in December, after a 2.1% decline in November.

The decline was mainly driven by a drop in non-food prices, which plunged 3.0% year-on-year in December.

Food prices remained unchanged at an annual rate of 0.3% in December.

"With retailers continuing to invest in price, relatively low commodity prices and intense competition a hallmark of the industry, we can expect falling prices to continue in the medium term," BRC Chief Executive, Helen Dickinson, said.

-

15:37

U.S. Stocks open: Dow -1.54%, Nasdaq -1.52%, S&P -1.50%

-

15:28

Before the bell: S&P futures -1.67%, NASDAQ futures -1.86%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 18,191.32 -182.68 -0.99%

Hang Seng 20,980.81 -207.91 -0.98%

Shanghai Composite 3,362.29 +74.58 +2.27%

FTSE 6,029.94 -107.30 -1.75%

CAC 4,449.88 -87.75 -1.93%

DAX 10,126.92 -183.18 -1.78%

Crude oil $34.76 (-3.36%)

Gold $10038.80 (+0.50%)

-

15:03

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

7.76

1.44%

8.4K

AT&T Inc

T

33.80

-0.91%

54.9K

ALTRIA GROUP INC.

MO

58.02

-0.91%

0.2K

Merck & Co Inc

MRK

52.60

-1.03%

1.4K

Hewlett-Packard Co.

HPQ

11.58

-1.11%

3.9K

Ford Motor Co.

F

13.56

-1.17%

7.5K

Verizon Communications Inc

VZ

45.38

-1.21%

23.7K

McDonald's Corp

MCD

117.70

-1.26%

0.2K

Wal-Mart Stores Inc

WMT

62.13

-1.26%

14.7K

Procter & Gamble Co

PG

77.60

-1.30%

0.6K

Pfizer Inc

PFE

31.75

-1.34%

6.7K

The Coca-Cola Co

KO

41.98

-1.34%

4.3K

International Business Machines Co...

IBM

134.00

-1.36%

2.7K

Goldman Sachs

GS

171.60

-1.43%

4.7K

Johnson & Johnson

JNJ

99.45

-1.44%

3.7K

Visa

V

75.15

-1.47%

6.3K

FedEx Corporation, NYSE

FDX

142.52

-1.47%

03K

Yahoo! Inc., NASDAQ

YHOO

31.72

-1.49%

9.4K

General Electric Co

GE

30.27

-1.53%

73.2K

Nike

NKE

61.42

-1.54%

7.1K

JPMorgan Chase and Co

JPM

62.75

-1.54%

1.2K

Microsoft Corp

MSFT

54.20

-1.54%

34.8K

Walt Disney Co

DIS

99.33

-1.56%

5.1K

Intel Corp

INTC

33.30

-1.57%

7.1K

Facebook, Inc.

FB

101.11

-1.58%

116.6K

UnitedHealth Group Inc

UNH

114.79

-1.62%

0.2K

Home Depot Inc

HD

128.31

-1.63%

3.2K

Citigroup Inc., NYSE

C

50.02

-1.65%

42.5K

Cisco Systems Inc

CSCO

25.85

-1.67%

30.8K

3M Co

MMM

144.97

-1.69%

1.5K

Google Inc.

GOOG

730.00

-1.69%

11.7K

American Express Co

AXP

65.10

-1.75%

1.7K

Boeing Co

BA

138.60

-1.75%

1.8K

Exxon Mobil Corp

XOM

76.74

-1.77%

51.6K

Starbucks Corporation, NASDAQ

SBUX

57.60

-1.79%

10.5K

International Paper Company

IP

37.28

-1.87%

35.4K

Twitter, Inc., NYSE

TWTR

21.50

-1.92%

74.6K

Caterpillar Inc

CAT

65.95

-1.98%

3.3K

Yandex N.V., NASDAQ

YNDX

15.10

-2.01%

0.6K

United Technologies Corp

UTX

93.75

-2.06%

2.5K

Tesla Motors, Inc., NASDAQ

TSLA

218.80

-2.07%

10.7K

Chevron Corp

CVX

87.75

-2.08%

17.2K

General Motors Company, NYSE

GM

31.75

-2.10%

16.9K

Amazon.com Inc., NASDAQ

AMZN

620.07

-2.16%

20.0K

Apple Inc.

AAPL

100.29

-2.36%

621.0K

ALCOA INC.

AA

8.98

-3.13%

31.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.45

-3.87%

273.9K

-

14:58

U.S. trade deficit narrows to $42.37 billion in November

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit narrowed to $42.37 billion in November from a deficit of $44.58 billion in October. October's figure was revised down from a deficit of $43.89 billion.

Analysts had expected a trade deficit of $44.0 billion.

The decline of a deficit was driven by a drop in imports. Exports fell by 0.9% in November, while imports decreased by 1.7%.

A stronger U.S. dollar weighed on exports.

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

United Technologies Incorporated (UTX) downgraded to Neutral from Buy at Sterne Agee CRT

Other:

Procter & Gamble (PG) initiated with a Neutral at Atlantic Equities

-

14:43

Canada's trade deficit narrows to C$1.99 billion in November

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$1.99 billion in November from a deficit of C$2.49 billion in October. October's figure was revised up from a deficit of C$2.76 billion.

Analysts had expected a trade deficit of C$2.6 billion.

The fall in deficit was driven by a rise in exports and a drop in imports. Exports rose 0.4% in November, while imports fell 0.7%.

Exports of motor vehicles and parts increased by 5.9% in November, exports of energy products fell by 6.6%, while exports of metal and non-metallic mineral products climbed 20.4%.

Imports of consumer products declined by 1.0% in November, and imports of electronic and electrical equipment and parts dropped 2.9%, while imports of energy products slid 6.4%.

-

14:34

U.S. ADP Employment Report: private sector adds 257,000 jobs in December

Private sector in the U.S. added 257,000 jobs in December, according the ADP report on Wednesday. November's figure was revised down to 211,000 jobs from a previous reading of 217,000 jobs.

Analysts expected the private sector to add 192,000 jobs.

Services sector added 234,000 jobs in December, while goods-producing sector added 23,000.

"Strong job growth shows no signs of abating. The only industry shedding jobs is energy. If this pace of job growth is sustained, which seems likely, the economy will be back to full employment by mid-year," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in December. The U.S. economy is expected to add 200,000 jobs in December, after adding 211,000 jobs in November.

-

14:29

Final Markit/Nikkei services purchasing managers' index for Japan falls to 51.5 in December

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan fell to 51.5 in December from 51.6 in November.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The index was driven by a rise in new orders.

"New business growth in the service sector accelerated to a four-month high in December, supporting a further increase in both output and employment," economist at Markit, Amy Brownbill, said.

-

12:00

European stock markets mid session: stocks traded lower on concerns over the slowdown in the Chinese economy

Stock indices traded lower on concerns over the slowdown in the Chinese economy. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3.

News that North Korea successfully tested hydrogen nuclear bomb also weighed on stock markets.

Meanwhile, the economic data from Eurozone was mixed. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) remained unchanged at 54.2 in December, up from the preliminary reading of 53.9.

The index was driven by a rise in business activity in Germany, Italy, Spain and Ireland.

Eurozone's final composite output index rose to 54.3 in December from 54.2 in November, up from the preliminary reading of 54.0.

"The Eurozone economy starts 2016 on a solid footing and well placed to enjoy a year of robust expansion. Growth of business activity continued to edge higher at the end of 2015, with an upturn in the PMI rounding off the strongest quarter for four and-a-half years," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy grew at 0.4% in the fourth quarter and 1.5% in 2015.

Germany's final services purchasing managers' index (PMI) rose to 56.0 in December from 55.6 in November, up from the preliminary reading of 55.4. It was the highest level since July 2014.

France's final services purchasing managers' index (PMI) dropped to 49.8 in December from 51.0 in November, down from the preliminary reading of 50.0.

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.2% in November, in line with expectations, after a 0.3% decrease in October.

On a yearly basis, Eurozone's producer price index dropped 3.2% in November, missing expectations for a 3.1% decrease, after a 3.2% fall in October. October's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in November.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. declined to 55.5 in December from 55.9 in November, missing expectations for a fall to 55.6.

A reading above 50 indicates expansion in the sector.

The decline was driven by a slower growth in new business and job creation.

"The services sector remained the key driver of the UK's economic upturn in December, helping to offset the recent weakness seen in manufacturing and putting the economy on the starting block for another year of 2-2.5% growth in 2016," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy expanded 0.5% in the fourth quarter of 2015.

Current figures:

Name Price Change Change %

FTSE 100 6,057.1 -80.14 -1.31 %

DAX 10,170.77 -139.33 -1.35 %

CAC 40 4,472.62 -65.01 -1.43 %

-

11:52

Spain’s services PMI falls to 55.1 in December

Markit Economics released final services purchasing managers' index (PMI) for Spain on Wednesday. Spain's final services purchasing managers' index (PMI) fell to 55.1 in December from 56.7 in November.

The index was driven by a slower growth in new business.

"The Spanish service sector ended 2015 with a sense of optimism, according to the latest PMI survey. The data, collected prior to the general election on December 20th, signalled a further sharp rise in business activity, and improved optimism that growth will be maintained during 2016," Senior Economist at Markit Andrew Harker said.

-

11:45

Italy’s services PMI remains climbs to 55.3 in December

Markit/ADACI's services purchasing managers' index (PMI) for Italy climbed to 55.3 in December from 53.4 in November.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in total activity, new business and job creation.

"With data showing further solid gains in new business and the pace of job creation strengthening, businesses head into 2016 in much finer fettle than that which they began 2015," an economist at Markit Phil Smith said.

-

11:40

France's final services PMI declines to 49.8 in December

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) dropped to 49.8 in December from 51.0 in November, down from the preliminary reading of 50.0.

The index was driven by a slowdown in new business growth and in backlogs of work.

"The French service sector broadly stagnated in December, ending a ten-month run of expanding activity. Anecdotal evidence suggested that a number of businesses continued to be affected by cancellations following the recent terrorist attacks, exerting a drag on new business growth," Senior Economist at Markit Jack Kennedy said.

-

11:36

French consumer confidence index remains unchanged at 96 in December

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index remained unchanged at 96 in December, beating expectations for a decline to 95.

The index of the outlook on consumers' saving capacity remained unchanged at -4 in December.

The index of households' assessment of their financial situation in the past twelve months fell to -25 in December from -24 in November.

The index of the outlook on consumers' financial situation for next twelve months increased to -7 in December from-10 in November.

The index of the outlook on unemployment rising in coming months rose to 46 in December from 35 in November.

The index for future inflation expectations was up to -38 in December from -41 in November.

-

11:30

Germany's final services PMI rises to 56.0 in December, the highest level since July 2014

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) rose to 56.0 in December from 55.6 in November, up from the preliminary reading of 55.4. It was the highest level since July 2014.

The index was driven by a rise in new business.

"The upturn in Germany's service sector continued at the year-end with activity increasing at the strongest rate in nearly one-and-a-half years. Moreover, the combination of strongly rising new business levels and a further accumulation of work outstanding suggests that companies will remain in expansion mode as we move into 2016," an economist at Markit, Oliver Kolodseike, said.

-

11:23

Eurozone's producer price index declines 0.2% in November

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.2% in November, in line with expectations, after a 0.3% decrease in October.

Intermediate goods prices fell 0.3% in November, capital goods prices were flat, non-durable consumer goods prices declined 0.2%, and durable consumer goods prices were stable, while energy prices decreased 0.3%.

On a yearly basis, Eurozone's producer price index dropped 3.2% in November, missing expectations for a 3.1% decrease, after a 3.2% fall in October. October's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in November. Energy prices dropped at an annual rate of 9.4%.

-

11:12

Eurozone's final services PMI remains unchanged at 54.2 in December

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) remained unchanged at 54.2 in December, up from the preliminary reading of 53.9.

The index was driven by a rise in business activity in Germany, Italy, Spain and Ireland.

Eurozone's final composite output index rose to 54.3 in December from 54.2 in November, up from the preliminary reading of 54.0.

"The Eurozone economy starts 2016 on a solid footing and well placed to enjoy a year of robust expansion. Growth of business activity continued to edge higher at the end of 2015, with an upturn in the PMI rounding off the strongest quarter for four and-a-half years," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy grew at 0.4% in the fourth quarter and 1.5% in 2015.

-

10:53

UK’s services PMI falls to 55.5 in December

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. declined to 55.5 in December from 55.9 in November, missing expectations for a fall to 55.6.

A reading above 50 indicates expansion in the sector.

The decline was driven by a slower growth in new business and job creation.

"The services sector remained the key driver of the UK's economic upturn in December, helping to offset the recent weakness seen in manufacturing and putting the economy on the starting block for another year of 2-2.5% growth in 2016," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy expanded 0.5% in the fourth quarter of 2015.

-

10:47

North Korea successfully tests hydrogen nuclear bomb

North Korea announced on Wednesday morning that it successfully tested hydrogen nuclear bomb. The announcement followed detection of a 5.1 magnitude earthquake. It would be the fourth nuclear test since 2006.

The governments of Japan and South Korea have expressed concerns about the North Korean test, calling it a threat to its security.

North Korea's actions will be discussed at an emergency meeting of the UN today.

-

10:33

European Central Bank Executive Board member Peter Praet: the central bank will continue its quantitative easing until the 2% inflation target will be reached

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview with Belgian weekly magazine Knack that the central bank will continue its quantitative easing until the 2% inflation target will be reached.

"If we look at the economic situation, I think that the current policy will certainly be in place until March 2017 and longer if necessary," he said.

-

10:12

Chinese Markit/Caixin services PMI falls to 50.2 in December

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3.

The index was driven by a subdued client demand.

Recruitment at services continued to rise in December, while backlogs of work were little-changed.

"In light of the setback to services sector growth, the government needs to gradually relax restrictions in the sector. This will release the potential of supply-side reform, improve the economic structure and help with the industrial transformation and upgrading," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

07:30

Global Stocks: U.S. stock indices little changed

U.S. stock indices traded mixed and closed not far from open levels as investors continued to overcome Monday selloff shock.

The Dow Jones Industrial Average added 9.72 points, or less than 0.1%, to 17,158.66. The S&P 500 climbed 4.04 points, or 0.2%, to 2,016.70. The Nasdaq Composite declined 11.66 points, or 0.2%, to 4,891.43.

Business activity rose in New York in December despite expectations of a moderate worsening. The corresponding index from the Institute for Supply Management rose to 62.0 points in December from 60.7 in the previous month. Economists had expected the index to decline to 60.0. Despite a slight decline the index remained above the 50 points threshold suggesting expansion.

This morning in Asia Hong Kong Hang Seng fell 0.64%, or 135.35, to 21,053.37. China Shanghai Composite Index gained 1.39%, or 45.63, to 3,333.34. The Nikkei fell 1.04%, or 191.98, to 18,182.02.

Asian stock indices traded mixed. Japanese stocks climbed at the beginning of the session taking a lead from Wall Street, but declined later amid a stronger yen, which is unfavorable for exporters. The yen rose against the U.S. dollar to the highest level since October 15 as risk sentiment declined after Chinese authorities set the exchange rate of the yuan lower.

-

03:01

Nikkei 225 18,308.12 -65.88 -0.36 %, Hang Seng 21,146.5 -42.22 -0.20 %, Shanghai Composite 3,295.46 +7.75 +0.24 %

-

00:31

Stocks. Daily history for Sep Jan 5’2016:

(index / closing price / change items /% change)

Nikkei 225 18,374 -76.98 -0.42 %

Hang Seng 21,188.72 -138.40 -0.65 %

Shanghai Composite 3,287.71 -8.55 -0.26 %

FTSE 100 6,137.24 +43.81 +0.72 %

CAC 40 4,537.63 +15.18 +0.34 %

Xetra DAX 10,310.1 +26.66 +0.26 %

S&P 500 2,016.71 +4.05 +0.20 %

NASDAQ Composite 4,891.43 -11.66 -0.24 %

Dow Jones 17,158.66 +9.72 +0.06 %

-