Noticias del mercado

-

17:51

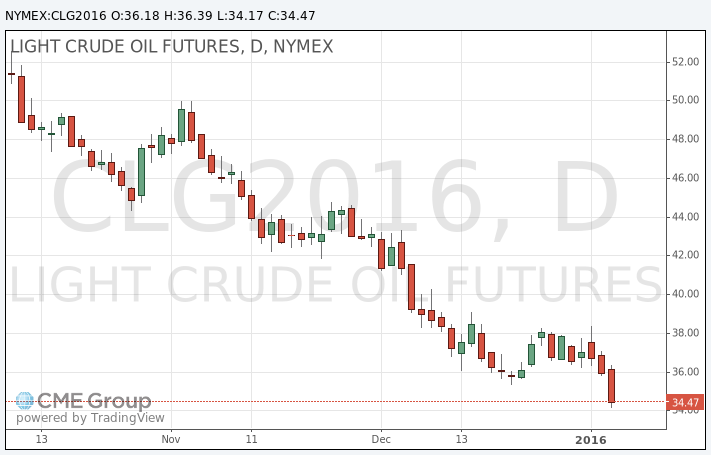

Oil prices decline on the U.S. crude oil inventories data

Oil prices declined on the U.S. crude oil inventories data as U.S. gasoline inventories and crude stocks at the Cushing rose last week. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories slid by 5.1 million barrels to 482.3 million in the week to January 01.

Analysts had expected U.S. crude oil inventories to decline by 1.5 million barrels.

Gasoline inventories increased by 10.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 917,000 barrels.

U.S. crude oil imports decreased by 382,000 barrels per day.

Refineries in the U.S. were running at 92.5% of capacity, down from 92.6% the previous week.

The weak Chinese services data also weighed on oil prices. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3. The index was driven by a subdued client demand.

WTI crude oil for February delivery declined to $34.17 a barrel on the New York Mercantile Exchange.

Brent crude oil for February fell to $34.63 a barrel on ICE Futures Europe.

-

17:24

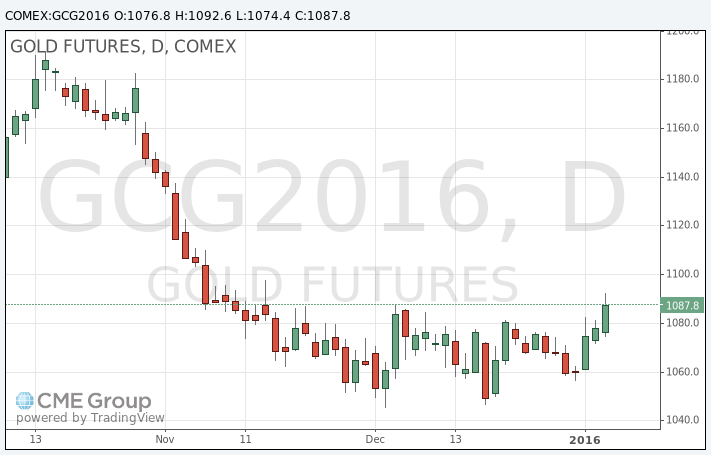

Gold hits 1.5-month high

Gold price rose due to increasing demand for safe-haven assets. News that North Korea successfully tested hydrogen nuclear bomb supported gold price.

Market participants continued to eye the situation in the Middle East.

Concerns over slowdown in the Chinese economy also supported gold price. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3. The index was driven by a subdued client demand.

February futures for gold on the COMEX today rose to 1092.60 dollars per ounce.

-

16:55

U.S. crude inventories slides by 5.1 million barrels to 482.3 million in the week to January 01

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories slid by 5.1 million barrels to 482.3 million in the week to January 01.

Analysts had expected U.S. crude oil inventories to decline by 1.5 million barrels.

Gasoline inventories increased by 10.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 917,000 barrels.

U.S. crude oil imports decreased by 382,000 barrels per day.

Refineries in the U.S. were running at 92.5% of capacity, down from 92.6% the previous week.

-

14:34

U.S. ADP Employment Report: private sector adds 257,000 jobs in December

Private sector in the U.S. added 257,000 jobs in December, according the ADP report on Wednesday. November's figure was revised down to 211,000 jobs from a previous reading of 217,000 jobs.

Analysts expected the private sector to add 192,000 jobs.

Services sector added 234,000 jobs in December, while goods-producing sector added 23,000.

"Strong job growth shows no signs of abating. The only industry shedding jobs is energy. If this pace of job growth is sustained, which seems likely, the economy will be back to full employment by mid-year," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in December. The U.S. economy is expected to add 200,000 jobs in December, after adding 211,000 jobs in November.

-

10:47

North Korea successfully tests hydrogen nuclear bomb

North Korea announced on Wednesday morning that it successfully tested hydrogen nuclear bomb. The announcement followed detection of a 5.1 magnitude earthquake. It would be the fourth nuclear test since 2006.

The governments of Japan and South Korea have expressed concerns about the North Korean test, calling it a threat to its security.

North Korea's actions will be discussed at an emergency meeting of the UN today.

-

10:21

Saudi Arabia cuts the prices it charges for crude oil in Europe

Saudi Arabia on Tuesday lowered the prices it charges for crude oil in Europe. Saudi Arabian Oil Co., the country's state-owned oil company, said that it cut its light crude by $0.60 a barrel to Northwest Europe and by $0.20 a barrel in the Mediterranean for February delivery.

This action could add to the escalation of the situation in the Middle East as Iran plans to raise its oil exports once the sanctions are lift off.

-

10:12

Chinese Markit/Caixin services PMI falls to 50.2 in December

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3.

The index was driven by a subdued client demand.

Recruitment at services continued to rise in December, while backlogs of work were little-changed.

"In light of the setback to services sector growth, the government needs to gradually relax restrictions in the sector. This will release the potential of supply-side reform, improve the economic structure and help with the industrial transformation and upgrading," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

07:54

Oil prices gave up earlier gains

West Texas Intermediate futures for February delivery is currently at $36.08 (+0.31%), while Brent crude is at $36.50 (+0.22%) staying not far from eleven-year lows. Investors are concerned over the persistent supply glut and rising stockpiles. In fact, some analysts believe that the conflict between major oil producers Saudi Arabia and Iran will only intensify the oversupply issue as now these two countries are even less likely to co-operate in order to support oil prices. Meanwhile Iran is preparing to raise supplies this year.

Market participants are waiting for the Energy Information Administration to report on U.S. crude oil stockpiles later today.

-

07:40

Gold holds onto gains

Gold steadied at $1,079.00 (+0.06%) amid demand for safe-haven assets supported by tensions in the Middle East and the Korean peninsula.

North Korea said it had successfully tested a miniaturised hydrogen nuclear device on Wednesday morning. Japan called this event a threat to Japan's security.

Investors traditionally turn to gold at times of crisis and geopolitical tensions, but such gains are normally short-lived. Analysts noted that this time the precious metal hasn't gained much.

The dollar, bullion's traditional opponent, is likely to be strong on higher rates, which are expected to grow further this year.

-

00:32

Commodities. Daily history for Jan 5’2016:

(raw materials / closing price /% change)

Oil 36.27 +0.83%

Gold 1,077.10 -0.12%

-