Noticias del mercado

-

17:58

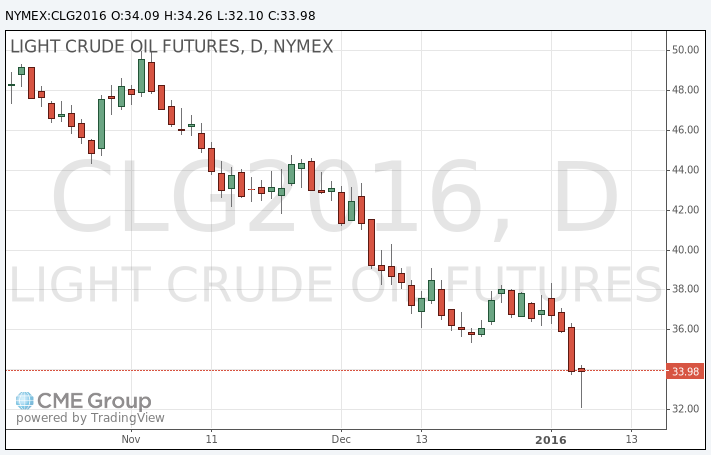

Oil prices hit 10-year lows

Oil prices declined to 10-year lows as Chinese stocks dropped. The People's Bank of China (PBoC) continued to devaluate the yuan. The central bank set the yuan midpoint at 6.5646, down 0.5% from the day before. It was the lowest level since March 2011, and the highest cut since August 2015. Trading was halted after stocks plunged. It was the shortest trading day in the stock market's 25-year history.

Concerns over the global oil oversupply also weighed oil prices. According to the U.S. Energy Information Administration (EIA) on Wednesday, U.S. crude inventories slid by 5.1 million barrels to 482.3 million in the week to January 01.

Analysts had expected U.S. crude oil inventories to decline by 1.5 million barrels.

Gasoline inventories increased by 10.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 917,000 barrels.

WTI crude oil for February delivery declined to $32.10 a barrel on the New York Mercantile Exchange.

Brent crude oil for February fell to $32.16 a barrel on ICE Futures Europe.

-

17:44

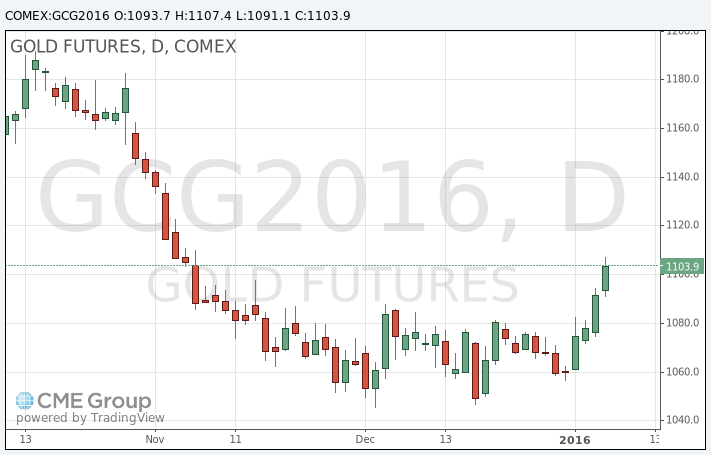

Gold hits 9-week high

Gold price rose due to increasing demand for safe-haven assets. Geopolitical tensions and concerns over slowdown in the Chinese economy supported gold price. The People's Bank of China (PBoC) continued to devaluate the yuan. The central bank set the yuan midpoint at 6.5646, down 0.5% from the day before. It was the lowest level since March 2011. Trading was halted after stocks plunged.

February futures for gold on the COMEX today rose to 1107.40 dollars per ounce.

-

14:40

Initial jobless claims decline to 277,000 in the week ending January 02

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 02 in the U.S. declined by 10,000 to 277,000 from 287,000 in the previous week. Analysts had expected jobless claims to fall to 275,000.

Jobless claims remained below 300,000 the 44th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 25,000 to 2,230,000 in the week ended December 26.

-

10:07

Fed’s December monetary policy meeting minutes: Fed officials express concerns about low inflation in the U.S

The Fed released its December monetary policy meeting minutes on Wednesday. The Fed raised its interest rate in December. Fed officials expressed concerns about low inflation in the U.S., saying that they "would carefully monitor actual and expected progress toward its inflation goal".

Fed officials said that labour market continued to improve, noting that "underutilization of labour resources has diminished appreciably since early this year".

According to the minutes, the U.S. economy is expected to grow moderately, while the labour market is expected to continue to improve.

The minutes showed that further interest rate hikes will depend on the labour market and inflation data.

Fed officials pointed out that the downside risks to U.S. economy from global economic and financial developments diminished since late summer.

-

09:13

World Bank lowered its global economic forecasts for 2016 and 2017

The World Bank on Wednesday cut its global economic growth forecast for 2016 and 2017 due to weak growth in major emerging economies.

The World Bank expects that the global economy would grow 2.9% in 2016, down from its June forecast of 3.3%. 2017 global growth was downgraded to 3.1%, down from its June forecast of 3.2%.

"This outlook is expected to be buttressed by recovery in major high-income economies, stabilizing commodity prices, and a continuation of low interest rates. All this does not rule out the fact that there is a low-probability risk of disorderly slowdown in major emerging markets, as U.S. interest rates rise after a long break and the US dollar strengthens, and as a result of geopolitical concerns," World Bank Senior Vice President and Chief Economist Kaushik Basu said in the report.

The global economy was estimated to expand 2.4% in 2015.

China's economy is expected to expand 6.7% in 2016 (6.9% in 2015), down from its June forecast of 7.0%, and 6.5% in 2017, down from its June forecast of 6.9%.

Growth in the U.S. is expected to expand 2.7% in 2016, down from its June forecast of 2.8, and 2.4% in 2017, unchanged from its June forecast.

In the Eurozone, the economy is expected to grow 1.7% in 2016, down from its June forecast of 1.8%, and 1.7% in 2017, up from its June forecast of 1.6%.

In Japan, the economy is expected to expand 1.3% in 2016, down from its June forecast of 1.7%, and 0.9% in 2017, down from its June forecast of 1.2%.

Developing countries are expected to grow by 4.8% in 2016, down from its June forecast of 5.2%.

-

07:41

Oil prices plunged

West Texas Intermediate futures for February delivery plunged to $32.94 (-3.03%), while Brent crude dropped to $33.09 (-3.33%) amid turmoil on Chinese stock markets and the ongoing global supply glut. Trading on Chinese stock markets was suspended twice this week. Today stocks lost around 7% in less than half an hour. Investors are concerned about economic growth in the world's second-biggest oil consumer.

Meanwhile the Energy Information Administration reported yesterday that U.S. crude oil stockpiles fell by 5.1 million barrels last week. However production remained above 9 million barrels a day, which is more than last year.

-

07:25

Gold advanced on safe-haven demand

Gold rose to $1,099.00 (+0.65%) as demand for this safe-haven asset rose amid plunging stocks. Chinese stocks dropped more than 7% triggering automatic stop mechanism for the second time this week after People's Bank of China today lowered the yuan against the U.S. dollar.

Some analysts say that investors are going to be concerned about emerging-market currencies and currencies of countries exposed to shocks from China's economy boosting demand for gold, the yen and the U.S. dollar.

-

00:38

Commodities. Daily history for Jan 6’2016:

(raw materials / closing price /% change)

Oil 34.06 +0.26%

Gold 1,093.30 +0.13%

-