Noticias del mercado

-

19:40

American focus: the US dollar rose

The US dollar rose against other currencies, as investors favored safe-haven against the backdrop of renewed concerns about the prospects for China's economy, the news about the likely bomb test by North Korea, as well as the fall in oil prices.

In the first trading days of 2016, investors preferred the dollar, given the new signs of weakness in China and the euro zone. On Wednesday, new data have been published that indicate that the Chinese authorities can not cope with a slowing economy. Indicators of activity in the service sector in China, which usually has a positive effect on economic growth, were weak. Partly China is responsible for the drop in oil prices, while the markets spread concerns about the economic situation in the country.

Investors are also faced with the problem of reducing the yuan. On Wednesday, China's central bank set the mid exchange rate at its lowest level in five years.

In addition, on Wednesday, North Korea announced the successful testing of a more perfect form of nuclear weapons, which was another reason why investors preferred safe-haven assets.

More positive-than-expected US data also helped strengthen the dollar.

Data provided by Automatic Data Processing (ADP), have shown that the growth rate of employment in the US private sector has significantly increased in December, despite the expectations of a moderate decline. According to a report last month, the number of employees increased by 257 thousand. People, compared with a revised downward indicator for November at 211 thousand. (Originally reported growth of 217 thousand.). We add, according to the average forecast value of this indicator was to reach 192 thousand.

In addition, the US Commerce Department reported that the trade deficit decreased markedly in November as imports and exports fell to their lowest level in recent years. Last Modified indicates that the volume of world trade is gradually slowing down due to low commodity prices and fluctuations in major currencies.

According to the report, the trade deficit decreased by 5% compared with October, while reaching $ 42.37 billion. Exports fell by 0.9%, while imports dropped even more - by 1.7%, to its lowest level from February 2011. The deficit for October was revised to $ 44.58 from $ 43.89 billion. Economists had expected a deficit of $ 44.0 billion.

The euro rose slightly against the dollar, the currency of support have data on business activity in Germany and the euro zone. It is learned that private sector activity in Germany increased at the end of December, registering with the fastest expansion in 17 months. This was reported in the final report, Markit Economics. The composite index of business activity, which covers the manufacturing sector and the service sector increased to 55.5 points in December against 55.2 in November. Recall previously reported a decline to 54.9 points. The final PMI index for the services sector rose to 56.0 compared with 55.6 in November and preliminary value of 55.4. The last reading was the highest since July 2014.

Meanwhile, the final data, provided by Markit Economics, showed that business activity in the euro zone's private sector grew in December, more than in the previous month, and faster than originally anticipated. The composite PMI index rose to 54.3 in December from 54.2 in November. In a preliminary report, it reported a decline in the index to 54.0. It is worth emphasizing, the index remains above the neutral mark of 50 points for 30 consecutive months and diamonds. PMI for the services sector remained at 54.2 points in December. Previously it reported 53.9 points. Analysts had forecast that the index was 53.9.

The pound fell against the dollar after the publication of weak statistics on Britain. The report CIPS and Markit Economics reported that the index of business activity in the services sector in Britain has decreased moderately in December, but remained above the neutral mark of 50, which indicates expansion. According to the data at the end of December, the PMI index for the services sector fell to 55.5 against 55.9 in November. Analysts had expected the index to fall to 55.6 points. The average value of the index for the 2nd half of 2015 amounted to 55.4 points, which is lower than the same period in 2013 (56.9 points) and 2014 (58.2 points). On average, in 2015 the index was 56.7 points. "The research results indicate that the UK economy grew by 0.5% in the 4th quarter. This means that at the end of 2015, GDP grew by 2.2%," - said Chris Williamson, economist at Markit.

The Canadian dollar has fallen more than 100 pips against the US dollar, reaching the psychological mark CAD1.4100 and updating the 12-year minimum. The main reason for such dynamics was a significant decline in oil prices because of concerns about oversupply of raw materials. Yesterday, the American Petroleum Institute issued its report, which showed a reduction in oil reserves by 5.6 million barrels from December 26 to January 1. According to the report, gasoline inventories rose by 7.1 million barrels, while distillate stocks - by 5.6 million barrels per day. US Energy Information Administration on Wednesday reported on the fall of commercial oil stocks in the United States to 5.09 million barrels last week, while analysts had expected an increase of 300,000 barrels. However, at the same time it became aware of the strong increase in stocks of gasoline and distillates. Oil reserves in Cushing terminal reached a new record high.

Statistics Canada stated: In November, exports rose slightly have contributed to a reduction in the trade deficit to 1.99 billion. Canadian dollars against 2.49 billion. Canadian dollars in October (revised from 2.76 billion.). Analysts had forecast a deficit of 2.60 billion. Canadian dollars. It is worth emphasizing the deficit in trade in goods is fixed for the 15th consecutive month, reflecting the continuing economic difficulties of the low oil prices and a weak Canadian dollar.

-

17:09

Australian Industry Group’s services purchasing managers’ index for Australia slides to 46.3 in December, the lowest level since November 2014

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Tuesday evening. The index slid to 46.3 in December from 48.2 in October. It was the lowest level since November 2014.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Four of the five activity sub-indexes were below 50 points in December.

Main contributor to the drop was the sales sub-index, which slid by 6.3 points in December.

-

16:33

U.S. factory orders decline 0.2% in November

The U.S. Commerce Department released factory orders data on Wednesday. Factory orders in the U.S. declined 0.2% in November, in line with expectations, after a 1.3% rise in October. October's figure was revised down from a 1.5% increase.

Durable goods orders were flat in November, while orders for nondurable goods declined 0.4%.

Factory orders excluding transportation declined 0.3% in November, after a 0.1% rise in October.

-

16:30

U.S.: Crude Oil Inventories, January -5.085 (forecast -1.5)

-

16:21

ISM non-manufacturing purchasing managers’ index falls to 55.3 in December

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index fell to 55.3 in December from 55.9 in November, missing expectations for an increase to 56.0.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index jumped to 58.2 in December from 57.5 in November.

The business activity/production index rose to 58.7 in December from 58.2 in November.

The ISM's employment index was up to 55.7 in December from 55.0 in November.

The prices index declined to 49.7 in December from 50.3 in November.

-

16:00

U.S.: Factory Orders , November -0.2% (forecast -0.2%)

-

16:00

U.S.: ISM Non-Manufacturing, December 55.3 (forecast 56)

-

15:50

Final U.S. services PMI drops to 54.3 in December

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Wednesday. Final U.S. services purchasing managers' index (PMI) fell to 54.3 in December from 56.1 in November, up from the preliminary reading of 53.7. It was the lowest level since January 2015

The index was driven by weaker confidence among clients.

"While the survey data indicate that the economy grew at a reasonably healthy 1.9% annualised clip in the fourth quarter, the weakness seen in the final month of the year raises concerns that growth is losing momentum, possibly quite markedly," Chief Economist at Markit Chris Williamson said.

-

15:45

U.S.: Services PMI, December 54.3 (forecast 55.1)

-

15:42

BRC: U.K. shop prices are down 2.0% year-on-year in December

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 2.0% year-on-year in December, after a 2.1% decline in November.

The decline was mainly driven by a drop in non-food prices, which plunged 3.0% year-on-year in December.

Food prices remained unchanged at an annual rate of 0.3% in December.

"With retailers continuing to invest in price, relatively low commodity prices and intense competition a hallmark of the industry, we can expect falling prices to continue in the medium term," BRC Chief Executive, Helen Dickinson, said.

-

14:58

U.S. trade deficit narrows to $42.37 billion in November

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit narrowed to $42.37 billion in November from a deficit of $44.58 billion in October. October's figure was revised down from a deficit of $43.89 billion.

Analysts had expected a trade deficit of $44.0 billion.

The decline of a deficit was driven by a drop in imports. Exports fell by 0.9% in November, while imports decreased by 1.7%.

A stronger U.S. dollar weighed on exports.

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY 119.00 (USD 669m) 119.50 (711m) 120.00 (308m) 120.25 (401m)

EURUSD 1.0750 (EUR 350m) 1.0800 (EUR 740m) 1.0905 (676m) 1.0925 (854m)

AUDUSD 0.7275 (AUD 991m)

NZDUSD 0.6380 (NZD 711m) 0.6700 (250m)

-

14:43

Canada's trade deficit narrows to C$1.99 billion in November

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$1.99 billion in November from a deficit of C$2.49 billion in October. October's figure was revised up from a deficit of C$2.76 billion.

Analysts had expected a trade deficit of C$2.6 billion.

The fall in deficit was driven by a rise in exports and a drop in imports. Exports rose 0.4% in November, while imports fell 0.7%.

Exports of motor vehicles and parts increased by 5.9% in November, exports of energy products fell by 6.6%, while exports of metal and non-metallic mineral products climbed 20.4%.

Imports of consumer products declined by 1.0% in November, and imports of electronic and electrical equipment and parts dropped 2.9%, while imports of energy products slid 6.4%.

-

14:34

U.S. ADP Employment Report: private sector adds 257,000 jobs in December

Private sector in the U.S. added 257,000 jobs in December, according the ADP report on Wednesday. November's figure was revised down to 211,000 jobs from a previous reading of 217,000 jobs.

Analysts expected the private sector to add 192,000 jobs.

Services sector added 234,000 jobs in December, while goods-producing sector added 23,000.

"Strong job growth shows no signs of abating. The only industry shedding jobs is energy. If this pace of job growth is sustained, which seems likely, the economy will be back to full employment by mid-year," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in December. The U.S. economy is expected to add 200,000 jobs in December, after adding 211,000 jobs in November.

-

14:30

Canada: Trade balance, billions, November -1.99 (forecast -2.6)

-

14:30

U.S.: International Trade, bln, November -42.37 (forecast -44)

-

14:29

Final Markit/Nikkei services purchasing managers' index for Japan falls to 51.5 in December

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan fell to 51.5 in December from 51.6 in November.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The index was driven by a rise in new orders.

"New business growth in the service sector accelerated to a four-month high in December, supporting a further increase in both output and employment," economist at Markit, Amy Brownbill, said.

-

14:16

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:45 China Markit/Caixin Services PMI December 51.2 52.3 50.2

07:45 France Consumer confidence December 96 95 96

08:50 France Services PMI (Finally) December 51 50 49.8

08:55 Germany Services PMI (Finally) December 55.6 55.4 56

09:00 Eurozone Services PMI (Finally) December 54.2 53.9 54.2

09:30 United Kingdom Purchasing Manager Index Services December 55.9 55.6 55.5

10:00 Eurozone Producer Price Index, MoM November -0.3% -0.2% -0.2%

10:00 Eurozone Producer Price Index (YoY) November -3.2% Revised From -3.1% -3.1% -3.2%

12:00 U.S. MBA Mortgage Applications December 7.3% -11.6%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data today. According to the ADP employment report, the U.S. economy is expected to add 192,000 jobs in December.

The ISM non-manufacturing purchasing managers' index is expected to rise to 56.0 in December from 55.9 in November.

The U.S. factory orders are expected to decline 0.2% in November, after a 1.5% rise in October.

The Fed will release its latest monetary policy minutes at 19:00 GMT.

The euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) remained unchanged at 54.2 in December, up from the preliminary reading of 53.9.

The index was driven by a rise in business activity in Germany, Italy, Spain and Ireland.

Eurozone's final composite output index rose to 54.3 in December from 54.2 in November, up from the preliminary reading of 54.0.

"The Eurozone economy starts 2016 on a solid footing and well placed to enjoy a year of robust expansion. Growth of business activity continued to edge higher at the end of 2015, with an upturn in the PMI rounding off the strongest quarter for four and-a-half years," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy grew at 0.4% in the fourth quarter and 1.5% in 2015.

Germany's final services purchasing managers' index (PMI) rose to 56.0 in December from 55.6 in November, up from the preliminary reading of 55.4. It was the highest level since July 2014.

France's final services purchasing managers' index (PMI) dropped to 49.8 in December from 51.0 in November, down from the preliminary reading of 50.0.

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.2% in November, in line with expectations, after a 0.3% decrease in October.

On a yearly basis, Eurozone's producer price index dropped 3.2% in November, missing expectations for a 3.1% decrease, after a 3.2% fall in October. October's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in November.

The British pound traded mixed against the U.S. dollar despite the weaker-than-expected services PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. declined to 55.5 in December from 55.9 in November, missing expectations for a fall to 55.6.

A reading above 50 indicates expansion in the sector.

The decline was driven by a slower growth in new business and job creation.

"The services sector remained the key driver of the UK's economic upturn in December, helping to offset the recent weakness seen in manufacturing and putting the economy on the starting block for another year of 2-2.5% growth in 2016," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy expanded 0.5% in the fourth quarter of 2015.

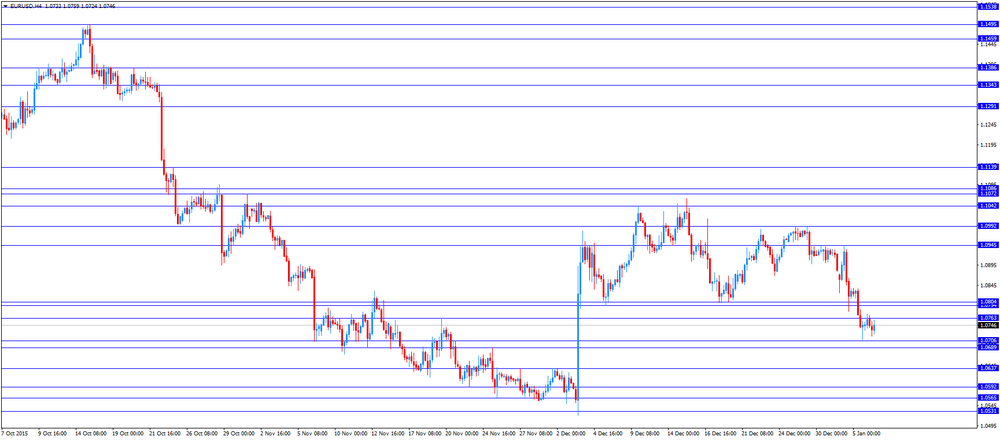

EUR/USD: the currency pair rose to $1.0759

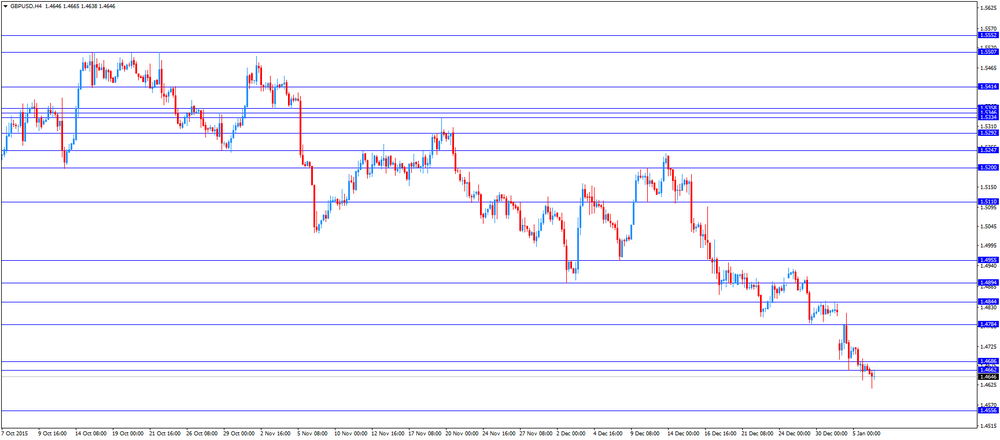

GBP/USD: the currency pair traded mixed

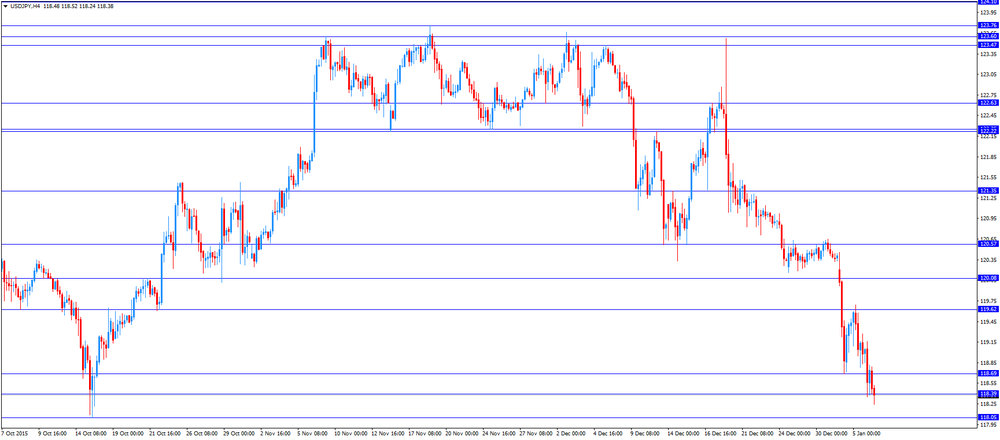

USD/JPY: the currency pair decreased to Y118.24

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report December 217 192

13:30 Canada Trade balance, billions November -2.76 -2.6

13:30 U.S. International Trade, bln November -43.89 -44

14:45 U.S. Services PMI (Finally) December 56.1 55.1

15:00 U.S. ISM Non-Manufacturing December 55.9 56

15:00 U.S. Factory Orders November 1.5% -0.2%

15:30 U.S. Crude Oil Inventories January 2.629 -1.5

19:00 U.S. FOMC meeting minutes

-

14:15

U.S.: ADP Employment Report, December 257 (forecast 192)

-

13:45

Orders

EUR/USD

Offers 1.0750 1.0770 1.0785 1.0800 1.0825 1.0840 1.0865 1.0880 1.0900

BIds 1.0720 1.0700 1.0680 1.0665 1.0650 1.0630 1.0600 1.0585 1.0565 1.0550

GBP/USD

Offers 1.4665 1.4685 1.4700 1.4725-30 1.4750 1.4765 1.4780 1.4800

BIds 1.4630 1.4600 1.4580 1.4565 1.4550 1.4530 1.4500

EUR/GBP

Offers 0.7350 0.7370 0.7385 0.740 0.7420 0.7435 0.7450

BIds 0.7320 0.7300 0.7275-80 0.7250 0.7230 0.7200

EUR/JPY

Offers 127.30 127.50 127.75 128.00 128.20 128.50 128.75 129.00

BIds 127.00 126.80 126.50 126.30 126.00 125.85 125.50

USD/JPY

Offers 118.80-85 119.00 119.30 119.60 119.80 120.00 120.20-25 120.50

BIds 118.35-40 118.20 118.00 117.80-85 117.50 117.25-30 117.00

AUD/USD

Offers 0.7100 0.7120-25 0.7150 0.7165 0.7185 0.7200 0.7220-25 0.7250

BIds 0.7075-80 0.7050 0.7030 0.7000 0.6985 0.6950

-

13:00

U.S.: MBA Mortgage Applications, December -11.6%

-

11:52

Spain’s services PMI falls to 55.1 in December

Markit Economics released final services purchasing managers' index (PMI) for Spain on Wednesday. Spain's final services purchasing managers' index (PMI) fell to 55.1 in December from 56.7 in November.

The index was driven by a slower growth in new business.

"The Spanish service sector ended 2015 with a sense of optimism, according to the latest PMI survey. The data, collected prior to the general election on December 20th, signalled a further sharp rise in business activity, and improved optimism that growth will be maintained during 2016," Senior Economist at Markit Andrew Harker said.

-

11:45

Italy’s services PMI remains climbs to 55.3 in December

Markit/ADACI's services purchasing managers' index (PMI) for Italy climbed to 55.3 in December from 53.4 in November.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in total activity, new business and job creation.

"With data showing further solid gains in new business and the pace of job creation strengthening, businesses head into 2016 in much finer fettle than that which they began 2015," an economist at Markit Phil Smith said.

-

11:40

France's final services PMI declines to 49.8 in December

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) dropped to 49.8 in December from 51.0 in November, down from the preliminary reading of 50.0.

The index was driven by a slowdown in new business growth and in backlogs of work.

"The French service sector broadly stagnated in December, ending a ten-month run of expanding activity. Anecdotal evidence suggested that a number of businesses continued to be affected by cancellations following the recent terrorist attacks, exerting a drag on new business growth," Senior Economist at Markit Jack Kennedy said.

-

11:36

French consumer confidence index remains unchanged at 96 in December

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index remained unchanged at 96 in December, beating expectations for a decline to 95.

The index of the outlook on consumers' saving capacity remained unchanged at -4 in December.

The index of households' assessment of their financial situation in the past twelve months fell to -25 in December from -24 in November.

The index of the outlook on consumers' financial situation for next twelve months increased to -7 in December from-10 in November.

The index of the outlook on unemployment rising in coming months rose to 46 in December from 35 in November.

The index for future inflation expectations was up to -38 in December from -41 in November.

-

11:30

Germany's final services PMI rises to 56.0 in December, the highest level since July 2014

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) rose to 56.0 in December from 55.6 in November, up from the preliminary reading of 55.4. It was the highest level since July 2014.

The index was driven by a rise in new business.

"The upturn in Germany's service sector continued at the year-end with activity increasing at the strongest rate in nearly one-and-a-half years. Moreover, the combination of strongly rising new business levels and a further accumulation of work outstanding suggests that companies will remain in expansion mode as we move into 2016," an economist at Markit, Oliver Kolodseike, said.

-

11:28

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.00 (USD 669m) 119.50 (711m) 120.00 (308m) 120.25 (401m)

EUR/USD 1.0750 (EUR 350m) 1.0800 (EUR 740m) 1.0905 (676m) 1.0925 (854m)

AUD/USD 0.7275 (AUD 991m)

NZD/USD 0.6380 (NZD 711m) 0.6700 (250m)

-

11:23

Eurozone's producer price index declines 0.2% in November

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.2% in November, in line with expectations, after a 0.3% decrease in October.

Intermediate goods prices fell 0.3% in November, capital goods prices were flat, non-durable consumer goods prices declined 0.2%, and durable consumer goods prices were stable, while energy prices decreased 0.3%.

On a yearly basis, Eurozone's producer price index dropped 3.2% in November, missing expectations for a 3.1% decrease, after a 3.2% fall in October. October's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in November. Energy prices dropped at an annual rate of 9.4%.

-

11:12

Eurozone's final services PMI remains unchanged at 54.2 in December

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) remained unchanged at 54.2 in December, up from the preliminary reading of 53.9.

The index was driven by a rise in business activity in Germany, Italy, Spain and Ireland.

Eurozone's final composite output index rose to 54.3 in December from 54.2 in November, up from the preliminary reading of 54.0.

"The Eurozone economy starts 2016 on a solid footing and well placed to enjoy a year of robust expansion. Growth of business activity continued to edge higher at the end of 2015, with an upturn in the PMI rounding off the strongest quarter for four and-a-half years," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy grew at 0.4% in the fourth quarter and 1.5% in 2015.

-

11:00

Eurozone: Producer Price Index (YoY), November -3.2% (forecast -3.1%)

-

11:00

Eurozone: Producer Price Index, MoM , November -0.2% (forecast -0.2%)

-

10:53

UK’s services PMI falls to 55.5 in December

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. declined to 55.5 in December from 55.9 in November, missing expectations for a fall to 55.6.

A reading above 50 indicates expansion in the sector.

The decline was driven by a slower growth in new business and job creation.

"The services sector remained the key driver of the UK's economic upturn in December, helping to offset the recent weakness seen in manufacturing and putting the economy on the starting block for another year of 2-2.5% growth in 2016," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy expanded 0.5% in the fourth quarter of 2015.

-

10:47

North Korea successfully tests hydrogen nuclear bomb

North Korea announced on Wednesday morning that it successfully tested hydrogen nuclear bomb. The announcement followed detection of a 5.1 magnitude earthquake. It would be the fourth nuclear test since 2006.

The governments of Japan and South Korea have expressed concerns about the North Korean test, calling it a threat to its security.

North Korea's actions will be discussed at an emergency meeting of the UN today.

-

10:33

European Central Bank Executive Board member Peter Praet: the central bank will continue its quantitative easing until the 2% inflation target will be reached

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview with Belgian weekly magazine Knack that the central bank will continue its quantitative easing until the 2% inflation target will be reached.

"If we look at the economic situation, I think that the current policy will certainly be in place until March 2017 and longer if necessary," he said.

-

10:30

United Kingdom: Purchasing Manager Index Services, December 55.5 (forecast 55.6)

-

10:12

Chinese Markit/Caixin services PMI falls to 50.2 in December

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3.

The index was driven by a subdued client demand.

Recruitment at services continued to rise in December, while backlogs of work were little-changed.

"In light of the setback to services sector growth, the government needs to gradually relax restrictions in the sector. This will release the potential of supply-side reform, improve the economic structure and help with the industrial transformation and upgrading," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:00

Eurozone: Services PMI, 54.2 (forecast 53.9)

-

09:55

Germany: Services PMI, December 56 (forecast 55.4)

-

09:50

France: Services PMI, 49.8 (forecast 50)

-

08:45

France: Consumer confidence , December 96 (forecast 95)

-

08:30

Options levels on wednesday, January 6, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0840 (2813)

$1.0813 (1535)

$1.0772 (1184)

Price at time of writing this review: $1.0732

Support levels (open interest**, contracts):

$1.0700 (2761)

$1.0670 (4892)

$1.0633 (3355)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 55654 contracts, with the maximum number of contracts with strike price $1,1100 (7169);

- Overall open interest on the PUT options with the expiration date January, 8 is 73813 contracts, with the maximum number of contracts with strike price $1,0450 (8033);

- The ratio of PUT/CALL was 1.33 versus 1.33 from the previous trading day according to data from January, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.4901 (477)

$1.4801 (533)

$1.4704 (198)

Price at time of writing this review: $1.4649

Support levels (open interest**, contracts):

$1.4597 (827)

$1.4499 (208)

$1.4400 (132)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 21147 contracts, with the maximum number of contracts with strike price $1,5100 (2007);

- Overall open interest on the PUT options with the expiration date January, 8 is 19196 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.91 versus 0.92 from the previous trading day according to data from January, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:13

Foreign exchange market. Asian session: the yen advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:45 China Markit/Caixin Services PMI December 51.2 52.3 50.2

The yen rose against the U.S. dollar to the highest level since October 15 as risk sentiment declined after Chinese authorities set the exchange rate of the yuan lower today. The People's Bank of China has lowered the rate to 6.5314 yuan per dollar from 6.5169 yuan per dollar yesterday.

New Zealand and Australian dollars declined after data showed that Markit/Caixin Services PMI for China declined to 50.2 points in December from 51.2 reported previously. Economists had expected a reading of 52.3. This means that activity growth has slowed down. Recently a corresponding index for manufacturers declined. Investors are concerned over China's ability to meet its growth target this year.

The Australian dollar was also weighed by domestic data. The AIG Services Index fell to 46.3 points in December (the weakest result since November 2014) from 48.2 reported previously.

EUR/USD: the pair declined to $1.0733 in Asian trade

USD/JPY: the pair fell to Y118.71

GBP/USD: the pair fell to $1.4648

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Consumer confidence December 96 95

08:50 France Services PMI (Finally) 51 50

08:55 Germany Services PMI (Finally) December 55.6 55.4

09:00 Eurozone Services PMI (Finally) 54.2 53.9

09:30 United Kingdom Purchasing Manager Index Services December 55.9 55.6

10:00 Eurozone Producer Price Index, MoM November -0.3% -0.2%

10:00 Eurozone Producer Price Index (YoY) November -3.1% -3.1%

12:00 U.S. MBA Mortgage Applications December

13:15 U.S. ADP Employment Report December 217 192

13:30 Canada Trade balance, billions November -2.76 -2.6

13:30 U.S. International Trade, bln November -43.89 -44

14:45 U.S. Services PMI (Finally) December 56.1 55.1

15:00 U.S. ISM Non-Manufacturing January 55.9 56

15:00 U.S. Factory Orders November 1.5% -0.2%

15:30 U.S. Crude Oil Inventories January 2.629 -1.5

19:00 U.S. FOMC meeting minutes

-

02:45

China: Markit/Caixin Services PMI, December 50.2 (forecast 52.3)

-

00:29

Currencies. Daily history for Jan 5’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0747 -0,77%

GBP/USD $1,4673 -0,27%

USD/CHF Chf1,0084 +0,63%

USD/JPY Y119,04 -0,33%

EUR/JPY Y127,96 -1,09%

GBP/JPY Y174,69 -0,60%

AUD/USD $0,7159 -0,41%

NZD/USD $0,6703 -0,70%

USD/CAD C$1,3994 +0,30%

-

00:01

Schedule for today, Wednesday, Jan 6’2016:

(time / country / index / period / previous value / forecast)

01:45 China Markit/Caixin Services PMI December 51.2

07:45 France Consumer confidence December 96 95

08:50 France Services PMI (Finally) 51 50

08:55 Germany Services PMI (Finally) December 55.6 55.4

09:00 Eurozone Services PMI (Finally) 54.2 53.9

09:30 United Kingdom Purchasing Manager Index Services December 55.9 55.6

10:00 Eurozone Producer Price Index, MoM November -0.3% -0.2%

10:00 Eurozone Producer Price Index (YoY) November -3.1% -3.1%

12:00 U.S. MBA Mortgage Applications December 7.3%

13:15 U.S. ADP Employment Report December 217 190

13:30 Canada Trade balance, billions November -2.76 -2.6

13:30 U.S. International Trade, bln November -43.89 -44

14:45 U.S. Services PMI (Finally) December 56.1 53.7

15:00 U.S. ISM Non-Manufacturing January 55.9 56

15:00 U.S. Factory Orders November 1.5% -0.2%

15:30 U.S. Crude Oil Inventories January 2.629

19:00 U.S. FOMC meeting minutes

-