Noticias del mercado

-

21:00

Dow +0.35% 16,456.61 +58.04 Nasdaq +0.62% 4,666.60 +28.61 S&P +0.33% 1,929.98 +6.31

-

18:37

National Federation of Independent Business’s small-business optimism index for the U.S. rises to 95.2 in December

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index rose to 95.2 in December from 94.8 in November.

6 of 10 sub-indexes rose last month, 3 sub-index fell, while one sub-index was flat.

"In December, Congress made expensing permanent and passed other favorable tax changes that had an immediate impact on bottom lines. However, prospects for any other substantive policy changes in 2016 are not good," NFIB Chief Economist Bill Dunkelberg said.

-

18:31

European Central Bank (ECB) Governing Council member Josef Bonnici: low oil prices have positive and negative effects

European Central Bank (ECB) Governing Council member Josef Bonnici said on Tuesday that low oil prices have positive and negative effects.

"The oil price fall has some positive impacts through raising the purchasing power of euro zone households, he said.

"There is also an impact on inflation, not in the desired direction," Bonnici added.

-

18:26

François Villeroy de Galhau, the European Central Bank (ECB) Governing Council member and Governor of the Banque de France: keeping interest rates low too long could lead to the next financial crisis

François Villeroy de Galhau, the European Central Bank (ECB) Governing Council member and Governor of the Banque de France, said in a speech on Tuesday that keeping interest rates low too long could lead to the next financial crisis.

"Staying too low for too long may fuel the next financial crisis as liquidity addiction and excess risk taking eventually lead to bubbles and financial instability," he said.

Villeroy de Galhau pointed out that the central bank's quantitative easing will around half a point to inflation in 2016 and almost the same to economic growth in the Eurozone.

He said in an interview with Bloomberg Television in Paris on Tuesday that inflation in the Eurozone remains too low, adding that the central bank has tools to expand its stimulus measures if needed.

-

18:14

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes pared back early gains on Tuesday as oil prices reversed course, but gains in Apple and healthcare stocks provided support. Crude prices retreated back toward $30 per barrel, which led to a 0.75% drop in the energy sector, making them the worst performing among the 10 major S&P sectors.

Most of Dow stocks in negative area (17 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -1,67%). Top gainer - UnitedHealth Group Incorporated (UNH, +2.01%).

S&P sectors mixed. Top looser - Basic Materials (-1,6%). Top gainer - Healthcare (+0,7%).

At the moment:

Dow 16320.00 +33.00 +0.20%

S&P 500 1919.75 +5.50 +0.29%

Nasdaq 100 4303.75 +30.75 +0.72%

Oil 30.31 -1.10 -3.50%

Gold 1086.00 -10.20 -0.93%

U.S. 10yr 2.13 -0.03

-

18:08

European stocks close: stocks closed higher despite falling oil prices

Stock indices closed higher despite falling oil prices. The stabilisation of the Chinese stock markets supported the European markets. The People's Bank of China (PBoC) intervened in the offshore yuan market on Tuesday. The offshore yuan strengthened after the intervention. The price gap against the dollar with the onshore yuan was eliminated.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in November, missing expectations for a 0.1% gain, after a 0.4% decrease in October.

Manufacturing output was mainly driven by a drop in basic pharmaceutical products and pharmaceutical preparations, which plunged by 4.9% in November.

On a yearly basis, manufacturing production in the U.K. decreased 1.2% in November, missing forecast of a 0.8% fall, after a 0.2% drop in October. October's figure was revised down from a 0.1% decrease.

Industrial production in the U.K. slid 0.7% in November, missing forecasts of a flat reading, after a 0.1% rise in October.

The decline was driven by a demand for energy. Electricity and gas output plunged 2.1% in November.

On a yearly basis, industrial production in the U.K. gained 0.9% in November, missing expectations for a 1.7% rise, after a 1.7% increase in October.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.6% in three months to December, after a 0.6% growth in three months to November.

According to the NIESR, the U.K. economy grew 2.2% in 2015, after a 2.9% rise in 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,929.24 +57.41 +0.98 %

DAX 9,985.43 +160.36 +1.63 %

CAC 40 4,378.75 +66.01 +1.53 %

-

17:45

WSE: Session Results

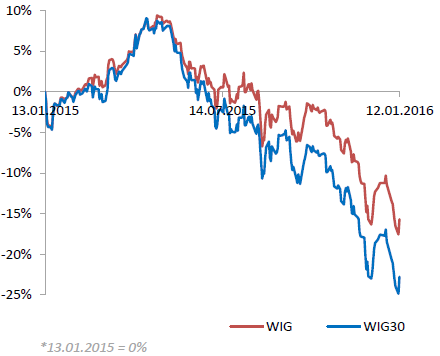

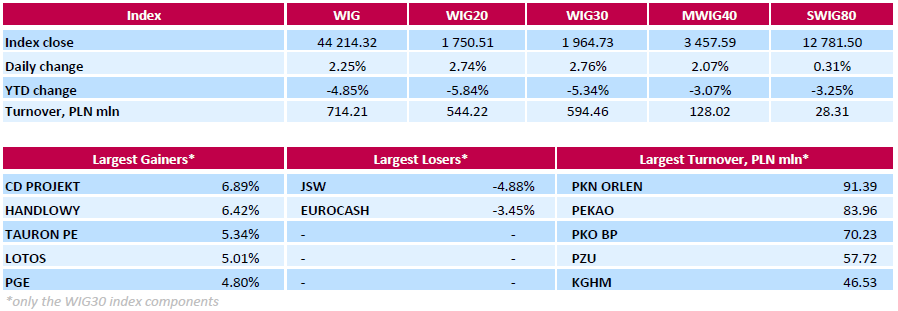

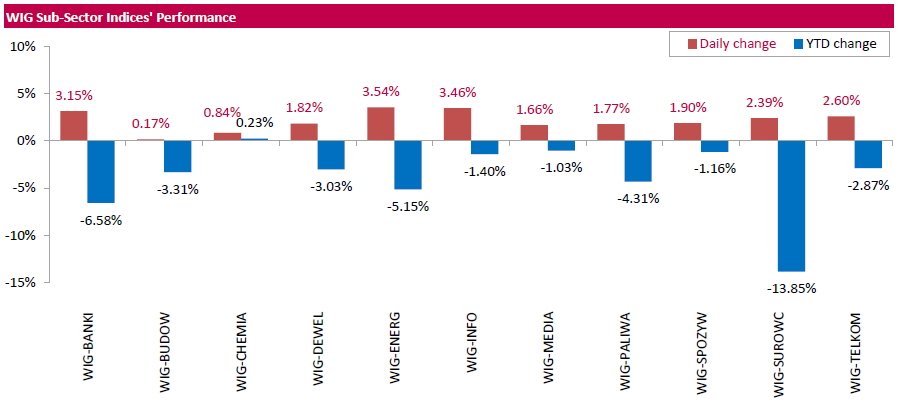

Polish equity market surged on Tuesday. The broad market measure, the WIG index, rose by 2.25%. All sectors in the WIG gained, with utilities (+3.54%) and IT-sector (+3.46%) outperforming.

The large-cap stocks' measure, the WIG30 Index, gained 2.76%. Only two index constituents generated losses: coking coal producer JSW (WSE: JSW) dropped by 4.88% and FMCG wholesaler EUROCASH (WSE: EUR) declined by 3.45%. On the plus side, videogame developer CD PROJEKT (WSE: CDR) and bank HANDLOWY (WSE: BHW) were the biggest advancers, climbing by 6.89% and 6.42% respectively. Other noticeable risers were oil refiner LOTOS (WSE: LTS) and two gencos TAURON PE (WSE: TPE) and PGE (WSE: PGE), adding 4.8%-5.34%.

-

17:02

Bank of Japan (BoJ) Governor Haruhiko Kuroda: the BoJ’s and the European Central Bank’s (ECB) monetary policies would succeed in the near future

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in his speech notes on Tuesday that the BoJ's and the European Central Bank's (ECB) monetary policies would succeed in the near future.

"I believe that monetary policy in both the euro area and Japan will succeed in the near future, thereby starting a new chapter for macroeconomics," he said.

Kuroda noted that inflation in Japan improved, supported by the labour market. He added that the central bank is only halfway to its 2% inflation target.

Kuroda cancelled his participation in the conference organised by the Bank of France but his speech notes were published on the BoJ's website.

-

16:24

NIESR’s gross domestic product rises by 0.6% in three months to December and by 2.2% in 2015 as whole

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.6% in three months to December, after a 0.6% growth in three months to November.

According to the NIESR, the U.K. economy grew 2.2% in 2015, after a 2.9% rise in 2014.

"The slowdown in the economy last year was largely due to a sharp moderation in growth of the construction sector and public spending, exacerbated by weaker net trade. The year looks to have ended with reasonable growth, close to the economy's long-run potential. There is little spare capacity in the economy, and we expect the output gap to continue to close in 2016," Jack Meaning, NIESR Research Fellow, said.

-

16:11

Job openings climb to 5.431 million in November

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings rose to 5.431 million in November from 5.349 million in October. October's figure was revised down from 5.383 million.

The number of job openings climbed for total private (4.926 million) and for government (506,000) in November from October.

The hires rate was 3.6% in November.

Total separations increased to 4.930 million in November from 4.901 million in October.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:04

The Federal Reserve transfers a record $97.7 billion to the U.S. Treasury

The Federal Reserve said on Monday that it sent a record $97.7 billion of its estimated 2015 net income to the U.S. Treasury. The 2015 figures are preliminary and could be adjusted. Audited figures are expected to be published in March.

The Federal Reserve provided $96.9 billion to the U.S. Treasury last year.

-

15:53

Dallas Fed President Robert Kaplan: it was the right decision to hike interest rates in December

Dallas Fed President Robert Kaplan said in a speech on Monday that it was the right decision to hike interest rates in December, adding that further interest rate hikes should be gradual and depend on the incoming economic data.

"I agree with, and argued for, the decision made in December by the FOMC to increase the federal funds rate … Future removals of accommodation will likely be done gradually and will depend on our ongoing assessment of incoming economic data and overall economic conditions," he said.

Kaplan pointed out that the slowdown in the Chinese economy could have a negative impact on the U.S. economy.

"Slower Chinese growth has the potential to further impact commodity prices and create headwinds for GDP growth in the U.S. and other economies," Dallas Fed president noted.

-

15:41

Japan’s consumer confidence index rises to 42.7 in December

Japan's Cabinet Office released its consumer confidence index on Tuesday. The consumer confidence index rose to 42.7 in December from 42.6 in November, beating expectations for a decline to 42.3.

The increase was driven by rises in 2 of 4 sub-indexes. The overall livelihood sub-index increased to 41.1 in December from 40.9 in November, the income growth sub-index was up to 41.8 from 41.1, the employment sub-index fell to 46.3 from 46.7, while the willingness to buy durable goods sub-index remained unchanged at 41.6.

-

15:34

U.S. Stocks open: Dow +0.69%, Nasdaq +1.00%, S&P +0.74%

-

15:28

Before the bell: S&P futures +0.95%, NASDAQ futures +0.96%

U.S. stock-index futures rallied.

Global Stocks:

Nikkei 17,218.96 -479.00 -2.71%

Hang Seng 19,711.76 -176.74 -0.89%

Shanghai Composite 3,023.19 +6.48 +0.21%

FTSE 5,970.8 +98.97 +1.69%

CAC 4,414.81 +102.07 +2.37%

DAX 10,057.88 +232.81 +2.37%

Crude oil $31.94 (+1.69%)

Gold $1088.50 (-0.70%)

-

15:05

Bank lending in Japan increases 2.2% year-on-year in December

The Bank of Japan released its bank lending data on late Monday evening. Bank lending in Japan increased 2.2% year-on-year in December, after a 2.3% gain in December.

Lending excluding trusts climbed 2.2% year-on-year in December.

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.41

2.32%

68.3K

Apple Inc.

AAPL

100.33

1.83%

588.5K

Twitter, Inc., NYSE

TWTR

19.99

1.73%

33.2K

Starbucks Corporation, NASDAQ

SBUX

58.77

1.64%

10.1K

The Coca-Cola Co

KO

42.25

1.61%

5.4K

Tesla Motors, Inc., NASDAQ

TSLA

211.20

1.61%

12.7K

General Motors Company, NYSE

GM

30.70

1.49%

6.1K

Boeing Co

BA

132.00

1.37%

2.0K

Ford Motor Co.

F

12.94

1.33%

6.4K

Caterpillar Inc

CAT

62.28

1.32%

0.6K

Yandex N.V., NASDAQ

YNDX

13.03

1.32%

11.6K

E. I. du Pont de Nemours and Co

DD

59.95

1.30%

4.1K

Yahoo! Inc., NASDAQ

YHOO

30.55

1.26%

15.8K

JPMorgan Chase and Co

JPM

59.54

1.21%

0.4K

Google Inc.

GOOG

724.68

1.21%

8.4K

Facebook, Inc.

FB

98.67

1.19%

242.9K

American Express Co

AXP

64.80

1.17%

0.3K

Citigroup Inc., NYSE

C

47.38

1.13%

26.1K

Visa

V

74.75

1.12%

6.2K

Exxon Mobil Corp

XOM

74.50

1.10%

3.6K

Amazon.com Inc., NASDAQ

AMZN

624.51

1.10%

31.3K

Intel Corp

INTC

32.41

1.09%

62.8K

Goldman Sachs

GS

167.52

1.08%

1.6K

Microsoft Corp

MSFT

52.86

1.07%

69.1K

Nike

NKE

60.18

1.06%

0.3K

Pfizer Inc

PFE

31.40

1.06%

0.4K

Chevron Corp

CVX

81.60

1.03%

3.4K

Cisco Systems Inc

CSCO

25.53

1.03%

0.8K

Wal-Mart Stores Inc

WMT

64.85

0.98%

0.8K

McDonald's Corp

MCD

117.74

0.90%

0.5K

Merck & Co Inc

MRK

51.70

0.88%

0.8K

ALCOA INC.

AA

8.07

0.88%

54.1K

Home Depot Inc

HD

126.88

0.87%

1.2K

Walt Disney Co

DIS

100.75

0.83%

3.1K

Procter & Gamble Co

PG

77.30

0.82%

0.2K

Johnson & Johnson

JNJ

98.35

0.80%

0.3K

General Electric Co

GE

28.80

0.77%

33.0K

International Business Machines Co...

IBM

134.19

0.72%

0.9K

Verizon Communications Inc

VZ

45.40

0.69%

0.1K

ALTRIA GROUP INC.

MO

59.85

0.66%

1.3K

UnitedHealth Group Inc

UNH

110.22

0.58%

0.5K

AT&T Inc

T

34.13

0.53%

10.8K

FedEx Corporation, NYSE

FDX

133.00

0.02%

0.1K

Barrick Gold Corporation, NYSE

ABX

8.05

-1.23%

9.3K

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Coca-Cola (KO) upgraded to Buy from Hold at Stifel; target $54

Intel (INTC) upgraded to Buy from Neutral at Mizuho; target $37

Apple (AAPL) upgraded to Buy from Neutral at BofA/Merrill; target $130

Downgrades:

Freeport-McMoRan (FCX) downgraded to Hold from Buy at Jefferies

Other:

Amazon (AMZN) target raised to $800 from $777 at Credit Suisse

Apple (AAPL) remains Top Pick for 2016 at Piper Jaffray; target $179, Overweight

Intel (INTC) resumed with a Overweight at JP Morgan; target $40

Alphabet A (GOOGL) target raised to $900 from $850 at Credit Suisse

-

14:41

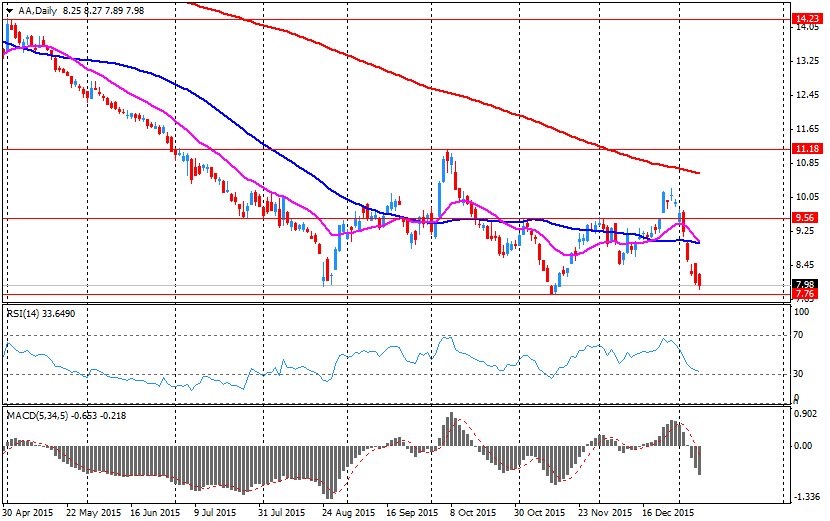

Company News: Alcoa (AA) Q4 Earnings Beats Expectations

Alcoa (AA) reported Q4 earnings of $0.04 per share (versus $0.33 in Q4 FY 2014), beating analysts' consensus of $0.01.

The company's revenues amounted to $5.245 bln (-17.8% y/y), generally inline with consensus estimate of $5.278 bln. Alcoa noted that its strong productivity gains were more than offset by lower aluminum and alumina prices, which fell by a respective 28% y/y and 43% y/y in 2015.

The company also announced that its business separation into two publicly traded cos is expected to be completed in the second half of 2016.

AA fell to $7.98 (-0.25%) in pre-market trading.

-

14:34

Japan’s Eco Watchers' current conditions index climbs to 48.7 in December

Japan's Cabinet Office released Eco Watchers' Index figures on Tuesday. Japan's economy watchers' current conditions index climbed to 48.7 in December from 46.1 in November, exceeding expectations for a rise to 46.7.

Japan's economy watchers' future conditions index remained unchanged at 48.2 in December.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

12:00

European stock markets mid session: stocks traded higher as the Chinese stock markets seemed to stabilise

Stock indices traded higher as the Chinese stock markets seemed to stabilise. The People's Bank of China (PBoC) intervened in the offshore yuan market on Tuesday. The offshore yuan strengthened after the intervention. The price gap against the dollar with the onshore yuan was eliminated. The intervention helped to stabilised the markets.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in November, missing expectations for a 0.1% gain, after a 0.4% decrease in October.

Manufacturing output was mainly driven by a drop in basic pharmaceutical products and pharmaceutical preparations, which plunged by 4.9% in November.

On a yearly basis, manufacturing production in the U.K. decreased 1.2% in November, missing forecast of a 0.8% fall, after a 0.2% drop in October. October's figure was revised down from a 0.1% decrease.

Industrial production in the U.K. slid 0.7% in November, missing forecasts of a flat reading, after a 0.1% rise in October.

The decline was driven by a demand for energy. Electricity and gas output plunged 2.1% in November.

On a yearly basis, industrial production in the U.K. gained 0.9% in November, missing expectations for a 1.7% rise, after a 1.7% increase in October.

Current figures:

Name Price Change Change %

FTSE 100 5,935.25 +63.42 +1.08 %

DAX 10,053.27 +228.20 +2.32 %

CAC 40 4,401.66 +88.92 +2.06 %

-

11:48

The People’s Bank of China (PBoC) intervens in the offshore yuan market

The People's Bank of China (PBoC) intervened in the offshore yuan market on Tuesday. The offshore yuan strengthened after the intervention. The price gap against the dollar with the onshore yuan was eliminated. The intervention helped to stabilised the markets.

-

11:33

BRC and KPMG sales monitor: U.K. retail sales rise by an annual rate of 0.1% on a like-for-like basis in December

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales increased by an annual rate of 0.1% on a like-for-like basis in December, after a 0.4% decline in November.

On a total basis, retail sales climbed 1.0% year-on-year in December.

"2015 drew to a disappointing close for retailers, with December seeing just 1 per cent sales growth, notwithstanding the strong underlying momentum of an improving consumer environment buoyed by rising real incomes, low inflation and low unemployment," BRC Chief Executive, Helen Dickinson, said.

-

11:15

Bank of France expects the French economy to expand 0.3% in the fourth quarter

The Bank of France cuts its growth forecast for the fourth quarter on Tuesday. The central bank expects the French economy to expand 0.3% in the fourth quarter, unchanged from the previous estimate.

The manufacturing business confidence index increased to 99 in December from 98 in November.

The services business sentiment index remained unchanged at 96 in December.

The construction business sentiment index remained unchanged at 96 in December.

-

11:04

U.K. manufacturing production falls 0.4% in November, while industrial production drops 0.7%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in November, missing expectations for a 0.1% gain, after a 0.4% decrease in October.

Manufacturing output was mainly driven by a drop in basic pharmaceutical products and pharmaceutical preparations, which plunged by 4.9% in November.

On a yearly basis, manufacturing production in the U.K. decreased 1.2% in November, missing forecast of a 0.8% fall, after a 0.2% drop in October. October's figure was revised down from a 0.1% decrease.

Industrial production in the U.K. slid 0.7% in November, missing forecasts of a flat reading, after a 0.1% rise in October.

The decline was driven by a demand for energy. Electricity and gas output plunged 2.1% in November.

On a yearly basis, industrial production in the U.K. gained 0.9% in November, missing expectations for a 1.7% rise, after a 1.7% increase in October.

-

10:40

China’s economy likely expands 7.0% in 2015

Li Pumin, spokesman for China's National Reform and Development Commission (NDRC), said on Tuesday that China achieved its main economic targets in 2015. The economy likely expanded 7.0% in 2015 and added 13 million new jobs.

Official fourth-quarter and full-year 2015 figures will be released on Monday.

-

10:21

Atlanta Fed President Dennis Lockhart: there will be not enough data on inflation to raise interest rate in January or March

Atlanta Fed President Dennis Lockhart said after a speech in Atlanta on Monday that there will be not enough data on inflation to raise interest rate in January or March.

""How much will we know about inflation trends or developments going into the mid-March meeting? We will have some new data but not a great deal more," he said.

Lockhart pointed out in his speech that he does not think turmoil abroad will have impact on the U.S. economy.

"When such volatility develops, I think it's helpful to look at the real economy of the United States (as opposed to the financial economy) and ask if something is fundamentally wrong. Are there serious imbalances that make the broad economy vulnerable to foreign shocks? I don't see that kind of connection in current circumstances," Atlanta Fed president noted.

-

10:10

Japan’s current account surplus declines to ¥1,143.5 billion in November

Japan's Ministry of Finance released its current account data for Japan late Monday evening. Japan's current account surplus fell to ¥1,143.5 billion in November from ¥1,458.4 billion in October, beating expectations for a surplus of ¥858.5 billion.

The goods trade surplus turned into a deficit of ¥271.5 billion in November, down from a surplus of ¥200.2 billion in October.

Exports dropped at an annual rate of 6.3% in November, while imports plunged 10.9%.

-

07:19

Global Stocks: U.S. stock indices fell

U.S. stock indices climbed from session's lows to close mixed.

The Dow Jones Industrial Average gained 52.12 points, or 0.3%, to 16,398.57. The S&P 500 climbed 1.64 point, or less than 0.1%, to 1,923.67. The Nasdaq Composite edged down 5.64 points, or 0.1%, to 4,637.99.

Stocks were partly influenced by comments by a Federal Reserve's official, who said that worsening of the economic situation overseas does not undermine strength of the U.S. economy. These words pointed to a possibility of an additional rate hike this year.

This morning in Asia Hong Kong Hang Seng declined 0.30%, or 60.48, to 19,828.02. China Shanghai Composite Index rose 0.73%, or 22.08, to 3,038.79. The Nikkei lost 2.76%, or 488.14, to 17,209.82.

Asian stocks traded mixed. Japanese stocks fell amid global selloff seen in the last few days and a stronger yen.

Chinese stocks rose after a governmental official expressed optimism about the country's economic growth and inflation.

-

03:04

Nikkei 225 17,426.16 -271.80 -1.54 %, Hang Seng 20,086.77 +198.27 +1.00 %, Shanghai Composite 3,032.15 +15.45 +0.51 %

-

00:32

Stocks. Daily history for Sep Jan 11’2016:

(index / closing price / change items /% change)

Hang Seng 19,888.5 -565.21 -2.76 %

Shanghai Composite 3,018 -168.42 -5.29 %

FTSE 100 5,871.83 -40.61 -0.69%

CAC 40 4,312.74 -21.02 -0.49 %

Xetra DAX 9,825.07 -24.27 -0.25 %

S&P 500 1,923.67 +1.64 +0.09 %

NASDAQ Composite 4,637.99 -5.64 -0.12 %

Dow Jones 16,398.57 +52.12 +0.32 %

-