Noticias del mercado

-

21:00

Dow -0.90% 16,022.22 -145.01 Nasdaq -1.82% 4,484.52 -83.15 S&P -0.88% 1,886.84 -16.79

-

18:43

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock indexes mixed on Wednesday as Apple's disappointing forecast and oil prices comeback, ahead of the Federal Reserve's statement on monetary policy.

Apple's shares were down 4% after the company also reported its slowest-ever rise in iPhone shipments on Tuesday. The stock was the biggest influence on the S&P 500 and the Nasdaq.

Oil futures turned higher after trading down as much as 4%, near $30 a barrel as data showed a jump in weekly demand for products such as heating oil when a cold front hit the country, although analysts said the rise in prices may not last long.

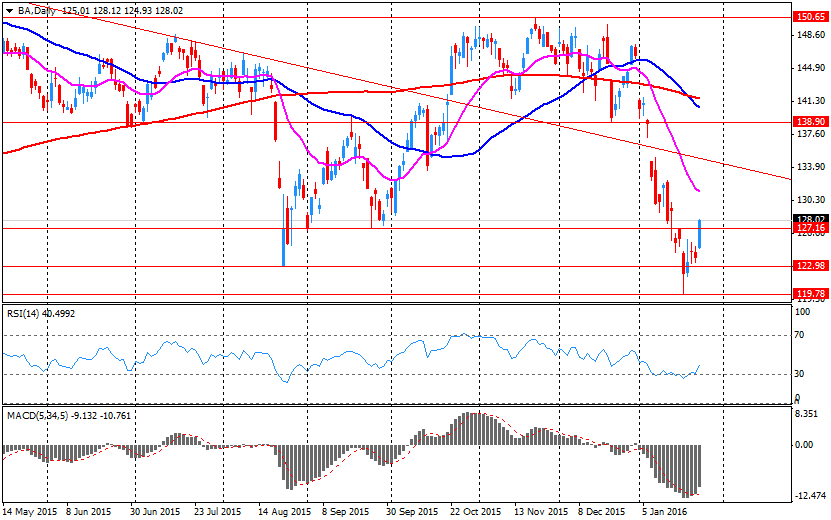

Almost all of Dow stocks in positive area (24 of 30). Top looser - The Boeing Company (BA, -6,68%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,46%).

Almost all S&P sectors also in positive area. Top gainer - Basic Materials (+1,6%).

At the moment:

Dow 16121.00 +55.00 +0.34%

S&P 500 1905.50 +9.50 +0.50%

Nasdaq 100 4206.50 -20.25 -0.48%

Oil 32.73 +1.28 +4.07%

Gold 1117.40 -2.80 -0.25%

U.S. 10yr 2.04 +0.05

-

18:00

European stocks close: stocks closed lower ahead of the release of the Fed's monetary policy meeting results

Stock indices traded lower ahead of the release of the Fed's monetary policy meeting results later in the day. Analysts expect the Fed to keep its monetary policy unchanged.

The European Central Bank (ECB) Executive Board member Benoît Cœuré said on Wednesday that Eurozone's countries should use fiscal space to boost the economic growth in the Eurozone.

"Using fiscal space would speed up the euro area's return to growth and support the ECB's objective of medium-term price stability. But, in many countries, such fiscal space simply does not exist, because rules have not been enforced in the past," he said.

Meanwhile, the economic data from the Eurozone was better than expected. Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index remained unchanged at 9.4 in February, beating expectations for a drop to 9.3.

"The consumer climate has therefore been able to withstand the recent growth in risks it is facing. However, in the next few months the escalating terror threat and the rising fears among certain groups of the population that Germany could eventually become overstretched by the persistently high influx of refugees and asylum seekers may cause consumer confidence to wane in the long term. In turn, this would have a lasting impact on the consumer climate," Gfk noted.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index rose to 97 in January from 96 in December. Analysts had expected the index to remain unchanged at 96.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals decreased to 43,975 in December from 44,533 in November, missing expectations for a rise to 45,500. November's figure was revised up from 45,437.

"Last year was a strong year for household borrowing. There was a 6% rise in mortgage borrowing compared to 2014 and consumer credit expanded at more than 5% annually within an overall unsecured market which is growing at nearly 10% annually," the chief economist at the BBA, Richard Woolhouse, said.

The Nationwide Building Society released its house prices data for the U.K. on Wednesday. UK house prices were up 0.3% in January, missing expectations for a 0.6% rise, after a 0.8% increase in December.

On a yearly basis, house prices fell to 4.4% in January from 4.5% in December. Analysts had expected house prices to rise by 4.7%.

"As we look ahead, the risks are skewed towards a modest acceleration in house price growth, at least at the national level, Robert Gardner, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,990.37 +78.91 +1.33 %

DAX 9,880.82 +58.07 +0.59 %

CAC 40 4,380.36 +23.55 +0.54 %

-

17:50

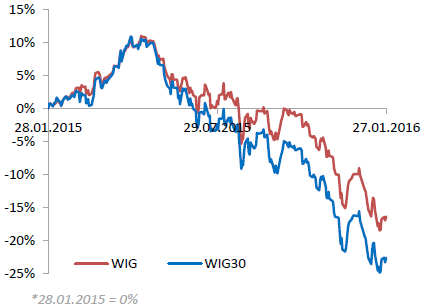

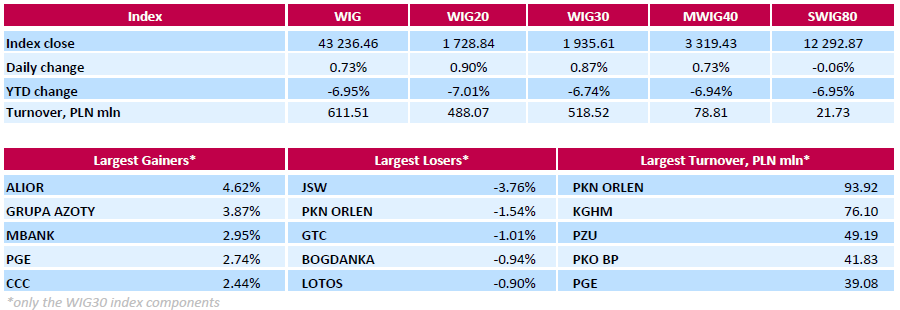

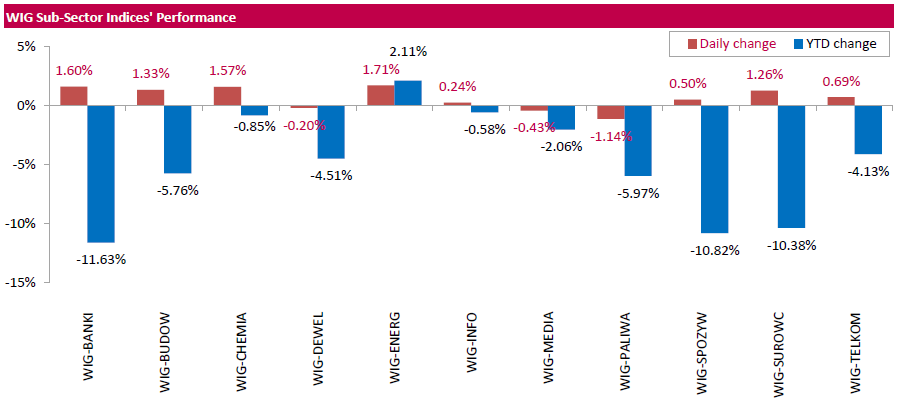

WSE: Session Results

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, added 0.73%. Sector-wise, utilities stocks (+1.71%) fared the best, while oil and gas sector names (-1.14%) tumbled the most.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.87%. Within the index components, bank ALIOR (WSE: ALR) led the gainers with a 4.62% surge. It was followed by chemical producer GRUPA AZOTY (WSE: ATT), bank MBANK (WSE: MBK) and genco PGE (WSE: PGE), which grew by 3.87%, 2.95% and 2.74% respectively. At the same time, the session's biggest decliners were coking coal miner JSW (WSE: JSW), oil refiner PKN ORLEN (WSE: PKN) and property developer GTC (WSE: GTC), which fell by 3.76%, 1.54% and 1.01% respectively.

-

17:16

European Central Bank Executive Board member Benoît Cœuré: Eurozone’s countries should use fiscal space to boost the economic growth in the Eurozone

The European Central Bank (ECB) Executive Board member Benoît Cœuré said on Wednesday that Eurozone's countries should use fiscal space to boost the economic growth in the Eurozone.

"Using fiscal space would speed up the euro area's return to growth and support the ECB's objective of medium-term price stability. But, in many countries, such fiscal space simply does not exist, because rules have not been enforced in the past," he said.

-

16:27

Fitch cuts New Zealand’s outlook to "stable" from "positive"

Rating agency Fitch Ratings affirmed New Zealand's sovereign debt rating at 'AA' on Tuesday, but downgraded the outlook to "stable" from "positive". The reason for the downgrade was a weaker growth outlook.

"Fitch expects a slight rebound in business investment from its currently subdued level, and continued high net immigration levels to support consumption growth. We assume this will be partly offset by lower dairy production and slower residential investment growth, with stronger construction activity in Auckland unable to fully replace a decreasing contribution from the Canterbury rebuild," the agency said.

-

16:20

New home sales in the U.S. jump 10.8% in December

The U.S. Commerce Department released new home sales data on Wednesday. New home sales increased 10.8% to a seasonally adjusted annual rate of 544,000 units in December from 491,000 units in November. November's figure was revised up from 490,000 units.

Analysts had expected new home sales to reach 500,000 units.

The increase was mainly driven by higher sales in the Midwest. New home sales in the Midwest soared 31.6% in December.

-

15:52

Profits of industrial companies in China drop 4.7% in December

China's National Bureau of Statistics (NBS) said on Wednesday that profits of industrial companies in China declined 4.7% in December from a year earlier, after a 1.4% fall in November.

In 2015 as whole, industrial profits fell 2.3% from a year earlier.

Profits in the mining sector dropped 58.2% in 2015, while manufacturing profits rose 2.8%.

-

15:48

The German government cuts its growth forecasts for 2016

The German government on Wednesday lowered its growth forecasts for 2016 due to the slowdown in emerging economies, which could lead to lower exports. The government expects the German economy to expand 1.7% this year, down from its previous forecast of a 1.8% growth.

Exports are expected to rise 3.2% in 2016, while imports are expected to increase 4.8%.

The government forecasts domestic consumption to rise 1.9% this year.

-

15:35

U.S. Stocks open: Dow -0.84%, Nasdaq -0.50%, S&P -0.44%

-

15:31

Before the bell: S&P futures -0.23%, NASDAQ futures -0.52%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 17,163.92 +455.02 +2.72%

Hang Seng 19,052.45 +191.65 +1.02%

Shanghai Composite 2,736.13 -13.65 -0.50%

FTSE 5,922.47 +11.01 +0.19%

CAC 4,351 -5.81 -0.13%

DAX 9,822.53 -0.22 0.00%

Crude oil $30.76 (-2.19%)

Gold $1118.50 (-0.15%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

FedEx Corporation, NYSE

FDX

130

2.14%

6.2K

Ford Motor Co.

F

11.97

0.93%

30.5K

Facebook, Inc.

FB

97.83

0.50%

109.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.22

0.48%

115.6K

Yandex N.V., NASDAQ

YNDX

13.32

0.45%

1.6K

McDonald's Corp

MCD

120.77

0.28%

3.2K

E. I. du Pont de Nemours and Co

DD

53.46

0.00%

18.5K

AMERICAN INTERNATIONAL GROUP

AIG

55.9

-0.02%

0.3K

Citigroup Inc., NYSE

C

40.49

-0.02%

5.8K

Visa

V

71.85

-0.04%

0.4K

Twitter, Inc., NYSE

TWTR

17

-0.06%

232.1K

Intel Corp

INTC

29.9

-0.13%

70.3K

JPMorgan Chase and Co

JPM

57

-0.14%

0.2K

Procter & Gamble Co

PG

78.6

-0.27%

4.3K

Microsoft Corp

MSFT

52

-0.33%

7.1K

Pfizer Inc

PFE

30.57

-0.33%

0.4K

Walt Disney Co

DIS

95.95

-0.33%

10.8K

Amazon.com Inc., NASDAQ

AMZN

599.04

-0.37%

8.1K

Caterpillar Inc

CAT

58.92

-0.41%

1.1K

American Express Co

AXP

54.86

-0.42%

0.2K

General Electric Co

GE

28.19

-0.42%

2.3K

Nike

NKE

60.85

-0.43%

0.4K

Google Inc.

GOOG

709.71

-0.47%

1K

Yahoo! Inc., NASDAQ

YHOO

29.83

-0.50%

0.7K

Cisco Systems Inc

CSCO

23.6

-0.51%

4.8K

ALCOA INC.

AA

7.1

-0.56%

3.0K

Goldman Sachs

GS

153.5

-0.62%

0.1K

Barrick Gold Corporation, NYSE

ABX

9.47

-0.63%

16.3K

Johnson & Johnson

JNJ

100.49

-0.68%

2.6K

ALTRIA GROUP INC.

MO

58.56

-0.68%

0.1K

Verizon Communications Inc

VZ

47.91

-0.70%

8.4K

Chevron Corp

CVX

83.5

-0.74%

1.1K

Tesla Motors, Inc., NASDAQ

TSLA

192.03

-0.79%

11.5K

Starbucks Corporation, NASDAQ

SBUX

58.11

-0.85%

30.5K

United Technologies Corp

UTX

84.8

-0.99%

8.7K

Exxon Mobil Corp

XOM

75.85

-1.11%

45.5K

Merck & Co Inc

MRK

50.72

-1.42%

1.6K

AT&T Inc

T

34.55

-2.40%

460.0K

Apple Inc.

AAPL

96.87

-3.12%

1.9M

Boeing Co

BA

120.25

-6.06%

259.4K

-

14:57

Australian leading economic index falls 0.3% in December

Westpac Bank released the Westpac-Melbourne Institute leading economic index for Australia on late Tuesday evening. The leading economic index decreased 0.3% in December, after a 0.3% drop in November. November's figure was revised down from a 0.2% fall.

"This is another disappointing result. The Index has now been growing below trend for the last eight months. It continues to signal that growth in the Australian economy in the first half of 2016 will be below trend," Westpac's Chief Economist, Bill Evans, said.

-

14:53

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Buy at Argus; target $140

Downgrades:

Other:

Apple (AAPL) target lowered to $172 from $179 at Piper Jaffray

Apple (AAPL) target lowered to $130 from $150 at FBR Capital

Apple (AAPL) target lowered to $120 from $140 at Stifel

DuPont (DD) resumed with a Neutral at Credit Suisse

-

14:24

Company News: Boeing (BA) Q4 Earnings Beat Analysts’ Estimates

Boeing reported Q4 FY 2015 earnings of $1.60 per share (versus $2.31 in Q4 FY 2014), beating analysts' consensus of $1.27.

The company's quarterly revenues amounted to $23.573 bln (-3.7% y/y), in line with consensus estimate of $23.553 bln.

Boeing issued downside guidance for FY 2016, projecting EPS of $8.15-8.35 (versus analysts' consensus of $9.41) and revenues of $93-95 bln (versus analysts' consensus of $97.26 bln).

-

13:42

Company News: United Tech (UTX) Q4 Earnings Beat Expectations

United Tech reported Q4 FY 2015 earnings of $1.53 per share (versus $1.67 in Q4 FY 2014), beating analysts' consensus of $1.52.

The company's quarterly revenues amounted to $14.300 bln (-4.5% y/y), missing consensus estimate of $15.257 bln.

United Tech reaffirmed guidance for FY 2016, projecting EPS of $6.30-6.60 (versus analysts' consensus of $6.55) and revenues of $56-58 bln (versus analysts' consensus of $57.85 bln).

UTX rose to $85.65 (+0.88%) in in yesterday's trading.

-

12:00

European stock markets mid session: stocks traded lower ahead of the release of the Fed’s monetary policy meeting results

Stock indices traded lower ahead of the release of the Fed's monetary policy meeting results later in the day. Analysts expect the Fed to keep its monetary policy unchanged.

Meanwhile, the economic data from the Eurozone was better than expected. Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index remained unchanged at 9.4 in February, beating expectations for a drop to 9.3.

"The consumer climate has therefore been able to withstand the recent growth in risks it is facing. However, in the next few months the escalating terror threat and the rising fears among certain groups of the population that Germany could eventually become overstretched by the persistently high influx of refugees and asylum seekers may cause consumer confidence to wane in the long term. In turn, this would have a lasting impact on the consumer climate," Gfk noted.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index rose to 97 in January from 96 in December. Analysts had expected the index to remain unchanged at 96.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals decreased to 43,975 in December from 44,533 in November, missing expectations for a rise to 45,500. November's figure was revised up from 45,437.

"Last year was a strong year for household borrowing. There was a 6% rise in mortgage borrowing compared to 2014 and consumer credit expanded at more than 5% annually within an overall unsecured market which is growing at nearly 10% annually," the chief economist at the BBA, Richard Woolhouse, said.

The Nationwide Building Society released its house prices data for the U.K. on Wednesday. UK house prices were up 0.3% in January, missing expectations for a 0.6% rise, after a 0.8% increase in December.

On a yearly basis, house prices fell to 4.4% in January from 4.5% in December. Analysts had expected house prices to rise by 4.7%.

"As we look ahead, the risks are skewed towards a modest acceleration in house price growth, at least at the national level, Robert Gardner, said.

Current figures:

Name Price Change Change %

FTSE 100 5,879.78 -31.68 -0.54 %

DAX 9,768.03 -54.72 -0.56 %

CAC 40 4,332.65 -24.16 -0.55 %

-

11:45

Italian consumer confidence index climbs to 118.9 in January

The Italian statistical office ISTAT released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index climbed to 118.9 in January from 117.7 in December. December's figure was revised up from 117.6.

The increase was driven by rises in all components: economic, personal, current and future.

The business confidence index fell to 103.2 in January from 104.0 in December. December's figure was revised down from 104.1.

The decline was driven by less favourable assessments on order books and production expectations.

-

11:33

UBS consumption index rises to 1.62 in December

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.62 in December from 1.55 in November. November's figure was revised down from 1.66.

The bank expect the consumption to rise.

"Consumer sentiment will likely start the year strong despite a seasonal increase in the unemployment rate in December. As low interest rates provide little incentive to save, people tend to consume more," the bank said.

The bank noted that low consumer prices were driven by low energy prices in general and crude oil in particular.

-

11:27

French consumer confidence index rises to 97 in January

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index rose to 97 in January from 96 in December. Analysts had expected the index to remain unchanged at 96.

The index of the outlook on consumers' saving capacity fell to -6 in January from -5 in December.

The index of households' assessment of their financial situation in the past twelve months rose to -24 in January from -25 in December.

The index of the outlook on consumers' financial situation for next twelve months decreased to -8 in January from -7 in December.

The index of the outlook on unemployment rising in coming months dropped to 34 in January from 45 in December.

The index for future inflation expectations was down to -39 in January from -38 in December.

-

11:20

German Gfk consumer confidence index remains unchanged at 9.4 in February

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index remained unchanged at 9.4 in February, beating expectations for a drop to 9.3.

2 of 3 indicators increased.

The economic expectations index rose by 1.3 points to 4.2 points in January, while the willingness to buy index increased 3.7 points to 52.7.

The income expectations index fell by 3.6 points to 47.2 in January.

"The consumer climate has therefore been able to withstand the recent growth in risks it is facing. However, in the next few months the escalating terror threat and the rising fears among certain groups of the population that Germany could eventually become overstretched by the persistently high influx of refugees and asylum seekers may cause consumer confidence to wane in the long term. In turn, this would have a lasting impact on the consumer climate," Gfk noted.

-

11:10

Nationwide: UK house prices rise 0.3% in January

The Nationwide Building Society released its house prices data for the U.K. on Wednesday. UK house prices were up 0.3% in January, missing expectations for a 0.6% rise, after a 0.8% increase in December.

On a yearly basis, house prices fell to 4.4% in January from 4.5% in December. Analysts had expected house prices to rise by 4.7%.

"As we look ahead, the risks are skewed towards a modest acceleration in house price growth, at least at the national level, Robert Gardner, said.

-

10:56

Number of mortgage approvals in the U.K. declines to 43,975 in December

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals decreased to 43,975 in December from 44,533 in November, missing expectations for a rise to 45,500. November's figure was revised up from 45,437.

"Last year was a strong year for household borrowing. There was a 6% rise in mortgage borrowing compared to 2014 and consumer credit expanded at more than 5% annually within an overall unsecured market which is growing at nearly 10% annually," the chief economist at the BBA, Richard Woolhouse, said.

-

10:29

Consumer prices in Australia climb 0.4% in the fourth quarter

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia rose 0.4% in the fourth quarter, beating expectations for a 0.3% gain, after a 0.5% increase in the third quarter.

The quarterly inflation was mainly driven by higher prices for alcohol and tobacco, clothing and footwear, and recreation and culture.

On a yearly basis, Australia's consumer price inflation rose to 1.7% in the fourth quarter from 1.5% in the third quarter, exceeding expectations for an increase to 1.6%.

The annual inflation was mainly driven by higher prices for alcohol and tobacco, education and health care.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) remained unchanged at 2.1% year-on-year in the fourth quarter, in line with expectations.

-

10:22

JPMorgan & Chase Co.’s chief Asia strategist Adrian Mowat: capital outflows from China could hit $500 billion this year

JPMorgan & Chase Co.'s chief Asia strategist, Adrian Mowat, said on Tuesday that capital outflows from China could hit $500 billion this year. He noted that while China's central bank tries to control the yuan's fall, those holding assets denominated in the yuan could sell to avoid losses.

-

07:19

Global Stocks: U.S. stock indices rose

U.S. stock indices closed higher on Tuesday as stocks continued tracking oil prices.

The Dow Jones Industrial Average gained 282 points, or 1.8%, to 17,167. The S&P 500 rose 26.55 points, or 1.4%, to 1,903 (all of its 10 sectors rose). The Nasdaq Composite rose 49.2 points, or 1.1%, to 4,567.

The S&P's energy sector gained 3.8%, but it's still down 7.8% for the year.

Activity in the services sector of the U.S. economy has slowed its growth at the beginning of the year. A preliminary report by Markit Economics reflected this change. The Services PMI declined to 53.7 in January from 54.3 in December marking the slowest expansion since December 2014, although it still suggests growth.

This morning in Asia Hong Kong Hang Seng rose 0.88%, or 166.31, to 19,027.11. China Shanghai Composite Index plunged 2.56%, or 70.36, to 2,679.43. The Nikkei jumped 2.93%, or 490.36, to 17,199.26.

Asian stock indices traded mixed. Japanese stocks rose on expectations of BOJ's monetary policy easing.

Chinese stocks climbed at the beginning of the session, but dropped sharply later on. Investors are cautious ahead of the end of the Fed meeting.

-

03:03

Nikkei 225 17,176.67 +467.77 +2.80%, Hang Seng 19,187.04 +326.24 +1.73%, Shanghai Composite 2,766.57 +16.78 +0.61% .

-

01:02

Stocks. Daily history for Sep Jan 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,708.9 -402.01 -2.35%

Hang Seng 18,860.8 -479.34 -2.48%

Shanghai Composite 2,751.03 -187.49 -6.38%

FTSE 100 5,911.46 +34.46 +0.59%

CAC 40 4,356.81 +45.48 +1.05%

Xetra DAX 9,822.75 +86.60 +0.89%

S&P 500 1,903.63 +26.55 +1.41%

NASDAQ Composite 4,567.67 +49.18 +1.09%

Dow Jones 16,167.23 +282.01 +1.78%

-