Noticias del mercado

-

18:17

Fed Vice President Stanley Fischer: it is too early to say if the interest rate in September is likely or not due to the recent market turbulences

The Fed Vice President Stanley Fischer said in an interview with CNBC that it is too early to say if the interest rate in September is likely or not due to the recent market turbulences.

"I think it's early to tell: The change in the circumstances which began with the Chinese devaluation is relatively new and we're still watching how it unfolds, so I wouldn't want to go ahead and decide right now what the case is-more compelling, less compelling, etc.," he said.

Fischer noted that the Fed has not decided on its interest rates

The Fed vice president expects the inflation to return to the Fed's 2% target.

He pointed out that the increase in interest rates will be slow.

-

17:05

Greek President Prokopis Pavlopoulous confirms the date of September 20 for the snap election

-

16:28

Thomson Reuters/University of Michigan final consumer sentiment index decreases to 91.9 in August

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 91.9 in August from 93.1 in July, missing the preliminary estimate of 92.9.

The downward revision was driven by the recent turbulences on the markets.

"Overall, the data suggest that real personal consumption expenditures will expand by a still healthy 2.9% in 2015, with the pace of growth rising to 3.0% in 2016. Needless to say, consumer sentiment must be carefully monitored in the months ahead," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index declined to 105.1 in August from 107.2 in July, down from a preliminary reading of 107.1.

The index of consumer expectations fell to 83.4 in August from 84.1 in July, down from a preliminary reading of 83.8.

The inflation expectations for the next year remained unchanged at 2.8% in August.

-

16:15

St. Louis Fed President James Bullard: the U.S. outlook remains good despite the recent turbulences on the markets

St. Louis Fed President James Bullard said in an interview with Bloomberg on Friday that the U.S. outlook remains good despite the recent turbulences on the markets.

"The U.S. outlook still looks very good," he said.

St. Louis Fed president also said that the Fed should start raising its interest rate.

"I've been arguing that we should get going, because interest rates -- it's not that we're a little bit below normal, we're all the way down at zero, so you've got to think about: How is this going to play out over the next two to three years," he said.

Bullard is not a voting member of the Federal Open Market Committee this year.

-

16:02

Minneapolis Fed President Narayana Kocherlakota: the Fed should not raise its interest rate this year

Minneapolis Fed President Narayana Kocherlakota said in an interview with CNBC on Friday that the Fed should not raise its interest rate this year.

"Barring that, I don't see a near-term increase in interest rates as being appropriate, and by near-term I mean really through the course of 2015," he said.

Minneapolis Fed president also said that the inflation in the U.S. remains low, and a slowdown in the global economy is a risk to the U.S. outlook.

He noted that more quantitative easing might be appropriate right now.

Kocherlakota is not a voting member of the Federal Open Market Committee this year. He will leave the Fed at the end of the year.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, August 91.9 (forecast 93)

-

15:50

Federal Reserve Bank of Cleveland President Loretta Mester: the U.S. economy is solid for the interest rate hike despite the recent turbulences on the markets

The Federal Reserve Bank of Cleveland President Loretta Mester said in an interview with The Wall Street Journal on Friday that the U.S. economy is solid for the interest rate hike despite the recent turbulences on the markets.

"I want to take the time I have between now and the September meeting to evaluate all the economic information that's come in, including recent volatility in markets and the reasons behind that. But it hasn't so far changed my basic outlook that the U.S. economy is solid and it could support an increase in interest rates," she said.

Mester is not a voting member of the Federal Open Market Committee this year.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1150(E327mn), $1.1300(E481mn), $1.1355(E1.1bn)

USD/JPY: Y121.00($737mn), Y121.55($360mn), Y122.00-15($723mn)

AUD/USD: $0.7200(A$674mn), $0.7260(A$375mn)

NZD/USD: $0.6500(NZ$251mn)

USD/CAD: C$1.3150($450mn), C$1.3250($431mn), C$1.3350($285mn)

-

15:41

The People's Bank of China injects 60 billion yuan into the financial system

The People's Bank of China (PBoC) injected 60 billion yuan (about €8.3 billion) into the financial system via a short-term liquidity operation on Friday. The central bank wants to support the country's economy and to calm down the markets.

It was the second loan this week. The PBoC has injected 140 billion yuan (about €19 billion) on Wednesday.

-

15:34

Greek producer prices decrease 1.6% in July

The Hellenic Statistical Authority released its producer price index (PPI) data on Friday. Greek producer prices decreased 1.6% in July, after a 0.7% decline in June.

Domestic market prices fell by 1.3%, while foreign market prices slid 2.5%.

On a yearly basis, Greek PPI plunged 6.7% in July, after a 5.7% drop in June.

Domestic market prices slid 5.4% year-on-year in July, while foreign market prices dropped 10.3%.

Energy prices plunged 17.5%, while non-durable consumer goods industrial prices were down 0.1%.

-

15:25

Greek final GDP rises at a seasonally-and-calendar adjusted 0.9% in the second quarter

The Hellenic Statistical Authority released its final gross domestic product (GDP) data for Greece on Friday. The Greek final GDP rose at a seasonally-and-calendar adjusted 0.9% rate in the second quarter, up from the preliminary reading of a 0.8% gain.

The first quarter's figure was revised up to a 0.1% rise from a flat reading.

On a yearly basis, Greek final GDP rose at a seasonally-and-calendar adjusted 1.6% rate in the second quarter, up from the preliminary reading of a 1.4% increase.

The first quarter's figure was revised up to a 0.6% growth from a 0.5% rise.

Final consumption expenditure rose 2.2% year-on-year in the second quarter.

Exports dropped 1.8% in the second quarter, while imports declined 3.5%.

-

15:15

Italian consumer confidence index climbs to 109.0 in July

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. The Italian consumer confidence index climbed to 109.0 in August from 106.7 in July. July's figure was revised up from 106.5.

The increase was driven by rises in economic and personal financial expectations subindices.

-

15:11

Retail sales in Spain rise at a seasonally adjusted rate of 1.3% in July

The Spanish statistical office INE released its retail sales data on Friday. Retail sales in Spain rose at a seasonally adjusted rate of 1.3% in July, after a 0.8% fall in June.

Food sales were up 1.6% in July, while non-food sales climbed by 1.5%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 4.1% in July, after a 2.4% rise in June. Retail sales have been increasing since August 2015.

Sales of non-food products jumped 4.9% in July from a year ago, while food sales rose 1.6%.

-

15:00

U.S. personal spending climbs 0.3% in July

The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending rose 0.3% in July, missing expectations for a 0.4% gain, after a 0.3% increase in June. June's figure was revised up from a 0.2% increase.

Consumer spending makes more than two-thirds of U.S. economic activity.

Personal spending was driven by higher demand for automobiles. Spending on auto mobiles jumped 1.1% in July.

The saving rate rose to 4.9% in July from 4.7% in June.

Personal income increased 0.4% in July, in line with expectations, after a 0.4% gain in June.

Wages and salaries climbed 0.5% in July, the largest increase since November 2014.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in July, in line with forecasts, after a 0.1% gain in June.

On a yearly basis, the PCE price index excluding food and index increased 1.2% in July, the smallest rise since March 2011, after a 1.3% gain in June.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:50

Canadian industrial product price indexes climbs in July, while raw materials prices drop

Statistics Canada released its industrial product and raw materials price indexes on Friday. The Industrial Product Price Index (IPPI) climbed 0.7% in July, beating forecasts for a flat reading, after a 0.5% gain in June.

The increase was driven by higher prices for motorized and recreational vehicles, which rose 2.5% in July.

17 of the 21 commodity groups increased, 2 declined and 2 were unchanged.

The Raw Materials Price Index (RMPI) dropped 5.9% in July, after a 0.2% rise in June.

The decline was driven by lower prices for crude energy products. Crude energy products plunged 13.0% in June.

2 of the 6 commodity groups rose, 3 decreased and 1 were unchanged.

-

14:34

Preliminary consumer price inflation in Spain declines 0.3% in August

The Spanish statistical office INE released its preliminary consumer price inflation data on Friday. Consumer price inflation in Spain was down 0.3% in August, after a 0.9% drop in July.

On a yearly basis, consumer prices fell by 0.4% in August from a year ago, after a 0.1% rise in July.

The decline was mainly driven by the decline in the prices of fuels (gas and diesel oil) and electricity.

-

14:30

Canada: Industrial Product Price Index, y/y, July 0.1%

-

14:30

U.S.: Personal spending , July 0.3% (forecast 0.4%)

-

14:30

Canada: Industrial Product Price Index, m/m, July 0.7% (forecast 0%)

-

14:30

U.S.: Personal Income, m/m, July 0.4% (forecast 0.4%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, July 1.2%

-

14:30

U.S.: PCE price index ex food, energy, m/m, July 0.1% (forecast 0.1%)

-

14:22

German consumer price inflation is flat in August

Destatis released its consumer price data for Germany on Friday. German preliminary consumer price index was flat in August, beating expectations for a 0.1% decline, after a 0.2% rise in July.

On a yearly basis, German preliminary consumer price index remained unchanged at 0.2% in August, in line with expectations.

Higher services prices offset lower goods prices, which were driven by a decline in energy prices.

-

14:11

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the revised GDP data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:45 Switzerland Gross Domestic Product (YoY) Quarter II 1.2% Revised From 1.1% 0.9% 1.2%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter II -0.2% -0.1% 0.2%

08:30 United Kingdom Business Investment, q/q Quarter II 2% 1.7% 2.9%

08:30 United Kingdom GDP, y/y (Revised) Quarter II 2.9% 2.6% 2.6%

08:30 United Kingdom GDP, q/q (Revised) Quarter II 0.4% 0.7% 0.7%

09:00 Eurozone Economic sentiment index August 104 103.8 104.2

09:00 Eurozone Consumer Confidence (Finally) August -7.2 Revised From -7.1 -6.9 -6.9

09:00 Eurozone Business climate indicator August 0.41 Revised From 0.39 0.34 0.21

09:00 Eurozone Industrial confidence August -2.9 -3.1 -3.7

12:00 Germany CPI, y/y (Preliminary) August 0.2% 0.2% 0.2%

12:00 Germany CPI, m/m (Preliminary) August 0.2% -0.1% 0%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in July, after a 0.1 rise in June.

Personal income in the U.S. is expected to rise 0.4% in July, after a 0.4% gain in June.

Personal spending in the U.S. is expected to gain 0.4% in July, after a 0.2% rise in June.

The final Reuters/Michigan Consumer Sentiment Index is expected to decline to 93.0 in August from 93.1 in July.

The greenback remained supported by yesterday's GDP data from the U.S. The U.S. revised GDP climbed 3.7% in the second quarter, exceeding expectations for a 3.2% increase, up from the preliminary estimate of a 2.3% rise.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. German preliminary consumer price index was flat in August, beating expectations for a 0.1% decline, after a 0.2% rise in July.

On a yearly basis, German preliminary consumer price index remained unchanged at 0.2% in August, in line with expectations.

The European Commission released its economic sentiment index for the Eurozone on Friday. The index increased to 104.2 in August from 104.0 in July, beating expectations for a decline to 103.8. It was the highest level since June 2011.

The increase was driven by improvements in the construction, services and retail trade sectors.

The industrial confidence index decreased to -3.7 in August.

The final consumer confidence index was up to -6.9 in August from -7.2 in July, in line with expectations. July's figure was revised down from -7.1.

The business climate index was down to 0.21 in August from 0.41 in July, missing forecasts of a decline to 0.34.

The British pound traded lower against the U.S. dollar after the revised GDP data from the U.K. The revised U.K. GDP expanded at 0.7% in the second quarter, in line with expectations and the preliminary reading, after a 0.4% rise in the first quarter.

The growth was driven by a rise in exports and business investment. Exports climbed 3.9% in the second quarter, while imports were up 0.6%.

Business investment jumped 2.9% in the second quarter.

Economists have said the increase trade might be temporary due to a stronger pound, which makes British products more expensive abroad.

On a yearly basis, the revised U.K. GDP rose 2.6% in the second quarter, in line with expectations and the preliminary reading, after a 2.9% gain in the first quarter.

The service sector climbed 0.7% in the second quarter.

Household spending rose 0.7% in the second quarter, after a 0.9% increase in the first quarter.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of Canadian Industrial Product Price Index, which is expected to be flat in July, after a 0.5% rise in June.

The Swiss franc traded higher against the U.S. dollar after the positive GDP data from Switzerland. Switzerland's GDP increased 0.2% in the second quarter, beating expectations for a 0.1% fall, after a 0.2% decline in the first quarter.

The increase was driven by higher exports. Exports of goods climbed 0.5% in the first quarter.

Household spending climbed to 0.3% in the second quarter, government spending was up 0.2%, equipment and software spending rose 1.5%, while construction spending increased 0.1%.

On a yearly basis, Switzerland's economy grew at 1.2% in the first quarter, exceeding expectations for a 0.9% rise, after a 1.2% increase in the first quarter. The first quarter's figure was revised up from a 1.1% gain.

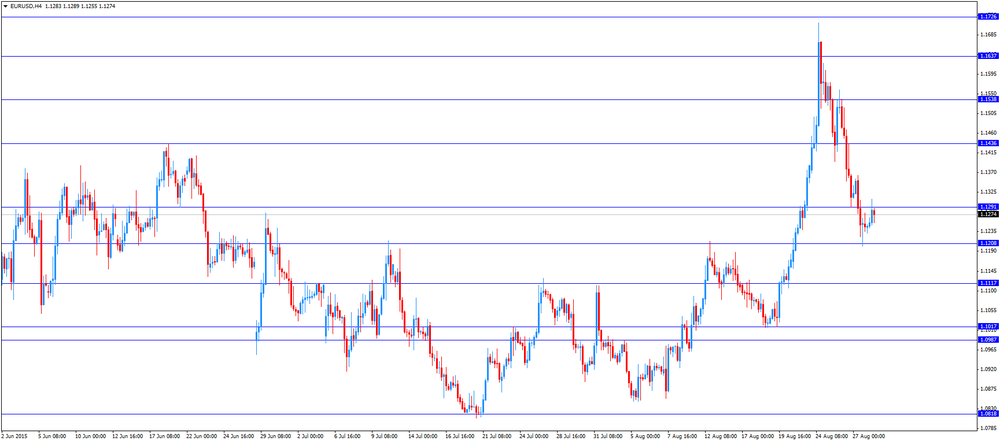

EUR/USD: the currency pair traded mixed

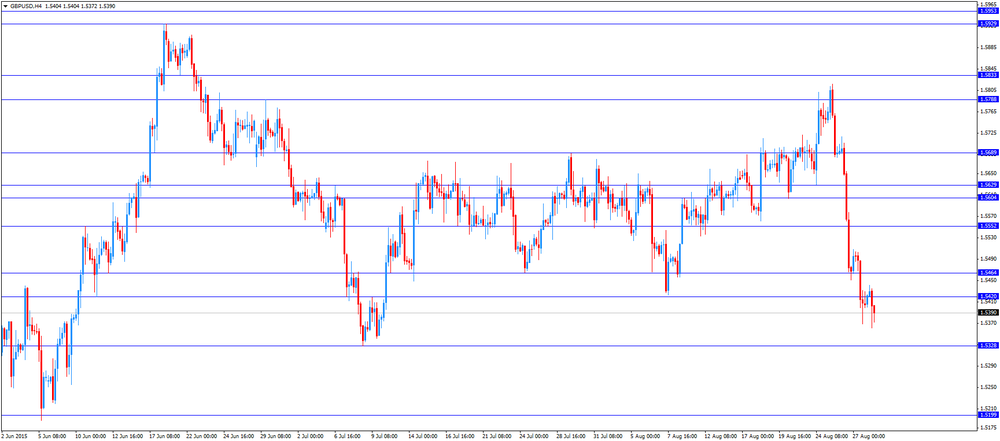

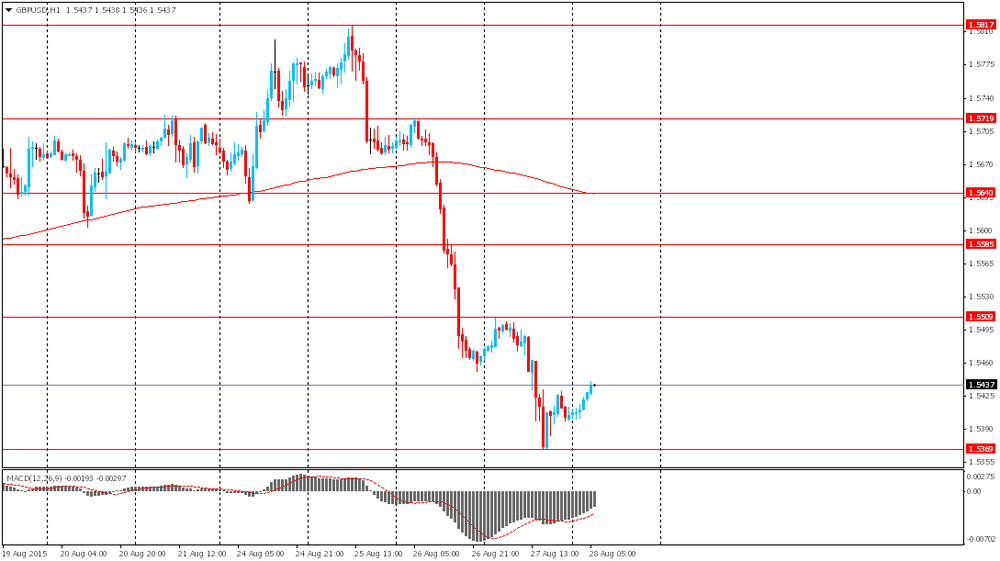

GBP/USD: the currency pair fell to $1.5362

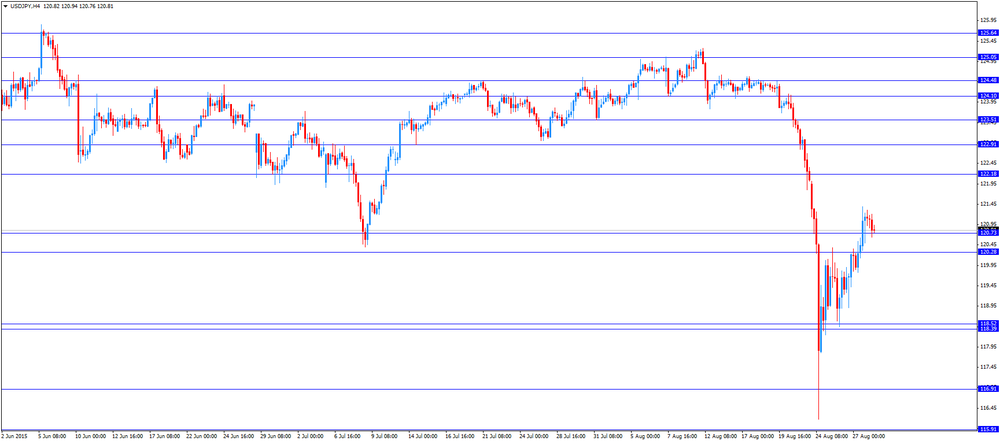

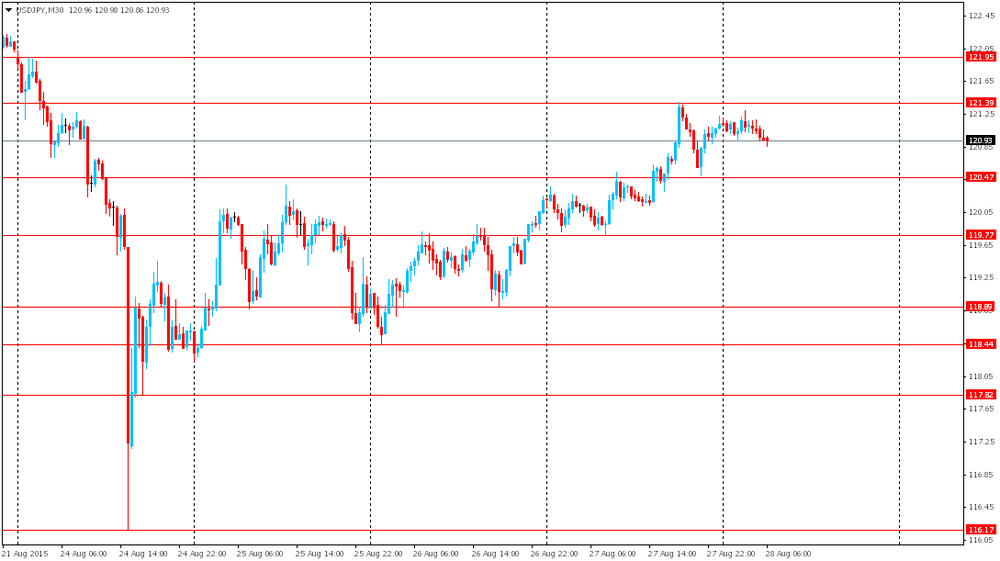

USD/JPY: the currency pair declined to Y120.64

The most important news that are expected (GMT0):

12:30 Canada Industrial Product Price Index, m/m July 0.5% 0%

12:30 U.S. Personal Income, m/m July 0.4% 0.4%

12:30 U.S. Personal spending July 0.2% 0.4%

12:30 U.S. PCE price index ex food, energy, m/m July 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y July 1.3%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 93.1 93

16:00 U.S. Jackson Hole Symposium

-

14:00

Germany: CPI, y/y , August 0.2% (forecast 0.2%)

-

14:00

Germany: CPI, m/m, August 0% (forecast -0.1%)

-

13:45

Orders

EUR/USD

Offers 1.1300 1.1325 1.1340 1.1355-60 1.1380 1.1400 1.1425 1.1450

Bids 1.1265-70 1.1250 1.1225-30 1.1200 1.1185 1.1150

GBP/USD

Offers 1.5430 1.5450 1.5480 1.5500-05 1.5520 1.5550 1.5580-85 1.5600

Bids 1.5400 1.5385 1.5350 1.5330 1.5310 1.5300 1.5285

EUR/GBP

Offers 0.7335-40 0.7350 0.7365 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7300 0.7280-85 0.7265-70 0.7250 0.7230 0.7200

EUR/JPY

Offers 136.80 137.00 137.50 137.80 138.00 138.50 139.0

Bids 136.00 136.85 135.50 135.20 135.00 134.80 134.50

USD/JPY

Offers 121.00 121.20 121.50 121.75-80 122.00

Bids 120.60 120.45-50 120.20 120.00 119.80-85 119.50 119.25-30 119.00

AUD/USD

Offers 0.7200 0.7220-25 0.7250 0.7265 0.7285 0.7300

Bids 0.7155-60 0.7120 0.7100 0.7075-80 0.7050 0.7000 0.6950

-

11:49

Switzerland's GDP rises 0.2% in the second quarter

The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Friday. Switzerland's GDP increased 0.2% in the second quarter, beating expectations for a 0.1% fall, after a 0.2% decline in the first quarter.

The increase was driven by higher exports.

Exports of goods climbed 0.5% in the first quarter, while exports of services increased 0.9%.

Imports of goods dropped 3.6% in the second quarter, while imports of services were up 3.0%.

Household spending climbed to 0.3% in the second quarter, government spending was up 0.2%, equipment and software spending rose 1.5%, while construction spending increased 0.1%.

On a yearly basis, Switzerland's economy grew at 1.2% in the first quarter, exceeding expectations for a 0.9% rise, after a 1.2% increase in the first quarter. The first quarter's figure was revised up from a 1.1% gain.

-

11:37

Eurozone’s economic sentiment index is up to 104.2 in August, the highest level since June 2011

The European Commission released its economic sentiment index for the Eurozone on Friday. The index increased to 104.2 in August from 104.0 in July, beating expectations for a decline to 103.8. It was the highest level since June 2011.

The increase was driven by improvements in the construction, services and retail trade sectors.

The industrial confidence index decreased to -3.7 in August.

The final consumer confidence index was up to -6.9 in August from -7.2 in July, in line with expectations. July's figure was revised down from -7.1.

The business climate index was down to 0.21 in August from 0.41 in July, missing forecasts of a decline to 0.34.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1150(E327mn), $1.1300(E481mn), $1.1355(E1.1bn)

USD/JPY: Y121.00($737mn), Y121.55($360mn), Y122.00-15($723mn)

AUD/USD: $0.7200(A$674mn), $0.7260(A$375mn)

NZD/USD: $0.6500(NZ$251mn)

USD/CAD: C$1.3150($450mn), C$1.3250($431mn), C$1.3350($285mn)

-

11:12

Revised U.K. GDP grows at 0.7% in the second quarter

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Friday. The revised U.K. GDP expanded at 0.7% in the second quarter, in line with expectations and the preliminary reading, after a 0.4% rise in the first quarter.

The growth was driven by a rise in exports and business investment. Exports climbed 3.9% in the second quarter, while imports were up 0.6%.

Business investment jumped 2.9% in the second quarter.

Economists have said the increase trade might be temporary due to a stronger pound, which makes British products more expensive abroad.

On a yearly basis, the revised U.K. GDP rose 2.6% in the second quarter, in line with expectations and the preliminary reading, after a 2.9% gain in the first quarter.

The service sector climbed 0.7% in the second quarter.

Household spending rose 0.7% in the second quarter, after a 0.9% increase in the first quarter.

-

11:02

Eurozone: Business climate indicator , August 0.21 (forecast 0.34)

-

11:01

Eurozone: Industrial confidence, August -4.0 (forecast -3.1)

-

11:01

Eurozone: Economic sentiment index , August 104.2 (forecast 103.8)

-

11:01

Eurozone: Consumer Confidence, August -7.0 (forecast -6.9)

-

10:58

French producer prices decrease 0.1% in July

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices decreased 0.1% in July, after a 0.1% rise in June.

The decline was driven a fall in prices for refined petroleum products, which were down 6.2% in July.

On a yearly basis, French PPI fell 1.6% in July, after a 1.9% drop in June.

Import prices plunged 4.4% in July, after a 1.0% fall in June.

-

10:52

GfK’s U.K. consumer confidence index climbs to 7 in August

Gfk released its consumer confidence index for the U.K. on late Thursday evening. GfK's U.K. consumer confidence index rose to 7 in August from 4 in July. Analysts had expected the index to remain unchanged at 4.

4 of 5 measures increased.

"Rising house price inflation and improving employment growth prospects, combined with falling petrol prices and day-to-day living costs, as well as low interest rates, are translating into high levels of confidence across all major measures. Confidence in the future for both our personal financial and general economic situation for the next 12 months remains strong," Joe Staton, Head of Market Dynamics at GfK, said.

-

10:45

Former president of the Federal Reserve Bank of Philadelphia Charles Plosser: the Fed officials should not be influenced by short-term fluctuations in financial markets

Former president of the Federal Reserve Bank of Philadelphia, Charles Plosser, said in an interview on Thursday that the Fed officials should not be influenced by short-term fluctuations in financial markets.

"I think the Fed needs to be careful and not overreact to short-term events," he said. Plosser added that Fed officials "should keep the focus on the longer term".

He also pointed that the monetary policy is not responsible for markets.

"The less the Fed says about [the selloff] the better, because it creates the impression that monetary policy is responsible for markets, which it's not," Plosser said.

-

10:34

Eurozone’s leading index rises 0.3% in July

The Conference Board (CB) released its leading economic index for the Eurozone on Thursday. The leading economic index for the Eurozone was up 0.3% to 107.7 in July, after a 0.5% rise in June.

The increase was mainly driven by rises in consumer expectations and new orders for manufacturing.

"The Leading Economic Index for the Euro Area increased in July, suggesting the European economy will continue to improve moderately through the final months of the year," Director of Business Cycles and Growth Research at The Conference Board, Ataman Ozyildirim, said.

The coincident economic index, which measures current economic activity, climbed to 100.4 in July.

-

10:30

United Kingdom: Business Investment, q/q, Quarter II 2.9% (forecast 1.7%)

-

10:30

United Kingdom: GDP, q/q, Quarter II 0.7% (forecast 0.7%)

-

10:30

United Kingdom: GDP, y/y, Quarter II 2.6% (forecast 2.6%)

-

10:18

Japan's inflation rises 0.2% year-on-year-in July

Japan's Ministry of Internal Affairs and Communications released its inflation data late Thursday evening. Japan's national consumer price index (CPI) fell to an annual rate of 0.2% in July from 0.4% in June, in line with expectations.

Japan's national CPI excluding fresh food declined to an annual rate of 0.0% in July from 0.1% in June, beating expectations for a 0.2% decrease.

Household spending in Japan were down at annual rate of 0.2% in July, missing forecasts of a 1.3% increase, after a 2.0% fall in June.

Japan's unemployment rate fell to 3.3% in July from 3.4%. Analysts had expected the unemployment rate to remain unchanged at 3.4%. The participation rate was down to 59.6% in July from 60.0% in June.

According to the Ministry of Economy, Trade and Industry, retail sales in Japan climbed at an annual rate of 1.6% in July, exceeding expectations for a 1.1% rise, after a 0.9% gain in June.

-

10:12

Average weekly earnings of Canadian non-farm payroll employees increases 1.9% in June

Statistics Canada released its average weekly earnings data of Canadian non-farm payroll employees on Thursday. Average weekly earnings of Canadian non-farm payroll employees increased 1.9% in June year-on-year. Weekly earnings were C$955 in June.

Employees in Canada worked an average 33.0 hours per week in June.

Total non-farm employment declined by 11,700 in June, after a 24,000 increase in May. Construction, accommodation and food services, retail trade, and mining, quarrying and oil and gas extraction sectors lost the most jobs.

On a yearly basis, the number of non-farm payroll employees rose by 154,500 or 1.0%.

-

08:37

Foreign exchange market. Asian session: the U.S. dollar continued gaining

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:45 Switzerland Gross Domestic Product (YoY) Quarter II 1.2% Revised From 1.1% 0.9% 1.2%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter II -0.2% -0.1% 0.2%

The U.S. dollar continued strengthening against leading currencies amid recovery in stock markets and strong U.S. economic data. The country's Department of Commerce reported Thursday U.S. gross domestic product expanded by 3.7% in the second quarter compared to an initial reading of +2.3%. Consumer spending and business investment were revised up. Exports say that strong GDP data increase probability of a rate hike in September, though situation is still not clear.

The pound slightly gained against the greenback after GFK released its U.K. consumer confidence data. The index came in at 7 in August compared to 4 in July. Economists expected that the index would remain at 4.

The New Zealand dollar fluctuated in a narrow range amid lower volatility in Asian markets. The Standard&Poor's rating agency affirmed the country's rating at "AA" with stable outlook, thus supporting the NZD.

The yen little changed despite plenty of statistics. Japanese retail sales rose by 1.6% y/y in July beating expectations for a 1.1% increase. This was the fourth gain in a row. Meanwhile the core consumer price index was unchanged in July compared to the same period a year ago after a 0.1% growth in June. However this small gain was welcomed by the Bank of Japan, which struggles to get rid of deflation.

EUR/USD: the pair fluctuated within $1.1230-65 in Asian trade

USD/JPY: the pair traded within Y120.90-30

GBP/USD: the pair rose to $1.5440

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Business Investment, q/q Quarter II 2% 1.7%

08:30 United Kingdom GDP, y/y (Revised) Quarter II 2.9% 2.6%

08:30 United Kingdom GDP, q/q (Revised) Quarter II 0.4% 0.7%

09:00 Eurozone Economic sentiment index August 104 103.8

09:00 Eurozone Consumer Confidence (Finally) August -7.1 -6.9

09:00 Eurozone Business climate indicator August 0.39 0.34

09:00 Eurozone Industrial confidence August -2.9 -3.1

12:00 Germany CPI, y/y (Preliminary) August 0.2% 0.2%

12:00 Germany CPI, m/m (Preliminary) August 0.2% -0.1%

12:30 Canada Industrial Product Price Index, m/m July 0.5% 0%

12:30 Canada Industrial Product Price Index, y/y July -0.9%

12:30 U.S. Personal Income, m/m July 0.4% 0.4%

12:30 U.S. Personal spending July 0.2% 0.4%

12:30 U.S. PCE price index ex food, energy, m/m July 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y July 1.3%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 93.1 93

16:00 U.S. Jackson Hole Symposium

-

08:26

Options levels on friday, August 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1449 (3306)

$1.1385 (4441)

$1.1337 (4888)

Price at time of writing this review: $1.1258

Support levels (open interest**, contracts):

$1.1183 (4210)

$1.1131 (4718)

$1.1062 (4990)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 88715 contracts, with the maximum number of contracts with strike price $1,1350 (5434);

- Overall open interest on the PUT options with the expiration date September, 4 is 127633 contracts, with the maximum number of contracts with strike price $1,0500 (7811);

- The ratio of PUT/CALL was 1.44 versus 1.52 from the previous trading day according to data from August, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (1993)

$1.5602 (2555)

$1.5505 (2156)

Price at time of writing this review: $1.5426

Support levels (open interest**, contracts):

$1.5393 (2151)

$1.5297 (2445)

$1.5198 (1442)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30065 contracts, with the maximum number of contracts with strike price $1,5600 (2555);

- Overall open interest on the PUT options with the expiration date September, 4 is 35401 contracts, with the maximum number of contracts with strike price $1,5500 (2773);

- The ratio of PUT/CALL was 1.18 versus 1.16 from the previous trading day according to data from August, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:45

Switzerland: Gross Domestic Product (QoQ) , Quarter II 0.2% (forecast -0.1%)

-

07:45

Switzerland: Gross Domestic Product (YoY), Quarter II 1.2% (forecast 0.9%)

-

01:50

Japan: Retail sales, y/y, July 1.6% (forecast 1.1%)

-

01:37

Japan: National CPI Ex-Fresh Food, y/y, July 0.0% (forecast -0.2%)

-

01:36

Japan: Tokyo CPI ex Fresh Food, y/y, August -0.1% (forecast -0.2%)

-

01:36

Japan: Unemployment Rate, July 3.3% (forecast 3.4%)

-

01:35

Japan: Tokyo Consumer Price Index, y/y, August 0.1%

-

01:34

Japan: Household spending Y/Y, July -0.2% (forecast 1.3%)

-

01:33

Japan: National Consumer Price Index, y/y, July 0.2% (forecast 0.2%)

-

01:06

United Kingdom: Gfk Consumer Confidence, August 7 (forecast 4)

-

00:31

Currencies. Daily history for Aug 27’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1246 -0,60%

GBP/USD $1,5405 -0,34%

USD/CHF Chf0,9654 +1,18%

USD/JPY Y121,13 +0,77%

EUR/JPY Y136,23 +0,17%

GBP/JPY Y186,62 +0,36%

AUD/USD $0,7167 +0,57%

NZD/USD $0,6477 +0,42%

USD/CAD C$1,3203 -1,46%

-

00:01

Schedule for today, Friday, Aug 28’2015:

(time / country / index / period / previous value / forecast)

05:45 Switzerland Gross Domestic Product (YoY) Quarter II 1.1% 0.9%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter II -0.2% -0.1%

08:30 United Kingdom Business Investment, q/q Quarter II 2% 1.7%

08:30 United Kingdom GDP, y/y (Revised) Quarter II 2.9% 2.6%

08:30 United Kingdom GDP, q/q (Revised) Quarter II 0.4% 0.7%

09:00 Eurozone Economic sentiment index August 104 103.8

09:00 Eurozone Consumer Confidence (Finally) August -7.1 -6.9

09:00 Eurozone Business climate indicator August 0.39 0.34

09:00 Eurozone Industrial confidence August -2.9 -3.1

12:00 Germany CPI, y/y (Preliminary) August 0.2% 0.2%

12:00 Germany CPI, m/m (Preliminary) August 0.2% -0.1%

12:30 Canada Industrial Product Price Index, m/m July 0.5% 0%

12:30 Canada Industrial Product Price Index, y/y July -0.9%

12:30 U.S. Personal Income, m/m July 0.4% 0.4%

12:30 U.S. Personal spending July 0.2% 0.4%

12:30 U.S. PCE price index ex food, energy, m/m July 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y July 1.3%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 93.1 93

16:00 U.S. Jackson Hole Symposium

-