Noticias del mercado

-

20:23

American focus: the US dollar mixed

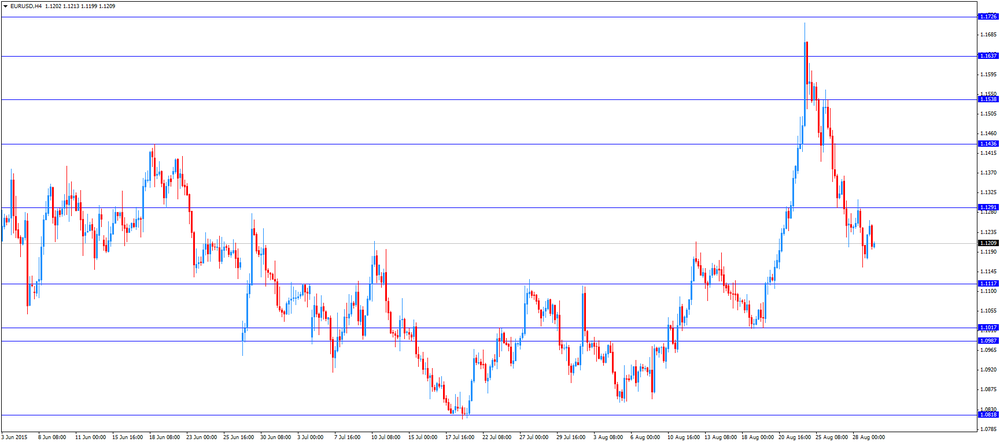

Dollar earlier in the week trading lower against the euro and the Japanese yen but higher against most currencies of other developed and developing markets.

Investors overestimate the fair rate of the dollar against the backdrop of continued instability in the markets and approaching meeting of the Federal Reserve System in September.

Over the weekend, Federal Reserve Vice Chairman Stanley Fischer made it clear that the increase in the key interest rate this year is still possible. The report on the US labor market on Friday to give any further guidance on the Fed's actions.

Dollar moves mixed on weak data on Chicago PMI. Managers Association of Chicago reported that the PMI index slightly worsened in August, contrary to the forecasts of experts who expect further growth.

According to the data, the August index of purchasing managers in the Chicago dropped to the level of 54.4 points against 54.7 points in July. Analysts believe that figure will reach 54.9 points.

The company said that the slight weakening of the components of production and new orders put pressure on the main index. However, despite the deterioration in August, the data sub-codes are still above the 12-month average value. Part of this stability was due to the increase in stocks at the fastest pace since November 2014.

Also, the data showed that the sub-index of unfilled orders fell slightly in August. This figure remains below the neutral mark the seventh consecutive month, meanwhile, is a component that tracks employment, rose in August to the highest level since April. But despite the recent improvement, the index remained in the territory of 4 consecutive month of contraction. Experts point out that the employment component was relatively weak in recent months, and the study shows that in the short term is unlikely to be traced much improved. Responding to a question, 63% of respondents said they do not plan to expand the size of their workforce over the next three months. In addition, studies have shown that the increase in purchase prices, which is noted in the last three months, was short-lived - in August were recorded a sharp decline, reflecting a reduction in the cost of commodities.

Earlier, the euro fell against the dollar amid inflation data in the euro zone. At the end of August, consumer prices rose by 0.2%, which coincided with the change recorded in the previous month. Experts expect that price growth slowed to 0.1%. It is worth emphasizing the increase in consumer prices is less than 1% have been 21 months in a row. For the ECB's inflation target is 2%. The report also stated that the cost of food, alcohol and tobacco rose by 1.2% compared to 0.9% in July, while the cost of services rose 1.2%, as in the previous month. Prices of non-energy goods increased by 0.6% compared to 0.4% in July, and the price of energy products fell 7.1% against -5.6% in July. The increase in core inflation remained at 1%. In monthly terms, core CPI, which excludes prices of food, energy, alcohol, and tobacco rose by 0.1% (seasonally adjusted), in line with expectations.

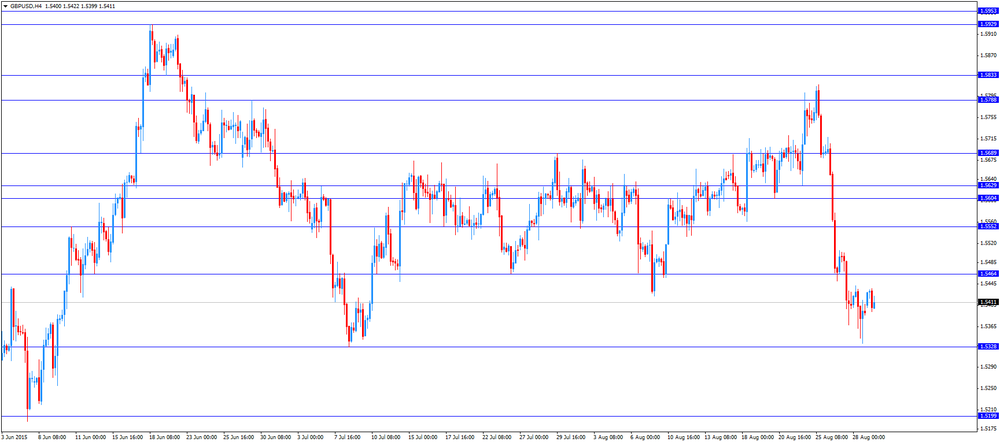

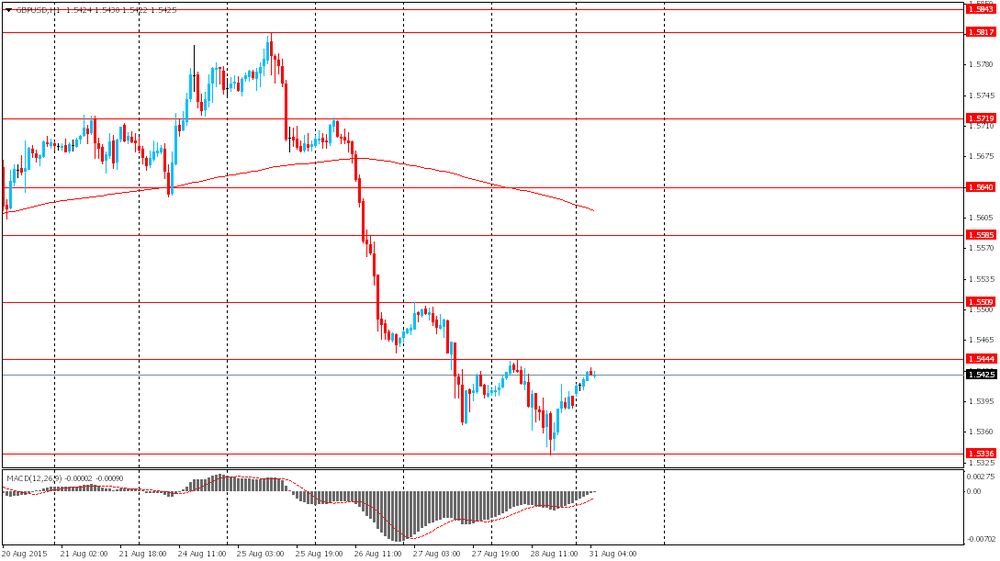

The pound fell against the dollar, while analysts say that arose before risk aversion began to decline, helping the dollar recover. Also, traders continue to assess the comments made during the symposium in Jackson Hole. It is expected that the pound will continue to consolidate amid the lack of British news. Also recall that the UK markets are closed today.

Meanwhile, the focus is gradually shifting to the data on business activity in Britain, the publication of which will be held this week. According to forecasts, the purchasing managers index indicate that activity continued to grow strong pace. It will be another sign of the health of the economy and will testify against the probability of weakening the country's economy because of the problems in China. Recall recently, market participants revised their forecasts on the timing of increases in interest rates by the Bank of England, which became the cause of weakening expectations regarding inflation or economic slowdown. Investors are now believe that the leadership of the Central Bank will raise short-term interest rate in the 3rd quarter of next year, but not in the 2nd.

-

17:03

Atlanta Fed President Dennis Lockhart: the interest rate hike is possible in every monetary policy meeting this year

Atlanta Fed President Dennis Lockhart said in an interview with Fox Business News on Friday that the interest rate hike is possible in every monetary policy meeting this year.

"I think all the upcoming meetings, the next three meetings, should all be live meetings and I think we should keep our options open," he said.

-

16:55

Preliminary consumer prices in Italy increase 0.2% in August

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Monday. Preliminary consumer prices in Italy increased 0.2% in August, after a 0.1% decline July.

Services prices related to transport increased 0.2% in June, while services prices to recreation, including repair and personal care, gained 0.4%.

On a yearly basis, consumer prices climbed 0.2% in August, after a 0.2% increase in July.

Consumer price inflation excluding unprocessed food and energy prices fell to 0.7% year-on-year in August from 0.8% in July.

Services prices related to transport were up at an annual rate of 0.7% in August, while goods prices declined 0.5%.

-

16:44

European Central Bank purchases €9.8 billion of government bonds last week

The European Central Bank (ECB) purchased €9.8 billion of government bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.94 billion of covered bonds, and €106 million of asset-backed securities.

-

16:20

Chicago purchasing managers' index falls to 54.4 in August

The Chicago purchasing managers' index declined to 54.4 in August from 54.7 in July, missing expectations for an increase to 54.9, according to MNI indicators.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was driven by decreases by the production and new orders indexes.

The employment index rose in August.

"While the slowdown earlier in the year looks temporary, we're still some way below the strong growth rates seen towards the end of 2014," Chief Economist of MNI Indicators Philip Uglow said.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E696mn), $1.1270(E273mn), $1.1410/15(E800mn)

USD/JPY: Y119.75($300mn)

EUR/JPY: Y137.00(E1.35bn)

NZD/USD: $0.6600(NZ$2.3bn)

AUDUSD 0.7250

NZDUSD 0.6585 0.6600 (2.3bn) 0.6750 (976m)

USDCAD 1.3200

-

15:45

U.S.: Chicago Purchasing Managers' Index , August 54.4 (forecast 54.9)

-

15:41

Spanish current account deficit widens to €1.34 billion in June

The Bank of Spain released its current account data on Monday. Spain's current account deficit widened to €1.34 billion in June from a surplus of €1.15 billion in May.

The surplus on trade in goods and services decreased to €2.4 billion from €3.2 billion, while the deficit on primary and second income declined to €1.1 billion from €2 billion.

-

15:05

Greek adjusted retail sales are down 0.5% in June

The Greek statistical office Hellenic Statistical Authority. Greek adjusted retail sales declined 0.5% in June, after a 2.1% gain in May.

On a yearly basis, German retail sales fell 0.4% in June, after a 4.1% rise in May. May's figure was revised down from a 4.2% increase.

Sales of food products decreased 0.3% in June, sales of non-food products dropped 1.1%, while sales of automotive fuel climbed by 4.4%.

-

14:43

Canadian current account deficit narrows to C$17.4 billion in the second quarter

Statistics Canada released current account data on Monday. Canadian current account deficit narrowed to C$17.4 billion in the second quarter from a deficit of C$18.2 billion in the first quarter. The first quarter figure was revised down from a deficit of C$17.5 billion.

The fall in deficit was driven by declines in the trade in goods and services deficit. The trade in goods deficit fell by C$0.3 billion to a record C$6.7 billion in the second quarter, while the deficit on international trade in services declined by $0.2 billion to C$5.5 billion.

-

14:30

Canada: Current Account, bln, Quarter II -17.4

-

14:25

Italian retail sales decline at a seasonally adjusted rate of 0.3% in June

The Italian statistical office Istat released its retail sales data for Italy on Monday. Italian retail sales fell at a seasonally adjusted rate of 0.3% in June, after a 0.2% decline in May.

Sales of food products fell 0.2% in June, while sales of non-food products declined by 0.3%.

On a yearly basis, retail sales in Italy rose 1.2% in June, after a 0.1% increase in May.

-

14:13

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m August 0.2% 0.1%

01:00 Australia HIA New Home Sales, m/m July 0.5% -0.4%

01:00 New Zealand ANZ Business Confidence August -15.3 -29.1%

01:30 Australia Private Sector Credit, m/m July 0.4% 0.5% 0.6%

01:30 Australia Private Sector Credit, y/y July 5.9% 6.1%

01:30 Australia Company Gross Profits QoQ Quarter II -0.3% Revised From 0.2% -2% -1.9%

05:00 Japan Construction Orders, y/y July 15.4% -4.0%

05:00 Japan Housing Starts, y/y July 16.3% 11% 7.4%

06:00 Germany Retail sales, real unadjusted, y/y July 5.2% Revised From 5.1% 1.9% 3.3%

06:00 Germany Retail sales, real adjusted July -1.0% Revised From -2.3% 1% 1.4%

07:00 Switzerland KOF Leading Indicator August 100.4 Revised From 99.8 99.5 100.7

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 1% 1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.1% 0.2%

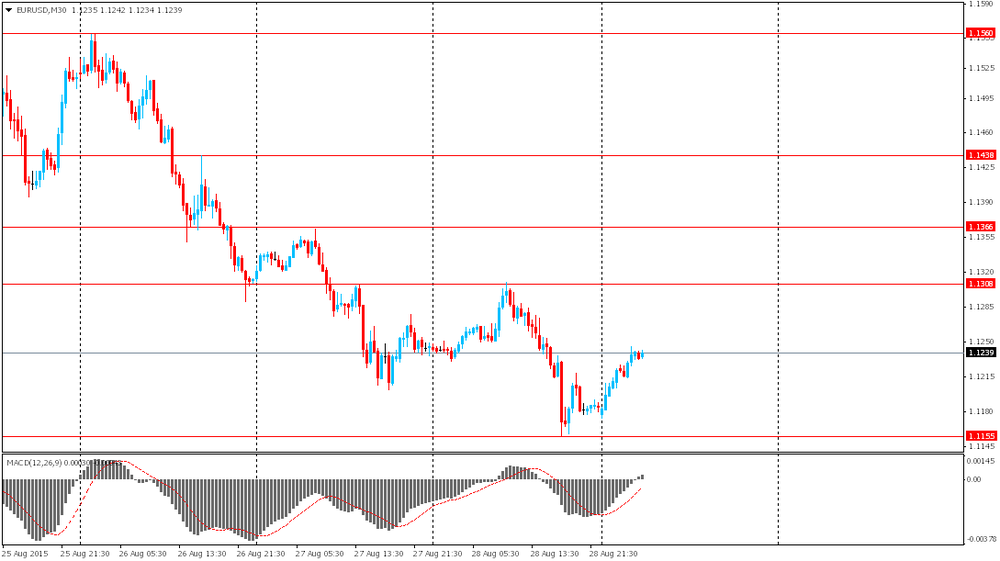

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the U.S. Chicago purchasing managers' index data. The Chicago purchasing managers' index is expected to rise to 54.9 in August from 54.7 in July.

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of Canadian current account data.

The Swiss franc traded lower against the U.S. dollar. The KOF leading indicator rose to 100.7 in August from 100.4 in July, beating expectations for a decline to 99.5. July's figure was revised up from 99.8.

According to the institute, the outlook for the Swiss economy remained unchanged since July.

EUR/USD: the currency pair declined to $1.1196

GBP/USD: the currency pair fell to $1.5393

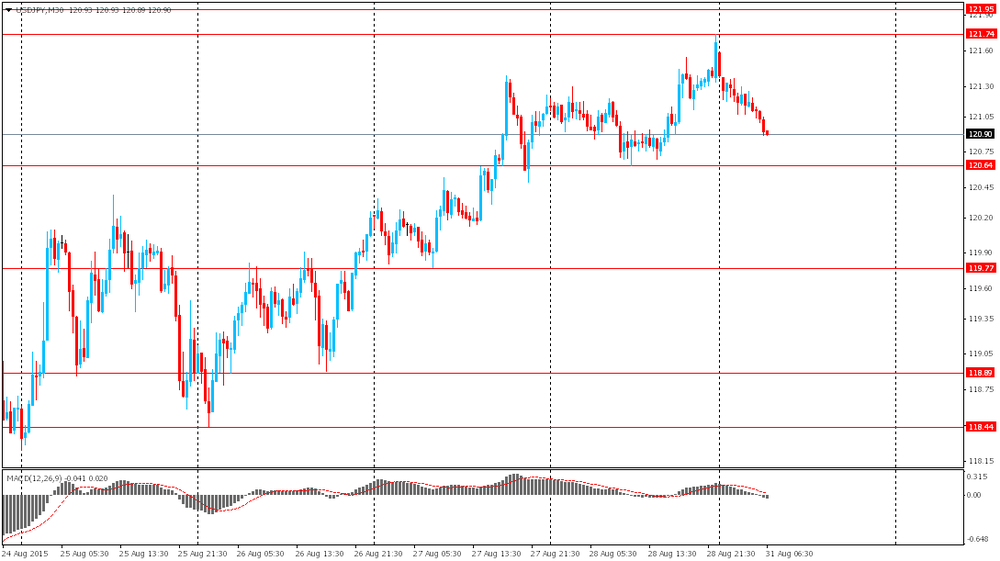

USD/JPY: the currency pair increased to Y121.35

The most important news that are expected (GMT0):

12:30 Canada Current Account, bln Quarter II -17.5

13:45 U.S. Chicago Purchasing Managers' Index August 54.7 54.9

23:30 Australia AIG Manufacturing Index August 50.4

23:50 Japan Capital Spending Quarter II 7.3% 9%

-

14:00

Orders

EUR/USD

Offers 1.1280 1.1300 1.1325 1.1340 1.1355-60 1.1395 1.1400

Bids 1.1200 1.1185 1.1160 1.1110 1.1100

GBP/USD

Offers 1.5450 1.5480 1.5500-05 1.5520 1.5550 1.5600

Bids 1.5400 1.5380 1.5350 1.5330 1.5300 1.5290

EUR/GBP

Offers 0.7300 0.7350 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7240 0.7200 0.7150 0.7130

EUR/JPY

Offers 136.50 136.80 137.00 137.50 137.80

Bids 135.50 135.20 135.00 134.80 134.50

USD/JPY

Offers 121.20 121.50 121.60 122.00

Bids 120.45-50 120.10 120.00 119.60

AUD/USD

Offers 0.7200 0.7250 0.7290 0.7300

Bids 0.7120 0.7100 0.7060 0.7050 0.7000

-

11:44

Industrial production in Japan declines 0.6% in July

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production figures on late Sunday evening. Industrial production in Japan declined 0.6% in July, after a 0.8% gain in June.

On a yearly basis, Japan's industrial production was up 0.2% in July, after a 2.3% rise in June.

Lower overseas demand weighed on the Japanese industrial production.

The decline was driven by decreases in the electrical components and the transport equipment industries.

-

11:33

KOF leading indicator for Switzerland climbs to 100.7 in August

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator rose to 100.7 in August from 100.4 in July, beating expectations for a decline to 99.5. July's figure was revised up from 99.8.

According to the institute, the outlook for the Swiss economy remained unchanged since July.

"Overall slightly positive tendencies in the manufacturing and banking sectors are balanced by slightly negative developments in primarily the construction sector. With the indicators capturing tendencies in the international environment as well as domestic consumption more or less stabilising at their previous readings, the overall result is a slight rise in the Barometer," the KOF said.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E696mn), $1.1270(E273mn), $1.1410/15(E800mn)

USD/JPY: Y119.75($300mn)

EUR/YEN: Y137.00(E1.35bn)

NZD/USD: $0.6600(NZ$2.3bn)

-

11:15

Preliminary consumer price inflation in the Eurozone remains unchanged at 0.2% in August

Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

-

11:02

Eurozone: Harmonized CPI ex EFAT, Y/Y, August 1%

-

11:00

Eurozone: Harmonized CPI, Y/Y, August 0.2% (forecast 0.1%)

-

10:54

German adjusted retail sales are up 1.4% in July

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

-

10:43

Federal Reserve Bank of Atlanta President Dennis Lockhart: the interest rate hike by the Fed in September is still possible

Federal Reserve Bank of Atlanta President Dennis Lockhart said in an interview on Bloomberg television Friday that the interest rate hike by the Fed in September is still possible. But he added that there is a risk now.

"We are sort of anxious to get going, but given the events of the last several weeks, a risk factor has arisen. It has to be considered an open question whether we move now or wait a little while," he said.

Lockhart is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:32

Swiss National Bank President Thomas Jordan: the interest rates in Switzerland will remain negative for a while

The Swiss National Bank (SNB) President Thomas Jordan said in an interview with the NZZ am Sonntag that the interest rates in Switzerland will remain negative for a while as there are many risks that could lead to a stronger Swiss franc, which is already a "clearly overvalued".

He added that "there are lights at the end of the tunnel" as the Fed and the Bank of England may start raising its interest rates and as Eurozone's economy is recovering.

Jordan pointed out that the central bank is ready to intervene in the foreign exchange market if needed, and it intervened in June.

The SNB president noted that the Swiss economy is in line with central bank's forecasts.

-

10:12

Bank of America Corp.: the rise in China's stock market will be short-lived

The rise in China's stock market will be short-lived as the government's intervention is too expensive to be continued for a long time, according to Bank of America Corp.

"As soon as people sense the government is withdrawing from direct intervention, there will be lots of investors starting to dump stocks again," China equity strategist at Bank of America in Singapore, David Cui, said.

He added that the Shanghai Composite Index have to fall another 35% before shares will become attractive.

Cui expects that the government will end its direct market purchases within the next month or two.

-

09:00

Switzerland: KOF Leading Indicator, August 100.7 (forecast 99.5)

-

08:09

Foreign exchange market. Asian session: the Australian dollar weakened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia MI Inflation Gauge, m/m August 0.2% 0.1%

01:00 Australia HIA New Home Sales, m/m July 0.5% -0.4%

01:00 New Zealand ANZ Business Confidence August -15.3 -29.1%

01:30 Australia Private Sector Credit, m/m July 0.4% 0.5% 0.6%

01:30 Australia Private Sector Credit, y/y July 5.9% 6.1%

01:30 Australia Company Gross Profits QoQ Quarter II -0.3% Revised From 0.2% -2% -1.9%

05:00 Japan Construction Orders, y/y July 15.4% -4.0%

05:00 Japan Housing Starts, y/y July 16.3% 11% 7.4%

06:00 Germany Retail sales, real unadjusted, y/y July 5.1% 1.9% 3.3%

06:00 Germany Retail sales, real adjusted July -2.3% 1% 1.4%

The U.S. dollar advanced against major currencies. The greenback is supported by Fed officials' comments made at the Jackson Hole symposium at the end of the week. Fed Vice Chairman Stanley Fischer said that the case for a rate increase in September is not clear. He said that the central bank is on track to raise rates, but he noted he wasn't sure that September is the right time to act.

The Australian dollar declined against the U.S. dollar amid TD Securities inflation data. The corresponding consumer price index fell to 0.1% in August from 0.2% reported previously. The index came in at 1.7% y/y compared to 1.6% y/y in July. Official data are published once per quarter, that's why data by TD Securities are very important.

The New Zealand dollar fell against the greenback amid weak statistics. The ANZ business confidence index fell to a six-year low of -29.1 in August. In the previous month the index stood at -15.3. ANZ also warned investors that the pace of declines in the economy picked up.

Declines in Asian stocks boosted demand for the yen, thus allowing this currency to strengthen against the dollar. Meanwhile Japanese industrial production fell 0.6% in July missing expectations for a 0.1% reading. On an annualized basis it dropped to 0.2% from 2.3%.

EUR/USD: the pair rose above $1.1250 in Asian trade

USD/JPY: the pair fell to Y120.85

GBP/USD: the pair rose to $1.5435

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator August 99.8 99.5

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.1%

12:30 Canada Current Account, bln Quarter II -17.5

13:45 U.S. Chicago Purchasing Managers' Index August 54.7 54.9

23:30 Australia AIG Manufacturing Index August 50.4

23:50 Japan Capital Spending Quarter II 7.3% 9%

-

08:00

Germany: Retail sales, real unadjusted, y/y, July 3.3% (forecast 1.9%)

-

08:00

Germany: Retail sales, real adjusted , July 1.4% (forecast 1%)

-

07:16

Japan: Construction Orders, y/y, July -4.0%

-

07:16

Japan: Housing Starts, y/y, July 7.4% (forecast 11%)

-

06:53

Options levels on monday, August 31, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1422 (3377)

$1.1345 (5053)

$1.1284 (5053)

Price at time of writing this review: $1.1256

Support levels (open interest**, contracts):

$1.1101 (4772)

$1.1044 (5333)

$1.0972 (6908)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 91056 contracts, with the maximum number of contracts with strike price $1,1350 (5293);

- Overall open interest on the PUT options with the expiration date September, 4 is 128591 contracts, with the maximum number of contracts with strike price $1,0500 (7857);

- The ratio of PUT/CALL was 1.41 versus 1.44 from the previous trading day according to data from August, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (1993)

$1.5601 (2546)

$1.5503 (2132)

Price at time of writing this review: $1.5430

Support levels (open interest**, contracts):

$1.5297 (2466)

$1.5199 (1493)

$1.5099 (359)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30167 contracts, with the maximum number of contracts with strike price $1,5600 (2546);

- Overall open interest on the PUT options with the expiration date September, 4 is 35448 contracts, with the maximum number of contracts with strike price $1,5500 (2759);

- The ratio of PUT/CALL was 1.18 versus 1.18 from the previous trading day according to data from August, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Australia: Private Sector Credit, m/m, July 0.6% (forecast 0.5%)

-

03:30

Australia: Company Gross Profits QoQ, Quarter II -1.9% (forecast -2%)

-

03:30

Australia: Private Sector Credit, y/y, July -1.9%

-

03:01

New Zealand: ANZ Business Confidence, August -29.1

-

03:01

Australia: HIA New Home Sales, m/m, July -0.4%

-

02:30

Australia: MI Inflation Gauge, m/m, August 0.1%

-

01:52

Japan: Industrial Production (MoM) , July -0.6%

-

01:51

Japan: Industrial Production (YoY), July 0.2%

-

00:47

New Zealand: Building Permits, m/m, July 20.4%

-

00:31

Currencies. Daily history for Aug 28’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1185 -0,55%

GBP/USD $1,5391 -0,09%

USD/CHF Chf0,9619 -0,36%

USD/JPY Y121,67 +0,44%

EUR/JPY Y136,07 -0,12%

GBP/JPY Y187,31 +0,37%

AUD/USD $0,7171 +0,06%

NZD/USD $0,6460 -0,26%

USD/CAD C$1,3199 -0,03%

-

00:01

Schedule for today, Monday, Aug 31’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia MI Inflation Gauge, m/m August 0.2%

01:00 Australia HIA New Home Sales, m/m July 0.5%

01:00 New Zealand ANZ Business Confidence August -15.3

01:30 Australia Private Sector Credit, m/m July 0.4% 0.5%

01:30 Australia Private Sector Credit, y/y July 5.9%

01:30 Australia Company Gross Profits QoQ Quarter II 0.2% -2%

05:00 Japan Construction Orders, y/y July 15.4%

05:00 Japan Housing Starts, y/y July 16.3% 11%

06:00 Germany Retail sales, real unadjusted, y/y July 5.1% 1.5%

06:00 Germany Retail sales, real adjusted July -2.3% 1.0%

07:00 Switzerland KOF Leading Indicator August 99.8 99.5

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.1%

12:30 Canada Current Account, bln Quarter II -17.5

13:45 U.S. Chicago Purchasing Managers' Index August 54.7 54.9

23:30 Australia AIG Manufacturing Index August 50.4

23:50 фJapan Capital Spending Quarter II 7.3% 9%

-