Noticias del mercado

-

22:16

U.S. stocks declined

U.S. stocks declined, with the Standard & Poor's 500 Index posting its worst month in more than three years, as investors harbored concerns about slowing global growth and the impact of a potential interest-rate increase by the Federal Reserve as soon as September.

The S&P 500 lost 0.8 percent to 1,972.15 at 4 p.m. in New York, capping its biggest monthly slide since May 2012. The gauge in earlier trading fell as much as 1.2 percent before nearly erasing the retreat. The Dow Jones Industrial Average sank 0.7 percent to complete its worst monthly drop since May 2010.

Equities trimmed their losses in the late morning after energy shares in the benchmark index reversed a 2.5 percent selloff to rally as much as 1.4 percent. The move followed a jump in oil prices after a government report reduced its crude production estimates and OPEC said it's ready to talk to other global producers to achieve "fair prices." Stocks have been whipsawed by gains and losses since last week as markets remain subject to sudden shifts in investor sentiment.

The S&P 500 ended down 6.3 percent this month as China's currency devaluation earlier this month spurred concern over global growth, erasing more than $5.3 trillion in equity market values worldwide. The benchmark's 0.9 percent gain last week masked a volatile period in which the S&P 500 plunged the most since 2011 to enter a correction, only to rally more than 6 percent over two days for its best back-to-back gains since the beginning of the bull market in 2009.

More than $2 trillion of share value was erased from U.S. markets between the end of July and the lowest levels of last week, a sum equal to roughly two years of S&P 500 earnings, data compiled by Bloomberg show.

While August ranks in the middle among months based on share performance, it has produced some of the worst returns of the year since 2009. During the week ended August 12, 2011, the S&P 500 alternated between gains and losses of at least 4 percent for four days, something never seen in 88 years of data compiled by Bloomberg. In 2013, the S&P 500 fell 3.1 percent in August, one of only two months of negative returns in a year when the index surged 30 percent.

Despite this month's equities rout, remarks by Federal Reserve Vice Chairman Stanley Fischer suggested the central bank hasn't ruled out raising interest rates when the Federal Open Market Committee gathers on Sept. 16-17. Bets on a September liftoff climbed after Fischer said there is "good reason" to believe inflation will accelerate. Traders are now pricing in a 40 percent chance the central bank will act in September, up from a one-in-four chance last Wednesday.

The Fed has said it will be appropriate to raise rates when it has seen some further improvement in the labor market and is "reasonably confident" inflation will move back to its 2 percent target over the medium term.

-

21:00

DJIA 16487.91 -155.10 -0.93%, NASDAQ 4766.48 -61.85 -1.28%, S&P 500 1968.60 -20.27 -1.02%

-

20:23

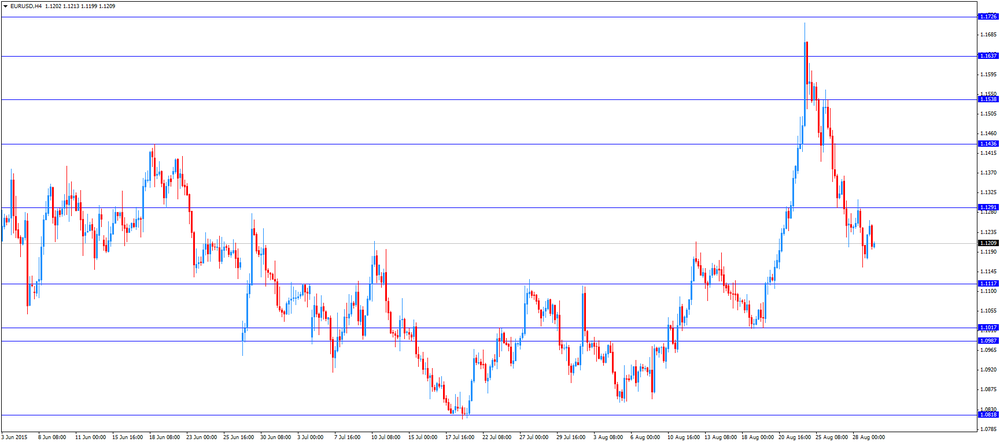

American focus: the US dollar mixed

Dollar earlier in the week trading lower against the euro and the Japanese yen but higher against most currencies of other developed and developing markets.

Investors overestimate the fair rate of the dollar against the backdrop of continued instability in the markets and approaching meeting of the Federal Reserve System in September.

Over the weekend, Federal Reserve Vice Chairman Stanley Fischer made it clear that the increase in the key interest rate this year is still possible. The report on the US labor market on Friday to give any further guidance on the Fed's actions.

Dollar moves mixed on weak data on Chicago PMI. Managers Association of Chicago reported that the PMI index slightly worsened in August, contrary to the forecasts of experts who expect further growth.

According to the data, the August index of purchasing managers in the Chicago dropped to the level of 54.4 points against 54.7 points in July. Analysts believe that figure will reach 54.9 points.

The company said that the slight weakening of the components of production and new orders put pressure on the main index. However, despite the deterioration in August, the data sub-codes are still above the 12-month average value. Part of this stability was due to the increase in stocks at the fastest pace since November 2014.

Also, the data showed that the sub-index of unfilled orders fell slightly in August. This figure remains below the neutral mark the seventh consecutive month, meanwhile, is a component that tracks employment, rose in August to the highest level since April. But despite the recent improvement, the index remained in the territory of 4 consecutive month of contraction. Experts point out that the employment component was relatively weak in recent months, and the study shows that in the short term is unlikely to be traced much improved. Responding to a question, 63% of respondents said they do not plan to expand the size of their workforce over the next three months. In addition, studies have shown that the increase in purchase prices, which is noted in the last three months, was short-lived - in August were recorded a sharp decline, reflecting a reduction in the cost of commodities.

Earlier, the euro fell against the dollar amid inflation data in the euro zone. At the end of August, consumer prices rose by 0.2%, which coincided with the change recorded in the previous month. Experts expect that price growth slowed to 0.1%. It is worth emphasizing the increase in consumer prices is less than 1% have been 21 months in a row. For the ECB's inflation target is 2%. The report also stated that the cost of food, alcohol and tobacco rose by 1.2% compared to 0.9% in July, while the cost of services rose 1.2%, as in the previous month. Prices of non-energy goods increased by 0.6% compared to 0.4% in July, and the price of energy products fell 7.1% against -5.6% in July. The increase in core inflation remained at 1%. In monthly terms, core CPI, which excludes prices of food, energy, alcohol, and tobacco rose by 0.1% (seasonally adjusted), in line with expectations.

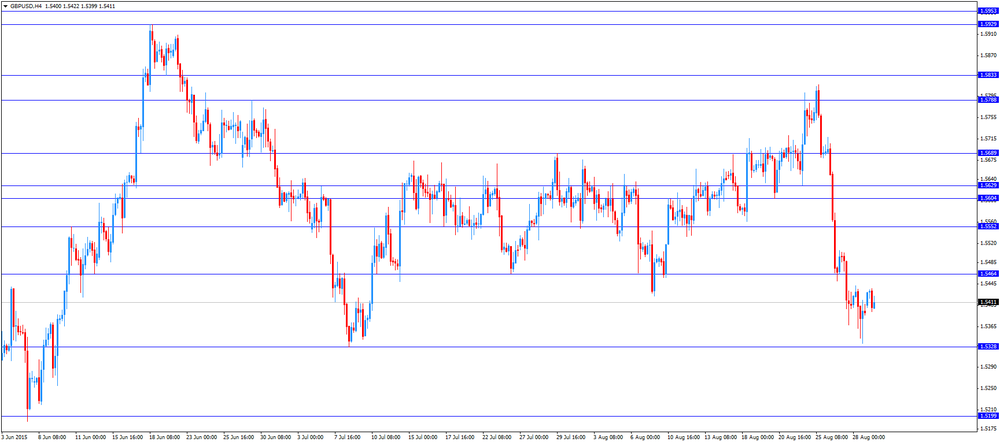

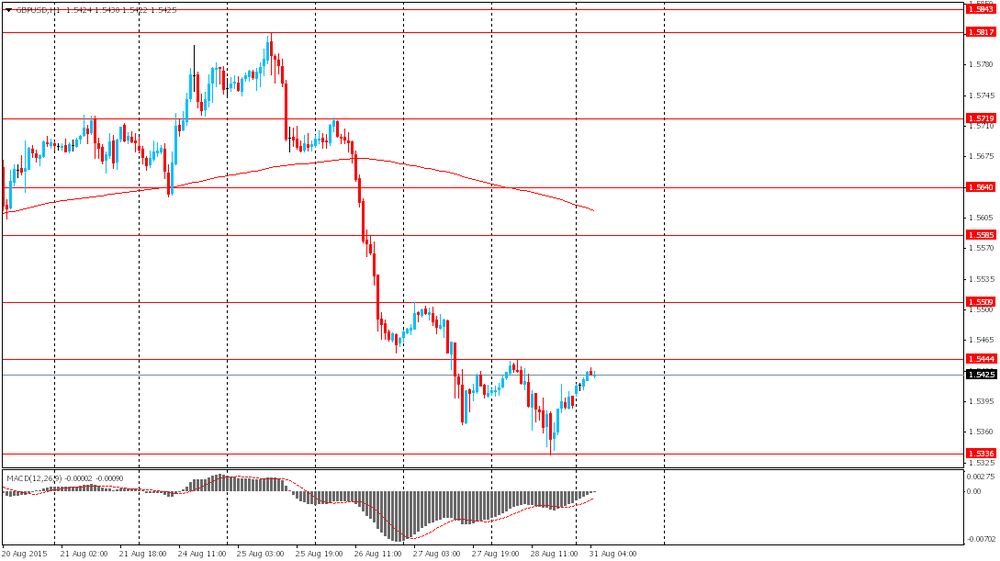

The pound fell against the dollar, while analysts say that arose before risk aversion began to decline, helping the dollar recover. Also, traders continue to assess the comments made during the symposium in Jackson Hole. It is expected that the pound will continue to consolidate amid the lack of British news. Also recall that the UK markets are closed today.

Meanwhile, the focus is gradually shifting to the data on business activity in Britain, the publication of which will be held this week. According to forecasts, the purchasing managers index indicate that activity continued to grow strong pace. It will be another sign of the health of the economy and will testify against the probability of weakening the country's economy because of the problems in China. Recall recently, market participants revised their forecasts on the timing of increases in interest rates by the Bank of England, which became the cause of weakening expectations regarding inflation or economic slowdown. Investors are now believe that the leadership of the Central Bank will raise short-term interest rate in the 3rd quarter of next year, but not in the 2nd.

-

18:18

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Monday on worries about the health of China's economy and the timing of a U.S. interest rate hike. The No. 2 Fed official said U.S. inflation would likely rebound as pressure from the dollar fades, allowing the Fed to raise interest rates gradually.

Most of all Dow stocks in negative area (21 of 30). Top looser - Merck & Co. Inc. (MRK, -2.24%). Top gainer - Intel Corporation (INTC, +1.30).

Most of all S&P index sectors in negative area. Top looser - Utilities (-2.0%). Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 16576.00 -83.00 -0.50%

S&P 500 1978.50 -11.25 -0.57%

Nasdaq 100 4313.00 -20.00 -0.46%

10 Year yield 2,18% -0,01

Oil 47.90 +2.68 +5.93%

Gold 1133.50 -0.50 -0.04%

-

18:00

European stocks closed: FTSE 6247.94 55.91 0.90%, DAX 10259.46 -39.07 -0.38%, CAC 40 4652.95 -22.18 -0.47%

-

18:00

European stocks close: stocks closed lower on concerns over a slowdown in the Chinese economy

Stock indices closed lower on concerns over a slowdown in the Chinese economy. The Chinese stock market declined again. The Financial Times reported that the Chinese government ended its large-scale share purchase programme.

Meanwhile, the economic data from the Eurozone was positive. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

Indexes on the close:

Name Price Change Change %

FTSE 100 closed

DAX 10,259.46 -39.07 -0.38 %

CAC 40 4,652.95 -22.18 -0.47 %

-

17:57

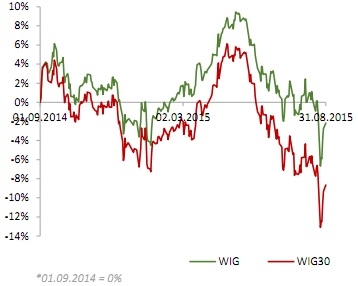

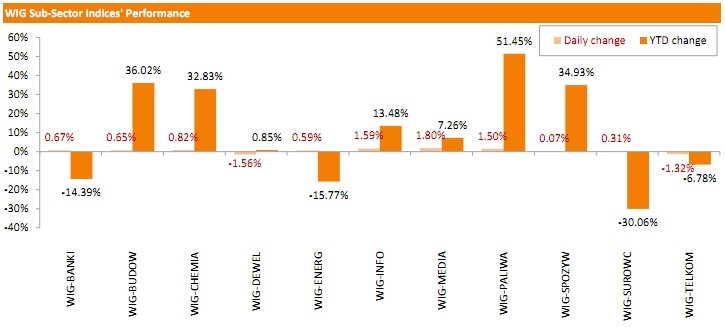

WSE: Session Results

Polish equity market closed higher on Monday. The broad market measure, the WIG index, added 0.6%. Real estate sector (-1.56%) and telecommunications (1.32%) were the only groups in the WIG, which recorded losses. At the same time, media sector (+1.8%) and information technologies (+1.59%) were the best performers.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.77%. In the index basket, coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW) continued to rally for the third consecutive day, gaining 8.72% and 7.37% respectively. Other major outperformers were CYFROWY POLSAT (WSE: CPS), LPP (WSE: LPP) and ALIOR (WSE: ALR), which advanced by 3.86%, 3.56% and 2.06% respectively. On the other side of the ledger, GTC (WSE: GTC) led the decliners with a 4.07% drop, followed by CCC (WSE: CCC) and ORANGE POLSKA (WSE: OPL), sliding a respective 2.31% and 1.66%.

-

17:42

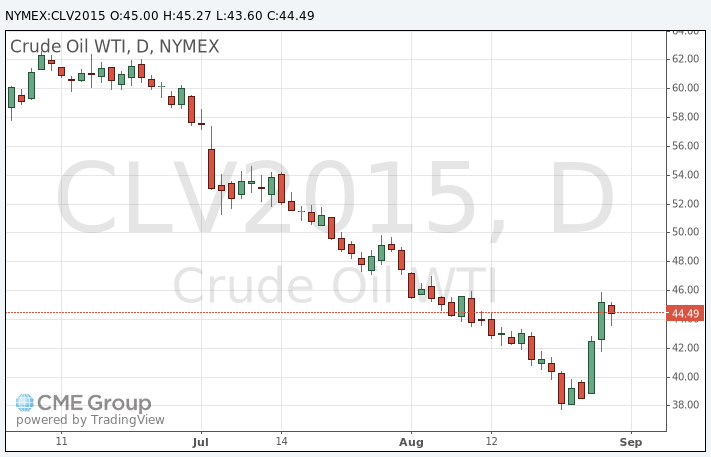

Oil prices declines on concerns over a slowdown in the Chinese economy and concerns over the global oil oversupply

Oil prices fell on concerns over a slowdown in the Chinese economy and concerns over the global oil oversupply. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 1 rigs to 675 last week. It was the sixth consecutive increase. Combined oil and gas rigs fell by 8 to 877.

The Chinese stock market declined on Monday. The Financial Times reported that the Chinese government ended its large-scale share purchase programme.

OPEC expressed concerns over the decline in oil prices in its bulletin on Monday.

"As the Organization has stressed on numerous occasions, it stands ready to talk to all other producers. But this has to be on a level playing field. OPEC will protect its own interests," OPEC said.

WTI crude oil for October delivery decreased to $43.60 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $48.62 a barrel on ICE Futures Europe.

-

17:24

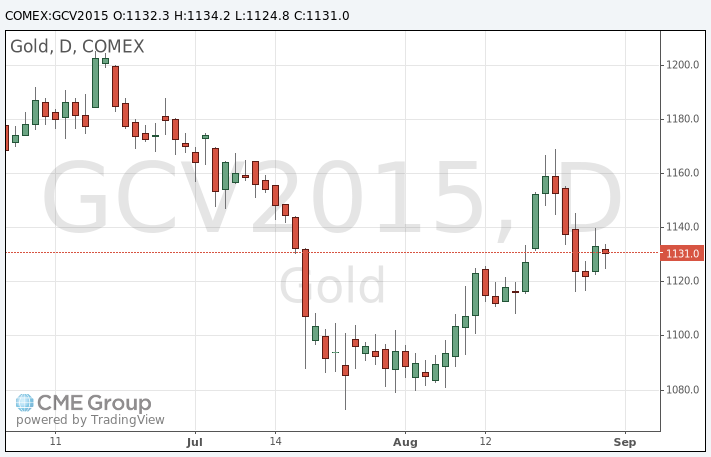

Gold price falls on a possible interest rate by the Fed in September

Gold price declined on a possible interest rate by the Fed in September. Gold lost 2.2% last week as market participants eyed the U.S. economic data.

Some Fed officials said at a conference at Jackson Hole, Wyoming, at the weekend, that the Fed could raise its interest rate this year despite the recent turbulences.

Market participants are awaiting the release of the U.S. ADP Employment report, ISM manufacturing and services PMIs, and the labour market data this week.

October futures for gold on the COMEX today fell to 1124.80 dollars per ounce.

-

17:03

Atlanta Fed President Dennis Lockhart: the interest rate hike is possible in every monetary policy meeting this year

Atlanta Fed President Dennis Lockhart said in an interview with Fox Business News on Friday that the interest rate hike is possible in every monetary policy meeting this year.

"I think all the upcoming meetings, the next three meetings, should all be live meetings and I think we should keep our options open," he said.

-

16:55

Preliminary consumer prices in Italy increase 0.2% in August

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Monday. Preliminary consumer prices in Italy increased 0.2% in August, after a 0.1% decline July.

Services prices related to transport increased 0.2% in June, while services prices to recreation, including repair and personal care, gained 0.4%.

On a yearly basis, consumer prices climbed 0.2% in August, after a 0.2% increase in July.

Consumer price inflation excluding unprocessed food and energy prices fell to 0.7% year-on-year in August from 0.8% in July.

Services prices related to transport were up at an annual rate of 0.7% in August, while goods prices declined 0.5%.

-

16:44

European Central Bank purchases €9.8 billion of government bonds last week

The European Central Bank (ECB) purchased €9.8 billion of government bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.94 billion of covered bonds, and €106 million of asset-backed securities.

-

16:20

Chicago purchasing managers' index falls to 54.4 in August

The Chicago purchasing managers' index declined to 54.4 in August from 54.7 in July, missing expectations for an increase to 54.9, according to MNI indicators.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was driven by decreases by the production and new orders indexes.

The employment index rose in August.

"While the slowdown earlier in the year looks temporary, we're still some way below the strong growth rates seen towards the end of 2014," Chief Economist of MNI Indicators Philip Uglow said.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E696mn), $1.1270(E273mn), $1.1410/15(E800mn)

USD/JPY: Y119.75($300mn)

EUR/JPY: Y137.00(E1.35bn)

NZD/USD: $0.6600(NZ$2.3bn)

AUDUSD 0.7250

NZDUSD 0.6585 0.6600 (2.3bn) 0.6750 (976m)

USDCAD 1.3200

-

15:45

U.S.: Chicago Purchasing Managers' Index , August 54.4 (forecast 54.9)

-

15:41

Spanish current account deficit widens to €1.34 billion in June

The Bank of Spain released its current account data on Monday. Spain's current account deficit widened to €1.34 billion in June from a surplus of €1.15 billion in May.

The surplus on trade in goods and services decreased to €2.4 billion from €3.2 billion, while the deficit on primary and second income declined to €1.1 billion from €2 billion.

-

15:32

U.S. Stocks open: Dow -0.60%, Nasdaq -0.42%, S&P -0.49%

-

15:29

Before the bell: S&P futures -0.90%, NASDAQ futures -0.80%

U.S. stock-index futures fell, commodities declined and the yen strengthened as sentiment toward China soured while Federal Reserve officials signaled they're prepared to raise interest rates.

Global Stocks:

Nikkei 18,890.48 -245.84 -1.28%

Hang Seng 21,670.58 +58.19 +0.27%

Shanghai Composite 3,207.07 -25.28 -0.78%

FTSE 6,247.94 +55.91 +0.90%

CAC 4,629.14 -45.99 -0.98%

DAX 10,213.85 -84.68 -0.82%

Crude oil $43.94 (-2.90%)

Gold $1127.70 (-0.56%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Twitter, Inc., NYSE

TWTR

27.76

+3.47%

370.3K

Hewlett-Packard Co.

HPQ

28.00

-0.11%

0.1K

Intel Corp

INTC

28.38

-0.14%

13.4K

American Express Co

AXP

76.50

-0.20%

2.8K

Merck & Co Inc

MRK

55.25

-0.22%

0.2K

General Motors Company, NYSE

GM

28.90

-0.34%

19.9K

The Coca-Cola Co

KO

39.31

-0.35%

0.3K

Microsoft Corp

MSFT

43.75

-0.42%

2.4K

Boeing Co

BA

132.64

-0.45%

1.1K

3M Co

MMM

143.50

-0.49%

0.2K

ALTRIA GROUP INC.

MO

53.90

-0.50%

1.0K

Nike

NKE

111.90

-0.53%

1.1K

AT&T Inc

T

33.11

-0.54%

6.5K

International Business Machines Co...

IBM

147.18

-0.54%

0.2K

Walt Disney Co

DIS

101.92

-0.55%

12.7K

Amazon.com Inc., NASDAQ

AMZN

515.15

-0.55%

7.1K

Johnson & Johnson

JNJ

94.63

-0.57%

1.1K

McDonald's Corp

MCD

95.69

-0.58%

0.5K

Procter & Gamble Co

PG

70.80

-0.58%

9.8K

Starbucks Corporation, NASDAQ

SBUX

55.30

-0.59%

3.6K

Goldman Sachs

GS

186.60

-0.61%

4.3K

Home Depot Inc

HD

116.80

-0.61%

1.8K

Cisco Systems Inc

CSCO

25.84

-0.62%

0.6K

E. I. du Pont de Nemours and Co

DD

51.51

-0.64%

17.3K

Pfizer Inc

PFE

32.45

-0.64%

0.7K

Verizon Communications Inc

VZ

45.77

-0.65%

0.9K

Facebook, Inc.

FB

90.35

-0.73%

228.9K

Wal-Mart Stores Inc

WMT

64.46

-0.74%

1.4K

Deere & Company, NYSE

DE

81.85

-0.75%

0.3K

Google Inc.

GOOG

625.63

-0.75%

3.7K

Visa

V

71.90

-0.77%

0.2K

Citigroup Inc., NYSE

C

52.85

-0.81%

15.2K

AMERICAN INTERNATIONAL GROUP

AIG

60.50

-0.82%

1.4K

Apple Inc.

AAPL

112.27

-0.90%

282.5K

General Electric Co

GE

24.92

-0.94%

11.8K

Ford Motor Co.

F

13.60

-1.02%

6.4K

Chevron Corp

CVX

79.60

-1.03%

60.9K

UnitedHealth Group Inc

UNH

116.01

-1.08%

1.6K

JPMorgan Chase and Co

JPM

63.40

-1.14%

0.3K

Yahoo! Inc., NASDAQ

YHOO

32.75

-1.18%

7.5K

Exxon Mobil Corp

XOM

74.15

-1.23%

10.6K

Caterpillar Inc

CAT

74.98

-1.28%

6.9K

United Technologies Corp

UTX

91.75

-1.60%

0.2K

Tesla Motors, Inc., NASDAQ

TSLA

244.36

-1.66%

34.1K

Barrick Gold Corporation, NYSE

ABX

07.01

-1.68%

13.0K

ALCOA INC.

AA

9.22

-2.02%

30.1K

Yandex N.V., NASDAQ

YNDX

12.07

-2.27%

2.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.26

-2.29%

125.8K

-

15:06

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Buy from Neutral at Sun Trust Rbsn Humphrey, target $38

Intel (INTC) upgraded to Outperform from Market Perform at Northland Capital, target $32

Goldman Sachs (GS) upgraded to Buy from Hold at Evercore ISI

Downgrades:

United Tech (UTX) downgraded to Equal Weight from Overweight at Barclays

Other:

-

15:05

Greek adjusted retail sales are down 0.5% in June

The Greek statistical office Hellenic Statistical Authority. Greek adjusted retail sales declined 0.5% in June, after a 2.1% gain in May.

On a yearly basis, German retail sales fell 0.4% in June, after a 4.1% rise in May. May's figure was revised down from a 4.2% increase.

Sales of food products decreased 0.3% in June, sales of non-food products dropped 1.1%, while sales of automotive fuel climbed by 4.4%.

-

14:43

Canadian current account deficit narrows to C$17.4 billion in the second quarter

Statistics Canada released current account data on Monday. Canadian current account deficit narrowed to C$17.4 billion in the second quarter from a deficit of C$18.2 billion in the first quarter. The first quarter figure was revised down from a deficit of C$17.5 billion.

The fall in deficit was driven by declines in the trade in goods and services deficit. The trade in goods deficit fell by C$0.3 billion to a record C$6.7 billion in the second quarter, while the deficit on international trade in services declined by $0.2 billion to C$5.5 billion.

-

14:30

Canada: Current Account, bln, Quarter II -17.4

-

14:25

Italian retail sales decline at a seasonally adjusted rate of 0.3% in June

The Italian statistical office Istat released its retail sales data for Italy on Monday. Italian retail sales fell at a seasonally adjusted rate of 0.3% in June, after a 0.2% decline in May.

Sales of food products fell 0.2% in June, while sales of non-food products declined by 0.3%.

On a yearly basis, retail sales in Italy rose 1.2% in June, after a 0.1% increase in May.

-

14:13

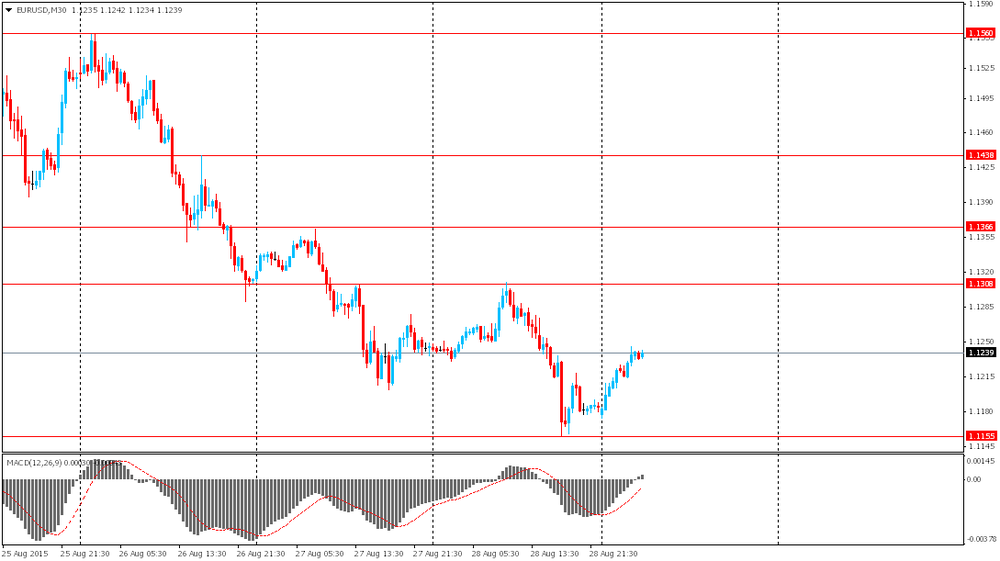

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m August 0.2% 0.1%

01:00 Australia HIA New Home Sales, m/m July 0.5% -0.4%

01:00 New Zealand ANZ Business Confidence August -15.3 -29.1%

01:30 Australia Private Sector Credit, m/m July 0.4% 0.5% 0.6%

01:30 Australia Private Sector Credit, y/y July 5.9% 6.1%

01:30 Australia Company Gross Profits QoQ Quarter II -0.3% Revised From 0.2% -2% -1.9%

05:00 Japan Construction Orders, y/y July 15.4% -4.0%

05:00 Japan Housing Starts, y/y July 16.3% 11% 7.4%

06:00 Germany Retail sales, real unadjusted, y/y July 5.2% Revised From 5.1% 1.9% 3.3%

06:00 Germany Retail sales, real adjusted July -1.0% Revised From -2.3% 1% 1.4%

07:00 Switzerland KOF Leading Indicator August 100.4 Revised From 99.8 99.5 100.7

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 1% 1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.1% 0.2%

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the U.S. Chicago purchasing managers' index data. The Chicago purchasing managers' index is expected to rise to 54.9 in August from 54.7 in July.

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of Canadian current account data.

The Swiss franc traded lower against the U.S. dollar. The KOF leading indicator rose to 100.7 in August from 100.4 in July, beating expectations for a decline to 99.5. July's figure was revised up from 99.8.

According to the institute, the outlook for the Swiss economy remained unchanged since July.

EUR/USD: the currency pair declined to $1.1196

GBP/USD: the currency pair fell to $1.5393

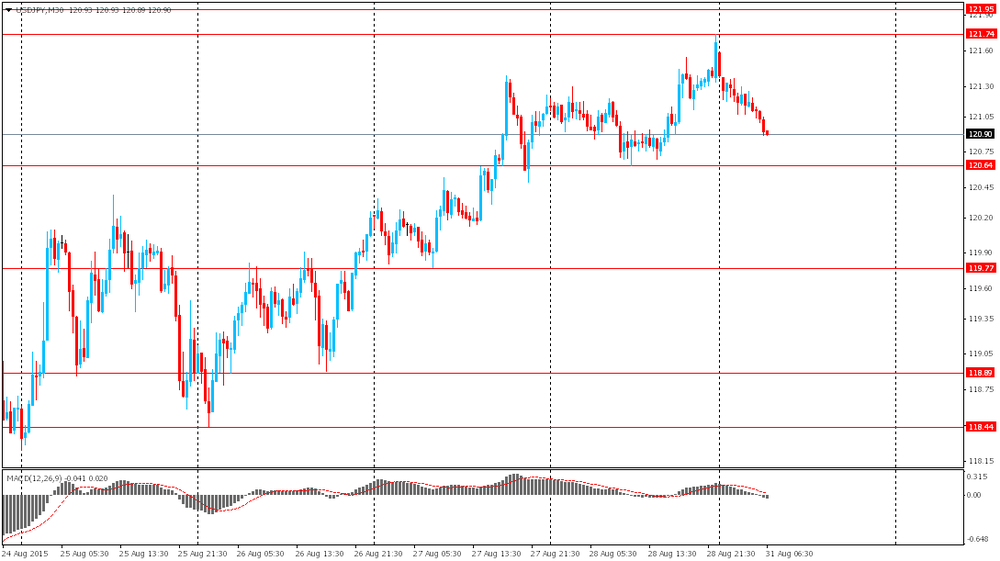

USD/JPY: the currency pair increased to Y121.35

The most important news that are expected (GMT0):

12:30 Canada Current Account, bln Quarter II -17.5

13:45 U.S. Chicago Purchasing Managers' Index August 54.7 54.9

23:30 Australia AIG Manufacturing Index August 50.4

23:50 Japan Capital Spending Quarter II 7.3% 9%

-

14:00

Orders

EUR/USD

Offers 1.1280 1.1300 1.1325 1.1340 1.1355-60 1.1395 1.1400

Bids 1.1200 1.1185 1.1160 1.1110 1.1100

GBP/USD

Offers 1.5450 1.5480 1.5500-05 1.5520 1.5550 1.5600

Bids 1.5400 1.5380 1.5350 1.5330 1.5300 1.5290

EUR/GBP

Offers 0.7300 0.7350 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7240 0.7200 0.7150 0.7130

EUR/JPY

Offers 136.50 136.80 137.00 137.50 137.80

Bids 135.50 135.20 135.00 134.80 134.50

USD/JPY

Offers 121.20 121.50 121.60 122.00

Bids 120.45-50 120.10 120.00 119.60

AUD/USD

Offers 0.7200 0.7250 0.7290 0.7300

Bids 0.7120 0.7100 0.7060 0.7050 0.7000

-

12:00

European stock markets mid session: stocks traded lower as the Chinese stock market declined again

Stock indices traded lower as the Chinese stock market declined again. The Financial Times reported that the Chinese government ended its large-scale share purchase programme.

Meanwhile, the economic data from the Eurozone was positive. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

Current figures:

Name Price Change Change %

FTSE 100 closed

DAX 10,179.32 -119.21 -1.16 %

CAC 40 4,628.52 -46.61 -1.00 %

-

11:44

Industrial production in Japan declines 0.6% in July

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production figures on late Sunday evening. Industrial production in Japan declined 0.6% in July, after a 0.8% gain in June.

On a yearly basis, Japan's industrial production was up 0.2% in July, after a 2.3% rise in June.

Lower overseas demand weighed on the Japanese industrial production.

The decline was driven by decreases in the electrical components and the transport equipment industries.

-

11:33

KOF leading indicator for Switzerland climbs to 100.7 in August

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator rose to 100.7 in August from 100.4 in July, beating expectations for a decline to 99.5. July's figure was revised up from 99.8.

According to the institute, the outlook for the Swiss economy remained unchanged since July.

"Overall slightly positive tendencies in the manufacturing and banking sectors are balanced by slightly negative developments in primarily the construction sector. With the indicators capturing tendencies in the international environment as well as domestic consumption more or less stabilising at their previous readings, the overall result is a slight rise in the Barometer," the KOF said.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E696mn), $1.1270(E273mn), $1.1410/15(E800mn)

USD/JPY: Y119.75($300mn)

EUR/YEN: Y137.00(E1.35bn)

NZD/USD: $0.6600(NZ$2.3bn)

-

11:15

Preliminary consumer price inflation in the Eurozone remains unchanged at 0.2% in August

Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

-

11:02

Eurozone: Harmonized CPI ex EFAT, Y/Y, August 1%

-

11:00

Eurozone: Harmonized CPI, Y/Y, August 0.2% (forecast 0.1%)

-

10:54

German adjusted retail sales are up 1.4% in July

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

-

10:43

Federal Reserve Bank of Atlanta President Dennis Lockhart: the interest rate hike by the Fed in September is still possible

Federal Reserve Bank of Atlanta President Dennis Lockhart said in an interview on Bloomberg television Friday that the interest rate hike by the Fed in September is still possible. But he added that there is a risk now.

"We are sort of anxious to get going, but given the events of the last several weeks, a risk factor has arisen. It has to be considered an open question whether we move now or wait a little while," he said.

Lockhart is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:32

Swiss National Bank President Thomas Jordan: the interest rates in Switzerland will remain negative for a while

The Swiss National Bank (SNB) President Thomas Jordan said in an interview with the NZZ am Sonntag that the interest rates in Switzerland will remain negative for a while as there are many risks that could lead to a stronger Swiss franc, which is already a "clearly overvalued".

He added that "there are lights at the end of the tunnel" as the Fed and the Bank of England may start raising its interest rates and as Eurozone's economy is recovering.

Jordan pointed out that the central bank is ready to intervene in the foreign exchange market if needed, and it intervened in June.

The SNB president noted that the Swiss economy is in line with central bank's forecasts.

-

10:18

The number of active U.S. rigs rises by 1 rigs to 675 last week

The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 1 rigs to 675 last week. It was the sixth consecutive increase.

Combined oil and gas rigs fell by 8 to 877.

-

10:12

Bank of America Corp.: the rise in China's stock market will be short-lived

The rise in China's stock market will be short-lived as the government's intervention is too expensive to be continued for a long time, according to Bank of America Corp.

"As soon as people sense the government is withdrawing from direct intervention, there will be lots of investors starting to dump stocks again," China equity strategist at Bank of America in Singapore, David Cui, said.

He added that the Shanghai Composite Index have to fall another 35% before shares will become attractive.

Cui expects that the government will end its direct market purchases within the next month or two.

-

09:12

Oil prices fell after a week of gains

West Texas Intermediate futures for October delivery fell to $44.59 (-1.39%), while Brent crude dropped to $49.20 (-1.70%). Some analysts said that prices declined amid profit taking after both crudes finished last week with gains.

Investors are still focused on Fed interest rates. Higher rates would make this dollar-denominated commodity more expensive for holders of other currencies.

Market participants are also eyeing the result of planned United Nations-brokered talks later this week between Libya's warring factions aimed at forming a unity government. Yesterday the Tripoli-based central bank reported that Libya recorded a budget deficit of $3.3 billion in the first seven months of 2015 as oil prices and production fell.

-

09:00

Switzerland: KOF Leading Indicator, August 100.7 (forecast 99.5)

-

08:49

Gold fluctuates near open level

Gold is currently at $1,133.40 (-0.05%) fluctuating near its open level as a data-rich week begins. Investors are waiting for more clues on future of interest rates in the U.S. Probability of a rate hike at a September 16-17 meeting is still in place after strong U.S. economic data, which were published at the end of last week. However Fed Vice Chairman Stanley Fischer increased uncertainty saying at the Jackson Hole symposium over the weekend that it was too early to tell whether September is suitable for an increase in rates.

Meanwhile St. Louis Federal Reserve Bank President James Bullard told Bloomberg on Friday that strong U.S. data are more important than volatility triggered by Asian markets. "The key question for the committee - and no decisions have been made here - but the key question for the committee is how much would you want to change the outlook based on the volatility that we've seen over the last 10 days? I think the answer to that is going to be not very much," he said.

Investors will also pay much attention to the U.S. August nonfarm payrolls due on Friday.

Turmoil in Asian equity markets supports demand for bullion; however investors are mostly focused on Fed rates.

-

08:13

Global Stocks: Asian stock indices declined on Monday

U.S. stock indices mostly ended Friday with modest gains as market volatility steadied compared to earlier days. Strong GDP and consumer spending data, which came in on Thursday and Friday, gave investors confidence about the U.S. economy.

The Dow Jones Industrial Average lost 11.76 points, or 0.1%, to 16643.01. The S&P 500 added 1.21, or 0.1%, to 1988.87. The Nasdaq Composite gained 15.62, or 0.3%, to 4828.32.

This morning in Asia Hong Kong Hang Seng declined 0.77%, or 165.95 points, to 21,446.44. China Shanghai Composite Index dropped 2.61%, or 84.27 points, to 3,148.08. The Nikkei dropped 1.82%, or 348.81 points, to 18,787.51.

Japanese stocks are in the red zone. Analysts believe that investors are waiting for news on Fed interest rate hike prospects. The decision itself will be made at a meeting held on September 16-17. Fed Vice Chairman Stanley Fischer said at the Jackson Hole symposium over the weekend that it was too early to tell whether September is suitable for an increase in rates.

Stocks were also influenced by Japanese industrial production data. The corresponding index fell 0.6% in July missing expectations for a 0.1% reading. On an annualized basis it dropped to 0.2% from 2.3%.

-

08:09

Foreign exchange market. Asian session: the Australian dollar weakened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia MI Inflation Gauge, m/m August 0.2% 0.1%

01:00 Australia HIA New Home Sales, m/m July 0.5% -0.4%

01:00 New Zealand ANZ Business Confidence August -15.3 -29.1%

01:30 Australia Private Sector Credit, m/m July 0.4% 0.5% 0.6%

01:30 Australia Private Sector Credit, y/y July 5.9% 6.1%

01:30 Australia Company Gross Profits QoQ Quarter II -0.3% Revised From 0.2% -2% -1.9%

05:00 Japan Construction Orders, y/y July 15.4% -4.0%

05:00 Japan Housing Starts, y/y July 16.3% 11% 7.4%

06:00 Germany Retail sales, real unadjusted, y/y July 5.1% 1.9% 3.3%

06:00 Germany Retail sales, real adjusted July -2.3% 1% 1.4%

The U.S. dollar advanced against major currencies. The greenback is supported by Fed officials' comments made at the Jackson Hole symposium at the end of the week. Fed Vice Chairman Stanley Fischer said that the case for a rate increase in September is not clear. He said that the central bank is on track to raise rates, but he noted he wasn't sure that September is the right time to act.

The Australian dollar declined against the U.S. dollar amid TD Securities inflation data. The corresponding consumer price index fell to 0.1% in August from 0.2% reported previously. The index came in at 1.7% y/y compared to 1.6% y/y in July. Official data are published once per quarter, that's why data by TD Securities are very important.

The New Zealand dollar fell against the greenback amid weak statistics. The ANZ business confidence index fell to a six-year low of -29.1 in August. In the previous month the index stood at -15.3. ANZ also warned investors that the pace of declines in the economy picked up.

Declines in Asian stocks boosted demand for the yen, thus allowing this currency to strengthen against the dollar. Meanwhile Japanese industrial production fell 0.6% in July missing expectations for a 0.1% reading. On an annualized basis it dropped to 0.2% from 2.3%.

EUR/USD: the pair rose above $1.1250 in Asian trade

USD/JPY: the pair fell to Y120.85

GBP/USD: the pair rose to $1.5435

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator August 99.8 99.5

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.1%

12:30 Canada Current Account, bln Quarter II -17.5

13:45 U.S. Chicago Purchasing Managers' Index August 54.7 54.9

23:30 Australia AIG Manufacturing Index August 50.4

23:50 Japan Capital Spending Quarter II 7.3% 9%

-

08:00

Germany: Retail sales, real unadjusted, y/y, July 3.3% (forecast 1.9%)

-

08:00

Germany: Retail sales, real adjusted , July 1.4% (forecast 1%)

-

07:16

Japan: Construction Orders, y/y, July -4.0%

-

07:16

Japan: Housing Starts, y/y, July 7.4% (forecast 11%)

-

06:53

Options levels on monday, August 31, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1422 (3377)

$1.1345 (5053)

$1.1284 (5053)

Price at time of writing this review: $1.1256

Support levels (open interest**, contracts):

$1.1101 (4772)

$1.1044 (5333)

$1.0972 (6908)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 91056 contracts, with the maximum number of contracts with strike price $1,1350 (5293);

- Overall open interest on the PUT options with the expiration date September, 4 is 128591 contracts, with the maximum number of contracts with strike price $1,0500 (7857);

- The ratio of PUT/CALL was 1.41 versus 1.44 from the previous trading day according to data from August, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (1993)

$1.5601 (2546)

$1.5503 (2132)

Price at time of writing this review: $1.5430

Support levels (open interest**, contracts):

$1.5297 (2466)

$1.5199 (1493)

$1.5099 (359)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30167 contracts, with the maximum number of contracts with strike price $1,5600 (2546);

- Overall open interest on the PUT options with the expiration date September, 4 is 35448 contracts, with the maximum number of contracts with strike price $1,5500 (2759);

- The ratio of PUT/CALL was 1.18 versus 1.18 from the previous trading day according to data from August, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:02

Nikkei 225 18,915.87 -220.45 -1.15 %, Hang Seng 21,592.65 -19.74 -0.09 %, Shanghai Composite 3,203.56 -28.79 -0.89 %

-

03:30

Australia: Private Sector Credit, m/m, July 0.6% (forecast 0.5%)

-

03:30

Australia: Company Gross Profits QoQ, Quarter II -1.9% (forecast -2%)

-

03:30

Australia: Private Sector Credit, y/y, July -1.9%

-

03:01

New Zealand: ANZ Business Confidence, August -29.1

-

03:01

Australia: HIA New Home Sales, m/m, July -0.4%

-

02:30

Australia: MI Inflation Gauge, m/m, August 0.1%

-

01:52

Japan: Industrial Production (MoM) , July -0.6%

-

01:51

Japan: Industrial Production (YoY), July 0.2%

-

00:47

New Zealand: Building Permits, m/m, July 20.4%

-

00:32

Commodities. Daily history for Aug 28’2015:

(raw materials / closing price /% change)

Oil 45.33 +0.24%

Gold 1,133.30 -0.06%

-

00:32

Stocks. Daily history for Aug 28’2015:

(index / closing price / change items /% change)

Nikkei 225 19,136.32 +561.88 +3.03 %

Hang Seng 21,612.39 -226.15 -1.04 %

S&P/ASX 200 5,263.56 +30.24 +0.58 %

Shanghai Composite 3,234.61 +151.02 +4.90 %

FTSE 100 6,247.94 +55.91 +0.90 %

CAC 40 4,675.13+16.95 +0.36 %

Xetra DAX 10 ,298.53 -17.09 -0.17 %

S&P 500 1,988.87 +1.21 +0.06 %

NASDAQ Composite 4,828.33 +15.62 +0.32 %

Dow Jones 16,643.01 -11.76 -0.07 %

-

00:31

Currencies. Daily history for Aug 28’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1185 -0,55%

GBP/USD $1,5391 -0,09%

USD/CHF Chf0,9619 -0,36%

USD/JPY Y121,67 +0,44%

EUR/JPY Y136,07 -0,12%

GBP/JPY Y187,31 +0,37%

AUD/USD $0,7171 +0,06%

NZD/USD $0,6460 -0,26%

USD/CAD C$1,3199 -0,03%

-

00:01

Schedule for today, Monday, Aug 31’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia MI Inflation Gauge, m/m August 0.2%

01:00 Australia HIA New Home Sales, m/m July 0.5%

01:00 New Zealand ANZ Business Confidence August -15.3

01:30 Australia Private Sector Credit, m/m July 0.4% 0.5%

01:30 Australia Private Sector Credit, y/y July 5.9%

01:30 Australia Company Gross Profits QoQ Quarter II 0.2% -2%

05:00 Japan Construction Orders, y/y July 15.4%

05:00 Japan Housing Starts, y/y July 16.3% 11%

06:00 Germany Retail sales, real unadjusted, y/y July 5.1% 1.5%

06:00 Germany Retail sales, real adjusted July -2.3% 1.0%

07:00 Switzerland KOF Leading Indicator August 99.8 99.5

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.1%

12:30 Canada Current Account, bln Quarter II -17.5

13:45 U.S. Chicago Purchasing Managers' Index August 54.7 54.9

23:30 Australia AIG Manufacturing Index August 50.4

23:50 фJapan Capital Spending Quarter II 7.3% 9%

-