Noticias del mercado

-

22:47

U.S.: Total Vehicle Sales, mln, August 17.81 (forecast 17.3)

-

22:08

U.S. stocks closed

U.S. stocks led a renewed rout in equities worldwide as concern that China's slowing economy will hamper global growth roiled financial markets.

The Standard & Poor's 500 Index swooned into September with its third-biggest loss in 2015 as the beating that erased $5.7 trillion from the value of global equities in August continued. Crude tumbled the most in two months, emerging assets plunged and a measure of risk premium on high-yield debt jumped. Demand surged for haven assets from Treasuries to gold.

The S&P 500 dropped 3 percent at 4 p.m. in New York after plunging 6.3 percent in August for its worst month since 2012. It has fallen 1.1 percent on average in September going back to 1927, the most of any month according to data compiled by Bloomberg.

Asian shares started Tuesday's selloff after a gauge of Chinese manufacturing fell to a three-year low. European stocks followed after a reports pointed to weaker growth in the region, and the slump spread to the U.S. amid data showing the slowest expansion in manufacturing in two years. Treasuries and gold climbed while oil tumbled after entering a bull market. The yen strengthened the most among major currencies.

Trading in U.S. equities has been volatile. Last week alone, the S&P 500 plunged the most since 2011 to enter a correction before rallying more than 6 percent over two days for its best back-to-back gains since the beginning of the bull market in 2009. Selling resumed Monday after Federal Reserve officials signaled they are preparing to raise rates as soon as this month.

The Chicago Board Options Volatility Index jumped 14 percent Tuesday after posting its biggest monthly advance in data going back to 1990.

Stocks in emerging countries also picked up where they left off in August, sliding by 2.4 percent Tuesday. A slowdown in China has repercussions for countries from Brazil to Russia and South Africa, which rely on demand from the world's second-largest economy for exports of goods. The prospects of the Federal Reserve raising interest rates as soon as this month is also weighing on sentiment.

The Fed is scrutinizing data to determine the timing and pace of its first interest-rate increase since 2006. Attention will focus this week on the government's August jobs report, due Friday, as the last major data point before the Fed's meeting on Sept. 16-17.

Boston Fed President Eric Rosengren said Tuesday uncertainty over inflation and global growth justifies a modest pace of interest-rate increases, regardless of when the central bank begins tightening.

Futures traders are betting the Fed will push back a rate increase to later this year. The likelihood they assign an increase in September has fallen to 38 percent, down from 48 percent two weeks ago, according to data compiled by Bloomberg. The chances assume that the federal funds rate will average 0.375 percent after the first hike.

The International Monetary Fund on Tuesday joined private forecasters including Citigroup Inc. and Morgan Stanley in anticipating slower expansion as China's growth weakens and Brazil's economy shrinks.

-

21:00

DJIA 16117.78 -410.25 -2.48%, NASDAQ 4659.98 -116.53 -2.44%, S&P 500 1921.80 -50.38 -2.55%

-

20:21

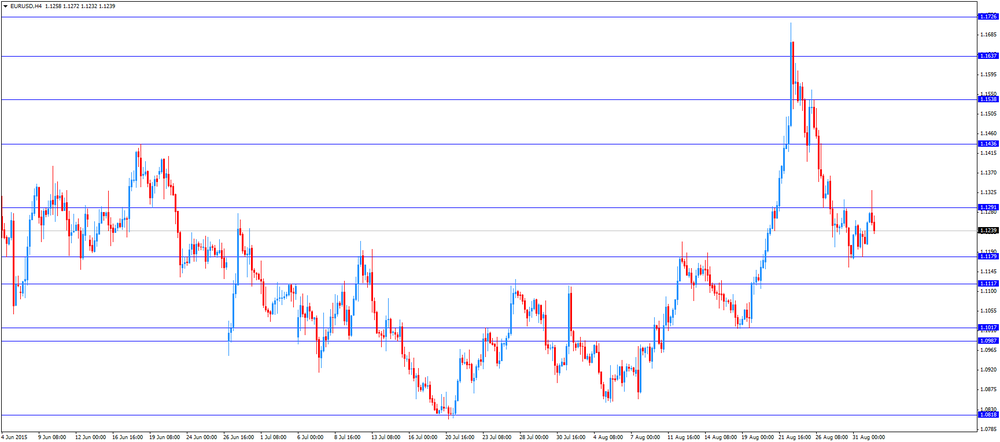

American focus: the US dollar fell

Dollar falls against against other major currencies after data ISM showed that manufacturing activity in the US in August increased at the slowest rate in more than two years, while concerns about the prospects for economic growth China still exerts pressure on the US currency.

A report published by the Institute of Supply Management (ISM), showed that in August, activity in the US manufacturing sector deteriorated sharply, with the average exceeded the forecasts of experts

The PMI index for the US manufacturing in August was 51.1 points versus 52.7 points in July. The latter value was the lowest since August 2013. It was expected that this figure will drop to 52.6 points.

The report also reported that the rate of new orders fell in August to 51.7 from 56.5 previously, while the sub-index of production - to 53.6 from 56.0. Unfilled orders rose to 46.5 from 42.5 in July. The employment index fell from 52.7 to 51.2, while export orders component fell to 46.5 from 48.0. Meanwhile, the index of inventories fell to 48.5 against 49.5 in July, while the price index dropped to 39.0 from 44.0.

The single currency was supported after Eurostat said the unemployment rate in the euro area fell to 10.9% in July from 11.1% in June, becoming the lowest level since February 2012. Analysts had expected the unemployment rate will remain at the same level in July. Meanwhile, it was reported that among the 28 EU countries the unemployment rate fell to 9.5% against 9.6% in June and 10.2% in July 2014. It was the lowest since June 2011.

According to estimates by Eurostat, 23,067 million. Men and women in ES28, of which 17,532 million. Resident in the euro area, were unemployed in July. Compared with June, the number of unemployed decreased by 232 000 people in the EU and 213,000 in the eurozone. Compared with July 2014, unemployment fell by 1.648 million. EU and 1,116,000. In the eurozone.

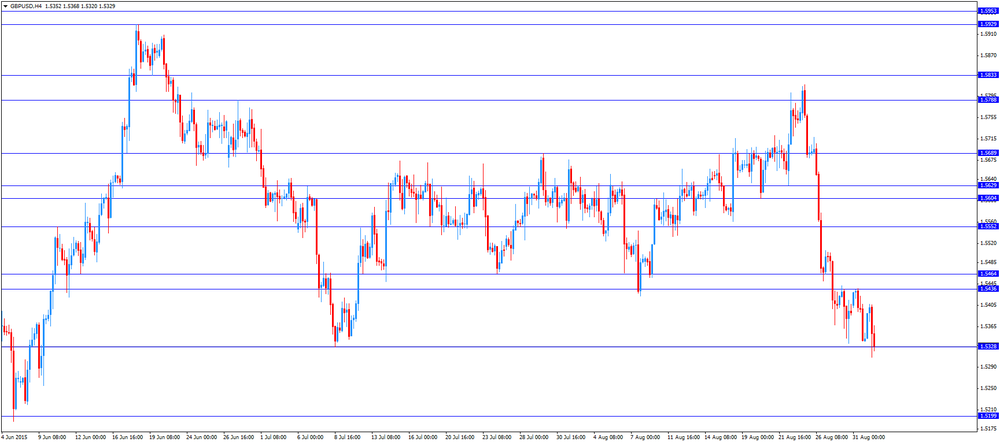

The pound fell sharply against the US dollar, breaking the mark of $ 1.5300. The main pressure exerted data on business activity in Britain. As it became known on the results of studies Markit / CIPS, the growth of activity in the manufacturing sector slowed slightly in Britain last month, contrary to expectations of further improvement, pointing out that the sector is unlikely to make a solid contribution to GDP for the 3rd quarter. This became known According to the data, the index of manufacturing activity PMI fell to 51.5 in August from 51.9 in July. Experts predicted that the figure will rise to the level of 52.0 points. While the index is still holding above the neutral mark of 50, the survey emphasized the dependence of the UK economy on the service sector and large consumer spending. Meanwhile, the report noted that new orders rose at the fastest pace in five months, received major support from the domestic market. Meanwhile, export orders recorded its fifth consecutive monthly reduction. Company attributed the weakening of external demand to the pound. Also add that the number of unfilled orders fell at the fastest pace since March 2013, and the employment sub-index fell below 50 for the first time since April of 2013. Average costs were reduced as much as possible in the last 16 years because of the growth of the pound and cheaper oil. Average prices continued to rise in the sale, and inflation has remained below 11-month high recorded in July. UK manufacturing sector remains on standby. Production hovers around stagnation, while employment fell for the first time in 26 months. In view of recent developments, it is unlikely that the sector will have considerable support GDP figures for the third quarter, "- said Rob Dobson, senior economist at Markit:

The yen has strengthened significantly against the US dollar, reaching a maximum at the same time on August 27 which was due to a new wave of risk aversion, triggered by concerns about China. Posted PMI in the industrial sector in China has confirmed the country's weakening economy. As previously reported, the manufacturing PMI fell to 49.7 in August, in line with analysts' expectations, but the last value was the lowest in the past three years. The sub-index of new orders - an indicator of future domestic and external demand - fell to 49.7 in August from 49.9 in July. The sub-index of new export orders fell to 47.7 from 47.9 in July. The sub-index of employment fell to 47.9 from 48.0 in July. Meanwhile, the PMI index for the manufacturing of China Caixin Media Co. and in August, Markit fell to 47.3 against 47.8 in July, its lowest level in more than six years. The index is expected to increase to 53.9.

Experts also note that the dollar remains under pressure due to fears of the impact of the situation in China on expectations of Fed rate. Meanwhile, investors are waiting for the publication of a report on the US labor market, which will shed light on the prospects for Fed rate hikes.

The Canadian dollar weakened against the US dollar after the release of Canadian data on GDP. Report submitted by Statistics Canada showed that after falling for five consecutive months, the real gross domestic product grew in June by 0.5%. Experts expect that the economy will expand by only 0.2% after falling 0.2% in May. The first estimate of GDP for the 2nd quarter was -0.5% versus a fall of a revised figure for the first quarter at -0.8% and -1.0% forecast experts

Meanwhile, the report stated that the increase in June was broadly based, led by the mining sector, quarrying and oil and gas extraction and, to a lesser extent, wholesale trade, finance and insurance sector as well as arts and entertainment .

Output in manufacturing industries rose by 0.9% in June. Manufacturing, agriculture and forestry, and utilities have also shown an increase. In contrast, the construction sector had registered a decline.

Output in the service sector grew by 0.3% after a zero change in May. Increase was recorded in wholesale trade, finance, security, arts and entertainment in the public sector (education, health and public administration). Zero change was noted in the retail sector.

Mining, oil and gas production expanded by 3.1% in June. Oil and gas production increased by 3.9% after falling 3.5% in April and 0.5% in May. The increase in June, was mainly a result of 9.4 percent increase in the sector of non-traditional oil production. Conventional oil and gas production remained unchanged in June. Mining (except oil and gas) increased by 2.6% compared with May.

After increasing 1.6% in April and a decline of 1.1% in May, wholesale trade rose 1.0% in June. Finance and insurance expanded by 0.7% in June, mainly due to an increase banking services and, to a lesser degree, the financial investment services.

Industrial production grew by 0.4%. Production of non-durable goods increased by 0.9%, primarily due to increased production of chemical, food and textile, apparel and leather products. Meanwhile, durable goods manufacturing did not change in June.

-

18:18

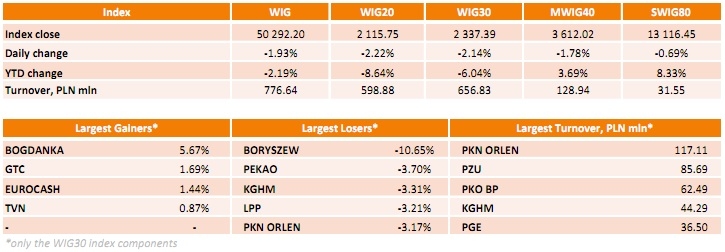

WSE: Session Results

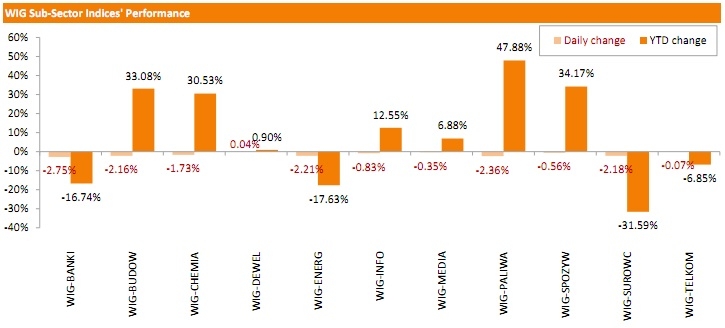

Polish equity market retreated on Tuesday. The broad market measure, the WIG Index, lost 1.93%. All sectors, but for real estate (+0.04%), were down. Banking sector (-2.75%) fared the worst, followed by oil and gas sector (-2.36%) and utilities (-2.21%).

The large-cap stocks' measure, the WIG30 Index, declined by 2.14%. There were only four gainers among the index components. BOGDANKA (WSE: LWB) was the best-performing name, climbing by 5.67%. It was followed by GTC (WSE: GTC), EUROCASH (WSE: EUR) and TVN (WSE: TVN), returning 1.69%, 1.44% and 0.87% respectively. On the other side of the ledger, BORYSZEW (WSE: BRS) was the weakest performer, slumping by 10.65%. Other major decliners included PEKAO (WSE: PEO), KGHM (WSE: KGH), LPP (WSE: LPP), PKN ORLEN (WSE: PKN), PKO BP (WSE: PKO) and SYNTHOS (WSE: SNS), dropping between 3% and 4%.

-

18:00

European stocks closed: FTSE 6058.54 -189.40 -3.03%, DAX 10015.57 -243.89 -2.38%, CAC 40 4541.16 -111.79 -2.40%

-

18:00

European stocks close: stocks closed lower on concerns over a slowdown in the global economy

Stock indices closed lower on concerns over a slowdown in the global economy. The Chinese stock market declined on the weak Chinese manufacturing and services PMIs on Tuesday. The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009. The decline was driven by falls in total new orders and new export business.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9. The decline was driven by a weaker increase in new orders.

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Tuesday that the global growth will be weaker than expected earlier due to a slower recovery in advanced economies and a further slowdown in emerging economies.

Meanwhile, the economic data from the Eurozone was positive. Eurozone's unemployment rate declined to 10.9% in July from 11.1% in June. It was the lowest level since February 2012. Analysts had expected the unemployment rate to remain unchanged at 11.1%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.3 in August from 52.4 in July, down from a preliminary reading of 52.4.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 7,000 in August, exceeding expectations for a 2,000 decline, after a 8,000 rise in July. July's figure was revised down from a 9,000 increase.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in August from 51.9 in July, missing expectations for a rise to 52.0.

A reading above 50 indicates expansion.

The decline was driven by a drop in purchase prices. Average costs showed the steepest decline during the past 16 years.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,058.54 -189.40 -3.03 %

DAX 10,015.57 -243.89 -2.38 %

CAC 40 4,541.16 -111.79 -2.40 %

-

17:36

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes are lower on Tuesday after weak data from China heightened fears of a slowdown in the world's second-largest economy and its effect on global growth. Data showed that China's manufacturing sector shrank at its fastest pace in three years. The services sector, one of the lone bright spots in the country's economy, also showed signs of cooling. China's official manufacturing Purchasing Managers' Index (PMI) fell to 49.7 in August from 50.0 in July.

All Dow stocks in negative area (30 of 30). Top looser - Exxon Mobil Corporation (XOM, -3.43%).

All S&P index sectors in negative area. Top looser - Basic Materials (-3.1%).

At the moment:

Dow 16219.00 -289.00 -1.75%

S&P 500 1934.75 -34.50 -1.75%

Nasdaq 100 4219.75 -52.00 -1.22%

10 Year yield 2,19% -0,01

Oil 46.21 -2.99 -6.08%

Gold 1139.60 +7.10 +0.63%

-

17:34

Oil prices declines on concerns over a slowdown in the Chinese economy

Oil prices fell on concerns over a slowdown in the Chinese economy. The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009. The decline was driven by falls in total new orders and new export business.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9. The decline was driven by a weaker increase in new orders.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for October delivery decreased to $45.76 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $51.89 a barrel on ICE Futures Europe.

-

17:25

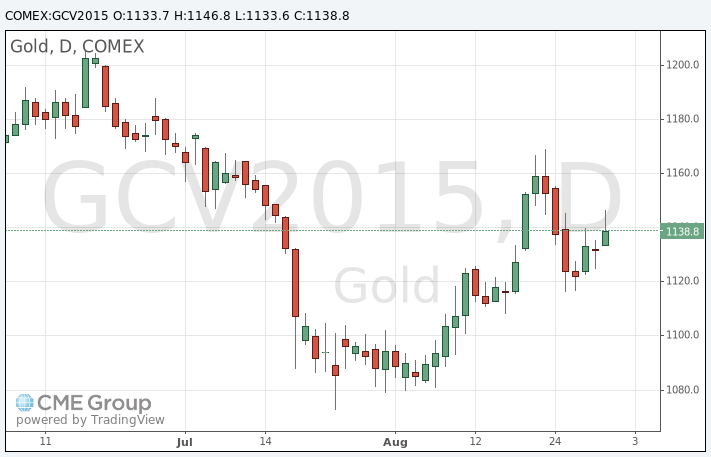

Gold price rises due to increased demand for the safe-haven asset

Gold price rose due to increased demand for the safe-haven asset as global stock indices and the U.S. dollar declined.

The U.S. dollar fell against other currencies after the release of the weaker-than-expected ISM manufacturing purchasing managers' index (PMI). The index declined to 51.1 in August from 52.7 in July, missing expectations for a fall to 52.6. It was the lowest level since May of 2013.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in new orders.

Global stock markets traded lower on concern over a slowdown in the Chinese economy. The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009. The decline was driven by falls in total new orders and new export business.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9. The decline was driven by a weaker increase in new orders.

October futures for gold on the COMEX today rose to 1146.80 dollars per ounce.

-

17:17

European Economic and Monetary Affairs Commissioner Pierre Moscovici is confident that recent market developments in China will not destabilise the European economy

European Economic and Monetary Affairs Commissioner Pierre Moscovici said on Tuesday that he is confident that recent market developments in China will not destabilise the European economy.

"We are carefully monitoring economic and financial developments in China and Russia. I am convinced that the recent developments on markets are not such as to destabilise the European economy," he said.

He added that there is no need to change EU's growth forecasts for 2015.

-

17:12

International Monetary Fund Managing Director Christine Lagarde expects the global growth to be weaker than expected earlier

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Tuesday that the global growth will be weaker than expected earlier due to a slower recovery in advanced economies and a further slowdown in emerging economies.

"Overall, we expect global growth to remain moderate and likely weaker than we anticipated last July. This reflects two forces: a weaker than expected recovery in advanced economies, and a further slowdown in emerging economies, especially in Latin America," she said.

The IMF managing director warned emerging countries to "be vigilant for spillovers" from a slowdown in the Chinese economy.

Lagarde noted that the Chinese economy was slowing as it adjusts to a new growth model.

"The transition to a more market-based economy and the unwinding of risks built up in recent years is complex and could well be somewhat bumpy," she said.

-

16:57

Italy’s unemployment rate decreases to 12.0% in July, the lowest level since February 2013

The Italian statistical office Istat released its unemployment data on Tuesday. The seasonally adjusted unemployment rate decreased to 12.0% in July from 12.5 in June. It was the lowest level since February 2013.

The number of unemployed people was 3.074 million in July, down by 4.4% from the month before.

The youth unemployment rate fell to 40.5% in July from 43.0% in June. It was the lowest youth unemployment rate since July 2013.

The employment rate increased to 56.3% in July from 56.2% in June.

-

16:44

Construction spending in the U.S. is up 0.7% in July

The U.S. Commerce Department released construction spending data on Tuesday. Construction spending in the U.S. rose 0.7% in July, exceeding expectations for a 0.6% gain, after a 0.7% increase in June. June's figure was revised up from a 0.1% rise.

The increase was driven by a rise in private construction. Private construction spending climbed 1.3% in July.

Spending on private non-residential construction projects increased 1.5% in July, while spending on private residential construction was up 1.1%.

Public construction spending decreased 1.0% in July.

-

16:27

ISM manufacturing purchasing managers’ index falls to 51.1 in August, the lowest level since May of 2013

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Tuesday. The index declined to 51.1 in August from 52.7 in July, missing expectations for a fall to 52.6. It was the lowest level since May of 2013.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in new orders. The new orders index dropped to 51.7 in August from 56.5 in July.

The employment index was down to 51.2 in August from 52.7 in July.

The production index declined to 53.6 in August from 56.0 in July.

The price index declined to 39.0 in August from 44.0 in July.

-

16:14

Final Markit/Nikkei manufacturing purchasing managers' index for Japan increases to 51.7 in August

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan increased to 51.7 in August from 51.2 in July, down from the preliminary reading of 51.9.

A reading below 50 indicates contraction of activity.

The index was driven by an improvement in operating conditions and by a rise new orders, output and employment.

"Operating conditions in the Japanese manufacturing sector improved noticeably in the latest survey period, with new order growth accelerating to a seven-month high. This was also supported by increases in both production and employment," economist at Markit, Amy Brownbill, said.

-

16:00

U.S.: Construction Spending, m/m, July 0.7% (forecast 0.6%)

-

16:00

U.S.: ISM Manufacturing, August 51.1 (forecast 52.6)

-

15:55

U.S. final manufacturing purchasing managers' index (PMI) decreases to 53.0 in August

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 53.0 in August from 53.8 in July, up from the previous estimate of 52.9.

A reading above 50 indicates expansion in economic activity.

The decline was driven by the slower growth in output, new orders and employment.

New export work fell in August.

"August's survey highlights that the U.S. manufacturing sector continues to struggle under the weight of the strong dollar and heightened global economic uncertainty, but resilient domestic spending and subdued cost pressures are keeping the recovery on track. Reflecting this, new orders from abroad have now fallen in four of the past five months, which represents the weakest phase of manufacturing export performance since late-2012," Markit's Senior Economist Tim Moore said.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E336mn), $1.1250(E417mn), $1.1300(E1.51bn)

USD/JPY: Y121.00($205mn), Y121.75($230mn)

EUR/GBP: Gbp0.7200(E347mn)

AUD/USD: $0.7300(A$548mn)

NZD/USD: $0.6500(NZ$370mn)

-

15:45

U.S.: Manufacturing PMI, August 53 (forecast 52.9)

-

15:34

Italian final GDP rises 0.3% in the second quarter

The Italian statistical office Istat released its final gross domestic product (GDP) data for Greece on Tuesday. The Italian final GDP increased 0.3% in the second quarter, after a 0.4% rise in the first quarter.

On a yearly basis, Italian final GDP rose 0.7% in the second quarter, after a 0.2% increase in the first quarter.

Final consumption expenditure climbed by 0.3% in the second quarter, gross fixed capital formation fell by 0.3%, imports and exports jumped by 2.2% and 1.2% respectively.

-

15:32

U.S. Stocks open: Dow -1.21%, Nasdaq -2.02%, S&P -1.24%

-

15:25

Before the bell: S&P futures -2.63%, NASDAQ futures -2.70%

U.S. Stock-Index futures tumble as China growth concern deepens.

Global Stocks:

Nikkei 18,165.69 -724.79 -3.84%

Hang Seng 21,185.43 -485.15 -2.24%

Shanghai Composite 3,165.07 -40.91 -1.28%

FTSE 6,057.36 -190.58 -3.05%

CAC 4,518.08 -134.87 -2.90%

DAX 9,962.54 -296.92 -2.89%

Crude oil $47.25 (-3.98%)

Gold $1139.10 (+0.58%)

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

6.91

-0.58%

87.8K

ALTRIA GROUP INC.

MO

52.75

-1.55%

6.8K

Hewlett-Packard Co.

HPQ

27.59

-1.67%

0.1K

AT&T Inc

T

32.63

-1.72%

90.9K

Wal-Mart Stores Inc

WMT

63.51

-1.88%

3.2K

Johnson & Johnson

JNJ

92.20

-1.89%

5.0K

Cisco Systems Inc

CSCO

25.38

-1.93%

11.0K

Yandex N.V., NASDAQ

YNDX

11.96

-1.97%

28.8K

Verizon Communications Inc

VZ

45.10

-1.98%

2.2K

Travelers Companies Inc

TRV

97.55

-2.01%

0.1K

Ford Motor Co.

F

13.59

-2.02%

108.7K

Intel Corp

INTC

27.95

-2.07%

33.6K

Procter & Gamble Co

PG

69.20

-2.08%

5.1K

The Coca-Cola Co

KO

38.50

-2.09%

1.9K

General Motors Company, NYSE

GM

28.80

-2.17%

45.3K

Deere & Company, NYSE

DE

80.00

-2.18%

4.1K

Walt Disney Co

DIS

99.64

-2.20%

11.0K

Microsoft Corp

MSFT

42.55

-2.23%

106.3K

Caterpillar Inc

CAT

74.73

-2.24%

9.7K

International Business Machines Co...

IBM

144.55

-2.26%

1.2K

HONEYWELL INTERNATIONAL INC.

HON

97.00

-2.29%

0.2K

Apple Inc.

AAPL

110.17

-2.30%

746.6K

American Express Co

AXP

74.95

-2.31%

14.0K

UnitedHealth Group Inc

UNH

113.00

-2.33%

0.9K

McDonald's Corp

MCD

92.80

-2.34%

3.0K

Home Depot Inc

HD

113.11

-2.38%

5.1K

Google Inc.

GOOG

603.50

-2.39%

6.4K

Nike

NKE

109.00

-2.46%

0.7K

United Technologies Corp

UTX

89.34

-2.48%

0.3K

Amazon.com Inc., NASDAQ

AMZN

500.16

-2.48%

21.1K

Merck & Co Inc

MRK

52.50

-2.51%

1.3K

Pfizer Inc

PFE

31.40

-2.55%

2.4K

Yahoo! Inc., NASDAQ

YHOO

31.41

-2.57%

52.7K

AMERICAN INTERNATIONAL GROUP

AIG

58.75

-2.64%

1.5K

General Electric Co

GE

24.15

-2.70%

9.1K

Twitter, Inc., NYSE

TWTR

27.03

-2.73%

332.3K

Boeing Co

BA

127.00

-2.82%

3.1K

Visa

V

69.22

-2.92%

3.2K

Citigroup Inc., NYSE

C

51.90

-2.95%

21.9K

JPMorgan Chase and Co

JPM

62.20

-2.96%

58.0K

FedEx Corporation, NYSE

FDX

146.15

-2.96%

0.4K

Chevron Corp

CVX

78.58

-2.98%

28.0K

Exxon Mobil Corp

XOM

73.00

-2.98%

43.4K

Facebook, Inc.

FB

86.75

-3.00%

65.2K

Goldman Sachs

GS

182.80

-3.08%

5.5K

Starbucks Corporation, NASDAQ

SBUX

53.00

-3.13%

3.0K

Tesla Motors, Inc., NASDAQ

TSLA

241.00

-3.24%

56.3K

ALCOA INC.

AA

9.13

-3.39%

30.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.06

-5.45%

177.8K

-

15:09

Greece’s final manufacturing PMI increases to 39.1 in August

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Tuesday. Greece's manufacturing purchasing managers' index (PMI) jumped to 39.1 in August from 30.2 in July.

The decline was driven by falls in new orders and production.

Employment declined for fifth successive month.

"Overall, the headline PMI reading paints a disconcerting picture of the health of the Greek economy, as uncertainty builds around the nation's future political and financial position," Markit economist Samuel Agass said.

-

15:05

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Freeport-McMoRan (FCX) downgraded to Neutral from Buy at Citigroup

Other:

-

14:55

Italy’s final manufacturing PMI plunges to 53.8 in August, the lowest level since August 2014

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Italy on Tuesday. Italy's manufacturing purchasing managers' index (PMI) plunged to 53.8 in August from 55.3 in July. It was the lowest level since August 2014.

The output and new orders rose in June, while the employment was up, smallest increase since January.

Input prices declined for first time in six months due to lower material costs.

"August's PMI data showed a further expansion of production in Italy's manufacturing sector, led by another strong performance among capital goods producers. However, data pointed to some loss of growth momentum, with output, new orders, employment and purchasing activity all rising at slower rates than in July," Markit economist Phil Smith said.

-

14:44

Canada's GDP declines 0.1% in the second quarter

Statistics Canada released GDP (gross domestic product) growth data on Tuesday. Canada's GDP growth rose 0.5% in June, exceeding expectations for a 0.2% increase, after a 0.2% drop in May.

On a quarterly basis, GDP fell 0.1% in the second quarter, missing expectations for a 0.2% rise, after 0.2% decline in the first quarter. The first quarter's figure was revised down from a 0.1% decrease.

Household final consumption expenditure was up 0.6% in the second quarter as spending on durable goods and semi-durable goods rose.

Final domestic demand was flat in the second quarter.

Exports of goods and services rose 0.1% in the second quarter, while imports of goods and services declined 0.4%.

The mining, quarrying and oil and gas extraction sector plunged 4.5% in the second quarter.

Business gross fixed capital formation dropped 2.0% in the second quarter.

On a yearly basis, GDP declined 0.5% in the second quarter, beating expectations for a 0.5% fall, after 0.8% drop in the first quarter. The first quarter's figure was revised down from a 0.6% decline.

-

14:30

Canada: GDP (m/m) , June 0.5% (forecast 0.2%)

-

14:30

Canada: GDP QoQ, Quarter II -0.1% (forecast 0.2%)

-

14:30

Canada: GDP (YoY), Quarter II -0.5% (forecast -1%)

-

14:25

Spain’s final manufacturing PMI falls to 53.2 in August

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Spain on Tuesday. Spain's manufacturing purchasing managers' index (PMI) declined to 53.2 in August from 53.6 in July. It was the lowest level since October 2014.

The decline was driven by a slower increase in new orders. It was the weakest pace of new orders since December 2013.

"Growth of new work continued to ease at Spanish manufacturers in August, providing further evidence of a slowdown in the sector," a senior economist at Markit Andrew Harker said.

He added that "any signs of increasing inflationary pressure seen during Q2 have dissipated".

-

14:17

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Non-Manufacturing PMI August 53.9 53.4

01:00 China Manufacturing PMI August 50 49.7 49.7

01:30 Australia Current Account, bln Quarter II -13.5 Revised From -10.7 -15.8 -19.0

01:30 Australia Building Permits, m/m July -5.2% Revised From -8.2% 2.5% 4.2%

01:35 Japan Manufacturing PMI (Finally) August 51.2 51.9 51.7

01:45 China Markit/Caixin Services PMI August 53.8 53.9 51.5

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

07:30 Switzerland Manufacturing PMI August 48.7 49.7 52.2

07:50 France Manufacturing PMI (Finally) August 49.6 48.6 48.3

07:55 Germany Manufacturing PMI (Finally) August 51.8 53.2 53.3

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4% 6.4%

07:55 Germany Unemployment Change August 8 Revised From 9 -2 -7

08:00 Eurozone Manufacturing PMI (Finally) August 52.4 52.4 52.3

08:30 United Kingdom Consumer credit, mln July 1230 Revised From 1220 1200 1173

08:30 United Kingdom Net Lending to Individuals, bln July 3.9 Revised From 3.8 3.9 3.9

08:30 United Kingdom Purchasing Manager Index Manufacturing August 51.9 52 51.5

08:30 United Kingdom Mortgage Approvals July 67.07 Revised From 66.58 68 68.76

09:00 Eurozone Unemployment Rate July 11.1% 11.1% 10.9%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. manufacturing purchasing managers' index data. The final manufacturing purchasing managers' index is expected to decline to 52.9 in August from 53.8 in July.

The ISM manufacturing purchasing managers' index is expected to fall to 52.6 in August from 52.7 in July.

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. Eurozone's unemployment rate declined to 10.9% in July from 11.1% in June. It was the lowest level since February 2012. Analysts had expected the unemployment rate to remain unchanged at 11.1%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.3 in August from 52.4 in July, down from a preliminary reading of 52.4.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 7,000 in August, exceeding expectations for a 2,000 decline, after a 8,000 rise in July. July's figure was revised down from a 9,000 increase.

The British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in August from 51.9 in July, missing expectations for a rise to 52.0.

A reading above 50 indicates expansion.

The decline was driven by a drop in purchase prices. Average costs showed the steepest decline during the past 16 years.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. was up to 68,764 in July from 67,069 in June, exceeding expectations for an increase to 68,000. It was the highest reading since February 2014.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of Canadian GDP data. Canada's GDP is expected to rise 0.2% in June, after a 0.2% decline in May.

The Swiss franc traded lower against the U.S. dollar despite the better-than-expected the manufacturing PMI from Switzerland. Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Tuesday. The manufacturing purchasing managers' index in Switzerland climbed to 52.2 in August from 48.7 in July, exceeding expectations for an increase to 49.7. It was the highest reading since December 2014.

The increase was largely driven by a rise in production.

EUR/USD: the currency pair declined to $1.1232

GBP/USD: the currency pair fell to $1.5308

USD/JPY: the currency pair decreased to Y119.53

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) June -0.2% 0.2%

12:30 Canada GDP QoQ Quarter II -0.1% 0.2%

12:30 Canada GDP (YoY) Quarter II -0.6% -1%

13:45 U.S. Manufacturing PMI (Finally) August 53.8 52.9

14:00 U.S. Construction Spending, m/m July 0.1% 0.6%

14:00 U.S. ISM Manufacturing August 52.7 52.6

-

14:00

Orders

EUR/USD

Offers 1.1325 1.1340 1.1355-60 1.1395 1.1400

Bids 1.1250 1.1200 1.1185 1.1160 1.1110 1.1100

GBP/USD

Offers 1.5420 1.5450 1.5480 1.5500-05 1.5520 1.5550 1.5600

Bids 1.5300 1.5290

EUR/GBP

Offers 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7300 0.7240 0.7200 0.7150 0.7130

EUR/JPY

Offers 136.50 136.80 137.00 137.50 137.80

Bids 134.80 134.50

USD/JPY

Offers 121.00 121.30 121.50 121.60 122.00

Bids 119.60 119.00

AUD/USD

Offers 0.7150 0.7200 0.7250 0.7290 0.7300

Bids 0.7060 0.7050 0.7000

-

12:10

European stock markets mid session: stocks traded lower on concerns over a slowdown in the global economy

Stock indices traded lower on concerns over a slowdown in the global economy. The Chinese stock market declined on the weak Chinese manufacturing and services PMIs. The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009. The decline was driven by falls in total new orders and new export business.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9. The decline was driven by a weaker increase in new orders.

Meanwhile, the economic data from the Eurozone was positive. Eurozone's unemployment rate declined to 10.9% in July from 11.1% in June. It was the lowest level since February 2012. Analysts had expected the unemployment rate to remain unchanged at 11.1%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.3 in August from 52.4 in July, down from a preliminary reading of 52.4.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 7,000 in August, exceeding expectations for a 2,000 decline, after a 8,000 rise in July. July's figure was revised down from a 9,000 increase.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in August from 51.9 in July, missing expectations for a rise to 52.0.

A reading above 50 indicates expansion.

The decline was driven by a drop in purchase prices. Average costs showed the steepest decline during the past 16 years.

Current figures:

Name Price Change Change %

FTSE 100 6,100.88 -147.06 -2.35 %

DAX 9,985.69 -273.77 -2.67 %

-

12:04

Swiss manufacturing PMI rises to 52.2 in August

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Tuesday. The manufacturing purchasing managers' index in Switzerland climbed to 52.2 in August from 48.7 in July, exceeding expectations for an increase to 49.7. It was the highest reading since December 2014.

The increase was largely driven by a rise in production. The production was up to 62.4, the highest level since December 2010

Purchase prices decreased 4.1 points to 36.1 points in August, while the backlog of orders sub-index rose by 3.9 points to 52.4.

-

11:57

Number of mortgages approvals in the U.K. rise to 68,764 in July

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. was up to 68,764 in July from 67,069 in June, exceeding expectations for an increase to 68,000. It was the highest reading since February 2014.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. declined by £1.173 billion in July, after a rise by £1.230 billion in June.

Net lending to individuals in the U.K. increased by £3.9 billion in July, after a £3.9 billion gain in June.

-

11:45

France’s final manufacturing PMI drops to 48.3 in August

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) dropped to 48.3 in August from 49.6 in July, down from the preliminary reading of 48.6.

The decline was driven by decreases in output, new orders, employment and prices charged.

"The French manufacturing sector slipped further into contraction during August, led by a sharper decline in new orders. The fragile demand environment shows no sign of abating, with another round of output price reductions unable to prevent the latest drop in new work. Correspondingly, manufacturers cut stock levels further and reduced headcounts, as the prospects of a revival continue to look weak," Markit Senior Economist Jack Kennedy said.

-

11:40

Number of unemployed people in Germany declines by 7,000 in August

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 7,000 in August, exceeding expectations for a 2,000 decline, after a 8,000 rise in July. July's figure was revised down from a 9,000 increase.

The number of unemployed people was 1.97 million in July, according to Destatis.

Germany's adjusted unemployment rate remained unchanged at 6.4% in July, in line with expectations.

-

11:34

Germany’s final manufacturing PMI jumps to 53.3 in August

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Tuesday. Germany's final manufacturing purchasing managers' index (PMI) rose to 53.3 in August from 51.8 in July, up from a preliminary reading of 53.2.

The increase was driven by a rise in new orders and employment.

"August's business survey results provide some encouraging news for Germany's goods-producing sector. The headline PMI rose to a 16-month high, fuelled by accelerated growth of both output and new orders. Moreover, we saw rising workloads feed through to notable employment gains, with the rate of job creation the strongest since January 2012," Markit economist Oliver Kolodseike said.

-

11:29

Eurozone’s final manufacturing PMI falls to 52.3 in August

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.3 in August from 52.4 in July, down from a preliminary reading of 52.4.

"While there remain pockets of strength in a number of national domestic markets, August also saw signs of that being matched by a step up in export demand. Export order inflows rose at a faster pace, although we will have to wait and see if recent concerns regarding a slowdown in China filter through to the figures in coming months," Rob Dobson, Senior Economist at Markit said.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E336mn), $1.1250(E417mn), $1.1300(E1.51bn)

USD/JPY: Y121.00($205mn), Y121.75($230mn)

EUR/GBP: Gbp0.7200(E347mn)

AUD/USD: $0.7300(A$548mn)

NZD/USD: $0.6500(NZ$370mn)

-

11:23

Eurozone's unemployment rate is down to 10.9% in July, the lowest level since February 2012

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.9% in July from 11.1% in June. It was the lowest level since February 2012.

Analysts had expected the unemployment rate to remain unchanged at 11.1%.

There were 17.532 million unemployed in the Eurozone in July, down 213,000 from June.

The lowest unemployment rate in the Eurozone in April was recorded in Germany (4.7%), and the highest in Greece (25.0% in May 2015) and Spain (22.2%).

The youth unemployment rate was 21.9% in the Eurozone in July, compared to 23.8% in July a year ago.

-

11:15

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declines to 51.5 in August

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in August from 51.9 in July, missing expectations for a rise to 52.0.

A reading above 50 indicates expansion.

The decline was driven by a drop in purchase prices. Average costs showed the steepest decline during the past 16 years.

"Some of the underlying dynamics of the manufacturing survey did improve in August, such as the indices for output and new orders ticking higher, but the sector remains highly dependent on the domestic market, especially the consumer, to eke out any growth," Markit's Senior Economist Rob Dobson said.

-

11:09

Final Chinese Markit/Caixin manufacturing PMI falls to 47.3 in August

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009.

The decline was driven by falls in total new orders and new export business.

"The final Caixin China Manufacturing PMI for August continued to retreat, with sub-indices signalling continued weak demand in the markets for goods and factors of production. Recent volatilities in global financial markets could weigh down on the real economy, and a pessimistic outlook may become self-fulfilling," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9.

The decline was driven by a weaker increase in new orders.

"The headline Caixin China Services PMI remained above the 50-point mark that separates growth from contraction in August, but the increase in activity was smaller than in July, driven in part by a softer expansion in the financial services sector caused to some extent by stock market fluctuations," Dr. He Fan said.

-

11:02

Official data: Chinese manufacturing PMI declines to 49.7 in August, the lowest level since August 2012

The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

-

11:00

Eurozone: Unemployment Rate , July 10.9% (forecast 11.1%)

-

10:55

Reserve Bank of Australia keeps unchanged its interest rate at 2.00%

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He said that the economic growth was "below longer-term averages", growth of employment was stronger, and "domestic inflationary pressures have been contained".

Stevens pointed out that "monetary policy needs to be accommodative", and it "will most effectively foster sustainable growth and inflation consistent with the target".

The central lowered its interest rate twice this year.

-

10:49

Building permits in Australia jump 4.2% in July

The Australian Bureau of Statistics released its building permits data on Tuesday. Building permits in Australia jumped 4.2% in July, exceeding expectations for a 2.5% gain, after a 5.2% drop in June. June's figure was revised up from a 8.2% decline.

On a yearly basis, building permits climbed 13.4% in July, after a 8.6% increase in June.

The seasonally adjusted estimate of the value of total building approved was up 7.8% in July, after a 2.9% decrease in the previous month.

-

10:33

OPEC expresses concerns over the decline in oil prices

The Organization of the Petroleum Exporting Countries (OPEC) expressed concerns over the decline in oil prices in its bulletin on Monday.

"Today's continuing pressure on prices, brought about by higher crude production, coupled with market speculation, remains a cause for concern for OPEC and its members-indeed for all stakeholders in the industry," OPEC said.

OPEC is ready to discuss the problem with other producers. But OPEC added that it will protect its own interests.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , August 51.5 (forecast 52)

-

10:30

United Kingdom: Consumer credit, mln, July 1173 (forecast 1200)

-

10:30

United Kingdom: Mortgage Approvals, July 68.76 (forecast 68)

-

10:30

United Kingdom: Net Lending to Individuals, bln, July 3.9 (forecast 3.9)

-

10:18

German Chancellor Angela Merkel is confident that Greece will fulfil its obligations

The German Chancellor Angela Merkel said on Monday that she is confident that Greece will fulfil its obligations on the third bailout programme.

"I expect that Greece will meet its obligation," she said.

Greece already received the first tranche of €86 billion bailout package.

-

10:10

Goldman Sachs cuts its growth forecasts for China

Goldman Sachs downgraded its growth forecasts for China on Monday. The bank expect the Chinese economy to expand 6.4% in 2016, down from the previous forecast of 6.7%, 6.1% in 2017, down from the previous forecast of 6.5%, and 5.8% in 2018, down from the previous forecast of 6.2%.

Goldman Sachs' forecasts are based on labour, capital and productivity.

"In China's case, each of these three components is expected to decelerate: labour due to demographics, capital deepening as the capital share of the economy comes down from exceptionally high levels, and total factor productivity growth as the economy narrows the gap with the richest economies," the bank said.

-

10:00

Eurozone: Manufacturing PMI, August 52.3 (forecast 52.4)

-

09:56

Germany: Unemployment Change, August -7 (forecast -2)

-

09:56

Germany: Manufacturing PMI, August 53.3 (forecast 53.2)

-

09:55

Germany: Unemployment Rate s.a. , July 6.4% (forecast 6.4%)

-

09:50

France: Manufacturing PMI, August 48.3 (forecast 48.6)

-

09:30

Switzerland: Manufacturing PMI, August 52.2 (forecast 49.7)

-

09:03

Oil prices declined

West Texas Intermediate futures for October delivery fell to $47.62 (-3.21%), while Brent crude dropped to $42.57 (-2.92%) as investors took profits after yesterday's surge.

Yesterday OPEC said in an article that it is ready to talk to other producers to help support oil prices. Declines in revenues from oil industry in undiversified economies of Gulf countries could lead to "loss of much-needed revenue required from member countries' socio-economic development".

At the same time Russian President Vladimir Putin and the President of Venezuela Nicolas Maduro will discuss "possible mutual steps" to stabilize global oil prices when they visit China this week to attend a military parade in Beijing dedicated to 70 years since the end of World War Two in Asia.

The Energy Information Administration published revised data on Monday. Thus U.S. domestic oil production reached slightly beyond 9.6 million barrels per day in April, but fell by more than 300,000 bpd over May and June.

-

08:37

Gold climbed on safe haven demand

Gold rose to $1,142.00 (+0.84%) as continuous declines in equities and concerns over China's economy made investors seek safe haven. However bullion's upside potential is limited by a looming rate increase in the U.S. This could be the first rate hike in nearly a decade. Many analysts believe that Friday's non-farm payrolls report could determine Fed officials' readiness to raise rates when they meet on September 16-17.

Meanwhile China Federation of Logistics and Purchasing reported that the manufacturing PMI of the world's second-biggest economy fell to 49.7 in August from 50 in July, slipping below the 50 points threshold that separates expansion from contraction.

-

08:30

Options levels on tuesday, September 1, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1470 (2558)

$1.1429 (3298)

$1.1358 (5056)

Price at time of writing this review: $1.1283

Support levels (open interest**, contracts):

$1.1181 (4755)

$1.1133 (4813)

$1.1067 (5555)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 90454 contracts, with the maximum number of contracts with strike price $1,1350 (5266);

- Overall open interest on the PUT options with the expiration date September, 4 is 129509 contracts, with the maximum number of contracts with strike price $1,0500 (7855);

- The ratio of PUT/CALL was 1.43 versus 1.41 from the previous trading day according to data from August, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (1953)

$1.5601 (2514)

$1.5502 (2100)

Price at time of writing this review: $1.5396

Support levels (open interest**, contracts):

$1.5296 (2465)

$1.5198 (1475)

$1.5099 (365)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30141 contracts, with the maximum number of contracts with strike price $1,5600 (2548);

- Overall open interest on the PUT options with the expiration date September, 4 is 34731 contracts, with the maximum number of contracts with strike price $1,5500 (2751);

- The ratio of PUT/CALL was 1.15 versus 1.18 from the previous trading day according to data from August, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

Global Stocks: U.S. stock indices ended August with substantial loss

U.S. stock indices fell on Monday amid concerns over China's economy and an imminent rate increase by the Federal Reserve.

The Dow Jones Industrial Average lost 114 points, or 0.7%, to 16,528. The S&P 500 fell 16 points, or 0.8%, to 1,972. The Nasdaq Composite dropped 52 points, or 1.1%, to 4,776. The indices ended August with losses of 6.6%, 6.3% and 6.9% respectively.

Data showed yesterday that Chicago Purchasing Managers' Index declined significantly in August despite expectations for further growth. The index fell to 54.4 compared to 54.7 in July. Analysts expected an increase to 54.9. The index was weighed by output and new orders sub-indices. Nevertheless these sub-indices remained above their 12-month averages.

This morning in Asia Hong Kong Hang Seng declined 0.47%, or 101.44 points, to 21,569.14. China Shanghai Composite Index dropped 1.06%, or 33.96 points, to 3,172.03. The Nikkei plunged 2.14%, or 404.22 points, to 18,486.26.

Asian stocks fell amid declines in U.S. equities and disappointing data from China. The country's official manufacturing purchasing managers' index (PMI) fell to 49.7 in August from 50 in July, slipping below the 50 points threshold that separates expansion from contraction.

-

08:16

Foreign exchange market. Asian session: the Australian dollar declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 China Non-Manufacturing PMI August 53.9 53.4

01:00 China Manufacturing PMI August 50 49.7 49.7

01:30 Australia Current Account, bln Quarter II -13.5 Revised From -10.7 -15.8 -19.0

01:30 Australia Building Permits, m/m July -5.2% Revised From -8.2% 2.5% 4.2%

01:35 Japan Manufacturing PMI (Finally) August 51.2 51.9 51.7

01:45 China Markit/Caixin Services PMI August 53.8 53.9 51.5

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

The Australian dollar declined against the U.S. dollar after the Reserve Bank of Australia announced that it had left its interest rate unchanged at 2%. The central bank aimed at stimulating activity in such spheres as retail sales and housing construction, which drove growth earlier. Meanwhile the RBA is concerned about the overheating housing market, which can lead to risky investments and undermine fragile recovery. The AUD was also influenced by data from its main trade partner China. The Federation of Logistics and Purchasing reported that China's manufacturing PMI fell to 49.7 in August from 50 in July, slipping below the 50 points threshold that separates expansion from contraction.

The yen rose against the dollar as declines in Asian stocks boosted demand for this safe-haven currency.

Earlier the euro declined against the greenback amid euro zone inflation data. Consumer prices rose by 0.2% in August, just like in July. Analysts expected price growth to slow down to 0.1%. Inflation growth has remained below 1% for 21 months. Prices of food, alcohol and tobacco rose 1.2% compared to +0.9% in July. Prices of services rose by 1.2%. Energy costs fell by 7.1%.

EUR/USD: the pair rose to $1.1275 in Asian trade

USD/JPY: the pair fell to Y120.55

GBP/USD: the pair rose to $1.5405

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:30 Switzerland Manufacturing PMI August 48.7 49.7

07:50 France Manufacturing PMI (Finally) August 49.6 48.6

07:55 Germany Manufacturing PMI (Finally) August 51.8 53.2

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4%

07:55 Germany Unemployment Change August 9 -2

08:00 Eurozone Manufacturing PMI (Finally) August 52.4 52.4

08:30 United Kingdom Consumer credit, mln July 1220 1200

08:30 United Kingdom Net Lending to Individuals, bln July 3.8 3.9

08:30 United Kingdom Purchasing Manager Index Manufacturing August 51.9 52

08:30 United Kingdom Mortgage Approvals July 66.58 68

09:00 Eurozone Unemployment Rate July 11.1% 11.1%

12:30 Canada GDP (m/m) June -0.2% 0.2%

12:30 Canada GDP QoQ Quarter II -0.1% 0.2%

12:30 Canada GDP (YoY) Quarter II -0.6% -1%

13:45 U.S. Manufacturing PMI (Finally) August 53.8 52.9

14:00 U.S. Construction Spending, m/m July 0.1% 0.6%

14:00 U.S. ISM Manufacturing August 52.7 52.6

20:30 U.S. API Crude Oil Inventories August -7.3

20:45 U.S. Total Vehicle Sales, mln August 17.55 17.3

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 2.0% (forecast 2%)

-

04:03

Nikkei 225 18,585.76 -304.72 -1.61 %, Hang Seng 21,592.5 -78.08 -0.36 %, Shanghai Composite 3,139.05 -66.94 -2.09 %

-

03:45

China: Markit/Caixin Services PMI, August 51.5 (forecast 53.9)

-

03:35

Japan: Manufacturing PMI, August 51.7 (forecast 51.9)

-

03:30

Australia: Building Permits, m/m, July 4.2% (forecast 2.5%)

-

03:30

Australia: Current Account, bln, Quarter II -19.0 (forecast -15.8)

-

03:00

China: Manufacturing PMI , August 49.7 (forecast 49.7)

-

03:00

China: Non-Manufacturing PMI, August 53.4

-

01:58

Japan: Capital Spending, Quarter II 5.6% (forecast 9%)

-

01:31

Australia: AIG Manufacturing Index, August 51.7

-

00:34

Commodities. Daily history for Aug 31’2015:

(raw materials / closing price /% change)

Oil 48.16 -2.11%

Gold 1,133.90 +0.12%

-

00:31

Stocks. Daily history for Aug 31’2015:

(index / closing price / change items /% change)

Nikkei 225 18,890.48 -245.84 -1.28 %

Hang Seng 21,670.58 +58.19 +0.27 %

S&P/ASX 200 5,206.98 -56.58 -1.07 %

Shanghai Composite 3,207.07 -25.28 -0.78 %

FTSE 100 6,247.94 +55.91 +0.90 %

CAC 40 4,652.95 -22.18 -0.47 %

Xetra DAX 10,259.46 -39.07 -0.38 %

S&P 500 1,972.18 -16.69 -0.84 %

NASDAQ Composite 4,776.51 -51.82 -1.07 %

Dow Jones 16,528.03 -114.98 -0.69 %

-

00:30

Currencies. Daily history for Aug 31’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1208 +0,21%

GBP/USD $1,5343 -0,31%

USD/CHF Chf0,9657 +0,39%

USD/JPY Y121,23 -0,36%

EUR/JPY Y135,89 -0,13%

GBP/JPY Y186,01 -0,70%

AUD/USD $0,7112 -0,83%

NZD/USD $0,6344 -1,83%

USD/CAD C$1,3136 -0,48%

-

00:01

Schedule for today,Tuesday, Sep 1’2015:

(time / country / index / period / previous value / forecast)

01:00 China Non-Manufacturing PMI August 53.9

01:00 China Manufacturing PMI August 50 49.7

01:30 Australia Current Account, bln Quarter II -10.7 -15.8

01:30 Australia Building Permits, m/m July -8.2% 2.5%

01:35 Japan Manufacturing PMI (Finally) August 51.2 51.9

01:45 China Markit/Caixin Services PMI August 53.8

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2%

04:30 Australia RBA Rate Statement

07:30 Switzerland Manufacturing PMI August 48.7 49.7

07:50 France Manufacturing PMI (Finally) August 49.6 48.6

07:55 Germany Manufacturing PMI (Finally) August 51.8 53.2

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4%

07:55 Germany Unemployment Change August 9 -3

08:00 Eurozone Manufacturing PMI (Finally) August 52.4 52.4

08:30 United Kingdom Consumer credit, mln July 1220 1200

08:30 United Kingdom Net Lending to Individuals, bln July 3.8 3.9

08:30 United Kingdom Purchasing Manager Index Manufacturing August 51.9 52

08:30 United Kingdom Mortgage Approvals July 66.58 68

09:00 Eurozone Unemployment Rate July 11.1% 11.1%

12:30 Canada GDP (m/m) June -0.2% 0.2%

12:30 Canada GDP QoQ Quarter II -0.1% 0.2%

12:30 Canada GDP (YoY) Quarter II -0.6% -0.9%

13:45 U.S. Manufacturing PMI (Finally) August 53.8 52.9

14:00 U.S. Construction Spending, m/m July 0.1% 0.6%

14:00 U.S. ISM Manufacturing August 52.7 52.7

20:30 U.S. API Crude Oil Inventories August -7.3

20:45 U.S. Total Vehicle Sales, mln August 17.55 17.3

-