Noticias del mercado

-

17:34

Oil prices declines on concerns over a slowdown in the Chinese economy

Oil prices fell on concerns over a slowdown in the Chinese economy. The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009. The decline was driven by falls in total new orders and new export business.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9. The decline was driven by a weaker increase in new orders.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for October delivery decreased to $45.76 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $51.89 a barrel on ICE Futures Europe.

-

17:25

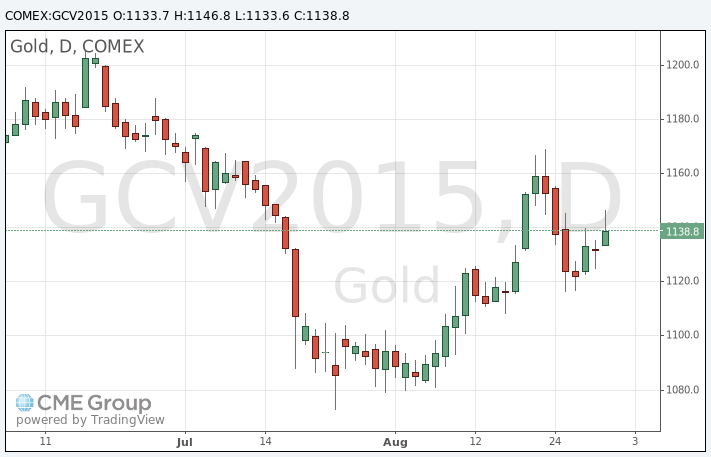

Gold price rises due to increased demand for the safe-haven asset

Gold price rose due to increased demand for the safe-haven asset as global stock indices and the U.S. dollar declined.

The U.S. dollar fell against other currencies after the release of the weaker-than-expected ISM manufacturing purchasing managers' index (PMI). The index declined to 51.1 in August from 52.7 in July, missing expectations for a fall to 52.6. It was the lowest level since May of 2013.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in new orders.

Global stock markets traded lower on concern over a slowdown in the Chinese economy. The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009. The decline was driven by falls in total new orders and new export business.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9. The decline was driven by a weaker increase in new orders.

October futures for gold on the COMEX today rose to 1146.80 dollars per ounce.

-

17:12

International Monetary Fund Managing Director Christine Lagarde expects the global growth to be weaker than expected earlier

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Tuesday that the global growth will be weaker than expected earlier due to a slower recovery in advanced economies and a further slowdown in emerging economies.

"Overall, we expect global growth to remain moderate and likely weaker than we anticipated last July. This reflects two forces: a weaker than expected recovery in advanced economies, and a further slowdown in emerging economies, especially in Latin America," she said.

The IMF managing director warned emerging countries to "be vigilant for spillovers" from a slowdown in the Chinese economy.

Lagarde noted that the Chinese economy was slowing as it adjusts to a new growth model.

"The transition to a more market-based economy and the unwinding of risks built up in recent years is complex and could well be somewhat bumpy," she said.

-

11:09

Final Chinese Markit/Caixin manufacturing PMI falls to 47.3 in August

The final Chinese Markit/Caixin manufacturing PMI declined to 47.3 in August from 47.8 in July, beating the preliminary reading of a fall to 47.1. It was the lowest level since March 2009.

The decline was driven by falls in total new orders and new export business.

"The final Caixin China Manufacturing PMI for August continued to retreat, with sub-indices signalling continued weak demand in the markets for goods and factors of production. Recent volatilities in global financial markets could weigh down on the real economy, and a pessimistic outlook may become self-fulfilling," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 51.5 in August from 53.8 in July, missing expectations for a rise to 53.9.

The decline was driven by a weaker increase in new orders.

"The headline Caixin China Services PMI remained above the 50-point mark that separates growth from contraction in August, but the increase in activity was smaller than in July, driven in part by a softer expansion in the financial services sector caused to some extent by stock market fluctuations," Dr. He Fan said.

-

11:02

Official data: Chinese manufacturing PMI declines to 49.7 in August, the lowest level since August 2012

The Chinese manufacturing PMI declined to 49.7 in August from 50.0 in July, in line with expectations, according to the Chinese government. It was the lowest level since August 2012.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

"There is insufficient growth momentum in the country's manufacturing sector," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The services PMI fell to 53.4 in August from 53.9 in July.

-

10:33

OPEC expresses concerns over the decline in oil prices

The Organization of the Petroleum Exporting Countries (OPEC) expressed concerns over the decline in oil prices in its bulletin on Monday.

"Today's continuing pressure on prices, brought about by higher crude production, coupled with market speculation, remains a cause for concern for OPEC and its members-indeed for all stakeholders in the industry," OPEC said.

OPEC is ready to discuss the problem with other producers. But OPEC added that it will protect its own interests.

-

10:10

Goldman Sachs cuts its growth forecasts for China

Goldman Sachs downgraded its growth forecasts for China on Monday. The bank expect the Chinese economy to expand 6.4% in 2016, down from the previous forecast of 6.7%, 6.1% in 2017, down from the previous forecast of 6.5%, and 5.8% in 2018, down from the previous forecast of 6.2%.

Goldman Sachs' forecasts are based on labour, capital and productivity.

"In China's case, each of these three components is expected to decelerate: labour due to demographics, capital deepening as the capital share of the economy comes down from exceptionally high levels, and total factor productivity growth as the economy narrows the gap with the richest economies," the bank said.

-

09:03

Oil prices declined

West Texas Intermediate futures for October delivery fell to $47.62 (-3.21%), while Brent crude dropped to $42.57 (-2.92%) as investors took profits after yesterday's surge.

Yesterday OPEC said in an article that it is ready to talk to other producers to help support oil prices. Declines in revenues from oil industry in undiversified economies of Gulf countries could lead to "loss of much-needed revenue required from member countries' socio-economic development".

At the same time Russian President Vladimir Putin and the President of Venezuela Nicolas Maduro will discuss "possible mutual steps" to stabilize global oil prices when they visit China this week to attend a military parade in Beijing dedicated to 70 years since the end of World War Two in Asia.

The Energy Information Administration published revised data on Monday. Thus U.S. domestic oil production reached slightly beyond 9.6 million barrels per day in April, but fell by more than 300,000 bpd over May and June.

-

08:37

Gold climbed on safe haven demand

Gold rose to $1,142.00 (+0.84%) as continuous declines in equities and concerns over China's economy made investors seek safe haven. However bullion's upside potential is limited by a looming rate increase in the U.S. This could be the first rate hike in nearly a decade. Many analysts believe that Friday's non-farm payrolls report could determine Fed officials' readiness to raise rates when they meet on September 16-17.

Meanwhile China Federation of Logistics and Purchasing reported that the manufacturing PMI of the world's second-biggest economy fell to 49.7 in August from 50 in July, slipping below the 50 points threshold that separates expansion from contraction.

-

00:34

Commodities. Daily history for Aug 31’2015:

(raw materials / closing price /% change)

Oil 48.16 -2.11%

Gold 1,133.90 +0.12%

-