Noticias del mercado

-

17:37

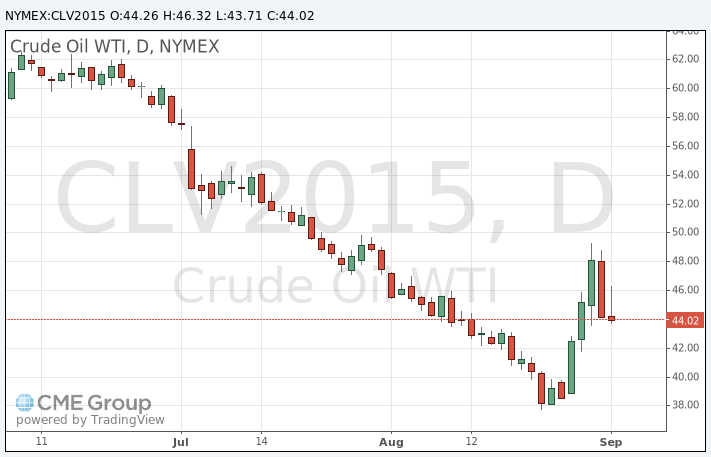

Oil prices declines on the U.S. crude oil inventories data

Oil prices fell on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories climbed by 4.67 million barrels to 455.4 million in the week to August 28. It was the biggest one-week increase since April.

Analysts had expected U.S. crude oil inventories to decline by 1.5 million barrels.

Gasoline inventories decreased by 271,000 barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, declined by 388,000 barrels.

U.S. crude oil imports increased by 656,000 barrels per day.

Refineries in the U.S. were running at 92.8% of capacity, down from 94.5% the previous week.

Oil prices dropped yesterday on the weaker-than-expected manufacturing PMI data from China.

WTI crude oil for October delivery decreased to $43.71 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $48.97 a barrel on ICE Futures Europe.

-

17:23

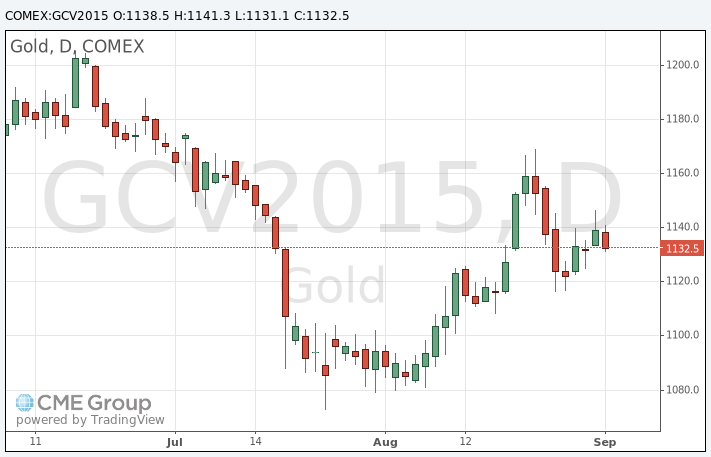

Gold price falls as the global stock markets and the U.S. dollar increased

Gold price declined as the global stock markets and the U.S. dollar increased. The U.S. dollar rose against other currencies on the U.S. economic data. The U.S. Labor Department released its revised non-farm productivity figures on Wednesday. Revised productivity in the U.S. non-farm businesses rose at a 3.3% annual rate in the second quarter, up from the preliminary reading of a 1.3% increase, after a 1.1% drop in the first quarter.

The upward revision was driven by higher output, which rose 4.7% in the second quarter, up from the preliminary reading of a 2.8% gain.

Private sector in the U.S. added 190,000 jobs in August, according the ADP report on Wednesday. July's figure was revised down to 177,000 jobs from a previous reading of 185,000 jobs.

Analysts expected the private sector to add 201,000 jobs.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to decline to 5.2% in August from 5.3% in July. The U.S. economy is expected to add 220,000 jobs in August, after adding 215,000 jobs in July.

October futures for gold on the COMEX today fell to 1131.10 dollars per ounce.

-

16:55

U.S. crude inventories climb by 4.67 million barrels to 455.4 million in the week to August 28

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories climbed by 4.67 million barrels to 455.4 million in the week to August 28. It was the biggest one-week increase since April.

Analysts had expected U.S. crude oil inventories to decline by 1.5 million barrels.

Gasoline inventories decreased by 271,000 barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, declined by 388,000 barrels.

U.S. crude oil imports increased by 656,000 barrels per day.

Refineries in the U.S. were running at 92.8% of capacity, down from 94.5% the previous week.

-

08:57

Oil prices fell sharply

West Texas Intermediate futures for October delivery fell to $44.31 (-2.42%), while Brent crude dropped to $48.41 (-2.32%) amid weak stock markets and expectations of greater U.S. crude inventories. Late Tuesday the American Petroleum Institute said U.S. crude stocks rose by 7.6 million barrels to 457 million barrels last week beating expectations for a more modest rise. The more precise inventory data from the U.S. Energy Information Administration will be published later today.

Venezuela and China have signed a deal for a $5 billion loan aimed to increasing Venezuela's oil production. No details of the deal were revealed.

-

08:38

Gold climbed after negative beginning of the session

Gold is currently at $1,141.10 (+0.11%). The precious metal managed to climb slightly after it declined at the beginning of the session. Early declines took place despite sharp drops in U.S. stocks. "This suggests that in the short term, stock market meltdown or no meltdown, gold prices are unwilling to move above $1,145 (and) it will take a way stronger catalyst, say a very weak non-farm payrolls number this Friday, to substantially bring prices (higher),'' said Howie Lee, analyst at Phillip Futures in Singapore.

Investors are waiting for U.S. payrolls data to assess probability of a rate hike by the Federal Reserve in September. ADP Employment Report is due today 12:15 GMT. It might provide some clues on payrolls.

-

00:31

Commodities. Daily history for Sep 1’2015:

(raw materials / closing price /% change)

Oil 44.19 -2.69%

Gold 1,139.30 -0.04%

-